Professional Documents

Culture Documents

Module 1 Notes

Uploaded by

dimpy dOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 1 Notes

Uploaded by

dimpy dCopyright:

Available Formats

Module 1: Chapter 1 - Proprietorship and Partnership generally follow

ASPE for external; not required to follow any for

USERS AND USERS OF ACCOUNTING internal

o ACCOUNTING – identifies and records economic TYPES OF BUSINESS ACTIVITIES

events of an organization and communicates to

1. FINANCING – obtaining and repaying funds

interested users

to finance the operations of the business.

CATEGORIES OF USERS

[ex. selling or repurchasing shares (equity

Internal Users works FOR the company; manages financing); borrowing money or repaying

the company, non-profit, and loans (debt financing)]

government orgs.

(ex. company officers, managers & o FORMS OF DEBT – bank

directors in finance, marketing, indebtedness, bank loans, long-

human resources, production)

External Users DO NOT work for the company.

term debt (mortgages, bonds,

(ex. investors, creditors, customers, finance leases).

employees, labour unions, taxing 2. INVESTING – purchase or sale of long-lived

authorities & regulators) assets needed to operate the company.

[ex. purchase or sale of property, plant, and

equipment, and intangible assets; purchase

ETHICAL BEHAVIOUR or sale of investments (shares or debt

securities of other companies)]

- have rules or codes of conduct to guide ethical

behaviour. 3. OPERATING – main day-to-day activities of

o FOR ACCOUNTING INFO TO HAVE the business

VALUE:

Actions are legal and responsible, [ex. sources of income (revenue and

and income); expenses; related accounts

Consider organization’s interests (accounts receivable and accounts payable)]

FORMS OF BUSINESS ORGANIZATIONS FINANCIAL STATEMENTS

Characteristic Proprietorshi Partnershi Corporation 1. STATEMENT OF INCOME (INCOME

p p STATEMENT) – reports of revenues and

No. of 1 2 or more Shareholders expenses

Owners ; 1 or more o REVENUES – sales from products

Owner’s Unlimited Unlimited Limited or services; INFLOW of assets

Liability o EXPENSES – cost of assets

Separate No No Yes

consumed or services used;

Legal

OUTFLOW of assets

Entity

Taxation of Owner Partners Corporation/

Net Income (loss) = Revenue - Expenses

Profits Organization

Life of Limited Limited Unlimited 2. STATEMENT OF CHANGES IN EQUITY –

Organizatio

reports the changes in each component of

n

shareholder’s equity

o SHARE CAPITAL – amounts

contributed by shareholders

GENERALLY ACCEPTED ACCOUNTING

Common and preferred

PRINCIPLES (GAAP)

share classes

- rules and practices for the preparation of financial o RETAINED EARNINGS/ DEFICIT –

statements cumulative net income retained in

- different for public and private corporations. the corporation LESS any dividends

o PUBLIC – International Financial paid to shareholders

Reporting Standards (IFRS) o OTHER SHAREHOLDERS’

o PRIVATE – IFRS or Accounting ACCOUNTS

Standards for Private Enterprises

(ASPE)

CHANGES IN COMMON SHARES

IFRS vs. ASPE

Key Standard IFRS ASPE

Differences

CHANGES IN RETAINED EARNINGS Accounting Used by publicly Normally used by

Standards traded corp.; can private corp.;

also be used by must be

private corp. consistently

applied.

Generally

followed by

proprietorship and

partnership.

