Professional Documents

Culture Documents

Mas - 8

Uploaded by

Rosemarie CruzOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mas - 8

Uploaded by

Rosemarie CruzCopyright:

Available Formats

During October, 10,000 direct labor hours were worked at a standard cost of $10 per hour.

If the direct

labor rate variance for October was $4,000 unfavorable, the actual cost per direct labor hour must be

$10.40

SUPPORTING CALCULATIONS: 10,000 × $10 = $100,000 $100,000 + $4,000 = $104,000 $104,000/10,000

= $10.40

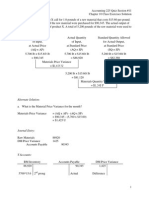

Bodacious Corporation produced 100 units of Product AA. The total standard and actual costs for

materials and direct labor for the 100 units of Product AA are as follows: Materials: Standard Actual

Standard: 200 pounds at $3.00 per pound $600 Actual: 220 pounds at $2.85 per pound $627 Direct

labor: Standard: 400 hours at $15.00 per hour $6,000 Actual: 368 hours at $16.50 per hour $6,072 What

is the labor efficiency variance for Bodacious Corporation?

$480 (F)

SUPPORTING CALCULATIONS: (368 − 400) × $15 = $480 (F)

As a general rule, an investigation of a variance should be undertaken only if the

anticipated benefits are greater than the expected costs

Which of the following factors would cause an unfavorable material quantity variance?

using poorly maintained machinery

Biscuit Company has developed the following standards for one of its products. Direct labor hours is the

driver used to assign overhead costs to products. Direct materials: 10 pounds × $3 per pound Direct

labor: 2.5 hours × $8 per hour Variable manufacturing overhead: 2.5 hours × $2 per hour The following

activity occurred during the month of June: Materials purchased: 125,000 pounds at $2.60 per pound

Materials used: 110,000 pounds Units produced: 10,000 units Direct labor: 24,000 hours at $7.50 per

hour Actual variable manufacturing overhead: $51,000 The company records materials price variances

at the time of purchase. The direct labor efficiency variance is

$8,000

SUPPORTING CALCULATIONS: (24,000 × $8) − (10,000 × 2.5 × $8) = $8,000 favorable

Colina Production Company uses a standard costing system. The following information pertains to the

current year. Direct labor hours is the driver used to assign overhead costs to products. Actual

production 5,500 units Actual factory overhead costs ($16,500 is fixed) $40,125 Actual direct labor costs

(11,250 hours) $131,625 Standard direct labor for 5,500 units: Standard hours allowed 11,000 hours

Labor rate $12.00 The factory overhead rate is based on an activity level of 10,000 direct labor hours.

Standard cost data for 5,000 units is as follows: Variable factory overhead $22,500 Fixed factory

overhead 13,500 Total factory overhead $36,000 What is the variable overhead efficiency variance for

Colina Production Company?

562.50

SUPPORTING CALCULATIONS: (11,250 − 11,000) × ($22,500 / 10,000) = $562.50 (U)

You might also like

- SOX ProcessDocument6 pagesSOX ProcessPrakaash100% (3)

- Test 1 - Ma1 Practice in ClassDocument8 pagesTest 1 - Ma1 Practice in ClassNgaka MokakeNo ratings yet

- Chapter 8: Standard Cost Accounting - Materials, Labor, and Factory OverheadDocument67 pagesChapter 8: Standard Cost Accounting - Materials, Labor, and Factory OverheadSaeym SegoviaNo ratings yet

- BUS 5110 - Written Assignment - Unit 5 - MADocument5 pagesBUS 5110 - Written Assignment - Unit 5 - MAAliyazahra Kamila100% (1)

- Relevant Costing Sample ProblemsDocument29 pagesRelevant Costing Sample ProblemsAngela Padua100% (2)

- 2.2 Discussion Assignment Revenue Cycle Exercise Flowchart AnalysisDocument1 page2.2 Discussion Assignment Revenue Cycle Exercise Flowchart AnalysisRosemarie CruzNo ratings yet

