Professional Documents

Culture Documents

Retail Banking Operation Procedure Part 2

Retail Banking Operation Procedure Part 2

Uploaded by

esulawyer20010 ratings0% found this document useful (0 votes)

45 views39 pagesBank Procedure and Manual

Original Title

3. Retail Banking Operation Procedure Part 2

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBank Procedure and Manual

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

45 views39 pagesRetail Banking Operation Procedure Part 2

Retail Banking Operation Procedure Part 2

Uploaded by

esulawyer2001Bank Procedure and Manual

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 39

ABAY BANK S.

CHAPTER 11

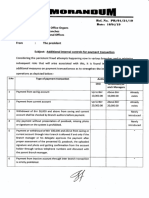

Transaction-Authorization Limit

‘The following Transaction Authorization limit will be applied for supervisory

level.

‘Authorization Limits

Line of Business Activities

1. Depository and Payment A/Cs Services

it for Supervisors

TL. Deposit of S/A 500,000.00

1.2. Withdrawal of S/A 20,000.00

13. Deposit of C/A '500,000.00

1.4. Withdrawal of C/A 20,000.00

1.5. Cheque Deposit to Accounts 100,000.00 |

16. Fixed Time Deposit 100,000.00

[U7.tssuanceofCPOs "10,000.00

1.8. Liquidation of CPOs ~~ | 10,000.00

[19.tssuanceofDrafts ~~ | 10,000.00

1.10, Payment of Drafts 70,000.00

Ti. Blocking (CA/SA) 5,000.00

1.12, Account to Account Transfer | 5,000.00

2. Money Transfer Services

2.1. Local Transfer (incoming) 30,000.00

2.2. Local Transfer (Outgoing) 30,000.00

2.3. Foreign Money Transfer Payments 10,000.00 -

3. Reversal a

Every Transactions Reversals shall require approvals T

ABAY BANK S.C.

CHAPTER 12

Cash Operations

12.1 General Principles

Cashier and Client Relations Officers

a) Always give due attention to accuracy in keeping & controlling cash;

b) Keep adequate cash in the Cash Office, so as to be able to meet immediate

requirements and to avoid opening the vault more often than necessary;

€) Keep sufficient coins to meet the moderate requirements of the Bank's

customers;

d) Make sure that the cash limit is always kept to a minimum;

€) Inform the branch's Management whenever unusual transactions take

place;

f) Be fully aware of security requirements at the branch level and make it

a point to strictly comply with all the security-related regulations;

g) Familiarize yourself with the specimens of the signatures and of the

initials of the branch's authorized personnel;

h) Make sure that you are aware of counterfeit notes and the methods that

must be used to detect them;

i) Render to all customers of the Bank efficient and helpful services without

being partial to any of them and as cordially as possible;

j) Make sure that all the staffs of the Bank who work in the-cash area look

neat and presentable;

janking Operations Procedure - March 201

ABAY BANK S.C.

k) Form good working relations with customers of the branch, and

familiarize yourself with their signatures and the transactions of their

accounts;

1) Make sure that all the blank spaces that appear before and after the

amount of the money to be deposited, which is written on both the

original and the copy, have been closed;

m)As much as possible, discourage long queues around the window of the

transfer, cash payment and the receipt instrument by rendering these

services from another window where there is no queue;

rn) After you have rendered to the customer the service that she or he had

come seeking, never forget to thank her/him for coming to the Bank;

©) The handing and taking over of cash has to be evidenced by an

authorization on the system;

P) Make sure that cash is promptly transferred to the cashier, so as to avoid

an unnecessary accumulation thereof;

4g) Make it a point to invariably keep cash notes inside the cash drawers—

out of public view—not at the counter;

1) Prevent the huge build-up of surplus cash in the Cash Office by promptly

transferring it to the vault, even if it has not yet been sorted for security

purpose:

8) In the event that you must, for one reason or another, leave the cash area,

keep the cash locked in your drawers and take with you all the keys; and

t) Try, as much as possible, to avoid frequently opening the vault by

working with all those concerned in a more concerted manner so as to be

able to determine the cash requirement for the day’s operations.

Banking Operations Procedure - M: Page 120

ABAY BANK S.

——S

12.2 Concentration and Security

cl

nt Relations Officer

a) Make it a point to always concentrate only on what you are doing while

counting, receiving and paying cash;

b) You should always keep cash and cashed items only in lockable

drawers—not in shelves or elsewhere;

¢) Do away with the now-obsolete practice of recording cash

denominations after the payment has been effected;

4) You must always keep in mind that such cash-related items as vouchers,

checks, payments and receipt instruments are almost as good as cash;

e) Avoid putting your initials/signing on notes’ wrappers before the cash

has been wrapped, and shred all wrappers that bear the initials of the

Client Relations Officer, whenever you find them;

f) Never forget to lock the drawers wherein you stash up cash whenever

you have to leave the cash area and after office hours;

9) Before you leave the premises for lunch, balance your cash, ascertain the

correctness of the amount thereof and hand it(the cash in your

possession) over to the cashier and lock the drawers;

fh) Count all the cash taken from the cashier (mandatory especially in the

case of Birr 50 and Birr 100 notes) before delivering it to the customers

of the Bank;

i) You have to always slit/open wrapped notes—especially Birr notes of big

denominations—before delivering them to the customers of the Bank;

i) Remind customers of the need for carefully counting the cash given to

them before leaving the cash counter;

k) Avoid talking while counting cash, so as to prevent making ar

1) If and when the customer changes her/his mind regarding the cash,

Retail Banking Operations Proc

ABAY BANK S.

denominations during payment, do not try to attend to her or his request

up until you have given her/him the cash as per her/his earlier

preference;

m) While exchanging money notes (from one currency to another), do not

remove the cash presented by the customer from the counter until you

have made sure that she or he has fully agreed to proceed with the

exchange;

A) Before effecting payment thereof, always make sure that the value of the

check has been posted and that the appropriate account has been

debited.

Cashier

a) Discourage the Bank's Client Relations Officers who are working at

separate windows from exchanging Birr notes;

b) Whenever possible, undertake all your cash-related activities on

relatively quiet days;

©) Avoid putting coins in a money bag set aside for other denominations;

d) Never forget to lock the drawers wherein you supply up cash whenever

you have to leave the cash area and after office hours;

€) Avoid talking while counting cash, so as to prevent making any errors;

f) Client Relations Officers are not allowed to keep items like bags, pieces of

luggage, lunch boxes, etc. in the cash area.

9) No one should be admitted into the cash area, other than those

employees whose work involves some type of cash-handling. Even such

employees should not be allowed to roam around the cash area or to

cause unnecessary commotion.

h) While on duty, Client Relations Officers are not allowed to leave their

windows under any circumstances or to be engaged in long

conversations with other Client Relations Officers or with the customers

of the Bank across their partitions.

