Professional Documents

Culture Documents

Week 12 - Ch13 Formula List (Grouped)

Uploaded by

Anthony Malizia0 ratings0% found this document useful (0 votes)

6 views2 pagesThis document provides an overview of various financial ratios used to analyze a company's performance across several categories: liquidity, profit management, debt management, asset management, and market factors. It defines key ratios for each category, such as current ratio and quick ratio for liquidity, return on assets and return on equity for profitability, debt ratio and equity ratio for leverage, accounts receivable turnover for efficiency, and price-earnings ratio for market factors. Formulas are provided for calculating each ratio. Students are expected to understand how to group and interpret these ratios for financial analysis.

Original Description:

Original Title

Week 12_Ch13 Formula List (Grouped) (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an overview of various financial ratios used to analyze a company's performance across several categories: liquidity, profit management, debt management, asset management, and market factors. It defines key ratios for each category, such as current ratio and quick ratio for liquidity, return on assets and return on equity for profitability, debt ratio and equity ratio for leverage, accounts receivable turnover for efficiency, and price-earnings ratio for market factors. Formulas are provided for calculating each ratio. Students are expected to understand how to group and interpret these ratios for financial analysis.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views2 pagesWeek 12 - Ch13 Formula List (Grouped)

Uploaded by

Anthony MaliziaThis document provides an overview of various financial ratios used to analyze a company's performance across several categories: liquidity, profit management, debt management, asset management, and market factors. It defines key ratios for each category, such as current ratio and quick ratio for liquidity, return on assets and return on equity for profitability, debt ratio and equity ratio for leverage, accounts receivable turnover for efficiency, and price-earnings ratio for market factors. Formulas are provided for calculating each ratio. Students are expected to understand how to group and interpret these ratios for financial analysis.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

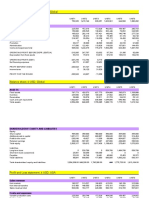

ADMS2500

Winter 2023

Financial Ratio Analysis

Topic of Analysis Ratios

Liquidity Current Ratio Quick Ratio

Working Capital Position

Profit Management Return on Assets (ROA)

Return on Common Shareholders’ Equity (ROE)

Earnings per Share (EPS)

Return on Sales (ROS), Gross Profit %, Operating income %

Debt Management Equity Ratio Equity Ratio

(Solvency, leverage) Bond Interest Coverage Preferred Dividend Coverage

Asset Management Receivable turnover; Average Collection Period

Inventory turnover Accounts Payable Turnover

Working Capital Turnover Fixed Assets Turnover

Asset Turnover

Market Price to Earnings Ratio Dividend Yield

Dividend Payout Ratio

Liquidity (life or death) – ability to pay debts immediately due

1. Current Ratio = Current Assets / Current Liabilities

2. Quick Ratio = Quick Assets / Current Liabilities

(*Quick assets = cash + temporary investments + receivables)

3. Working capital = Current assets – Current liabilities

Profitability (profit management) – ability to make money

1. Return on Assets (ROA) = Operating Income / Average Total Assets

2. Return on Equity (ROE) = Operating Income / Average Owners’ Equity

Return on Common Shareholders Equity = (Net Income – Preferred Dividend) /

Average Common Shareholders’ Equity

3. Earnings Per Share (EPS) = (Net income – Preferred Div. Requirement) / Average # of

common shares

4. Vertical analysis (e.g.)

a. Gross profit percentage = gross profit / net sales

b. Operating income % = Operating Income / net sales

c. Return on Sales (ROS) = Net Income / Net Sales

Leverage (debt management, solvency, ability to meet debt obligations)

1. Debt ratio = Total Liabilities / Total Assets

2. Equity Ratio = Common Shareholders' Equity / Total Assets

3. Bond Interest Coverage = Operating Income / Annual Bond Interest

4. Preferred Dividend Coverage = Operating Income / (Annual Bond Interest + Preferred

Dividend Requirements)

Efficiency (asset Management; ability to effectively use assets)

1. Accounts Receivable Turnover = Net Sales / Average of net Accounts Receivables

ADMS2500

Winter 2023

Financial Ratio Analysis

Average Collection Period = 365 / Accounts Receivable Turnover

2. Inventory Turnover = Cost of Goods Sold / Average Inventory

Average days of outstanding inventory = 365 / Inventory Turnover

3. Working Capital Turnover = Net Sales / Average Working Capital

4. Fixed Assets Turnover = Net Sales / Average fixed assets

5. Asset turnover = Net sales / Average total assets

6. Accounts Payable turnover = Cost of Goods Sold / Average Accounts Payable

Average days of outstanding accounts payable = 365 / Accounts Payable turnover

Cost of Goods Sold (CGS, or COGS) sometimes also called Cost of Sales

* Sales – COGS = Gross profit – operating expense = operating income – int exp –

income tax exp = net income

Market (the firm’s attractiveness/popularity to the market)

