Professional Documents

Culture Documents

1.0 Inventories Exercise 4.0

Uploaded by

Elmer, Jr. LimbauanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1.0 Inventories Exercise 4.0

Uploaded by

Elmer, Jr. LimbauanCopyright:

Available Formats

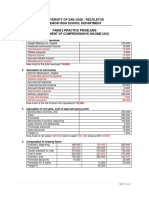

ACC 151

EXERCISE - INVENTORIES

PROBLEM 1

Your Song Company uses the FIFO retail method of inventory valuation.

The following information is available:

@Cost @Retail

Beginning Inventory P145,000.00 P160,000.00

Purchases (net) 283,920.00 420,800.00

Additional markups 25,200.00

Mark up cancellations 9,200.00

Markdowns 38,100.00

Markdown cancellations 6,900.00

Sales revenue 450,000.00

Sales returns 15,200.00

Sales discounts 3,800.00

What would be the estimated cost of ending inventory using:

1. Conventional/Conservative Method

2. Average Method

3. FIFO- Conventional Method

4. FIFO – Average

PROBLEM 2

The retail inventory method is used by FILAY Company. The records of inventory, purchases, and sales

for the year 2022 are given below:

@Cost @Retail

Beginning Inventory P185,700.00 P202,000.00

Purchases 339,380.00 458,000.00

Purchase Allowance 11,000.00

Freight In 7,300.00

Departmental Transfer in 2,000.00 3,000.00

Additional Markups 12,000.00

Markup cancellations 2,500.00

Inventory Shortage 7,000.00

Sales (including sales of 374,000.00

P4,500 which were

marked down from

P6,000)

1. Compute the cost of the ending inventory using:

a. Average retail method

b. FIFO retail method

2. Compute the cost of goods sold under the:

a. Average retail method

b. FIFO retail method

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- The Valuation of Digital Intangibles: Technology, Marketing and InternetFrom EverandThe Valuation of Digital Intangibles: Technology, Marketing and InternetNo ratings yet

- Retail Inventory MethodDocument2 pagesRetail Inventory Methodpcdesktop.brarNo ratings yet

- Inventory EstimationDocument2 pagesInventory EstimationFiona MoralesNo ratings yet

- Problem 1Document3 pagesProblem 1Cinderella Ladyong0% (2)

- Cpa Review School of The Philippines Mani LaDocument2 pagesCpa Review School of The Philippines Mani LaJustine CruzNo ratings yet

- Inventory Problems (Continuation)Document5 pagesInventory Problems (Continuation)Eleina Bea BernardoNo ratings yet

- 08.12.2017 Activity - Acfunda LabDocument2 pages08.12.2017 Activity - Acfunda LabPatOcampoNo ratings yet

- Cpa Review School of The Philippines Mani LaDocument2 pagesCpa Review School of The Philippines Mani LaGuinevereNo ratings yet

- 8 Inventory EstimationDocument3 pages8 Inventory EstimationJorufel PapasinNo ratings yet

- Chapter 33 - Retail Method: Problem 33-1 (AICPA Adopted)Document15 pagesChapter 33 - Retail Method: Problem 33-1 (AICPA Adopted)Kimberly Claire Atienza83% (6)

- Chapter 34Document7 pagesChapter 34loise0% (1)

- Problems - Inventory Estimation: Retail Inventory MethodDocument13 pagesProblems - Inventory Estimation: Retail Inventory MethodKez MaxNo ratings yet

- 8-Inventory EstimationDocument5 pages8-Inventory EstimationYulrir Alesteyr HiroshiNo ratings yet

- Activity - RIMDocument1 pageActivity - RIMRoi PeñalesNo ratings yet

- Inventory EstimationDocument11 pagesInventory EstimationTrace ReyesNo ratings yet

- Retail Method and Biological AssetDocument3 pagesRetail Method and Biological AssetLuiNo ratings yet

- Income Statement & Closing Entries ProblemDocument1 pageIncome Statement & Closing Entries ProblemLiwliwa BrunoNo ratings yet

- 4 Gross and Profit Method Retail Inventory MethodDocument6 pages4 Gross and Profit Method Retail Inventory MethodSilverly Batisla-ongNo ratings yet

- Madamot Company Year 2022 (End) Year 2021 (Beg)Document11 pagesMadamot Company Year 2022 (End) Year 2021 (Beg)VonDrei MedinaNo ratings yet

- INVENTORY PROBLEMS AND CONCEPTS QUE and ANSDocument11 pagesINVENTORY PROBLEMS AND CONCEPTS QUE and ANSMALICDEM, CharizNo ratings yet

- Inventory - GP and Retail MethodDocument2 pagesInventory - GP and Retail MethodFlorimar LagdaNo ratings yet

- Gross Profit and Retail MethodDocument2 pagesGross Profit and Retail MethodMary Dale Joie BocalaNo ratings yet

- Gross Profit and Retail MethodDocument2 pagesGross Profit and Retail MethodMary Dale Joie Bocala0% (1)

