Professional Documents

Culture Documents

Kelompok 5 - Mind Map Chapter 6

Uploaded by

Akashi SeijuroOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kelompok 5 - Mind Map Chapter 6

Uploaded by

Akashi SeijuroCopyright:

Available Formats

VERTICAL INTEGRATION STRATEGIES

CONCENTRATION STRATEGIES Advantage and Disadvantage of a Vertical Integration

Strategies

Advantage and DIsvantages of a Concentration Strategy : Vertical Integration and Transaction cost

Advantage : Allows an organization to master one Substitutes for Full Vertical Integration :Partial Vertical

bussines. Integration ,Taper Integration ,Quasi Integration,Long

Disadvantage :Dependence on one area is problem if the Term Agreement

industry is unstable

DIVERSIFICATION

STRATEGIES

Portfolio Management Related Diversification ( Based On Similarities)

Synergy ( Specific Market)

managing the mix of businesses in

1. Tangible Relatedness

the corporate portfolio. divide

2. Intangible Relatedness

organizational resources among

diversified units and where to GROUP 5 Unrelated Diversification

invest new capital, as well as which The Creation Synergy

businesses to divest. CORPORATE- 1.Strategic fit

Destination Portfolio Analysis

LEVEL STRATEGY 2. Organizational fit

Portfolio analysis can also be adapted to

AND

The Boston

tourism, Portfolio analysis is a useful tool

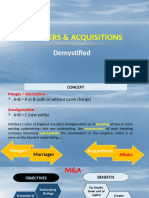

Consulting Group MERGERS AND ACQUISITIONS

for tourist destination management and

(BCG) Matrix

can help focus marketing and promotion

The BCG Matrix is

activities. attractiveness axis included RESTRUCTURING a. Consolidation

Industry consolidation, which

b. Merger Performance

The shareholders of an acquired firm

market size, market growth rate,

based on two factors: occurs as competitors merge, typically enjoy a huge payoff because

disposable income per capita, average

business growth rate is a major trend. Corporate they receive an enormous premium

daily spending, seasonality, distance from

and relative market raiding is another interesting over market value for the shares of

destination, benefits sought by tourists

share. phenomenon associated with stock they hold before the acquisition

when they travel abroad, and accessibility

mergers and acquisition announcement.

by air. Strategic Restructuring

c. Successful and Unsuccessful Mergers and Acquisition

Transformation, renewal, reorientation, and restructuring Acquisition premiums are the percentage paid for shares of

e. Changes to Organizational d. Leveraged Buyouts

are all words that describe the same general phenomenon: stock above their market value before the acquisition

Design Leveraged buyouts (LBOs)

a radical change in how business is conducted. announcement. Complementarity occurs when two companies

Organizational design can be a involve the private purchase of a

have strengths in different areas that complement each other.

potent force in restructuring efforts. business unit by managers,

For example, as organizations employees, unions, or private

diversify, top managers have a more investors. For example, Planet c. Chapter 11 Reorganization b. Refocusing a. Turnaround Strategies and Downsizing

difficult time processing the vast Hollywood is now a much smaller Chapter XI provides a Corporate Turnaround strategies (sometimes called retrenchment)

amounts of diverse infor- mation company and is privately owned, proceeding for an organization Assets can involve workforce reductions, selling assets to

that are needed to appropriately having been a publicly traded to work out a plan or Downscoping reduce debt, outsourcing unprofitable activities,

control each business. company before its LBO. arrangement for solving its Divestitures implementation of tighter cost or quality controls, or

financial problems under the new policies that emphasize quality or efficiency.

supervision of a federal court.

