Professional Documents

Culture Documents

00 Chartable Saving Account Procedure

Uploaded by

esulawyer20010 ratings0% found this document useful (0 votes)

28 views18 pagesBank Procedure and Manual

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBank Procedure and Manual

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views18 pages00 Chartable Saving Account Procedure

Uploaded by

esulawyer2001Bank Procedure and Manual

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 18

ak MEMoranDUM

Ref. No. PR/O1/10/19

Date: 04/03/19

To : Allhead office organs

Regional Offices

All branches

From 2 The President

Chartable Saving Account Procedure has been approved by the Executive

Management Committee of the Bank.

This is therefore to advise you all to implement Chartable Saving Account

Procedure effective March 04/2019 with utmost care.

Best regards,

Mh

ABAY BANK S.C.

CHARITABLE SAVING ACCOUNT PROCEDURE

£07 ALGIT M1 LAN verge:

(AB. ) ABAY BANKS. - CHARITABLE SAVING ACCOUNT PROCEDURE

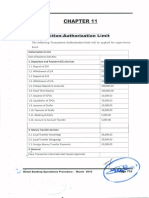

TABLE OF CONTENTS

|. INTRODUCTION...

11. PREAMBLE

1.2. OBJECTIVES...

13. SCOPE...

1.4. GOVERNING RULES...

1.5. DEFINITION OF TERMS..

1.6. AUTHORITY AND RESPONSIBILITIES .

1.6.1 PRESIDENT...

1.6.2 VICE PRESIDENT CORPORATE SERVICE...

1.6.3 DIRECTOR BUSINESS DEVELOPMENT, MARKETING AND COMMUNICATION.

1.64 — DIRECTOR BORM....

1.6.5 DIRECTOR INFORMATION TECHNOLOGY AND E- BANKING «0-0

1.6.6 MANAGER - REGIONAL OFFICES...

1.6.7 BRANCH MANAGERS...

2 CHARITABLE SAVING ACCOUNT...

2.1 GENERAL FEATURE.

2.2 SPECIFIC FEATURES.

2.1.1 THE CUSTOMER AND THE ACCOUNT.

2.1.2 MINIMUM DEPOSIT.....

2.1.3 INTEREST RATE AND PAYMENT.

2.3 ELIGIBLE CUSTOMERS AND REQUIRED DOCUMENTS...

23.1 ELIGIBLE CUSTOMERS ..

2.3.2. REQUIRED DOCUMENTS

24 ACCOUNT OPENING...

2.4.1 CUSTOMER CREATION...

2.4.2 ACCOUNT OPENING PROCEDURE

2.5 DEPOSIT

2.6 WITHDRAWALS...

2.7 CLOSURE OF AN ACCOUNT...

3 EXCEPTIONS...

4 REVISION OF THE PROCEDURE......

5 EFFECTIVE DATE

1 | Abay- Charitable Savi

le ABAY BANK S.C. - CHARITABLE SAVING ACCOUNT PROCEDURE

ACRONYMS

BORM Branch Operation and Resource Mobilization

RO Client Relation Officer

SACHR Chartable Saving Account

FCY Foreign Currency

kyc Know Your Customer

2 haritable Saving Account Feature, Account Opening And Handling Procedure

“Sii2__) ABAY BANK S.C. - CHARITABLE SAVING ACCOUNT PROCEDURE,

|. INTRODUCTION

1.1, PREAMBLE

Whereas, discharging social responsibility through promoting a socially responsible

business practice is set to be one of the corporate core values of Abay Bank:

Whereas, realizing such core values & building the Bank's image require development of

a teller made Banking products & services that could address the need of concerned

group:

Whereas, development of a teller made banking product & services will help to attract

those entities having immense potential for deposit & foreign currency and enable the

Bank to build long-term relationship with such entities & the community as whole,

Whereas, there are concerned individuals and charity organizations which are engaged

in humanitarian and donation activities that the Bank can work together and discharge

its social responsibility while mobilizing vital resources as the same time;

Now therefore, a new Charitable Saving Account product is developed to address such

targeted customers & this procedure is prepared to guide the proper implementation of

the product and to ensure consistency & uniformity in implementation of the product.

