Professional Documents

Culture Documents

BPS QN Inclusion WKG

BPS QN Inclusion WKG

Uploaded by

adi_mrmarkOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BPS QN Inclusion WKG

BPS QN Inclusion WKG

Uploaded by

adi_mrmarkCopyright:

Available Formats

To illustrate, Indus, an Indian company exports goods to its associated enterprise IGE @ 1000 euros.

If the ALP under CUP method is determined at 1050 euros, then the transaction is considered to be

at ALP, as the difference between ALP and transaction price is less than 5%. If the ALP determined

is 1080 euros, 80 euros shall be the transfer pricing adjustment, as the difference between ALP and

transaction price is more than 5%. Hence, 80 euros shall be added to the taxable income of Indian

company.

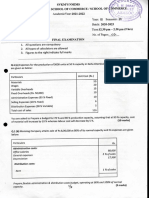

P1. P& L account of Ramana Bros an Indian company reflects the following

a. Rs. 20 Cr imports from AE

b. Rs.80 Cr other expenses in India

c. Rs. 15 Cr exports to to AE

d. Rs.90 Cr domestic sales.

e. Rs. 5 Cr book profit

A firm of Chartered Accountants carried out transfer pricing study. TNMM was considered as the

most appropriate method. Based on the TP study they determined ALP at 6% over cost. Please

advise the company whether the transaction with its AE is at ALP or TP adjustment is required?

Ans:

Computation of TP adjustment (in Crores)

Pariculars Rs. Rs.

Domestic sales 90.00

Exports to AE 15.00

Add: 5% Variation as per sec 92C(2) 0.75

15.75

(A) 105.75

Domestic expenses 80

Imports from AE 20

Less : 5% variation as per Sec. 92C(2) 1

19

(B) 99

Book profit with 5% variation (A)-(B) 6.75

Profit over cost is 6.81%. Arms’s length benchmark as pr TNMM is 6% over cost. Therefore no TP

adjustment is called for in the present case.

You might also like

- Maharashtra EB Sale No Yes Mar No: Wind Power Project - Financial StatementDocument5 pagesMaharashtra EB Sale No Yes Mar No: Wind Power Project - Financial Statementaby_000No ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- MA-II Assignment V - Short Run Decision AnalysisDocument4 pagesMA-II Assignment V - Short Run Decision Analysisshriya2413No ratings yet

- Transfer PricingDocument20 pagesTransfer PricingRia Gabs100% (1)

- Sneaker Excel Sheet For Risk AnalysisDocument11 pagesSneaker Excel Sheet For Risk AnalysisSuperGuyNo ratings yet

- Asphalting Detailed EstimateDocument19 pagesAsphalting Detailed EstimateAsrar Hussain KhanNo ratings yet

- Camelback Cost Management AnalysisDocument23 pagesCamelback Cost Management AnalysisVidya Sagar Ch100% (2)

- Camelback CommunicationsDocument9 pagesCamelback Communicationsvir1672100% (1)

- Heriot-Watt University Finance - December 2020 Section I Case StudiesDocument13 pagesHeriot-Watt University Finance - December 2020 Section I Case StudiesSijan PokharelNo ratings yet

- DI Pie Charts 2023Document21 pagesDI Pie Charts 2023nirdha345No ratings yet

- Management Accounting989 DqNgYxv2GjDocument3 pagesManagement Accounting989 DqNgYxv2GjPrekshit KalashdharNo ratings yet

- Manacc CaseDocument3 pagesManacc Caseshivam kumarNo ratings yet

- VAT CalculationDocument1 pageVAT CalculationMd. Abdul HaiNo ratings yet

- Question 3 FrojassDocument6 pagesQuestion 3 FrojassPaco RojasNo ratings yet

- Questions On BreakevenDocument10 pagesQuestions On BreakevenFrederick GbliNo ratings yet

- Cost of ProductionDocument27 pagesCost of Productionfaisal197No ratings yet

- IPO Cost Sheet - Format - Reg SDocument8 pagesIPO Cost Sheet - Format - Reg SRanjit SinghNo ratings yet

- Sneaker Excel Sheet For Risk AnalysisDocument11 pagesSneaker Excel Sheet For Risk AnalysisSuperGuyNo ratings yet

- Processcosting 170220162121Document19 pagesProcesscosting 170220162121Pari JainNo ratings yet

- Micro 4Document33 pagesMicro 4gauravpalgarimapalNo ratings yet

- Chapter 8 Ed 18Document27 pagesChapter 8 Ed 18Audi WibisonoNo ratings yet

- VDS TDS RateDocument3 pagesVDS TDS RateTanvir TanmoyNo ratings yet

- 12BBA Sem.-Ii CC-109 Cost Accounting-2Document8 pages12BBA Sem.-Ii CC-109 Cost Accounting-2FGEFGNo ratings yet

- AFM - Revision: International Investment Dec 2013 Q1 - ChumraDocument8 pagesAFM - Revision: International Investment Dec 2013 Q1 - ChumraHassan Raza ShahNo ratings yet

- 5) May 2007 Cost ManagementDocument32 pages5) May 2007 Cost Managementshyammy foruNo ratings yet

