Professional Documents

Culture Documents

Deductions Quiz 2 - U2-P1

Deductions Quiz 2 - U2-P1

Uploaded by

Angel Jamiana0 ratings0% found this document useful (0 votes)

3 views1 pageSalaries, wages, bonuses, and benefits for employees totaled $13.3 million for the year ended December 31, 20A1. Of this amount, $13.3 million qualifies as deductible business expenses according to tax law. Special bonuses from 20A0 of $200,000 and facilitation fees of $300,000 do not qualify as deductible expenses. The total deductible business expenses are $13.3 million and non-deductible expenses are $3,000,000.

Original Description:

Deductions review

Original Title

DEDUCTIONS QUIZ 2 - U2-P1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSalaries, wages, bonuses, and benefits for employees totaled $13.3 million for the year ended December 31, 20A1. Of this amount, $13.3 million qualifies as deductible business expenses according to tax law. Special bonuses from 20A0 of $200,000 and facilitation fees of $300,000 do not qualify as deductible expenses. The total deductible business expenses are $13.3 million and non-deductible expenses are $3,000,000.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageDeductions Quiz 2 - U2-P1

Deductions Quiz 2 - U2-P1

Uploaded by

Angel JamianaSalaries, wages, bonuses, and benefits for employees totaled $13.3 million for the year ended December 31, 20A1. Of this amount, $13.3 million qualifies as deductible business expenses according to tax law. Special bonuses from 20A0 of $200,000 and facilitation fees of $300,000 do not qualify as deductible expenses. The total deductible business expenses are $13.3 million and non-deductible expenses are $3,000,000.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

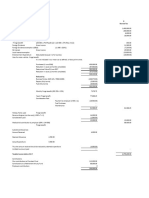

REQUIREMENT: DETERMINE THE AMOUNT OF DEDUCTIBLE BUSINESS EXPENSE FOR THE YEAR ENDED

DECEMBER 31, 20A1

GAAP expenses Deductible Non-deductible

Salaries and wages 5,000,000 5,000,000

Special bonuses 2,000,000 2,000,000

Special bonuses April 1, 20A1 2,600,000 2,600,000

Regular bonuses (14th month pay) 3,000,000 3,000,000

Regular bonuses 20A0 1,200,000 200,000

Other employee benefits

De minimis benefits 2,000,000 1,500,000 500,000

Other benefits 1,200,000 1,200,000

Facilitation fees 300,000 300,000

Total 13,300,000 3,000,000

NOTES

Requisites for deductibility

- must be ordinary and necessary

- paid or incurred during the taxable year

- connected with trade, business or practice of profession

- supported by sufficient evidence

- not against the law, morals, public policy or public order

- it must have been subjected to withholding tax if applicable

Things to remember

- accrued at year that was asked; deductible

- de minimis benefits are not required to be subjected to withholding tax

- when there is excess of the threshold of de minimis, it should be

subjected to withholding tax for it to be deductible

- facilitation fees are illegal

- taxpayer cannot control what can be deducted

You might also like

- IRS Form 1040es 2016Document12 pagesIRS Form 1040es 2016Freeman Lawyer100% (1)

- Colon JuniorDocument36 pagesColon JuniorVicmali Papeleria Ciber50% (2)

- w2 FINALDocument10 pagesw2 FINALmuhammad mudassarNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Im503357011 505022613Document2 pagesIm503357011 505022613Pushpendra Singh SisodiaNo ratings yet

- June 2014Document1 pageJune 2014Deepak GuptaNo ratings yet

- Enter Your Data: The Business Plan Will Appear in The Next SheetDocument13 pagesEnter Your Data: The Business Plan Will Appear in The Next SheetPrakash DuttaNo ratings yet

- Taxation in The Philippines: Readings in Philippine HistoryDocument23 pagesTaxation in The Philippines: Readings in Philippine HistoryBJ AmbatNo ratings yet

- INCOME TAXATION - Fringe Benefit TaxDocument7 pagesINCOME TAXATION - Fringe Benefit TaxErlle AvllnsaNo ratings yet