1.2. OBJECTIVES

The major objective of this Chartable saving account procedure is to set a clear and well

understandable reference on the features and technical/operational activities that are

expected to be undertaken while opening, maintaining and managing such accounts in

each of Abay bank branches. The procedure also has the following specific objectives:

A. To Indicate activities and steps that should be followed in opening Charitable Saving

Accounts,

B. To clearly define and explicitly set roles and responsibilities of different parties

involved on implementation of Charitable Saving Account.

\ccount Feature, Account Opening And

(SB._) ABAY BANK S.C. - CHARITABLE SAVING ACCOUNT PROCEDURE

1,3. SCOPE

This procedure will be applicable in all Abay bank branches, Sub-Branches and head

office organs that are directly & indirectly involved in the implementations of

Charitable Saving Accounts.

1.4. GOVERNING RULES

This procedure will be governed by:

|. Directives of National Bank of Ethiopia,

|, Abay Bank Retail Banking Procedure,

Il, Laws, regulations & conventions of the country applicable to banking business.

1.5. DEFINITION OF TERMS.

The following words and phrases in this procedure shall have the meaning and

definitions prescribed below:

|. The Bank- Shall mean Abay Bank S.C.

Il Chartable fund: is a fund established by some voluntary individuals or

organizations that have an interest to provide donation to support those

organizations engaged in charity activities.

Ill. Charity Organization: Refers to institutions established exclusively for charitable

Purposes and support: poor people, needy, unprivileged section of the society

and other philanthropy and support activities.

IV. Charitable Saving Account- refers to an interest bearing saving account opened

at any of Abay Bank Branches on which an interest calculated and accrued on

amount deposited in the account will be transferred to a designated charity

organization and ultimately used for charitable purposes

7) | Abay-- Charitable Saving Account Feature, Account Opening And Handling Procedure

CE sway nani sc.-cHanrTApte saviNG accouNT PROCEDURE

1.6. AUTHORITY AND RESPONSIBILITIES

1.6.1 PRESIDENT

A. Approves this Charitable Saving Account procedure,

B. Shall oversee the implementation of Charitable Saving Account and the

Retail Banking Operations procedures;

C. Shall provide an explicit, informed and strategic decision on the proper and

effective implementation of the procedure as required.

1.6.2 VICE PRESIDENT CORPORATE SERVICE

‘A. Shall oversee proper functioning of the product,

B._ Shall oversee the status and progress made on implantation of the product.

1.6.3. DIRECTOR BUSINESS DEVELOPMENT, MARKETING AND COMMUNICATION

A._ Shall ensure that, aggressive promotions and advertisements are made using

effective ways & channels in order to create awareness about the product,

B. Shall Undertake survey, collect opinion (data) about Chartable saving account

and recommend improvements based on feedbacks from customers & others.

1.6.4 DIRECTOR BORM

‘A. Shall monitor the proper implementation of Charitable Saving Account across

all regions,

B. Shall handle complaints related with Charitable Saving Account;

Shall ensure that; regional offices are properly discharging alll their duties and

responsibilities prescribed in this procedure.

1.65 DIRECTOR INFORMATION TECHNOLOGY AND E- BANKING

A. Shall create and incorporate Chartable saving Account on the Bank's core

Banking (Flex cube} system as one of the saving account products.

B. Shall provide technical support on the system, in relati lartable savin

Pr IPP ys eatinn.to chert 9

account. 7

| bay Charitable Saving Accoune ra oR 7

‘Sii@_) ABAY BANK S.C. - CHARITABLE SAVING ACCOUNT PROCEDURE

1.6.6 MANAGER - REGIONAL OFFICES

A. Shall coordinate & guide operations related with Charitable Saving Accounts;

B. Shall ensure that, branches have properly assessed their environment and

identified potential target groups for the product,

CC. Shall supervise branches under his/her domain and make sure that that duties

and responsibilities set for branches are properly discharged:

D. Shall follow up & resolve problems & challenges faced by branches in relation

to proper implementation of this Charitable Saving Accounts procedure.

