Professional Documents

Culture Documents

Contactless Transaction and Online Remittance of Contributions

Uploaded by

gilbert marimon chattoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Contactless Transaction and Online Remittance of Contributions

Uploaded by

gilbert marimon chattoCopyright:

Available Formats

CONTACTLESS TRANSACTION AND ONLINE

REMITTANCE OF CONTRIBUTIONS/PAYMENTS AND

ACCEPTANCE OF GOVERNMENT TAXES

SECTION 244. DECLARATION OF POLICY. – In order to devise mechanism that

lessens the chance of transmitting COVID-19, it is hereby declared the policy of

Batangas City Government to authorize the City Local Government to open an e-

government savings account for the purpose of facilitating a contactless transaction and

online remittance of contributions and/or payments and acceptance of government

taxes.

SECTION 245. DEFINITION OF TERMS. – As used in this Ordinance, the following

terms shall construe the meaning of:

1. a) Contactless Transaction – transactions that require no physical contact between the

payor, the agent, the payor’s payment device, the payee, and the physical payment

terminal. This type of payment can be through banks, online channels and contactless

mobile and web applications including but not limited to G-Cash, PayMaya, credit/debit

cards, and remittance centers.

2. b) Payment Channel – the platform on which the payor can make a payment and/or

remittance which includes online and mobile channels.

3. c) Payment Type – the method of payment that the payor uses to transfer its payment

and/or remittance. This includes credit/debit cards, mobile payments, online or over-the-

counter bank transfers, e-wallets, direct deposits, etc.

SECTION 246. COVERAGE. – This Ordinance shall apply to the following:

1. a) Acceptance of taxes and payments from all duly registered businesses, professions

and taxpayers within the territorial jurisdiction of the City of Batangas;

2. b) Acceptance of payments of real property taxes, local business taxes, licenses, fees

and charges due to the City Government;

3. c) Acceptance of payments of surcharges, penalties and interest arising from non-

payment of business and real property taxes;

4. d) Acceptance of all such payments due to the City Government of Batangas which are

not specified herein;

e) Payment of all remittances contributions of the City Government to other government

agencies including but not limited to the Government Service Insurance System (GSIS), Home

Development Mutual Fund (Pag-IBIG) and Philippine Health Insurance Corporation (PhilHealth).

SECTION 247. PAYMENT/TRANSFER OF PAYMENT. – Taxpayers of all such taxes,

fees and charges mentioned in Section 246 herein shall have the option to choose the

method of payment and payment channel of such taxes, fees and charges due to the

City Government and secure proof of such payment including but not limited to

electronic receipts and others to be able to present proof of payment should the need

arise. Payers may opt to choose any payment channel according to one’s convenience

but not limited to G-Cash, PayMaya and Online/Mobile Banking.

SECTION 248. PAYMENT OF GOVERNMENT REMITTANCES AND

CONTRIBUTIONS. – All contributions, remittances and payments charged by other

government agencies including but not limited to the Government Service Insurance

System (GSIS), Home Development Mutual Fund (Pag-IBIG) and Philippine Health

Insurance Corporation (PhilHealth) which are against the City Government may be paid

contactless through the Digital Banking Portal as discussed in the preceding paragraphs

herein.

SECTION 249. OPENING OF AN E-GOVERNMENT (E-GOV) SAVINGS ACCOUNT. –

To effectively carry out this Ordinance, the City Treasurer and the City Mayor shall be

authorized to open an E-Gov Savings Account at the Development Bank of the

Philippines (DBP) Batangas City Branch and to enroll the said E-Gov Savings Account

in the Digital Banking Portal feature of DBP for the purposes of embracing the

contactless transaction method as hereby discussed.

1. a) The City Treasurer shall have exclusive authority to access and manage the

Batangas City Government Account in the DBP Digital Banking Portal and shall

keep a physical record of all such transactions as appearing in the same. The

City Treasurer shall also have the authority to request a detailed breakdown of all

transactions which were made to and from the said E-Gov Savings Account if

needed.

2. b) The City Treasurer shall coordinate with other offices concerned including but

not limited to the Business Permits and Licensing Office (BPLO), City Assessor’s

Office and others with regards to the payments made through the City

Government’s E-Gov Savings Account and keep an updated record of such

payments made.

