Professional Documents

Culture Documents

AML - CFT - CPF - Amendment - CL33-Annex-A (28-11-2022)

Uploaded by

Ahmed Ali0 ratings0% found this document useful (0 votes)

7 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageAML - CFT - CPF - Amendment - CL33-Annex-A (28-11-2022)

Uploaded by

Ahmed AliCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Annexure to BPRD Circular Letter No.

33 dated November 28, 2022

Part-B: Definitions

The existing definition at Sr. No. 25 is amended as under:

Existing Provision Amended Provision

“Dormant or In-Operative Account” means the account “Dormant or In-Operative Account” means the account

in which no transaction has taken place during the in which no customer initiated transaction (debit or

preceding one year. credit) or activity (e.g. login through digital channels)

has taken place during the preceding one year.

Part-C: Regulations

REGULATION-2: CUSTOMER DUE DILIGENCE

The existing paragraph 24 in Regulation-2 is amended as under:

Existing Provision Amended Provision

Dormant accounts Dormant accounts

24) SBP REs may apply following measures for 24) SBP REs may apply following measures for dormant

activation of dormant account: accounts:

(a) For customers whose accounts are dormant or in- (a) SBP REs shall send prior notice to the account holder

operative, REs may allow credit entries without through any registered medium, e.g. SMS, email, etc.

changing at their own, the dormancy status of such before marking the account as dormant. Notices shall

accounts. Debit transactions/ withdrawals shall not be be sent one (1) month, seven (7) days and one (1) day

allowed until the account is activated on the request of prior to marking the account as dormant. Notice shall

the account holder. also include the account activation procedures/

(b) It may be noted that transactions e.g. debits under channels.

the recovery of loans and markup etc. any permissible (b) SBP REs may allow credit entries in dormant or in-

bank charges, government duties or levies and operative accounts.

instruction issued under any law or from the court will (c) Debit transactions/ withdrawals shall not be allowed

not be subject to debit or withdrawal restriction. until the account is activated. However, transactions

(c) REs may use the NADRA Verisys and a formal e.g. debits under the recovery of loans and markup etc.,

request (through postal address or email address or any permissible bank charges, government duties or

registered mobile number or landline number) for levies and instruction issued under any law or from the

activation of dormant account by customers. They court will not be subject to debit or withdrawal

should retain the NADRA Verisys for record keeping restriction

requirements (digitally or hard copy). (d) SBP REs may activate the dormant account upon

receipt of a formal request from the customer through

any authenticated medium, including their mobile

banking applications, internet banking portals, ATMs,

call centers, surface mail, email, registered mobile or

landline number, etc.

You might also like

- EAST WEST - Ewb Bills Collect 08302018Document3 pagesEAST WEST - Ewb Bills Collect 08302018Junior MiicNo ratings yet

- Kyc and Aml Guidelines-2020Document52 pagesKyc and Aml Guidelines-2020Nishesh KumarNo ratings yet

- Code of Conduct On The Switching of Current Accounts With Credit Institutions 1 October 2010Document11 pagesCode of Conduct On The Switching of Current Accounts With Credit Institutions 1 October 2010aaroyaeeNo ratings yet

- Terms and Conditions - Account OpeningDocument3 pagesTerms and Conditions - Account OpeningWasimullah KhanNo ratings yet

- Ecredit 01202021Document4 pagesEcredit 01202021Dj BacudNo ratings yet

- Contactless Transaction and Online Remittance of ContributionsDocument2 pagesContactless Transaction and Online Remittance of Contributionsgilbert marimon chattoNo ratings yet

- Account Opening Terms & ConditionsDocument7 pagesAccount Opening Terms & ConditionsM. JAWAD AFZALNo ratings yet

- General Terms and ConditionsDocument30 pagesGeneral Terms and Conditionsquynhquang.31211023290No ratings yet

- New Terms and ConditionDocument14 pagesNew Terms and ConditionBernie BenastoNo ratings yet

- RB Chapter 2A-Current Account-MITCDocument9 pagesRB Chapter 2A-Current Account-MITCRohit KumarNo ratings yet

- A Project Report: Mukand Lal National College, YAMUNA NAGAR-135001Document64 pagesA Project Report: Mukand Lal National College, YAMUNA NAGAR-135001Sudhir KakarNo ratings yet