ABAY BANK S.C.

i) Nobody should be admitted into the windows of the Client Relations

Officers. And no unauthorized person should be allowed to enter the

Cash Office at any time, Since all cash-related work requires maximum

care and accuracy, nothing that could disrupt the attention of the Client

Relations Officers should be tolerated in the cash area.

J) All staffs working in the cash area must be polite, courteous, attentive

and respectful toward the customers of the Bank. Proper information

must be given out in response to the inquiries coming from customers. If

the Client Relations Officers is uncertain about the inquiry forwarded to

her or him by a customer, she or he should direct the customer to the

pertinent person or Supervisor.

k) Since there is no insurance coverage for the excess cash over and above

the approved limit, Branch Manager and the cashier should make sure

that the branch’s cash-holding limit is within the approved limit.

The Branch Manager

‘The branch manager shall create awareness to Client Relations Officers

before assigning them at a front office.

a) To change the date on the cash stamp of the branch on a daily basis;

b) To concentrate on the work at hand even on relatively quiet days;

©) To check properly signatures, ID cards, posting, approval and the

sameness of the amount of money given in both words and figures;

d) To accurately write the denominations of the cash paid to the customers

of the Bank on the cash-payment instruments and to verify the

correctness of the denominations written on the cash deposit vouchers;

e) To retain the original of a deposit voucher and hang the slip

to the depositor;

Retail Banking Operations Procedure Page 123

ABAY BANK S.C.

————————

12.3 Attendance and Conduct

a) The cashier, the Client Relations Officers and the Cash Office personnel

should always be in the cash area 15 minutes before 8.00 A.M. to make

the necessary arrangements for the cash operations of the day and start

rendering the services to the customers of the Bank as soon as the branch

is open to its customers at 8.00 AM. Furthermore, since they are the

staffs whom the customers of the Bank come into contact with more

often, they should, as much as possible, be presentable in their

appearances and thereby reflect a positive image of the Bank.

b) The cashier, the Client Relations Officers and the Cash Office personnel

are not normally allowed to leave the cash area. If they are compelled to

do so, due to an unexpected circumstance that is beyond their control,

they have to at first get the go-ahead of the concerned supervisors.

€) Telephone calls should, as much as possible, is avoided during cash

hours. Client Relations Officers who are in their windows should not be

disturbed by outside calls. In the event that the telephone call has to do

with an important and urgent message, nevertheless, it should be

received by the supervisor and communicated to the CRO after she/he

has been cleared off her or his cash responsibility. Should the message

turn out to be urgent and thus calls for an immediate attention, the Client

Relations Officer must at first be relieved of the cash still in her/his

hands and then informed of the message.

d) As soon as the Client Relations Officer starts work, she or he must switch

off her/his mobile (cell) phone.

) The Client Relations Officer should never be reprimanded either in

writing or otherwise while she/he is in the middle of a cash operation.

f) No brawls or exchange of strong words between the staffs of the Bank

working in the cash area will be tolerated. The same is true about all acts

that are considered to be contributing factors to making errors.

ne

Retail Banking Operations Procedure - March 2016 ye 124

ABAY BANK S.C.

g) It goes without saying that idleness is one of the underlying causes for

errors and for other unacceptable acts. The Client Relations Officers are,

therefore, expected to keep themselves always busy—doing what they

are supposed to do. Even if they have completed their share of work, they

should assist the other staffs who have not yet completed their work. No

one should leave the cash area until the daily cash has been balanced.

Also, no mail should be delivered to the CROs during cash hours, as it

might contain some shocking news that could interfere with the

efficiency of its recipient.

h) Whenever a customer of the Bank has a complaint to lodge against a

Client Relations Officer and the complaint has something to do with

either the shortage or excess of cash, the cashier will have to report

thereon to the Branch Manager. The Branch Manager should then see to

it that the window of the concerned Client Relations Officer is closed and

balance all the cash still in the hands of that particular Client Relations

Officer, with a view to fully satisfying the customer who has lodged the

complaint against her or him. In a branch where there is a Branch

Controller, nonetheless, the checking must be done in her or his

presence.

i) All Client Relations Officers should be left alone and extra care must be

taken not to disturb them while they are on duty, as any disturbance or

conversation with them could result

a serious error on their part,

including a shortage of cash.

i) Ifand when a Client Relations Officer unexpectedly falls ill, she or he will

have to be given permission to seek medical attention during cash hours.

No matter what happens to her or him, she or he should not,

nevertheless, be allowed to leave the premises of the bank without

balancing and surrendering the cash in her/b

Retail Banking Operations Procedur Page 125

ABAY BANK S.C.

12.4 Cash handling between cash custody and issue

and branches

Cash collection from cash custody and issue/ the NBE Issue

Account-Holding Branch will be handled following the procedures

presented here in under>

12.4.1. Responsibility of the branch

City Branches

The Branch Manager

a) Prepares a letter of request to the Director Finance and Accounts and Issue or

prepares a message on the systems end through the Bank's computer

network like ERP, disclosing the total amount of the local currency or of the

foreign currency requested for, together with a breakdown there of in

denominations;

b) The Bank’s branches in the cities are supposed to lodge their requests in

writing, indicating there in the following:

> The total amount of the money requested for, together with a

breakdown thereof in denominations;

> The letter of request should be signed by the cashier and by Branch

Manager;

> The letter of request should bear the seal of the branch; and

> The letter of request should be sent to the Director Finance and

Accounts and Issue ina sealed envelope.

¢) Authorizes the transaction;

Retail Banking Operations Procedure - March 2016

ABAY BANK S.C.

SS

The Cashier

a) When receiving cash from the Cashier(cash custody and issue) counts

the cash, in collaboration with the Client Relations Officer at the table,

ascertains the correctness of the amount and the denominations there of

by comparing it with Handing and taking over format or Re-

imbursement claim, in front of the Cashier from the H.0. Finance and

Account:

b) Signs on the Handing and taking over format or the Re-imbursement

claim and gets the Client Relations Officer/Manager co-sign on it, affixes

a stamp and hands it over to the Cashier of the H.O. as an

acknowledgement of receipt of the cash;

©) Passes one copy of Handing and taking over format or the Re-

imbursement claim to one of the Client Relations Officers for posting the

cash received; and

d) Registers the denominations of the cash in her/his cash position book

and posts the total amount thereof into the system as cash received,

The Customer Services Officer

a) Receives one copy of Handing and taking over format or the Re-

imbursement claim from Cashier;

b) Posts the transactions.

The Branch Control

a) Receives the handing and taking over form or the Re-imbursement claim

from the Client Relations Officer;

'b) Checks the transaction on the system;

Retail Banking Operations Procedure - March 2016 Page 127

ABAY BANK S.C.

- Outlying branches

Branch Manager

a) The outlying branches Sends the tested message to Regional Manager

or Director Finance and Accounts, Branch Manager at the NBE Issue

Account-Holding Branch, as the case may be, by telephone or

prepares a message on the system send by secured Abay’s computer

network like ERP, disclosing the total amount of the local currency or

of the foreign currency requested for, together with a breakdown

there of in denominations;

b) The Director Finance and Accounts should be notified once a month,

through a report, of the cash shipment to, or from, the branches, so

that she or he will provide the necessary insurance coverage;

€) Authorizes the transaction.