You might also like

- Accounting Technician Level 3 - Module 3 Part 2Document4 pagesAccounting Technician Level 3 - Module 3 Part 2Rona Amor MundaNo ratings yet

- What Is Percentage Tax?Document3 pagesWhat Is Percentage Tax?Lucas JuanchoNo ratings yet

- 68120RR 1-2013 PDFDocument6 pages68120RR 1-2013 PDFandrew estimoNo ratings yet

- Percentage Tax: o o o o o oDocument11 pagesPercentage Tax: o o o o o oMark Joseph BajaNo ratings yet

- Percentage Tax ReviewerDocument5 pagesPercentage Tax ReviewerJerico ManaloNo ratings yet

- Iloilo City Regulation Ordinance 2014-315Document4 pagesIloilo City Regulation Ordinance 2014-315Iloilo City CouncilNo ratings yet

- 68120RR 1-2013Document6 pages68120RR 1-2013Allan AlcantaraNo ratings yet

- BIR Form 2551Q: Under Sections 116 To 126 of The Tax Code, As AmendedDocument9 pagesBIR Form 2551Q: Under Sections 116 To 126 of The Tax Code, As AmendedJAYAR MENDZNo ratings yet

- COA CIRCULAR NO. 2021 014 December 22 2021Document14 pagesCOA CIRCULAR NO. 2021 014 December 22 2021juanNo ratings yet

- E InvoiceDocument23 pagesE Invoicenallarahul86No ratings yet

- Tax UpdatesDocument79 pagesTax UpdatesFreijiah SonNo ratings yet

- The Extent To Which The Philippine Government Complied To Sections 27 and 28 of RDocument8 pagesThe Extent To Which The Philippine Government Complied To Sections 27 and 28 of RJanine PagtakhanNo ratings yet

- Bir RMC 55-2013Document8 pagesBir RMC 55-2013Coolbuster.NetNo ratings yet

- Mid-Term-Day 1-Other Percentage Taxes (Opt)Document52 pagesMid-Term-Day 1-Other Percentage Taxes (Opt)Christine Joyce MagoteNo ratings yet

- GST E InvoiceDocument23 pagesGST E Invoicenallarahul86No ratings yet

- Bureau of Internal Revenue Quezon CityDocument6 pagesBureau of Internal Revenue Quezon CityPeggy SalazarNo ratings yet

- Taxation - Review - BSA - LGC, OIC - 2018NDocument9 pagesTaxation - Review - BSA - LGC, OIC - 2018NKenneth Bryan Tegerero TegioNo ratings yet

- Eletronic Clearance Pro de DuralDocument15 pagesEletronic Clearance Pro de DuralanupkallatNo ratings yet

- 4 5931665743505525729wwwDocument17 pages4 5931665743505525729wwwokashkemal2No ratings yet

- Chapter 10 - Payment of TaxDocument13 pagesChapter 10 - Payment of Taxmadaanakansha91No ratings yet

- Percentage TaxDocument7 pagesPercentage TaxArielle CabritoNo ratings yet

- SB Order 2022Document113 pagesSB Order 2022Reshmi PillaiNo ratings yet

- SB Order 2022Document147 pagesSB Order 2022DheerajSharmaNo ratings yet

- SB Order 1 - 2022Document5 pagesSB Order 1 - 2022PALAKOL HONo ratings yet

- SB Order 2022Document183 pagesSB Order 2022Debasish BarmanNo ratings yet

- RR 16-02Document2 pagesRR 16-02saintkarriNo ratings yet

- RMC No. 004-21 - Guidlines in Filing Tax Return and Required AttachmentsDocument9 pagesRMC No. 004-21 - Guidlines in Filing Tax Return and Required AttachmentsVence EugalcaNo ratings yet

- RMC No. 4-2021 - Filing of Tax Returns, Attachments and PaymentDocument6 pagesRMC No. 4-2021 - Filing of Tax Returns, Attachments and PaymentTrisha TimpogNo ratings yet

- Percentage Tax - Bureau of Internal Revenue PDFDocument11 pagesPercentage Tax - Bureau of Internal Revenue PDFEjNo ratings yet

- SBGPA-ProgGuideandApp (Revised 5-25-22)Document11 pagesSBGPA-ProgGuideandApp (Revised 5-25-22)Alexander PichardoNo ratings yet

- AML - CFT - CPF - Amendment - CL33-Annex-A (28-11-2022)Document1 pageAML - CFT - CPF - Amendment - CL33-Annex-A (28-11-2022)Ahmed AliNo ratings yet

- New COC Template for Batangas CityDocument2 pagesNew COC Template for Batangas CityAlfa RabanesNo ratings yet

- Need For A Payment System ActDocument4 pagesNeed For A Payment System ActMohammad Shahjahan SiddiquiNo ratings yet

- Customer Protection PolicyDocument7 pagesCustomer Protection PolicyRuchika RaiNo ratings yet