- Hogsmeadow Garden Centre Case StudyDocument1 pageHogsmeadow Garden Centre Case StudyshaNo ratings yet

- Mid Term Evaluation Case - Domino's Master Franchise ModelDocument15 pagesMid Term Evaluation Case - Domino's Master Franchise ModelMSD FAN ACCOUNTNo ratings yet

- Mas - 7Document2 pagesMas - 7Rosemarie CruzNo ratings yet

- D. Factory Overhead Costs Incurred Were Less Than Overhead Costs Charged To ProductionDocument4 pagesD. Factory Overhead Costs Incurred Were Less Than Overhead Costs Charged To ProductionGuinevereNo ratings yet

- Cima Standard Costing and Variance Analysis Session 1 QuestionsDocument13 pagesCima Standard Costing and Variance Analysis Session 1 QuestionsKiri chrisNo ratings yet

- UAS-ACCT6130-cost Accounting-Latihan persiapan-PJJDocument4 pagesUAS-ACCT6130-cost Accounting-Latihan persiapan-PJJOlim BariziNo ratings yet

- ExerDocument4 pagesExerdianne ballonNo ratings yet

- M11 CHP 10 1 Standard Costs 2011 0524Document58 pagesM11 CHP 10 1 Standard Costs 2011 0524Rose Ann De Guzman67% (3)

- 2009-07-29 133504 MathewDocument9 pages2009-07-29 133504 MathewAarti JNo ratings yet

- Managerial Accounting Bonus QuestionsDocument2 pagesManagerial Accounting Bonus Questionsmaha13aljasmiNo ratings yet

- Practice Questions On Direct and Indirect Cost VariancesDocument8 pagesPractice Questions On Direct and Indirect Cost VariancesAishwarya RaoNo ratings yet

- Standarvd Cost & VarianceDocument3 pagesStandarvd Cost & Variancemohammad bilalNo ratings yet

- Pre Assignment PracticeDocument7 pagesPre Assignment PracticeaeyNo ratings yet

- Chapter 10 5eDocument4 pagesChapter 10 5eym5c2324No ratings yet

- Problem10 18 and 10 20Document10 pagesProblem10 18 and 10 20roseNo ratings yet

- Acc1 ADocument4 pagesAcc1 AJereek EspirituNo ratings yet

- Acc349 P8-2A P11-4ADocument3 pagesAcc349 P8-2A P11-4AkskimblerNo ratings yet

- Practice - Chapter 7 - ACCT - 401Document8 pagesPractice - Chapter 7 - ACCT - 401mohammed azizNo ratings yet

- Ankitastic Exams Solutions MCQ and Long AnswerDocument29 pagesAnkitastic Exams Solutions MCQ and Long AnswerAnkitastic tutoring ServicesNo ratings yet

- Standard Costing and Variance AnalysisDocument38 pagesStandard Costing and Variance AnalysisAlexis Kaye DayagNo ratings yet

- Budgets For Control, Part 2Document29 pagesBudgets For Control, Part 2vukicevic.ivan5No ratings yet

- Ankitastic Exams SolutionsDocument30 pagesAnkitastic Exams SolutionsAnkitastic tutoring ServicesNo ratings yet

- Acc 0Document21 pagesAcc 0Ashish BhallaNo ratings yet

- Bài tập chương 6,7Document3 pagesBài tập chương 6,7mentran.13112002No ratings yet

- Item To Classify Standard Actual Type of VarianceDocument7 pagesItem To Classify Standard Actual Type of Variancedavid johnsonNo ratings yet

- Standard Quantity Standard Price Standard or Rate CostDocument4 pagesStandard Quantity Standard Price Standard or Rate CostRabie HarounNo ratings yet

- Latihan Soal Standar CostingDocument2 pagesLatihan Soal Standar Costing31 Sri RizkillahNo ratings yet

