Professional Documents

Culture Documents

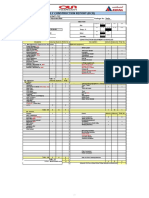

Cebu Davao Inventory Discussion Problems

Uploaded by

Monica GarciaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cebu Davao Inventory Discussion Problems

Uploaded by

Monica GarciaCopyright:

Available Formats

Manila * Cavite * Laguna * Cebu * Cagayan De Oro * Davao

Since 1977

FAR OCAMPO/OCAMPO

FAR.3402-Inventories MAY 2023

DISCUSSION PROBLEMS

1. Inventories are assets c. Goods sold to Garcia Company, under terms FOB

destination, invoiced for P18,500 which includes

I. Held for sale in the ordinary course of business.

P1,000 freight charges to deliver the goods.

II. In the process of production for sale in the ordinary

Goods are in transit.

course of business.

d. Purchased goods in transit, terms FOB origin,

III. In the form of materials or supplies to be

invoice price P48,000, freight cost, P3,000.

consumed in the production process or in the

e. Goods out on consignment to Manil Company,

rendering of services.

sales price P36,400, shipping cost of P2,000.

IV. Held for use in the production or supply of goods or

services. Assuming that the company's selling price is 140% of

V. Held for rental to others. inventory cost, the adjusted cost of Fair Company's

VI. Held for administrative purposes. inventory at Dec. 31 should be

a. P1,055,700 c. P1,039,300

a. All of these c. I and III only b. P1,039,500 d. P1,037,300

b. I, II, III and IV only d. I, II and III only

2. Which statement is correct regarding inventories? 5. What is the principle for recognition of inventory in

a. Inventories are monetary assets. accordance with PAS 2?

b. Inventories are financial assets. a. Recognition of inventory is not specified in PAS 2.

c. Inventories should have physical form. b. Inventory is recognized when, and only when, the

d. Inventories are reported as a separate line item in entity obtains the risks and rewards of ownership

the statement of financial position. of inventory and has the ability to dispose of the

inventory

3. La Union Corp. is considering the following items for c. Inventory is recognized when, and only when, the

inclusion in ‘Inventories’: entity becomes a party to a purchase commitment.

Materials on hand P1,200,000 d. Inventory is recognized when, and only when, it is

Materials in transit shipped FOB probable that future economic benefits will flow to

shipping point 470,000 the entity and the cost or value of the inventory

Materials in transit shipped FOB can be measured reliably.

destination 350,000

Advances for materials ordered 200,000 6. In accordance with PAS 2, inventories are required to

Goods in process 900,000 be measured at the

Finished goods in factory 3,000,000 a. Cost

Finished goods in company-owned b. Net realizable value

retail stores, including 50% profit c. Fair value less costs to sell

on cost 750,000 d. Lower of cost and net realizable value

Finished goods in hands of consignees

including 40% profit on sales 400,000 7. PAS 2 does not apply to the measurement of

Goods held on consignment, at sales inventories held by

price, cost P150,000 300,000 a. Producers of agricultural and forest products,

Finished goods in transit to customers, agricultural produce after harvest, and minerals

shipped FOB seller, at cost 250,000 and mineral products, to the extent that they are

Finished goods in transit to customers, measured at net realizable value in accordance

shipped FOB buyer, at cost 150,000 with well-established practices in those industries.

Unsalable finished goods, at cost 30,000 b. Commodity broker-traders who measure their

Office supplies 40,000 inventories at fair value less costs to sell.

Advertising catalogs and shipping c. Both a and b.

boxes 150,000 d. Neither a nor b.

Compute the amount to be presented as ‘Inventories’ 8. Which statement is incorrect regarding costs of

under current assets. inventories?

a. P6,460,000 c. P6,560,000 a. The cost of inventories should comprise all costs of

b. P6,510,000 d. P6,610,000 purchase, costs of conversion and other costs

incurred in bringing the inventories to their present

4. The inventory on hand at Dec. 31 for Fair Company location and condition.

valued at a cost of P947,800. The following items b. Trade discounts, rebates and other similar items

were not included in this inventory amount: are deducted in determining the costs of purchase.

a. Purchased goods, in transit, shipped FOB c. It may be appropriate to include non-production

destination invoice price P32,000 which included overheads or the costs of designing products for

freight charges of P1,600. specific customers in the cost of inventories.

b. Goods held on consignment by Fair Company at a d. Foreign exchange differences arising directly on

sales price of P28,000, including sales commission the recent acquisition of inventories invoiced in a

of 20% of the sales price. foreign currency are included in cost of inventories.

Page 1 of 8 www.teamprtc.com.ph FAR.3402

TEAM PRTC

9. Costs of purchase do not include The entity incurred the following selling expenses:

a. Purchase price. • Advertising costs = P30,000

b. Import duties and other non-refundable taxes. • Depreciation and maintenance of vehicles used by the

c. Transport, handling and other costs directly sales staff = P10,000

attributable to the acquisition of finished goods, • Salary of the administration personnel = P600,000

materials and services.

d. Fixed and variable manufacturing overheads. 12. The total costs of purchase is

a. P3,747,000 c. P4,100,000

10. Costs of conversion do not include b. P4,047,000 d. P4,249,000

a. Depreciation and maintenance of factory buildings

and equipment used in the production process. 13. The total costs of conversion is

b. Cost of factory management and administration. a. P1,134,000 c. P1,060,000

c. Indirect labor. b. P1,144,000 d. P1,070,000

d. Direct materials.

