Professional Documents

Culture Documents

Problems

Uploaded by

Aarti SaxenaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problems

Uploaded by

Aarti SaxenaCopyright:

Available Formats

a

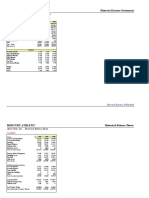

Year 2019 2018 2017 2016 2015

Total Revenue 39506 39831 37728 37047 38226

Net income 11083 3825 9335 8901 9938

Net profit Margin 28.05% 9.60% 24.74% 24.03% 26.00%

b

Year Total Revenue Net income profit %

2019 39506 11083 28.05%

2018 39831 3825 9.60%

2017 37728 9335 24.74%

2016 37047 8901 24.03%

2015 38226 9938 26.00%

Geomean 38453.1560782 8106.4027634

Year 2019 2018 2017 2016 2015

Total Revenue 39506 39831 37728 37047 38226

Net income 11083 3825 9335 8901 9938

Net profit Margin 28.05% 9.60% 24.74% 24.03% 26.00%

Change in revenue 0.9918 1.0557 1.0184 0.9692

Change in Net Income 2.8975 0.4097 1.0488 0.8957

Revenue growth 0.0088

Net Income growth 0.3129

Chart Title

40000

35000

30000

25000

20000

15000

10000

5000

0

1 2 3 4 5

Total Revenue Net income

Particulars 2020 2019

Sales 412500 398600 a

Cost of Goods Sold 318786 315300

Gross Profit 93714 83300

Depreciation Expense 29800 29652

Selling & Admin Expense 26250 24550

Other Operating Expense 1210 1245

Net Operating Income 36454 27853

Interest Expense 8582 8457

Earnings Before Taxes 27872 19396

Taxes 6968 4849

Net Income 20904 14547

Notes:

Tax Rate 25% 25%

Shares Outstanding 52100 52100

Earnings per Share 0.40 0.28

Particulars 2020 2019

Cash $ 16,435 $ 11,596

Marketable Securities 3656 619

Accounts receivable 45,896 47,404

Inventories 52,397 54,599

Total Current Assets 118,384 114,218

Gross fixed assets 436,573 397,023

Accumulated depreciation 87,450 57,650

Net Plant & Equipment 349,123 339,373

Total assets 467,507 453,591 c

Dupont Analysis

Accounts payable $ 37,752 $ 36,819 ROE Net income/ Revenue

Accrued Expenses 3,183 3,085 ROE 0.0506763636363636

Total Current Liabilities 40,935 39,904

Long-term debt 170,562 178,581

Total Liabilities 211,497 218,485

Common stock 58,664 58,664

Additional paid in capital 136,807 136,807

Retained earnings 60,539 39,635

Total Equity 256,010 235,106

Total Liabilities & Equity 467,507 453,591

d

2,020 2,019

Net operating Profit after tax 20904 14547

Capital Invested 514022 371337

WACC 9% 9%

Economic profit -25357.98 -18873.33

Current assets 100000

Current Liabilities 38000

Total assets 400000

NWC/TA 0.155

RE/TA 0.1

EBIT/TA 0.08

MVE/TL 1.1

SALES/TA 0.9

Net Working Capital/ Total Assets 0.155

ζ = 1.2A + 1.4B + 3.3C + 0.6D + 1.0E 2.15

Z-score between 1.81 and 2.99 means

a gray area, specifying that the

company may go bankrupt in the

following two years. Z-score less than

1.81 means the danger zone; i.e.

Imminent bankruptcy. Itt is not in

Imminent danger because it is stable

Ratios 2020 2019

Current Ratio 2.89199951142054 2.8623195669607 b

Quick Ratio 1.61199462562599 1.4940607457899

Inventory Turnover 7.87 7.30

Average Receivable Turn 8.99 8.41

Average Collection perio 40.61 43.41 days

Fixed Assets Turnover 0.94 1.00

Total assets turnover 0.88 0.88

Total debt ratio 45.24% 48.17%

long term debt Ratio 36.48% 39.37%

LTD To Total capitalizat 39.98% 43.17%

Debt to Equity 82.61% 92.93%

LTD to Equity 66.62% 75.96%

Times Interest Earned 7.7 6.8

Cash Coverage ratio 7.7 6.8

Gross Profit Margin 22.72% 20.90%

Operating Profit Margin 8.84% 6.99%

Net Profit Margin 5.07% 3.65%

Return on Total Assets 4.47% 3.21%

Return on Equity 8.17% 6.19%

Return on Common Equi 8.17% 6.19%

Revenue*Avg. Total AsseAverage Total Assets/ Avg. total Equity

0.88 1.82612788562947 8.17% 8.17%

Improved

Declined

You might also like

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Comparative Income Statement for Reliance Industries LtdDocument23 pagesComparative Income Statement for Reliance Industries LtdManan Suchak100% (1)