E. Shall undertake onsite and offsite supervision on branches under its domain;

discussing issues that affect the implementation of the procedure;

F. Shall initiate necessary amendments & corrections on content &

implementation problems which are beyond its control.

G. Shall follow up and periodically report, the performance and the amount of

deposit mobilized from each branch against their plan.

1.6.7 BRANCH MANAGERS

A. Shall create awareness on Charitable Saving Account product for all

employees in her/his branch & potential customers interested on the product;

B. Shall plan, coach, coordinates and dictates employees regarding expected

activities related to Charitable Saving Account operations;

. Shall ensure that account opening and daily transaction handling of Charitable

Saving Account are done in line with this procedure;

D. Shall assess surrounding business environment, identify and recruit potential

target groups and maintain strong business relation with those groups.

E. Shall Implement this procedure in conjunction with other polices, regulations,

the retail banking procedure & Relevant NBE directives,

F. Shall clarify the term and conditions of Charitable Saving Account and other

related issues to interested customers and staff members in times of any

ambiguity.

G. Shall report to its respective region regarding: the efforts made, result obtained

and overall implementation status of Charitable Saving Accounts.

‘Abay Chartable Saving Account Feature, Account Opering And Hanging Procedure

ea

ABAY BANK S.C. - CHARITABLE SAVING ACCOUNT PROCEDURE

2 CHARITABLE SAVING ACCOUNT

2.1 GENERAL FEATURE

A charitable Account is a premium interest bearing Saving Account

designed to raise funds from money deposited by those interested

individuals, governmental and non-governmental organizations that have

an interest to support charity organizations from the interest earned on their

money deposited in Abay Bank for this specific purpose.

2.2. SPECIFIC FEATURES

The account has the following specific features and characteristics:

2.1.1 THE CUSTOMER AND THE ACCOUNT

A. The donating customer can be any individual or organization including

existing customers having an interest to donate for charity organizations.

B. The donation receiving customer, however; must by a registered charity

‘organization.

C. The account can also be opened for a charity organization in order to support

another charity organization.

D. The donating customer can designate the charity receiving organization and

request to open account, however, the bank in its own discretion can select

the charity receiving organization in cases the customer has not nominated

and is willing to be selected by the Bank.

E. Passbook is issued to customers up on opening Charitable Saving Account,

2.1.2, MINIMUM DEPOSIT

A. Aminimum deposit of Birr 60,000 and Birr 100,000 is required for individual

and organizations respectively to get a premium interest privilege.

B. In some circumstance, the account can be opened by a minimum deposit

amount; however the’ privileged premium interest shall be applicable

whenever the minimum balance reaches to equal or above the stated balance.

7 | Ray Cora Saving coat Far, Rout Opening hd nding Pavere

388.) ABAY BANK S.C - CHARITABLE SAVING ACCOUNT PROCEDURE

2.1.3 INTEREST RATE AND PAYMENT

A. The prevailing default saving interest rate plus 1% will be computed on

minimum deposit balance in the account per annum.

B._ The bank can negotiate & increase the interest rate if customers want to make

significant amount of deposit channelling donations or other in local or FCY:

Interest calculation is made on monthly bases and the accrued interest is

transferred to the charity receiving organization monthly bases too as far as

the balance on the “Chartable Saving Account” is above Birr 60,000.00 and

Birr 100,000.00 for individual and organization respectively.

D. Customers can choose either of the available two ways of donating the

interest based on their preference:

= Donating the 1% marginal premium interest above the prevailing default

interest accrued on their deposit or

‘= The whole premium interest accrued balance (interest calculated based on

the prevailing default interest rate plus 1%) as desired by the customer.