11. The following may be included in the cost of 14. The following information pertains to King

inventories, except Corporation’s inventory in units:

a. Administrative overheads. Inventory, beginning 100,000

b. Storage costs. Purchases 900,000

c. Wasted materials, labor and other production Purchase returns 10,000

costs. Received from consignors 220,000

d. Selling costs. Transferred to consignees 160,000

Sales (excluding consignments) 750,000

Sales - received from consignors 80,000

Use the following information for the next two questions: Sales - consignees 42,000

Roweena Corp. began operations in the current year. Sales returns – in good condition 8,000

During the year it incurred the following expenditures in Sales returns - unsalable 5,000

purchasing materials for producing its product: How many units should King Corporation include in its

• Purchase price of raw materials = P3,000,000 inventory at the end of the period?

• Import duty and other non-refundable purchase taxes a. 193,000 c. 206,000

= P800,000 b. 201,000 d. 211,000

• Refundable purchase taxes = P100,000

• Freight costs for bringing the goods from the supplier 15. In accordance with the objective of PAS 2, a primary

to the factory raw material storeroom = P300,000 issue in accounting for inventories is

• Costs of unloading the materials into the raw material a. The amount of cost to be recognized as an asset

storeroom = P2,000 and carried forward until the related revenues are

• Packaging = P200,000 recognized.

The entity received P53,000 volume rebate from a supplier b. The cost formulas to be used to assign costs to

for purchasing more than P1,500,000 from the supplier inventories.

during the year. c. The measurement of inventories held by producers

of agricultural and forest products.

The entity incurred the following additional costs in the d. The measurement of inventories held by

production run: commodity broker-traders.

• Salary of the machine workers in the factory =

P500,000 16. Which statement is incorrect regarding cost formulas?

• Salary of factory supervisor = P300,000 a. An entity shall use the same cost formula for all

• Depreciation of the factory building and equipment inventories having a similar nature and use to the

used for production process = P60,000 entity.

• Consumables used in the production process = b. For inventories with a different nature or use,

P20,000 different cost formulas may be justified.

• Depreciation of vehicle used to transport the goods c. Both a and b.

from the raw materials storeroom to the machine floor d. Neither a nor b.

= P40,000

• Factory electricity usage charges = P30,000 17. Which statement is incorrect regarding cost formulas?

• Factory rental = P100,000 a. Specific identification of cost means that specific

• Depreciation and maintenance of the entity’s vehicle costs are attributed to identified inventory.

used by the factory supervisor (50 per cent for official b. The FIFO formula assumes that the items of

use and 50 per cent for personal use) = P20,000. inventory that were purchased or produced first

Private use of the vehicle is an employee benefit. are sold first, and consequently the items

remaining in inventory at the end of the period are

The entity incurred the following administration expenses: those most recently purchased or produced.

• Depreciation of the administration building = P50,000 c. Under the weighted average cost formula, the cost

• Depreciation and maintenance of vehicles used by the of each item is determined from the weighted

administrative staff = P15,000 average of the cost of similar items at the

• Salaries of the administration personnel = P305,000 beginning of a period and the cost of similar items

purchased or produced during the period.

Of the administration expenses 20 per cent are attributable d. Under the weighted average cost formula, the

to administering the factory. The rest of the average is calculated as each additional shipment

administration expenses are attributable, in equal is received, regardless of the circumstances of the

proportion, to the sales and other non-production entity.

operations (e.g. financing, tax and corporate secretarial

functions).

Page 2 of 8 www.teamprtc.com.ph FAR.3402

TEAM PRTC

18. When can an entity use last-in, first-out (LIFO)? LECTURE NOTES:

a. For items that are not ordinarily interchangeable.

Computation of the cost of ending inventory

b. For goods or services produced and segregated for

specific projects. Specific identification:

c. For items other than those mentioned in a and b.

Units on hand x Specific Unit Cost

d. Under no circumstances.

First-in, first-out method (FIFO)

19. Generally, which inventory costing method

approximates most closely the current cost for each of Units on hand x Unit Cost of latest purchases

the following?

Cost of goods sold Ending inventory Weighted Average

a. LIFO FIFO Units on hand x Weighted Average Unit Cost (WAUC)

b. LIFO LIFO

WAUC = Total cost of GAS/Total units available for sale

c. FIFO FIFO

d. FIFO LIFO

23. Which of the following is not affected by the inventory

Use the following information for the next three questions.

valuation method used by an entity?

Transactions for the month of June were: a. Cost of goods sold.

b. Net income of the entity.

Purchases Units Unit cost Total cost

c. Amounts owed for income taxes.

June 1 (balance) 400 P3.20 P 1,280

d. Amounts paid to acquire merchandise.

3 1,100 3.10 3,410

7 600 3.30 1,980

24. Maximilian uses the perpetual inventory system.

15 900 3.40 3,060

Maximilian's inventory transactions for the month of

22 250 3.50 875

August were as follows:

3,250 P10,605

Total

Sales No. Unit cost cost

June 2 300 @ P5.50 01 Aug. Beg. inventory 20 P4.00 P80.00

6 800 @ 5.50 07 Aug. Purchases 10 4.20 42.00

9 500 @ 5.50 10 Aug. Purchases 20 4.30 86.00

10 200 @ 6.00 12 Aug. Sales 15 ? ?

18 700 @ 6.00 16 Aug. Purchases 20 4.60 92

25 150 @ 6.00 20 Aug. Sales 40 ? ?

2,650 28 Aug. Sales returns 3 ? ?