- Solution Test TAX467 Mac 2019 BengkelDocument6 pagesSolution Test TAX467 Mac 2019 BengkelnurathirahNo ratings yet

- Electric Bill Aug.2022Document1 pageElectric Bill Aug.2022usserrNo ratings yet

- Chapter-21 (Solved Past Papers of CA Mod CDocument67 pagesChapter-21 (Solved Past Papers of CA Mod CJer Rama100% (4)

- St. Luke's Medical Center Vs CIR G.R. No. 203514: Sec 22 To 30Document1 pageSt. Luke's Medical Center Vs CIR G.R. No. 203514: Sec 22 To 30Anonymous MikI28PkJcNo ratings yet

- Invoice: Vitali Engineering SARLDocument1 pageInvoice: Vitali Engineering SARLIBNproductionNo ratings yet

- mgt101 Questions With AnswersDocument11 pagesmgt101 Questions With AnswersKinza LaiqatNo ratings yet

- MGT 101Document13 pagesMGT 101MuzzamilNo ratings yet

- Activity 1Document4 pagesActivity 1Louisa de VeraNo ratings yet

- Fabm2 Learning-Activity-2Document5 pagesFabm2 Learning-Activity-2Cha Eun WooNo ratings yet

- LEARNING KIT Accounting2 Week 3Document4 pagesLEARNING KIT Accounting2 Week 3Asahi HamadaNo ratings yet

- FDNACCT Unit 3 - Financial Statements - ExampleDocument2 pagesFDNACCT Unit 3 - Financial Statements - ExampleerinlomioNo ratings yet

- Intermediate Nov 2019 b4Document24 pagesIntermediate Nov 2019 b4georginageorge254No ratings yet

- ANSWER KEY Quiz On Tax On Compensation PDFDocument6 pagesANSWER KEY Quiz On Tax On Compensation PDFMeg CruzNo ratings yet

- Fabm 1 Las April 082024Document12 pagesFabm 1 Las April 082024gwynethpolia11No ratings yet

- T10 Ans 3Document2 pagesT10 Ans 3PUI TUNG CHONGNo ratings yet

- Computation of Business IncomeDocument9 pagesComputation of Business IncomeSuseela PNo ratings yet

- Assessment of Companies (Solution) : Solution 1 M/s John Morris IncDocument8 pagesAssessment of Companies (Solution) : Solution 1 M/s John Morris IncIQBALNo ratings yet

- Teodoro M. Luansing College of Rosario: Accounts Dr. CRDocument8 pagesTeodoro M. Luansing College of Rosario: Accounts Dr. CRSamantha Alice LysanderNo ratings yet

- Fa2 Module234Document20 pagesFa2 Module234Yanna100% (1)

- 02 Edu91 FM Practice Sheets QuestionsDocument77 pages02 Edu91 FM Practice Sheets Questionsprince soniNo ratings yet

- FS - LandscapeDocument9 pagesFS - LandscapeMekay OcasionesNo ratings yet

- Income TaxDocument21 pagesIncome TaxKhalid Aziz50% (2)

- Corporate Accounting - II (Solutions)Document107 pagesCorporate Accounting - II (Solutions)Leo JacobNo ratings yet

- Audit of FS QuizDocument3 pagesAudit of FS QuizGwyneth TorrefloresNo ratings yet

- Profit & Loss Praktikum SoftwareDocument1 pageProfit & Loss Praktikum SoftwareTry ElisaNo ratings yet

- Tax On CompensationDocument26 pagesTax On Compensationtyrone inocenteNo ratings yet

- Solved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)Document45 pagesSolved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)muneeb razaNo ratings yet

- Add: Depreciation As Per Books: © The Institute of Chartered Accountants of IndiaDocument15 pagesAdd: Depreciation As Per Books: © The Institute of Chartered Accountants of IndiaShubham KumarNo ratings yet

- Single Step Income StatementDocument1 pageSingle Step Income StatementAnne Christine Dela CruzNo ratings yet