E. The required minimum deposit amount (i.e. Birr 60,000.00 or Birr 100,000.00}

should be deposited at least for a period of one year to be entitled to the

premium interest privilege and will be set in a blocked amount limit;

F. In case the account holder withdraws below 60,000.00 or 100,000.00 for

individual and organization respectively; before one year time, all the interest

amount transferred to the charity organization up to point of withdrawals will

be computed and deducted from the requested withdrawal amount and

recorded as income but will get interest payment based on default interest

rate.

G. The charity receiving account will also be entitled to the privileged prevailing

default saving interest rate plus 1% as far as the balance maintained in the

account is above Birr 100,000.00 which helps the bank make charity through

extra (19%) interest payment.

H. The premium interest privilege is always set for a year time which may

continue or set to default interest rate based on assessment of conditions and

decision of the Bank’s top management.

& | Abay- Charitable Saving Account Feature, Account Opening And Handling Procedure

“a

Nee

)

ABAY BANK S.C - CHARITABLE SAVING ACCOUNT PROCEDURE

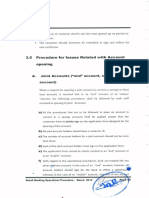

23.2 REQUIRED DOCUMENTS

Since this procedure is an integral part the Bank's Main Retail Banking

Procedure, the KYC Principle & all procedures indicated on the Retail

Banking Procedure and Document requirements for: Account Opening,

‘Customer Creation and duties and responsibilities of all performers equally

apply to “Charitable Saving Accounts” & remain in intact.

Moreover, the following shall be considered in opening such accounts in

addition to requirements stated on the main retail banking procedure:

a) An account opening form specially designed for opening “Charitable

Saving Account” shall be duly filled and signed by the customer along

with the term and conditions thereon.

b) The means of supporting charity organization shall be specified (If Possible}.

¢} Letter from a charitable organization and government organization

authorized to certify such charitable organization shall be presented if the

account is going to be opened by another charitable organization.

d)

Certificate or letter from authorized government body shalll be presented

by a charity society organized as an entity for which the interest accrued

is going to be transferred in the form of charity or donation.

€) The donation receiving Charity association, shall present a Memorandum

and Article of Association attested, registered & sealed by the concerned

Federal or Regional Offices; and

f] A letter of request to open and operate the account shall be presented,

which should be signed by the authorized person mentioned in the

Memorandum/Article of Association and shall bears the company’s official

stamp; AE J

10 | Abay= Charitable Saving Account Feature, Account i Proce

(SB) ABAY BANK'S, - CHARITABLE SAVING ACCOUNT PROCEDURE,

2.4 ACCOUNT OPENING

All account opening procedures which have been described in the Main

Retail banking procedure shall be applied up on opening charitable

Saving Account. Thus, account Opening phases, Customer Creation and

duties and responsibilities of all performers stated on the main retail

Banking procedure also apply while opening “Charitable Saving

Accounts” (Both Donating and Receiving) and remain in intact. Moreover,

the individual or organization applying to open account should not

appear on the IFC, OFAC & other sanction lists.

In general, features common to opening saving accounts are applied.

However, the account class/type code on the core banking system thjat

to be selected for “Charitable Saving Account’ is “SACHR”.

2.4.1 CUSTOMER CREATION

Customer Creation in the core-banking system for “Charitable Saving

Account’ will be the same as other saving account procedure described

on the retail Banking procedure; however, upon inserting basic information

on the customer screen, the account type/code shall be selected as “SACHR™

which represent Charitable Saving Account. After inserting basic information

about a customer the account shalll also be er-marked after the account

name as

A. ‘Charitable = Donation” : if the account is opened by an individual or

‘organization who want to donate and give charity of the interest

accrued in the account to a charitable organization in need of

support and donation. Or

B. “Charitable - Charity Receiving: if the account is going to be opened

to an organization which will receive charity or donation from a

“Charitable Saving Account” Of ae

yi

l= [ABAY BANK S.C. - CHARITABLE SAVING ACCOUNT PROCEDURE

2.4.2ACCOUNT OPENING PROCEDURE

Duties and fesponsibilities of all performers stipulated on the main retail

banking procedure also apply while opening “Charitable Saving

Donation/Receiving” account and remain in intact. In addition the

following shalll be given due attention:

A. Client Relations Officer (CRO) :

iv.

