Professional Documents

Culture Documents

Deluded1 - Fin 531 Corporate Finance - BW PDF

Uploaded by

Zulfiana SetyaningsihOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Deluded1 - Fin 531 Corporate Finance - BW PDF

Uploaded by

Zulfiana SetyaningsihCopyright:

Available Formats

FIN 531 Corporate Finance Cheat Sheet

by deluded1 via cheatography.com/42545/cs/12802/

Calculating Portfolio Risk Internal rate of return | IRR (cont) Present Value of a Growing Perpetuity

σ2=Wa 2 σa2+Wb 2 σb2+2(Wa Wb Pitfall 3 = Mutually exclusive projects- IRR PV = CF1 / r - g r > g

Cor σaσb) sometimes ignores magnitude of a project

Bond Valuation

σx=standard σ2= variance of portfolio Pitfall 4 – What Happens When There is More

than One Opportunity Cost of Capital PV=C1/(1+r)1+C2/(1+r)2...+(Par+Cn)/(1+r)n

deviation

Wx = weight of Covariance of stocks = Duration = [1xPV (c1)]/PV+[2xPV (c2)]/

Term Structure Assumption

stock in portfolio correlation *σa*σb PV...+(TxPV(CT)]/PV

We assume that discount rates are stable

σ = risk of an individual stock during the term of the project. Modified Duration = volatitliy

This assumption implies that all funds are (%)=duration/(1+yield)

ß = Market risk

reinvested at the IRR.

If you need to find out the standard deviation, This is a false assumption. DPS Calculation

take the square root of the answer. Variance,

leave it squared. D0=1.50

Efficient Frontier

D1=1.50(1.07)

D2=1.50(1.07)2

Book Rate of Return

D3=1.50(1.07)3

Book Rate of Book income/book D4=1.50(1.07) 3(1.05)

Return= assets

D5=1.50(1.07) 3(1.05)2

Payback & Discounted Payback Period

Sharpe Ratio = (r-rf)/(σ)

Payback = # of years to payback investment

Risk premium r-rf

(no NPV adjustment)

Standard Deviation σ

Discounted = # of years to payback investment

Covariance of multiple stocks

NPV adjustment) Ratio of risk premium to standard deviation.

With 100 securities, the box is 100 by 100.The Measures risk-adjusted performance of

NPV= C0+

variance terms are the diagonal terms, and thus investment managers

(C1/(1+r 1))+(C2 /(1+r 2))..............

there are 100 variance terms. The rest are the

(Ct/(1+r t)) covariance terms. Because the box has(100 × SML

100) terms altogether, the number of

Non-constant growth valuation stock covariance terms is:Number of covariance

terms = 1002– 100 = 9,900Half of these terms

G1= 20% for 2 years; G2=5% for rest of time

(i.e., 4,950) are different.

D0=1.25

bWith 50 stocks, all with the same standard

D1=1.25(1.20) = 1.50

deviation (.30), the same weight in the portfolio

D2=1.25(1.20) 2=1.80

(.02), and all pairs having the same correlation

D3=1.25(1.20) 2(1.05) =1.89

coefficient (.40), the portfolio variance is

D4=1.25(1.20) 2(1.05)2=1.98 :σ2= 50(.02)2(.30)2+ [(50)2– 50](.02)2(.40)

(.30)2= .03708σ = .193, or 19.3% The Y-intercept of the SML is equal to the risk-

Internal rate of return | IRR c.For a fully diversified portfolio, portfolio free interest rate. The slope of the SML is equal

variance equals the average covariance:σ2= to the market risk premium and reflects the risk

NPV must =0 to calculate

(.30)(.30)(.40) = .036σ = .190, or 19.0% return trade off at a given time.

