Professional Documents

Culture Documents

Statement of Cashflows

Uploaded by

Love Islam0 ratings0% found this document useful (0 votes)

3 views2 pagesThe document outlines the indirect and direct methods for preparing a statement of cash flows. The indirect method begins with net income and makes adjustments to reconcile it to net cash provided by operating activities. The direct method shows cash received from customers and cash paid to suppliers, employees, for interest and taxes to directly determine net cash from operations. Both methods also report net cash provided/used by investing and financing activities to reconcile to the change in cash and equivalents for the period.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the indirect and direct methods for preparing a statement of cash flows. The indirect method begins with net income and makes adjustments to reconcile it to net cash provided by operating activities. The direct method shows cash received from customers and cash paid to suppliers, employees, for interest and taxes to directly determine net cash from operations. Both methods also report net cash provided/used by investing and financing activities to reconcile to the change in cash and equivalents for the period.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views2 pagesStatement of Cashflows

Uploaded by

Love IslamThe document outlines the indirect and direct methods for preparing a statement of cash flows. The indirect method begins with net income and makes adjustments to reconcile it to net cash provided by operating activities. The direct method shows cash received from customers and cash paid to suppliers, employees, for interest and taxes to directly determine net cash from operations. Both methods also report net cash provided/used by investing and financing activities to reconcile to the change in cash and equivalents for the period.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

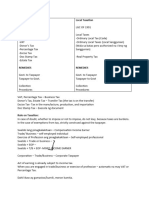

STATEMENT OF CASHFLOWS (DIRECT & INDIRECT METHOD)

Indirect Method:-

Company Name

Statement of Cashflows

For period ended 20XX

Cashflows from operating activities

Net Income

Add) Increase in Depreciation/Accumulated Depreciation

Add) loss

Less) Gain

Adjustment of Working Capital Items

Less) Increase in A/R

Less) Increase in Inventories

Add) Increase in A/P

Add) Increase in Accrual Liabilities

Add) Increase in Accrued Tax

Add) Increase in Deferred Tax

Less) Increase in Prepaid Expenses

Net Cash provided/Used by Operating Activities

(Used = Negative

Provided = Positive)

Cashflows from investing activities

Cashflow from fixed & other Assets

Net Cash provided/Used by investing activities

Cashflows from financing activities

Cashflow from fixed & other Assets

Add) increase in N/P

Add) increase in Long term debt

Add) increase in Common stock

Less) Dividend (if paid, not declared)

Net Cash provided/Used by financing activities

Net Cash provided/Used by Business Activities

Add) Opening Balance Cash & Equivalents

Opening Balance Cash & Equivalents

EBIT (earnings before interest & tax)

Less) Interest

EBT (earnings before tax )

Less) Tax

EAT(earnings after tax)/Net Income

Direct Method:-

Company Name

Statement of Cashflows

For period ended 20XX

Cashflows from operating activities

Cash received from customers

(Sales – Decrease in A/R)

Less) Cash paid to employees & suppliers

( CGS

+ Increase Inventories

- Depreciation (if inclusive)

+ Increase in prepaid expense

+ Decrease in A/P

+ Decrease in Accruals

+ Selling & Admin exp)

Less) Interest Paid

(Interest

+ Decrease in Accrual exp

+ Increase in prepaid interest (if any))

Less) Tax Paid

(Tax

+ Increase in prepaid tax

+ Decrease in Tax accrual

+ Decrease in deferred Tax)

Deferred = Late

Net Cash provided/Used by Operating Activities

(Used = Negative

Provided = Positive)

You might also like

- Direct and Indirect MethodDocument2 pagesDirect and Indirect MethodIan GolezNo ratings yet

- B203B - Accounting and Finance (Part BDocument32 pagesB203B - Accounting and Finance (Part Bahmed helmyNo ratings yet

- 1-Cash FlowsDocument1 page1-Cash Flowsahmedfouad0712No ratings yet

- Model FS - PFRS For SMEs (2022)Document17 pagesModel FS - PFRS For SMEs (2022)Joel RazNo ratings yet

- Cash Flow 2 AprilDocument12 pagesCash Flow 2 AprilMayank MalhotraNo ratings yet