Explains and cross sell the new “Charitable Saving Account “ to

potential customers while providing the usual banking services.

Ascertains whether the applicant maintains an account in other

branches so as to stick and use only one CIF for the customer.

Check the individuals name against sanction lists.

Select account class/Type code “SACHR” on the system.

B. Supervisor (Branch Managers, Assistant. Branch — Managers,

Senior/Accountants/Officer or their designates)

i

C. Branch Controller (Junior, controller or se

i

[2 | Abay- Charitable Saving Account Feature, ete ling Procedu

Shall Check and ascertain that the criteria and documents pertaining to

“Charitable Saving Account” are fulfilled and properly presented

Shall ascertain that all related data and information for Charitable Saving

Account are as per procedure and inserted properly in to the system

Shall approve the opening ascertaining it is in an orderly manner &

forward documents to branch controller or accountant as appropriate,

r] Or The Accountant

Check & ascertain that that the account is opened in line with the

procedure & necessary documents are correctly presented & processed.

Shall check & assures that, the data & information maintained in the

system are correct & same with evidences presented by the customer.

Ascertain that, the term and conditions pertaining to “Charitable Saving

Accounts” are duly signed by the customer.

Shall ascertain and assures that; the account class code for Charitable

Saving Account (SACHR) is properly selected and maintained.

Shall periodically check & ascertain that interests on Charitable Accounts

are properly computed & appropriately credits to the beneficiary.

HW ..

Gia) ABAY BANK S.C. - CHARITABLE SAVING ACCOUNT PROCEDURE

2.5 DEPOSIT

2.5.1 Deposit to "Charitable Saving Accounts” can be made either by the

account holder or anybody who wants to support the scheme as far as

he/she has come up with the pass book or account number.

2.5.2. Deposit can be made in another branch other than the branch where the

account is maintained through inter-branch transaction.

2.5.3 Deposit can be made by cheque, CPO, or cash transfer letter through

clearance from other bank and there is no limit for the amount of deposit.

2.5.4 Any deposit should be against receipt (Deposit advice), which is

stamped and initialled by the receiving Client Relation Officer.

2.5.5 Pass book may not be necessary presented for deposit by the

account holder or third party as far as he/she has come up with

the account number which shall be attached with the deposit

voucher and filed for future reference.

2.6 WITHDRAWALS

(PAYMENT FROM “SACHR” (DONATION OR RECEIVING)

2.6.1 Withdrawal from both “Charitable Saving Account” (Donation or

Receiving account] can be made up to the minimum deposit balance

of Birr 60,000 & Birr 100,000 for individuals & organizations

respectively which otherwise result in formfitting the premium

interest.

2.6.2 Fund transfer from Charity Saving Account to other normal account is

encouraged, unless the case is accepted by the branch manager.

2.6.3 In principle, withdrawal is not allowed to account holders without

presentation of pass-book, however, if customer is already known or

presented renewed 1D with a convincing reason, the branch can allow

withdrawal up on approval of the branch manager for an amount not

exceeding Br. 15,000.00 with careful scrutiny of particulars and photos.

i Account Feature, Account Opening —— |

on = 4})

ease)

eye. vy

aie) ABAY BANK S.C. - CHARITABLE SAVING ACCOUNT PROCEDURE.