- Tax 3702 Assignment 2Document3 pagesTax 3702 Assignment 2ngoloyintomboxoloNo ratings yet

- Laba/Rugi (Standar) : Dari 01 May 2019 Ke 31 May 2019Document1 pageLaba/Rugi (Standar) : Dari 01 May 2019 Ke 31 May 2019septherineNo ratings yet

- Uas - Laba Rugi - Mohammad Rafly Tri Rizky - 023001905005Document1 pageUas - Laba Rugi - Mohammad Rafly Tri Rizky - 023001905005raflyNo ratings yet

- J. P. Peralta Computer Clinic Worksheet For The Month Ended December 31, 2020Document2 pagesJ. P. Peralta Computer Clinic Worksheet For The Month Ended December 31, 2020Minjin lesner ManalansanNo ratings yet

- Examples Salary 2019Document18 pagesExamples Salary 2019Asma ZeeshanNo ratings yet

- TAXN 1016 FE - Long ProblemsDocument11 pagesTAXN 1016 FE - Long ProblemsCrystel Kate MananganNo ratings yet

- Sample Test (Extract)Document6 pagesSample Test (Extract)Julie KimNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- Laporan Laba RugiDocument1 pageLaporan Laba RugiaccpackmlbbNo ratings yet

- Worksheet - ABC Marketing AgencyDocument6 pagesWorksheet - ABC Marketing AgencyZymcel Ann VidallonNo ratings yet

- Term Test - 1Document7 pagesTerm Test - 1Abdullah Farooqi50% (2)

- Profit Prior To IncorporationDocument12 pagesProfit Prior To IncorporationKalash SharmaNo ratings yet

- Worksheet J. P. Peralta Computer ClinicDocument2 pagesWorksheet J. P. Peralta Computer ClinicMinjin lesner ManalansanNo ratings yet

- Bharat Chemicals Ltd. CPHi46l2eHDocument2 pagesBharat Chemicals Ltd. CPHi46l2eHChickooNo ratings yet

- Ia Forcadela Part IIIDocument5 pagesIa Forcadela Part IIIMary Joanne forcadelaNo ratings yet

- ULOa Let's Analyze Week 8 9Document2 pagesULOa Let's Analyze Week 8 9emem resuentoNo ratings yet

- Itemized Deduction Vs Optional Standard Deductions 40OSDDocument4 pagesItemized Deduction Vs Optional Standard Deductions 40OSDjason genitaNo ratings yet

- Activity 6: Paramount ServicesDocument5 pagesActivity 6: Paramount ServicesDJazel TolentinoNo ratings yet

- Quali Review Statement of Cash Flows Complete SolutionDocument5 pagesQuali Review Statement of Cash Flows Complete SolutionPaul Ivan CabanatanNo ratings yet

- MGSODocument4 pagesMGSOSum WhosinNo ratings yet

- Rs. RS.: Compass Company Balance Sheet, March 31Document2 pagesRs. RS.: Compass Company Balance Sheet, March 31aditi4garg-10% (1)

- Unit 12-Question 12-A Sol (2023)Document3 pagesUnit 12-Question 12-A Sol (2023)shirleygebenga020829No ratings yet

- Practice Problem SolutionDocument15 pagesPractice Problem SolutionTherese Noelle R. ARMADA100% (1)

- Laporan Laba Rugi - Cybertron - Agha Nur Sabri ADocument1 pageLaporan Laba Rugi - Cybertron - Agha Nur Sabri AaghaarekbasNo ratings yet

- Laporan Laba Rugi - CybertronDocument1 pageLaporan Laba Rugi - CybertronaghaarekbasNo ratings yet

- For The Year Ended December 31, 2020: Rcs Consultancy CorporationDocument11 pagesFor The Year Ended December 31, 2020: Rcs Consultancy CorporationYzzabel Denise L. TolentinoNo ratings yet

- Excel Inc Tax 1Document1 pageExcel Inc Tax 1Lysss EpssssNo ratings yet

- Karkits Corporation Excel Copy PasteDocument2 pagesKarkits Corporation Excel Copy PasteCoke Aidenry SaludoNo ratings yet