- Finance Department Standard Operating Procedure: Cash Handling Policies and ProceduresDocument9 pagesFinance Department Standard Operating Procedure: Cash Handling Policies and Proceduresparag994No ratings yet

- Letter of Undertaking From Developer To Provider - Gpi MD Agencia Mega Comunicacao IntegradaDocument16 pagesLetter of Undertaking From Developer To Provider - Gpi MD Agencia Mega Comunicacao IntegradaCleberCapobiancoOngAadeNo ratings yet

- DownloadDocument8 pagesDownloadyuvaduraiNo ratings yet

- Revenue Regulations No. 9-2001Document6 pagesRevenue Regulations No. 9-2001Anonymous GMUQYq8No ratings yet

- Bharat Billpay: Consumer Frequently Asked QuestionsDocument5 pagesBharat Billpay: Consumer Frequently Asked QuestionsShashi PrakashNo ratings yet

- Appendix 21 C Procedure of Electronic Fund Transfer (Procedure For Deposit/refund of Import Application Fees Through Electronic Fund Transfer For Notified Schemes Through Designated Banks)Document3 pagesAppendix 21 C Procedure of Electronic Fund Transfer (Procedure For Deposit/refund of Import Application Fees Through Electronic Fund Transfer For Notified Schemes Through Designated Banks)Samarjit KararNo ratings yet

- RR 3-2016Document5 pagesRR 3-2016Boyet CariagaNo ratings yet

- 48451rmc No. 1-2010Document3 pages48451rmc No. 1-2010Maureen PascualNo ratings yet

- RMC No. 111-2022 EO 170Document6 pagesRMC No. 111-2022 EO 170Paulus PacanaNo ratings yet

- Executive SummaryDocument8 pagesExecutive SummaryNathan Roy OngcarrancejaNo ratings yet

- Reg E Compliance GuideDocument2 pagesReg E Compliance GuideShahid RasheedNo ratings yet

- BBPS For Agent Institutions 26 05 17Document9 pagesBBPS For Agent Institutions 26 05 17Rachit AntaniNo ratings yet

- 29133rmo 10-2006Document15 pages29133rmo 10-2006Denzel Edward CariagaNo ratings yet

- PICPA Webinar - Tax Updates 07152020Document2 pagesPICPA Webinar - Tax Updates 07152020Kirt Russelle PeconadaNo ratings yet

- Budget 2022 BBDocument30 pagesBudget 2022 BBCA SRD & CONo ratings yet

- RuPay Credit Cards Can Now Be Linked to UPI for Digital PaymentsDocument4 pagesRuPay Credit Cards Can Now Be Linked to UPI for Digital Paymentsakshay_blitzNo ratings yet

- R e Q U e S T F o R P R o P o S A LDocument40 pagesR e Q U e S T F o R P R o P o S A LTamal ChakravartyNo ratings yet

- RBI Revised Notification 6 July 2017 PDFDocument9 pagesRBI Revised Notification 6 July 2017 PDFMoneylife FoundationNo ratings yet

- FDIC Law, Regulations, Related Acts: Part 205-Electronic Fund Transfers (Regulation E) SecDocument46 pagesFDIC Law, Regulations, Related Acts: Part 205-Electronic Fund Transfers (Regulation E) SecShahid RasheedNo ratings yet

- Financial: 1, AN INDocument9 pagesFinancial: 1, AN INCity Legal OfficeNo ratings yet

- Tool Kit for Tax Administration Management Information SystemFrom EverandTool Kit for Tax Administration Management Information SystemRating: 1 out of 5 stars1/5 (1)

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Launching A Digital Tax Administration Transformation: What You Need to KnowFrom EverandLaunching A Digital Tax Administration Transformation: What You Need to KnowNo ratings yet

- 2021 Ateneo Blue Notes Political LawDocument585 pages2021 Ateneo Blue Notes Political LawVanz100% (18)

- 2023 Propose ProgramDocument14 pages2023 Propose Programgilbert marimon chattoNo ratings yet

- Taxation Law Review Notes: I. Basic Principles of Taxation A. Taxation As An Inherent Power of The StateDocument47 pagesTaxation Law Review Notes: I. Basic Principles of Taxation A. Taxation As An Inherent Power of The Stategilbert marimon chattoNo ratings yet

- Dilg Opinion No. 89 S. 2022Document3 pagesDilg Opinion No. 89 S. 2022gilbert marimon chattoNo ratings yet

- Tax Supplemental Reviewer - October 2019Document46 pagesTax Supplemental Reviewer - October 2019Daniel Anthony CabreraNo ratings yet

