Professional Documents

Culture Documents

Varroc Engineering - Update - Kotak Institutional - 040522

Uploaded by

darshanmalde0 ratings0% found this document useful (0 votes)

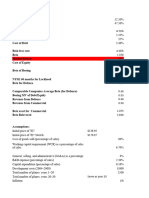

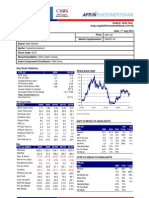

18 views8 pagesVarroc Engineering is an automotive components manufacturer with a market capitalization of 70 billion rupees. The stock is currently rated "ADD" with a closing price of 458 rupees. Forecasts show losses in 2022 and 2023 as EPS will be negative 63.4 rupees and 22.5 rupees respectively, before growing significantly to 6 rupees in 2024. Sales are expected to increase from 122 billion rupees in 2022 to 150 billion rupees in 2024, with EBITDA and net profits also projected to rise over the same period as the company returns to profitability.

Original Description:

wfqef

Original Title

Varroc Engineering_update_Kotak Institutional_040522

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentVarroc Engineering is an automotive components manufacturer with a market capitalization of 70 billion rupees. The stock is currently rated "ADD" with a closing price of 458 rupees. Forecasts show losses in 2022 and 2023 as EPS will be negative 63.4 rupees and 22.5 rupees respectively, before growing significantly to 6 rupees in 2024. Sales are expected to increase from 122 billion rupees in 2022 to 150 billion rupees in 2024, with EBITDA and net profits also projected to rise over the same period as the company returns to profitability.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views8 pagesVarroc Engineering - Update - Kotak Institutional - 040522

Uploaded by

darshanmaldeVarroc Engineering is an automotive components manufacturer with a market capitalization of 70 billion rupees. The stock is currently rated "ADD" with a closing price of 458 rupees. Forecasts show losses in 2022 and 2023 as EPS will be negative 63.4 rupees and 22.5 rupees respectively, before growing significantly to 6 rupees in 2024. Sales are expected to increase from 122 billion rupees in 2022 to 150 billion rupees in 2024, with EBITDA and net profits also projected to rise over the same period as the company returns to profitability.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

Varroc Engineering

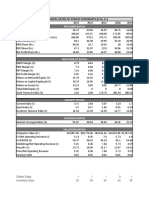

Stock data Forecasts/valuations 2022 2023E 2024E

CMP(Rs)/FV(Rs)/Rating 458/500/ADD EPS (Rs) (63.4) (22.5) 6.0

52-week range (Rs) (high-low) 494-260 EPS growth (%) (36.0) 64.5 126.8

Mcap (bn) (Rs/US$) 70/1 P/E (X) (7.2) (20.3) 75.8

ADTV-3M (mn) (Rs/US$) 301/4 P/B (X) 3.4 4.0 3.8

Shareholding pattern (%) EV/EBITDA (X) 91.2 12.9 7.7

Promoters 75.0 RoE (%) (46.4) (19.7) 5.0

FPIs/MFs/BFIs 3.5/13.1/1.1 Div. yield (%) 0.0 0.0 0.0

Price performance (%) 1M 3M 12M Sales (Rs bn) 122 134 150

Absolute 23.8 8.4 23.4 EBITDA (Rs bn) 1 7 12

Rel. to BSE-30 27.7 12.7 6.6 Net profits (Rs bn) (10) (3) 1

You might also like

- Delhivery - Update - Kotak Institutional - 251022Document9 pagesDelhivery - Update - Kotak Institutional - 251022darshanmaldeNo ratings yet

- Crams Icici SecuritiesDocument68 pagesCrams Icici SecuritiesKoushik BhattacharyyaNo ratings yet

- Cummins India Financial ModelDocument52 pagesCummins India Financial ModelJitendra YadavNo ratings yet

- Union Bank - MP: Result TableDocument4 pagesUnion Bank - MP: Result TableManjunath ManjuNo ratings yet

- CCS G4Document14 pagesCCS G4Harshit AroraNo ratings yet

- Key Financial Ratios of JK Tyre and IndustriesDocument3 pagesKey Financial Ratios of JK Tyre and IndustriesAchal JainNo ratings yet

- Educomp Solutions LTD - : Result TableDocument4 pagesEducomp Solutions LTD - : Result TableritzchavanNo ratings yet

