Professional Documents

Culture Documents

Auditing & Professional Ethics & Values - Paper 12

Uploaded by

Jacob Baraka OngengOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Auditing & Professional Ethics & Values - Paper 12

Uploaded by

Jacob Baraka OngengCopyright:

Available Formats

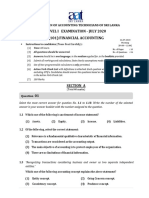

THE PUBLIC ACCOUNTANTS EXAMINATIONS BOARD

A Committee of the Council of ICPAU

CPA (U) EXAMINATIONS

LEVEL TWO

AUDITING & PROFESSIONAL ETHICS & VALUES – PAPER 12

THURSDAY 23 AUGUST, 2018

INSTRUCTIONS TO CANDIDATES:

1. Time allowed: 3 hours 15 minutes.

The first 15 minutes of this examination have been designated for reading

time. You may not start to write your answer during this time.

2. Section A has one compulsory case study question carrying 30 marks.

3. Section B has four questions and only three are to be attempted. Each

question carries 20 marks.

4. SectionC has two questions and only one is to be attempted.

Eachquestion carries 10 marks.

5. Write your answer to each question on a fresh page in your answer

booklet.

6. Please, read further instructions on the answer booklet, before attempting

any question.

2018 Public Accountants Examinations Board

Auditing & Professional Ethics & Values – Paper 12

SECTION A

This section has one compulsory question to be attempted

Question 1

Wired Telecom Limited (WTL) is a telecom service provider that deals in offering

call services, mobile money, airtime, phones and related accessories. Your firm,

PMG & Co. is the auditor of WTL for the year ended 30 June, 2018.

The telecommunication sector is growing rapidly and more services are on

demand by customers. Previously, it was just calls and airtime but now banking

services are the next service on demand. Client bank accounts are now linked to

telecom numbers. Clients are able to transact with banks using their phones and

vice versa. WTL has been forced to expand rapidly to match the competitors.

The sector is also highly regulated by Uganda Communications Commission

(UCC). It is now in the spotlight like never before. WTL has to file reports with

the regulator on a monthly basis, and as and when required.

There are new taxes to be collected by WTL on behalf of government. They are

in the budget for the financial year 2018/2019. Uganda Revenue Authority

requires that these taxes are remitted on time and without fail.

The International Accounting Standard Board (IASB) has issued new accounting

standards. IFRS 15: Revenue from contracts with customers and IFRS 16: Leases

are just some of the new standards. These are key standards to WTL operations.

WTL borrowed Shs 50 billion from off-shore banks and local banks to meet the

increasing demand for both physical and software infrastructure developments

throughout the country.

There are press reports that telecom companies have been under declaring their

revenue to the Uganda Revenue Authority hence paying less tax as required by

the Income Tax Act. WTL attributes this to weak software controls and an effort

will be made to upgrade the controls.

WTL’s inventory includes airtime cards, phone handsets, and data/internet

equipment. Airtime cards are now becoming obsolete as customers now prefer to

buy airtime online using mobile money. WTL has large amounts of inventory in

form of airtime cards.PMG & Co. will be required to attend the inventory count

scheduled for the week starting 1 July, 2018.

23August, 2018 Page 2 of 7

Auditing & Professional Ethics & Values – Paper 12

Required:

(a) Explain the business risks facing WTL. (6 marks)

(b) Suggest the interventions that can be undertaken to mitigate the risks in

(a) above.

(6 marks)

(c) Advise WTL on the effective software controls that can be put in place.

(8 marks)

(d) Describe the procedures PMG & Co. should carry out before the inventory

count at WTL.

(10 marks)

(Total 30 marks)

SECTION B

Attempt three of the four questions in this section

Question 2

BTS & Co., where you work as an audit senior is the auditor for Traders Saving

Association Limited (TSAL) for the year ended 30 June 2018. TSAL is a registered

Savings and Cooperative Society (SACCO) with over 1,000 members. BTS & Co.

has been auditing TSAL for the last 3 years. They gave a “Qualified opinion

except for” for the first two years. In 2017, they gave an “Unqualified audit

opinion”. The members have expressed concern about the change of audit

opinion and desire to know why this is the case.

