Professional Documents

Culture Documents

Chapter 5 Notes

Uploaded by

Natasha Angelica SusantoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 5 Notes

Uploaded by

Natasha Angelica SusantoCopyright:

Available Formats

Cost of equity of a Project:

Risk free rate: depends on the currency of cash flows

Beta: use bottom-up levered beta for the business (e.g., beta of theme park business of

Disney)

Market Risk Premium: Use implied equity risk premium (US, e.g., 5.5%) and add country risk

premium (depending on the location of the project, e.g., Brazil).

Indirect Method:

Cash Flow to Firm = After-tax Operating Income + Depreciation & Amortization – Capital

Expenditures-Change in Non-cash Working Capital

After-tax Operating Income = EBIT (1-t) = After-tax EBIT

The tax rate (t) used is the marginal tax rate (as opposed to the effective tax rate reported in income

statements and annual reports) because projects create income at the margin and will be taxed at

the margin.

Effective Tax Rate = Taxes Paid / Reported Pre-tax Income

Depreciation is not actual cash outflow but it affects Cash Flow to Firm because it determines the

amount of taxes paid.

Interest rates do not show up because we are computing earnings to the firm - operating income -

rather than earnings to equity - net income.

Capitalizing and amortizing the expense will have a more positive effect on income while expensing it

will have a more positive effect on cash flows (assuming there is an income to expense it).

Direct Method:

Cash Flow to Firm = Incremental Operating Income – Taxes + Incremental Depreciation – Capital

Expenditures-Change in Non-cash Working Capital

Incremental Operating Income = Revenues- Direct Expenses – Incremental Depreciation –

Incremental G&A

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

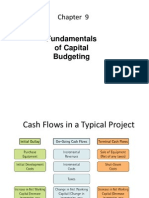

- Typical Cash Flows at The Start: Cost of Machines (200.000, Posses, So On Balance SheetDocument7 pagesTypical Cash Flows at The Start: Cost of Machines (200.000, Posses, So On Balance SheetSylvan EversNo ratings yet

- BEC Notes Chapter 3Document6 pagesBEC Notes Chapter 3cpacfa90% (10)

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Solution Manual For Corporate Finance A Focused Approach 6th EditionDocument37 pagesSolution Manual For Corporate Finance A Focused Approach 6th Editionjanetgriffintizze100% (12)

- Incremental Operating Cash Flow CalculationDocument11 pagesIncremental Operating Cash Flow Calculationmehrab1807100% (1)

- (Lecture 3) - Inflation and Capital AllowanceDocument9 pages(Lecture 3) - Inflation and Capital AllowanceAjay Kumar TakiarNo ratings yet

- Tax Income, Sunk Cost and Opportunity Cost: Week 13Document46 pagesTax Income, Sunk Cost and Opportunity Cost: Week 13satryoyu811No ratings yet

- Chapter 5Document34 pagesChapter 5yayobnNo ratings yet

- Acctg FormulasDocument7 pagesAcctg FormulasAira Santos VibarNo ratings yet

- Class Notes: Class: XI Topic: Financial StatementDocument3 pagesClass Notes: Class: XI Topic: Financial StatementRajeev ShuklaNo ratings yet

- Interest: L PinDocument8 pagesInterest: L Pineka putri sri andrianiNo ratings yet

- Financial Concepts: Weighted Average Cost of Capital (WACC)Document6 pagesFinancial Concepts: Weighted Average Cost of Capital (WACC)koshaNo ratings yet

- Cheat Sheet - Financial STDocument2 pagesCheat Sheet - Financial STMohammad DaulehNo ratings yet

- Valuation: Aswath DamodaranDocument100 pagesValuation: Aswath DamodaranhsurampudiNo ratings yet

- Investment Appraisal Taxation, InflationDocument8 pagesInvestment Appraisal Taxation, InflationJiya RajputNo ratings yet

- Fundamentals of Capital Budgeting: FIN 2200 - Corporate Finance Dennis NGDocument31 pagesFundamentals of Capital Budgeting: FIN 2200 - Corporate Finance Dennis NGNyamandasimunyolaNo ratings yet

- LXL Gr12Acc 01 Cash-Flow-Statement 16apr2015Document9 pagesLXL Gr12Acc 01 Cash-Flow-Statement 16apr2015Nezer Byl P. VergaraNo ratings yet

- LXL Gr12Acc 01 Cash-Flow-Statement 16apr2015 PDFDocument9 pagesLXL Gr12Acc 01 Cash-Flow-Statement 16apr2015 PDFNezer Byl P. VergaraNo ratings yet

- Defining Free Cash Flow Top-Down ApproachDocument2 pagesDefining Free Cash Flow Top-Down Approachchuff6675100% (1)

- Free Basic Short Financial Accounting - 2f20dc43 314d 49bf A7e8 F398e2c49e3dDocument32 pagesFree Basic Short Financial Accounting - 2f20dc43 314d 49bf A7e8 F398e2c49e3dCareer and TechnologyNo ratings yet

- Income Statement Revenues - Expenses Net IncomeDocument4 pagesIncome Statement Revenues - Expenses Net IncomeTanishaq bindalNo ratings yet

- DCF in Depth Calculate The Revenue Growth Rate: Forecasting Free Cash FlowsDocument5 pagesDCF in Depth Calculate The Revenue Growth Rate: Forecasting Free Cash FlowsJustBNo ratings yet