- Retail Method: Problem 20-1 (AICPA Adapted)Document9 pagesRetail Method: Problem 20-1 (AICPA Adapted)Anne EstrellaNo ratings yet

- AC - IntAcctg1 Quiz 2 Solution GuideDocument6 pagesAC - IntAcctg1 Quiz 2 Solution Guidejohn hellNo ratings yet

- Proforma Retail Inventory With Solutions To Given Activities and Book Problems Cont..Document6 pagesProforma Retail Inventory With Solutions To Given Activities and Book Problems Cont..Kelsey VersaceNo ratings yet

- Problem 1Document6 pagesProblem 1Elle VernezNo ratings yet

- Estimates of Inventory - Gross Profit Method and Retail Inventory MethodDocument4 pagesEstimates of Inventory - Gross Profit Method and Retail Inventory MethodMiru YuNo ratings yet

- HO 11 - Inventory EstimationDocument4 pagesHO 11 - Inventory EstimationMakoy BixenmanNo ratings yet

- VALLEJOS-ACCTG 301-Retail Inventoy Method-Hand OutDocument5 pagesVALLEJOS-ACCTG 301-Retail Inventoy Method-Hand OutEllah RahNo ratings yet

- 08 - Inventory EstimationDocument2 pages08 - Inventory EstimationROMAR A. PIGANo ratings yet

- 08 - Inventory EstimationDocument2 pages08 - Inventory EstimationROMAR A. PIGANo ratings yet

- Long Quiz 2Document3 pagesLong Quiz 2Carlos VillanuevaNo ratings yet

- Managerial Accounting - Final Project - Yahya Patanwala.12028Document4 pagesManagerial Accounting - Final Project - Yahya Patanwala.12028Yahya SaifuddinNo ratings yet

- 4 2 Endless Company PDFDocument3 pages4 2 Endless Company PDFJulius Mark Carinhay TolitolNo ratings yet

- Cost of Goods Sold WorksheetDocument4 pagesCost of Goods Sold Worksheetbutch listangco100% (1)

- Review of Financial Accounting Theory and PracticeDocument2 pagesReview of Financial Accounting Theory and PracticeMary Jullianne Caile SalcedoNo ratings yet

- XDocument2 pagesXjaymark canayaNo ratings yet

- Review of Financial Accounting Theory and PracticeDocument2 pagesReview of Financial Accounting Theory and PracticeMary Jullianne Caile SalcedoNo ratings yet

- ABANILLA, LORRAINE JOY M. - INTACC & 075 - Activity 1 (A01) - Overview of Inventories 3.0Document4 pagesABANILLA, LORRAINE JOY M. - INTACC & 075 - Activity 1 (A01) - Overview of Inventories 3.0Lorraine Joy AbanillaNo ratings yet

- True or False: Accounting 205 - Quiz 1Document3 pagesTrue or False: Accounting 205 - Quiz 1CHENGNo ratings yet

- DAIBB MA Math Solutions 290315Document11 pagesDAIBB MA Math Solutions 290315joyNo ratings yet

- Mdoukle 3Document2 pagesMdoukle 3Mina MyouiNo ratings yet

- AccountingDocument5 pagesAccountingMarinie CabagbagNo ratings yet

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- Inventory - Bio Asset - PPEDocument4 pagesInventory - Bio Asset - PPEPamela Joy AlvarezNo ratings yet

- 37 - Income StatementDocument2 pages37 - Income StatementROMAR A. PIGANo ratings yet

- Acctg110 FinalsDocument21 pagesAcctg110 FinalsRoman Dominic LlanoNo ratings yet

- Chapter 8 Inventory EstimationDocument5 pagesChapter 8 Inventory EstimationJharam TolentinoNo ratings yet

- DocumentDocument4 pagesDocumentJuliana ZamorasNo ratings yet

- DocumentDocument4 pagesDocumentJuliana ZamorasNo ratings yet

- Assignment InventoriesDocument7 pagesAssignment InventoriesKristine TiuNo ratings yet

- Exercises Exercise 1 (Periodic) Cramer Company Uses Periodic Inventory Procedure. DetermineDocument9 pagesExercises Exercise 1 (Periodic) Cramer Company Uses Periodic Inventory Procedure. DetermineAllie LinNo ratings yet

- Correct Amount of Inventory 677,500Document8 pagesCorrect Amount of Inventory 677,500Maria Kathreena Andrea AdevaNo ratings yet

- ACTBFAR - Group Practice SetDocument3 pagesACTBFAR - Group Practice SetElle KongNo ratings yet

- Income Statement - ProblemsDocument4 pagesIncome Statement - ProblemsKatlene JoyNo ratings yet

- Chapter 9 - Presentation of Fs (Statement of Comprehensive Income)Document2 pagesChapter 9 - Presentation of Fs (Statement of Comprehensive Income)Mark IlanoNo ratings yet

- Ia 450 455Document6 pagesIa 450 455Christine HingcoNo ratings yet