TSAL members have also expressed their concern why the auditors have never

communicated to them throughout their three years of audit of TSAL. ISA 260,

however, requires that the auditor determines the appropriate persons within the

organisation governance structure with whom to report relevant audit matters

concerning the organisation. BTS & Co. is, therefore, under no obligation to

communicate with all the members of TSAL. However being a socially

responsive audit which serves public interest, BTS & Co is considering a response

to concerns raised by TSAL members.

Required:

Prepare briefing notes to TSAL members:

(a) explaining the circumstances under which BTS & Co. may issue:

(i) Unqualified audit opinion. (6 marks)

(ii) Qualified opinion-except for. (6 marks)

(b) explaining the objectives the auditor seeks to achieve in determining the

appropriate persons within TSAL to communicate to during an audit.

(8 marks)

(Total 20 marks)

23August, 2018 Page 3 of 7

Auditing & Professional Ethics & Values – Paper 12

Question 3

In 2017, Uganda Revenue Authority (URA) in partnership with Uganda

Registration Services Bureau (URSB) and Kampala Capital City Authority (KCCA)

commenced a joint field operation within Kampala under the Taxpayer Register

Expansion Project (TREP). This operation was in response to the Uganda Bureau

of Statistics (UBS) report which indicated that Uganda’s informal sector

contributes at least 50 per cent of the country’s Gross Domestic Product (GDP)

but pays less than 20% in taxes.

This prompted URA to organize a tax clinic for Kikuubo tradersto sensitize them

about the benefits of formal business registration, their rights and obligations

with regard to payment of income taxes and trading licenses. The exercise was

seen as a move to improve value and ethics in business while reducing on the

unethical business practices amongst traders in Uganda. While addressing

traders, one of the representatives from URA, CPA John Musisi said “…..tax

compliance helps government raise revenue to meet huge public expenditure for

infrastructure and public services thus creating a favourable business

environment.”

The proprietorof Mapeera Enterprises has approached you to enlighten him on

several business ethical issues talked about at the tax clinic.

Required:

(a) Prepare briefing notes:

(i) explainingto the proprietor of Mapeera Enterprisesthe meaning of

the phrase “Value and Ethics in Business’’.

(2 marks)

(ii) describing the unethical business practices exhibited by traders in

Uganda. (4 marks)

(b) (i) Explainto Kikuubo traders the benefits of adhering to business

ethics. (6 marks)

(ii) Discuss the different myths about business ethics that Kikuubo

traders would encounter when trying to adhere.

(8 marks)

(Total 20 marks)

23August, 2018 Page 4 of 7

Auditing & Professional Ethics & Values – Paper 12

Question 4

Ms. Teddy Nunda is a new employee in the Finance & Accounts department of

VMC Electronics Limited, a company that deals in the sale of TVs and radios.

Teddy is an Accounts Assistant on probation. For the last three weeks, she has

had work related stress suspecting her immediate supervisor to be stealing funds

from the company. This suspicion arose after getting a variance between the

cashbook balance and the bank balance for last three consecutive months

whenever she prepared a bank reconciliation statement. The supervisor is on a

sick leave.

She wants to disclose the impropriety but fears to be victimised and still the

directors may fail to take action. She also fears making false disclosures.Besides,

her confirmation on the job depends on the supervisor’s recommendations. She

has discussed the matter with her former lecturer of Business Ethics and advised

her that this amounts to void employment contracts as per the Whistleblowers

Protection Act 2010.

Required:

Using the provisions of the Whistleblowers Protection Act 2010:

(a) Describethe:

(i) circumstances under which an employee is considered to be

victimised.

(4 marks)

(ii) steps to be taken to seek redress, if victimised.