The Cashier

* Follows the same procedure discussed here in above under the Cashier for

city Branch,

The Client Relations Officer

‘+ Follows the same procedure discussed here in above under the Client

Relations Officer for city Branch.

The Branch Controller

‘* Follows the same procedure discussed here in above under the Branch

Controller's task for city Branch.

inking Operations

ABAY BANK S.C.

Lene ee

12.4.2 Respon 'y of cash custody and issue/ the

NBE Issue Account-Holding Branch

A- City Branches

The Manager-Cash Custody and Issue

a) Upon receipt of the tested message from the branches, ascertain and

decodes the message and forwards it to the Head of Local Currency or to

the Head of Foreign Currency, so that she or he will keep it in her/his

custody; and

b) Provides a van/vehicle for transporting the cash, as well as the security

guards who will escort it (the cash).

The Head Cash Custody and Issue

a) Prepares cash Handing and taking over format or the Re-imbursement

claim for the total amount of money to be supplied to the branch,

disclosing the breakdown of the denominations thereof;

b) Arranges the date, the time and the cashier who will provide the cash to

the branch; and

¢) Arranges the cash requested for, in accordance with the preferred

denominations, and hands it over to the concerned cashier, together with

Handing and taking over form or Re-imbursement Claim,

The cashier at H.O. Finance and Accounts

a) Counts the bundled-up cash, which has subsequently been stashed

pin bricks, so as to ascertain the correctness of the amount thereof, in

line with the lodged request, and signs one copy of Handing and

taking over format or the Re-imbursement claim ill be

ABAY BANK S.C.

ee _

b) Takes the cash to the branch, having it escorted by the assigned

security guards; and

¢) Hands over the cash to the cashier at the branch, together with the

copy of Handing and taking over format or the Re-imbursement

claim.

12.4.3 Cash surrender to cash custody and issue/ the

NBE Issue Account-Holding Branch

Responsibility of the branch

a) City Branches

‘The Manager

Requests, the Director Finance and Accounts to collect the excess cash and

requests for the shipment thereof on the system send by secured the Bank's

computer network like ERP. Upon requesting for cash shipment, she or he

has to makes sure that the following have been fulfilled:

‘@. The total amount of the money to be dispatched to the H.O. or Issue

account and the breakdown of the denominations thereof;

b, The letter should be signed by Branch Manager; and

©. The letter should bear the stamp of the branch.

The Cashier (at the branch)

a) Requests for the ID card of the Cashier and ascertains that its number

is concordant with the one that appears in the letter;

b) Prepares Handing and taking over format or Re-imbursement claim for

the total cash to be sent to the NBE issue account-holding branch or

Department, indicating the breakdown of the denominations and signs

onit;

€) Prepares the cash to be sent from the vault to Cash custody and issue, in

collaboration with Branch Manager;

il Banking Operations Procedure - March 2016

ABAY BANK S.C.

d) Identifies the Cashier in charge on the file copy of the Handing and

taking over format or Re-imbursement claim which will be retained by

the branch and makes her or him sign on it to acknowledge receipt of the

cash; and

e) Transfers the amount and denomination of cash to be dispatched to the

Client Relations Officer through the system together with a copy of the

handing & taking over format or Re-imbursement claim for posting,

The cI

nt Relations Officer

* Accepts the money through the system and posts it into the system as

payment.

The Branch Supervisor

a) Authorizes the transaction; and

b) Jointly prepares, with the cashier, the cash to be sent from the vault

to the H.0. or issue account.

‘The Branch Controller

a) Receives the handing and taking over form or Re-imbursement claim from

the Cashier;

d) Checks the transaction on the system;

b) Outlying Branches

An outlying branch having excess cash shall first inform, in writing the

branch holding cash for the "National Bank of Ethiopia Issue Account” as,

follows:

a) Outlying branches should send tested messages by telephone or

prepares a message on the system send by secured Abay’s computer

network like via ERP;

b) The total amount of the money to be dispatched and the break down

thereof in denominations should be disclosed;

¢) The letter must have been signed by the Branch Manag,

Retail Banking Operations Procedure - March 2016

ABAY BANK S.C.

d) The letter must have been impressed by the seal of the branch. By a

copy of the same letter, the Director-Finance in the Head Office shall be

informed by mail of the need for an insurance coverage. The dispatching

branch should also make ready the cash prior to the date of collection;

€) Separates the good Birr notes from the mutilated and dog-eared Birr

notes;

f) All Birr notes—those that are in good condition as well as those that

are mutilated and dog-eared—should be wrapped up, in accordance with

their denominations, and the signatures of the pertinent personnel must

then be affixed to the wrappers;

9) Wrapped-up bundles of Birr notes should be arranged in bricks, with the

exception of the Birr notes that are mutilated as well as Birr 50 and Birr

100 notes, which require too longa time to amount toa complete brick;

hh) Arranges a box that can be locked or nailed shut, after the cash that is to

be dispatched is put in it; and

i) Prepare Handing and taking over format the total amount of money to be

dispatched, indicating the breakdown thereof in denominations;

J) Upon its arrival at the "NBE Issue Account-Holding Branch, “the branch

surrenders the cash to the Cashier, together with Handing and taking

over format. The cashier, for her or his part, accepts the cash and counts

it, with the help of the Client Relations Officers, and there by ascertains

the correctness of its amount as per the Handing and taking over for matt

hereof,

12. Security Precautions

Cash consignment from one branch to another and from the Issue Accounts

to the branches should always be escorted by security guards who have

had prior military or police training, if a branch has no security guard of its

own. If the distance to be covered requires an over-night stay on the way, it

must be planned in such a way that the town where the night is to be

passed should be preferred for the safety of the cash

Retail Banking Operations Procedure - March 2016 Page 132

ABAY BANK S.C.

‘Whenever possible, a trip with cash after sunset or before sun rise should

be avoided. If there is a branch of the bank in that town, the vehicle

carrying the cash should be made to stay for the night in the compound of

the branch, vigilantly watched by i

S escorts. In the absence of a branch,

however, the vehicle should be parked either in the compound of a nearby

police station or in a military camp, accompanied by its escorts.

12.

Cash handling within a branch

12.6.1 Cash Limit setting for Client Relations Officers

The Branch Manager and Cashier shall determine the cash limit of Client

Relations Officers for starting the day’s operation for a certain period

uniformly, considering the volume of the transaction. However, the limit

could be revised periodically, as and when required.

12.6.2 The Procedure for Opening and Starting the Day’s

Operations

The duties and responsibilities that the operators involved in opening

and starting the day’s cash operations are entrusted with comprise the

following;

The Cas!

.

a) Jointly, with Branch Manager, opens the vault and withdraws there from

the cash that will be needed for the day’s Operation:

b) Authorizes the vault transfer on the system to acknowledge receipt of the

cash withdrawn from vault.