20. The ending inventory on a FIFO basis is Using the information, assume that the Maximilian

a. P1,900 c. P2,041 uses the FIFO cost flow method and that the sales

b. P1,956 d. P2,065 returns relate to the 20 August sales. The sales return

21. Assuming that perpetual inventory records are kept in should be costed back into inventory at what unit cost?

units only, the ending inventory on an average-cost a. P4.00 c. P4.07

basis is b. P4.30 d. P4.60

a. P1,900 c. P2,041

b. P1,956 d. P2,065

25. Which statement is incorrect regarding net realizable

22. Assuming that perpetual inventory records are kept in value (NRV)?

units and pesos, the ending inventory on an average- a. NRV refers to the net amount that an entity

cost basis is expects to realize from the sale of inventory in the

a. P1,900 c. P2,041 ordinary course of business.

b. P1,956 d. P2,065 b. NRV is an entity-specific value.

c. NRV for inventories may not equal fair value less

SOLUTION FOR QUESTION #22: costs to sell.

d. Estimated costs necessary to make the sale are

limited to incremental costs when determining

NRV.

26. The cost of inventories may not be recoverable if

I. The inventories are damaged

II. The inventories have become wholly or partially

obsolete

III. The selling prices have declined

IV. The estimated costs of completion or the estimated

costs to be incurred to make the sale have

increased.

a. I, II, III and IV c. I and II only

b. I, II and III only d. I, II and IV only

Page 3 of 8 www.teamprtc.com.ph FAR.3402

TEAM PRTC

27. The closing inventory at cost of a company amounted 31. The Refenjol Corp. included the following in its

to P284,700. The following items were included at cost unadjusted trial balance as of December 31:

in the total: Inventory, 1/1 P 19,450,000

• 400 coats, which had cost P80 each and normally Purchases 127,850,000

sold for P150 each. Owing to a defect in Available for sale P147,300,000

manufacture, they were all sold after the reporting

date at 50% of their normal price. Selling The inventory at December 31 was counted at a cost

expenses amounted to 5% of the proceeds. of P14.5 million. This includes P500,000 of slow-

• 800 skirts, which had cost P20 each. These too moving inventory that is expected to be sold for a net

were found to be defective. Remedial work costs amount of P300,000.

P5 per skirt and selling expenses for the batch

The cost of sales for the year is

totaled P800. They were sold for P28 each.

a. P133,100,000 c. P132,800,000

What should the inventory value be according to PAS 2 b. P133,000,000 d. P132,600,000

Inventories after considering the above items?

a. P281,200 c. P282,800

b. P282,100 d. P329,200 32. In accordance with PAS 2, an entity should disclose

a. The amount of any write-down of inventories

recognized as an expense in the period.

28. The following figures relate to inventory held at Dec. b. The amount of any reversal of any write-down that

31: is recognized as a reduction in the amount of

inventories recognized as expense in the period.

Per Unit

c. The circumstances or events that led to the

Cost P10

reversal of a write-down of inventories.

General selling price 12

d. All of these.

Selling price in a binding contract to sell 14

Quoted price in an active market for

similar asset 11

33. In accordance with PIC Q&A No. 2018-10 PAS 2 –

Estimated costs to sell 3

Scope of disclosure of inventory write-downs, an entity

There were 10,000 units (including 2,000 held to satisfy should disclose

a binding contract to sell). a. Write-downs of inventory held at the end of the

reporting period.

At what amount should the entity report the inventory

b. Write-downs representing sales below cost during

on its statement of financial position?

the reporting period.

a. P100,000 c. P90,000

c. Both a and b.

b. P 92,000 d. P84,000

d. Neither a nor b.

29. Which is correct regarding write-down of inventory to

34. Which statement is incorrect regarding reversal of

net realizable value?

inventory write-down to net realizable value?

a. Materials and other supplies held for use in the

a. If the selling price of inventory that has been

production of inventories are not written down

written down to net realizable value in a prior

below cost if the finished products in which they

period, subsequently recovers, the previous

will be incorporated are expected to be sold at or

amount of the write-down can be reversed.

above cost.

b. The reversal is limited to the amount of the

b. When a decline in the price of materials indicates

original write-down.

that the cost of the finished products exceeds net

c. The amount of any reversal of any write-down of

realizable value, the materials are written down to

inventories, arising from an increase in net

net realizable value. In such circumstances, the

realizable value, shall be recognized as a reduction

best available measure of the net realizable value

in the amount of inventories recognized as an

of materials is the replacement cost.

expense in the period in which the reversal occurs.

c. Both a and b.

d. None, all the statements are correct.

d. Neither a nor b.

35. At the end of the reporting period, the balance of

30. The following figures relate to inventory of materials

inventory account of an entity was P502,000. The

held at Dec. 31:

balance of the allowance for inventory write-down was

Item X Item Y P33,000. The inventory cost and other data are as

follows: (amounts in thousands)

Cost P200,000 P400,000

Replace

Replacement cost 180,000 370,000 ment Sales Normal

Item Cost Cost Price NRV Profit

Estimated costs to convert A P 89 P 86 P 91 P 87 P 5

materials into finished goods 100,000 200,000 B 94 92 93 85 7

C 125 135 129 111 10

Estimated selling price of 320,000 610,000

D 194 114 205 197 20

finished goods

Total P502 P427 P518 P480 P32

Estimated costs to sell 10,000 15,000

The amount to be recognized as reversal of inventory

The entity should recognize loss on write-down of write down is

inventory of materials of a. P33,000 c. P8,000

a. P50,000 c. P5,000 b. P11,000 d. P 0

b. P30,000 d. Nil

Page 4 of 8 www.teamprtc.com.ph FAR.3402

TEAM PRTC

36. Caravana Development Corporation bought a 10- 38. Catapult Corp. purchased merchandise during the year

hectare land in Novaliches, to be improved, subdivided on credit for P200,000; terms 2/10, n/30. All of the

into lots, and eventually sold. Purchase price of the gross liability except P40,000 was paid within the

land was P58,000,000. Taxes and documentation discount period. The remainder was paid within the

expenses on the transfer of the property amounted to 30-day term. At the end of the annual accounting

P800,000. The lots were classified as follows: period, 90% of the merchandise had been sold and

Lot Number Selling price Total 10% remained in inventory. The entity has no

class of lots per lot clearing costs beginning inventory. The entity uses net method of

A 10 P1,000,000 None recording purchases.