(2 marks)

(b) Explainto Teddy the:

(i) details sheshould include in the disclosure of the impropriety.

(6 marks)

(ii) consequences of making false disclosures.

(2 marks)

(iii) consequences of failure to take action on the impropriety disclosed.

(2 marks)

(c) Identify the indicators of void employment contracts at workplace like VMC

Electronics Limited.

(4 marks)

(Total 20 marks)

23August, 2018 Page 5 of 7

Auditing & Professional Ethics & Values – Paper 12

Question 5

The King Report on Corporate Governance is a ground-breaking guide for the

governance structures and operation of companies in the world today. It was

issued by the King Committee on Corporate Governance. Four reports were

issued in 1994 (King I), 2002 (King II), 2009 (King III) and 2016/2017 (King IV).

The King Report has been cited as "the most effective summary of the best

international practices in corporate governance". Arguments have been

forwarded that in the wake of financial crisis; it is now common practice to

separate the roles of Chairman of the Board and CEO.

Required:

(a) With reference to King III report on corporate governance, discuss the

principles of:

(i) Ethical leadership and corporate citizenship. (3 marks)

(ii) Accountability. (2 marks)

(iii) Governing stakeholder relationships. (4 marks)

(iv) Integrated reporting and disclosure. (3 marks)

(b) Discuss the validity of the view that calls to separate the Chairman of the

Board and CEO roles in corporations.

(8 marks)

(Total 20 marks)

SECTION C

Attempt one of the two questions in this section

Question 6

Being an entrepreneur comes with many challenges and the biggest one is how

to make the business grow. Businesses can either grow organically or externally.

As the firm grows, it will be required to withhold taxes to the government and

one of the requirements for determining tax liability is the need for financial

statements.

Required:

(a) Explain the different ways through which a business can grow.

(5 marks)

(b) Describe the different users of accounting information.

(5 marks)

(Total 10 marks)

23August, 2018 Page 6 of 7

Auditing & Professional Ethics & Values – Paper 12

Queston 7

JKL Sports sells customized T-shirts, caps and shoes. The owner of the company

could not believe what he was seeing on his computer when he discovered, a

website that was a duplicate of his site DesignAshirt.com. This confirmed that his

intellectual property, such as graphics and images, had been stolen. Despite all

this, the business was growing steadily and this created a large appetite for

cash. With financial resources stretched, the firm is more vulnerable to

unexpected expenses and uncertainties. JKL Sports has been advised to manage

the financial resources effectively to minimize the challenges of business growth.

Required:

(a) (i) Define the term “intellectual property”.

(1 mark)

(ii) Explain the forms of protection a business like JKL Sports can use to

protect its intellectual property.

(4 marks)

(b) Explain how an entrepreneur can manage the financial resources as the

business grows.

(5marks)

(Total 10 marks)

23August, 2018 Page 7 of 7

You might also like

- May 2020 AA1 QuestionsDocument6 pagesMay 2020 AA1 QuestionsSarah RanduNo ratings yet

- NMIMS 2019 SeptemberDocument5 pagesNMIMS 2019 SeptemberRajni KumariNo ratings yet

- January 2020 AA2 QuestionsDocument8 pagesJanuary 2020 AA2 QuestionsSarah RanduNo ratings yet

- ADVANCED AUDIT ASSURANCE PAPER 3 2 May2018-1Document22 pagesADVANCED AUDIT ASSURANCE PAPER 3 2 May2018-1Prof. OBESENo ratings yet

- Paper 10 Financial ManagementDocument10 pagesPaper 10 Financial ManagementJoseph OsakoNo ratings yet

- Auditing Theory Par4Document8 pagesAuditing Theory Par4Taehyungiiee KimNo ratings yet

- 304.AUDP - .L III December 2020Document3 pages304.AUDP - .L III December 2020Md Joinal AbedinNo ratings yet