1. P/E ratio: Price Earnings Ratio = Market Price of Common Share / Earnings Per

Common Share

2. Dividend Payout Ratio = Dividends per Common Share / Earnings per Common Share

3. Dividend Yield = Dividends per Share / Market Price per share

Note

- This formula list will be provided in the final exam in alphabetical order (i.e., not

grouped into subcategories)

- Students are responsible for grouping and interpreting ratios.

You might also like

- Financial Statement AnalysisDocument10 pagesFinancial Statement AnalysisBeth Diaz LaurenteNo ratings yet

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- Understanding and Analyzing Financial Statements: School of Inspired LeadershipDocument17 pagesUnderstanding and Analyzing Financial Statements: School of Inspired LeadershipSachin YadavNo ratings yet

- Financial Accounting and Reporting Study Guide NotesFrom EverandFinancial Accounting and Reporting Study Guide NotesRating: 1 out of 5 stars1/5 (1)

- Financial Statement AnalysisDocument10 pagesFinancial Statement AnalysisAli Gokhan Kocan100% (1)

- 03 Financial AnalysisDocument55 pages03 Financial Analysisselcen sarıkayaNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- 04 Fs Analysis With StudentDocument10 pages04 Fs Analysis With StudentarianasNo ratings yet

- Business Combinations (Part 2) : Problem 1: True or FalseDocument12 pagesBusiness Combinations (Part 2) : Problem 1: True or FalseAlexanderJacobVielMartinez100% (3)

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- Project - Financial Statement AnalysisDocument25 pagesProject - Financial Statement Analysiskashi_8789% (9)

- Comparative Financial Analysis of Apex Footwear LTD & Bata Shoe Company (Bangladesh) LTDDocument27 pagesComparative Financial Analysis of Apex Footwear LTD & Bata Shoe Company (Bangladesh) LTDMD. SAMIUL HASAN ARICNo ratings yet

- Mas 15Document11 pagesMas 15Christine Jane AbangNo ratings yet

- ACCA F7 Mock Exam QuestionsDocument18 pagesACCA F7 Mock Exam QuestionsGeo Don100% (1)

- Week 2Document6 pagesWeek 2Maryane AngelaNo ratings yet

- Ratio AnalysisDocument6 pagesRatio AnalysisMilcah QuisedoNo ratings yet

- This Study Resource Was: Problem 12.8Document2 pagesThis Study Resource Was: Problem 12.8lana del reyNo ratings yet

- MAS-42O: Financial Statement Analysis: - T R S ADocument11 pagesMAS-42O: Financial Statement Analysis: - T R S AStefanie FerminNo ratings yet

- CFAS Reviewer - Module 4Document14 pagesCFAS Reviewer - Module 4Lizette Janiya SumantingNo ratings yet

- Financial Statements A ND AnalysisDocument43 pagesFinancial Statements A ND AnalysisJMNo ratings yet

- ACC 1100 Day 08&09 Ratio and Comparative AnalysisDocument32 pagesACC 1100 Day 08&09 Ratio and Comparative AnalysisMai Anh ĐàoNo ratings yet

- Important Points 1. 2. 3. 4. 5. 6. 7Document15 pagesImportant Points 1. 2. 3. 4. 5. 6. 7RAVI KUMARNo ratings yet

- 02 Fs AnalysisDocument14 pages02 Fs AnalysisWilsonNo ratings yet

- Chapter 2 Financial AnalysisDocument26 pagesChapter 2 Financial AnalysisCarl JovianNo ratings yet

- Problems On RatiosDocument4 pagesProblems On RatiosShahana AfrozNo ratings yet

- Summary of Financial Ratios DiscussionDocument30 pagesSummary of Financial Ratios DiscussionJohn Mark CabrejasNo ratings yet

- Financial Statements & AnalysisDocument36 pagesFinancial Statements & AnalysisMahiNo ratings yet

- ACC 1100 Day 08&09 Ratio and Comparative AnalysisDocument32 pagesACC 1100 Day 08&09 Ratio and Comparative AnalysisMai Anh ĐàoNo ratings yet