NPV=C0 +C 1/(1+IRR)1+C2/(1+IRR) 2=0 where:

Must use Excel to calculate

E(Ri) is an expected return on security

Pitfall 1 = Lending or borrowing? E(RM) is an expected return on market

Pitfall 2 = Multiple rates of return (when cash portfolio M

goes from + to -) β is a nondiversifiable or systematic risk

RM is a market rate of return

Rf is a risk-free rate

By deluded1 Published 3rd October, 2017. Sponsored by ApolloPad.com

cheatography.com/deluded1/ Last updated 3rd October, 2017. Everyone has a novel in them. Finish Yours!

Page 1 of 2. https://apollopad.com

FIN 531 Corporate Finance Cheat Sheet

by deluded1 via cheatography.com/42545/cs/12802/

Efficient Frontier Profitability Index

The efficient frontier is the set of optimal PI = NPV/Investment

portfolios that offers the highest expected return

Another Example - continued

for a defined level of risk or the lowest risk for a

Proj NPV Investment PI

given level of expected return. Portfolios that lie

A 230,000 200,000 1.15

below the efficient frontier are sub-optimal,

B 141,250 125,000 1.13

because they do not provide enough return for

C 194,250 175,000 1.11

the level of risk.

D 162,000 150,000 1.08

Stock Returns

Select projects with highest Weighted Avg PI

R=(Pt+1-Pt+D)/(Pt) WAPI (BD) = 1.13(125) + 1.08(150) + 0.0 (25)

(300) (300) (300)

R= Return

= 1.01

Pt= Stock Price @ time

D= Dividend Captal Rationing

Capital Rationing - Limit set on the amount of

CAPM = Capital Asset Pricing Model funds available for investment.

Soft Rationing - Limits on available funds

ri=rf +ß(rm-rf) ß=Beta

imposed by management.

rf= risk free rate rm = market rate Hard Rationing - Limits on available funds

imposed by the unavailability of funds in the

i = investment E(r) = expected return

capital market.

Expected risk beta x expected risk

premium on stock= premium on market

Market Risk premium

r-rf=ß(rm-rf)

=rm-rf

Beta is the extent to which a stock moves with

the market. CAPM says that the higher the For any investment, we can find the

Beta, the higher the risk opportunity cost of capital using the security

market line. With = 0.8, the opportunity cost of

capital is:

Market Efficiency

r = rf + B(rm – rf)

1.) Weak = Market reflects past info r = 0.04 + [0.8 B (0.12 – 0.04)] = 0.104 =

2.) Semi-Strong = Past & Current public info is 10.4%

reflected

The opportunity cost of capital is 10.4% and

3.) All information is reflected in the stock price

the investment is expected to earn 9.8%.

(public & private)

Therefore, the investment has a negative NPV.

Efficient Market - Market in which information is

reflected in stock prices quickly + correctly If return is 11.2% What is Beta?

r = rf + (rm – rf)

0.112 = 0.04 + (0.12 – 0.04) = 0.9

By deluded1 Published 3rd October, 2017. Sponsored by ApolloPad.com

cheatography.com/deluded1/ Last updated 3rd October, 2017. Everyone has a novel in them. Finish Yours!

Page 2 of 2. https://apollopad.com

You might also like

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Corporate Finance Cheat SheetDocument2 pagesCorporate Finance Cheat SheetMinyu LvNo ratings yet

- The FRM Part I: Formula Guide: Value and Risk ModelsDocument10 pagesThe FRM Part I: Formula Guide: Value and Risk ModelsJavneet KaurNo ratings yet

- 2022 Level I Key Facts and Formulas SheetDocument13 pages2022 Level I Key Facts and Formulas Sheetayesha ansari100% (2)

- 7 Dividend Valuation ModelDocument11 pages7 Dividend Valuation ModelDayaan ANo ratings yet

- Exam Cheat Sheet VSJDocument3 pagesExam Cheat Sheet VSJMinh ANhNo ratings yet

- CH 7 Efficient Diversification (Part 1) (W2024)Document38 pagesCH 7 Efficient Diversification (Part 1) (W2024)Graeme WilhelmNo ratings yet