- 2019 AIC22A2 Test 1Document10 pages2019 AIC22A2 Test 1kdmd.wwNo ratings yet

- 5 6172620504097096522Document6 pages5 6172620504097096522Pushpinder KumarNo ratings yet

- Acct1511 2013s2c2 Handout 2 PDFDocument19 pagesAcct1511 2013s2c2 Handout 2 PDFcelopurpleNo ratings yet

- Great Zimbabwe University Faculty of CommerceDocument5 pagesGreat Zimbabwe University Faculty of CommerceTawanda Tatenda HerbertNo ratings yet

- SME IIT Jodhpur ExamDocument15 pagesSME IIT Jodhpur ExamJatin yadavNo ratings yet

- May 2021 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeDocument19 pagesMay 2021 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeVonnieNo ratings yet

- Auditing June 2011 ExamDocument8 pagesAuditing June 2011 ExammohedNo ratings yet

- Mock Set C Paper 1BDocument3 pagesMock Set C Paper 1BMax KwokNo ratings yet

- AAT Past PaperDocument8 pagesAAT Past PaperMashi RetrieverNo ratings yet

- April 2022 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeDocument19 pagesApril 2022 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeVonnieNo ratings yet

- Auditing: Professional 1 Examination - April 2015Document17 pagesAuditing: Professional 1 Examination - April 2015Issa BoyNo ratings yet

- HI6026 Final Assessment T3 2021Document11 pagesHI6026 Final Assessment T3 2021adityapatnaik.022No ratings yet

- MML 5202Document6 pagesMML 5202MAKUENI PIGSNo ratings yet

- Advanced Taxation Novmock2019 PDFDocument13 pagesAdvanced Taxation Novmock2019 PDFAndy AsanteNo ratings yet

- Fca Aa Ican November 2023 Mock QuestionsDocument7 pagesFca Aa Ican November 2023 Mock QuestionsArogundade kamaldeenNo ratings yet

- Audit and Assurance (International) : Thursday 6 June 2013Document6 pagesAudit and Assurance (International) : Thursday 6 June 2013Asim NazirNo ratings yet

- 304.AUDP - .L III Question CMA June 2021 Exam.Document3 pages304.AUDP - .L III Question CMA June 2021 Exam.Md Joinal AbedinNo ratings yet

- 8508Document10 pages8508Danyal ChaudharyNo ratings yet

- 3 Business Finance12Document10 pages3 Business Finance12Abdullah al MahmudNo ratings yet

- Cuac 202 AssignmentssDocument18 pagesCuac 202 AssignmentssJoseph SimudzirayiNo ratings yet

- Public Sector Accounting & FinanceDocument21 pagesPublic Sector Accounting & Financeappiah ernestNo ratings yet

- PP 12 Bssiness Studies 2024Document24 pagesPP 12 Bssiness Studies 2024sourabhkumarrai7No ratings yet

- BST PQDocument11 pagesBST PQSakshi MauryaNo ratings yet

- Class 12 BST - PQDocument23 pagesClass 12 BST - PQvishishti sharmaNo ratings yet

- Audit and Assurance: Certificate in Accounting and Finance Stage ExaminationDocument3 pagesAudit and Assurance: Certificate in Accounting and Finance Stage ExaminationAdil AfridiNo ratings yet

- 2 Financial Accounting ReportingDocument5 pages2 Financial Accounting ReportingBizness Zenius HantNo ratings yet

- ACCA Fundamentals Level Paper F8 Audit and AssuranceDocument7 pagesACCA Fundamentals Level Paper F8 Audit and AssuranceEmon D' CostaNo ratings yet

- Pakistan: Time Allowed: 3 Hours Maximum Marks: 100 Roll No.Document2 pagesPakistan: Time Allowed: 3 Hours Maximum Marks: 100 Roll No.sohail merchantNo ratings yet

- Audit Assurance Paper 2.3 July 2023Document16 pagesAudit Assurance Paper 2.3 July 2023Godliving J LyimoNo ratings yet