3. STATEMENT OF FINANCIAL POSITION Statement of Statement of Statement of

(BALANCE SHEET) – assets, liabilities, and Changes in changes in equity retained earnings

Equity vs. must be presents is presented

shareholders’ equity

Statement of showing changes showing change

o ASSETS – resources owned and

Retained in all components in only one

controlled by a business Earnings of shareholders’ component of

o LIABILITIES – claims of lenders equity. shareholders’

and other creditors equity (retained

o SHAREHOLDERS’ EQUITY – claim earnings).

of shareholders

Assets = Liabilities + Shareholder’s Equity

Module 1: Chapter 2

4. STATEMENT OF CASH FLOWS – how

cash is obtained and used CLASSIFIED STATEMENT OF FINANCIAL

- reports the effect on cash related to POSITION

the company’s:

- generally contains the following standard

Operating activities

classifications:

Investing activities

Financing activities ASSETS LIABILITIES &

- shows net increase or decrease in SHAREHOLDERS’

cash for the period. EQUITY

Current assets: Current Liabilities:

PRIMARY PURPOSE: - Cash - Bank Indebtedness

Information about cash receipts and - Trading Investments - Accounts Payable

cash payments of a company. - Accounts Receivable - Deferred Revenue

- Inventory - Notes Payable

RELATIONSHIPS BETWEEN STATEMENTS - Supplies - Current portion of Long-

- Prepaid Expenses term Debt

THE STATEMENTS ARE INTERRELATED Non-current Assets: Non-current Liabilities:

- Long-term Investments - Bank Loan Payable

- results from some statements are used as

- Property, Plant and Shareholder’s Equity:

data in other statements. Equipment - Share Capital

- Intangible Assets - Retained Earnings

ANNUAL REPORT - Goodwill

- public corporations must produce an annual

report each year containing

Financial Statements CURRENT ASSETS

Management discussion and

- expected to be converted to cash, sold, or used

analysis

in the business within one year or operating

Auditor’s report

cycle.

Notes on financial statements

o OPERATING CYCLE – the average time it

takes to go from cash to cash in producing

revenue.

- usually listed in order of liquidity (North America)

NON-CURRENT ASSETS SHAREHOLDERS’ EQUITY

- aka long-term assets o SHARE CAPITAL – investment of cash in

- not expected to be converted to cash, sold, or the company by shareholders in exchange

used in the business within one year or operating for preferred or common shares

cycle. o RETAINED EARNINGS – cumulative net

- all assets not considered current income kept for use in the company

LONG-TERM INVESTMENTS CONCEPTUAL FRAMEWORK OF

- multi-year investments in: ACCOUNTING

o DEBT SECURITIES: - guides decisions about:

Loans o what to present in financial statements

Notes o alt ways of reporting economic events

Bonds

o appropriate ways of communicating info

Mortgages

o EQUITY SECURITIES: CONCEPTUAL FRAMEWORK FOR

Shares of other companies FINANCIAL REPORTING

- assets that are normally not intended to be sold

(and converted to cash) within one year. OBJECTIVE OF GENERAL-PURPOSE FINANCIAL

REPORTING

PROPERTY, PLANT & EQUIPMENT

- provide financial information that is useful to

- tangible assets with long useful life existing and potential investors, lenders, and

- used in operating a business other creditors

- usually listed in order of permanency - who makes decisions about providing resources

DEPRECIATION to a company:

buying, selling, holding equity and debt

- allocation of cost of property, plant, &equipment providing or settling loans or other credit

over estimated useful lives - financial info provided by general purpose

- cost of long-lived assets with indefinite lives = not financial statements

depreciated

o ACCUMULATED DEPRECIATION – shows total QUALITATIVE CHARACTERISTICS OF USEFUL

FINANCIAL INFORMATION

amount of depreciation recorded to date; a contra

asset account [less] - QUALITATIVE CHARACTERISTICS OF

o CARRYING AMOUNT – difference between cost ACCOUNTING INFORMATION

of the asset and accumulated depreciation. o RELEVANCE – info is relevant if it makes a

difference in user’s decision; may have

INTANGIBLE ASSETS

predictive value and/or confirmatory value

[copyright, patents, etc.]

MATERIALITY – nature of info or dollar

- non-current assets without physical substance value; info is considered material if its

but has significant value omission or misstatement could

o a privilege or a right held by the company influence the decisions of users

- generate a future value to the company o FAITHFUL REPRESENTATION – info

- amortized if no indefinite life should reflect economic reality; must be

complete (no omissions), neutral, and free

CURRENT LIABILITIES from error.