- Arvind Mills Investor Present A Ti IonDocument22 pagesArvind Mills Investor Present A Ti IonsharatchandNo ratings yet

- FM Sugar CaseDocument16 pagesFM Sugar CaseR RATED GAMERNo ratings yet

- Process CostingDocument19 pagesProcess CostingAbimanyu ShenilNo ratings yet

- Practice Problems Ch. 12 Perfect CompetitionDocument5 pagesPractice Problems Ch. 12 Perfect CompetitionYolanda TshakaNo ratings yet

- Chapter 9+10+11 - Revision QuestionsDocument23 pagesChapter 9+10+11 - Revision QuestionszonkezintlanuzembetaNo ratings yet

- Management Accounting Problem Unit 5Document7 pagesManagement Accounting Problem Unit 5princeNo ratings yet

- Extra QDocument8 pagesExtra QdubzayNo ratings yet

- 7 Costs of ProductionDocument24 pages7 Costs of Productionakshat guptaNo ratings yet

- Chapter 5. Exhibits y AnexosDocument7 pagesChapter 5. Exhibits y AnexosJulio Arroyo GilNo ratings yet

- 1Q21 Operating EBITDA Below COL Estimates On Lower-Than-Expected RevenuesDocument8 pages1Q21 Operating EBITDA Below COL Estimates On Lower-Than-Expected RevenuesJajahinaNo ratings yet

- FIN304 Capital Budgeting Mid-Sem Exam 2020 (ANSWER)Document8 pagesFIN304 Capital Budgeting Mid-Sem Exam 2020 (ANSWER)sha ve3No ratings yet

- CGE 660 March - June 2018 ProjectDocument2 pagesCGE 660 March - June 2018 ProjectPejal SahakNo ratings yet

- Maruti India Limited: SuzukiDocument15 pagesMaruti India Limited: SuzukiNikhil AdesaraNo ratings yet

- Paper 8Document60 pagesPaper 8rababkr23No ratings yet

- Assignment 4Document69 pagesAssignment 4amy ackerNo ratings yet

- Advance Management Accounting Test 2 130520200212Document7 pagesAdvance Management Accounting Test 2 130520200212PrinceNo ratings yet

- Epdgm Term 2 Alliance University: Corporate FinanceDocument4 pagesEpdgm Term 2 Alliance University: Corporate FinanceGeorgekutty GeorgeNo ratings yet

- Tutorial Set 5 - Microeconomics UGBS 201-2Document7 pagesTutorial Set 5 - Microeconomics UGBS 201-2FrizzleNo ratings yet

- OJ SalesDocument10 pagesOJ SalesIlly FreidinNo ratings yet

- Mock Deparmentals MASQDocument6 pagesMock Deparmentals MASQHannah Joyce MirandaNo ratings yet

- ABC June 2008Document2 pagesABC June 2008ACCA StudentNo ratings yet

- 15M 228-261 FinancialManagementInEnergySector - 20190410073530.029 - XDocument7 pages15M 228-261 FinancialManagementInEnergySector - 20190410073530.029 - XKartik AnejaNo ratings yet

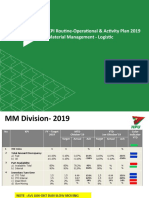

- MM KPI Review All Function - OKT 2019Document9 pagesMM KPI Review All Function - OKT 2019Arief RahmanNo ratings yet

- Lecture 4b-1Document37 pagesLecture 4b-1ShoObham ShibooNo ratings yet

- Merak Fiscal Model Library: Algeria R/T (2005)Document3 pagesMerak Fiscal Model Library: Algeria R/T (2005)Libya TripoliNo ratings yet

- Exercise 2 PRODUCTION COSTDocument1 pageExercise 2 PRODUCTION COSTAzlyn SyafikahNo ratings yet

- Sri Balaji University Pune (Sbup) Bitm SEMESTER-I-BATCH - 2020-22 Management Accounting - Assignment - Vii (UNIT-V)Document7 pagesSri Balaji University Pune (Sbup) Bitm SEMESTER-I-BATCH - 2020-22 Management Accounting - Assignment - Vii (UNIT-V)Jaya BharneNo ratings yet

- Motilal Oswal PVR Q2FY21 Result UpdateDocument12 pagesMotilal Oswal PVR Q2FY21 Result Updateumaj25No ratings yet

- 17 - Debajit Mahanta - OM05: Solution To Question-7 (pg-451)Document8 pages17 - Debajit Mahanta - OM05: Solution To Question-7 (pg-451)Gaurav JoardarNo ratings yet

- Fin Model Class9 Merger Model Using DCF MethodologyDocument1 pageFin Model Class9 Merger Model Using DCF MethodologyGel viraNo ratings yet

- Costs of ProductionDocument30 pagesCosts of ProductionANIKNo ratings yet

- Production Foreacast Model For Oil & Gas: #Addin?Document1 pageProduction Foreacast Model For Oil & Gas: #Addin?rafiullah353No ratings yet

- Fmci Vat RatesDocument19 pagesFmci Vat RatesFahim YusufNo ratings yet