Professional Documents

Culture Documents

Sample Problem No. 1: Ñas, Cavite

Uploaded by

2 BOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample Problem No. 1: Ñas, Cavite

Uploaded by

2 BCopyright:

Available Formats

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

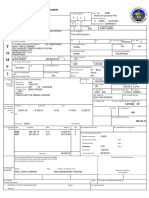

Sample Problem no. 1

Shipment of 1x40’ containing 80 drums of chemicals from Brazil with a total amount of duties,

taxes and other charges paid of PHP 403,550.00 using 20% duty rate and PHP 50.25/USD

exchange rate, compute the following:

(1.) Customs Duty

(2.) Brokerage Fee

(3.) Total Miscellaneous Expenses

(4.) Value Added Tax

(5.) FOB/drum (if ocean freight used is USD 560.00 covered by LIP of PHP 6,030.00 complete

with all requirement prescribed by law)

VIRTUE EXCELLENCE SERVICE

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

Formula: Summary of Duties, Taxes & Other Collectible Charges

Customs Duty 0.20 (DV)

Plus: Value Added Tax 0.14415 (DV) 2,631.666

Import Processing Fee 1,000.00

Customs Documentary Stamps 280.00

Container Security Fee + 503.00

Total Amount Due to the Government 0.34415 (DV)+ 4,414.666

VIRTUE EXCELLENCE SERVICE

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

Formula: Taxable Value & Value Added Tax – via Sea Ports of Entry

(Formal Entry Consumption/Warehousing)

Dutiable Value 1 (DV)

Plus: Customs Duty 0.20 (DV)

Brokerage Fees 0.00125 (DV) 5,050.00

Arrastre Charges 14,821.50

Wharfage Dues 779.05

Customs Documentary Stamp 280.00

Import Processing Fee + 1,000.00

Landed Cost 1.20125 (DV) 21,930.55

Multiply: VAT Rate x 0.12

Value-Added Tax 0.14415 (DV) 2,631.666

VIRTUE EXCELLENCE SERVICE

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

Formula: Taxable Value & Value Added Tax – via Sea Ports of Entry

(Formal Entry Consumption/Warehousing)

Reference:

TADTG PHP 403,550.00

Minus: - 4,414.666

PHP 399,135.334

Divide: ÷ 0.34415

Dutiable Value PHP 1,159,771.42

VIRTUE EXCELLENCE SERVICE

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

Formula: Dutiable Value

Reference:

Dutiable Value PHP 1,159,771.42

Multiply: Duty Rate x 0.20

Customs Duty 231,954.28

Divide: Total drums imported ÷ 80

Customs Duty per drum PHP 2,899.43

VIRTUE EXCELLENCE SERVICE

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

Reference:

Dutiable Value PHP 1,159,771.42

Multiply: x 0.00125

PHP 1,449.71

Plus: + 5,050.00

Brokerage Fee PHP 6,499.71

VIRTUE EXCELLENCE SERVICE

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

Reference:

Dutiable Value PHP 1,159,771.42

Multiply: x 0.00125

PHP 1,449.71

Plus: 6,330.00

14,821.50

+ 779.05

Miscellaneous Expenses PHP 23,380.26

VIRTUE EXCELLENCE SERVICE

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

Formula: Taxable Value & Value Added Tax – via Sea Ports of Entry

(Formal Entry Consumption/Warehousing)

Dutiable Value 1,159,771.42

Plus: Customs Duty 231,954.28

Brokerage Fees 6,499.71

Arrastre Charges 14,821.50

Wharfage Dues 779.05

Customs Documentary Stamp 280.00

Import Processing Fee + 1,000.00

Landed Cost 1,415,105.96

Multiply: VAT Rate x 0.12

Value-Added Tax 169,812.72

VIRTUE EXCELLENCE SERVICE

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

Formula: Taxable Value & Value Added Tax – via Sea Ports of Entry

(Formal Entry Consumption/Warehousing)

Reference:

Dutiable Value PHP 1,159,771.42

Multiply: x 0.14415

PHP 167,181.05

Plus: + 2,631.666

Value Added Tax PHP 169,812.72

VIRTUE EXCELLENCE SERVICE

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

Formula: Taxable Value & Value Added Tax – via Sea Ports of Entry

(Formal Entry Consumption/Warehousing)

