Professional Documents

Culture Documents

CHEAT CODE FOR THE DISCUSSION (March 25, 2023)

Uploaded by

Ace GonzalesOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CHEAT CODE FOR THE DISCUSSION (March 25, 2023)

Uploaded by

Ace GonzalesCopyright:

Available Formats

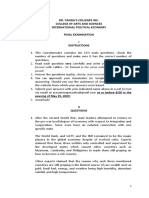

CHEAT CODE FOR THE DISCUSSION (MARCH 25, 2023)

GENERAL PRINCIPLES AND LIMITATIONS OF TAXATION POWER

DEFINITION OF TAXATION

It refers to an inherent power of the Government which raises revenue to defray the

expenses of the government.

NATURE OF THE POWER OF TAXATION

It is an attribute of sovereignty; legislative in character; delegation to the President; and

subject to constitutional and inherent limitations

STAGES OF TAXATION

Levy; assessment; and collection

LIFEBLOOD THEORY

Without revenue, the Government will not survive (being one of the elements of State),

resulting to detriment to society. Without taxes, the Government would be paralyzed

for lack of motive power to activate and operate it.

NECESSITY THEORY

The exercise of the power to tax emanates from necessity, because without taxes,

government cannot fulfill its mandate of promoting the general welfare and well-being

of the people.

BENEFITS-PROTECTION THEORY

The government is expected to respond in the form of tangible and intangible benefits

intended to improve the lives of the people.

DEFINITION OF “TAXES”; TAX vs. DEBT

Taxes are enforced proportional contributions.

CHARACTERISTICS OF SOUND TAX SYSTEM

Fiscal Adequacy; theoretical justice; and administrative feasibility

DOUBLE TAXATION; TAX EVASION vs. TAX AVOIDANCE

INHERENT LIMITATIONS

The levy must be for public purpose; non-delegation of the legislative power to tax;

exemption from taxation of government entities; international comity; and territorial

jurisdiction

CONSTITUTIONAL LIMITATIONS

Substantially from Bill of Rights (Due Process; Tax Exemption for religious, charitable,

and educational purposes)

Assignment:

Study the Kinds of Taxpayers; Gross Income; and Accounting Methods and Periods

You might also like

- Taxation Law ReviewerDocument6 pagesTaxation Law ReviewerAlex RabanesNo ratings yet

- Essential Elements of A TaxDocument31 pagesEssential Elements of A TaxJosephine Berces100% (5)

- Benjamin Aban - Basic Law On Taxation SummaryDocument99 pagesBenjamin Aban - Basic Law On Taxation Summaryfreegalado86% (7)

- Theory and Basis of TaxationDocument4 pagesTheory and Basis of TaxationJiyu50% (2)

- Discussion (March 25, 2023)Document1 pageDiscussion (March 25, 2023)Ace GonzalesNo ratings yet

- Law On Taxation Review.-Chapter 1Document17 pagesLaw On Taxation Review.-Chapter 1GeeanNo ratings yet

- General Principles of TaxationDocument25 pagesGeneral Principles of TaxationDon Ycay100% (1)

- Basic Taxation and Commercial LawDocument2 pagesBasic Taxation and Commercial LawSheila Marie RangcapanNo ratings yet

- Which Statement Below Expresses The Lifeblood Theory? (2012 Bar Question)Document1 pageWhich Statement Below Expresses The Lifeblood Theory? (2012 Bar Question)James BarzoNo ratings yet

- ADocument15 pagesAAnonymous uNLxqJUNo ratings yet

- Q and A Tax ReviewDocument2 pagesQ and A Tax ReviewJanice0% (1)

- General Principles of TaxationDocument6 pagesGeneral Principles of TaxationJaziel SestosoNo ratings yet

- Tax Reviewer: General Principles: BY: Rene CallantaDocument91 pagesTax Reviewer: General Principles: BY: Rene CallantaDaryl HollandNo ratings yet

- Tax NotesDocument8 pagesTax NotesChristian Paul PinoteNo ratings yet

- Chapter IDocument1 pageChapter IGlyza Kaye Zorilla PatiagNo ratings yet

- Tax Reviewer: Law of Basic Taxation in The Philippines Chapter 1: General PrinciplesDocument9 pagesTax Reviewer: Law of Basic Taxation in The Philippines Chapter 1: General PrinciplesEmily SantiagoNo ratings yet