- Question No 1 Answer: Madiha Baqai (12258) BbahDocument8 pagesQuestion No 1 Answer: Madiha Baqai (12258) BbahMadiha Baqai EntertainmentNo ratings yet

- University of Tunis Tunis Business SchoolDocument7 pagesUniversity of Tunis Tunis Business Schoolcyrine chahbaniNo ratings yet

- Chapter 2 Risk, Return Financial Asset PortfolioDocument16 pagesChapter 2 Risk, Return Financial Asset PortfoliortNo ratings yet

- FBL5Document12 pagesFBL5FaleeNo ratings yet

- Anatomy CBDocument22 pagesAnatomy CBKarya BangunanNo ratings yet

- EBW1063 Managerial Finance Tutorial - StockValuation - AnswerDocument3 pagesEBW1063 Managerial Finance Tutorial - StockValuation - AnswerJune JoysNo ratings yet

- Risk and Return: RETURN: If You Buy An Asset of Any Sort, Your Gain (Or Loss) From That Investment Is Called TheDocument15 pagesRisk and Return: RETURN: If You Buy An Asset of Any Sort, Your Gain (Or Loss) From That Investment Is Called TheFear Part 2No ratings yet

- P&RLIP Chapter BDocument30 pagesP&RLIP Chapter BSamyak ZaveriNo ratings yet

- FM Chapter 4Document16 pagesFM Chapter 4mearghaile4No ratings yet

- Formula Duration DerivaciónDocument2 pagesFormula Duration DerivaciónFranco CamachoNo ratings yet

- Risk and Return Risk and ReturnDocument64 pagesRisk and Return Risk and ReturnRaman SharmaNo ratings yet

- Principles of Finance Formulae SheetDocument4 pagesPrinciples of Finance Formulae SheetAmina SultangaliyevaNo ratings yet

- Session 3 Convexity ImmunizationDocument20 pagesSession 3 Convexity ImmunizationRabeya AktarNo ratings yet

- CMQ-OE FormulasDocument2 pagesCMQ-OE FormulasMusman SattarNo ratings yet

- Pro Set 2 SolDocument5 pagesPro Set 2 SolStephanieNo ratings yet

- Finance NoteDocument19 pagesFinance NoteHui YiNo ratings yet

- Topic 3 2020Document40 pagesTopic 3 2020GloriaNo ratings yet

- Adms3530f18 Final Exam Formula Sheet PDFDocument6 pagesAdms3530f18 Final Exam Formula Sheet PDFSandy SandNo ratings yet

- The Valuation of Long-Term SecuritiesDocument54 pagesThe Valuation of Long-Term SecuritiesRuman MahmoodNo ratings yet

- FormulasDocument20 pagesFormulasWilliam ZeNo ratings yet

- CorpFinance Cheat Sheet v2.2Document2 pagesCorpFinance Cheat Sheet v2.2subtle69100% (4)

- Hedging Interest Rate RiskDocument14 pagesHedging Interest Rate RiskVictor ManuelNo ratings yet

- Mathematics of Finance: S USD Euro R R e Fe e F eDocument6 pagesMathematics of Finance: S USD Euro R R e Fe e F eAnkit TanwarNo ratings yet

- Yoliana - Measuring Interest Rate RiskDocument17 pagesYoliana - Measuring Interest Rate RiskyolianaaNo ratings yet

- Formula Sheet FIMDocument4 pagesFormula Sheet FIMYNo ratings yet

- Stock Valuation by 4 ModelsDocument61 pagesStock Valuation by 4 ModelsAbhishek DalalNo ratings yet

- Financial Market Problems and FormulasDocument3 pagesFinancial Market Problems and FormulasNufayl KatoNo ratings yet

- CF 3 2016Document91 pagesCF 3 2016Siddhartha PatraNo ratings yet

- LSBF - Acca - f9 Study Notes June 2015Document216 pagesLSBF - Acca - f9 Study Notes June 2015Nausheen Ahmed Noba100% (1)