- Cashflow ExampleDocument6 pagesCashflow ExamplecoolyouhiNo ratings yet

- Cash Flow Statement Notes.12Document12 pagesCash Flow Statement Notes.12Sarthak PatilNo ratings yet

- Chapter 6Document9 pagesChapter 6Villanueva, Jane G.No ratings yet

- TAX - Gross Income (Compensation)Document12 pagesTAX - Gross Income (Compensation)Von Andrei MedinaNo ratings yet

- Module 2: Conceptual Framework For Financial ReportingDocument5 pagesModule 2: Conceptual Framework For Financial Reportingmonsta x noona-yaNo ratings yet

- Cash Flow Cheat SheetsDocument2 pagesCash Flow Cheat SheetsSarah SafiraNo ratings yet

- Deferred Tax Accounting - Lecture NotesDocument6 pagesDeferred Tax Accounting - Lecture Notesmax pNo ratings yet

- 1-7 Statement of Cash Flow - Indirect MethodDocument22 pages1-7 Statement of Cash Flow - Indirect MethodHazel Joy DemaganteNo ratings yet

- Cash Flow ModuleDocument5 pagesCash Flow ModuleEmzNo ratings yet

- Cash Flow StatementDocument17 pagesCash Flow StatementanuhyaextraNo ratings yet

- Cash Flow StatementDocument16 pagesCash Flow StatementSagnik Sharangi100% (1)

- Accounting Principles: Second Canadian EditionDocument38 pagesAccounting Principles: Second Canadian EditionErik Lorenz PalomaresNo ratings yet

- Cash FlowDocument6 pagesCash FlowKhaneik KingNo ratings yet

- Chapter 5 NotesDocument1 pageChapter 5 NotesNatasha Angelica SusantoNo ratings yet

- Cash Flow StatementDocument22 pagesCash Flow Statementshrestha.aryxnNo ratings yet

- Cash Flow Statement (BBA)Document43 pagesCash Flow Statement (BBA)shrestha.aryxnNo ratings yet

- Chapter 3 2023Document7 pagesChapter 3 2023Linh DieuNo ratings yet

- FR16 Taxation (Stud) .Document45 pagesFR16 Taxation (Stud) .duong duongNo ratings yet

- Lecture 2Document24 pagesLecture 2Bình MinhNo ratings yet

- FINS1613: Business Finance: Semester 1, 2017 Section III: Capital Budgeting The Indirect MethodDocument7 pagesFINS1613: Business Finance: Semester 1, 2017 Section III: Capital Budgeting The Indirect MethodHoward QinNo ratings yet

- Financial Ratios and Key Metrics for Business ProfilingDocument2 pagesFinancial Ratios and Key Metrics for Business Profilinganand_study100% (1)

- Income Tax Notes-IAS 12Document11 pagesIncome Tax Notes-IAS 12mehdi.jjh313No ratings yet

- Cost of Capital: Risk & ReturnDocument27 pagesCost of Capital: Risk & ReturnKrisi ManNo ratings yet

- CorpFin 2021 Fall 2 Risk Lecture 11Document27 pagesCorpFin 2021 Fall 2 Risk Lecture 11Krisi ManNo ratings yet

- 1.0 CFI - FS Primer PDFDocument10 pages1.0 CFI - FS Primer PDFSarthak NautiyalNo ratings yet

- Indirect Method Template: Cash From Operations Start With Net ProfitDocument1 pageIndirect Method Template: Cash From Operations Start With Net Profitchiayi91No ratings yet

- Unit 4: Relative ValuationDocument47 pagesUnit 4: Relative ValuationMadhvendra BhardwajNo ratings yet

- IAS-12 Lecture NotesDocument11 pagesIAS-12 Lecture NotesAli OptimisticNo ratings yet

- Acc Terms & Main StatementsDocument30 pagesAcc Terms & Main Statementszhaok0610No ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Cash Flow Statement in A NutshellDocument2 pagesCash Flow Statement in A NutshellJuan SalazarNo ratings yet

- Cash flows from investing activities:Purchase of long-term assets P612,000 (negative)Issuance of long-term debt 200,000 (positive)Net cash from investing activities P(412,000Document33 pagesCash flows from investing activities:Purchase of long-term assets P612,000 (negative)Issuance of long-term debt 200,000 (positive)Net cash from investing activities P(412,000Kyriye OngilavNo ratings yet

