Professional Documents

Culture Documents

Directors Assignment With Answers Batch 4

Uploaded by

Faihafarhan0 ratings0% found this document useful (0 votes)

8 views22 pagesOriginal Title

Directors_Assignment_with_answers__Batch_4_

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views22 pagesDirectors Assignment With Answers Batch 4

Uploaded by

FaihafarhanCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 22

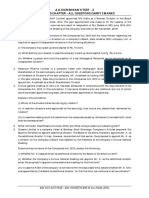

Date: 3rd November 2021

VIRTUAL COACHING CLASSES

ORGANISED BY BOS (ACADEMIC), ICAI

FINAL LEVEL

PAPER 4: CORPORATE AND ECONOMIC LAWS

Faculty: CA. S. SRIKANTH

© The Institute of Chartered Accountants of India

1. Which of the following is NOT a duty of a director?

a) To exercise his duties with due and reasonable care, skill and

diligence and to exercise independent judgment

b) Not to make any profit out of any contract entered into with the

company

c) To act in accordance with the articles of the company, subject to

the provisions of the Companies Act, 2013

d) Not to involve in a situation in which he may have a direct or

indirect interest that conflicts, or possibly may conflict, with the

interest of the company

3rd Nov 2021 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 2

Answer 1

b) Not to make any profit out of any contract

entered into with the company

3rd Nov 2021 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 3

2.The maximum number of directors of a Private

Company is

a) 2

b) 7

c) 15

d) 10

3rd Nov 2021 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 4

Answer 2

c) 15

3rd Nov 2021 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 5

3. Mango Foods Limited, an unlisted company provides the following details:

Equity Share Capital Rs. 9 crores

Preference Share Capital Rs. 21 crores

12% Debentures Rs. 10 crores

Turnover Rs. 250 crores

The company wishes to know if they are statutorily required to appoint a

Woman Director and Independent Directors.

Which of the following statements is true:

a) The company should appoint a woman director, but not independent directors

b) The company should appoint independent directors but not a woman director

c) The company should appoint both Independent Directors as well as a woman

director.

d) The company is not required to appoint a woman director as well as

independent directors

3rd Nov 2021 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 6

Answer 3

b) The company should appoint independent

directors but not a woman director

3rd Nov 2021 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 7

4. ABC limited wishes to appoint the following persons as directors of

the company. State which of the following persons would NOT be

disqualified under S. 164 of the Companies Act 2013 from being

appointed as a director of the company

a) Mr. Unfortunate who has applied to be adjudicated as an insolvent

b) Mr. Malicious who has been convicted for tax evasion and sentenced

to imprisonment in respect thereof for a period of two months

c) Mr. Crazy who stands declared by the competent court as of unsound

mind

d) Mr. Casual Approach who has failed to pay the call money on shares

held by him in ABC Limited within six months from the due date fixed

for payment of the call.

3rd Nov 2021 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 8

Answer 4

b) Mr. Malicious who has been convicted for tax

evasion and sentenced to imprisonment in

respect thereof for a period of two months

3rd Nov 2021 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 9

5. Which of the following category of directors can be removed by

the members under S. 169 of the Companies Act, 2013?

a) Directors appointed by the method of proportional representation

under S. 163 of the Companies Act, 2013.

b) Directors appointed by the Tribunal under S. 242 of the Companies

Act, 2013

c) Independent Directors

d) None of the above

3rd Nov 2021 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 10

Answer 5

c) Independent Directors

3rd Nov 2021 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 11

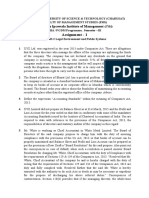

6. It is proposed to appoint Dr. Visesh Gupta as an independent director

on the board of Terminus Software Solutions Limited. Mr. Sailesh

Gupta, brother of Dr. Visesh Gupta is holding 5,00,000/- shares in the

company. The shares, currently trading on the NSE at Rs. 4,682/- per

share, are fully paid up and have a face value of Rs. 5/- each.

i. Can Mr. Visesh Gupta be appointed as an independent director on

the board of the company.

ii. In view of the immense knowledge of Mr. Visesh Gupta the

company is proposing to provide him with a fee based on profits in

as well as stock options. Is this permissible under the Companies

Act, 2013?