- Workshop 9Document8 pagesWorkshop 9Hakim AzmiNo ratings yet

- Formulas and ConceptsDocument7 pagesFormulas and Conceptscolen.anneNo ratings yet

- The GreeksDocument16 pagesThe GreeksTinasheNo ratings yet

- Chapter 3 Interest Rates and Security ValuationDocument26 pagesChapter 3 Interest Rates and Security ValuationMoneeka KumariNo ratings yet

- Delta HedgingDocument28 pagesDelta HedgingClaudia ChoiNo ratings yet

- Exam Formula SheetDocument2 pagesExam Formula SheetEmma WorkmanNo ratings yet

- ECMC49F Midterm Solution 2Document13 pagesECMC49F Midterm Solution 2Wissal RiyaniNo ratings yet

- R S RS: Var: I Am 99% Certain That There Will Be No Loss of More Than $801,27 in The Next 10 DaysDocument2 pagesR S RS: Var: I Am 99% Certain That There Will Be No Loss of More Than $801,27 in The Next 10 DaysMarcelo AlmeidaNo ratings yet

- Risk and Return TheoryDocument45 pagesRisk and Return Theoryanshika rathoreNo ratings yet

- Lecture 5.2 (Credit Risk - Quantitative Approaches) (Posted)Document7 pagesLecture 5.2 (Credit Risk - Quantitative Approaches) (Posted)Motivational speaker Pratham GuptaNo ratings yet

- Week 7Document37 pagesWeek 7NageenNo ratings yet

- Minimum Variance Efficient PortfolioDocument7 pagesMinimum Variance Efficient PortfoliohatemNo ratings yet

- Chapter 6Document46 pagesChapter 6Quynh Trang DinhNo ratings yet

- Blackwell Publishing American Finance AssociationDocument8 pagesBlackwell Publishing American Finance AssociationhectorNo ratings yet

- Ch03-5 Portifolio Theory - Risk Return AnalysisDocument113 pagesCh03-5 Portifolio Theory - Risk Return AnalysismupiwamasimbaNo ratings yet

- Formulae sheet: σ r a) 1 (r a r Document1 pageFormulae sheet: σ r a) 1 (r a r Linh NguyễnNo ratings yet

- (Formula Sheet) EMEM 533Document3 pages(Formula Sheet) EMEM 533Almaz ZhNo ratings yet

- A Primer On Implied CorrelationDocument5 pagesA Primer On Implied CorrelationfelixopNo ratings yet

- AFM Formula SheetDocument15 pagesAFM Formula Sheetganesh bhaiNo ratings yet

- CreditRisk Intro&MertonDocument25 pagesCreditRisk Intro&MertonmekontsodimitriNo ratings yet

- Risk and ReturnDocument43 pagesRisk and ReturnAbubakar OthmanNo ratings yet

- Answers To Problem Sets: Risk and The Cost of CapitalDocument8 pagesAnswers To Problem Sets: Risk and The Cost of CapitalTracywong100% (1)

- Formula SheetDocument2 pagesFormula SheetAnarghyaNo ratings yet

- Baye 10e PPT CH04Document29 pagesBaye 10e PPT CH04Beth Villarreal DávilaNo ratings yet

- Investingincoffeeshopbusiness 161216071535Document37 pagesInvestingincoffeeshopbusiness 161216071535Zulfiana SetyaningsihNo ratings yet

- Coffee: BusinessDocument18 pagesCoffee: BusinessZulfiana SetyaningsihNo ratings yet

- PLHB MEETING Package 2023 1 PDFDocument2 pagesPLHB MEETING Package 2023 1 PDFZulfiana SetyaningsihNo ratings yet

- Business Plan 1vDocument16 pagesBusiness Plan 1vMonik TudorNo ratings yet

- Georeferencing ArcMap 10Document8 pagesGeoreferencing ArcMap 10Zulfiana SetyaningsihNo ratings yet