You might also like

- Strategic Management Concepts and CasesDocument2 pagesStrategic Management Concepts and CasesI Nyoman Sujana GiriNo ratings yet

- SC Corp I4Document9 pagesSC Corp I4MUHAMMAD KASHIF SiddiqiNo ratings yet

- Class Slides Corporate Strategy Diversification Integration and OutsourcingDocument44 pagesClass Slides Corporate Strategy Diversification Integration and OutsourcingMichael SantaNo ratings yet

- Class Slides - Corporate Strategy - Diversification, Integration and OutsourcingDocument43 pagesClass Slides - Corporate Strategy - Diversification, Integration and Outsourcingrabia basriNo ratings yet

- Compare Contrast Among Merger Acquisition Joint Venture Strategic AlliancesDocument5 pagesCompare Contrast Among Merger Acquisition Joint Venture Strategic AlliancesSantosh AdhikariNo ratings yet

- 13 SM Core Session 13 2023-24Document9 pages13 SM Core Session 13 2023-24Reetik ParekhNo ratings yet

- Strategies for Growth, Retrenchment, and StabilityDocument1 pageStrategies for Growth, Retrenchment, and StabilityGaelle CBNo ratings yet

- Industry Situation AnalysisDocument38 pagesIndustry Situation AnalysisDenzel AlmoqueraNo ratings yet

- Compare Contrast Among Merger Acquisition Joint Venture Strategic AlliancesDocument5 pagesCompare Contrast Among Merger Acquisition Joint Venture Strategic AlliancesKhairun AmalaNo ratings yet

- Carpenter PPT Ch09Document23 pagesCarpenter PPT Ch09Maryam BielaNo ratings yet

- Strategic Management Part 9Document6 pagesStrategic Management Part 9aansh rajNo ratings yet

- Corporate StrategyDocument41 pagesCorporate StrategymussaiyibNo ratings yet

- Strategic Management/ Business PolicyDocument42 pagesStrategic Management/ Business PolicySuci Putri LNo ratings yet

- Strategic Management/ Business PolicyDocument42 pagesStrategic Management/ Business PolicySan Yee Mon KyawNo ratings yet

- CS Post Mid-TermDocument144 pagesCS Post Mid-TermShivam YadavNo ratings yet

- Strategy & Strategic PlanningDocument9 pagesStrategy & Strategic PlanningThe Natak CompanyNo ratings yet

- Icici Prudential Pms Pipe Strategy: Our Philosophy ForgrowthDocument31 pagesIcici Prudential Pms Pipe Strategy: Our Philosophy Forgrowthpiyush pushkarNo ratings yet

- Competitive Strategy and Industry Analysis: A La Michael PorterDocument4 pagesCompetitive Strategy and Industry Analysis: A La Michael PorterDaria TomescuNo ratings yet

- M3 N001 DivE PDFDocument31 pagesM3 N001 DivE PDFsthahviNo ratings yet

- Business Strategy 101Document10 pagesBusiness Strategy 101kananguptaNo ratings yet

- Strategic Management Module ThreeDocument52 pagesStrategic Management Module ThreeVimala Selvaraj VimalaNo ratings yet

- Etude - Joint - Venture - Juillet 2010.Document16 pagesEtude - Joint - Venture - Juillet 2010.yuszriNo ratings yet

- Aegis SReport 2014-15Document27 pagesAegis SReport 2014-15GrielNo ratings yet

- Lesson 8 Corporate DiversificationDocument14 pagesLesson 8 Corporate DiversificationNazia SyedNo ratings yet

- Strama Topics Week 11 - 15Document19 pagesStrama Topics Week 11 - 15Tabot Abbe ChrisNo ratings yet

- BA Chapter 3 Strategic ChoicesDocument44 pagesBA Chapter 3 Strategic ChoicesNguyễn HoaNo ratings yet

- SC Dir CL PP07Document16 pagesSC Dir CL PP07Marcel LimNo ratings yet

- Harvard Business Review - What Is Strategy - Michael Porter PDFDocument21 pagesHarvard Business Review - What Is Strategy - Michael Porter PDFPrem ChopraNo ratings yet

- Mac 311 Corporate StrategyDocument15 pagesMac 311 Corporate StrategyForjosh VNo ratings yet

- Corporate StrategiesDocument20 pagesCorporate StrategiesGonçalo SilvaNo ratings yet

- M&ADocument151 pagesM&APallavi Prasad100% (1)

- Strategic Management and CompetitivenessDocument3 pagesStrategic Management and CompetitivenessStephanie Nicole DiputadoNo ratings yet

- M6-Entrepreneurship-Lectures 29 and 30 - FinalDocument52 pagesM6-Entrepreneurship-Lectures 29 and 30 - FinalMd Rushd Al AminNo ratings yet