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- Income Statement Analysis and Projections 2005-2010Document5 pagesIncome Statement Analysis and Projections 2005-2010Gullible KhanNo ratings yet

- Estimating Walmarts Cost of CapitalDocument6 pagesEstimating Walmarts Cost of CapitalPrashuk Sethi0% (1)

- Petron vs Shell Financial AnalysisDocument5 pagesPetron vs Shell Financial AnalysisFRANCIS IMMANUEL TAYAGNo ratings yet

- Pacific Grove Spice CompanyDocument3 pagesPacific Grove Spice CompanyLaura JavelaNo ratings yet

- DataDocument11 pagesDataA30Yash YellewarNo ratings yet

- Bharti Airtel AnalysisDocument4 pagesBharti Airtel AnalysisRockNo ratings yet

- INS3030_Financial-Report-Analysis_Chu-Huy-Anh_Đề-3Document4 pagesINS3030_Financial-Report-Analysis_Chu-Huy-Anh_Đề-3Thảo Thiên ChiNo ratings yet

- Company Financial Analysis and Ratio Comparison Over 5 YearsDocument6 pagesCompany Financial Analysis and Ratio Comparison Over 5 YearsAanchal MahajanNo ratings yet

- Financial Analysis of Ultratech Cement LtdDocument7 pagesFinancial Analysis of Ultratech Cement LtdvikassinghnirwanNo ratings yet

- Financial Analysis of British American Tobacco BangladeshDocument7 pagesFinancial Analysis of British American Tobacco BangladeshabhikNo ratings yet

- Blaine Kitchenware: Case Exhibit 1Document15 pagesBlaine Kitchenware: Case Exhibit 1Fahad AliNo ratings yet

- Exhibit in ExcelDocument8 pagesExhibit in ExcelAdrian WyssNo ratings yet

- Particulars (INR in Crores) FY2015A FY2016A FY2017A FY2018ADocument6 pagesParticulars (INR in Crores) FY2015A FY2016A FY2017A FY2018AHamzah HakeemNo ratings yet

- Cash Flow/Share Revenue/Share Operating Cash Flow 26.02%Document2 pagesCash Flow/Share Revenue/Share Operating Cash Flow 26.02%Chesca Marie Arenal PeñarandaNo ratings yet

- AOFSDocument15 pagesAOFS1abd1212abdNo ratings yet

- Activity 3 123456789Document7 pagesActivity 3 123456789Jeramie Sarita SumaotNo ratings yet

- Merged Income Statement and Balance Sheet of Pacific Grove Spice CompanyDocument9 pagesMerged Income Statement and Balance Sheet of Pacific Grove Spice CompanyArnab SarkarNo ratings yet

- Particulars 2018-19 2017-18 Liquidity AnalysisDocument10 pagesParticulars 2018-19 2017-18 Liquidity AnalysisIvy MajiNo ratings yet

- IFFCO Financial Statement AnalysisDocument2 pagesIFFCO Financial Statement AnalysisSuprabhat SealNo ratings yet

- Drivers' Company Financial AnalysisDocument15 pagesDrivers' Company Financial AnalysisAtharva OrpeNo ratings yet

- Marico Financial Model (Final) (Final-1Document22 pagesMarico Financial Model (Final) (Final-1Jayant JainNo ratings yet

- Financial Table Analysis of ZaraDocument9 pagesFinancial Table Analysis of ZaraCeren75% (4)

- Quiz 1 Acco 204 - GonzagaDocument17 pagesQuiz 1 Acco 204 - GonzagaLalaine Keendra GonzagaNo ratings yet

- KPR Phase_1Document23 pagesKPR Phase_1Satyam1771No ratings yet

- FMUE Group Assignment - Group 4 - Section B2CDDocument42 pagesFMUE Group Assignment - Group 4 - Section B2CDyash jhunjhunuwalaNo ratings yet

- Business Evaluation CalculationsDocument16 pagesBusiness Evaluation CalculationsSoham AherNo ratings yet

- Công ty CP Dược Viễn Đông Financial ReportsDocument12 pagesCông ty CP Dược Viễn Đông Financial ReportsThảo LinhNo ratings yet

- Radico Khaitan SSGR Report and ForecastDocument38 pagesRadico Khaitan SSGR Report and Forecasttapasya khanijouNo ratings yet

