Professional Documents

Culture Documents

Review Jurnal

Review Jurnal

Uploaded by

Fdly Ikhsn Kmil0 ratings0% found this document useful (0 votes)

16 views5 pagesThe paper evaluates

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe paper evaluates

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views5 pagesReview Jurnal

Review Jurnal

Uploaded by

Fdly Ikhsn KmilThe paper evaluates

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

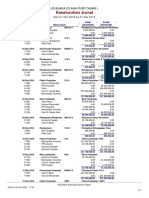

Judul A financial Ratio Analysis of Commercial Bank

Performance in South Africa

Jurnal Journal of African Review Economics and Finance

Volume&Halaman Vol. 2, No. 1

Tahun Dec 2010

Penulis Mabwe Kumbirai, and Robert Webb

Download Link https://www.ajol.info/index.php/aref/article/view/86945

Reviewer Fadly Ikhsan Kamil, Ulul Aulia

Tanggal 7 Mei, 2023

Background This paper investigates the performance of South

Africa’s commercial banking sector for the period

2005- 2009. Financial ratios are employed to

measure the profitability, liquidity and credit

quality performance of five large South African

based commercial banks. The study found that

overall bank performance increased considerably

in the first two years of the analysis. A significant

change in trend is noticed at the onset of the

global financial crisis in 2007, reaching its peak

during 2008-2009. This resulted in falling

profitability, low liquidity and deteriorating credit

quality in the South African Banking sector

Problems South African banks are faced with increasing

competition and rising costs as a result of

regulatory requirements, financial and

technological innovation, entry of large foreign

banks in the retail banking environment and

challenges of the recent financial crisis.

Purpose of the study This paper investigates the performance of South

Africa’s commercial banking

sector for the period 2005- 2009.

Research Methods This paper uses a descriptive financial ratio

analysis to measure, describe and analyse the

performance of commercial banks in South Africa

during the period 2005-2009.

Research sample The population for this research comprise of all

the banks operating in South Africa between

2005 and 2009. A sample of the top five

commercial banks was selected based on the

value of their total assets at the end of the 2009

financial year end (FirstRand Bank, Absa,

Nedbank, Standard Bank and Imperial bank).

Result The results showed that the bank's overall

performance in terms of profitability, liquidity,

and credit quality has improved from 2005 to

2007. However, the bank's performance

experienced a decline during 2008-2009 as the

bank's operational environment deteriorated due

to the global financial crisis and economic

slowdown.

Judul Capital Budgeting Theory and Practice: A Review

and Agenda for Future Research

Jurnal Research Journal of Finance and Accounting

Volume&Halaman Vol.7, No.1

Tahun 2016

Penulis Lingesiya Kengatharan

Download Link https://core.ac.uk/download/pdf/234631219.pdf

Reviewer Fadly Ikhsan Kamil, Ulul Aulia

Tanggal 7 Mei, 2023

Background The main purpose of this research was to

delineate unearth lacunae in the extant capital

budgeting theory and practice during the last two

decades and ipso facto become springboard for

future scholarships

Problems Problem statement of this study is how far capital

budgeting theory differentiates with practice and

to demonstrate the nature of the gaps in existing

capital budgeting literature.

Purpose of the study the main aim of this research is to demonstrate

unearth gaps in the existing capital budgeting

practices literature and to suggest the directions

for the future research

Research Methods The research strategy leads to design qualitative

research approach. This research covered

sufficient researches carried out during the past

two decades in the area of capital budgeting. This

research analyzed past literature by identifying

relevant themes and then thematic text analysis

was employed. Thus, this research is ‘subjective’

and adopts inductive approach in order to

answering research questions.