- Hilton CH 10 Select SolutionsDocument24 pagesHilton CH 10 Select SolutionsRaza Ze0% (1)

- The Problem Set Consists of 3 Questions. 2. You May Use Your Word Processor To Expand/contract The Space ProvidedDocument6 pagesThe Problem Set Consists of 3 Questions. 2. You May Use Your Word Processor To Expand/contract The Space ProvidedcospNo ratings yet

- Questions - Chapter 9Document5 pagesQuestions - Chapter 9sajedulNo ratings yet

- Standard CostingDocument12 pagesStandard CostingKUNAL GOSAVINo ratings yet

- Hite Company Has Developed The Following Standard Costs For Its Product For 2009Document6 pagesHite Company Has Developed The Following Standard Costs For Its Product For 2009Ghaill CruzNo ratings yet

- FB - Standard Costing. Tutorial ExerciseDocument2 pagesFB - Standard Costing. Tutorial ExerciseToni BuiNo ratings yet

- Whitestone Company: $ 658,800 654,225 $1,313,025 $43,005 F Price $ 691,740 664,290 $1,356,030 $16,470 U MixDocument4 pagesWhitestone Company: $ 658,800 654,225 $1,313,025 $43,005 F Price $ 691,740 664,290 $1,356,030 $16,470 U MixJashmin CosainNo ratings yet

- Management Accounting Sample QuestionsDocument14 pagesManagement Accounting Sample QuestionsMarjun Segismundo Tugano IIINo ratings yet

- Kelompok 4-SOAL STANDAR COSTINGDocument3 pagesKelompok 4-SOAL STANDAR COSTINGAndriana Butera0% (1)

- Chapter 10 BDocument12 pagesChapter 10 BMelissa Mclean100% (4)

- Cost Accounting 2 Fourth Year Second Semester 2020-2021 Review Questions CH (7) & CH (8) Part (Dr. El Ghareeb) (5) Presented By: Dr. Ahmed MokhtarDocument11 pagesCost Accounting 2 Fourth Year Second Semester 2020-2021 Review Questions CH (7) & CH (8) Part (Dr. El Ghareeb) (5) Presented By: Dr. Ahmed Mokhtarمحمود احمدNo ratings yet

- Final Test - MA - 2021. 06. 05. New-Đã Chuyển ĐổiDocument9 pagesFinal Test - MA - 2021. 06. 05. New-Đã Chuyển ĐổiHồng Đức TrầnNo ratings yet

- Chapter 7 The Master Budget and Flexible BudgetingDocument14 pagesChapter 7 The Master Budget and Flexible BudgetingJuana LyricsNo ratings yet

- 314 Chap 7&8Document9 pages314 Chap 7&8Jonah Marie TaghoyNo ratings yet

- Managerial Accounting Homework 1.3Document5 pagesManagerial Accounting Homework 1.3OvidiaNo ratings yet

- QS11 - Class Exercises SolutionDocument8 pagesQS11 - Class Exercises Solutionlyk0tex100% (2)

- Quiz 3 SolutionDocument5 pagesQuiz 3 SolutionMichel BanvoNo ratings yet

- Budgeting QuizDocument3 pagesBudgeting QuizMay Grethel Joy PeranteNo ratings yet

- Dodrio Doorknob Design CompanyDocument8 pagesDodrio Doorknob Design Companyloyd aradaNo ratings yet

- Garrison 13e Practice Exam - Chapter 11Document6 pagesGarrison 13e Practice Exam - Chapter 11pujarze2No ratings yet

- Practice Problems For Midterm - Spring 2017Document6 pagesPractice Problems For Midterm - Spring 2017Derny FleurimaNo ratings yet

- PracticeDocument6 pagesPracticeNgan Tran Ngoc ThuyNo ratings yet

- Standard Costing ExercisesDocument6 pagesStandard Costing ExercisesVatchdemonNo ratings yet