- INCOME AND BALANCE SHEET ANALYSISDocument6 pagesINCOME AND BALANCE SHEET ANALYSISRohanMohapatraNo ratings yet

- Exam 1 Masan GroupDocument4 pagesExam 1 Masan GroupQuynh NguyenNo ratings yet

- NPV Function: Discount Rate Time Periods 2 3 4 Cash Flows NPV $35.9Document11 pagesNPV Function: Discount Rate Time Periods 2 3 4 Cash Flows NPV $35.9Ali Hussain Al SalmawiNo ratings yet

- Appendices Financial RatiosDocument3 pagesAppendices Financial RatiosCristopherson PerezNo ratings yet

- DCF TVSDocument17 pagesDCF TVSSunilNo ratings yet

- Alk SidoDocument2 pagesAlk SidoRebertha HerwinNo ratings yet

- My Assignment (LMT) - Corporate FinanceDocument13 pagesMy Assignment (LMT) - Corporate Financeesmailkarimi456No ratings yet

- Apollo Hospitals Enterprise LimitedDocument10 pagesApollo Hospitals Enterprise LimitedHemendra GuptaNo ratings yet

- Project EngieDocument32 pagesProject EngieVijendra Kumar DubeyNo ratings yet

- Valuation GroupNo.12Document4 pagesValuation GroupNo.12John DummiNo ratings yet

- Ratios, VLOOKUP, Goal SeekDocument15 pagesRatios, VLOOKUP, Goal SeekVIIKHAS VIIKHASNo ratings yet

- Fin3320 Excelproject sp16 TravuobrileDocument9 pagesFin3320 Excelproject sp16 Travuobrileapi-363907405No ratings yet

- KPR MillsDocument32 pagesKPR MillsSatyam1771No ratings yet

- DCF Trident 2Document20 pagesDCF Trident 2Jayant JainNo ratings yet

- Mercury Athletic Historical Income StatementsDocument18 pagesMercury Athletic Historical Income StatementskarthikawarrierNo ratings yet

- Coca Cola Company Financial Ratios SummaryDocument66 pagesCoca Cola Company Financial Ratios SummaryZhichang ZhangNo ratings yet

- Financial Analysis Coles GroupDocument5 pagesFinancial Analysis Coles GroupAmmar HassanNo ratings yet

- New Microsoft Office Excel WorksheetDocument1 pageNew Microsoft Office Excel WorksheetManan SuchakNo ratings yet

- Fiscal Year Ending December 31 2020 2019 2018 2017 2016Document22 pagesFiscal Year Ending December 31 2020 2019 2018 2017 2016Wasif HossainNo ratings yet

- Cost AssignmentDocument16 pagesCost Assignmentmuhammad salmanNo ratings yet

- Mercury Case ExhibitsDocument10 pagesMercury Case ExhibitsjujuNo ratings yet

- AirThread CalcDocument15 pagesAirThread CalcSwati VermaNo ratings yet

- ONGC Consolidated Balance Sheet and Profit & Loss AnalysisDocument43 pagesONGC Consolidated Balance Sheet and Profit & Loss AnalysisNishant SharmaNo ratings yet

- Cariboo Case StudyDocument6 pagesCariboo Case Studyzahraa aabedNo ratings yet

- Comparative Income Statements and Balance Sheets For Merck ($ Millions) FollowDocument6 pagesComparative Income Statements and Balance Sheets For Merck ($ Millions) FollowIman naufalNo ratings yet

- Tire City SpreadsheetDocument7 pagesTire City Spreadsheetp23ayushsNo ratings yet

- Equity Research VRLDocument95 pagesEquity Research VRLshashlearnNo ratings yet

- Private Bank AnalysisDocument16 pagesPrivate Bank AnalysisfundeepNo ratings yet

- US Debt Rating DowngradedDocument3 pagesUS Debt Rating DowngradedmonarchadvisorygroupNo ratings yet

- FORTUNE ACCOUNTS - KERICHODocument35 pagesFORTUNE ACCOUNTS - KERICHOtowettNo ratings yet

- Chapter 4 - Ethics in The MarketplaceDocument21 pagesChapter 4 - Ethics in The MarketplaceTina Mariano Dy100% (1)

- Cement Industry in BDDocument26 pagesCement Industry in BDMahbubur Rahman75% (4)

- Understanding Cost Concepts and ClassificationsDocument53 pagesUnderstanding Cost Concepts and ClassificationsJessaNo ratings yet