B 20 800,000 P1,000,000

If the entity used the gross method of recording

C 40 700,000 3,000,000

purchases instead of the net method, the reported cost

D 50 600,000 8,000,000

of goods sold would have been

The cost per lot of class B lots under the relative sales a. The same c. Lower by P720

value method of inventory valuation is b. Higher by P720 d. P176,400

a. P674,285 c. P602,380

b. P610,000 d. P560,000

Use the following information for the next two questions.

On Nov. 15, 2022, Socrates entered into a commitment to

37. Buyer Co. regularly buys shirts from Vendor Company

purchase 200,000 units of raw material X for P40 per unit

and is allowed trade discounts of 20% and 10% from

to be delivered on Mar. 15, 2023. The contract cannot be

the list price. Buyer purchased shirts from Vendor on

cancelled. Socrates entered into this purchase commitment

May 27 and received an invoice with a list price of

to protect itself against the volatility in the price of raw

P100,000 and payment terms 2/10, n/30. If Buyer

material X. By Dec. 31, 2022, the purchase price of

uses the net method of recording purchases, the

material X had fallen to P35 per unit.

journal entry to record the payment on June 7 will

include

39. How much will be recognized as loss on purchase

a. A debit to Accounts payable of P72,000.

commitment on Mar. 15, 2023 if the price of the

b. A debit to Purchase Discounts Lost of P1,440.

material had fallen further to P32 per unit?

c. A credit to Purchase Discounts of P1,440.

a. P1,600,000 c. P600,000

d. A credit to Cash of P70,560.

b. P1,000,000 d. P 0

40. How much will be recognized as gain on purchase

LECTURE NOTES:

commitment on Mar. 15, 2023 if the price of the

Trade and Cash Discounts material had risen to P42 per unit?

a. P2,000,000 c. P400,000

Trade Cash b. P1,000,000 d. P 0

Objective Generate sales Encourage prompt

payment 41. On Jan. 1, 2023, Pastille Corp. signed a three-year

Accounting Not recorded Recorded using noncancelable purchase contract, which allows Pastille

separately either Gross or Net to purchase up to 500,000 units of a computer part

(Purchases/Sales method annually from Pyramid Supply Co. at P10 per unit and

net of trade guarantees a minimum annual purchase of 100,000

discount) units. During 2023, the part unexpectedly became

obsolete. Pastille had 250,000 units of this inventory

at Dec. 31, 2023, and believes these parts can be sold

Gross and Net method of recording purchases as scrap for P2 per unit. What amount of probable loss

from the purchase commitment should Pastille report

Gross Net in its 2023 profit or loss?

Cash Deducted from Deducted from a. P2,400,000 c. P1,600,000

discounts purchases/cost of purchases/cost of b. P2,000,000 d. P 800,000

inventory when inventory whether

taken taken or not 42. Which is not a required disclosure for inventories in

accordance with PAS 2?

Cash Deducted from Not accounted for a. The accounting policies adopted in measuring

discounts purchases/cost of separately since inventories.

taken inventory (purchase already deducted b. The carrying amount of inventories carried at fair

discounts) from purchases value less costs to sell.

c. The amount of inventories recognized as an

Cash Included in Reported as other expense during the period.

discounts purchases/cost of expense d. The fair value of inventories.

not taken inventory (purchase

discounts lost) 43. Which is not a required disclosure for inventories in

accordance with PAS 2?

a. Inventory costing methods employed.

b. Inventory composition.

c. Inventory financing arrangements.

d. Inventory location.

- done -

Page 5 of 8 www.teamprtc.com.ph FAR.3402

TEAM PRTC

ILLUSTRATIVE PROBLEMS

PROBLEM NO. 1 - Items considered as inventories

1. Dogs that a pet shop buys from breeders that it then sells

_______ 2. Equipment held for sale in the ordinary course of business

_______ 3. Equipment held for sale in accordance with PFRS 5

4. Lubricants that are consumed by an entity’s machinery in producing goods

5. Materials on hand

6. Materials in transit shipped FOB shipping point

7. Materials in transit shipped FOB destination

8. Advances for materials ordered

9. Goods in process

10. Finished goods in factory

11. Finished goods in company-owned retail stores

12. Finished goods in hands of consignees

13. Goods held on consignment

14. Finished goods in transit to customers, shipped FOB seller

15. Finished goods in transit to customers, shipped FOB buyer

16. Unsalable finished goods

17. Office supplies

18. Advertising catalogs and shipping boxes

19. Land held for sale in the ordinary course of business

20. Land and building for rental to others

REQUIRED:

YES OR NO. Write YES if the item is considered as inventories. If not, write NO.