- Taman Wisata Candi: Borobudur, Prambanan & Ratu BokoDocument1 pageTaman Wisata Candi: Borobudur, Prambanan & Ratu BokoZulfiana SetyaningsihNo ratings yet

- Impact Assessment of The COVID-19 Outbreak On International TourismDocument16 pagesImpact Assessment of The COVID-19 Outbreak On International TourismPetrosRochaNo ratings yet

- Oasis Applicant User GuideDocument43 pagesOasis Applicant User GuideJoko Tri RubiyantoNo ratings yet

- Rec LetterDocument1 pageRec LetterZulfiana SetyaningsihNo ratings yet

- Crisis Readiness: Are You Prepared and Resilient To Safeguard Your People & Destinations?Document17 pagesCrisis Readiness: Are You Prepared and Resilient To Safeguard Your People & Destinations?Zulfiana SetyaningsihNo ratings yet

- INDONESIANA EDISI 2 - ErDocument100 pagesINDONESIANA EDISI 2 - ErZulfiana SetyaningsihNo ratings yet

- 10 Tur Pre 2 PDFDocument31 pages10 Tur Pre 2 PDFZulfiana SetyaningsihNo ratings yet

- Conference On Culinary, Fashion, Beauty, and Tourism Nov 2020 MilneDocument59 pagesConference On Culinary, Fashion, Beauty, and Tourism Nov 2020 MilneZulfiana SetyaningsihNo ratings yet

- Conference On Culinary, Fashion, Beauty, and Tourism Nov 2020 MilneDocument59 pagesConference On Culinary, Fashion, Beauty, and Tourism Nov 2020 MilneZulfiana SetyaningsihNo ratings yet

- Oasis Applicant User GuideDocument43 pagesOasis Applicant User GuideJoko Tri RubiyantoNo ratings yet

- Prof DR Mohd Salehuddin Mohd Zahari - GASTRONOMIC TOURISM UpdateDocument15 pagesProf DR Mohd Salehuddin Mohd Zahari - GASTRONOMIC TOURISM UpdateZulfiana SetyaningsihNo ratings yet

- State:: - . NomlnatlonDocument2 pagesState:: - . NomlnatlonZulfiana SetyaningsihNo ratings yet

- Industry On Campus - Keynote UnpDocument16 pagesIndustry On Campus - Keynote UnpZulfiana SetyaningsihNo ratings yet

- Color GuideDocument40 pagesColor GuidePS Gupta100% (1)

- AAI Sustainable Tourism Management 2020 Brochure English FinalDocument2 pagesAAI Sustainable Tourism Management 2020 Brochure English FinalZulfiana SetyaningsihNo ratings yet

- DS01 - The Future of Festivals 8 Trends You Need To Know PDFDocument10 pagesDS01 - The Future of Festivals 8 Trends You Need To Know PDFZulfiana SetyaningsihNo ratings yet

- Amadeus Global Report 2018Document172 pagesAmadeus Global Report 2018William GuoNo ratings yet

- EDM Pop A Soft Shell Formation in A NewDocument21 pagesEDM Pop A Soft Shell Formation in A NewZulfiana SetyaningsihNo ratings yet

- Capstone Project-Grainger and Bosch: Digital Marketing CampaignDocument25 pagesCapstone Project-Grainger and Bosch: Digital Marketing Campaignk.saikumar100% (1)

- Introduction To Petroleum Engineering - Lecture 3 - 12-10-2012 - Final PDFDocument19 pagesIntroduction To Petroleum Engineering - Lecture 3 - 12-10-2012 - Final PDFshanecarlNo ratings yet

- Al in Source Grade 12 For Abm OnlyDocument275 pagesAl in Source Grade 12 For Abm OnlyAlliah PesebreNo ratings yet

- 2023 Macroeconomics Final Test SampleDocument2 pages2023 Macroeconomics Final Test Samplek. nastyasNo ratings yet

- Complete List of SAP Purchase Document ME21N Exit and BADIDocument8 pagesComplete List of SAP Purchase Document ME21N Exit and BADISamarth ShahNo ratings yet