€) Distributes adequate physical cash in all kinds of denominations to the

Client Relations Officers;

d) Transfers through the system to the concerned Clignt-Relations Officer

the required-cash balance; ZA” it~

ABAY BANK S.C.

———————————

€) Transfers the closing balance of the cash book of the previous day and

the balance of the day to the cash book as BBF.

f) Assigns Client Relations Officers who will assist and facilitate the cash

operation at the counter and at the master table; and

9) Assigns a CRO who will exchange Birr notes and coins.

The Branch Manager

a) Jointly, with the cashier, opens the vault and withdraws there from the

cash that will be needed for the day’s operations;

b) Transfer the amount of cash withdrawn from vault against the

denomination to the cashier.

©) Assigns Client Relations Officers who will assist and facilitate the cash

operation at the counter and at the master table(when the cashier is not

available) ;and

) Assigns a CRO who will exchange Birr notes and coins,

The Client Relation Officer

a) Collects the cash together with the personal cash brand/stamp from the

cashier when vaul

's opened in the morning;

b) Collects the cash from the cashier and checks all the complete bricks

to ascertain that each one of them contains 10 bundles and that all of

them have been wrapped;

©) Counts the cash in front of the cashier to confirm the amount of petty

cash,

d) Takes the cash to its cage, opens the computer and verifies the amount

of the petty cash transferred through the computer against the previous

day's record and accept/authorize;

e) Makes sure that the signatures or the initials of the Cash Counter and the

Verifier have been affixed to the bundle. Notes of Birr 50 and Birr 100

are to be accepted only by carefully counting each one of them;

Retail Banking Operations Procedure - March 2016 Page 134

ABAY BANK S.C.

f) Check the amount of cash transfer through the system, authorize the ‘Till

transfer’ as acknowledgment of receipt of cash for the daily operation;

G) Adjusts the date of the stamps (brands) before starting the day's

operations.

12.6.3. During the Day’s Operations

a) Request for Additional Cash

a) Requests the cashier the required additional cash through the system.

b) Collects the money, counts and ascertains the correctness of the amount

and of the denominations there of, by comparing it with what was

requested; and

€) Confirms to acknowledge receipt of the money by authorizing the cash

transfer through the system.

The Cashier

a) Coordinates and controls the activities of the

nt Relations Officers

and does follow-up on the balance still in their possession through the

system as well as physically;

b) Prepares the amount of money requested by them after ascertaining

actual need for big amount;

¢) Sends the required physical cash and transfer the same amount of Cash

though the system.

b) Transfer of Excess Cash in the Middle of the Gash

Operations

The Cli

nt Relations Officer

a) Sorts the cash at hand into bundles, in accordance with the

denominations and balances thereof;

b) Hand over the cash to the cashier, and transfer the ai f cash

through the system; and

Retail Banking Operations Procedure - March 2016

ABAY BANK S.C.

———— EEE

The Cashier

a) Receives the cash and counts it with help of Cash Office Personnel;

b) Ascertains the correctness of the money received, in accordance with

the denominations written down; and

©) Acknowledge receipt of the amount of money by authorizing the ‘till

transfer’ through the system;

d) Whenever the money at the table becomes too bulky, receives it by

carefully counting each bundle and brick and after checking the

correctness of its amount by comparing it with that in the system (till

balance) of the CRO.

12.6.4 Recel

ing Cash Deposit at the Table

The Client Relations Officer (at the table)

a) Collects from the customer the amount of money to be deposited in

excess of 15-bundle cash.

b) Counts the Birr notes against each denomination in the bundle sand

ascertains the correctness thereof by comparing it with that of the

voucher filled in,

©) Posts the amount of money to the customer's account using her/his

user ID, affixes as tamp to the voucher/s, signs on it and prints a deal

slip;

) Makes the cash office attendant wrap the bundles of the Birr notes

accor

ing to their denominations and affixes a stamp to the wrapping

paper;

) Signs on the wrapped Birr notes to confirm the correctness of the

amount of money in each bundle (two signatures are required on

wrapped notes of Birr five and above, and one signature on wrapped

notes of Birr one);and

) When the brick become too bulky, balances the money according to its

denominations and hands it over to the cashier, and transfer the cash

through the system.

Retail Page 136

ABAY BANK S.C.

a) Hand over all the Birr notes in bundles, except the loose ones, to the

cashier and make a ‘till transfer’ through the system;

‘b) Hands over to the Branch Controller/Cashier the remaining vouchers

in her or his possessi

m5

©) Balances the overall cash that is, the total cash received from

customers and from the cashier against the cash paid to them

(customers) and sent to the cashier with that of the remaining cash and

stamps in her/his hands;

The Cashier

a) Accepts the cash surrendered by the CROs, ascertains the correctness

of the denominations and of the total and acknowledges receipt of the

cash by authorizing the ‘till transfer’ on the system;

b) Ascertains the correctness of the cash-balancing done by the CRO that is,

the opening balance (the petty cash) and the cash received from him/her

against the cash surrendered and the cash still in her or his hands;

) Receives the total payments & receipts of each CRO;

d) Ascertains the correctness of the cash balance and of the petty cash in

her or his possession by comparing it with the amount of the money

debited and credited; and

e) Makes sure that the amount of the petty cash in the box is correct

against the ‘Till transfer ‘made to him as a petty sit in the

safe.

Retail Banking Operations Procedure - March

ABAY BANK S.C.

b) The Day-End Closing

The Client Relations Officer

a) Transfers to the Branch Controller the remaining deposit and payment

vouchers in her or his hands,;

b) Amalgamates the cash in her or his hands in bundles and loose notes,

sorting it by its denominations, and balances the overall cash as follows:

Petty Cash (beginning balance + cash received from customers +cash

received from the vault (the cashier) ~ cash paid to the customers-cash

sent to the vault = cash on hand).

€) After balancing it, transfers to the cashier the balance at the total

amount, which will be transferred to the table, and make a ‘Till transfer’;

and submits stamps to the cashier as well.

The Client Relations Officer (at the cash table)

a) Accepts the remaining bundles attend of day from the Client Relations

Officers sent to her or him;

b) Checks against the system the correctness of the amount of the cash

received from the table and of that surrendered to the table by each

Client Relations Officer during the day; and

€) Checks the correctness of the amounts of money in each brick and loose

bundle and surrenders them to the cashier.

The Cashier

a) Accepts the money from the CRO at the table, after checking against the

system;

b) Receives the total amount of cash from the Client Relations Officers by

authorizing the ‘Till transfer’ as acknowledgment of receipt of Cash.

€) Makes sure that the bricks contain 10 bundles of 100 Birr notes each

and that the packet bears the initials of the Counter and of the Verifier in

the cases of notes of Birr five and above;

ABAY BANK S.