- RBI Revised Notification 6 July 2017 PDFDocument9 pagesRBI Revised Notification 6 July 2017 PDFMoneylife FoundationNo ratings yet

- The Client Agrees To Provide All InformationDocument3 pagesThe Client Agrees To Provide All InformationJennell ArellanoNo ratings yet

- ECSDocument53 pagesECSApurva MeshramNo ratings yet

- Terms and Conditions Governing The Opening and Maintenance of AccountsDocument6 pagesTerms and Conditions Governing The Opening and Maintenance of Accountsjerald tanNo ratings yet

- Accounts Receivable PolicyDocument7 pagesAccounts Receivable PolicyJSNo ratings yet

- Complete Accounting For Government DisbursementsDocument127 pagesComplete Accounting For Government DisbursementsMaketh.Man100% (1)

- Termination of Bank-Customer RelationshipDocument5 pagesTermination of Bank-Customer Relationshipmuggzp100% (1)

- Compensation PolicyDocument17 pagesCompensation PolicySwetha BuridiNo ratings yet

- Virtual Account Service Agreement UpdateDocument4 pagesVirtual Account Service Agreement UpdateQuang Nguyễn LưuNo ratings yet

- GCredit Terms and Conditions 25032021Document6 pagesGCredit Terms and Conditions 25032021Scottlouie BanzagalesNo ratings yet

- Bank CONFIRMATION Tehsil Council Kehror PaccaDocument7 pagesBank CONFIRMATION Tehsil Council Kehror PaccaAamirNo ratings yet

- Branch Less BankingDocument48 pagesBranch Less Bankingsyedasiftanveer100% (2)

- CHAPTER 13 Payment SystemsDocument7 pagesCHAPTER 13 Payment SystemsCarl AbruquahNo ratings yet

- SweepDocument6 pagesSweepSwati PqrNo ratings yet

- Policy On Customer Protection - Limiting Liability of Customers in Unauthorised Electronic Banking TransactionDocument6 pagesPolicy On Customer Protection - Limiting Liability of Customers in Unauthorised Electronic Banking TransactionUttamNo ratings yet

- TermsandconditionDocument22 pagesTermsandconditionadrianNo ratings yet

- ECS Debit PartDocument18 pagesECS Debit PartSai PremNo ratings yet

- OBMB Accounts and Services Main Terms and Conditions ENG PDFDocument26 pagesOBMB Accounts and Services Main Terms and Conditions ENG PDFZoey chaiNo ratings yet

- SOP E PaymentDocument18 pagesSOP E PaymentkapsicumNo ratings yet

- Chapter-6 DisbursementDocument161 pagesChapter-6 DisbursementMyca Orticio100% (2)

- Client Account Course Workbook: Version: 2021-001 Last Modified: December 23, 2021Document29 pagesClient Account Course Workbook: Version: 2021-001 Last Modified: December 23, 2021Agamveer GillNo ratings yet

- Key Fact Sheet CCDocument3 pagesKey Fact Sheet CCcrkriskyNo ratings yet

- Auto Debit Arrangement - 20201019 - 095034 PDFDocument3 pagesAuto Debit Arrangement - 20201019 - 095034 PDFRobert Adrian De RuedaNo ratings yet

- Sample PDC - Biz MOA For Individual AccountsDocument10 pagesSample PDC - Biz MOA For Individual AccountsBrendon AgustinNo ratings yet

- MORB 03 of 16Document71 pagesMORB 03 of 16Dennis BacayNo ratings yet

- Unit 7: Finance Cycle ApplicationsDocument14 pagesUnit 7: Finance Cycle Applicationsyadelew likinaNo ratings yet

- Cheque Collection Policy 2020 21Document27 pagesCheque Collection Policy 2020 21Hareesh LNo ratings yet

- Exhibit 4 - Terms and Conditions Governing The Opening and Maintenance of Deposit AccountsDocument6 pagesExhibit 4 - Terms and Conditions Governing The Opening and Maintenance of Deposit AccountsJohn Dennis Sugata-onNo ratings yet