- Acquisition BenefitsDocument4 pagesAcquisition BenefitsShubham SrivastavaNo ratings yet

- Financial AnalysisDocument28 pagesFinancial AnalysisDr.Shaifali GargNo ratings yet

- Corporate Level SM 01Document27 pagesCorporate Level SM 01nitishNo ratings yet

- Corporate StrategyDocument28 pagesCorporate Strategyharrith martNo ratings yet

- 2018 9 - Barclays CSNY634764 Finding - Alpha A4Document24 pages2018 9 - Barclays CSNY634764 Finding - Alpha A4elizabethrasskazovaNo ratings yet

- Corportae LevelDocument8 pagesCorportae LevelRiyancy RajapakshaNo ratings yet

- Pemasaran-Week 2 (Developing Marketing Strategis and Plans)Document27 pagesPemasaran-Week 2 (Developing Marketing Strategis and Plans)citra kusuma dewiNo ratings yet

- Quick Revision: Financial Policy and Corporate Strategy Financial Policy and Corporate StrategyDocument11 pagesQuick Revision: Financial Policy and Corporate Strategy Financial Policy and Corporate StrategySagar singlaNo ratings yet

- Pidilite Industries: Robust Recovery Margin Pressure AheadDocument15 pagesPidilite Industries: Robust Recovery Margin Pressure AheadIS group 7No ratings yet

- Axis Business Cycles Fund NFO DetailsDocument2 pagesAxis Business Cycles Fund NFO Detailsamarnathb2001No ratings yet

- Bos 53810 CP 4Document35 pagesBos 53810 CP 4OwassoNo ratings yet

- CH 7Document7 pagesCH 7483-ROHIT SURAPALLINo ratings yet

- Strat Man Chap 4Document7 pagesStrat Man Chap 4Cesar LegaspiNo ratings yet

- Accenture Merger Acquisition Divestitureand Alliance ServicesDocument16 pagesAccenture Merger Acquisition Divestitureand Alliance Serviceszmezarina50% (2)

- Chapter 4 Corporate Level StrategiesDocument31 pagesChapter 4 Corporate Level StrategiesGaury DattNo ratings yet

- Strategies in Action Hekmat PartDocument13 pagesStrategies in Action Hekmat PartAhmed ZakariaNo ratings yet

- Chapter 4 - Strategies in ActionDocument64 pagesChapter 4 - Strategies in ActionNetsanet Workineh ነፃነት ወርቅነህ0% (1)

- Cost Focus-Firm Strives To Create A Cost 2. Differentiation Focus - Seeks ToDocument2 pagesCost Focus-Firm Strives To Create A Cost 2. Differentiation Focus - Seeks TocaicaiiNo ratings yet

- Implementing Strategies: Marketing, Finance, R&D, and MIS IssuesDocument22 pagesImplementing Strategies: Marketing, Finance, R&D, and MIS IssuesFelicia MonikaNo ratings yet

- EY Capturing Synergies in DealmakingDocument4 pagesEY Capturing Synergies in DealmakingAndrey PritulyukNo ratings yet

- CH - 04 7-7-11Document47 pagesCH - 04 7-7-11Myla GellicaNo ratings yet

- Designing an Ambidextrous Organization Structure for BPCLDocument15 pagesDesigning an Ambidextrous Organization Structure for BPCLAtul MishraNo ratings yet

- CHAPTER 1 Strat ManDocument8 pagesCHAPTER 1 Strat ManAngelica MangaliliNo ratings yet

- Magic Quadrant For Single Instance ERP For Product Centric Midmarket CompaniesDocument21 pagesMagic Quadrant For Single Instance ERP For Product Centric Midmarket Companiesjonder2000No ratings yet

- Mergers and Acquisitions Toolkit - Overview and ApproachDocument55 pagesMergers and Acquisitions Toolkit - Overview and ApproachFrancisco LópezNo ratings yet

- Strategic AlliancesDocument15 pagesStrategic AlliancesShashank VarmaNo ratings yet

- Strategic Analysis of Internal Environment of a Business OrganisationFrom EverandStrategic Analysis of Internal Environment of a Business OrganisationNo ratings yet