SS —eeeeeeeSOee

4) Balances the total cash transaction against the Client Relations Officers’

balance in the system;

e) Writes the balance of the daily debits and credit

on the cash book;

f) Fills the amount of money withdrawn from the vault during the day and

the amount of money lodged to the vault on the cashbook;

9) Balances the cashbook and signs on the space provided for that purpose;

hh) Signs on the cash book on the space provided for that purpose;

i) Posts the cash lodged to the vault on thesystem under the file 'Till to

Vault transfer’; and

j) Jointly, with Branch Manager transfers the cash lodgment to the

vault, together with stamps.

The Branch Manager/Accountant/D/B/Manager

a) Checks the correctness of the amount of the cash balanced by the

cashier against ‘Till balance by denomination’ in the system;

b) Makes sure that each brick contains 10 bundles and counts all the loose

Birr notes;

¢) Authoi

the ‘Till to Vault transfer’ made by Cashier;

d) Jointly, with the Cashier, transfers the physical cash lodgment to the

vault, together with the stamps.

en eee

nking Operations Procedure - March 2016 Page 139

ABAY BANK S.C.

12.8 Cash Difference

a) A cash discrepancy (shortage and excess) involving Birr 100.00 and

above, but below Birr 1,000.00, be reported to the Branch Manager.

b) A cash discrepancy involving a shortage of Birr 10,000.00 or more

must be immediately reported to the Director -Internal Audit, BORM

and HRM. A letter should follow indicating the effort made to trace

the difference. The letter should contain the following:

The amount of money involved;

— The name of the Client Relations Officer;

= The effort made to trace the discrepancy;

- The action taken to settle the discrepancy; and

= Any other relevant facts.

) In the event that a substantial sum of cash is detected as a shortage, it

should be jointly reported by the Branch Manager & the Branch

Controller.

d) The Branch Manager should arrange the whole cash, including the vault

cash, to be checked and for a proper investigation to be done thereon.

‘And, whenever the cash indemnity account of the concerned Client

Relations Officer is insufficient to cover the loss involved, appropriate

action must be taken to balance the cash position.

€) Although, for control purposes only, a difference of Birr 1,000.00 or of

any amount in excess thereof, needs to be reported separately, it is

important to note that any difference should be treated as being equally

serious—regardless of its amount. After all, a shortage or an excess of

Birr 100.00 could well have been a shortage or an excess of Birr 1,

000.00 oF more.

f) All branches are required to send to the Manager in their respective

Regional offices their cash-discrepancy reports (shortage or excess)

Retail Banking Operations Procedure - Marc! Page 140

ABAY BANK S.C.

at the end of each month, regardless of the amount of money involved,

12.8.1 Refund of Excess Cash

a) A cash excess of up to Birr 10,000.00 has to be refunded to the

rightful claimant so long as there fund has been jointly approved by

the Branch Manager.

b) There fund of an excess cash of over Birr 10,001.00, but less than Birr

50,000.00 ,has to be jointly approved by the concerned Branch

Manager and the Regional Manager.

¢) There fund of an excess cash of over Birr 50,001.00 has to be jointly

approved by the Branch Manager with the concerned Regional

Manager and Director - BORM.

d) At the time of approval ,the following, among others, should be

considered:

Application of the Claimant

A request for such is fund should normally be lodged instantly. And,

unless a valid reason has been given for the delay, such claims should not

be entertained 15 days after the money was deposited. The claimant's

application must contain such pertinent information as to how the excess

occurred as well as the denominations and the other factors. This

information should be counter checked against the statement of the

concerned Client Relations Officer.

A Written Statement of the Client Relations Officer

‘The Client Relations Officer may recall the circumstance under which the

excess occurred and she/he may even recognize the claimant. This must

be included in the Client Relations Officer's report, which should be

critically looked in to. Receipt or a Payment Voucher in which the

Excess is claimed to have occurred denominations written on it.

ABAY BANK S.C.

Se =e

was involved at the time of the deposit or withdrawal in order for the excess

to occur.

Other Pertinent Circumstantial Evidence

All other factors that corroborate the claim may be considered, although it is

difficult to enumerate all of them here.

The Branch Controller and the Branch Manager should work out the

denominations of the excess. Deposit will be added on to the beginning cash

balance by denomination and withdrawals will be deducted in the same

manner to arrive at the denominations of the closing cash balance. This

should be performed without fail, and those who approve the refund of

excesses will consider such reports in their decisions

UNDERTAKING AND GUARANTEE

Ifand when it cannot be completely proved that the excess belongs to the

claimant, but there are some reasons to support the claim, an

undertaking / guarantee should be obtained for paying back the money

with interest thereon, in case another claimant appears later on.

REPORTING EXCESS CASH

‘The Branch Controller should report to the concerned office on the

excess refund approved by the branch. The regional office should then

communicate the approval of the excess cash to the Internal Audit.

12.9 Forged Notes

a) The Financial intelligence office has warned that any marking on

counterfeit Birr notes could interfere with the effort to determine the

characteristics of the counterfeit Birr notes and should not, therefore,

be made.

b) It is imperative that counterfeit Birr notes presented by customers be

marked “COUNTERFIET” in front of the presenter. Otherwise, she/he

March 2016

inking Operations Procedu Page 142

ABAY BANK S.C.

Nee enn ee,

will have aground on which to lodge a complaint as having been

unduly expropriated of her/his property.

¢) Ifa rubber stamp is used for marking, it should not be heavily inked

or cover the numbers, the portrait, the signature or any other feature

that makes the note clearly different from that of a genuine Birr note

d) If a counterfeit money note is noticed after it has been accepted and

mixed with the overall cash of the Bank and there is no way to

pinpoint the presenter of the note, the Client Relations Officer who

has discovered the counterfeit is liable for making the value of the

Birr note as good as it should be. In addition to that, she or he will

have to discover the Birr note and mark it accordingly and then

withdraw it from circulation.

e) Whenever a counterfeit Birr note is intercepted by the Bank, the

Federal Police /nearest police station has to be informed about it

immediately. In fact, the note itself should be sent to the nearest

police station, after a stamp indicating that it is counterfeit has been

affixed to it, together with a written report thereon, The report should

clearly show the address of the customer and her/his statement as to

how she/he acquired the note. A copy of this report must then be sent

to the Director - BORM, Director -RCM, Director -Accounts and

Finance and the Regional Office.

f) The Bank has no authority to detain the possessor of the note. Still, it

will have to notify the police on the phone while preparing the report.

Retail Banking Operations Procedure - March 2016 Page 143

ABAY BANK S.C.

12.10 Cash Custody

12.10.1 Good Coins

If the branch has a coin-counting machine, the counting of the coins

should be done by Cash Office Personnel. The numbering of the

machine should, however, should be attended by the Client Relations

Officer. In a branch where there is no such machine, however, the

counting of the coins should be done by hand, by Cash Office

attendant. In the event that the work load of the cash work is too

heavy for Cash Office Personnel to do the counting, never the less, the

customer may be requested to assist in stacking up the coins. If she or

he is willing to assist, he should, however, be provided with the coin

tray of the Bank.