Research sample Based on the set criteria, 363 research papers

were reduced to 201 and they

analyzed using a coding procedure

Result Results Multi-disciplinary concepts of capital

budgeting During the past twenty years, a total of

202 research papers appeared in peer reviewed

indexed journals were identified across many

academic journals. Majority of the papers

appeared in Engineering Economist (N= 32)

yielding 15.92% followed by Managerial Finance

(27), Public Budgeting & Finance (16), Financial

Management(9), Journal of Banking and Finance

(8), Journal of Business Finance & Accounting (6),

Accounting Education(5), Management

Accounting Research(5), The Journal of

Finance(5), Journal of Corporate Accounting &

Finance (4), Management Decision (4) and The

Review of Financial Studies. All of these journals

represented 62.20 % of research papers in capital

budgeting in the last two decades. The reminder

of the research papers appeared in many

journals. Capital budgeting is thus multi-

disciplinary aspects and applied across many

discipline. The table 1 below summarizes entire

list of journals contained capital budgeting

research papers.

Judul Efficiency of Financial Ratios Analysis for Evaluating Companies’ Liquidity

Jurnal International Journal of Social Sciences & Educational Studies

Volume& Vol.4, No.4

Halaman

Tahun March 2018

Penulis Chnar Abdullah Rashid

Download https://www.researchgate.net/profile/Chnar-Rashid/publication/

Link 325870971_Efficiency_of_Financial_Ratios_Analysis_for_Evaluating_Companies'_Liquidit

y/links/5b2a20f30f7e9b1d009bcd54/Efficiency-of-Financial-Ratios-Analysis-for-

Evaluating-Companies-Liquidity.pdf

Reviewer Fadly Ikhsan Kamil, Ulul Aulia

Tanggal 7 Mei, 2023

Background

Problems

Purpose of the study

Research Methods

Research sample

Result

You might also like

- A Comparative Study of Performance of Local Banks in Sultanate of OmanDocument10 pagesA Comparative Study of Performance of Local Banks in Sultanate of OmanResearch StudiesNo ratings yet

- Planwards - EnP Mock Exam Set ADocument26 pagesPlanwards - EnP Mock Exam Set ARonnie A. Fernandez100% (1)

- Chapter 1 - An Overview of Financial Managemen: ReviewerDocument3 pagesChapter 1 - An Overview of Financial Managemen: ReviewerChristian Mozo Oliva67% (3)

- CAMEL Model in Banking SectorDocument6 pagesCAMEL Model in Banking SectorAshenafi GirmaNo ratings yet

- Profitabilityof Saudi Commercial Banks AComparative Evaluationbetween Domesticand Foreign Banksusing CAMELDocument9 pagesProfitabilityof Saudi Commercial Banks AComparative Evaluationbetween Domesticand Foreign Banksusing CAMELNahid Md. AlamNo ratings yet

- Synopsis Kumar K NDocument8 pagesSynopsis Kumar K Nswamy yashuNo ratings yet

- ProposalDocument10 pagesProposalSagar KarkiNo ratings yet

- Determinants of Financial Performance of Commercial Banks in EthiopiaDocument8 pagesDeterminants of Financial Performance of Commercial Banks in Ethiopiamesfin DemiseNo ratings yet

- Proposal of Liquidity Analysis of Citizen Bank International LimitedDocument5 pagesProposal of Liquidity Analysis of Citizen Bank International Limitedprajwaldhakal2057No ratings yet

- Analysis of Capital Structure and Performance of Banking Sectorin Middle East CountriesDocument13 pagesAnalysis of Capital Structure and Performance of Banking Sectorin Middle East Countriesclelia jaymezNo ratings yet

- 2009 AEC - Efficiency of The Banking Sector in South AfricaDocument44 pages2009 AEC - Efficiency of The Banking Sector in South AfricaNokuthulaNo ratings yet

- Financial Performance Comparison of Public and Private BanksDocument15 pagesFinancial Performance Comparison of Public and Private BanksShiny StaarNo ratings yet

- IJMS V6 I3 Paper 5 1273 1275Document3 pagesIJMS V6 I3 Paper 5 1273 1275tamiltop886No ratings yet

- Suraj's ProposalDocument10 pagesSuraj's ProposalRam khadkaNo ratings yet

- Group Members:: Khalil Ullah Mohammad Asif Mumtaz Mohammad Ali Butt Mohammad Affan Mr. Gulzar Ahmed KhawajaDocument13 pagesGroup Members:: Khalil Ullah Mohammad Asif Mumtaz Mohammad Ali Butt Mohammad Affan Mr. Gulzar Ahmed Khawajaripperage1No ratings yet