ANSWERS:

1. YES

2. YES

3. NO

4. YES

5. YES

6. YES

7. NO

8. NO

9. YES

10. YES

11. YES

12. YES

13. NO

14. NO

15. YES

16. NO

17. NO

18. NO

19. YES

20. NO

Page 6 of 8 www.teamprtc.com.ph FAR.3402

TEAM PRTC

PROBLEM NO. 2 - Cost flow assumptions

The following information has been extracted from the records of Praktis Corporation about one of its products.

Date No. of Units Unit Cost Total Cost

January 1 Beginning balance 1,600 P14.00 P22,400

January 6 Purchased 600 14.10 8,460

February 5 Sold @ P24.00 per unit 2,000

March 19 Purchased 2,200 14.70 32,340

March 24 Purchase returns 160 14.70 2,352

April 10 Sold @ P24.20 per unit 1,400

June 22 Purchased 16,800 15.00 252,000

July 31 Sold @ P26.50 per unit 3,600

August 4 Sales returns @ P26.50 per unit 40

September 4 Sold @ P27.00 per unit 7,000

November 15 Purchased 1,000 16.00 16,000

December 28 Sold @ P30.00 per unit 6,200

REQUIRED:

Compute for the closing inventory under each of the following pricing methods. (Round unit costs to two decimal places.)

1. FIFO – Periodic 3. Weighted average - Periodic

2. FIFO – Perpetual 4. Weighted average – Perpetual (Moving average)

SOLUTION:

FIFO – Periodic

From November 15 purchases (1,000 units x P16.00) - P16,000

From June 22 purchases (880 units x P15.00) - 13,200

Total P29,200

FIFO – Perpetual

Purchases Sales Balance

Unit Unit Unit

Units Cost Total Cost Units Cost Total Cost Units Cost Total Cost

Jan. 1 1,600 14.00 22,400

Jan. 6 600 14.10 8,460 1,600 14.00 22,400

600 14.10 8,460

2,200 30,860

Feb. 5 1,600 14.00 22,400

400 14.10 5,640 200 14.10 2,820

Mar. 19 2,200 14.70 32,340 200 14.10 2,820

2,200 14.70 32,340

2,400 35,160

Mar. 24 (160) 14.70 (2,352) 200 14.10 2,820

2,040 14.70 29,988

2,240 32,808

Apr. 10 200 14.10 2,820

1,200 14.70 17,640 840 14.70 12,348

Jun. 22 16,800 15.00 252,000 840 14.70 12,348

16,800 15.00 252,000

17,640 264,348

Jul. 31 840 14.70 12,348

2,760 15.00 41,400 14,040 15.00 210,600

Aug. 4 (40) 15.00 (600) 14,080 15.00 211,200

Sep. 4 7,000 15.00 105,000 7,080 15.00 106,200

Nov. 15 1,000 16.00 16,000 7,080 15.00 106,200

1,000 16.00 16,000

8,080 122,200

Dec. 28 6,200 15.00 93,000 880 15.00 13,200

1,000 16.00 16,000

1,880 29,200

Page 7 of 8 www.teamprtc.com.ph FAR.3402

TEAM PRTC

Average – Periodic

Total cost (1,880 units x P14.92) - P28,050

Weighted average unit cost (P328,848/22,040 units) - P14.92

Average – Perpetual (Moving average)

Purchases Sales Balance

Unit Unit Unit

Units Cost Total Cost Units Cost Total Cost Units Cost Total Cost

Jan. 1 1,600 14.00 22,400

Jan. 6 600 14.10 8,460 1,600 14.00 22,400

600 14.10 8,460

2,200 14.03 30,860

Feb. 5 2,000 14.03 28,060 200 14.03 2,800

Mar. 19 2,200 14.70 32,340 200 14.03 2,800

2,200 14.70 32,340

2,400 14.64 35,140

Mar. 24 (160) 14.70 (2,352) 200 14.03 2,800

2,040 14.70 29,988

2,240 14.64 32,788

Apr. 10 1,400 14.64 20,496 840 14.64 12,292

Jun. 22 16,800 15.00 252,000 840 14.64 12,292

16,800 15.00 252,000

17,640 14.98 264,292

Jul. 31 3,600 14.98 53,928 14,040 14.98 210,364

Aug. 4 (40) 14.98 (599) 14,080 14.98 210,963

Sep. 4 7,000 14.98 104,860 7,080 14.98 106,103

Nov. 16 1,000 16.00 16,000 7,080 14.98 106,103

1,000 16.00 16,000

8,080 15.11 122,103

Dec. 28 6,200 15.11 93,682 1,880 15.11 28,421

J - end of FAR.3402 - J

Page 8 of 8 www.teamprtc.com.ph FAR.3402

You might also like

- FAR.3202 InventoriesDocument8 pagesFAR.3202 InventoriesMira Louise HernandezNo ratings yet

- Since 1977: Inventory CostsDocument8 pagesSince 1977: Inventory CostsCV CVNo ratings yet

- Since 1977: Inventory DiscussionsDocument8 pagesSince 1977: Inventory Discussionsmusic niNo ratings yet

- FAR.2902 Inventories PDFDocument8 pagesFAR.2902 Inventories PDFNah HamzaNo ratings yet

- INVENTORY ADJUSTMENTSDocument6 pagesINVENTORY ADJUSTMENTSDrie LimNo ratings yet

- Inventories Problems To DiscussDocument6 pagesInventories Problems To Discusskeisha santosNo ratings yet

- Inventories QuizDocument4 pagesInventories QuizIvy Salise100% (1)

- ACCO 201 - Accounting For InventoryDocument4 pagesACCO 201 - Accounting For InventoryLorraine GrimaldoNo ratings yet