- Accounting For Income TaxDocument1 pageAccounting For Income Taxguliramsam5No ratings yet

- Cash FlowDocument1 pageCash FlowAnonymous ZoxMWONo ratings yet

- acc questions PDFDocument4 pagesacc questions PDFneharajt06061No ratings yet

- !!!!guide To Cash FlowsDocument3 pages!!!!guide To Cash Flowsws. cloverNo ratings yet

- 02 Accounting 3 Statements Linking GuideDocument2 pages02 Accounting 3 Statements Linking GuideGus MarNo ratings yet

- Free Basic Short Financial Accounting - 2f20dc43 314d 49bf A7e8 F398e2c49e3dDocument32 pagesFree Basic Short Financial Accounting - 2f20dc43 314d 49bf A7e8 F398e2c49e3dCareer and TechnologyNo ratings yet

- Module 1 - PGBPDocument50 pagesModule 1 - PGBPAarushi GuptaNo ratings yet

- New Abv Chapter 4Document29 pagesNew Abv Chapter 4manoj sharmaNo ratings yet

- FAR Notes CH1: Income Statement & Balance Sheet & Discontinued Operations 1.0 (Becker 2017)Document7 pagesFAR Notes CH1: Income Statement & Balance Sheet & Discontinued Operations 1.0 (Becker 2017)charles100% (1)

- Class Notes: Class: XI Topic: Financial StatementDocument3 pagesClass Notes: Class: XI Topic: Financial StatementRajeev ShuklaNo ratings yet

- Statement of Cash Flows Ca5106Document57 pagesStatement of Cash Flows Ca5106Bon juric Jr.No ratings yet

- CASH FLOW STATEMENT ANALYSISDocument16 pagesCASH FLOW STATEMENT ANALYSISKalidindi Vamsi Krishna VarmaNo ratings yet

- Lecture 1Document23 pagesLecture 1John TomNo ratings yet

- Financial Leverage One DriveDocument30 pagesFinancial Leverage One DrivemeraheNo ratings yet

- Financial Statements With Year End AdjustmentsDocument4 pagesFinancial Statements With Year End AdjustmentsセニタNo ratings yet

- FRAV Individual Assignment - Pranjali Silimkar - 2016PGP278Document12 pagesFRAV Individual Assignment - Pranjali Silimkar - 2016PGP278pranjaligNo ratings yet

- Cash Flow Statement GuideDocument5 pagesCash Flow Statement Guidepulitha kodituwakkuNo ratings yet

- FCFF Formula Excel - TemplateDocument5 pagesFCFF Formula Excel - TemplateSakshi KatochNo ratings yet

- National Taxation Local TaxationDocument13 pagesNational Taxation Local TaxationjoanamaetaclasNo ratings yet

- Single Company Cash Flow StatementDocument20 pagesSingle Company Cash Flow StatementAchiek JamesNo ratings yet

- Expenses Emp TechDocument2 pagesExpenses Emp TechAngelica SiguaNo ratings yet

- TPB-Formulae StructureDocument14 pagesTPB-Formulae StructureNaresh NavuluriNo ratings yet

- Analysisof Enterprise Financial Accounting Information Managementfromthe Perspectiveof Big Data IJSRDocument6 pagesAnalysisof Enterprise Financial Accounting Information Managementfromthe Perspectiveof Big Data IJSRLove IslamNo ratings yet

- Euro Fin Management - 2023 - Cumming - Mergers and Acquisitions Research in Finance and Accounting Past Present andDocument41 pagesEuro Fin Management - 2023 - Cumming - Mergers and Acquisitions Research in Finance and Accounting Past Present andLove IslamNo ratings yet

- CostingDocument6 pagesCostingLove IslamNo ratings yet

- BudgetingDocument7 pagesBudgetingLove IslamNo ratings yet

- Internal Business Process PerformanceDocument1 pageInternal Business Process PerformanceLove IslamNo ratings yet

- CGS and Income Statement AnalysisDocument2 pagesCGS and Income Statement AnalysisLove IslamNo ratings yet

- Chapter No 4 - Process CostingDocument2 pagesChapter No 4 - Process CostingLove IslamNo ratings yet

- Income Statement AnalysisDocument6 pagesIncome Statement AnalysisLove IslamNo ratings yet