- A STUDY ON PROFITABILITY POSITION OF Nabil BankDocument9 pagesA STUDY ON PROFITABILITY POSITION OF Nabil Bankpujan sundasNo ratings yet

- Camelmodel ProjectDocument26 pagesCamelmodel ProjectDEVARAJ KGNo ratings yet

- NOV164552Document4 pagesNOV164552Henok AkiyaNo ratings yet

- Capital Structureand Profitabilityof Deposit Money BanksDocument13 pagesCapital Structureand Profitabilityof Deposit Money BanksRaja RehanNo ratings yet

- A Study On Financial Performance Analysis at City Union BankDocument15 pagesA Study On Financial Performance Analysis at City Union BankManjunath ShettyNo ratings yet

- Bank Efficiency and Non-Performing Loans: Evidence From Malaysia and SingaporeDocument16 pagesBank Efficiency and Non-Performing Loans: Evidence From Malaysia and SingaporeAshraful AlamNo ratings yet

- A Synopsis On PEoBDocument8 pagesA Synopsis On PEoBAsit kumar BeheraNo ratings yet

- Radhe ShyamDocument13 pagesRadhe Shyamchanchal shahiNo ratings yet

- Investment Banking Activities in Nigeria A CriticaDocument12 pagesInvestment Banking Activities in Nigeria A Criticanuredin yimamNo ratings yet

- 10.2478 - JCBTP 2022 0025Document18 pages10.2478 - JCBTP 2022 0025ZinebNo ratings yet

- Ic and Revenue GrowthDocument12 pagesIc and Revenue GrowthEkta MehtaNo ratings yet

- A Study On Financial Performance Analysis at City Union BankDocument30 pagesA Study On Financial Performance Analysis at City Union BankArnab BaruaNo ratings yet

- 1 s2.0 S1572308921000462 MainDocument12 pages1 s2.0 S1572308921000462 MainDr. Maryam IshaqNo ratings yet

- Francis, M. E. (2013) .Document14 pagesFrancis, M. E. (2013) .Vita NataliaNo ratings yet

- Use of CAMEL Rating Framework: A Comparative Performance Evaluation of Selected Bangladeshi Private Commercial BanksDocument9 pagesUse of CAMEL Rating Framework: A Comparative Performance Evaluation of Selected Bangladeshi Private Commercial BanksShadabNo ratings yet

- Theories of ProfitDocument9 pagesTheories of ProfitDeus SindaNo ratings yet

- The Contribution of Financial Ratios Analysis On Effective Decision Making in Commercial BanksDocument8 pagesThe Contribution of Financial Ratios Analysis On Effective Decision Making in Commercial BanksSAIsanker DAivAMNo ratings yet

- Financial Performance BanksDocument17 pagesFinancial Performance BanksShobujurRahmanNo ratings yet

- Financial Performance Analysis of Everest Bank Limited: A Research ProposalDocument15 pagesFinancial Performance Analysis of Everest Bank Limited: A Research Proposalutsav9maharjanNo ratings yet

- Ijirt154811 PaperDocument4 pagesIjirt154811 PaperAshutosh LandeNo ratings yet

- Risk and Return Analysis of Commercial Bank in Nepal (Proposal Body)Document34 pagesRisk and Return Analysis of Commercial Bank in Nepal (Proposal Body)Bhupendra TamangNo ratings yet

- Financial Performance of Palestinian Commercial Banks: Graduate Student of Finance at Birzeit University PalestineDocument10 pagesFinancial Performance of Palestinian Commercial Banks: Graduate Student of Finance at Birzeit University PalestineIrfan Ul HaqNo ratings yet

- 08 v31 2 July2018Document13 pages08 v31 2 July2018Farhan SarwarNo ratings yet

- Attitudes of Employees Towards The Use ODocument12 pagesAttitudes of Employees Towards The Use ONahid Md. AlamNo ratings yet