- Inventories Pratical ExercisesDocument6 pagesInventories Pratical ExercisesKrystyn Myrhyll50% (2)

- Handout No. 3Document6 pagesHandout No. 3Villena Divina VictoriaNo ratings yet

- Practical Accounting 1 Review: PAS 41 and PAS 16 Key ConceptsDocument2 pagesPractical Accounting 1 Review: PAS 41 and PAS 16 Key ConceptsJobelle Candace Flores AbreraNo ratings yet

- P1 Day4 RMDocument15 pagesP1 Day4 RMSharmaine Sur100% (1)

- F FAR PBFPBOCT19.pdf 93604515Document16 pagesF FAR PBFPBOCT19.pdf 93604515Athena AthenaNo ratings yet

- Far First Set ADocument8 pagesFar First Set APaula Villarubia100% (1)

- Ust Jpia Inventories Reviewer Ca51010 PDFDocument10 pagesUst Jpia Inventories Reviewer Ca51010 PDFLlyana paula SuyuNo ratings yet

- MidtermS2 InventoriesDocument11 pagesMidtermS2 InventoriesQueenie Dayagro0% (2)

- Financial Accounting and ReportingDocument12 pagesFinancial Accounting and ReportingMyrrh ErosNo ratings yet

- This Study Resource Was: FAR EasyDocument9 pagesThis Study Resource Was: FAR EasyPM HauglgolNo ratings yet

- Inventories HandoutDocument4 pagesInventories HandoutRoselle Jane LanabanNo ratings yet

- 1 CA51010 InventoriesDocument4 pages1 CA51010 InventoriesatashaNo ratings yet

- 3.1.5 Audit of Inventories ANSWERDocument38 pages3.1.5 Audit of Inventories ANSWERAnna TaylorNo ratings yet

- FAR-INVENTORIES-ASSIGNMENTDocument7 pagesFAR-INVENTORIES-ASSIGNMENTplenostheamickaelaNo ratings yet

- MQ1 - Topics FAR.2901 To 2915.Document7 pagesMQ1 - Topics FAR.2901 To 2915.Waleed MustafaNo ratings yet

- ACCTG102 MidtermQ2 InventoriesDocument10 pagesACCTG102 MidtermQ2 InventoriesDayan DudosNo ratings yet

- Inventories Test Bank PDFDocument13 pagesInventories Test Bank PDFAB CloydNo ratings yet

- Inventory CalculationsDocument3 pagesInventory CalculationsAleiza MalaluanNo ratings yet

- Audit of Inventories Problems CompressDocument19 pagesAudit of Inventories Problems CompressSajj PrrtyNo ratings yet

- Internal Control Measures Audit InventoryDocument8 pagesInternal Control Measures Audit InventoryMel palomaNo ratings yet

- PRTC FAR-1stPB 5.22Document9 pagesPRTC FAR-1stPB 5.22Ciatto SpotifyNo ratings yet

- Chapter 5 Inventories Exercises Answer Guide Summer AY2122 PDFDocument10 pagesChapter 5 Inventories Exercises Answer Guide Summer AY2122 PDFwavyastroNo ratings yet

- 3-Prefinals-Exam-Intermediate-Accounting-IA-Bloc-3Document3 pages3-Prefinals-Exam-Intermediate-Accounting-IA-Bloc-3Lourence Lee ServidadNo ratings yet

- FAR Ocampo/Cabarles/Soliman/Ocampo First Pre-Board OCTOBER 2018Document5 pagesFAR Ocampo/Cabarles/Soliman/Ocampo First Pre-Board OCTOBER 2018kai luvNo ratings yet

- Galatians 6: 9 "Let Us Not Become Weary in Doing Good, For at The Proper Time We Will Reap A Harvest If We Do Not Give Up."Document5 pagesGalatians 6: 9 "Let Us Not Become Weary in Doing Good, For at The Proper Time We Will Reap A Harvest If We Do Not Give Up."Kei TsukishimaNo ratings yet

- InventoriesDocument64 pagesInventoriesJoey WassigNo ratings yet

- InventoriesDocument64 pagesInventoriesMarjorie PalmaNo ratings yet

- Intermediate Accounting 1 QuizDocument8 pagesIntermediate Accounting 1 QuizGabriela Marie F. PalatulanNo ratings yet

- Far - Team PRTC 1stpb May 2023Document8 pagesFar - Team PRTC 1stpb May 2023Alexander IgotNo ratings yet

- Audit of Inventories: Problem No. 1Document272 pagesAudit of Inventories: Problem No. 1Aldrin Zolina100% (12)

- Far Set1Document5 pagesFar Set1bea kullinNo ratings yet

- Audit of Inventories - Part 1Document5 pagesAudit of Inventories - Part 1Mark Lawrence YusiNo ratings yet

- Assignment Accounting For MaterialsDocument6 pagesAssignment Accounting For MaterialsAngel MarieNo ratings yet

- Perpetual Inventory System Quiz with Accounting Journal EntriesDocument5 pagesPerpetual Inventory System Quiz with Accounting Journal EntriesKei Tsukishima100% (2)

- Handout - InventoriesDocument6 pagesHandout - Inventoriescj alveroNo ratings yet

- MKMKMDocument5 pagesMKMKMKei TsukishimaNo ratings yet

- FAR-4105 INVENTORIES - Part 2Document3 pagesFAR-4105 INVENTORIES - Part 2music niNo ratings yet