- ENHANCING QUALITIES OF USEFEL

- obligations to be paid or settled within one year

INFORMATION

or one operating cycle

o COMPARABILITY – users can identify and

NON-CURRENT LIABILITIES understand similarities and differences

among items

- obligations to be paid or settled after one year o VERIFIABILITY – independent consensus

- usually accompanied by extensive notes to the that information is faithfully represented

financial statements o TIMELINESS – available before it loses its

usefulness in decision-making

o UNDERSTANDABILITY – classified, recorded and reported

characterized, and presented clearly and at fair value.

concisely In choosing between these two, apply the concepts of

relevance and faithful representation.

PREDICTIVE VALUE

- helps users make predictions about future ACCURAL vs CASH BASED ACCOUNTING

events.

ACCURAL BASED transactions and other

CONFIRMATORY VALUE ACCOUNTING events recorded in the

period they occur,

- helps users confirm or correct their previous

rather than when the

predictions or expectations.

cash is received.

COST CONSTRAINT

CASH BASED revenue is recorded

- ensures that value of information provided by ACCOUNTING when cash is received;

financial reporting is greater than the cost of can be simple but

providing it misleading as revenues

- benefits of financial reporting should justify the are not “matched” with

costs of providing and using it expenses therefore

- GOING CONCERN ASSUMPTION profits misrepresented;

can be lower cost.

o business will continue operating in the

foreseeable future

o key assumption – provides a foundation for REVENUE RECOGNITION PRINCIPLE

accounting and justification for using cost as

the value of certain assets o REVENUE – recognized when service has

been performed or goods have been sold

ELEMENTS OF FINANCIAL STATEMENTS and delivered, regardless of the timing of

o ASSETS cash; amount of assets created from the sale

of goods or services.

o LIABILITIES

o EQUITY

NET INCOME = revenues - expenses

o INCOME

o EXPENSES ASSETS are listed in the order in which they are

expected to be converted into cash.

MEASUREMENT OF THE ELEMENTS OF

FINANCIAL STATEMENTS o EXPENSES – amount of assets consumed

through business operations

- accountants have developed principles that

describe which, when, and how the elements of

financial statements should be:

Recognized,

Measured, and

Reported

- known as Generally Accepted Accounting

Principles (GAAP)

GENERALLY ACCEPTED ACCOUNTING

PRINCIPLES (GAAP)

HISTORICAL COST Assets and liabilities

should be recorded at

their cost when

acquired.

Not only at time of

purchase, but

throughout the life of

each asset and liability

FAIR VALUE Certain assets and

liabilities should be

You might also like

- The Cost of Capital CalculationDocument45 pagesThe Cost of Capital CalculationNino NatradzeNo ratings yet

- Financial Reporting and AnalysisDocument50 pagesFinancial Reporting and AnalysisGeorge Shevtsov83% (6)

- AFAR TestbankDocument56 pagesAFAR TestbankDrama SubsNo ratings yet

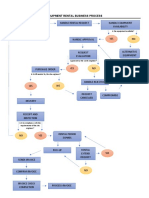

- Equipment Rental Business ProcessDocument1 pageEquipment Rental Business Processdimpy dNo ratings yet

- 2024 L1 CorpIssuersDocument73 pages2024 L1 CorpIssuershamna wahabNo ratings yet

- Behavior Finance MCQDocument27 pagesBehavior Finance MCQBattina Abhisek81% (16)

- Capital Gains Tax ProvisionsDocument27 pagesCapital Gains Tax ProvisionsdeepakadhanaNo ratings yet

- Analysis of Reformulated Financial StatementsDocument46 pagesAnalysis of Reformulated Financial StatementsAkib Mahbub KhanNo ratings yet

- Introduction to Accounting BasicsDocument11 pagesIntroduction to Accounting BasicsBlueBladeNo ratings yet

- Partnership and Corporation Accounting ReviewerDocument9 pagesPartnership and Corporation Accounting ReviewerMarielle ViolandaNo ratings yet