- Chapter 2 Buiness FinanxceDocument38 pagesChapter 2 Buiness FinanxceShajeer HamNo ratings yet

- BDHCH 9Document37 pagesBDHCH 9tzsyxxwht100% (1)

- Chapter 3Document5 pagesChapter 3Hal kNo ratings yet

- Notes - An Introduction To Financ, Accouting, Modeling, and ValuationDocument8 pagesNotes - An Introduction To Financ, Accouting, Modeling, and ValuationperNo ratings yet

- DCF Valuation - Aswath DamodaranDocument60 pagesDCF Valuation - Aswath DamodaranUtkarshNo ratings yet

- Fundamentals of Capital BudgetingDocument54 pagesFundamentals of Capital BudgetingLee ChiaNo ratings yet

- Midterm Review - Key ConceptsDocument10 pagesMidterm Review - Key ConceptsGurpreetNo ratings yet

- Unit 4 Earnings Multiplier and EVADocument3 pagesUnit 4 Earnings Multiplier and EVAJaikishan FabyaniNo ratings yet

- Chapter 3 BecDocument11 pagesChapter 3 BecStephen ZhaoNo ratings yet

- Estimation of Project Cash FlowsDocument26 pagesEstimation of Project Cash Flowssupreet2912No ratings yet

- 25 Questions On DCF ValuationDocument4 pages25 Questions On DCF ValuationZain Ul AbidinNo ratings yet

- 02 - Basic Perf MeasuresDocument14 pages02 - Basic Perf MeasureshoalongkiemNo ratings yet

- Financial Statement Analysis For ValuationDocument5 pagesFinancial Statement Analysis For Valuationsanu sayedNo ratings yet

- Minimum Acceptable Rate of ReturnDocument17 pagesMinimum Acceptable Rate of ReturnRalph Galvez100% (1)

- Corporate Valuation: Principles and PracticesDocument12 pagesCorporate Valuation: Principles and PracticesvishalNo ratings yet

- MFM AantekeningenDocument27 pagesMFM AantekeningenabcdefNo ratings yet

- DCF Analysis Forecasting Free Cash FlowsDocument4 pagesDCF Analysis Forecasting Free Cash Flowshamrah1363No ratings yet

- Statement of CashflowsDocument2 pagesStatement of CashflowsLove IslamNo ratings yet

- Effect of Taxat-Wps OfficeDocument10 pagesEffect of Taxat-Wps OfficeZameer DalviNo ratings yet

- Document 26Document2 pagesDocument 26José GómezNo ratings yet

- Statement of Retained Earings and Its Components HandoutDocument12 pagesStatement of Retained Earings and Its Components HandoutRitesh LashkeryNo ratings yet

- Corporate TaxationDocument3 pagesCorporate TaxationRod AnthonyNo ratings yet

- Project Cashflow EstimationDocument11 pagesProject Cashflow EstimationKrishnapriya NairNo ratings yet

- Project Cashflow EstimationDocument11 pagesProject Cashflow EstimationKrishnapriya NairNo ratings yet

- F M S Investment Appraisal: Inancial AnagementDocument50 pagesF M S Investment Appraisal: Inancial AnagementsaadaltafNo ratings yet

- 9 Mas Capital Budgeting Sessions 3 4Document14 pages9 Mas Capital Budgeting Sessions 3 4seya dummyNo ratings yet

- Unit 4: Relative ValuationDocument47 pagesUnit 4: Relative ValuationMadhvendra BhardwajNo ratings yet

- Review SessionDocument25 pagesReview SessionK60 Bùi Phương AnhNo ratings yet

- Advanced Financial Accounting - II CH 1-4Document24 pagesAdvanced Financial Accounting - II CH 1-4TAKELE NEDESANo ratings yet

- Lecture Notes Section 5Document18 pagesLecture Notes Section 5Marc OurfaliNo ratings yet

- How To Calculate Markup PercentageDocument8 pagesHow To Calculate Markup PercentageGilbert AranaNo ratings yet

- FADM Cheat SheetDocument2 pagesFADM Cheat Sheetvarun022084No ratings yet

- International Tax: Dominican Republic Highlights 2019Document4 pagesInternational Tax: Dominican Republic Highlights 2019Juan Enrique GuilianiNo ratings yet

- Capbud CFDocument8 pagesCapbud CFVARUN MONGANo ratings yet

- FINALS - 1ST SEM TER 2021-2022: Valuation, Concepts and MethodsDocument6 pagesFINALS - 1ST SEM TER 2021-2022: Valuation, Concepts and MethodsJoanna MalubayNo ratings yet

- 3 - Income Statement-Without Correction of ExercisesDocument58 pages3 - Income Statement-Without Correction of ExercisesClaire YINo ratings yet

- Soal UAS Startup FinancingDocument6 pagesSoal UAS Startup FinancingNatasha Angelica SusantoNo ratings yet

- 2023 3 Decision Tree AnalysisDocument24 pages2023 3 Decision Tree AnalysisNatasha Angelica SusantoNo ratings yet

- 2023 2 Linear ProgrammingDocument26 pages2023 2 Linear ProgrammingNatasha Angelica SusantoNo ratings yet

- Chapter 4 - Part III NotesDocument1 pageChapter 4 - Part III NotesNatasha Angelica SusantoNo ratings yet