- FAR-4105 PART 2Document3 pagesFAR-4105 PART 2kdltcalderon102No ratings yet

- 6 This Will Help You Be BetterDocument65 pages6 This Will Help You Be Betteryes yesnoNo ratings yet

- Inventories: Chapter 8: Theory of Accounts ReviewerDocument25 pagesInventories: Chapter 8: Theory of Accounts ReviewerYuki100% (1)

- Chapter 7 Acctng For Materials Activity PDFDocument3 pagesChapter 7 Acctng For Materials Activity PDFGwyneth Hannah Sator RupacNo ratings yet

- PAS 02 InventoryDocument8 pagesPAS 02 InventoryRia GayleNo ratings yet

- PRACTICE SET-Inventories (Problems)Document8 pagesPRACTICE SET-Inventories (Problems)polxrixNo ratings yet

- Review Handouts and Materials: Semester First Semester School Year 2019-2020 Subject Handout # TopicDocument34 pagesReview Handouts and Materials: Semester First Semester School Year 2019-2020 Subject Handout # TopicWilson TanNo ratings yet

- InventoryDocument10 pagesInventoryGirlie Ann JimenezNo ratings yet

- Ap-500Q: Quizzer On Purchasing/Disbursement Production and Revenue/Receipt Cycles: Audit of Inventories, Receivables and Cash and Cash EquivalentsDocument27 pagesAp-500Q: Quizzer On Purchasing/Disbursement Production and Revenue/Receipt Cycles: Audit of Inventories, Receivables and Cash and Cash Equivalentsruel c armillaNo ratings yet

- Inventory Costing MethodsDocument3 pagesInventory Costing MethodsGigi LuceroNo ratings yet

- Forest Products: Advanced Technologies and Economic AnalysesFrom EverandForest Products: Advanced Technologies and Economic AnalysesNo ratings yet

- IFRS, Fair Value and Corporate Governance: The Impact on Budgets, Balance Sheets and Management AccountsFrom EverandIFRS, Fair Value and Corporate Governance: The Impact on Budgets, Balance Sheets and Management AccountsRating: 4 out of 5 stars4/5 (1)

- FAR.3402 2018-10 PAS 2 - Scope of Disclosure of Inventory Write-DownsDocument2 pagesFAR.3402 2018-10 PAS 2 - Scope of Disclosure of Inventory Write-DownsMonica GarciaNo ratings yet

- FAR.3207 PPE-RevaluationDocument2 pagesFAR.3207 PPE-RevaluationMira Louise HernandezNo ratings yet

- FAR.3408 2017-06 PAS 2 16 and 40 - Accounting For Collector S ItemsDocument4 pagesFAR.3408 2017-06 PAS 2 16 and 40 - Accounting For Collector S ItemsMonica GarciaNo ratings yet

- FAR.3408 2017-10 PAS 40 - Separation of Property and Classification As Investment PropertyDocument5 pagesFAR.3408 2017-10 PAS 40 - Separation of Property and Classification As Investment PropertyMonica GarciaNo ratings yet

- IFRS List Philippines 2023Document5 pagesIFRS List Philippines 2023Monica GarciaNo ratings yet

- Philippine Interpretations Committee (Pic) Questions and Answers (Q&As)Document5 pagesPhilippine Interpretations Committee (Pic) Questions and Answers (Q&As)RicaNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument5 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoMonica GarciaNo ratings yet

- MS 3411 Risks Returns and Capital StructureDocument4 pagesMS 3411 Risks Returns and Capital StructureMonica GarciaNo ratings yet

- FAR.3405 PPE-Acquisition and Subsequent ExpendituresDocument6 pagesFAR.3405 PPE-Acquisition and Subsequent ExpendituresMonica GarciaNo ratings yet

- MS 3412 Capital BudgetingDocument6 pagesMS 3412 Capital BudgetingMonica GarciaNo ratings yet

- MS 3404 Standard Costing and Variance AnalysisDocument6 pagesMS 3404 Standard Costing and Variance AnalysisMonica GarciaNo ratings yet

- MS 3413 Activity-Based Costing SystemDocument5 pagesMS 3413 Activity-Based Costing SystemMonica GarciaNo ratings yet

- MS 3406 Short-Term Budgeting Additional Financing Needed and ForecastingDocument7 pagesMS 3406 Short-Term Budgeting Additional Financing Needed and ForecastingMonica GarciaNo ratings yet

- Financial Statement Analysis RatiosDocument6 pagesFinancial Statement Analysis RatiosMonica GarciaNo ratings yet

- MS 3402 Costs Behavior Determination and PredictionDocument5 pagesMS 3402 Costs Behavior Determination and PredictionMonica GarciaNo ratings yet

- Management Accounting Roles and FunctionsDocument7 pagesManagement Accounting Roles and FunctionsANTONIA LORENA BITUINNo ratings yet

- RFBT.3409 Fria Tila PDFDocument12 pagesRFBT.3409 Fria Tila PDFMonica GarciaNo ratings yet

- MS 3403 Costs Volume Profit AnalysisDocument6 pagesMS 3403 Costs Volume Profit AnalysisMonica GarciaNo ratings yet

- Variable and Absorption Costing Income StatementsDocument5 pagesVariable and Absorption Costing Income StatementsMonica GarciaNo ratings yet

- RFBT.10 - Lecture Notes (Labor Law)Document9 pagesRFBT.10 - Lecture Notes (Labor Law)Monica GarciaNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument7 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoMonica GarciaNo ratings yet

- RFBT.3407 Cooperatives PDIC and Bank Secrecy PDFDocument10 pagesRFBT.3407 Cooperatives PDIC and Bank Secrecy PDFMonica GarciaNo ratings yet