2.7 CLOSURE OF AN ACCOUNT

Account closure procedure for both types of “Charitable interest Trust

Fund Saving Accounts” account will follow procedural steps indicated

on the main Retail Banking Procedure, however, the reason for the

closure can be

2.7.1 Request by Charity Donating party and same consent of charity

receiving person or association and the vice versa

27.2 When any of the account customer reports loss of passbook:

2.7.3 When there is a court order for closure of such accounts;

2.7.4 Asa result of death, bankruptcy, insanity, etc. of account holders;

In such instances the following shall be followed:

i. The usual interview why parties are going to close the account

shall be requested and as far as possible the customers shall be

convinced to retain the account and continue the relationship.

ii, If the account is being closed due to dissatisfaction or

misunderstanding encountered by the customer, measure must

be taken immediately to correct the irregularity created on the

part of the Branch and retain the customer,

If closing the account is must, the pass book provided to the

customer must be collected; the balance should be updated if

there is any difference due to interest calculation examining the

initial agreement.

iv. Supervisors shall Makes sure that interest calculation & payments

are made as per the initial agreement & as per the procedure

Vv. The Branch Controller or accountant shall receive and ascertain

that the account transfer, interest and payments are in line with

initial agreement and as dictated in this procedure.

vi. Close the account following the usual account closing procedure

indicated on the main Retail Banking Procedure.

14 Ser Sa he eer ee eae aS

| CB pony want sc -CHARITABLE SAVING ACCOUNT PROCEDURE

3 EXCEPTIONS

All exceptions to this procedure shall be approved by the President.

4 REVISION OF THE PROCEDURE

This “Charitable Saving Account Procedure” shall be revised every

three years. However, it can be revised when deemed necessary

and if a need rises at any time.

5 EFFECTIVE DATE

This procedure shall come in to force as approved by the Bank's

Executive Management Committee and from the date signed by

President of the Bank as indicated below:

once Alesis

a——~\

President Signature:

<>) ABAY BANK S.C. - CHARITABLE SAVING ACCOUNT PROCEDURE.

ANNEXES

Os

sak

Photo

CHARITABLE SAVING ACCOUNT

P04 ALGAE kend LON

‘Account Opening Application Form

PLAN ooh sF eran FO

‘Account Number:

Puna dene

PRIDANT ae 9%

Full mameName of Business

Anamhaainarb asc.

‘Address

meer aah

House No. Telephone number

tomes rac dere 19+

1D Passport No. Place of tue

Pre AL ae aah hewn noo once UL Sibert a

‘Tradefiv License No. TINO, Intl deposit

acre 10, 1 —

Monthly income (Fhnown) Nationality

en nome mann — 2]

[Name of Business Charitable Organization “Ta be donated by the Bank

aeernoa neh RE vee +04.

‘Address Zone Bcity Wereds Kebele

Fans an PM — mere wns (Additional) 1% — ]

Interest Donation reference

‘v4-1 @H8 (Al Premium Interest) [—]

Iu Me Ramio. ge2IF AHHATE MOM OMe? NIMAVEATEHIMAY NHTrHeM. MAAN DC HEH AMLRLA orang

SMPOCNC NOTEAT emda UT owe - hme aE HOUSE VAL IMGGOIMAT: WHAT 2C (EERE SPY LOE

APF NALNHIND MoI FAU NOSE

We confirm that the info

Fablty Formal operaio

tation given herein above is correct and true. | ame are alo filly aware ofthe criminal and civil

‘accounts, Ijwe have also read and agreed the Term and Conditions related with the scxoun