- Unit 7 - Wiley Plus ExamplesDocument14 pagesUnit 7 - Wiley Plus ExamplesMohammed Al DhaheriNo ratings yet

- Managerial Accounting JONGAY (AutoRecovered)Document24 pagesManagerial Accounting JONGAY (AutoRecovered)Jhoy AmoscoNo ratings yet

- MASQUIZDocument11 pagesMASQUIZGelyn CruzNo ratings yet

- Cima Standard Costing Seesion 2 QuestionsDocument3 pagesCima Standard Costing Seesion 2 QuestionsKiri chrisNo ratings yet

- Standard CostingDocument2 pagesStandard CostingsumairaNo ratings yet

- Acct2302 E3Document12 pagesAcct2302 E3zeeshan100% (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Gross Profit From SaleDocument5 pagesGross Profit From SaleRosemarie CruzNo ratings yet

- Employees of ROHQsDocument4 pagesEmployees of ROHQsRosemarie CruzNo ratings yet

- Amg Manufacturing CompanyDocument3 pagesAmg Manufacturing CompanyRosemarie CruzNo ratings yet

- Deductible ExpenseDocument4 pagesDeductible ExpenseRosemarie CruzNo ratings yet

- Cost - ComputationalDocument2 pagesCost - ComputationalRosemarie CruzNo ratings yet

- De MinimisDocument5 pagesDe MinimisRosemarie CruzNo ratings yet

- Capital Gains Tax: Use The Following Data For The Next Four (4) QuestionsDocument4 pagesCapital Gains Tax: Use The Following Data For The Next Four (4) QuestionsRosemarie CruzNo ratings yet

- Far 5Document3 pagesFar 5Rosemarie CruzNo ratings yet

- 2.3 Discussion Assignment The Revenue CycleDocument8 pages2.3 Discussion Assignment The Revenue CycleRosemarie CruzNo ratings yet

- Far 1Document2 pagesFar 1Rosemarie CruzNo ratings yet

- Far 2Document2 pagesFar 2Rosemarie CruzNo ratings yet

- Far 6Document2 pagesFar 6Rosemarie CruzNo ratings yet

- UntitledDocument1 pageUntitledRosemarie CruzNo ratings yet

- Far 3Document1 pageFar 3Rosemarie CruzNo ratings yet

- Mas - 2Document2 pagesMas - 2Rosemarie CruzNo ratings yet

- Mas - 6Document2 pagesMas - 6Rosemarie CruzNo ratings yet

- Mas - 4Document2 pagesMas - 4Rosemarie CruzNo ratings yet

- Mas - 5Document2 pagesMas - 5Rosemarie CruzNo ratings yet

- VariancesDocument2 pagesVariancesRosemarie CruzNo ratings yet

- Mas - 3Document2 pagesMas - 3Rosemarie CruzNo ratings yet

- Assignment 2.3 - Reflection Paper SAP Simple Finance - General LedgerDocument1 pageAssignment 2.3 - Reflection Paper SAP Simple Finance - General LedgerRosemarie CruzNo ratings yet

- Mas - 1Document1 pageMas - 1Rosemarie CruzNo ratings yet

- MASDocument2 pagesMASRosemarie CruzNo ratings yet

- CS NotesDocument2 pagesCS NotesRosemarie CruzNo ratings yet

- Assignment 2.2 - Reflection Paper Importance of Procurement - Transfer of StockDocument1 pageAssignment 2.2 - Reflection Paper Importance of Procurement - Transfer of StockRosemarie CruzNo ratings yet

- Discussion 2.1 - Discussion Clarification and QA.Document2 pagesDiscussion 2.1 - Discussion Clarification and QA.Rosemarie CruzNo ratings yet

- Assignment 2.1 - Reflection Paper Contract ManagementDocument1 pageAssignment 2.1 - Reflection Paper Contract ManagementRosemarie CruzNo ratings yet

- Designing Promotion and Advertising Strategies12Document13 pagesDesigning Promotion and Advertising Strategies12Abbas KhanNo ratings yet