- ACCTG 013 - Module 6Document33 pagesACCTG 013 - Module 6Andrea Lyn Salonga CacayNo ratings yet

- Reviewer: Accounting For Manufacturing OperationsDocument16 pagesReviewer: Accounting For Manufacturing Operationsgab mNo ratings yet

- Chapter 4 Cost of CapitalDocument19 pagesChapter 4 Cost of CapitalmedrekNo ratings yet

- Project Report On Financial Analysis of Nestle India Limited ProjectDocument65 pagesProject Report On Financial Analysis of Nestle India Limited ProjectSonu Dhangar77% (57)

- Internal Control of Fixed Assets: A Controller and Auditor's GuideFrom EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideRating: 4 out of 5 stars4/5 (1)

- LLP Agreement Black SampleDocument7 pagesLLP Agreement Black SampleWoodzNo ratings yet

- Accounting fundamentalsDocument5 pagesAccounting fundamentalsArianette MedokeNo ratings yet

- Accounting Principles and Business Transactions Cheat Sheet: by ViaDocument1 pageAccounting Principles and Business Transactions Cheat Sheet: by Viaheehan6No ratings yet

- Financial Accounting NotesDocument7 pagesFinancial Accounting NotesGan JessieNo ratings yet

- Accounting Principles and Business Transactions Cheat Sheet: by ViaDocument1 pageAccounting Principles and Business Transactions Cheat Sheet: by ViaAlison JcNo ratings yet

- BusfinanzDocument4 pagesBusfinanzfrancine ًNo ratings yet

- ACC111Document5 pagesACC111Trisha SacmanNo ratings yet

- Introduction To Accounting: Basic Financial StatementsDocument15 pagesIntroduction To Accounting: Basic Financial StatementsStellaNo ratings yet

- 2Q - Fabm 2Document7 pages2Q - Fabm 2Alexandra Norin RodriguezNo ratings yet

- Acctg Final NotesDocument3 pagesAcctg Final NotesLeenaNo ratings yet

- Financial Management - Module 1 - 3Document5 pagesFinancial Management - Module 1 - 322-54470No ratings yet

- ABM 2 - Statement of Financial PositionDocument19 pagesABM 2 - Statement of Financial PositionMarlou Chester BendañoNo ratings yet

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsHershey Celine LaguaNo ratings yet

- Accounting - PonesDocument4 pagesAccounting - PonesLuisa PonesNo ratings yet

- Chapter 1 - Accounting in ActionDocument42 pagesChapter 1 - Accounting in ActionFify AmalindaNo ratings yet

- Current Vs Non-Current AssetsDocument3 pagesCurrent Vs Non-Current AssetsTrisha GarciaNo ratings yet

- Chapter 1 8Document19 pagesChapter 1 8Ren AikawaNo ratings yet

- A1 NotesDocument43 pagesA1 NotesAndrea ReyesNo ratings yet

- Financial Accounting FundamentalsDocument5 pagesFinancial Accounting FundamentalsJialei -No ratings yet

- DPB2012 - T6Document26 pagesDPB2012 - T6suhanaNo ratings yet

- Fabm L2Document3 pagesFabm L2Mar InaNo ratings yet

- SHAREHOLDER WEALTH MAXIMATIONDocument6 pagesSHAREHOLDER WEALTH MAXIMATIONHennessy Shania Gallera ArdienteNo ratings yet

- A 1 Financial StatementsDocument7 pagesA 1 Financial Statementsmohit0503No ratings yet

- Note 1-Government AccountingDocument5 pagesNote 1-Government AccountingAngelica RubiosNo ratings yet

- Fundamentals of Acocunting and Business Management 1 2Document14 pagesFundamentals of Acocunting and Business Management 1 2kristinekaylegusimat12No ratings yet

- Chap 2 (PT 2)Document2 pagesChap 2 (PT 2)Allen Jierqs SanchezNo ratings yet

- Financial Management: Handout #01 - Basic Concept of Financial Management & Financial MarketsDocument5 pagesFinancial Management: Handout #01 - Basic Concept of Financial Management & Financial MarketsMaryrose SumulongNo ratings yet

