Professional Documents

Culture Documents

Truth and Transparency in Lending

Uploaded by

Joshua Assin0 ratings0% found this document useful (0 votes)

14 views1 pageThe document discusses enhancing transparency in lending by assuring full disclosure of credit costs and terms to prevent uninformed use. A disclosure statement must be attached to all loan contracts and include at minimum: 1) total amount financed, 2) all finance and incidental charges, 3) net loan proceeds, 4) payment schedule, and 5) effective interest rate as a percentage of the total financed amount. Borrowers have a right to demand a copy of the disclosure statement.

Original Description:

Original Title

TRUTH-AND-TRANSPARENCY-IN-LENDING (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses enhancing transparency in lending by assuring full disclosure of credit costs and terms to prevent uninformed use. A disclosure statement must be attached to all loan contracts and include at minimum: 1) total amount financed, 2) all finance and incidental charges, 3) net loan proceeds, 4) payment schedule, and 5) effective interest rate as a percentage of the total financed amount. Borrowers have a right to demand a copy of the disclosure statement.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views1 pageTruth and Transparency in Lending

Uploaded by

Joshua AssinThe document discusses enhancing transparency in lending by assuring full disclosure of credit costs and terms to prevent uninformed use. A disclosure statement must be attached to all loan contracts and include at minimum: 1) total amount financed, 2) all finance and incidental charges, 3) net loan proceeds, 4) payment schedule, and 5) effective interest rate as a percentage of the total financed amount. Borrowers have a right to demand a copy of the disclosure statement.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

TRUTH AND TRANSPARENCY IN LENDING

Enhanced Implementation of the Truth in lending Act

(Republic Act 3765)

The State protects its citizens from a lack of awareness of the true cost of credit to the customer by

assuring a full disclosure of such cost and other terms and conditions with a view of preventing the

uninformed use of credit.

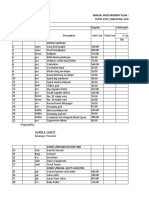

As such, a disclosure statement is a required attachment to thee loa contact.

It shall include, at a minimum, the following information:

1) Total amount to be financed

2) Finance Charges and all other charges incident to the loan

3) Net Proceeds of the loan

4) Schedule of payments

5) The percentage that the finance change bears to the total amount to be financed expressed as

an Effective Interest Rate (EIR)

IMPORTANT NOTICE

The borrower has a right to demand a copy

Of the disclosure statement

You might also like

- Truth in Lending Act (Notes)Document2 pagesTruth in Lending Act (Notes)Vernie Anne100% (2)

- Explanation of SecuritizationDocument15 pagesExplanation of SecuritizationForeclosure Fraud100% (15)

- Attachment A Explanation of SecuritizationDocument13 pagesAttachment A Explanation of SecuritizationTA WebsterNo ratings yet

- Special Comml Laws - Tila and AmlaDocument20 pagesSpecial Comml Laws - Tila and AmlaJoseph John Santos RonquilloNo ratings yet

- Tila LawDocument2 pagesTila LawMichael RitaNo ratings yet

- NOTES ON TILA - Truth in Lending Act (RA 3765)Document8 pagesNOTES ON TILA - Truth in Lending Act (RA 3765)edrianclydeNo ratings yet

- Summary of Anthony Crescenzi's The Strategic Bond Investor, Third EditionFrom EverandSummary of Anthony Crescenzi's The Strategic Bond Investor, Third EditionNo ratings yet

- Restructuring A Sovereign Debtor's Contingent LiabilitiesDocument10 pagesRestructuring A Sovereign Debtor's Contingent Liabilitiesvidovdan9852No ratings yet

- Truth-In-Lending-Act-HandoutDocument6 pagesTruth-In-Lending-Act-HandoutHazel Anne QuilosNo ratings yet

- Metrobank Loan Agreement PDFDocument21 pagesMetrobank Loan Agreement PDFCari Mangalindan MacaalayNo ratings yet

- Gonder IndictmentDocument9 pagesGonder IndictmentChris GothnerNo ratings yet

- Syndicated Loan AgreementDocument49 pagesSyndicated Loan Agreementcasey9759949No ratings yet

- PrepartionDocument31 pagesPrepartionbaapanil100% (1)

- 1C6-Truth in Lending ActDocument92 pages1C6-Truth in Lending Actmoor2010No ratings yet

- Primer On Factoring BusinessDocument8 pagesPrimer On Factoring BusinessNidhi BothraNo ratings yet

- Annual Procurement Plan 2023Document4 pagesAnnual Procurement Plan 2023Joshua AssinNo ratings yet

- Chap026 - SwapsDocument24 pagesChap026 - SwapsAmir Khan0% (1)

- BFS L0 Ques464Document360 pagesBFS L0 Ques464Aayush AgrawalNo ratings yet

- FIN2601-chapter 6Document28 pagesFIN2601-chapter 6Atiqa Aslam100% (1)