Coins of all denominations that are hand-counted should bear ranged

ina pile of twenty coins each and be put in a tray in rows. A tray of

coins should contain 100 piles of coins—that is, ten piles wide by ten

piles long (10X10). Before the coins are put in a bag, the Client

Relations Officer should check the accuracy of the counting of the

coins arranged in the tray.

After the counterfeit money has been counted, a small card that

shows the amount, the initials of the Counter and of the Verifier as

well as the date on which the counting was done should be put in the

bag, Then the bag must be sealed.

A coin bag that is full should either be sealed or tied with a string.

‘Thereafter, a tag with the appropriate color should be attached at the

end of it, showing the denominations, the amount of money, the date

‘on which it was sealed and the initials of the persons by whom it was

counted and verified as well as the name of the branch.

In the. vault, or in the cash held for the National Bank of Ethiopia

(NBE), the coin bags should be kept separately, according to the types

coins of one denomination

Page 144

of coins they contain. In other words,

sanking Operations

ABAY BANK S.C.

Se ed

should be kept in one bag as indicated above.

Dilapidated coins should be kept separated from the coins that are in

good condition, with a note in the bag showing the amount there of

and the initials of the two custodians.

12.10.2 Good Money Notes

Except notes of Birr one, all other money notes should be counted by

one person and then verified by another. Both the Counter and the

Verifier of the notes should sign at the two corners of the bundles

containing the first money notes. The Counter should sign in black

ink, and the Verifier in red. The money so counted should then be

wrapped. It must also bear the initials of the Counter and of the

Verifier in the colors mentioned above and the date on which it was

wrapped and the name of the branch where the wrapping of the

bundles was done,

A bundle should contain 100 Birr notes, and a brick 1,000 Birr notes.

In other words, the Birr notes have to come in ten bundles, a rubber

string strapped around them, with a label on one side of the brick

showing the following:

+ The amount of the money in Birr;

‘© The date on which it was strapped;

‘+ The name of the branch; and

+ The initials of the Counter and of the Verifier.

No amount of money that comprises less than 100 Birr notes should

be wrapped. And loose Birr notes should be strapped with a rubber

band, and the number of the Birr notes should be written at the

corner of the first Birr note.

ABAY BANK S.C.

order of first-in, first-out and should not be kept for more than one

year after they have been strapped in to bricks.

All the initials or signatures on the bundles of the Birr notes must be

legible.

An incoming or outgoing consignment of cash should always be

opened in the presence of the cashier, the Branch Manager and the

Branch Controller, if there is one.

Cash Office Personnel should never be left alone to wrap the Birr

notes without the supervision of either the Client Relations Officer or

the cashier.

All Client Relations Officers should be occasionally requested to

deposit fresh specimens of their respective signatures and initials in

duplicate. The original must be kept by the Cashier and the duplicate

should be passed on to the Branch Controller so that she or he will

keep it in her/his custody. The frequency for obtaining such

specimens is left to the discretion of the cashier the Branch Manager.

12.10.3 Birr Notes that are in Bad Conditions

Birr notes that are in bad physical conditions should be kept

separately, according to their denominations, segregated from the

Birr notes that are still in good condition. Any mutilated or dog-eared

Birr note should be withdrawn from circulation and kept together

with the other Birr notes that are like it so that it may not be re-issued

by mistake. However old, every time a Birr note of a certain

denomination reaches 100 in number, it should be counted, verified

and wrapped and treated like all other bundles of new Birr notes.

After all the counting, wrapping and signing is completed, however, a

stamp should be affixed to each bundle, to both sides thereof, with a

large rubber stamp marked “Deteriorated” with bold letters, so that

the stamping appears on the full length of the bundle. Once a bundle is

is highly improbable that it could be

Page 146

obliterated with such a stamp,

Retail Banking Operations Procedure - March

ABAY BANK S.C.

issued again by mistake for circulation.

‘The dog-eared or mutilated Birr notes presented at the counter of the

Abay Bank s.c. for redemption of their value shall be treated as

follows:

¥ If it is mutilated where the serial number is written and then

glued together on another paper, the Birr note has no value

what so ever;

Y If it happens to be of a size that is equal or less than one-

quarter of the original note, it has no value, even if the serial

numbers appearing thereon are complete;

Y Ifitisa

r note with several perforations and mutilated

edges and if its serial numbers at both corners are complete

and the Birr note is a whole one—that is, it is not torn apart

and patched up later on—the Birr note should fetch its full

value; and

¥ Even though the Birr note does not bear in full the serial

number at either of its two corners, but one corner of the Bir

note is not mutilated and bears a complete serial number and

its size is not less than three-fourths of the whole note, the

Birr note so presented should fetch its full value.

The shapes and sizes that these remnant Birr notes take on from

some fire, rodents and other blights are varied and numerous. Not

many patterns may be devised and shaped to illustrate each of them.

‘The NBE has, however, devised eleven patterns against which we

should try to compare and determine the values of the mutilated and

dog-eared Birr notes presented for redemption. Their samples are

forwarded to all the bank’s branches under a separate cover. If a

branch, nonetheless, happens to come across Birr notes whose shapes

do not have any semblance to any of the eleven patterp

Retail Banking Operations Procedure - March 2016

ABAY BANK S.C.

12.10.4 Exchange of Birr Notes

a) For the exchange of Birr notes, the Client Relations Officer will receive

from the cashier a fixed amount of physical cash in different

denominations, preferably small denominations, and through the

system.

b) The Client Relations Officer shall count the cash she or he is provided

with in front of the cashier. If an additional amount of money is

needed for exchange, the cashier shall provide the cash against

through the system.

¢) The Client Relations Officer shall authorize the ‘Till transfer’ on the

system as acknowledgment of the receipt of cash.

d) The Client Relations Officer will exchange big Birr notes received

from the public into Birr notes of smaller denominations and vice

versa.

e) At the end of the cash operations, during lunch time and at the day-

end closing, the Client Relations Officer will have to surrender the

cash in her or his hands to the cashier in different denomi

ions and

shall make a ‘Till to Till transfer’. The amount of the cash thus

surrendered must be equal to the amount that was received by

her/him during the day and ‘Till balance by denominations’ on the

system till transfer.

12.10.5 Exchange of Coins

‘a) For the exchange of coins, the Client Relations Officer will receive in

the morning coins in bags with different denominations from the

cashier and authorize the till transfer for acceptance.

b) The Client Relations Officer shall examine the tag on the coin bags and

the lead used for packing the coin and counts the coins with a coin-

counting machine to ascertain the correctness of the amount thereof.