- Sarawak Plantation 100827 RN2Q10Document2 pagesSarawak Plantation 100827 RN2Q10limml63No ratings yet

- Spritzer Berhad: Results ReportDocument3 pagesSpritzer Berhad: Results ReportohjayeeNo ratings yet

- BCTA-RR (2QFY19) - LTHB-FinalDocument4 pagesBCTA-RR (2QFY19) - LTHB-FinalZhi_Ming_Cheah_8136No ratings yet

- Breaking Events: Building MaterialsDocument5 pagesBreaking Events: Building Materialsapi-26443191No ratings yet

- Top Glove 140618Document5 pagesTop Glove 140618Joseph CampbellNo ratings yet

- A E L (AEL) : Mber Nterprises TDDocument8 pagesA E L (AEL) : Mber Nterprises TDdarshanmadeNo ratings yet

- Etihad Etisalat Company (Mobily) Defining A League... July 22, 2008Document36 pagesEtihad Etisalat Company (Mobily) Defining A League... July 22, 2008AliNo ratings yet

- Airtel DividdendDocument6 pagesAirtel DividdendRishab KatariaNo ratings yet

- BRS Banking Sector ValuationsDocument1 pageBRS Banking Sector Valuationsdasun1988No ratings yet

- Freight Management 20100527Document3 pagesFreight Management 20100527limml63No ratings yet

- Stock Selection Guide: Symbol: TXNDocument2 pagesStock Selection Guide: Symbol: TXNMayank PatelNo ratings yet

- Key Indicators of IndiaDocument3 pagesKey Indicators of IndiavishwanathNo ratings yet

- Pidilite Industries: ReduceDocument9 pagesPidilite Industries: ReduceIS group 7No ratings yet

- NYSF Walmart Solutionv2Document41 pagesNYSF Walmart Solutionv2Vianna NgNo ratings yet

- LS India Cements Q1FY11Document2 pagesLS India Cements Q1FY11prateepnigam355No ratings yet

- DABUR Easy Ratio AnalysisDocument4 pagesDABUR Easy Ratio AnalysisLakshay TakhtaniNo ratings yet

- Kossan 2Q10Document3 pagesKossan 2Q10limml63No ratings yet

- Consolidated Key Financial Ratios of Hindalco IndustriesDocument3 pagesConsolidated Key Financial Ratios of Hindalco IndustriesManav JhaveriNo ratings yet

- Titan Industries: Performance HighlightsDocument10 pagesTitan Industries: Performance Highlightscbz786skNo ratings yet

- Jio Financial Analysis (5 Yrs)Document2 pagesJio Financial Analysis (5 Yrs)Yash Saxena KhiladiNo ratings yet

- THP 2Q10Document3 pagesTHP 2Q10limml63No ratings yet

- 17691e0002 Assignment 2Document4 pages17691e0002 Assignment 2Ajay KumarNo ratings yet

- Particulars: KEY FINANCIAL RATIOS of Tata Consultancy Services LTDDocument4 pagesParticulars: KEY FINANCIAL RATIOS of Tata Consultancy Services LTDMayank PatelNo ratings yet

- CT CLSA - Hayleys Fabric (MGT) 3Q21 Results Update - 22 February 2021Document11 pagesCT CLSA - Hayleys Fabric (MGT) 3Q21 Results Update - 22 February 2021Imran ansariNo ratings yet

- KBSV REE 1Q23 EngDocument8 pagesKBSV REE 1Q23 Engsurananamita99No ratings yet

- B D E (BDE) : LUE ART XpressDocument18 pagesB D E (BDE) : LUE ART XpresshemantNo ratings yet

- Asian Paints Financial ModelDocument15 pagesAsian Paints Financial ModelDeepak NechlaniNo ratings yet

- Stitch Fix Inc NasdaqGS SFIX FinancialsDocument41 pagesStitch Fix Inc NasdaqGS SFIX FinancialsanamNo ratings yet

- Singapore Exchange Limited: Firing On All CylindersDocument6 pagesSingapore Exchange Limited: Firing On All CylindersCalebNo ratings yet

- Key Financial Ratios of GAIL India - in Rs. Cr.Document2 pagesKey Financial Ratios of GAIL India - in Rs. Cr.Anonymous N7yzbYbHNo ratings yet