- Spouses Viola v. Equitable PCI BankDocument2 pagesSpouses Viola v. Equitable PCI BankDale DampilNo ratings yet

- Disbursement Vouchers DoneDocument1 pageDisbursement Vouchers DoneJoshua AssinNo ratings yet

- BFM132 Ch10 Truth and Transparency in LendingDocument7 pagesBFM132 Ch10 Truth and Transparency in LendingTrisha LawasNo ratings yet

- Special Commercial LawsDocument31 pagesSpecial Commercial LawsPrincess Vie0% (1)

- Demystifying The Impact of Hybrid InstrumentsDocument26 pagesDemystifying The Impact of Hybrid InstrumentsAshhab KhanNo ratings yet

- Truth Lending and Data PrivacyDocument14 pagesTruth Lending and Data PrivacyRyan MiguelNo ratings yet

- MBA Regulatory Compliance Conference: Renaissance Washington DC Downtown Hotel Washington, D.C. September 25, 2011Document15 pagesMBA Regulatory Compliance Conference: Renaissance Washington DC Downtown Hotel Washington, D.C. September 25, 2011Cairo AnubissNo ratings yet

- Truth and Lending ActDocument2 pagesTruth and Lending ActmarkNo ratings yet

- Truth in Lending ActDocument7 pagesTruth in Lending ActBea GarciaNo ratings yet

- CREDIT AND COLLECTION Module 6.docx 1 PDFDocument22 pagesCREDIT AND COLLECTION Module 6.docx 1 PDFRosemarie ArtigasNo ratings yet

- CIMB Bank BHD V Reliance Shipping & AnorDocument22 pagesCIMB Bank BHD V Reliance Shipping & AnorNajumuddinNo ratings yet

- C5. Factoring and ForfeitingDocument21 pagesC5. Factoring and ForfeitingK59 Vo Doan Hoang AnhNo ratings yet

- TILA ACA Palma, JDADocument2 pagesTILA ACA Palma, JDAJames Daniel PalmaNo ratings yet

- LOAN AGREEMENT Diego PizzamiglioDocument8 pagesLOAN AGREEMENT Diego PizzamiglioEric WittNo ratings yet

- AE128 - VI.c. Truth in Lending ActDocument2 pagesAE128 - VI.c. Truth in Lending Act마마무AyaNo ratings yet

- 6 Agreement-Cum-Pledge - CorpDocument7 pages6 Agreement-Cum-Pledge - CorpAshish BangurNo ratings yet

- Plevin Second Report - RedactedDocument26 pagesPlevin Second Report - RedactedDamaris Emilia IrimieNo ratings yet

- Indian Economic EnvironmentDocument14 pagesIndian Economic Environmentrenu13205No ratings yet

- Procurement of Health Sector Goods: Trial EditionDocument26 pagesProcurement of Health Sector Goods: Trial EditionMuhammad Salman RaufNo ratings yet

- Tan Jing Jeong V Allianz Life Insurance Malaysia BHD & AnorDocument19 pagesTan Jing Jeong V Allianz Life Insurance Malaysia BHD & AnorhaqimNo ratings yet

- Truth Lending Act - AmlaDocument10 pagesTruth Lending Act - AmlapendonNo ratings yet

- Chapter 6 Solution Manual For Principles of Managerial Finance 13th Edition Lawrence PDFDocument24 pagesChapter 6 Solution Manual For Principles of Managerial Finance 13th Edition Lawrence PDFNazar FaridNo ratings yet

- Lease Financing DaibbDocument9 pagesLease Financing DaibbShajib KhanNo ratings yet

- Claim Reserving Estimation by Using The Chain Ladder Method: Conference PaperDocument13 pagesClaim Reserving Estimation by Using The Chain Ladder Method: Conference PaperAzhal23No ratings yet

- TILA - Usec YebraDocument2 pagesTILA - Usec YebraGieeNo ratings yet

- Sovereign Financial Guarantees: by Tomas Magnusson Director and General Counsel The Swedish National Debt OfficeDocument15 pagesSovereign Financial Guarantees: by Tomas Magnusson Director and General Counsel The Swedish National Debt OfficeKHALID SHAMIMNo ratings yet

- 4 - Loan AgreementDocument14 pages4 - Loan AgreementKavit ThakkarNo ratings yet

- Terms and ConditionsDocument11 pagesTerms and ConditionslucozzadeNo ratings yet

- BFM Mod D-1Document2 pagesBFM Mod D-1Raghvendra SinghNo ratings yet

- Development of The Fraud Rule in Letter of Credit Law - The JourneDocument50 pagesDevelopment of The Fraud Rule in Letter of Credit Law - The JourneQasim RashidNo ratings yet

- Appendix 2 - Product Disclosure SheetDocument6 pagesAppendix 2 - Product Disclosure SheetSharp AhmadNo ratings yet

- Downloaded Emails PDFDocument31 pagesDownloaded Emails PDFJames M FullertonNo ratings yet