Reference:

Dutiable Value PHP 1,159,771.42

Plus: Customs Duty 231,954.28

Miscellaneous Expenses x 23,380.26

Landed Cost PHP 1,415,105.96

Multiply 0.12

Value Added Tax PHP 169,812.72

VIRTUE EXCELLENCE SERVICE

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

Formula: Taxable Value & Value Added Tax – via Sea Ports of Entry

(Formal Entry Consumption/Warehousing)

Reference:

Dutiable Value PHP 1,159,771.42

Multiply: x 1.20125

PHP 1,393,175.42

Plus: B/F, IPF & CDS 6,330.00

Arrastre Charges 14,821.50

Wharfage Dues + 779.05

Landed Cost 1,415,105.97

Multiply: x 0.12

Value Added Tax PHP 169,812.72

VIRTUE EXCELLENCE SERVICE

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

Formula: FOB

Reference:

Dutiable Value PHP 1,159,771.42

Divide: Exchange Rate ÷ 50.25

Dutiable Value USD 23,080.03

Minus: Dutiable Freight 560.00

Dutiable Insurance - 120.00

Free on Board USD 22,400.03

Divide: Total Drums Imported ÷ 80

FOB per Drum USD 280.00

VIRTUE EXCELLENCE SERVICE

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

Sample Problem no. 2

Importation of 2x20’ STC; bolts and nuts from Japan with a total duties and taxes paid of PHP

352,147.924 Using 10% duty rate and PHP 50.00/USD exchange rate assess the following:

(1.) Customs Duty

(2.) Brokerage Fee

(3.) Total Miscellaneous Expenses

(4.) Value Added Tax

(5.) FOB (if the freight charges was USD 500.00 and no amount of insurance was provided)

VIRTUE EXCELLENCE SERVICE

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

Formula: Summary of Duties, Taxes & Other Collectible Charges

Customs Duty 0.10 (DV)

Plus: Value Added Tax 0.13215 (DV) 1,917.924

Import Processing Fee 1,000.00

Customs Documentary Stamps 280.00

Container Security Fee + 500.00

Total Amount Due to the Government 0.23215 (DV)+ 3,697.924

VIRTUE EXCELLENCE SERVICE

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

Formula: Taxable Value & Value Added Tax – via Sea Ports of Entry

(Formal Entry Consumption/Warehousing)

Reference:

TADTG PHP 352,147.924

Minus: - 3,697.924

PHP 348,450.00

Divide: ÷ 0.23215

Dutiable Value PHP 1,500,969.20

VIRTUE EXCELLENCE SERVICE

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

Formula: Dutiable Value

Reference:

Dutiable Value PHP 1,500,969.20

Multiply: Duty Rate x 0.10

Customs Duty per drum PHP 150,096.92

VIRTUE EXCELLENCE SERVICE

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

Reference:

Dutiable Value PHP 1,500,969.20

Multiply: x 0.00125

PHP 1,876.21

Plus: + 5,050.00

Brokerage Fee PHP 6,926.21

VIRTUE EXCELLENCE SERVICE

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

Reference:

Dutiable Value PHP 1,500,969.20

Multiply: x 0.00125

PHP 1,876.21

Plus: 6,330.00

8,614.00

+ 1,038.70

Miscellaneous Expenses PHP 17,858.91

VIRTUE EXCELLENCE SERVICE

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

Formula: Taxable Value & Value Added Tax – via Sea Ports of Entry

(Formal Entry Consumption/Warehousing)

Brokerage Fee 6,926.21

Plus: Arrastre Charges 8,614.00

Wharfage Dues 1,038.70

Customs Documentary Stamp 280.00

Import Processing Fee + 1,000.00

Miscellaneous Expenses 17,858.91

VIRTUE EXCELLENCE SERVICE

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

Formula: Taxable Value & Value Added Tax – via Sea Ports of Entry

(Formal Entry Consumption/Warehousing)

Dutiable Value 1,500,969.20

Plus: Customs Duty 150,096.92

Brokerage Fees 6,926.21

Arrastre Charges 8,614.00

Wharfage Dues 1,038.70

Customs Documentary Stamp 280.00

Import Processing Fee + 1,000.00

Landed Cost 1,668,925.03

Multiply: VAT Rate x 0.12

Value-Added Tax 200,271.00

VIRTUE EXCELLENCE SERVICE

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

Formula: Taxable Value & Value Added Tax – via Sea Ports of Entry

(Formal Entry Consumption/Warehousing)