- A Study To Analyze The Financial PerformanceDocument11 pagesA Study To Analyze The Financial PerformanceRaghav AryaNo ratings yet

- Impact of CG On Banks Performance in Nigeria PDFDocument4 pagesImpact of CG On Banks Performance in Nigeria PDFRizka HayatiNo ratings yet

- Jenita. NPDocument7 pagesJenita. NPshresthanikhil078No ratings yet

- A Selective Study Camels Analysis of Indian Private Sector BanksDocument7 pagesA Selective Study Camels Analysis of Indian Private Sector Banksmahesh toshniwalNo ratings yet

- Wa0004.Document50 pagesWa0004.pradhanraja05679No ratings yet

- Evaluating Performance of Bank Through Camels Model: A Case Study of Select Public and Private Banks in IndiaDocument6 pagesEvaluating Performance of Bank Through Camels Model: A Case Study of Select Public and Private Banks in IndiaAkarsh BhattNo ratings yet

- New Publication2Document25 pagesNew Publication2Kanbiro OrkaidoNo ratings yet

- Impact of Bank Internal Factors On Profitability of Commercial Banks in Sri Lanka: A Panel Data AnalysisDocument14 pagesImpact of Bank Internal Factors On Profitability of Commercial Banks in Sri Lanka: A Panel Data Analysisnuwany2kNo ratings yet

- Capital Structure and Financial Performance in NigeriaDocument12 pagesCapital Structure and Financial Performance in Nigeriaalikali usmanNo ratings yet

- Earning Quality of Scheduled Commercial Banks in India: Bank-Wise and Sector-Wise AnalysisDocument26 pagesEarning Quality of Scheduled Commercial Banks in India: Bank-Wise and Sector-Wise AnalysisPavithra GowthamNo ratings yet

- Harsh & Apurv & AdityaDocument14 pagesHarsh & Apurv & AdityaApurv AswaleNo ratings yet

- CAPITALSTRUCTUREOFBANK IN GhanaDocument14 pagesCAPITALSTRUCTUREOFBANK IN Ghananle brunoNo ratings yet

- 1 Measuring Bank Performance of Nepali BanksDocument6 pages1 Measuring Bank Performance of Nepali Bankssabin x maniaNo ratings yet

- Proper ReportDocument56 pagesProper ReportvijaypratapsinghjaipurNo ratings yet

- Determinnt of Banking Profitability - 2Document5 pagesDeterminnt of Banking Profitability - 2thaonguyenpeoctieuNo ratings yet

- Determination of Commercial Banking Liquidsystematic ReviewDocument3 pagesDetermination of Commercial Banking Liquidsystematic ReviewHempstone KimaniNo ratings yet

- Jayanthi 26Document4 pagesJayanthi 26Kavishek KalindiNo ratings yet

- Liquidity Management and The Performance of Commercial Banks in NigeriaDocument12 pagesLiquidity Management and The Performance of Commercial Banks in NigeriaResearch ParkNo ratings yet

- The Effect of Capital Structure, Operating Efficiency and Non-Interest Income On Bank Profitability: New Evidence From AsiaDocument20 pagesThe Effect of Capital Structure, Operating Efficiency and Non-Interest Income On Bank Profitability: New Evidence From AsiaEllen AgustinNo ratings yet

- A Research Report For BBS 4th Year 2073Document34 pagesA Research Report For BBS 4th Year 2073Sudhir Yadav100% (1)

- An Analysis of The Non-Performing Assets of Some Selected Public Sector Banks in IndiaDocument21 pagesAn Analysis of The Non-Performing Assets of Some Selected Public Sector Banks in IndiaGangu DeepikaNo ratings yet

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- Universty of Gonder: College of Business and EconomicsDocument9 pagesUniversty of Gonder: College of Business and EconomicsJossi AbuleNo ratings yet

- Peta 1&2Document3 pagesPeta 1&2Jolito FloirendoNo ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1Bigbi Kumar100% (1)