- Poa ReviewerDocument4 pagesPoa Reviewerdevora aveNo ratings yet

- Eh Chap 1Document52 pagesEh Chap 1Jawad ArkoNo ratings yet

- Principles of Accounting (Notes)Document6 pagesPrinciples of Accounting (Notes)hjpa2023-7388-23616No ratings yet

- Types of Business According To OwnershipDocument5 pagesTypes of Business According To OwnershiphahaniNo ratings yet

- Financial Statements ExplainedDocument24 pagesFinancial Statements ExplainedJemarse GumpalNo ratings yet

- Financial StatementsDocument27 pagesFinancial StatementsIrish Castillo100% (1)

- Chapter 1: The Role of Managerial FinanceDocument21 pagesChapter 1: The Role of Managerial FinanceXinNo ratings yet

- AD1101 AY15 - 16 Sem 1 Lecture 1Document21 pagesAD1101 AY15 - 16 Sem 1 Lecture 1weeeeeshNo ratings yet

- Fabm 2Document5 pagesFabm 2Robillos FaithNo ratings yet

- BF BinderDocument7 pagesBF BinderShane VeiraNo ratings yet

- Chapter 1 Bus FinDocument12 pagesChapter 1 Bus FinMickaella DukaNo ratings yet

- Business Ethics Week 1 8 ReviewerDocument11 pagesBusiness Ethics Week 1 8 ReviewerKeiNo ratings yet

- UNDERSTANDING THE BASICS OF ACCOUNTING AND FINANCEDocument99 pagesUNDERSTANDING THE BASICS OF ACCOUNTING AND FINANCEArnel De Los SantosNo ratings yet

- Xparcoac Midterms ReviewerDocument11 pagesXparcoac Midterms ReviewerKristine dela CruzNo ratings yet

- Usgaap, Igaap & IfrsDocument7 pagesUsgaap, Igaap & IfrsdhangarsachinNo ratings yet

- BFAR NotesDocument6 pagesBFAR NotesHannah Dela CruzNo ratings yet

- Fabm 2 Second Quarter NotesDocument7 pagesFabm 2 Second Quarter NotesBIGTING, DANIANA MEURNo ratings yet

- Chapter1 Corporation and Corporate GovernanceDocument4 pagesChapter1 Corporation and Corporate GovernancefasdsadsaNo ratings yet

- Business Ethics ReviewerDocument8 pagesBusiness Ethics Reviewerparenas.jpcNo ratings yet

- Lecture 3-PostDocument45 pagesLecture 3-PostcoolirlbbNo ratings yet

- Financial Statements and Business DecisionsDocument37 pagesFinancial Statements and Business DecisionsHARMAN SINGHNo ratings yet

- Chapter 1 Class NotesDocument6 pagesChapter 1 Class NotesCaroline RiosNo ratings yet

- Act201 Ch1 NNHDocument42 pagesAct201 Ch1 NNHTiloma M. ZannatNo ratings yet

- Act201 Ch1 NNHDocument42 pagesAct201 Ch1 NNHTiloma M. ZannatNo ratings yet

- Digest - PFRS 3 and PFRS 10Document4 pagesDigest - PFRS 3 and PFRS 10Elizabeth DumawalNo ratings yet

- Parcoac - CorporationDocument2 pagesParcoac - CorporationSSG100% (1)

- VAT (Theory & Problem)Document10 pagesVAT (Theory & Problem)dimpy dNo ratings yet

- Estate Tax (Extra Notes)Document8 pagesEstate Tax (Extra Notes)dimpy dNo ratings yet

- 06M Midterm Quiz No. 2 Income Tax On CorporationsDocument4 pages06M Midterm Quiz No. 2 Income Tax On CorporationsMarko IllustrisimoNo ratings yet

- Financial Statements With Notes To FsDocument2 pagesFinancial Statements With Notes To Fsdimpy dNo ratings yet