- Module 4 - Activity ParaisoDocument2 pagesModule 4 - Activity ParaisoJulian Rose ParaisoNo ratings yet

- Julian Rose V. Paraiso BSAIS-21 Activity For Module 4: TRUTH IN LENDING ACTDocument2 pagesJulian Rose V. Paraiso BSAIS-21 Activity For Module 4: TRUTH IN LENDING ACTJulian Rose ParaisoNo ratings yet

- Modelul de Lege PT DIFDocument45 pagesModelul de Lege PT DIFPotoroaca Madalin BilaNo ratings yet

- Vencor Hospitals v. Blue Cross, 169 F.3d 677, 11th Cir. (1999)Document7 pagesVencor Hospitals v. Blue Cross, 169 F.3d 677, 11th Cir. (1999)Scribd Government DocsNo ratings yet

- Determination of Interest RatesDocument18 pagesDetermination of Interest RatesTanvir SazzadNo ratings yet

- Ifm Scheme of Valuation 2021Document9 pagesIfm Scheme of Valuation 2021bhupesh tkNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument13 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- I. The Lifeblood of International CommerceDocument0 pagesI. The Lifeblood of International CommerceRoy BhardwajNo ratings yet

- The Prudential Insurance Company of America v. Commissioner of Internal Revenue, 882 F.2d 832, 3rd Cir. (1989)Document12 pagesThe Prudential Insurance Company of America v. Commissioner of Internal Revenue, 882 F.2d 832, 3rd Cir. (1989)Scribd Government DocsNo ratings yet

- FAR14. Borrowing CostsDocument1 pageFAR14. Borrowing CostsJohn Kenneth BacanNo ratings yet

- RAAFDocument2 pagesRAAFJoshua AssinNo ratings yet

- Book 1Document2 pagesBook 1Joshua AssinNo ratings yet

- Abyib ResolutionDocument1 pageAbyib ResolutionJoshua AssinNo ratings yet

- Liquidation ReportDocument1 pageLiquidation ReportJoshua AssinNo ratings yet

- CashbookDocument2 pagesCashbookJoshua AssinNo ratings yet

- BDRRMF UtilizationDocument2 pagesBDRRMF UtilizationJoshua AssinNo ratings yet

- Volleyball Scoresheets FinalDocument3 pagesVolleyball Scoresheets FinalJoshua AssinNo ratings yet

- Power ConsumtionDocument2 pagesPower ConsumtionJoshua AssinNo ratings yet

- ASF PermitDocument2 pagesASF PermitJoshua AssinNo ratings yet

- Consolidated Demog ReportDocument11 pagesConsolidated Demog ReportJoshua AssinNo ratings yet

- Untitled BracketDocument1 pageUntitled BracketJoshua AssinNo ratings yet

- Pricing LibraryDocument1 pagePricing LibraryJoshua AssinNo ratings yet

- Caravan TarpDocument5 pagesCaravan TarpJoshua AssinNo ratings yet

- 6.1 Approved Contingency PlanDocument14 pages6.1 Approved Contingency PlanJoshua AssinNo ratings yet

- Senior CitizensDocument1 pageSenior CitizensJoshua AssinNo ratings yet

- Kra 3Document19 pagesKra 3Joshua AssinNo ratings yet

- 6.2 Certificates of ParticipationDocument11 pages6.2 Certificates of ParticipationJoshua AssinNo ratings yet

- Kra 2Document10 pagesKra 2Joshua AssinNo ratings yet

- Student Information SheetDocument1 pageStudent Information SheetJoshua AssinNo ratings yet

- NDRRMC MC 001-2023 - Guidelines For 23RD GK Seal and Special Awards For Excellence in DRRM and Humanitarian Assistance Cy 2023Document14 pagesNDRRMC MC 001-2023 - Guidelines For 23RD GK Seal and Special Awards For Excellence in DRRM and Humanitarian Assistance Cy 2023Joshua AssinNo ratings yet

- Enterprise SupportDocument1 pageEnterprise SupportJoshua AssinNo ratings yet

- Formatted Brgy. Forms EditDocument21 pagesFormatted Brgy. Forms EditJoshua AssinNo ratings yet

- Application Letter - AssinDocument2 pagesApplication Letter - AssinJoshua AssinNo ratings yet

- ANNEX C Report On Fund UtilizationDocument1 pageANNEX C Report On Fund UtilizationJoshua AssinNo ratings yet

- LP ScienceDocument6 pagesLP ScienceJoshua AssinNo ratings yet

- ANNEX D Project ProfileDocument1 pageANNEX D Project ProfileJoshua AssinNo ratings yet

- Accomplishement - JOSHUA ASSINDocument1 pageAccomplishement - JOSHUA ASSINJoshua AssinNo ratings yet

- First Time JobseekersDocument1 pageFirst Time JobseekersJoshua AssinNo ratings yet