Professional Documents

Culture Documents

COMP

Uploaded by

Sairishi GhoshCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

COMP

Uploaded by

Sairishi GhoshCopyright:

Available Formats

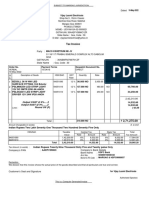

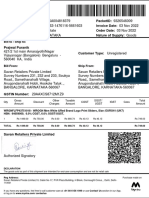

SASWATA GHOSH

Name of Assessee : SASWATA GHOSH

Father's Name : SUNIL KUMAR GHOSH

Address : 33B, M. G. ROAD, HARIDEVPUR

TALLYGUNG KOLKATA-700082

Date of Birth : 20-08-1984 Status : Individual

Permanent Account No. : AHDPG1551A Previous Year ended on : 31-03-2021

Ward/Circle/Range : Ward 53(1) KOL Assessment Year : 2021-22

Return Filing Due Date : 31-12-2021 Aadhar No. : 597628137939

Mobile No. : 9804272897

COMPUTATION OF INCOME

Profits and Gains of Business or Profession

Elegible business u/s 44AD

INCOME FROM BUSINESS

Turnover/Receipt @ 8 7950000.00

Deemed Profit 636000.00 636000.00

Income from Other Sources

Interest

Bank Interest F/D INTEREST 196943.00

Saving Bank Interest SAVINGS BANK INTEREST 17180.00

Other Interest IT REFUND INTEREST 534.00 214657.00

Others

INCOME FROM DIVIDEND 12940.00 227597.00

Gross Total Income 863597.00

Deductions Chapter VIA

80C

Life Insurance Premium 150000.00 150000.00

80TTA

Intt from SAVINGS BANK INTEREST 17180.00 10000.00 160000.00

Total Income 703597.00

Rounded off as per section 288A 703600.00

Tax on Above 53220.00

Add : Education Cess 2129.00

55349.00

Add : Interest

U/s 234 A 1254.00

U/s 234 B 5016.00

U/s 234 C 418.00 6688.00

Add : Penalty for Late Filing 5000.00

Net Tax 67037.00

Tax Paid 13463.00

Payable 53570.00

An MDA Software Page 1 of 2

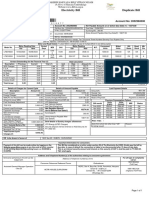

TDS On

S.No. Deducted By TAN Amount Date

1 INDIAN OIL CORPORATION LIMITED MUMI15947B 531.00 31/03/2021

2 BANK OF BARODA VASAI WEST BRANCH MUMB19696F 12932.00 31/03/2021

Total : 13463.00

Grand Total : 13463.00

Details of all banks accounts held in India at any time during the previous year (excluding dormat accounts)

S. No. IFS CODE OF NAME OF THE BANK ACCOUNT NUMBER (of 9 (tick one account

THE BANK digits or more as per CBS for refund)

system of the bank)

1. HDFC0001927 HDFC BANK 19271000006518 ü

Tax Comparison Between New and Old Regime of Taxation

Old Regime New Regime

Net Income : 703600.00

Adj. u/s 115BAC :

Standard Deduction : 0.00

Entertainment Allowance : 0.00

Professional Tax : 0.00

Other Salary Exemption : 0.00

House Property Loss : 0.00

Family Pension Exemption : 0.00

B/f Losses Setoff ag. House Property Income : 0.00

Deduction u/c VIA : 160000.00

Income Tax : 53220.00 54540.00

SASWATA GHOSH

An MDA Software Page 2 of 2

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- ITR filing of Santosh Kumar SinghDocument2 pagesITR filing of Santosh Kumar SinghAnkit KumarNo ratings yet

- Usha Com PDFDocument2 pagesUsha Com PDFMukesh MishraNo ratings yet

- Ramesh ComputationDocument2 pagesRamesh ComputationRambabu guptaNo ratings yet

- 99018037_MAR_2023Document1 page99018037_MAR_2023gaurav sharmaNo ratings yet

- Hansa Polymer's Bal 23-24Document1 pageHansa Polymer's Bal 23-24ppsindNo ratings yet