- Announcement From Systems - Circulars Issued by - Released Thru Systems (For December)Document18 pagesAnnouncement From Systems - Circulars Issued by - Released Thru Systems (For December)Andy EdonoNo ratings yet

- FINO Payments Bank Citizen's Charter FINO Payments Bank Citizen's CharterDocument7 pagesFINO Payments Bank Citizen's Charter FINO Payments Bank Citizen's Chartershriyanshuswain909No ratings yet

- Sub: Compensation Cum Customer Relation Policy 2021 - 22: Operation & Services DeptDocument20 pagesSub: Compensation Cum Customer Relation Policy 2021 - 22: Operation & Services DeptAmitKumarNo ratings yet

- Eletronic Clearance Pro de DuralDocument15 pagesEletronic Clearance Pro de DuralanupkallatNo ratings yet

- E - Svanidhi SchemeDocument16 pagesE - Svanidhi SchemeHarshit GoelNo ratings yet

- Procedures No 3511 Customer Billing and CollectionsDocument6 pagesProcedures No 3511 Customer Billing and Collectionsakondolenin74No ratings yet

- Barclays: Via Electronic MailDocument7 pagesBarclays: Via Electronic MailVarun KumarNo ratings yet

- Electronic Clearing ServiceDocument41 pagesElectronic Clearing Servicejsdhilip0% (1)

- Credit FrameworkDocument10 pagesCredit Frameworkzubair1951No ratings yet

- Customer Protection PolicyDocument7 pagesCustomer Protection PolicyRuchika RaiNo ratings yet

- Teyesrms and ConditionsDocument8 pagesTeyesrms and Conditionsrahul jainNo ratings yet

- Hand Book For NSDL Depository Operations Module 3Document108 pagesHand Book For NSDL Depository Operations Module 3mhussainNo ratings yet

- Bangladesh Automated Clearing HouseDocument24 pagesBangladesh Automated Clearing HouseMorium ZafarNo ratings yet

- Online Funds TransferDocument2 pagesOnline Funds TransferKarthi kk mobileNo ratings yet

- Deposit Account - Terms and Conditions - UpdatedDocument4 pagesDeposit Account - Terms and Conditions - UpdatedSodyJamalNo ratings yet

- Collection Agency Contract: 1. Scope of ServicesDocument9 pagesCollection Agency Contract: 1. Scope of ServicesjoeNo ratings yet

- Mega Project Assurance: Volume One - The Terminological DictionaryFrom EverandMega Project Assurance: Volume One - The Terminological DictionaryNo ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- Evaluation of Some Online Payment Providers Services: Best Online Banks and Visa/Master Cards IssuersFrom EverandEvaluation of Some Online Payment Providers Services: Best Online Banks and Visa/Master Cards IssuersNo ratings yet

- CL2 2Document2 pagesCL2 2Ahmed AliNo ratings yet

- State Bank of Pakistan: Finance Department I.I. Chundrigar Road KarachiDocument1 pageState Bank of Pakistan: Finance Department I.I. Chundrigar Road KarachiAhmed AliNo ratings yet

- CL 12Document1 pageCL 12Ahmed AliNo ratings yet

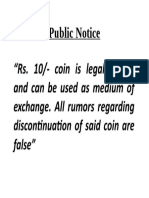

- Notice Rs.10 CoinsDocument1 pageNotice Rs.10 CoinsAhmed AliNo ratings yet

- State Bank of Pakistan: SBP Currency Management Strategy - Banknotes Packing InstructionsDocument1 pageState Bank of Pakistan: SBP Currency Management Strategy - Banknotes Packing InstructionsAhmed AliNo ratings yet

- Pakistan's Strategy For Navigating Fy2023 - Five Important FactsDocument4 pagesPakistan's Strategy For Navigating Fy2023 - Five Important FactsAhmed AliNo ratings yet

- The Digital FutureDocument68 pagesThe Digital FutureAhmed AliNo ratings yet

- Guidelines and Instructions For BIR Form No. 1707-A Annual Capital Gains Tax ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 1707-A Annual Capital Gains Tax ReturnKylie sheena MendezNo ratings yet

- FM Assignment 9 - Group 4Document15 pagesFM Assignment 9 - Group 4Puspita RamadhaniaNo ratings yet