- MUSIC 9 - Q III (Lesson 1-2) : Mapeh 9 - Quarter Iii (For Modular Only)Document1 pageMUSIC 9 - Q III (Lesson 1-2) : Mapeh 9 - Quarter Iii (For Modular Only)gilbert marimon chattoNo ratings yet

- Proof of IdentificationDocument1 pageProof of Identificationgilbert marimon chattoNo ratings yet

- Proof of Official TransactionDocument2 pagesProof of Official Transactiongilbert marimon chattoNo ratings yet

- Proof of BillingDocument1 pageProof of Billinggilbert marimon chattoNo ratings yet

- DDA statement inquiryDocument1 pageDDA statement inquirygilbert marimon chattoNo ratings yet

- TAXATION: THE LIFEBLOOD OF GOVERNMENTDocument119 pagesTAXATION: THE LIFEBLOOD OF GOVERNMENTgilbert marimon chattoNo ratings yet

- Dimaampao Lecture NotesDocument119 pagesDimaampao Lecture NotesArt Anthony VillarinoNo ratings yet

- Dimaampao Lecture NotesDocument119 pagesDimaampao Lecture NotesArt Anthony VillarinoNo ratings yet

- Tariff and Customs Code Reviewer with Key ProvisionsDocument359 pagesTariff and Customs Code Reviewer with Key Provisionsgilbert marimon chatto100% (7)

- Tagum City National High School PAYSLIP : Employee NumberDocument3 pagesTagum City National High School PAYSLIP : Employee Numbergilbert marimon chattoNo ratings yet

- 2019 Commercial Law Ateneo Summer Reviewer PDFDocument256 pages2019 Commercial Law Ateneo Summer Reviewer PDFGrace D67% (3)

- MUSIC 9 - Q III (Lesson 1-2) : Mapeh 9 - Quarter Iii (For Modular Only)Document1 pageMUSIC 9 - Q III (Lesson 1-2) : Mapeh 9 - Quarter Iii (For Modular Only)gilbert marimon chattoNo ratings yet

- Consolidated Result of Grade 7 Proficiency Level in Science Grade 7 Sections No. of Students No. of Items No. of Takers Total RAW ScoreDocument45 pagesConsolidated Result of Grade 7 Proficiency Level in Science Grade 7 Sections No. of Students No. of Items No. of Takers Total RAW Scoregilbert marimon chattoNo ratings yet

- TAXATION: THE LIFEBLOOD OF GOVERNMENTDocument119 pagesTAXATION: THE LIFEBLOOD OF GOVERNMENTgilbert marimon chattoNo ratings yet

- Tagum City National High School PAYSLIP : Employee NumberDocument3 pagesTagum City National High School PAYSLIP : Employee Numbergilbert marimon chattoNo ratings yet

- Tariff and Customs Code Reviewer with Key ProvisionsDocument359 pagesTariff and Customs Code Reviewer with Key Provisionsgilbert marimon chatto100% (7)

- MUSIC 9 - Q III (Lesson 1-2) : Mapeh 9 - Quarter Iii (For Modular Only)Document1 pageMUSIC 9 - Q III (Lesson 1-2) : Mapeh 9 - Quarter Iii (For Modular Only)gilbert marimon chattoNo ratings yet

- Science 9 Module 3RD QuarterDocument47 pagesScience 9 Module 3RD Quartergilbert marimon chattoNo ratings yet

- 1xbet 338653393 10 15 2021Document1 page1xbet 338653393 10 15 2021gilbert marimon chattoNo ratings yet

- Tariff and Customs Code Reviewer with Key ProvisionsDocument359 pagesTariff and Customs Code Reviewer with Key Provisionsgilbert marimon chatto100% (7)

- 2019 Commercial Law Ateneo Summer Reviewer PDFDocument256 pages2019 Commercial Law Ateneo Summer Reviewer PDFGrace D67% (3)

- Science 9 Module 3RD QuarterDocument47 pagesScience 9 Module 3RD Quartergilbert marimon chattoNo ratings yet

- MUSIC 9 - Q III (Lesson 1-2) : Mapeh 9 - Quarter Iii (For Modular Only)Document1 pageMUSIC 9 - Q III (Lesson 1-2) : Mapeh 9 - Quarter Iii (For Modular Only)gilbert marimon chattoNo ratings yet

- Dimaampao Lecture NotesDocument119 pagesDimaampao Lecture NotesArt Anthony VillarinoNo ratings yet

- 2019 Commercial Law Ateneo Summer Reviewer PDFDocument256 pages2019 Commercial Law Ateneo Summer Reviewer PDFGrace D67% (3)

- Diesel Injector FailureDocument19 pagesDiesel Injector FailureWayne Mcmeekan100% (2)

