Professional Documents

Culture Documents

Cima Standard Costing Seesion 2 Questions

Uploaded by

Kiri chrisOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cima Standard Costing Seesion 2 Questions

Uploaded by

Kiri chrisCopyright:

Available Formats

STANDARD COSTING AND

VARIANCE ANALYSIS

SESSION 2

SLIDES PREPARED AND PRESENTED BY

NELSON PANDE

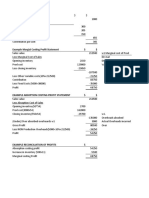

Kitana manufactures a single product. The standard cost card for one unit of the product is given:

$

Direct material: 10 kg × $7 per kg 70

Direct labour: 40 hours × $10 per hour 400

Variable overhead: 40 hours × $3 per hour 120

590

Standard selling price per unit. 650

Actual sales revenue was $1,350,000

For January, the company had budgeted to produce and sell 2,000 units, but 2,100 units were

actually produced and sold and the actual costs incurred were as follows:

Direct material: 22,500 kg purchased and used at a cost of $146,250

Direct labour: 83,000 hours worked at a cost of $845,000

Variable overhead: $248,200

Prepare an operating statement reconciling Budgeted contribution to Actual contribution

Sub-zero manufactures a single product. The standard cost card for one unit of the product is

given:

$

Direct material: 7 kg × $10 per kg 70

Direct labour: 50 hours × $8 per hour 400

Variable overhead: 50 hours × $2.4 per hour 120

590

Standard selling price per unit. 700

Actual sales revenue was $1,200,000

For November, the company had budgeted to produce and sell 1,000 units, but 1,500 units were

actually produced and sold and the actual costs incurred were as follows:

Direct material: 15,500 kg purchased and used at a cost of $186,000

Direct labour: 80,000 hours worked at a cost of $800,000

Variable overhead: $198,000

Prepare an operating statement reconciling Budgeted contribution to Actual contribution

You might also like

- CH 8 Practice HomeworkDocument11 pagesCH 8 Practice HomeworkNCT100% (1)

- Chapter 4Document8 pagesChapter 4Châu Ánh ViNo ratings yet

- In May 2010 The Budgeted Sales Were 19Document4 pagesIn May 2010 The Budgeted Sales Were 19Bisag AsaNo ratings yet

- Variance Analysis WorksheetDocument8 pagesVariance Analysis WorksheetLeigh018No ratings yet

- Problems For Absorption and Variable Costing: Column Files Unit/Module WeekDocument10 pagesProblems For Absorption and Variable Costing: Column Files Unit/Module Weekkrisha millo100% (1)

- Cima Standard Costing and Variance Analysis Session 1 QuestionsDocument13 pagesCima Standard Costing and Variance Analysis Session 1 QuestionsKiri chrisNo ratings yet

- Cima Standard Costing Seesion 2 QuestionsDocument16 pagesCima Standard Costing Seesion 2 QuestionsKiri chrisNo ratings yet

- Practice - Chapter 7 - ACCT - 401Document8 pagesPractice - Chapter 7 - ACCT - 401mohammed azizNo ratings yet

- Exercises For The Course Cost and Management Accounting IIDocument8 pagesExercises For The Course Cost and Management Accounting IIDawit AmahaNo ratings yet

- Budgets For Control, Part 2Document29 pagesBudgets For Control, Part 2vukicevic.ivan5No ratings yet

- UAS-ACCT6130-cost Accounting-Latihan persiapan-PJJDocument4 pagesUAS-ACCT6130-cost Accounting-Latihan persiapan-PJJOlim BariziNo ratings yet

- ACC108 Assignment No. 1 (Standard Costing)Document5 pagesACC108 Assignment No. 1 (Standard Costing)John Andrei ValenzuelaNo ratings yet

- Standarvd Cost & VarianceDocument3 pagesStandarvd Cost & Variancemohammad bilalNo ratings yet

- M11 CHP 10 1 Standard Costs 2011 0524Document58 pagesM11 CHP 10 1 Standard Costs 2011 0524Rose Ann De Guzman67% (3)

- Variable Costing SeatworkDocument5 pagesVariable Costing SeatworkPortgas D. AceNo ratings yet

- FAS1 - STD CostDocument9 pagesFAS1 - STD CostMica Moreen GuillermoNo ratings yet

- Standard Costing Practise QuestionsDocument6 pagesStandard Costing Practise QuestionsGHULAM NABI0% (1)