- How Conversational Business Can Help You Get - and Stay - Closer To Your CustomersDocument6 pagesHow Conversational Business Can Help You Get - and Stay - Closer To Your CustomersJodh SinghNo ratings yet

- Ranjit Atwal LinkedinDocument2 pagesRanjit Atwal LinkedinAmar DoshiNo ratings yet

- Colgate - PalmoliveDocument11 pagesColgate - PalmoliveLucía PonzoniNo ratings yet

- 201 1ST Ass With AnswersDocument19 pages201 1ST Ass With AnswersLyn AbudaNo ratings yet

- Fulla DollsDocument5 pagesFulla Dollsshuming weiNo ratings yet

- Participate in Workplace CommunicationDocument65 pagesParticipate in Workplace CommunicationAbel ZegeyeNo ratings yet

- Philippine Cacao Industry Roadmap PDFDocument33 pagesPhilippine Cacao Industry Roadmap PDFEliza Paule100% (1)

- Assignment No 2Document6 pagesAssignment No 2Amazing worldNo ratings yet

- Key Objective: Team Members (Div/Dept.)Document3 pagesKey Objective: Team Members (Div/Dept.)Shariful IslamNo ratings yet

- PMG Note Chapter 5Document15 pagesPMG Note Chapter 5Nur Alisa FatinNo ratings yet

- YES TRANSACT Smart Trade OfferingDocument1 pageYES TRANSACT Smart Trade OfferingAndorran ExpressNo ratings yet

- Build A Multi Vendor Marketplace EbookDocument36 pagesBuild A Multi Vendor Marketplace EbookMushfiq AhmedNo ratings yet

- INDUSTRIAL ENGINEERING Assignment 1Document21 pagesINDUSTRIAL ENGINEERING Assignment 1AmanNo ratings yet

- Nashik Division 1Document2 pagesNashik Division 1PATIL HIRAN JAJOO GSTNo ratings yet

- Chilime Annual Report 2078-79Document92 pagesChilime Annual Report 2078-79Arun LuitelNo ratings yet

- Order #37677567: Item Info Order SummaryDocument1 pageOrder #37677567: Item Info Order Summaryagrace burgosNo ratings yet

- Entrepreneur Ship Development: Deepa Kumari Deepa - Kumari@sharda - Ac.inDocument25 pagesEntrepreneur Ship Development: Deepa Kumari Deepa - Kumari@sharda - Ac.inREHANRAJNo ratings yet

- ILO Min Wage 1st Jul 2022 - Consolidated InterpretationDocument1 pageILO Min Wage 1st Jul 2022 - Consolidated InterpretationJulio MoranNo ratings yet

- Inventory Management in HBLDocument72 pagesInventory Management in HBLNareshkumar KoppalaNo ratings yet

- Essentials of Marketing Research Putting Research Into Practice 1st Edition Test BankDocument13 pagesEssentials of Marketing Research Putting Research Into Practice 1st Edition Test BankCarmen4100% (1)

- Citibank Case Study Group1Document11 pagesCitibank Case Study Group1Deepaksayu100% (1)

- Material de Trabajo Ingles Tecnico Semana 09 Ing de SsitemasDocument2 pagesMaterial de Trabajo Ingles Tecnico Semana 09 Ing de Ssitemasjulio berrocalNo ratings yet

- Cement Industry Senior ContactsDocument13 pagesCement Industry Senior ContactsCorrosion Protection Engineers India Gnanasekaran D100% (1)

- RES614 Part A and Part B CFAP225 5B Group 1Document110 pagesRES614 Part A and Part B CFAP225 5B Group 1umairhakim30100% (1)

- Jobdesk - (Qa) Quality AssuranceDocument5 pagesJobdesk - (Qa) Quality AssuranceHasna KhairiyyahNo ratings yet

- Assessment and Proposal Writeshop For Peoples Organization Under Biodiversity Friendly EnterpriseDocument3 pagesAssessment and Proposal Writeshop For Peoples Organization Under Biodiversity Friendly EnterpriseCirilo Jr. LagnasonNo ratings yet

- MNM1504 Study GuideDocument263 pagesMNM1504 Study GuideImperium NadiaNo ratings yet

- PRELIMSDocument4 pagesPRELIMSJadon MejiaNo ratings yet