- Solution To Problem 5Document2 pagesSolution To Problem 5dimpy dNo ratings yet

- LAW 1 ArtDocument1 pageLAW 1 Artdimpy dNo ratings yet

- Straight Problems Income Tax Bsa2Document2 pagesStraight Problems Income Tax Bsa2dimpy dNo ratings yet

- Taxation 1-5Document6 pagesTaxation 1-5dimpy dNo ratings yet

- Estate Tax (Exercises)Document3 pagesEstate Tax (Exercises)dimpy dNo ratings yet

- INTERMEDIATE ACCOUNTING 1 - Cash and Cash Equivalents - Comprehensive Sample ProblemsDocument2 pagesINTERMEDIATE ACCOUNTING 1 - Cash and Cash Equivalents - Comprehensive Sample Problemsdimpy dNo ratings yet

- Insurance FormatDocument4 pagesInsurance Formatsmit9993No ratings yet

- DLX Earnings Presentation Q2 2018Document25 pagesDLX Earnings Presentation Q2 2018Nikos FatsisNo ratings yet

- Chapter 6-Cost Concepts and Measurement: Multiple ChoiceDocument29 pagesChapter 6-Cost Concepts and Measurement: Multiple Choiceakash deepNo ratings yet

- OGE-2021 Economic Evaluation Methods Without TVM: 1. UrgencyDocument4 pagesOGE-2021 Economic Evaluation Methods Without TVM: 1. UrgencyAbdurabu AL-MontaserNo ratings yet

- Complete Financial Statements With SCF Direcdt MethodDocument23 pagesComplete Financial Statements With SCF Direcdt MethodJuja FlorentinoNo ratings yet

- Negros Occidental (ACCOUNTING1)Document7 pagesNegros Occidental (ACCOUNTING1)Maxine Ceballos Glodove100% (1)

- Guarantee of Profits: Profit & Loss Appropriation A/cDocument4 pagesGuarantee of Profits: Profit & Loss Appropriation A/cVarun RaghunathanNo ratings yet

- 2018 City of Vancouver Financial StatementsDocument114 pages2018 City of Vancouver Financial StatementsCTV VancouverNo ratings yet

- Segment Reporting in BankingDocument11 pagesSegment Reporting in BankingabhicshettyNo ratings yet

- 2019 ResultsDocument98 pages2019 ResultsJulieAnnPaguicanNo ratings yet

- Basic Structure of Accounting 1: Chapter OneDocument15 pagesBasic Structure of Accounting 1: Chapter OneSeid KassawNo ratings yet

- Report RedbusDocument27 pagesReport RedbusomkarNo ratings yet

- Chap 17Document34 pagesChap 17ridaNo ratings yet

- Answer To MTP - Intermediate - Syllabus 2016 - Dec2017 - Set 1: Paper 5-Financial AccountingDocument15 pagesAnswer To MTP - Intermediate - Syllabus 2016 - Dec2017 - Set 1: Paper 5-Financial Accountingpirates123No ratings yet

- Capital Budgeting PPT 2Document32 pagesCapital Budgeting PPT 2Sakshi SharmaNo ratings yet

- Mas Lecture Brad DelacruzDocument4 pagesMas Lecture Brad DelacruzAnnyeong AngeNo ratings yet

- Economics MCQs BankDocument49 pagesEconomics MCQs BankMuhammad Nadeem SarwarNo ratings yet

- Cash and Cash EquivalentsDocument2 pagesCash and Cash EquivalentsJennifer EcleNo ratings yet

- Multiple Choice Questions 1 A Business Owner Makes 1 000 Items ADocument2 pagesMultiple Choice Questions 1 A Business Owner Makes 1 000 Items Atrilocksp SinghNo ratings yet

- FAR.2909 Intangible Assets PDFDocument8 pagesFAR.2909 Intangible Assets PDFEki OmallaoNo ratings yet

- Financial Statements and Ratio Analysis: True or FalseDocument18 pagesFinancial Statements and Ratio Analysis: True or FalseAbd El-Rahman El-syeoufyNo ratings yet