3rd Nov 2021 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 12

Answer 6

i. As the face value of the shares held by Mr. Sailesh Gupta is less

than rupees fifty lakhs, the exemption will apply. Therefore Dr.

Visesh Gupta can be appointed as an independent director of

Terminus Software Solutions Limited.

ii. Fee based on profits can be paid but stock options shall not be

provided.

3rd Nov 2021 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 13

7.Mr Gardhab was appointed by the board of directors of

Zootopia Industries Limited at the board meeting held on

15.10.2020. He resigned for personal reasons on

15.1.2021. The Board appointed Mr. Bandar on 2.2.2021

in the casual vacancy created by the resignation of Mr.

Gardhab. Is the appointment of Mr. Bandar valid?

3rd Nov 2021 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 14

Answer 7

Mr. Gardhab was appointed by the board and not

by the shareholders at general meeting. Therefore

the casual vacancy created by his resignation

cannot be filled under sec. 161 (4) by appointing

Mr. Bandar

3rd Nov 2021 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 15

8. Zootopia Industries Limited has 5500 small shareholders. 700 small

share holders have left their intention to appoint Ms. Khara Ghosh

to represent them. Mr. Akrosh Sinh, the Managing Director is of the

opinion that the appointment is not valid as it should have been

signed by not less than 1000 small shareholders. Is this view

correct.

Will your answer be different if you are informed that

i. Ms. Khara Ghosh is NOT holding any shares in Zootopia Industries

Limited?

ii. Ms. Khara Ghosh is already a small shareholders’ director in Jungli

Informatics Limited and Aranya Hotels Limited?

3rd Nov 2021 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 16

Answer 8

The view held by Mr. Sinh is incorrect because the proposal may be

signed by 1000 small shareholders or 1/10th of the total no. of small

shareholders whichever is lower. Therefore 700 shareholders is

sufficient as the number is more than 550 which is 1/10th of the total

no. of small shareholders.

i. A small shareholder director need not be small shareholder.

ii. A person shall hold the position of small shareholders’ director in

NOT more than two companies at the same time. Therefore, as Ms.

Ghosh is already small shareholders’ director in Jungli

InformaticsLimited and Aranya Hotels Limited she cannot br

appointed in Zootopia Industries Limited.

3rd Nov 2021 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 17

9. Ms. Khara Ghosh after attending the board meetings of Zootopia

Industries Limited finds the company is being seriously mismanaged

by Mr. Akrosh Sinh, the managing director, and his cronies on the

board. She objects to this vehemently but is not heeded. She,

therefore, sends her resignation in writing to the Board of the

company on 2.5.2021. On 15.7.2021, a penalty is levied on the

company and its directors under the Companies Act, 2013 for failure

to pay interim dividend announced on 21.5.2021. Comment

whether Ms. Khara Ghosh is liable for this penalty.

3rd Nov 2021 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 18

Answer 9

The resignation of Ms. Ghosh will take effect on

receipt by the company. Thereafter she is not

liable for any offences committed by the company.

Therefore, Ms. Khara Ghosh is NOT liable for the

penalty for non-payment of interim dividend

announced on 21.5.2021.

3rd Nov 2021 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 19

10.Mr. Neel Tendue, a director of Zootopia Industries

Limited was arrested for insider trading and sentenced

to imprisonment for three years on 15.5.2021. On

16.5.2021 he attended a board meeting of the

company and voted on certain resolutions. Explain the

legal consequences of Mr. Tendue’s actions under the

Companies Act, 2013.

3rd Nov 2021 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 20

Answer 10

A director shall automatically vacate office if he is convicted by a court

of any offence, whether involving moral turpitude or otherwise and

sentenced in respect thereof to imprisonment for not less than six

months. In the instant case Mr. Tendue has been sentenced to

imprisonment for three years. Therefore, he will automatically vacate

office on 15.5.2021. So attending the board meeting on 16.5.2021 is a

violation of law.

Mr. Tendue is liable to a penalty of not less than rupees one lakh

which may extend upto rupees five lakhs for functioning as a

director even when knowing that the office of director held by him

has become vacant on account of any of the disqualifications specified

in sec. 167 (1).