- Tax Reviewer - CallantaDocument52 pagesTax Reviewer - CallantaAnonymous 8SUSyvGc3dNo ratings yet

- Taxation Reviewer UP Sigma RhoDocument271 pagesTaxation Reviewer UP Sigma RhoEL Janus GarnetNo ratings yet

- Group2 Btax1 JdesingañoDocument1 pageGroup2 Btax1 JdesingañoJay DesinganoNo ratings yet

- Tax 1 (Reviewer)Document15 pagesTax 1 (Reviewer)Lemuel Angelo M. Eleccion100% (1)

- Juicy Notes 2011compiled PDFDocument93 pagesJuicy Notes 2011compiled PDFShanelle Napoles100% (1)

- Tax Reviewer: Law of Basic Taxation in The Philippines Chapter 1: General PrinciplesDocument93 pagesTax Reviewer: Law of Basic Taxation in The Philippines Chapter 1: General PrinciplesAnonymous oTRzcSSGunNo ratings yet

- Taxation - Chapter 1Document12 pagesTaxation - Chapter 1CIARA MAE ORTIZNo ratings yet

- Handout For General Principles of TaxationDocument44 pagesHandout For General Principles of TaxationDianne LontacNo ratings yet

- Intax Chapter1-4 PDFDocument88 pagesIntax Chapter1-4 PDFPILAR GEOFFREYNo ratings yet

- Taxation FinalDocument10 pagesTaxation FinalMaelyn GelilangNo ratings yet

- BACC105-1 Introduction To TaxationDocument29 pagesBACC105-1 Introduction To TaxationJunel MamarilNo ratings yet

- Business TaxDocument14 pagesBusiness Taxgelalata0816No ratings yet

- Chapter 1 Introduction To Taxation: Chapter Overview and ObjectivesDocument30 pagesChapter 1 Introduction To Taxation: Chapter Overview and ObjectivesNoeme LansangNo ratings yet

- General Principles of TaxDocument36 pagesGeneral Principles of Taxuserfriendly12345No ratings yet

- MadrigalDocument468 pagesMadrigalGenelle Mae MadrigalNo ratings yet

- Tax ReviewerDocument53 pagesTax ReviewerLouie CascaraNo ratings yet

- Local Media7305767987836246830Document20 pagesLocal Media7305767987836246830John RellonNo ratings yet

- Introduction To Taxation (Notes)Document21 pagesIntroduction To Taxation (Notes)Tricia Sta TeresaNo ratings yet

- Taxation Principles and Remedies Finals ReviewerDocument39 pagesTaxation Principles and Remedies Finals ReviewerRamilNo ratings yet

- Police Power: I. TaxationDocument11 pagesPolice Power: I. TaxationJanine anzanoNo ratings yet

- Tax 1Document16 pagesTax 1Ryan MiguelNo ratings yet

- General Principles of TaxationDocument4 pagesGeneral Principles of TaxationYvonne DolorosaNo ratings yet

- Chapter 1-Income TaxDocument56 pagesChapter 1-Income TaxRochelle ChuaNo ratings yet

- Taxation Reviewer UP Sigma Rho 2Document203 pagesTaxation Reviewer UP Sigma Rho 2Jp RamirezNo ratings yet

- FUNDAMENTAL PRINCIPLES OF TAXATION Part 1 - 044115 PDFDocument20 pagesFUNDAMENTAL PRINCIPLES OF TAXATION Part 1 - 044115 PDFYelly HazeNo ratings yet

- Theory and Basis of TaxationDocument4 pagesTheory and Basis of TaxationJiyuNo ratings yet

- Income Taxation Chapter 1Document3 pagesIncome Taxation Chapter 1Kristine Allen D. ArmandoNo ratings yet

- Chapter 1 - TAXDocument9 pagesChapter 1 - TAXJuliannaMendozaMaleNo ratings yet

- Fundamental Principles in TaxationDocument50 pagesFundamental Principles in TaxationKristine AllejeNo ratings yet

- Notes Baribal Co 2 1 PDFDocument26 pagesNotes Baribal Co 2 1 PDFPola100% (1)

- Income TaxationDocument57 pagesIncome Taxationrosalenegega03No ratings yet

- Tax NotesDocument6 pagesTax NotesJanel MendozaNo ratings yet

- Definition, Aspects, Purpose of Income TaxationDocument9 pagesDefinition, Aspects, Purpose of Income TaxationPeyti PeytNo ratings yet