- Adobe Scan Feb 11, 2024Document20 pagesAdobe Scan Feb 11, 2024DEVIL RDXNo ratings yet

- Employee DataDocument1 pageEmployee DataSubhankar DasNo ratings yet

- 99018037_APR_2023Document1 page99018037_APR_2023gaurav sharmaNo ratings yet

- Infogain Solutions settlement statement summaryDocument1 pageInfogain Solutions settlement statement summaryArmaanNo ratings yet

- Kirandeep August SalaryDocument1 pageKirandeep August Salaryprince.gill07No ratings yet

- SMS0928 - 31 12 2022Document1 pageSMS0928 - 31 12 2022UTF RecordsNo ratings yet

- Kirandeep September SalaryDocument1 pageKirandeep September Salaryprince.gill07No ratings yet

- NIRMAL TODI'S TAX RETURNDocument24 pagesNIRMAL TODI'S TAX RETURNSujan TripathiNo ratings yet

- Pricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementDocument15 pagesPricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementRajat SinghNo ratings yet

- Payslip 102703 202303 PDFDocument1 pagePayslip 102703 202303 PDFAnagha AnuNo ratings yet

- Payslip Sep 2022Document1 pagePayslip Sep 2022GloryNo ratings yet

- SettlementReportDocument1 pageSettlementReportSarath KumarNo ratings yet

- SalarySlipwithTaxDetails 2021 MayDocument1 pageSalarySlipwithTaxDetails 2021 MaySameer KulkarniNo ratings yet

- UntitledDocument1 pageUntitleddefxsoulNo ratings yet

- CG JUL 2023 46237545 PayslipDocument1 pageCG JUL 2023 46237545 Payslipsubalsahoo2018No ratings yet

- Dec 2022Document1 pageDec 2022n1234567890987654321No ratings yet

- Chola Business Services Pay SlipDocument3 pagesChola Business Services Pay SlipsathyaNo ratings yet

- Computation Anita SareeDocument3 pagesComputation Anita SareeSURYAKANT PATHAKNo ratings yet

- SalaryDocument1 pageSalarypankajNo ratings yet

- Earnings Deductions: B9 Beverages LimitedDocument1 pageEarnings Deductions: B9 Beverages LimitedStark Satindra SunnyNo ratings yet

- CG AUG 2023 46237545 PayslipDocument1 pageCG AUG 2023 46237545 Payslipsubalsahoo2018No ratings yet

- Grofers India PVT LTD: Payslip For The Month of APRIL 2021Document1 pageGrofers India PVT LTD: Payslip For The Month of APRIL 2021Anirban GhoshNo ratings yet

- Anup Umbarkar 2019Document7 pagesAnup Umbarkar 2019Ramu TangiralaNo ratings yet

- March 2024Document1 pageMarch 2024irshadahmed563No ratings yet

- Jagan Mohan Absli Payslip AprilDocument1 pageJagan Mohan Absli Payslip AprilSurya GodasuNo ratings yet

- Sag ComDocument2 pagesSag ComNitish SinghNo ratings yet

- 1 PDFDocument1 page1 PDFpahalNo ratings yet

- Apr 23Document1 pageApr 23Amit ShindeNo ratings yet

- Salary SlipDocument2 pagesSalary Slipprnali.vflNo ratings yet

- Payslip 147988 202311-10Document1 pagePayslip 147988 202311-10SUNKARA ISNo ratings yet

- DHBVNDocument1 pageDHBVNGaurav BediNo ratings yet

- RPTCONSBLDocument1 pageRPTCONSBLshayaltanisha198No ratings yet

- Computation 2022-23Document2 pagesComputation 2022-23DKINGNo ratings yet

- 20200731-0100003503-SMMG-Mall-CULLINAN GROUP INCDocument4 pages20200731-0100003503-SMMG-Mall-CULLINAN GROUP INCEdjon AndalNo ratings yet