3rd Nov 2021 © THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA 21

THANK YOU

3rd Nov 2021 © THE

© THE INSTITUTE

INSTITUTE OF

OFCHARTERED

CHARTEREDACCOUNTANTS

ACCOUNTANTSOF

OFINDIA

INDIA 22

You might also like

- 18 Audit and Auditors 1657952321Document102 pages18 Audit and Auditors 1657952321Jayesh MPNo ratings yet

- P 13 2. Law Question Bank PDFDocument41 pagesP 13 2. Law Question Bank PDFColms JoseNo ratings yet

- 76925bos61942 6Document10 pages76925bos61942 6nerises364No ratings yet

- Sample TestDocument2 pagesSample TestSanpra AccsNo ratings yet

- Assignment - 1: Indukaka Ipcowala Institute of ManagementDocument7 pagesAssignment - 1: Indukaka Ipcowala Institute of ManagementhardikgosaiNo ratings yet

- Law Questions RTPDocument45 pagesLaw Questions RTPamrita tamangNo ratings yet

- Corporate Law Year Wise RTP Compilation 2016 Dec To 2021 Dec ExtractedDocument14 pagesCorporate Law Year Wise RTP Compilation 2016 Dec To 2021 Dec Extractedamrita tamangNo ratings yet

- Notice of AGM - Nanded City Development Construction Co. LTDDocument8 pagesNotice of AGM - Nanded City Development Construction Co. LTDajaymane2020No ratings yet

- Company Law - Test IVDocument5 pagesCompany Law - Test IVArundhati PawarNo ratings yet

- Corporate Law Year Wise RTP Compilation 2016 Dec To 2021 Dec ExtractedDocument11 pagesCorporate Law Year Wise RTP Compilation 2016 Dec To 2021 Dec Extractedamrita tamangNo ratings yet

- Date: January 20, 2021Document9 pagesDate: January 20, 2021wekepix890No ratings yet

- Penalty For Non-Appointment of Company Secretary: Cs Divesh GoyalDocument5 pagesPenalty For Non-Appointment of Company Secretary: Cs Divesh Goyalnishi ranjanNo ratings yet

- Mcq's MergedDocument720 pagesMcq's MergedPruthil MonpariyaNo ratings yet

- Bos 050121 Interp 2 CDocument155 pagesBos 050121 Interp 2 CRahul AgrawalNo ratings yet

- LAW Smart WorkDocument10 pagesLAW Smart WorkmaacmampadNo ratings yet

- Bos 50846 MCQP 4Document191 pagesBos 50846 MCQP 4priyankaNo ratings yet

- Bos 50846 MCQP 4Document190 pagesBos 50846 MCQP 4Reddy Sanjeev RkoNo ratings yet

- TigerDocument101 pagesTigerAmeya WartyNo ratings yet

- Dunlop India Limited 2012 PDFDocument10 pagesDunlop India Limited 2012 PDFdidwaniasNo ratings yet

- NK Academy For Ca: Revision Exam - 2Document5 pagesNK Academy For Ca: Revision Exam - 2S SNo ratings yet

- Icici Lombard: Atag148RDocument243 pagesIcici Lombard: Atag148RSagar DulgajNo ratings yet

- Paper 4 - LawDocument21 pagesPaper 4 - LawManish ChawlaNo ratings yet

- Annual Report - FY 2018-19Document17 pagesAnnual Report - FY 2018-19malepati prudhvirajNo ratings yet

- Riddhi Siddhi Annual Report 2023Document166 pagesRiddhi Siddhi Annual Report 2023MY SUPPORTNo ratings yet

- Ar 2018Document96 pagesAr 2018KCNo ratings yet

- 137595Document106 pages137595haya.noor11200No ratings yet

- Paper - 2: Corporate & Other Laws: © The Institute of Chartered Accountants of IndiaDocument15 pagesPaper - 2: Corporate & Other Laws: © The Institute of Chartered Accountants of IndiaKetan DedhaNo ratings yet

- Jaimni Astrology A Case Study of A Systems Analyst Chara DashaDocument138 pagesJaimni Astrology A Case Study of A Systems Analyst Chara DashaPoonam AggarwalNo ratings yet

- Annual Report 2019-20Document96 pagesAnnual Report 2019-20Gaurav GhareNo ratings yet