- Standard CostingDocument2 pagesStandard CostingsumairaNo ratings yet

- Assignment On CH 3 and 4 Cost 2Document4 pagesAssignment On CH 3 and 4 Cost 2sadiya AbrahimNo ratings yet

- 11 Standard CostingDocument30 pages11 Standard CostingLalan JaiswalNo ratings yet

- Mas - 8Document2 pagesMas - 8Rosemarie CruzNo ratings yet

- ACC103 Revision Qs 2020 PDFDocument4 pagesACC103 Revision Qs 2020 PDFWSLeeNo ratings yet

- Latihan Soal Standar CostingDocument2 pagesLatihan Soal Standar Costing31 Sri RizkillahNo ratings yet

- Managerial Accounting - Invidual Task 4Document7 pagesManagerial Accounting - Invidual Task 4Alexander CordovaNo ratings yet

- Assignment CVPDocument4 pagesAssignment CVPKwason TaylorNo ratings yet

- Bài tập chương 6,7Document3 pagesBài tập chương 6,7mentran.13112002No ratings yet

- PracticeDocument6 pagesPracticeNgan Tran Ngoc ThuyNo ratings yet

- TOPIC Practice Questions: Question: MayDocument13 pagesTOPIC Practice Questions: Question: MayPines MacapagalNo ratings yet

- Chapter 11 - Cost-Volume-Profit Analysis: A Managerial Planning ToolDocument19 pagesChapter 11 - Cost-Volume-Profit Analysis: A Managerial Planning ToolSkyler LeeNo ratings yet

- Putin LTD Produces A Product MKI - VarianceDocument4 pagesPutin LTD Produces A Product MKI - VariancebiggykhairNo ratings yet

- Standard Costing Extra QuestionsDocument2 pagesStandard Costing Extra QuestionsMUSTHARI KHANNo ratings yet

- Problem 1Document5 pagesProblem 1Cường Trần MinhNo ratings yet

- Standard CostingDocument18 pagesStandard Costingpakistan 123No ratings yet

- 6.standard CostingDocument11 pages6.standard CostingInnocent escoNo ratings yet

- Standard Costing & Variance Analysis - Sample Problems With SolutionsDocument8 pagesStandard Costing & Variance Analysis - Sample Problems With SolutionsMarjorie NepomucenoNo ratings yet

- Flexible Budgets and Computation of Labour and Material VariancesDocument4 pagesFlexible Budgets and Computation of Labour and Material VariancesBisag AsaNo ratings yet

- Pre Assignment PracticeDocument7 pagesPre Assignment PracticeaeyNo ratings yet

- ABC LTD (Standard Costing and Variance Anylasis)Document1 pageABC LTD (Standard Costing and Variance Anylasis)wasay aliNo ratings yet

- Standard Costing Exercises Problem 1Document5 pagesStandard Costing Exercises Problem 1sehun ohNo ratings yet

- Standard Costing Quiz PrintingDocument9 pagesStandard Costing Quiz PrintingLovErsMaeBasergoNo ratings yet

- Chapter 10 Lab Review WorksheetDocument2 pagesChapter 10 Lab Review WorksheetKyle AndersNo ratings yet

- Required:: ExplanationDocument3 pagesRequired:: ExplanationAshari PsiNo ratings yet

- Standard CostingDocument3 pagesStandard CostingSergio, JesharelleNo ratings yet

- Tutor 1 (Inventory Costing - Capacity Analysis)Document2 pagesTutor 1 (Inventory Costing - Capacity Analysis)auliaNo ratings yet

- Week 12 Assignment Chapter 8Document2 pagesWeek 12 Assignment Chapter 8tucker jacobsNo ratings yet

- Review ExercisesDocument5 pagesReview ExercisesThy Tran HongNo ratings yet

- Bca 423-Marginal Vs Absoption Costing.Document8 pagesBca 423-Marginal Vs Absoption Costing.James GathaiyaNo ratings yet

- Chap 11, 12 - Performance Variance AnalysisDocument2 pagesChap 11, 12 - Performance Variance Analysis37. Nguyễn Lê Mỹ TiênNo ratings yet

- Accounting Revision QuestionsDocument46 pagesAccounting Revision QuestionsshailohNo ratings yet

- Standard Costing Hand-OutDocument1 pageStandard Costing Hand-OutJoshua RomasantaNo ratings yet

- Prepare An Analysis of VarianceDocument1 pagePrepare An Analysis of Varianceyunie1001No ratings yet

- Exercises With Solutions - CH0104Document17 pagesExercises With Solutions - CH0104M AamirNo ratings yet