Reference:

Dutiable Value PHP 1,500,969.20

Multiply: x 0.13215

PHP 198,353.08

Plus: + 1,917.924

Value Added Tax PHP 200,271.00

VIRTUE EXCELLENCE SERVICE

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

Formula: Taxable Value & Value Added Tax – via Sea Ports of Entry

(Formal Entry Consumption/Warehousing)

Reference:

Dutiable Value PHP 1,500,969.20

Plus: Customs Duty 150,096.92

Miscellaneous Expenses x 17,858.91

Landed Cost PHP 1,668,925.03

Multiply 0.12

Value Added Tax PHP 200,271.00

VIRTUE EXCELLENCE SERVICE

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

Formula: FOB

Reference:

Dutiable Value PHP 1,500,969.20

Divide: Exchange Rate ÷ 50.00

Dutiable Value USD 30,019.38

Minus: Dutiable Freight - 500.00

Cost and Insurance USD 29,519.38

Divide: ÷ 1.02

FOB USD 28,940.57

VIRTUE EXCELLENCE SERVICE

EMILIO AGUINALDO COLLEGE ISO 9001: 2015 CERTIFIED

QUALITY MANAGEMENT SYSTEM

City of Dasmariñas,Cavite

Sample Problem no. 3

An L/C importation of 2x40’ STC; plastic fittings from Japan with a total duties and taxes paid of

PHP 485,040.912 using 15% duty rate and PHP 50.00/USD exchange rate assess the

following:

(1.) Customs Duty

(2.) Brokerage Fee

(3.) Total Miscellaneous Expenses

(4.) Value Added Tax

(5.) FOB (if the freight charges was USD 620.00 and no amount of insurance was provided)

VIRTUE EXCELLENCE SERVICE

You might also like

- Midterm WarehousingDocument8 pagesMidterm WarehousingAngelo Ace M. MañalacNo ratings yet

- Computation Project in Tariff 5Document37 pagesComputation Project in Tariff 5Travis OpizNo ratings yet

- Harmonized System Code PDFDocument20 pagesHarmonized System Code PDFRiza MaeNo ratings yet

- BSCA Refresher Quiz 1Document23 pagesBSCA Refresher Quiz 1Jomar Catapang VitoNo ratings yet

- CLAP CUSTOMS REVIEW TARIFF CONVERSIONSDocument5 pagesCLAP CUSTOMS REVIEW TARIFF CONVERSIONSAngelica RoseNo ratings yet

- Cmta - Section 800Document15 pagesCmta - Section 800isabella fordNo ratings yet

- CAO 03 - 2019 Customs Jurisdiction and Exercise of Police AuthorityDocument50 pagesCAO 03 - 2019 Customs Jurisdiction and Exercise of Police Authorityrld LobianoNo ratings yet

- Customs Valuation System PrelimDocument26 pagesCustoms Valuation System Prelim2 BNo ratings yet

- Tariff Competency Exam - Post-Test 7Document4 pagesTariff Competency Exam - Post-Test 7Jimenez C. Shainah MarieNo ratings yet

- Elements of The Dutiable ValueDocument21 pagesElements of The Dutiable ValueJimmy Maban IINo ratings yet

- Section 400 418Document7 pagesSection 400 418Macy Andrade100% (1)

- Cases On Authority of BOC CASE DIGESTSDocument17 pagesCases On Authority of BOC CASE DIGESTSRhea Mae A. SibalaNo ratings yet

- Finals - Course Req in Tariff 5Document27 pagesFinals - Course Req in Tariff 5MarjorieNo ratings yet

- Customs warehouses and bonded facilitiesDocument2 pagesCustoms warehouses and bonded facilitiesAce ParkerNo ratings yet

- CDP LONG QUIZ EXAMDocument26 pagesCDP LONG QUIZ EXAMElaine Antonette RositaNo ratings yet

- Components of Dutiable ValueDocument25 pagesComponents of Dutiable ValueJemimah MalicsiNo ratings yet

- CBW (Wefz Midterms1)Document19 pagesCBW (Wefz Midterms1)Jay GalleroNo ratings yet