- BoeingDocument11 pagesBoeingPreksha GulatiNo ratings yet

- BCTA-RR (1QFY19) - LTHB-FinalDocument3 pagesBCTA-RR (1QFY19) - LTHB-FinalZhi_Ming_Cheah_8136No ratings yet

- Nerolac - Solution PDFDocument5 pagesNerolac - Solution PDFricha krishnaNo ratings yet

- Tutorial On How To Use The DCF Model. Good Luck!: DateDocument9 pagesTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNo ratings yet

- The Case of Missing Sales Growth: Zydus WellnessDocument5 pagesThe Case of Missing Sales Growth: Zydus WellnessasdasdNo ratings yet

- Aspires Aggressive Market Share: UnratedDocument10 pagesAspires Aggressive Market Share: Unratedmbts.14014cm020No ratings yet

- Tata MotorsDocument11 pagesTata MotorsshrishtiNo ratings yet

- Prerna Shivach SM A3 (2201920700250) ' With YouDocument26 pagesPrerna Shivach SM A3 (2201920700250) ' With YouRakesh ShuklaNo ratings yet

- Irctc InvestmentDocument6 pagesIrctc InvestmentYashNo ratings yet

- Hiap Teck RN 20100701 AffinDocument3 pagesHiap Teck RN 20100701 Affinlimml63No ratings yet

- ICICI Securities Sees 34% UPSIDE in Info Edge Green Shoots VisibleDocument6 pagesICICI Securities Sees 34% UPSIDE in Info Edge Green Shoots Visiblemanitjainm21No ratings yet

- DISH TV India - Financial Model - May 28 2010Document29 pagesDISH TV India - Financial Model - May 28 2010Sandeep HsNo ratings yet

- Industry Median 2018 2017 2016 2015 2014 2013 2012Document10 pagesIndustry Median 2018 2017 2016 2015 2014 2013 2012AnuragNo ratings yet

- Comparison ResultDocument3 pagesComparison ResultSanjhi ParasharNo ratings yet

- Quantamental Research - ITC LTDDocument1 pageQuantamental Research - ITC LTDsadaf hashmiNo ratings yet

- Financial Modeling Institute: Henderson ManufacturingDocument15 pagesFinancial Modeling Institute: Henderson ManufacturingTafadzwanashe MaringireNo ratings yet

- TVS Motor Company: CMP: INR549 TP: INR548Document12 pagesTVS Motor Company: CMP: INR549 TP: INR548anujonwebNo ratings yet

- Crecendo 20100630 TADocument2 pagesCrecendo 20100630 TAlimml63No ratings yet

- Financials of Wipro LTD.: Yukta Rajpurohit 17030720022Document10 pagesFinancials of Wipro LTD.: Yukta Rajpurohit 17030720022Gautam MulchanNo ratings yet

- JUBLFOOD Equity Research ReportDocument9 pagesJUBLFOOD Equity Research ReportAshutosh RanjanNo ratings yet

- Cenlub Industries - Nov 2012Document6 pagesCenlub Industries - Nov 2012JovMac ManzanoNo ratings yet

- Bharat Forge: Performance HighlightsDocument13 pagesBharat Forge: Performance HighlightsarikuldeepNo ratings yet

- Economic Indicators for Southeastern Asia and the Pacific: Input–Output TablesFrom EverandEconomic Indicators for Southeastern Asia and the Pacific: Input–Output TablesNo ratings yet

- 3M India Q4FY21 ResultsDocument7 pages3M India Q4FY21 ResultsdarshanmaldeNo ratings yet

- Orient ElectricDocument34 pagesOrient ElectricdarshanmaldeNo ratings yet

- Aarti Industries - Q1FY20 - Result Update - Axis DirectDocument6 pagesAarti Industries - Q1FY20 - Result Update - Axis DirectdarshanmaldeNo ratings yet

- Aavas Edelweiss 2.08.19Document15 pagesAavas Edelweiss 2.08.19darshanmaldeNo ratings yet

- Aavas Financiers - MNCL - 090522Document6 pagesAavas Financiers - MNCL - 090522darshanmaldeNo ratings yet

- Garware Technical FibresDocument28 pagesGarware Technical FibresdarshanmaldeNo ratings yet

- Nestle India - Initiating Coverage (ADD) - Spark Capital ResearchDocument78 pagesNestle India - Initiating Coverage (ADD) - Spark Capital ResearchdarshanmaldeNo ratings yet