- Kelompok 4-SOAL STANDAR COSTINGDocument3 pagesKelompok 4-SOAL STANDAR COSTINGAndriana Butera0% (1)

- Quiz 3 SolutionDocument5 pagesQuiz 3 SolutionMichel BanvoNo ratings yet

- Standard Costing and Variance Analysis ProblemsDocument4 pagesStandard Costing and Variance Analysis ProblemsJoann RiveroNo ratings yet

- M11-Chp-06-5-Prb-Direct-Costing. Page 1 of 2Document2 pagesM11-Chp-06-5-Prb-Direct-Costing. Page 1 of 2ALLIA LOPEZNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Refund FormsDocument2 pagesRefund FormsKiri chrisNo ratings yet

- Test 1 Business Organisations and Their StakeholdersDocument8 pagesTest 1 Business Organisations and Their StakeholdersKiri chrisNo ratings yet

- Lecture 1 Business Organisations and Their StakeholdersDocument12 pagesLecture 1 Business Organisations and Their StakeholdersKiri chrisNo ratings yet

- FA - Preparing Simple Consolidated Financial StatementsDocument13 pagesFA - Preparing Simple Consolidated Financial StatementsKiri chrisNo ratings yet

- Lecture 3 The Macro Economic EnvironmentDocument19 pagesLecture 3 The Macro Economic EnvironmentKiri chrisNo ratings yet

- Lecture 2 The Business EnvironmentDocument26 pagesLecture 2 The Business EnvironmentKiri chrisNo ratings yet

- FR Lesson 1 TawandaDocument1 pageFR Lesson 1 TawandaKiri chrisNo ratings yet

- Ias 16Document33 pagesIas 16Kiri chris100% (1)

- Test 2 The Business EnvironmentDocument10 pagesTest 2 The Business EnvironmentKiri chrisNo ratings yet

- IFRS 15 Part 2 Performance Obligations Satisfied Over TimeDocument26 pagesIFRS 15 Part 2 Performance Obligations Satisfied Over TimeKiri chrisNo ratings yet

- Limited Companies - Capital Structure & Finance Costs HandoutDocument11 pagesLimited Companies - Capital Structure & Finance Costs HandoutKiri chrisNo ratings yet

- IFRS 15 Part 2 Performance Obligations Satisfied Over Time QUESTIONSDocument13 pagesIFRS 15 Part 2 Performance Obligations Satisfied Over Time QUESTIONSKiri chrisNo ratings yet

- IFRS 9 Financial InstrumentsDocument38 pagesIFRS 9 Financial InstrumentsKiri chrisNo ratings yet

- Overhead Analysis QuestionsDocument9 pagesOverhead Analysis QuestionsKiri chrisNo ratings yet

- Capital BudgetingDocument1 pageCapital BudgetingKiri chrisNo ratings yet

- IFRS 15 Part 2 Perfomance Obligations Satisfied Over TimeDocument26 pagesIFRS 15 Part 2 Perfomance Obligations Satisfied Over TimeKiri chrisNo ratings yet

- Ifrs 9 AnswersDocument2 pagesIfrs 9 AnswersKiri chrisNo ratings yet

- Overhead Analysis SolutionDocument1 pageOverhead Analysis SolutionKiri chrisNo ratings yet

- Ias 23 Borrrowing Costs QuestionsDocument3 pagesIas 23 Borrrowing Costs QuestionsKiri chrisNo ratings yet

- Ifrs 9 QuestionsDocument10 pagesIfrs 9 QuestionsKiri chrisNo ratings yet

- BANK RECONCILIATION STATEMENTS HandoutDocument14 pagesBANK RECONCILIATION STATEMENTS HandoutKiri chrisNo ratings yet

- Ifrs 15Document2 pagesIfrs 15Kiri chrisNo ratings yet

- Limited Companies - Capital Structure & Finance Costs HandoutDocument11 pagesLimited Companies - Capital Structure & Finance Costs HandoutKiri chrisNo ratings yet

- Chesnut Model AnswerDocument2 pagesChesnut Model AnswerKiri chrisNo ratings yet

- Error Lesson WorkingsDocument4 pagesError Lesson WorkingsKiri chrisNo ratings yet

- IAS 23 Borrrowing CostsDocument17 pagesIAS 23 Borrrowing CostsKiri chrisNo ratings yet

- Acca Margianl and Absorption Costing SolutionDocument2 pagesAcca Margianl and Absorption Costing SolutionKiri chrisNo ratings yet

- Handout Errors LessonDocument14 pagesHandout Errors LessonKiri chrisNo ratings yet