- Border Control and Security Finals (Reviewer)Document19 pagesBorder Control and Security Finals (Reviewer)Shaina DalidaNo ratings yet

- Draft PH Bureau of Customs Rules On Temporary Storage of GoodsDocument7 pagesDraft PH Bureau of Customs Rules On Temporary Storage of GoodsPortCalls100% (1)

- Title Iv Import Clearance and Formalities Goods DeclarationDocument42 pagesTitle Iv Import Clearance and Formalities Goods Declarationdennilyn recaldeNo ratings yet

- Cao 1-2009 - Revised Rules For The Estab. of CBWDocument10 pagesCao 1-2009 - Revised Rules For The Estab. of CBWBertGeronMindanao100% (3)

- 200 Problems For Alcohol ProductsDocument51 pages200 Problems For Alcohol ProductsGabriel CarumbaNo ratings yet

- Ra 9280Document7 pagesRa 9280Jay-arr ValdezNo ratings yet

- Tariff Case - 2 Cases 1.24.19 For WritinngDocument2 pagesTariff Case - 2 Cases 1.24.19 For WritinngAbby ReyesNo ratings yet

- E2m Import Assessment SystemDocument27 pagesE2m Import Assessment SystemCHLOJJ Trading100% (3)

- Schedule of Import Export Arrastre and Wharfage ChargesDocument1 pageSchedule of Import Export Arrastre and Wharfage Chargessieuihm67% (3)

- REVIEWER 5 Computation 2 1Document7 pagesREVIEWER 5 Computation 2 1Princess100% (1)

- Practical ComputationsDocument57 pagesPractical ComputationsFrancis Aragon Alterado100% (4)

- TCCP v. CMTADocument45 pagesTCCP v. CMTAIvan Luzuriaga50% (2)

- BERISO, Ella's Financial Status Analysis 2022Document8 pagesBERISO, Ella's Financial Status Analysis 2022kasandra dawn BerisoNo ratings yet

- PH Subsidies and Countervailing Duties ExplainedDocument29 pagesPH Subsidies and Countervailing Duties ExplainedErika LaguitanNo ratings yet

- Estimated Duties and Taxes PDFDocument1 pageEstimated Duties and Taxes PDFDianne Bernadeth Cos-agonNo ratings yet

- Ra 8752 Gr1 OutlineDocument5 pagesRa 8752 Gr1 OutlineIELTSNo ratings yet

- Module Customs Operations and Cargo HandlingDocument170 pagesModule Customs Operations and Cargo HandlingRosette RocoNo ratings yet

- 02 2017 Review TL INCOTERMS 2010 Concepts EXAM With ANSDocument36 pages02 2017 Review TL INCOTERMS 2010 Concepts EXAM With ANSKeziel Ray CejarNo ratings yet

- Manual On Cargo Clearance Process (E2m Customs Import Assessment System)Document43 pagesManual On Cargo Clearance Process (E2m Customs Import Assessment System)Musa Batugan Jr.100% (1)

- Port of ManilaDocument29 pagesPort of ManilaPrecious Mae Saguid Sager75% (4)

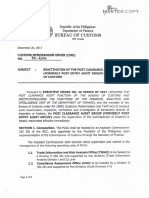

- BOC CMO 32-2017 Reactivation of The Post Clearance Audit Group of The Bureau of CustomsDocument3 pagesBOC CMO 32-2017 Reactivation of The Post Clearance Audit Group of The Bureau of CustomsPortCalls100% (2)

- Customs Valuation - Frequently Asked Questions PDFDocument23 pagesCustoms Valuation - Frequently Asked Questions PDFTravis Opiz50% (2)

- Post Clearance Audit QuizDocument10 pagesPost Clearance Audit QuizJeammuel ConopioNo ratings yet

- BOC Tax ComputationDocument2 pagesBOC Tax ComputationRom100% (1)

- Solution To Workshop No. 1Document10 pagesSolution To Workshop No. 1Bryan PazNo ratings yet

- Clearance Procedures for ImportsDocument36 pagesClearance Procedures for ImportsNina Bianca Espino100% (1)

- Customs WarehousingDocument21 pagesCustoms WarehousingCOLEEN AGODILLANo ratings yet