- CSE August 2020Document15 pagesCSE August 2020tNo ratings yet

- MBA 325 - Accounting For Managers 2021 Paper ModratedDocument2 pagesMBA 325 - Accounting For Managers 2021 Paper ModratednavalojiniravindranNo ratings yet

- CA Final Audit Q MTP 2 Nov23 Castudynotes ComDocument12 pagesCA Final Audit Q MTP 2 Nov23 Castudynotes ComRajdeep GuptaNo ratings yet

- CMA Sample Questions and Answers 2020Document25 pagesCMA Sample Questions and Answers 2020LhenNo ratings yet

- Advanced Audit & Assurance PDFDocument17 pagesAdvanced Audit & Assurance PDFmohed100% (1)

- Advice: Non Deduction of Tax at SourceDocument5 pagesAdvice: Non Deduction of Tax at SourceSrikrishna DharNo ratings yet

- AuditingDocument8 pagesAuditingShahadath HossenNo ratings yet

- S2 Paper1 2000 Exam PDFDocument6 pagesS2 Paper1 2000 Exam PDFJeff GundyNo ratings yet

- Ethics QuestionsDocument4 pagesEthics QuestionsShwaibu Sella100% (1)

- Audit and Internal ReviewDocument6 pagesAudit and Internal ReviewkhengmaiNo ratings yet

- Test Aud 689 - Apr 2018Document3 pagesTest Aud 689 - Apr 2018Nur Dina AbsbNo ratings yet

- KVS Agra XI BST Annual Exam QP & MS 2019Document10 pagesKVS Agra XI BST Annual Exam QP & MS 2019Dhruv KaushikNo ratings yet

- BST Paper For Function of Management 2.0Document6 pagesBST Paper For Function of Management 2.0Ranjan RoyNo ratings yet

- Advanced Auditing and Prof Ethics PDFDocument8 pagesAdvanced Auditing and Prof Ethics PDFmohedNo ratings yet

- C2 Grande Finale Solving Nov 2023 - Set 2 (Questions)Document6 pagesC2 Grande Finale Solving Nov 2023 - Set 2 (Questions)Jones lubaNo ratings yet

- Tutorial Questions FMF June 2022 Tutorial 3 B - 6Document12 pagesTutorial Questions FMF June 2022 Tutorial 3 B - 6Clarinda LeeNo ratings yet

- Financial Accounting: Level I Examination - July 2020Document10 pagesFinancial Accounting: Level I Examination - July 2020jamespotheadNo ratings yet

- IM Dec 2003 QADocument12 pagesIM Dec 2003 QALweendo SikalumbaNo ratings yet

- Paper 12 Auditing & Professional Ethics & ValuesDocument7 pagesPaper 12 Auditing & Professional Ethics & ValuesJacob Baraka OngengNo ratings yet

- Subjects For Study in Intermediate (Integrated Professional Competence) CourseDocument15 pagesSubjects For Study in Intermediate (Integrated Professional Competence) CourseRamya SanthakumarNo ratings yet

- Management Decision & Control - Paper 11Document8 pagesManagement Decision & Control - Paper 11Jacob Baraka OngengNo ratings yet

- Mock+Exams AAA+RM+Questions+March+2019+FINALDocument12 pagesMock+Exams AAA+RM+Questions+March+2019+FINALJawad rahmanaccaNo ratings yet

- Model answer: Launching a new business in Networking for entrepreneursFrom EverandModel answer: Launching a new business in Networking for entrepreneursNo ratings yet

- Udp Solutions Guide PDFDocument998 pagesUdp Solutions Guide PDFTotezgzNo ratings yet

- Vehicle Scrapping PolicyDocument7 pagesVehicle Scrapping Policypranavraikar1No ratings yet

- Nexteer PPAP Process Checklist / Sign Off Sheet InstructionsDocument7 pagesNexteer PPAP Process Checklist / Sign Off Sheet Instructionscong daNo ratings yet