- Inventory Management in The Age of Big Data: by Morris A. CohenDocument3 pagesInventory Management in The Age of Big Data: by Morris A. CohenValee FuentealbaNo ratings yet

- You Are The Chief Financial Officer For A Firm That Sells Electric Fans. Your FirmDocument4 pagesYou Are The Chief Financial Officer For A Firm That Sells Electric Fans. Your FirmRamy ShabanaNo ratings yet

- SWOT Analysis-CMD CosmeticsDocument7 pagesSWOT Analysis-CMD CosmeticsHuyền HoàngNo ratings yet

- LRN - Pre U Assignment - Foundation Business and Management - FINAL - May 2020Document2 pagesLRN - Pre U Assignment - Foundation Business and Management - FINAL - May 2020treasurestrendy8No ratings yet

- NNPC Ms 2012 May Rev1Document79 pagesNNPC Ms 2012 May Rev1idristeekay100% (2)

- Group 4 - StartechDocument7 pagesGroup 4 - StartechSubhasish BalaNo ratings yet

- Internship Report "Potentiality of Beautina Facewash in Bangladesh Facewash Market" Submitted ToDocument35 pagesInternship Report "Potentiality of Beautina Facewash in Bangladesh Facewash Market" Submitted ToAnik MahmudNo ratings yet

- IB Project - Group 3Document15 pagesIB Project - Group 3Prakash KakaniNo ratings yet

- Marketing Communications in The Digital AgeDocument9 pagesMarketing Communications in The Digital AgeNayla Azzahra SNo ratings yet

- Chapter 14: JIT and Lean Operations: History of ToyotaDocument11 pagesChapter 14: JIT and Lean Operations: History of ToyotaPOREDDY BHARATH KUMAR REDDY Mechanical EngineeringNo ratings yet

- Quality Control and Six SigmaDocument37 pagesQuality Control and Six SigmaShruti GuptaNo ratings yet

- Material Specifications Forged Products Manufactured With The Forging Rev.04Document13 pagesMaterial Specifications Forged Products Manufactured With The Forging Rev.04Emre TekinNo ratings yet

- 9th YLDP Brochure 2022Document20 pages9th YLDP Brochure 2022arkamitraNo ratings yet

- TW Vis OpsDocument10 pagesTW Vis Opstwizas3926No ratings yet

- LP - Process MappingDocument47 pagesLP - Process MappingmangofaNo ratings yet

- Entrep PPT Week4 Module4 1STQTR-1Document14 pagesEntrep PPT Week4 Module4 1STQTR-1Rey ManibaleNo ratings yet

- 1 SMDocument8 pages1 SMKadek AdiNo ratings yet

- Debre Tabor University: Faculty of Social ScienceDocument30 pagesDebre Tabor University: Faculty of Social Sciencebamlak shumetNo ratings yet

- Reviewer in Entrep 2nd QuarterDocument5 pagesReviewer in Entrep 2nd QuarterKyla Jane GabicaNo ratings yet

- Various Forging ProcessesDocument24 pagesVarious Forging ProcessesHeetNo ratings yet

- Nbog-2010-1 (Auditing Suppliers)Document7 pagesNbog-2010-1 (Auditing Suppliers)DO KHNo ratings yet

- Advertising Module 1Document15 pagesAdvertising Module 1kavya krosuruNo ratings yet

- IATF16949-2016 Standard e PDFDocument60 pagesIATF16949-2016 Standard e PDFjinto antony100% (1)

- Pricing Structur E: Tactics For Pricing Differently Across Customers SegmentsDocument20 pagesPricing Structur E: Tactics For Pricing Differently Across Customers SegmentsnegosyomailNo ratings yet

- How Competitive Forces Shape StrategyDocument13 pagesHow Competitive Forces Shape StrategyKushalNo ratings yet

- Manufacturing Planning PresentationDocument14 pagesManufacturing Planning PresentationMaheer SohbatNo ratings yet