- Capital AllowancesDocument106 pagesCapital AllowancesAwaiZ zahidNo ratings yet

- Quiz 1.01 Financial Statements To Interim ReportingDocument22 pagesQuiz 1.01 Financial Statements To Interim ReportingJohn Lexter MacalberNo ratings yet

- BUSN AssigmentDocument4 pagesBUSN AssigmentMalik Khurram AwanNo ratings yet

- Activity On Gross Income and Allowable DeductionsDocument2 pagesActivity On Gross Income and Allowable DeductionsAkawnting MaterialsNo ratings yet

- ACYMAG2 NotesDocument60 pagesACYMAG2 NotesAngel JamianaNo ratings yet

- If The World Were 100 PeopleDocument3 pagesIf The World Were 100 PeopleAngel JamianaNo ratings yet

- Group Case 3Document8 pagesGroup Case 3Angel JamianaNo ratings yet

- DEDUCTIONSDocument2 pagesDEDUCTIONSAngel JamianaNo ratings yet

- Unitel Vs CirDocument2 pagesUnitel Vs Cirian ballartaNo ratings yet

- Pension CalculationDocument1 pagePension Calculationulmilu15No ratings yet

- Bills Material PurchaseDocument2 pagesBills Material PurchaseChanchal PathakNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearBiju KumarNo ratings yet

- Irish Heritage Center BrochureDocument2 pagesIrish Heritage Center BrochureBradDubanNo ratings yet

- Claim For Refund and Request For AbatementDocument1 pageClaim For Refund and Request For AbatementIRSNo ratings yet

- Section 43 of GST - Matching, Reversal and Reclaim of ReductionDocument5 pagesSection 43 of GST - Matching, Reversal and Reclaim of ReductionNavyaNo ratings yet

- U.S. Individual Income Tax Return: (See Instructions.)Document2 pagesU.S. Individual Income Tax Return: (See Instructions.)Daniel RamirezNo ratings yet

- Sudarshan Herb & Health Care: Tax InvoiceDocument1 pageSudarshan Herb & Health Care: Tax InvoiceShreeshyam BabaNo ratings yet

- Aug'18Document1 pageAug'18shakeel aftab100% (1)

- 1ccounting VoucherDocument3 pages1ccounting VoucherSuhas TopkarNo ratings yet

- GSTR3B 09humps0863q1zf 072023Document3 pagesGSTR3B 09humps0863q1zf 072023mahtab begNo ratings yet

- Invoice Books 3Document1 pageInvoice Books 3SagarNo ratings yet

- Brokerage Account Xxx9881 Consolidated Form 1099 2023Document10 pagesBrokerage Account Xxx9881 Consolidated Form 1099 2023gabriela.paradaNo ratings yet

- Invoice, Phil Girgenti, Jr. 5808 St. Jean, 11-3-09Document1 pageInvoice, Phil Girgenti, Jr. 5808 St. Jean, 11-3-09smill015973No ratings yet

- Direct Sales Office Hindustan Petroleum Corporation LimitedDocument1 pageDirect Sales Office Hindustan Petroleum Corporation Limitedmc3lawrinNo ratings yet

- Train Law-Wps OfficeDocument4 pagesTrain Law-Wps OfficeAdam Ross Toledo BrionesNo ratings yet

- Tax Invoice: Ramoji Film City, Hyderabad Gstin/Uin: 36AAACU2690P1ZS State Name: Telangana, Code: 36Document1 pageTax Invoice: Ramoji Film City, Hyderabad Gstin/Uin: 36AAACU2690P1ZS State Name: Telangana, Code: 36JKV APPA RAONo ratings yet

- Fish Farming Project Proposal in PNGDocument1 pageFish Farming Project Proposal in PNGWillie PayneNo ratings yet

- Invoice CVIU 1 13969 2023-03-31Document1 pageInvoice CVIU 1 13969 2023-03-31kanika jainNo ratings yet