¢) The Client Relations Officer should balance the coins during lunch

time and at the day-end closing and hand over to the Supervisor the

equivalent thereof in Birr note:

Page 148

ABAY BANK S.C.

ee

12.10.6 Sorting Table

a) A detailed record must be kept by the cashier for recording cash

denominations received from the Client Relations Officers.

b) Regardless of their denominations, all Birr notes must be sorted, counted

and wrapped, in collaboration with the Client Relations Officers and Cash

Office Personnel;

¢) Wrapped Birr notes should be impressed by a cash stamp and signed by

both the Counter and the Verifier or by the cashier.

d) The Table Master/Client Relations Officer should make sure that the total

of the cash surrendered by the Client Relations Officers, as recorded in

the ‘Till to Till Transfer’, agrees with that of the cash sorted and held in

the Table.

e) After balancing, the Table Master/ Client Relations Officer in charge will

have to deliver the cash, according to its denominations, to the cashier

and shall make a “Till to till transfer’.

12.11. Cash Consolidation

a) It is the responsibility of the cashier to combine all the cash surrendered

to her/him, including any balance of cash, which is kept in the cash room,

with help from the Client Relations Officer (at the table) or her/his

Assistant.

b) The cashier prepares the cash book and balances the overall cash in her

or his hands with that of the “Till transaction today’ and denomination by

till.

©) While amalgamating and consolidating cash, the cashier must make sure

that the following procedures are strictly followed.

Y Abrick should contain 10 bundles, and,

notes;

ABAY BANK S.C.

———_—_—_—_———————

Y Bundles must be properly wrapped, sealed and bear the

signatures of the Counter and of the Verifier—that is,; and

Y Birr 50 and Birr 100 notes will have to be carefully counted

either by herself/himself or by the Table Master/ Client

Relations Officer in charge.

12.12 Cash Lodgment to the Vault

After handling of the cash is secured and the final closing in the

cashbook is recorded according to the denominations, Branch

Manager shall undertake the following:

a) Verifies the correctness of the cashbook filled out by the cashier

against the ‘Teller Transaction today’ report and ‘till balance by

denomination’ on the system;

b) Verifies that each brick contains 10 bundles, before transferring the

cash to the vault;

€) Balances the vault cash with that of the ‘till to vault’ transfer made by

Cashier; and

) Authorize the ‘Till to Vault transfer’ for amount lodged.

12.13 Stamp management

The duties and responsibilities that the operators involved in

handling stamp are entrusted with consist of the following.

Client Relations Officers

The cash brand/stamp shall be transferred to, or exchanged with, other

Client Relations Officers, as far as handing and taking over is signed

between them

The Cashier

Registers the cash stamp into a register book, affixes the stamp to the

register book and keeps it (the register book) in her or his custody;

inking Operations Procedure - March Page 150

ABAY BANK S.C.

CHAPTER 13

Property Management System

13.1 Inventory of Fixed Assets

Properties and Fixed Assets constitute one of the major possessions of

the Bank in terms of value and are subject to close supervision and

management. The Branch Manager is fully and entirely responsible

for proper handling and recording of Fixed Assets in Branches.

All Fixed Assets in the Branch should be registered in the

Inventory Sheet and retained by the Branch. The copy of which

should be sent to Facility and Procurement Department, Accounts &

Finance Department and Internal Audit Department for eventual

recording and control purposes.

Any addition to the Fixed Asset of the Branch should be duly

captured by the inventory sheet and it should also be updated with the

records of Facility Department , Accounts & Finance, and Internal Audit

Department.

Damaged or obsolete items should be repaired timely or sent back to

Facility and Procurement Department for further maintenance or shall

be returned to the Department after the records with all Departments

are adjusted accordingly. The Branch Manager should conduct an

inventory of Fixed Assets Semi-annually

13.2 Rubber Stamps

Rubber stamps are vital tool, which are used in the Bank to validate

transactions, business letters, and standardize and simplify internal

duties. Hence utmost care should be taken to ensure safe custody of

these items

A wide variety of rubber stamps are being used in the

Retail Banking Operations Procedure - March 2016

ABAY BANK S.C.

rubber stamps used must be recorded in the stamps catalogue/register

of the Bank.

As stamps are sensitive by nature, the staffs who keep custody of rubber

stamps should bear in mind that they must be kept under lock when not

in use. The following are the steps to be taken in this regard.

The Branch Manager

a) Submits a stamp-requisition letter to the Procurement and Facilities

Directorate, clearly indicating the type there of—that is, either a new

one or a replacement;

b) Registers all stamps received from the Directorate;

¢) Issues the stamp to the staff who uses it against her/his signature by

registering on the register book prepared for this purpose;

d) Periodically makes sure that the designated staffs of the Bank properly

handle the stamps in their custody and always keep them locked up

after office hours;

e) Collects old rubber stamps whenever they are replaced by new ones;

f) Makes sure that when a staff is transferred to, and from, the branch, the

staff who takes her or his place takes over the rubber stamp against

her/his signature in the register system ;and

9) Periodically reviews the register in the system and makes sure that it is

properly updated.

Staffs Holding the Bank’s Rubber Stamps

a) Receives the rubber stamps from Branch Manager

b) All Abay Bank’s staffs holding the Bank’s rubber stamps are

responsible for all the stamps they have received against their

signatures;

¢) At the end of the day, every rubber stamp should be kept locked up by

the staff that has received it against her/his signature; and

d) When a staff of Abay is transferred to, or from, a branch, the staff who

replaces her or him has to make sure that the register on the system

Retail Banking Operations Proced: age 152

ABAY BANK S.C.

eS...

for rubber stamps has been updated accordingly and that the rubber

stamps do exist.

13.3 Keys

Since Keys are paramount in preserving Cash and various documents of

the Bank, proper handling of keys of Bank's Strong Rooms, Safes, Filing

Cabinets, Machines, Desks and other equipment is an indispensable task.

Bank keys are categorized as follows:

‘+ Keys for strong room doors and large safes used as cash vaults.

‘+ Keys of safes and grill doors for petty cash.

‘+ Keys for safes or fireproof cabinets containing valuable

documents.

+ Carkeys, Generator Keys and Machine Keys

* Keys for regular filing cabinets and desks.

a) Keys of strong room doors and large safes used as Vaults must be held

by:

Managers and cashiers in Grade C Branches, where there is no

Deputy Branch Manger

«Inthe absence of Deputy Branch Manager or The Branch Manager,

and during skeletal hours and Saturday afternoon, branch

accountants may formally be delegated to takeover and handle

such keys

b) Duplicate keys of Keys for strong room doors and large safes used as

cash vaults should be sent in a separate sealed envelope to the

Internal Audit Department to be kept under its custody whereas the

combination codes of main and petty cash safes should be sent in

separate sealed envelope to the Controller to be kept under his

custody both are to be used during emergency cases only.

) Keys for safes and fireproof cabinets containing valuable documents

must be held by those who are in charge of the documents. Such

documents include: title deeds, share certificate

Retail Banking Operations Procedure - March 2016

ABAY BANK S.C.

ES

books, CPOs, Demand Drafts and other Payment Instruments, etc.

4) Individuals who use the cabinets and desks hold their respective keys.

€) A separate register book must be maintained whereby the keys must

be recorded and signed for.

f) Duplicate keys should be kept with the Branch Manager under

his/her custody.