- FormDocument1 pageFormKANHAIYA KUMARNo ratings yet

- Payslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)SK TECH TRICKSNo ratings yet

- (As Per Annexure: A) (As Per Annexure: D)Document9 pages(As Per Annexure: A) (As Per Annexure: D)Gurpreet KaurNo ratings yet

- S.Samanta & Co.: (Chartered Accountants)Document2 pagesS.Samanta & Co.: (Chartered Accountants)Samrat MajumderNo ratings yet

- Payslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, GurugramDocument1 pagePayslip For The Month of Jan 2024: 6th Floor, Garage Society, BPTP Centra One, Sector-61, Gurugramps384077No ratings yet

- Computation 23-24 Buta Singh.Document2 pagesComputation 23-24 Buta Singh.Sharn RamgarhiaNo ratings yet

- Geojit Financial Services Pay SlipDocument1 pageGeojit Financial Services Pay Slipsanjit deyNo ratings yet

- Tax Invoice: Order No. Payment Terms Delivery Note Despatch Document NoDocument1 pageTax Invoice: Order No. Payment Terms Delivery Note Despatch Document NoNarayan Kumar GoaNo ratings yet

- Electricity Bill Duplicate Bill: Account No: 6670250000Document1 pageElectricity Bill Duplicate Bill: Account No: 6670250000RohitNo ratings yet

- Dharmbir Computation 22-23 (1) - 1Document2 pagesDharmbir Computation 22-23 (1) - 1Ashish SehrawatNo ratings yet

- EPF Universal Account Number: LIC ID / Policy IDDocument2 pagesEPF Universal Account Number: LIC ID / Policy IDBiswajit DasNo ratings yet

- View-Bill June 2023Document1 pageView-Bill June 2023Satish TejankarNo ratings yet

- DellDocument1 pageDellNaresh Kumar Yadav (nari)No ratings yet

- 00331686_SalarySlipwithTaxDetails (10)Document1 page00331686_SalarySlipwithTaxDetails (10)Nilesh GopnarayanNo ratings yet

- 4 MergedDocument12 pages4 MergedPonugoti Pavan kumarNo ratings yet

- Fiserv December SalaryDocument1 pageFiserv December SalarySiddharthNo ratings yet

- Electricity Bill House No 113 Sector 38Document2 pagesElectricity Bill House No 113 Sector 38pawan singhalNo ratings yet

- PDF - 14-12-22 10-24-17 PDFDocument2 pagesPDF - 14-12-22 10-24-17 PDFGourav sheelNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- New Doc 20 MarDocument1 pageNew Doc 20 MarSairishi GhoshNo ratings yet

- Interim Inpatient Bill (Summary)Document2 pagesInterim Inpatient Bill (Summary)Sairishi GhoshNo ratings yet

- Funds Transfer to Other Bank (NEFTDocument2 pagesFunds Transfer to Other Bank (NEFTSairishi GhoshNo ratings yet

- Stock InventoryDocument1 pageStock InventorySairishi GhoshNo ratings yet

- Interim Inpatient Bill (Summary) : SL - No. Amount (RS) Service Name Company Amt Patient AmtDocument1 pageInterim Inpatient Bill (Summary) : SL - No. Amount (RS) Service Name Company Amt Patient AmtSairishi GhoshNo ratings yet

- Interim Inpatient Bill (Summary)Document2 pagesInterim Inpatient Bill (Summary)Sairishi GhoshNo ratings yet

- Logcat 1682530938550Document1 pageLogcat 1682530938550Sairishi GhoshNo ratings yet

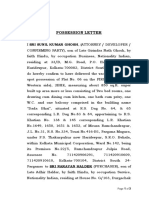

- Letter of FlatDocument3 pagesLetter of FlatSairishi GhoshNo ratings yet

- Log File Monitoring and Time TrackingDocument1 pageLog File Monitoring and Time TrackingSairishi GhoshNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountPrajwal PuranikNo ratings yet