- Aavas Q4FY21 ResultsDocument16 pagesAavas Q4FY21 ResultsdarshanmaldeNo ratings yet

- Laurus Labs Stock VisualisationDocument42 pagesLaurus Labs Stock VisualisationdarshanmaldeNo ratings yet

- Aarti Industries - Upgrade To Buy - 2QFY20 Result - EdelDocument13 pagesAarti Industries - Upgrade To Buy - 2QFY20 Result - EdeldarshanmaldeNo ratings yet

- Aarti Industries - Company Update - 170921Document19 pagesAarti Industries - Company Update - 170921darshanmaldeNo ratings yet

- Aarti Industries - 1QFY19 RU - KR ChokseyDocument7 pagesAarti Industries - 1QFY19 RU - KR ChokseydarshanmaldeNo ratings yet

- Aarti Industries - 3QFY20 Result - RsecDocument7 pagesAarti Industries - 3QFY20 Result - RsecdarshanmaldeNo ratings yet

- Aarti Industries - Alpha - Buy - JM FinancialDocument9 pagesAarti Industries - Alpha - Buy - JM FinancialdarshanmaldeNo ratings yet

- Aarti Industries - Q2FY22 Result Update - 02-11-2021 - 13Document8 pagesAarti Industries - Q2FY22 Result Update - 02-11-2021 - 13darshanmaldeNo ratings yet

- Blue Dart Express (NOT RATED) - BOBCAPS SecDocument3 pagesBlue Dart Express (NOT RATED) - BOBCAPS SecdarshanmaldeNo ratings yet

- Dilip Buildcon LTD ARO 2020-21 - YES SecuritiesDocument5 pagesDilip Buildcon LTD ARO 2020-21 - YES SecuritiesdarshanmaldeNo ratings yet

- PNC Infratech LTD: ESG Disclosure ScoreDocument5 pagesPNC Infratech LTD: ESG Disclosure ScoredarshanmaldeNo ratings yet

- Container Corporation of India (CCRI IN, Buy) - 1QFY20 Result - NomuraDocument7 pagesContainer Corporation of India (CCRI IN, Buy) - 1QFY20 Result - NomuradarshanmaldeNo ratings yet

- Bharti Airtel: Q4 FY 2022 ResultsDocument7 pagesBharti Airtel: Q4 FY 2022 ResultsdarshanmaldeNo ratings yet

- Apollo Tyres (APTY IN, Buy) - 1QFY20 Result - NomuraDocument7 pagesApollo Tyres (APTY IN, Buy) - 1QFY20 Result - NomuradarshanmaldeNo ratings yet

- Dixon Technologies (India) Limited: Financial HighlightsDocument5 pagesDixon Technologies (India) Limited: Financial HighlightsdarshanmaldeNo ratings yet

- Federal Bank LTD.: BUY (Upside 20%)Document8 pagesFederal Bank LTD.: BUY (Upside 20%)darshanmaldeNo ratings yet

- (Kotak) Zee Entertainment Enterprises, May 30, 2022Document11 pages(Kotak) Zee Entertainment Enterprises, May 30, 2022darshanmaldeNo ratings yet

- Gujarat Gas (GUJGA IN) - Company Update - PL IndiaDocument7 pagesGujarat Gas (GUJGA IN) - Company Update - PL IndiadarshanmaldeNo ratings yet

- Tanla Platforms LTD - Management Meet Update - Indsec - 240622Document11 pagesTanla Platforms LTD - Management Meet Update - Indsec - 240622darshanmaldeNo ratings yet

- Britannia Industries - Q1FY20 Result Update - Centrum 10082019Document12 pagesBritannia Industries - Q1FY20 Result Update - Centrum 10082019darshanmaldeNo ratings yet

- Sansera Engineering LTD - Company Update - 26 June 2022 - Nirmal Bang (Inst.)Document4 pagesSansera Engineering LTD - Company Update - 26 June 2022 - Nirmal Bang (Inst.)darshanmaldeNo ratings yet

- PNB Housing Finance - 1QFY20 Result - JM FinancialDocument11 pagesPNB Housing Finance - 1QFY20 Result - JM FinancialdarshanmaldeNo ratings yet

- Asahi India Glass Uljk 24062022 62b591700001e6ef3fc20002Document7 pagesAsahi India Glass Uljk 24062022 62b591700001e6ef3fc20002darshanmaldeNo ratings yet