- RFBT.09 - Lecture Notes (Truth in Lending Act)Document3 pagesRFBT.09 - Lecture Notes (Truth in Lending Act)Monica GarciaNo ratings yet

- RFBT.3410 Insurance Labor SSS PDFDocument39 pagesRFBT.3410 Insurance Labor SSS PDFMonica GarciaNo ratings yet

- RFBT.3406 AMLA and BP 22 PDFDocument10 pagesRFBT.3406 AMLA and BP 22 PDFMonica GarciaNo ratings yet

- RFBT.3408 Ipl Eca Dpa PDFDocument14 pagesRFBT.3408 Ipl Eca Dpa PDFMonica GarciaNo ratings yet

- RFBT.10 - Lecture Notes (SSS Law)Document10 pagesRFBT.10 - Lecture Notes (SSS Law)Monica Garcia100% (1)

- RFBT.3405 CorporationDocument22 pagesRFBT.3405 CorporationMonica GarciaNo ratings yet

- RFBT.3404 PartnershipDocument11 pagesRFBT.3404 PartnershipMonica GarciaNo ratings yet

- Information Booklet 2022Document28 pagesInformation Booklet 2022Tora SarkarNo ratings yet

- Case - INOXDocument2 pagesCase - INOXRam PowruNo ratings yet

- NUTECH Company Profile FinalDocument33 pagesNUTECH Company Profile FinalMohd KashifNo ratings yet

- As 116941 Im-H3ee RM 96M16412 WW GB 2021 2 PDFDocument332 pagesAs 116941 Im-H3ee RM 96M16412 WW GB 2021 2 PDFPierre-Olivier MouthuyNo ratings yet

- ABCDDocument10 pagesABCDmary maryNo ratings yet

- Financial and Managerial Accounting 13th Edition Warren Test BankDocument25 pagesFinancial and Managerial Accounting 13th Edition Warren Test BankGinaRobinsoneoib100% (64)

- Audit of Liabilities - Guidance Note PDFDocument22 pagesAudit of Liabilities - Guidance Note PDFRicalyn E. SumpayNo ratings yet

- Test Bank For Principles of Cost Accounting, 16th EditionDocument56 pagesTest Bank For Principles of Cost Accounting, 16th EditionFornierNo ratings yet

- Cultural Difference Management, WalmartDocument6 pagesCultural Difference Management, WalmartMbugua Wa IrunguNo ratings yet

- Tesla Supplier Code of ConductDocument4 pagesTesla Supplier Code of ConductT.Y.A3 BHISARA SHREYANo ratings yet

- RTM Cia 1Document9 pagesRTM Cia 1Shivani K Nair 2028149No ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument8 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceProficient CyberNo ratings yet

- ElementDocument3 pagesElementMaiko Gil HiwatigNo ratings yet

- Custom Authentication in Oracle APEXDocument19 pagesCustom Authentication in Oracle APEXBala SubramanyamNo ratings yet

- Posting HFEP Chem & Hema Analyzer June 25, 2020 Ai FinalDocument93 pagesPosting HFEP Chem & Hema Analyzer June 25, 2020 Ai FinalDustin Padilla FormalejoNo ratings yet

- Edexcel Business Full Notes-Unit 1Document35 pagesEdexcel Business Full Notes-Unit 1muhamed.ali.2905No ratings yet

- Adobe Scan 12-Jan-2024Document7 pagesAdobe Scan 12-Jan-2024Paawni GuptaNo ratings yet

- Maintenance StrategiesDocument2 pagesMaintenance StrategiesBassemNo ratings yet

- The corridor of customer satisfaction and loyalty in B2B marketsDocument16 pagesThe corridor of customer satisfaction and loyalty in B2B marketsJohn SmithNo ratings yet

- Final Project - A STUDY OF GROWTH PROSPECTS OF ONLINE REATAILORS AND E-COMMERCE IN INDIADocument94 pagesFinal Project - A STUDY OF GROWTH PROSPECTS OF ONLINE REATAILORS AND E-COMMERCE IN INDIAhariiNo ratings yet

- Refrence Material 1 - Unit I-IIIDocument120 pagesRefrence Material 1 - Unit I-IIIFROSTOPNo ratings yet

- Piling Works Tender For NrepDocument10 pagesPiling Works Tender For NrepPratik GuptaNo ratings yet

- Merchandising - Journal EntriesDocument3 pagesMerchandising - Journal EntriesBhea Ballesteros CabasanNo ratings yet

- 2 Industrial Attachment Final DraftDocument185 pages2 Industrial Attachment Final DraftGolam Rabbi Sagor0% (1)

- Wa0004.Document16 pagesWa0004.DEBASHISHCHATTERJE78No ratings yet

- International Conference (INAPR) ,: Daftar PustakaDocument4 pagesInternational Conference (INAPR) ,: Daftar PustakakaskusNo ratings yet

- Literature @jun-2020 MODIFIEDDocument26 pagesLiterature @jun-2020 MODIFIEDEng-Mukhtaar CatooshNo ratings yet

- Unfuckyourbusiness PreviewDocument5 pagesUnfuckyourbusiness PreviewtesterNo ratings yet

- Daily Construction Report (DCR) : Project ManagerDocument5 pagesDaily Construction Report (DCR) : Project ManagerMoath AlhajiriNo ratings yet

- Case Analysis of Infosys 1326776317Document5 pagesCase Analysis of Infosys 1326776317Shweta P PaiNo ratings yet