- Fundamentals of Accountancy, Business, and Management 2 SY 2020-2021 QTR1 WK 7 Financial Statement (FS) Analysis MELC/sDocument8 pagesFundamentals of Accountancy, Business, and Management 2 SY 2020-2021 QTR1 WK 7 Financial Statement (FS) Analysis MELC/sAlma Dimaranan-AcuñaNo ratings yet

- RatiosDocument12 pagesRatiosOmer ArifNo ratings yet

- FM Group AssignmentDocument3 pagesFM Group AssignmentAbdela AyalewNo ratings yet

- Liquidity RatioDocument2 pagesLiquidity RatioThea DagunaNo ratings yet

- Advanced Financial MGMT AssignmentDocument2 pagesAdvanced Financial MGMT AssignmentAleko tamiruNo ratings yet

- Chapter 6 Basic Finance 2023 2024 LatestDocument5 pagesChapter 6 Basic Finance 2023 2024 LatestPACIOLI-EDRADA, BEANo ratings yet

- Financial Statement Analysis Word FileDocument25 pagesFinancial Statement Analysis Word FileolmezestNo ratings yet

- 2 FS Analysis USTDocument22 pages2 FS Analysis USTFk TnccNo ratings yet

- Chapter 3Document46 pagesChapter 3Md. Shams SaleheenNo ratings yet

- Fsa 2Document15 pagesFsa 2Abinash MishraNo ratings yet

- Cost and Financial Accounting Session 5 NotesDocument4 pagesCost and Financial Accounting Session 5 NotesDreadshadeNo ratings yet

- Chapter 5 Building Profit PlanDocument28 pagesChapter 5 Building Profit PlanOkta SelregaNo ratings yet

- Fin Man 1 FINANCIAL Ratio AnalysisDocument15 pagesFin Man 1 FINANCIAL Ratio AnalysisAnnie EinnaNo ratings yet

- Financial RatiosDocument13 pagesFinancial RatioscheeriosNo ratings yet

- Financial Ratios Explanation: Icap Group S.ADocument15 pagesFinancial Ratios Explanation: Icap Group S.Asteven_c22003No ratings yet

- 2financial Statement AnalysisDocument24 pages2financial Statement AnalysisSachin YadavNo ratings yet

- ACCT 610 - Study Guide - Part 1 - Financial Statement AnalysisDocument12 pagesACCT 610 - Study Guide - Part 1 - Financial Statement AnalysisRahil VermaNo ratings yet

- Analyzing and Interpreting Financial StatementsDocument32 pagesAnalyzing and Interpreting Financial StatementsmarieieiemNo ratings yet

- Financial Statement Analysis 1Document23 pagesFinancial Statement Analysis 1MedicareMinstun Project100% (1)

- Module - Financial Statement AnalysisDocument3 pagesModule - Financial Statement AnalysisCATHERINE FRANCE LALUCISNo ratings yet

- Accounting PPT 2Document46 pagesAccounting PPT 2Carla RománNo ratings yet

- Financial Reporting and Analysis: Mcgraw-Hill/Irwin ©2007, The Mcgraw-Hill Companies, All Rights ReservedDocument37 pagesFinancial Reporting and Analysis: Mcgraw-Hill/Irwin ©2007, The Mcgraw-Hill Companies, All Rights ReservedMutiara RamadhaniNo ratings yet

- Resa Material Financial Statement AnalysisDocument12 pagesResa Material Financial Statement Analysispatrickjames.ravelaNo ratings yet

- 2.3 Financial Ratios SummaryDocument21 pages2.3 Financial Ratios SummaryNiela Marie LazaroNo ratings yet

- Chapter 3 Summary - Dion Bonaventura - 2006464940Document4 pagesChapter 3 Summary - Dion Bonaventura - 2006464940Dion Bonaventura ManaluNo ratings yet

- Module 8 (FINP7)Document4 pagesModule 8 (FINP7)David VillaNo ratings yet

- Chapter 2 Financail Analysis&planningDocument13 pagesChapter 2 Financail Analysis&planninganteneh hailieNo ratings yet

- Adjustments IDocument45 pagesAdjustments InarmadaNo ratings yet

- Financial Statement Analysis Using RatiosDocument26 pagesFinancial Statement Analysis Using RatiosSophia NicoleNo ratings yet

- 02 Analysis of Financial Statements HandoutsDocument13 pages02 Analysis of Financial Statements HandoutsCheska EvaristoNo ratings yet