- HSS 101 - Economics HandbookDocument4 pagesHSS 101 - Economics HandbookAditya PriyadarshiNo ratings yet

- Supply Chain Management - An Overview - RGDocument71 pagesSupply Chain Management - An Overview - RGprakashinaibs100% (2)

- ALDO'S Global Omnichannel Imperative Group 8Document5 pagesALDO'S Global Omnichannel Imperative Group 8David RojasNo ratings yet

- Management Accounting (Malaysia) Model Answers Series 2 2009Document16 pagesManagement Accounting (Malaysia) Model Answers Series 2 2009Ti SodiumNo ratings yet

- JAIIB Accounting Module B NotesDocument247 pagesJAIIB Accounting Module B NotesAkanksha MNo ratings yet

- Section Managerial PDFDocument7 pagesSection Managerial PDFFery AnnNo ratings yet

- Introduction to Innovation Management and New Product DevelopmentDocument20 pagesIntroduction to Innovation Management and New Product DevelopmentWeeHong NgeoNo ratings yet

- Beginners Guide FXDocument6 pagesBeginners Guide FXKhebz FxNo ratings yet

- Bangla Link 1Document12 pagesBangla Link 1Sakhawat HossainNo ratings yet

- Case 2: KeventersDocument2 pagesCase 2: KeventersTejas YadavNo ratings yet

- Adidas Market Segmentation - POWTOONDocument6 pagesAdidas Market Segmentation - POWTOONGilvi Anne MaghopoyNo ratings yet

- Unit Iii Vehicles Parts, Supply Management and BudgetDocument3 pagesUnit Iii Vehicles Parts, Supply Management and Budgetdbzdivik100% (1)

- Eco401 Economics Mcqs VuabidDocument103 pagesEco401 Economics Mcqs Vuabidsaeedsjaan82% (17)

- (Name of The Company) : Marketing Report OnDocument16 pages(Name of The Company) : Marketing Report Onhajra ubaidNo ratings yet

- MS 6002 June 11 AccountingDocument19 pagesMS 6002 June 11 AccountingKazi Sayeed AhmedNo ratings yet

- Tokopedia and Shopee Case AnalysisDocument6 pagesTokopedia and Shopee Case AnalysisIlham NurdianaNo ratings yet

- COSTDocument6 pagesCOSTJO SH UANo ratings yet

- Michael Dhafin: Work ExperienceDocument1 pageMichael Dhafin: Work Experiencemichael dhafinNo ratings yet

- Analysis of Automobile IndustryDocument100 pagesAnalysis of Automobile IndustryHarshil SanghaviNo ratings yet

- Indoco Remedies LTD - Initiating Coverage FinalDocument9 pagesIndoco Remedies LTD - Initiating Coverage Finalalok_deoraNo ratings yet

- Cbi AssignmentDocument9 pagesCbi AssignmentRISHABH MEHNDIRATTANo ratings yet

- Economics Question Bank - Docx - 1610116234978 PDFDocument137 pagesEconomics Question Bank - Docx - 1610116234978 PDFJeremiah NakibingeNo ratings yet

- Craft winning wine strategies in a mature US marketDocument5 pagesCraft winning wine strategies in a mature US marketAkankshaNo ratings yet

- Saas Sales Acceleration ProgramDocument42 pagesSaas Sales Acceleration ProgramRavi GowdaNo ratings yet

- SolutionQuestionnaireUNIT 3 - 2020Document5 pagesSolutionQuestionnaireUNIT 3 - 2020LiNo ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyFrom EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyRating: 4 out of 5 stars4/5 (4)

- NLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsFrom EverandNLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsRating: 4.5 out of 5 stars4.5/5 (4)

- Business Valuation: Private Equity & Financial Modeling 3 Books In 1: 27 Ways To Become A Successful Entrepreneur & Sell Your Business For BillionsFrom EverandBusiness Valuation: Private Equity & Financial Modeling 3 Books In 1: 27 Ways To Become A Successful Entrepreneur & Sell Your Business For BillionsNo ratings yet

- Emprender un Negocio: Paso a Paso Para PrincipiantesFrom EverandEmprender un Negocio: Paso a Paso Para PrincipiantesRating: 3 out of 5 stars3/5 (1)

- Basic Accounting: Service Business Study GuideFrom EverandBasic Accounting: Service Business Study GuideRating: 5 out of 5 stars5/5 (2)

- Full Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperFrom EverandFull Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperRating: 5 out of 5 stars5/5 (3)

- Mysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungFrom EverandMysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungRating: 4 out of 5 stars4/5 (1)