- Chapter OneDocument9 pagesChapter OneNoorshikha NeupaneNo ratings yet

- Air Wick STP - PratishthaDocument6 pagesAir Wick STP - PratishthaGarima Bhandari100% (1)

- Spotlight On Telecommunications AccountingDocument8 pagesSpotlight On Telecommunications AccountingHasan YasinNo ratings yet

- Organisation Structure and Design Wildfire Entertainent: Presented By-Group 3 (Sec-D)Document6 pagesOrganisation Structure and Design Wildfire Entertainent: Presented By-Group 3 (Sec-D)Sidhant NayakNo ratings yet

- 2 - CH 16 (ICAP Book) - Introduction To Project Appraisal - FinalDocument93 pages2 - CH 16 (ICAP Book) - Introduction To Project Appraisal - FinalArslanNo ratings yet

- WTO Exam.S1030310Document10 pagesWTO Exam.S1030310Raymond PasiliaoNo ratings yet

- Tesla PPT 111Document19 pagesTesla PPT 111Shraddha MoreNo ratings yet

- Keseluruhan Jurnal: Ud Buana (Diana Puspitasari)Document3 pagesKeseluruhan Jurnal: Ud Buana (Diana Puspitasari)diana puspitasariNo ratings yet

- San 6 PC Arrear CalcuDocument9 pagesSan 6 PC Arrear Calcusandip2929No ratings yet

- European and International Economic Environment: UB Bachelor Degree in International Business Academic Year 2020/2021Document67 pagesEuropean and International Economic Environment: UB Bachelor Degree in International Business Academic Year 2020/2021Lorena LiNo ratings yet

- David - Backhouse@cscrecruitment - Co.uk: Group Chief Financial Officer - ConstructionDocument1 pageDavid - Backhouse@cscrecruitment - Co.uk: Group Chief Financial Officer - Constructionjaga67No ratings yet

- Summary of Gsis BenefitsDocument4 pagesSummary of Gsis BenefitsFrank Lloyd CadornaNo ratings yet

- Analysis of Costs: Cost Function Cost FunctionDocument10 pagesAnalysis of Costs: Cost Function Cost Functionkanv gulatiNo ratings yet

- Company LawDocument6 pagesCompany LawTremaine AllenNo ratings yet

- Volini Spray 360 Degree L Press ReleaseDocument2 pagesVolini Spray 360 Degree L Press ReleasePavan ReddyNo ratings yet

- Call Centres Transforming IndiaDocument44 pagesCall Centres Transforming Indiaarun1974No ratings yet

- StatementOfAccount 7245571180 18092022 070918Document3 pagesStatementOfAccount 7245571180 18092022 070918somesh chandraNo ratings yet

- Branding ChoicesDocument16 pagesBranding ChoicesAlessandra_ANo ratings yet

- Employment Visa Designation ListDocument4 pagesEmployment Visa Designation ListAhtesham ArshadNo ratings yet

- Case Studies - (Chapter - 2) Principles of Management, BST Class 12 Commerce Notes - EduRevDocument33 pagesCase Studies - (Chapter - 2) Principles of Management, BST Class 12 Commerce Notes - EduRevSrikant SinghNo ratings yet

- Singapore: Basel Convention Country Fact SheetDocument6 pagesSingapore: Basel Convention Country Fact SheetBenedictha NiidyaNo ratings yet

- Evaluation of Cotton Textile Supply Chain Programme and Potential For Scale-Up in Hyderabad, IndiaDocument87 pagesEvaluation of Cotton Textile Supply Chain Programme and Potential For Scale-Up in Hyderabad, IndiaOxfamNo ratings yet

- ERP Sales & Mark by Poorva Sagar MahuriDocument18 pagesERP Sales & Mark by Poorva Sagar MahuriMahuri KesharwaniNo ratings yet

- Class 7 Maths Chapter 8 Revision NotesDocument2 pagesClass 7 Maths Chapter 8 Revision NotesNAMANNo ratings yet

- GD TopicDocument2 pagesGD TopicrohitNo ratings yet