- 180 2 1 PDFDocument34 pages180 2 1 PDFlaura melissaNo ratings yet

- Lahore School of Economics Financial Management I Time Value of Money - 3 Assignment 4Document2 pagesLahore School of Economics Financial Management I Time Value of Money - 3 Assignment 4Ahmed ZafarNo ratings yet

- AshZjxFuEemP8Qpm209XvA Rewiring-Trade-FinanceDocument5 pagesAshZjxFuEemP8Qpm209XvA Rewiring-Trade-Financezvishavane zvishNo ratings yet

- GPOA (PR Consultant)Document7 pagesGPOA (PR Consultant)Jeydrew TVNo ratings yet

- Accounting: G.C.E. Advanced LevelDocument11 pagesAccounting: G.C.E. Advanced LevelMartinolesterNo ratings yet

- PJSC National Bank Trust and Anor V Boris Mints and OrsDocument33 pagesPJSC National Bank Trust and Anor V Boris Mints and OrshyenadogNo ratings yet

- Chapter 7 Project Termination and Project Management Practices in BDDocument19 pagesChapter 7 Project Termination and Project Management Practices in BDbba19047No ratings yet

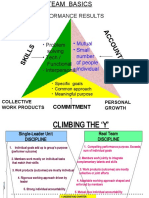

- Team BasicsDocument3 pagesTeam BasicsSoumya Jyoti BhattacharyaNo ratings yet

- 01-CalapanCity2019 Transmittal LetterDocument6 pages01-CalapanCity2019 Transmittal LetterkQy267BdTKNo ratings yet

- Pengaruh Kompensasi Dan MotivasiDocument9 pagesPengaruh Kompensasi Dan Motivasibpbj kabproboNo ratings yet

- CH 05Document37 pagesCH 05Janna KarapetyanNo ratings yet

- Vansh Course Prospectous 12 Feb 2021Document8 pagesVansh Course Prospectous 12 Feb 2021Komal S.No ratings yet

- ECO Ebook by CA Mayank KothariDocument404 pagesECO Ebook by CA Mayank KothariHemanthNo ratings yet

- Research On Fastrack WatchesDocument23 pagesResearch On Fastrack Watcheskk_kamal40% (5)

- Problems On Ages Questions Specially For Sbi Po PrelimsDocument18 pagesProblems On Ages Questions Specially For Sbi Po Prelimsabinusundaram0No ratings yet

- Independent University, Bangladesh School of Business: Strategic ManagementDocument4 pagesIndependent University, Bangladesh School of Business: Strategic ManagementDevdip ÇhâwdhúrÿNo ratings yet

- PretestDocument3 pagesPretestDonise Ronadel SantosNo ratings yet

- Kaizen: A Lean Manufacturing Tool For Continuous ImprovementDocument24 pagesKaizen: A Lean Manufacturing Tool For Continuous ImprovementSamrudhi PetkarNo ratings yet

- Set8 Maths Classviii PDFDocument6 pagesSet8 Maths Classviii PDFLubna KaziNo ratings yet

- Why Satisfied Customers Defect - Group 3&4Document8 pagesWhy Satisfied Customers Defect - Group 3&4Satyajeet TripathyNo ratings yet

- Business Interruption Insurance Notes-Final 2023Document12 pagesBusiness Interruption Insurance Notes-Final 2023tshililo mbengeniNo ratings yet

- 84 UCin LRev 327Document23 pages84 UCin LRev 327Shashwat BaranwalNo ratings yet

- Master in Business Administration: Join Our Global CommunityDocument8 pagesMaster in Business Administration: Join Our Global Communityfrans1593No ratings yet

- Faktor Resiko TBDocument15 pagesFaktor Resiko TBdrnurmayasarisihombingNo ratings yet

- Essentials of College and University AccountingDocument121 pagesEssentials of College and University AccountingLith CloNo ratings yet