- Module 1 Introduction To TaxationDocument7 pagesModule 1 Introduction To TaxationChryshelle Anne Marie LontokNo ratings yet

- General Principles of TaxationDocument1 pageGeneral Principles of Taxationrar rorNo ratings yet

- Chapter 1 - General Principles and Concepts of TaxationDocument13 pagesChapter 1 - General Principles and Concepts of Taxationchesca marie penarandaNo ratings yet

- Taxation Ethics 2Document14 pagesTaxation Ethics 2Angel CandidoNo ratings yet

- Bar NIEL Final TAX PrintDocument48 pagesBar NIEL Final TAX PrintNiel S. DefensorNo ratings yet

- Income Taxation Fundamental Principles Part 1Document4 pagesIncome Taxation Fundamental Principles Part 1gwyneth dian belotendosNo ratings yet

- Legal Framework of TaxationDocument34 pagesLegal Framework of TaxationCamille HofilenaNo ratings yet

- IN BAD FAITH: The Republican Plan to Destroy Social SecurityFrom EverandIN BAD FAITH: The Republican Plan to Destroy Social SecurityNo ratings yet

- "Social Double-Account-System with Three-Column-Funding with free prices and money administration by the citizens themselves" Adapted to US Economy, strong market-based and joining social needs (All your claims are fulfilled): A potential Health Care Act by Donald Trump, President of the United States (To be urgently forwarded to) New Deal Health Care (to vanish old-fashioned "Obama Care")From Everand"Social Double-Account-System with Three-Column-Funding with free prices and money administration by the citizens themselves" Adapted to US Economy, strong market-based and joining social needs (All your claims are fulfilled): A potential Health Care Act by Donald Trump, President of the United States (To be urgently forwarded to) New Deal Health Care (to vanish old-fashioned "Obama Care")No ratings yet

- Fixing Everything: Government Spending, Taxes, Entitlements, Healthcare, Pensions, Immigration, Tort Reform, Crime…From EverandFixing Everything: Government Spending, Taxes, Entitlements, Healthcare, Pensions, Immigration, Tort Reform, Crime…No ratings yet

- Final Examination - IPEDocument5 pagesFinal Examination - IPEAce GonzalesNo ratings yet

- QUIZ No. 2 - FJSGDocument7 pagesQUIZ No. 2 - FJSGAce GonzalesNo ratings yet

- CSCQC Grading Sheet Rev1.0 (TM 119)Document34 pagesCSCQC Grading Sheet Rev1.0 (TM 119)Ace GonzalesNo ratings yet

- Cheat Code For The Discussion (April 15, 2023)Document1 pageCheat Code For The Discussion (April 15, 2023)Ace GonzalesNo ratings yet

- Sps. Miano vs. MERALCODocument5 pagesSps. Miano vs. MERALCOAce GonzalesNo ratings yet

- CIR vs. San Miguel CorporationDocument22 pagesCIR vs. San Miguel CorporationAce GonzalesNo ratings yet

- ADR NOTES Page 3Document24 pagesADR NOTES Page 3Ace GonzalesNo ratings yet

- Islaw Bar QuestionsDocument3 pagesIslaw Bar QuestionsAce GonzalesNo ratings yet

- Affidavit of Desistance Misapprehension of FactsDocument188 pagesAffidavit of Desistance Misapprehension of FactsAce GonzalesNo ratings yet

- Legal Ethics Bar QuestionsDocument6 pagesLegal Ethics Bar QuestionsAce GonzalesNo ratings yet

- Duty To Observe Candor and FairnessDocument18 pagesDuty To Observe Candor and FairnessAce GonzalesNo ratings yet

- Vega vs. The San Carlos Milling Co. Ltd.Document11 pagesVega vs. The San Carlos Milling Co. Ltd.Ace GonzalesNo ratings yet

- Resume - Francisco Jeremiah Santos GonzalesDocument3 pagesResume - Francisco Jeremiah Santos GonzalesAce GonzalesNo ratings yet

- Chung Fu Industries vs. Court of AppealsDocument9 pagesChung Fu Industries vs. Court of AppealsAce GonzalesNo ratings yet

- Joanie Surposa Uy vs. Jose Ngo Chua G.R. No. 183965 September 18, 2009Document9 pagesJoanie Surposa Uy vs. Jose Ngo Chua G.R. No. 183965 September 18, 2009Ace GonzalesNo ratings yet