- Accounts of CompaniesDocument6 pagesAccounts of CompaniesIndhuja MNo ratings yet

- 78338bos62701 10Document10 pages78338bos62701 10nerises364No ratings yet

- A Internship Report ON For The Award of Bachelor of Business Administration (BBA)Document9 pagesA Internship Report ON For The Award of Bachelor of Business Administration (BBA)Akash RajputNo ratings yet

- April, 2019 - Company LawDocument10 pagesApril, 2019 - Company LawHarshvardhan MelantaNo ratings yet

- Imp Question ListDocument18 pagesImp Question Listvganatra273No ratings yet

- VCC CA Inter Paper2 ch1 Company Law 2nd July 2020 SonaliShahDocument64 pagesVCC CA Inter Paper2 ch1 Company Law 2nd July 2020 SonaliShahpah studNo ratings yet

- 25 Annual ReportDocument56 pages25 Annual ReportMrudula SurveNo ratings yet

- Bos 25517 CP 1Document5 pagesBos 25517 CP 1Utkarsh NolkhaNo ratings yet

- Gici Agm NoticeDocument13 pagesGici Agm NoticeSivaKumarNo ratings yet

- CMBL Annual ReportDocument95 pagesCMBL Annual ReportSundararaghavan RNo ratings yet

- Company Law Ii Midterm NotesDocument17 pagesCompany Law Ii Midterm NotesKumar PrabhakarNo ratings yet

- P13 Corporate Laws ComplianceDocument3 pagesP13 Corporate Laws Compliancekiran babuNo ratings yet

- Annual Report 2012 13Document40 pagesAnnual Report 2012 13Ketan HingarNo ratings yet

- Sunrise Efficient Marketing LimitedDocument83 pagesSunrise Efficient Marketing Limitedanady135344No ratings yet

- September, 2021 - Corporate LawsDocument11 pagesSeptember, 2021 - Corporate LawsHarshvardhan MelantaNo ratings yet

- Important Question by Shantanu & Tanya Academy: Company LAW Important Questions FOR December 2021Document7 pagesImportant Question by Shantanu & Tanya Academy: Company LAW Important Questions FOR December 2021punugauriNo ratings yet

- Ethics Group-Assignment HavellsDocument22 pagesEthics Group-Assignment HavellsNikhil KochrekarNo ratings yet

- Annual Report 2021Document36 pagesAnnual Report 2021anushaNo ratings yet

- SBILLDocument5 pagesSBILLSrishti 2k22No ratings yet

- Plot No. C/L, G Block: India LTDDocument513 pagesPlot No. C/L, G Block: India LTDqwertNo ratings yet

- November, 2016 - Company LawDocument12 pagesNovember, 2016 - Company LawHarshvardhan MelantaNo ratings yet

- The Business Plan: Submitted By: Submitted To: Rohit Bisht Mr. Sandeep Bisht 20551359Document28 pagesThe Business Plan: Submitted By: Submitted To: Rohit Bisht Mr. Sandeep Bisht 20551359rohit bishtNo ratings yet

- India Entry For SMEDocument4 pagesIndia Entry For SMEGaurav VashisthaNo ratings yet

- ResultDocument20 pagesResultPayal JainNo ratings yet

- Order in The Matter of Sai Prasad Properties LimitedDocument25 pagesOrder in The Matter of Sai Prasad Properties LimitedShyam SunderNo ratings yet

- BSE Limited National Stock Exchange Oflndia Limited: 'AnnexureDocument11 pagesBSE Limited National Stock Exchange Oflndia Limited: 'AnnexurePrasadNo ratings yet

- 23Rd Annual Report 2014-2015: Hindustan Bio Sciences LimitedDocument52 pages23Rd Annual Report 2014-2015: Hindustan Bio Sciences LimitedMrudula SurveNo ratings yet

- MMPL Annual Report 2016-17Document101 pagesMMPL Annual Report 2016-17xyzNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Criminal Law. L.b.reyesDocument8 pagesCriminal Law. L.b.reyeserikha_araneta100% (1)

- Ebecryl-4175 en A4Document1 pageEbecryl-4175 en A4I Love MusicNo ratings yet

- Case 20Document6 pagesCase 20Chelle Rico Fernandez BONo ratings yet

- God Sees The Truth But Waits Leo Tolstoy AnalysisDocument3 pagesGod Sees The Truth But Waits Leo Tolstoy AnalysisKeithNo ratings yet