- Excel Latihan 7 & 9 Jovi AndreaDocument6 pagesExcel Latihan 7 & 9 Jovi AndreaJovi AndreaNo ratings yet

- AUTHORITY - LETTER - Airtel DLTDocument2 pagesAUTHORITY - LETTER - Airtel DLTSubodh JhaNo ratings yet

- Madiha Mahfooz MBA (Marketing) ResumeDocument1 pageMadiha Mahfooz MBA (Marketing) ResumeMadihaNo ratings yet

- VECV - FortiCare and RMA ServicesDocument10 pagesVECV - FortiCare and RMA ServicesLohit YadavNo ratings yet

- Risk AssesmentDocument47 pagesRisk AssesmentMohd ObaidullahNo ratings yet

- Fifteenth Edition: Managing KnowledgeDocument43 pagesFifteenth Edition: Managing KnowledgeaaafffNo ratings yet

- Yamaha Supply ChainDocument7 pagesYamaha Supply ChainkagneyNo ratings yet

- Top 100 Ib InterviewDocument44 pagesTop 100 Ib Interviewxz6ydhrzxcNo ratings yet

- Exp19 Excel Ch02 Cap Appliances InstructionsDocument2 pagesExp19 Excel Ch02 Cap Appliances Instructionsdylandumont1314No ratings yet

- Experience: ReferencesDocument2 pagesExperience: ReferencesBezawit HabtamuNo ratings yet

- Malavika Harita Short CV August 2022Document2 pagesMalavika Harita Short CV August 2022satya deoNo ratings yet

- Acctg 112 Reviewer Pas 1 8Document26 pagesAcctg 112 Reviewer Pas 1 8surbanshanrilNo ratings yet

- DLL in Eim 7 Daily Lesson Log in Electrical Installation and MaintenanceDocument9 pagesDLL in Eim 7 Daily Lesson Log in Electrical Installation and MaintenanceMitchell CamNo ratings yet

- Accounting Textbook Solutions - 5Document18 pagesAccounting Textbook Solutions - 5acc-expertNo ratings yet

- 8D Report TemplateDocument4 pages8D Report TemplateVbaluyoNo ratings yet

- Dnyansagar Institute of Management and ResearchDocument29 pagesDnyansagar Institute of Management and ResearchMACHHINDRA TAMBENo ratings yet

- Pensonic Holdings BHD Fundamental Company Report Including Financial, SWOT, Competitors and Industry AnalysisDocument14 pagesPensonic Holdings BHD Fundamental Company Report Including Financial, SWOT, Competitors and Industry AnalysisWai Min0% (1)

- Snoop Doggs Trademark ApplicationDocument9 pagesSnoop Doggs Trademark ApplicationBillboardNo ratings yet

- InteGrade Premium White Gen3 Commercial Leaflet-Fashion RetailersDocument8 pagesInteGrade Premium White Gen3 Commercial Leaflet-Fashion Retailersyordanos hailuNo ratings yet

- Paca112 Proj ADocument10 pagesPaca112 Proj AKatrina PaquizNo ratings yet

- The Cleaning Industry in EuropeDocument10 pagesThe Cleaning Industry in EuropeAlan PulmanNo ratings yet

- NCWA I To XIDocument1 pageNCWA I To XIRohit GoswamiNo ratings yet

- Tungsten Carbide Rolls enDocument12 pagesTungsten Carbide Rolls endesetek100% (1)

- EPC4A HUC Estimating Methodology Rev 0Document21 pagesEPC4A HUC Estimating Methodology Rev 0Amine DabbabiNo ratings yet

- Digital TransformationDocument348 pagesDigital Transformationertawa waterNo ratings yet

- Iem QuizDocument10 pagesIem QuizAJITH .DNo ratings yet

- Certificate of Incorporation: Government of India Ministry of Corporate AffairsDocument1 pageCertificate of Incorporation: Government of India Ministry of Corporate AffairsAdam V. ArzateNo ratings yet