- Tariff Reform ProgramDocument5 pagesTariff Reform ProgramBro King Solomon0% (1)

- Tarrif Cases PhilippinesDocument12 pagesTarrif Cases PhilippinesGodofredo SabadoNo ratings yet

- Tariff and Customs Laws ReviewerDocument39 pagesTariff and Customs Laws ReviewerDessa Reyes100% (1)

- C U S T O M S: Boc Single Administrative DocumentDocument2 pagesC U S T O M S: Boc Single Administrative DocumentGwen CondezNo ratings yet

- Tax Quiz SolutionsDocument3 pagesTax Quiz SolutionsLora Mae JuanitoNo ratings yet

- Special Duties & Trade RemediesDocument21 pagesSpecial Duties & Trade RemediesAlyanna JoyceNo ratings yet

- Tax ComputationsDocument22 pagesTax ComputationsArmy KamiNo ratings yet

- Computation of Excise TaxDocument4 pagesComputation of Excise TaxMax IIINo ratings yet

- Cao 1-1990Document7 pagesCao 1-1990Elaine Villafuerte AchayNo ratings yet

- Documentary Stamp Tax GuideDocument9 pagesDocumentary Stamp Tax GuideQuinnee VallejosNo ratings yet

- Challenges customs brokers faced during the pandemicDocument2 pagesChallenges customs brokers faced during the pandemickatlicNo ratings yet

- Launch Jasper ReportDocument2 pagesLaunch Jasper ReportZelalem RegasaNo ratings yet

- Itemized Deduction Vs Optional Standard Deductions 40OSDDocument4 pagesItemized Deduction Vs Optional Standard Deductions 40OSDjason genitaNo ratings yet

- Company Income Statement Report and Analysis 2015-2014Document4 pagesCompany Income Statement Report and Analysis 2015-2014Charmaine ShaninaNo ratings yet

- Launch Jasper ReportDocument2 pagesLaunch Jasper Reportakmeljundi092No ratings yet

- Income StatementDocument1 pageIncome StatementLaila Mae PiloneoNo ratings yet

- Solvingpart 2Document4 pagesSolvingpart 22 BNo ratings yet

- AbstractT E M O RDocument3 pagesAbstractT E M O R2 BNo ratings yet

- CIC student survey on English communicationDocument4 pagesCIC student survey on English communication2 BNo ratings yet

- Customs Valuation System PrelimDocument26 pagesCustoms Valuation System Prelim2 BNo ratings yet

- Customs Valuation System PrelimDocument26 pagesCustoms Valuation System Prelim2 BNo ratings yet

- Learning Activity Sheet/Gawaing Pagkatuto Answer Sheet LESSON: - DATE STARTED: - DATE FINISHEDDocument3 pagesLearning Activity Sheet/Gawaing Pagkatuto Answer Sheet LESSON: - DATE STARTED: - DATE FINISHED2 BNo ratings yet

- CITIZEN CHARTER Latest With Revisions Services 2 3 6Document352 pagesCITIZEN CHARTER Latest With Revisions Services 2 3 62 BNo ratings yet

- AHTN2017Document4 pagesAHTN2017norwiNo ratings yet

- Learning Activity Sheet/Gawaing Pagkatuto Answer Sheet LESSON: - DATE STARTED: - DATE FINISHEDDocument3 pagesLearning Activity Sheet/Gawaing Pagkatuto Answer Sheet LESSON: - DATE STARTED: - DATE FINISHED2 BNo ratings yet

- IMPORT CLEARANCE OVERVIEWDocument1 pageIMPORT CLEARANCE OVERVIEWAnnabelle GuilingNo ratings yet

- CommissionersDocument1 pageCommissioners2 BNo ratings yet

- Bussiness Model Canvas Dian Paramita 2Document2 pagesBussiness Model Canvas Dian Paramita 2Muhammad RusyadiNo ratings yet

- Cost APProachDocument40 pagesCost APProachMANNAVAN.T.N100% (1)

- Working at Height PermitDocument1 pageWorking at Height PermitharikrishnaNo ratings yet

- Chapter 1: Purchasing and Supply Chain ManagementDocument23 pagesChapter 1: Purchasing and Supply Chain ManagementUyên DươngNo ratings yet