- PeopleSoft Procure To Pay CycleDocument9 pagesPeopleSoft Procure To Pay Cyclejaish2No ratings yet

- The Autonomy Myth. A Theory of Dependency (Martha Fineman)Document426 pagesThe Autonomy Myth. A Theory of Dependency (Martha Fineman)Patrícia CiríacoNo ratings yet

- Editorial by Vishal Sir: Click Here For Today's Video Basic To High English Click HereDocument22 pagesEditorial by Vishal Sir: Click Here For Today's Video Basic To High English Click Herekrishna nishadNo ratings yet

- Gmail - Bus Ticket - Sagar To Bhopal On Wed, 18 Dec 2019 and Rate Your ExperienceDocument3 pagesGmail - Bus Ticket - Sagar To Bhopal On Wed, 18 Dec 2019 and Rate Your ExperienceShivamSrivastavaNo ratings yet

- YehDocument3 pagesYehDeneree Joi EscotoNo ratings yet

- Week 9 11 Intro To WorldDocument15 pagesWeek 9 11 Intro To WorldDrea TheanaNo ratings yet

- In Modern BondageDocument221 pagesIn Modern BondageetishomeNo ratings yet

- List of CrimesDocument10 pagesList of CrimesTiofilo VillanuevaNo ratings yet

- Posting and Preparation of Trial Balance 1Document33 pagesPosting and Preparation of Trial Balance 1iTs jEnInONo ratings yet

- Powerpoint For Chapter Four of Our Sacraments CourseDocument23 pagesPowerpoint For Chapter Four of Our Sacraments Courseapi-344737350No ratings yet

- Level 2 Repair: 7-1. Components On The Rear CaseDocument9 pagesLevel 2 Repair: 7-1. Components On The Rear CaseVietmobile PageNo ratings yet

- Ioana Ramona JurcaDocument1 pageIoana Ramona JurcaDaia SorinNo ratings yet

- Marijuana Prohibition FactsDocument5 pagesMarijuana Prohibition FactsMPPNo ratings yet

- About Dhanalaxmi Bank KarthikDocument4 pagesAbout Dhanalaxmi Bank KarthikYkartheek GupthaNo ratings yet

- Good MoralDocument8 pagesGood MoralMary Grace LemonNo ratings yet

- Acko Insurance Copy - PDF - Insurance Policy - InsuranceDocument5 pagesAcko Insurance Copy - PDF - Insurance Policy - InsuranceMalaya Ranjan SahuNo ratings yet

- Panay Autobus v. Public Service Commission (1933)Document2 pagesPanay Autobus v. Public Service Commission (1933)xxxaaxxxNo ratings yet

- Tutorial 1Document2 pagesTutorial 1Netra PujarNo ratings yet

- Dawes and Homestead Act Webquest 2017Document4 pagesDawes and Homestead Act Webquest 2017api-262890296No ratings yet

- Sample Affidavit of Loss of A DiplomaDocument1 pageSample Affidavit of Loss of A DiplomaDina Pasion92% (13)

- IVS 2017 & Valuation For Secured LendingDocument53 pagesIVS 2017 & Valuation For Secured LendingRanganathan Krishnan0% (1)

- Chap 013Document19 pagesChap 013Xeniya Morozova Kurmayeva100% (1)

- 15.05.2023-123m-Swift Gpi-Gts Gmbh-Harvest Profit - 230628 - 153120Document3 pages15.05.2023-123m-Swift Gpi-Gts Gmbh-Harvest Profit - 230628 - 153120MSFT2022100% (1)

- Thieves' World Murder at The Vulgar Unicorn (d20)Document81 pagesThieves' World Murder at The Vulgar Unicorn (d20)Red Stone100% (4)

- COMMERCE MCQs WITH ANSWERS by Usman GhaniDocument7 pagesCOMMERCE MCQs WITH ANSWERS by Usman GhaniMuhammad Irfan haiderNo ratings yet

- Vitanzos April Mae E. Long Quiz ApDocument5 pagesVitanzos April Mae E. Long Quiz ApMitch MinglanaNo ratings yet