- Working Capital MGTDocument12 pagesWorking Capital MGTssimi137No ratings yet

- Fundamental Analysis Part 2Document3 pagesFundamental Analysis Part 2Wuzmal HanduNo ratings yet

- United International University: Assignment On Ratio Analysis & Dupont AnalysisDocument8 pagesUnited International University: Assignment On Ratio Analysis & Dupont AnalysisMostofa Reza PigeonNo ratings yet

- Financial PlanningDocument24 pagesFinancial PlanningDayaan ANo ratings yet

- Financial Statement Analysis 1Document23 pagesFinancial Statement Analysis 1Theang ʚĩɞNo ratings yet

- 01 Financial Statement Analysis - LectureDocument40 pages01 Financial Statement Analysis - LectureChelsea ManuelNo ratings yet

- Financial Statement Analysis 2 2Document23 pagesFinancial Statement Analysis 2 2Denise Roque100% (1)

- Financial Statement AnalysisDocument14 pagesFinancial Statement AnalysisAllona BatonghinogNo ratings yet

- CORPORATE REPORTING Icag PDFDocument31 pagesCORPORATE REPORTING Icag PDFmohedNo ratings yet

- Financial Results Quarter Ended Mar 31 2023 Recommendation Final DividendDocument20 pagesFinancial Results Quarter Ended Mar 31 2023 Recommendation Final DividendSudipta DasNo ratings yet

- Diploma in International Financial Reporting: Thursday 6 December 2007Document9 pagesDiploma in International Financial Reporting: Thursday 6 December 2007Ajit TiwariNo ratings yet

- Chapter 7 To Chapter 9: CorrectDocument10 pagesChapter 7 To Chapter 9: CorrectChaiz MineNo ratings yet

- Practice Problems On Long Term Financing and Cost of CapitalDocument8 pagesPractice Problems On Long Term Financing and Cost of CapitalDhairya ShahNo ratings yet

- Titan Co Financial ModelDocument15 pagesTitan Co Financial ModelAtharva OrpeNo ratings yet

- Corporate Reporting Strategy-MBA 2023 - Vertical GroupsDocument58 pagesCorporate Reporting Strategy-MBA 2023 - Vertical GroupsbiggykhairNo ratings yet

- BMSR 2016 PDFDocument205 pagesBMSR 2016 PDFFitria Rizal Eka PutriNo ratings yet

- Week 1 Practice SolutionsDocument7 pagesWeek 1 Practice SolutionsalexandraNo ratings yet

- Mock QE Questionnaire - Second Year Answer KeyDocument29 pagesMock QE Questionnaire - Second Year Answer KeyAngel Madelene BernardoNo ratings yet

- Chapter 4 Governmental AccountingDocument8 pagesChapter 4 Governmental Accountingmohamad ali osmanNo ratings yet

- ROKKO Holdings 2011 Annual ReportDocument117 pagesROKKO Holdings 2011 Annual ReportWeR1 Consultants Pte LtdNo ratings yet

- HP Service Company TransactionsDocument18 pagesHP Service Company TransactionsAndrew Sy ScottNo ratings yet

- Round 2Document68 pagesRound 2fereNo ratings yet

- Basic Accounting Principles and GuidelinesDocument23 pagesBasic Accounting Principles and GuidelinesgaurabNo ratings yet

- REDOBLE Consolidation Subsequent To Date of AcquisitionDocument2 pagesREDOBLE Consolidation Subsequent To Date of AcquisitionShiela Mae RedobleNo ratings yet

- AC15 Quiz 1 Test PaperDocument6 pagesAC15 Quiz 1 Test PaperKristine Esplana ToraldeNo ratings yet

- Audit Report UnqualifiedDocument19 pagesAudit Report Unqualifiedbona veronica viduyaNo ratings yet

- LK PD AngkasaDocument19 pagesLK PD AngkasaTashya NovitaNo ratings yet

- ReceivablesDocument20 pagesReceivablesGemmalyn FolguerasNo ratings yet

- F AccountDocument39 pagesF AccountChandra Prakash SoniNo ratings yet

- Eval6 04 1xlsxDocument14 pagesEval6 04 1xlsx司雨鑫No ratings yet

- Subsidiary Preferred Stock Consolidated Earnings Per Share, and Consolidated Income TaxationDocument16 pagesSubsidiary Preferred Stock Consolidated Earnings Per Share, and Consolidated Income TaxationAnzas Rustamaji PratamaNo ratings yet

- Vedanta DCFDocument50 pagesVedanta DCFmba23subhasishchakrabortyNo ratings yet