- (A) (B) (C) (D) (A) (B) (C) (D) (A) (B) (C) (D) (A) (B) (C) (D) (A) (B) (C) (D) (A) (B) (C) (D) (A) (B) (C) (D)Document46 pages(A) (B) (C) (D) (A) (B) (C) (D) (A) (B) (C) (D) (A) (B) (C) (D) (A) (B) (C) (D) (A) (B) (C) (D) (A) (B) (C) (D)Mạnh NgọcNo ratings yet

- Step 6 Prepare Technology NegotiationsDocument6 pagesStep 6 Prepare Technology NegotiationsjaviarangoNo ratings yet

- International Business and Trade GuideDocument9 pagesInternational Business and Trade GuideGilbert Ocampo100% (2)

- Latest Marketing CV Rishabh Jain-1Document1 pageLatest Marketing CV Rishabh Jain-1Shubham RaiNo ratings yet

- 1000 Stocks - 7b48eDocument3 pages1000 Stocks - 7b48eAshok DewanganNo ratings yet

- Food Quality FactorsDocument19 pagesFood Quality FactorsBubacarr Fatty100% (9)

- Far QuizDocument7 pagesFar QuizMeldred EcatNo ratings yet

- TaxReturn2022 1040Document10 pagesTaxReturn2022 1040Trish Hit100% (3)

- Income Taxation CHAPTER 6Document14 pagesIncome Taxation CHAPTER 6Mark67% (3)

- MIS Procter & Gamble Q2 AndQ3 by WatieDocument7 pagesMIS Procter & Gamble Q2 AndQ3 by WatieAtielia De SamsNo ratings yet

- CP1 Prelims 27 RetryDocument18 pagesCP1 Prelims 27 RetrySun Tea Seguin0% (2)

- Case 1.1 Ba-Zynga! Zynga Faces Trouble in Farmville FINAL 1-19-20Document3 pagesCase 1.1 Ba-Zynga! Zynga Faces Trouble in Farmville FINAL 1-19-20eamccuneNo ratings yet

- Rex S Reclaimers Entered Into A Contract With Dan S Demolition ToDocument1 pageRex S Reclaimers Entered Into A Contract With Dan S Demolition ToAmit PandeyNo ratings yet

- Dr. D. Y. Patil College of Agriculture Business Management, Akurdi, Pune-44 RAWE PROGAMME 2020-2021Document92 pagesDr. D. Y. Patil College of Agriculture Business Management, Akurdi, Pune-44 RAWE PROGAMME 2020-2021Yuvraj PatilNo ratings yet

- ASG - Amanat Shah Group NextrDocument7 pagesASG - Amanat Shah Group NextrshakibNo ratings yet

- SITRAIN Training Course FeesDocument2 pagesSITRAIN Training Course FeesSead ArifagićNo ratings yet

- NUTECH Company Profile FinalDocument33 pagesNUTECH Company Profile FinalMohd KashifNo ratings yet

- Artificial Intelligence Chatbot Adoption FrameworkDocument18 pagesArtificial Intelligence Chatbot Adoption FrameworksaraNo ratings yet

- Process Failure Modes and Effects AnalysisDocument20 pagesProcess Failure Modes and Effects AnalysisHemantNo ratings yet

- Prelims Reviewer Corpo Momo Eats Et - Al 1 1Document73 pagesPrelims Reviewer Corpo Momo Eats Et - Al 1 1Francois Amos PalomoNo ratings yet

- KYC InglesDocument2 pagesKYC InglesJakeNo ratings yet

- Contact Information Passenger Information Flight Ticket NumbersDocument1 pageContact Information Passenger Information Flight Ticket Numbersصالح قشوطNo ratings yet

- Walmart - Market Leader StrategiesDocument4 pagesWalmart - Market Leader Strategiesmurtaza mannanNo ratings yet

- Class 1 CDCS-TRANSPORT DOCUMENT ARTICLE 19-27Document28 pagesClass 1 CDCS-TRANSPORT DOCUMENT ARTICLE 19-27Bangladesh CanadaNo ratings yet

- An Analysis On Commodity Market With Special Reference To Gold 1Document15 pagesAn Analysis On Commodity Market With Special Reference To Gold 1Bala muruganNo ratings yet

- Ramos V Peralta DigestDocument1 pageRamos V Peralta DigestJermone MuaripNo ratings yet