- At 3Document2 pagesAt 3annnoyynnmussNo ratings yet

- BM1 QuizDocument2 pagesBM1 QuizRianna CclNo ratings yet

- Ethiopia D3S4 Income TaxesDocument81 pagesEthiopia D3S4 Income TaxesyididiyayibNo ratings yet

- Karnataka Co-Operative Milk Producers Federation Limited - India Ratings and ResearchDocument11 pagesKarnataka Co-Operative Milk Producers Federation Limited - India Ratings and ResearchDebabrata SahanaNo ratings yet

- Jun 2023 110874Document1 pageJun 2023 110874augus1982No ratings yet

- Income Taxation ReviewerDocument9 pagesIncome Taxation ReviewerAira MabezaNo ratings yet

- CPA UGANDA PAPER 11 TAXATION November 20Document4 pagesCPA UGANDA PAPER 11 TAXATION November 20agaba fredNo ratings yet

- Calculating Deferred Tax for Permai BhdDocument3 pagesCalculating Deferred Tax for Permai Bhddini sofiaNo ratings yet

- Reaction Paper - Philippine Debt ManagementDocument1 pageReaction Paper - Philippine Debt ManagementMiah MensuradoNo ratings yet

- 1proceedings EKCC DEC 2018 PDFDocument696 pages1proceedings EKCC DEC 2018 PDFVeronica BulatNo ratings yet

- Accounting For Withholding Taxes in The PhilippinesDocument3 pagesAccounting For Withholding Taxes in The PhilippinesRollie ConteNo ratings yet

- TwillsPrivilege Receipt 123428636344Document2 pagesTwillsPrivilege Receipt 123428636344Babu Nuvu evaruNo ratings yet

- (Digest) CIR v. AlgueDocument2 pages(Digest) CIR v. AlgueHomer SimpsonNo ratings yet

- Cus Cir-7Document7 pagesCus Cir-7satya narayan kumarNo ratings yet

- Income Tax On SalaryDocument23 pagesIncome Tax On SalarySarvesh MishraNo ratings yet

- Second Statement: For The Purpose of Donor's Tax, A Stranger Is A Person Who Is Not ADocument2 pagesSecond Statement: For The Purpose of Donor's Tax, A Stranger Is A Person Who Is Not AAllen KateNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearParth GamiNo ratings yet

- Lipc C250872923Document1 pageLipc C250872923Vineet HegdeNo ratings yet

- 121719-2006-Pansacola v. Commissioner of Internal Revenue20190605-5466-1nfbihwDocument7 pages121719-2006-Pansacola v. Commissioner of Internal Revenue20190605-5466-1nfbihwJose Antonio BarrosoNo ratings yet

- Federal Electronic Filing Instructions: Tax Year 2018Document13 pagesFederal Electronic Filing Instructions: Tax Year 2018Adonis TorrefielNo ratings yet

- New York Corporation Tax ReturnDocument4 pagesNew York Corporation Tax Returnbshahn1189No ratings yet

- CE Luzon Geothermal Power Company vs. BIR on unutilized input VAT refundDocument11 pagesCE Luzon Geothermal Power Company vs. BIR on unutilized input VAT refundJaysonNo ratings yet

- 7 Dr. Dineros - PhilHealth CHO MHODocument15 pages7 Dr. Dineros - PhilHealth CHO MHOKristel Joy Verzon-BunaganNo ratings yet

- TaxReturn2022 1040Document10 pagesTaxReturn2022 1040Trish Hit100% (3)

- Canadian Taxation Notes 1Document21 pagesCanadian Taxation Notes 1spiotrowskiNo ratings yet

- It Computation Sheet Fy 2020-21 - LopamudraDocument3 pagesIt Computation Sheet Fy 2020-21 - LopamudraGirija Prasad SwainNo ratings yet

- Income Statement - FacebookDocument6 pagesIncome Statement - FacebookFábia RodriguesNo ratings yet

- Corporate Tax Planning: Tax Evasion and AvoidanceDocument8 pagesCorporate Tax Planning: Tax Evasion and AvoidanceShainaNo ratings yet