- Baja2018 Unisa Team3 Design ReportDocument23 pagesBaja2018 Unisa Team3 Design ReportDaniel MabengoNo ratings yet

- Thermodynamics d201Document185 pagesThermodynamics d201Rentu PhiliposeNo ratings yet

- Copyblogger Content Marketing Research 2 PDFDocument44 pagesCopyblogger Content Marketing Research 2 PDFvonnig100% (1)

- Filiation and Support ClaimsDocument3 pagesFiliation and Support ClaimsEugene BalagotNo ratings yet

- Bank Account Details and Contact NumbersDocument38 pagesBank Account Details and Contact NumbersD-Blitz StudioNo ratings yet

- Comments PRAG FinalDocument13 pagesComments PRAG FinalcristiancaluianNo ratings yet

- GUEST REGISTRATION CARDDocument1 pageGUEST REGISTRATION CARDRasmi Ranjan Kar100% (1)

- Drilling Products and Solutions CatalogDocument141 pagesDrilling Products and Solutions CatalogAlex Boz100% (1)

- Juno Gi BrochureDocument2 pagesJuno Gi BrochureJerry VagilidadNo ratings yet

- Polity by LaxmikantDocument3 pagesPolity by LaxmikantJk S50% (6)

- Key Benefits of Cloud-Based Internet of Vehicle (IoV) - Enabled Fleet Weight Management SystemDocument5 pagesKey Benefits of Cloud-Based Internet of Vehicle (IoV) - Enabled Fleet Weight Management SystemVelumani sNo ratings yet

- Set 1Document4 pagesSet 1insan biasaNo ratings yet

- Ict OhsDocument26 pagesIct Ohscloyd mark cabusogNo ratings yet

- ASSIGNMENTDocument5 pagesASSIGNMENTClifford Jay CalihatNo ratings yet

- The Multi Faceted Nature of The Multi Grade TeacherDocument23 pagesThe Multi Faceted Nature of The Multi Grade TeacherTEDLYN JOY ESPINONo ratings yet

- Matrix 210N Reference Manual 2017 PDFDocument167 pagesMatrix 210N Reference Manual 2017 PDFiozsa cristianNo ratings yet

- SolidWorks Motion Tutorial 2010Document31 pagesSolidWorks Motion Tutorial 2010Hector Adan Lopez GarciaNo ratings yet

- Cebu Oxygen Acetylene Co., vs. Drilon, G.R. No. 82849, August 2, 1989Document6 pagesCebu Oxygen Acetylene Co., vs. Drilon, G.R. No. 82849, August 2, 1989JemNo ratings yet

- Product Data Sheet: Standard Auxiliary Contact, Circuit Breaker Status OF/SD/SDE/SDV, 1 Changeover Contact TypeDocument2 pagesProduct Data Sheet: Standard Auxiliary Contact, Circuit Breaker Status OF/SD/SDE/SDV, 1 Changeover Contact TypeChaima Ben AliNo ratings yet

- KEB GM 2014 3 - enDocument109 pagesKEB GM 2014 3 - envankarpNo ratings yet

- Benetton CaseDocument23 pagesBenetton CaseNnifer AnefiNo ratings yet

- 20-Sdms-02 (Overhead Line Accessories) Rev01Document15 pages20-Sdms-02 (Overhead Line Accessories) Rev01Haytham BafoNo ratings yet

- Natural Fibres For Composites in EthiopiaDocument12 pagesNatural Fibres For Composites in EthiopiaTolera AderieNo ratings yet

- S3 Unseen PracticeDocument7 pagesS3 Unseen PracticeTanush GoelNo ratings yet

- Best Frequency Strategies - How Often To Post On Social Media PDFDocument24 pagesBest Frequency Strategies - How Often To Post On Social Media PDFLiet CanasNo ratings yet

- Global Service Learning: M325D MH / M325D L MH Material HandlersDocument52 pagesGlobal Service Learning: M325D MH / M325D L MH Material Handlersanon_828943220100% (2)

- Slimline F96T12 DX Alto: Product Family Description T12 Single Pin Linear Fluorescent LampsDocument2 pagesSlimline F96T12 DX Alto: Product Family Description T12 Single Pin Linear Fluorescent LampsJon GosnellNo ratings yet

- Iwan Lab Guide v1.1 FinalDocument63 pagesIwan Lab Guide v1.1 FinalRicardo SicheranNo ratings yet

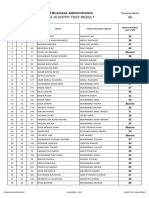

- Entry Test Result MPhil 2014 PDFDocument11 pagesEntry Test Result MPhil 2014 PDFHafizAhmadNo ratings yet