OMT an eeueremnD. aw. 4001 5006

Operated by Specimen signature

rhe vec _

Opened BY a

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- ECX Coffee Contracts Approved by ECEA March 29 2018 PDFDocument13 pagesECX Coffee Contracts Approved by ECEA March 29 2018 PDFesulawyer2001100% (1)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Determinants of Coffee Export Supply in PDFDocument8 pagesDeterminants of Coffee Export Supply in PDFesulawyer2001No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Manufacturing-export-earning-is-in-deficitDocument4 pagesManufacturing-export-earning-is-in-deficitesulawyer2001No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Large-And-Medium-Manufacturing-Industry-Survey-Report-2020-G.C.-2012-E.F.YDocument30 pagesLarge-And-Medium-Manufacturing-Industry-Survey-Report-2020-G.C.-2012-E.F.Yesulawyer2001No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- ES 3.16 Feasibility Study and Equipment Installation To Produce Pellets From Coffee Pulp PDFDocument3 pagesES 3.16 Feasibility Study and Equipment Installation To Produce Pellets From Coffee Pulp PDFesulawyer2001No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- CoffeeContracts PDFDocument13 pagesCoffeeContracts PDFesulawyer2001No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Coffee Annual - Addis Ababa - Ethiopia - 5-29-2019 PDFDocument6 pagesCoffee Annual - Addis Ababa - Ethiopia - 5-29-2019 PDFesulawyer2001No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Abay Gift Card ProcedureDocument12 pagesAbay Gift Card Procedureesulawyer2001No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 0.diaspora Banking ProcedureDocument48 pages0.diaspora Banking Procedureesulawyer2001No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Pre-Feasibility Study Restoring Coffee Landscapes PDFDocument74 pagesPre-Feasibility Study Restoring Coffee Landscapes PDFesulawyer2001No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Retail Banking Operation Procedure Part 2Document39 pagesRetail Banking Operation Procedure Part 2esulawyer2001No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Retail Banking Operation Procedure Page 45Document1 pageRetail Banking Operation Procedure Page 45esulawyer2001No ratings yet

- 0.consumer Loan Procedure For NGO EmployeesDocument13 pages0.consumer Loan Procedure For NGO Employeesesulawyer2001No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Ifrs 8 and Ias 34-Operating Segments & Interim ReportingDocument46 pagesIfrs 8 and Ias 34-Operating Segments & Interim Reportingesulawyer2001No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- IAS 37 ProvisionDocument38 pagesIAS 37 Provisionesulawyer2001No ratings yet

- 00... Additional Internal Controls For Payment Transaction 2Document2 pages00... Additional Internal Controls For Payment Transaction 2esulawyer2001No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Ifrs13 Fair ValueDocument19 pagesIfrs13 Fair Valueesulawyer2001No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Ias 36 ImpairementDocument24 pagesIas 36 Impairementesulawyer2001No ratings yet

- Introduction Iasb Conceptual FrameworkDocument84 pagesIntroduction Iasb Conceptual Frameworkesulawyer2001No ratings yet

- IFRS 9 FINANCIAL INSTRUMENTS-AddisDocument35 pagesIFRS 9 FINANCIAL INSTRUMENTS-Addisesulawyer2001No ratings yet

- Ifrs 15 Revenue RecognitionDocument46 pagesIfrs 15 Revenue Recognitionesulawyer2001No ratings yet

- Ifrs 1 First Time AdoptionDocument27 pagesIfrs 1 First Time Adoptionesulawyer2001No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ias 1 Presentation of Financial StatementsDocument30 pagesIas 1 Presentation of Financial Statementsesulawyer2001No ratings yet

- Ias 23 Borrowing CostsDocument18 pagesIas 23 Borrowing Costsesulawyer2001No ratings yet

- Ias 21 ForexDocument32 pagesIas 21 Forexesulawyer2001No ratings yet

- Ifrs 16 LeasesDocument33 pagesIfrs 16 Leasesesulawyer2001100% (1)

- Ias 8 Accounting Policy-PresentationDocument49 pagesIas 8 Accounting Policy-Presentationesulawyer2001No ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- IAS 24 Related PartyDocument11 pagesIAS 24 Related Partyesulawyer2001No ratings yet

- Ias 10 Events After Reporting PeriodDocument13 pagesIas 10 Events After Reporting Periodesulawyer2001No ratings yet

- IAS 16 PPE and IAS 40Document81 pagesIAS 16 PPE and IAS 40esulawyer2001No ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)