) Loss of keys must be immediately reported in writing by the

indivi

lual key holders to the immediate supervisor. The supervisor

should then contact the concerned unit for replacement.

h) At the time when an employee is supplied with the original key to any

office equipment (especially of vaults and petty cash safes), it is the

prime duty of those supplying the keys to make the employee aware

of the measures which will be taken against him if he loses his keys. If

a key is lost action could be taken as per the Bank's regulation.

13.4 Register Books, Formats, & Equipment Required

‘The following are used in the general account operation at a branch.

13.4.1 Register Books

+ Saving/Current Account Opening register,

* Cheque Book Stock register book

* Cheque Book delivery register book

+ Passbook Delivery Register book

‘+ Passbook Stock Register book

+ Dishonored checks register book

+ Security Register

+ Cash Book Register

+ Blotter

+ Cash delivery

‘+ Negotiable Instruments Stock Register Book

Retail Banking Operations Procedure - March 2016 ge 154

ABAY BANK S.C.

———SEE es

13.4.2 Formats

* Account Opening application forms (single, joint, joint &

several),

* Cheque requisition form

+ Cheque clearance forms

+ General debit and credit tickets with advice

‘+ Statement dispatch forms

+ Dishonored Cheques attachment slip (for returned

cheques)

‘+ Warning letter due to in sufficient funds (1st, 2nd & 3rd)

‘+ Account Blocking forms

‘* Stop payment forms

13.4.3 STAMPS

Accepted for Deposit" pending clearance

"Date" stamp

"Canceled" stamps

General crossing stamp

Endorsement stamps

13.4.4 EQUIPMENT

© Adding and calculating machines

* Cheque printer

‘+ Specimen signature cards filing cabinets

‘There may be similar items in use as and when the need arises. Beware

that stamps, headed letters and all other sensitive items should be kept

safe and secure under the custody of an auth;

Retail Banking Operations Proced

S.. Page 155

ABAY BANK S.C.

Revision of the Procedure

This procedure will be revised every three years. However, it shall be

revised as and when deemed necessary,

Effective Date

This procedure shall come in to force from the date of

issuance by the President of the Bank as indicated below:

Date Of issuance:

President Signature:

a Gessesse Glee

ale

vou President

SERRE EErEn ERE EEReeeeteeeemeeeeeinememeeneneeeeneE

Retail Banking Operations Procedure - March 2016 Page 156

»

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5808)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Ias 1 Presentation of Financial StatementsDocument30 pagesIas 1 Presentation of Financial Statementsesulawyer2001No ratings yet

- Ifrs 16 LeasesDocument33 pagesIfrs 16 Leasesesulawyer2001100% (1)

- Manufacturing-export-earning-is-in-deficitDocument4 pagesManufacturing-export-earning-is-in-deficitesulawyer2001No ratings yet

- CoffeeContracts PDFDocument13 pagesCoffeeContracts PDFesulawyer2001No ratings yet

- ES 3.16 Feasibility Study and Equipment Installation To Produce Pellets From Coffee Pulp PDFDocument3 pagesES 3.16 Feasibility Study and Equipment Installation To Produce Pellets From Coffee Pulp PDFesulawyer2001No ratings yet

- Coffee Annual - Addis Ababa - Ethiopia - 5-29-2019 PDFDocument6 pagesCoffee Annual - Addis Ababa - Ethiopia - 5-29-2019 PDFesulawyer2001No ratings yet

- Large-And-Medium-Manufacturing-Industry-Survey-Report-2020-G.C.-2012-E.F.YDocument30 pagesLarge-And-Medium-Manufacturing-Industry-Survey-Report-2020-G.C.-2012-E.F.Yesulawyer2001No ratings yet

- ECX Coffee Contracts Approved by ECEA March 29 2018 PDFDocument13 pagesECX Coffee Contracts Approved by ECEA March 29 2018 PDFesulawyer2001100% (1)

- Determinants of Coffee Export Supply in PDFDocument8 pagesDeterminants of Coffee Export Supply in PDFesulawyer2001No ratings yet

- Pre-Feasibility Study Restoring Coffee Landscapes PDFDocument74 pagesPre-Feasibility Study Restoring Coffee Landscapes PDFesulawyer2001No ratings yet

- 00... Additional Internal Controls For Payment Transaction 2Document2 pages00... Additional Internal Controls For Payment Transaction 2esulawyer2001No ratings yet

- 00 Chartable Saving Account ProcedureDocument18 pages00 Chartable Saving Account Procedureesulawyer2001No ratings yet

- 0.diaspora Banking ProcedureDocument48 pages0.diaspora Banking Procedureesulawyer2001No ratings yet

- 0.consumer Loan Procedure For NGO EmployeesDocument13 pages0.consumer Loan Procedure For NGO Employeesesulawyer2001No ratings yet

- IFRS 9 FINANCIAL INSTRUMENTS-AddisDocument35 pagesIFRS 9 FINANCIAL INSTRUMENTS-Addisesulawyer2001No ratings yet

- Abay Gift Card ProcedureDocument12 pagesAbay Gift Card Procedureesulawyer2001No ratings yet

- Retail Banking Operation Procedure Page 45Document1 pageRetail Banking Operation Procedure Page 45esulawyer2001No ratings yet

- Introduction Iasb Conceptual FrameworkDocument84 pagesIntroduction Iasb Conceptual Frameworkesulawyer2001No ratings yet

- Ifrs13 Fair ValueDocument19 pagesIfrs13 Fair Valueesulawyer2001No ratings yet

- Ifrs 15 Revenue RecognitionDocument46 pagesIfrs 15 Revenue Recognitionesulawyer2001No ratings yet

- IAS 24 Related PartyDocument11 pagesIAS 24 Related Partyesulawyer2001No ratings yet

- Ifrs 8 and Ias 34-Operating Segments & Interim ReportingDocument46 pagesIfrs 8 and Ias 34-Operating Segments & Interim Reportingesulawyer2001No ratings yet

- Ias 23 Borrowing CostsDocument18 pagesIas 23 Borrowing Costsesulawyer2001No ratings yet

- IAS 37 ProvisionDocument38 pagesIAS 37 Provisionesulawyer2001No ratings yet

- Ifrs 1 First Time AdoptionDocument27 pagesIfrs 1 First Time Adoptionesulawyer2001No ratings yet

- Ias 21 ForexDocument32 pagesIas 21 Forexesulawyer2001No ratings yet

- Ias 36 ImpairementDocument24 pagesIas 36 Impairementesulawyer2001No ratings yet

- IAS 16 PPE and IAS 40Document81 pagesIAS 16 PPE and IAS 40esulawyer2001No ratings yet

- Ias 8 Accounting Policy-PresentationDocument49 pagesIas 8 Accounting Policy-Presentationesulawyer2001No ratings yet

- Ias 10 Events After Reporting PeriodDocument13 pagesIas 10 Events After Reporting Periodesulawyer2001No ratings yet