Professional Documents

Culture Documents

Outlook 2023 3jan2023

Uploaded by

Project AtomOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Outlook 2023 3jan2023

Uploaded by

Project AtomCopyright:

Available Formats

3 JANUARY 2023

INDIA ECONOMICS

2023 OUTLOOK

Fragmented world with elevated inflation;

India in a sweet spot

Co-ordinated fiscal and

Global shift of de-risking monetary intervention Indian markets set to

of supply chains to warranted in 2023 to command higher

benefit India wade through multiples from hereon

uncertainties

3 January 2023 India | Strategy

2023 Outlook

Fragmented world with elevated inflation; India in a sweet spot

This report presents our outlook on wide aspects ranging from the major shifts happening globally Hitesh Suvarna

to expected monetary policy action in 2023. Additionally, we also highlight corrective fiscal actions hitesh.suvarna@jmfl.com | Tel: (91 22) 66303351

needed to give a fillip to India’s manufacturing ambition. We believe that the global shift of de-

risking of supply chains amidst uncertainties on the course of monetary policy action, inflation, and

geopolitical conflicts, would prove to be positive for EM economies. India’s robust domestic

demand, if coupled with coordinated fiscal and monetary measures, will place it in a dominant

position to capture the global manufacturing space as well as command higher valuation

multiples. We like private banks as we expect NIMs to sustain at least till H1 2023. Defence sector

would benefit from increased global defence spending, valuations need a close watch here. We

would play the theme of revival in private capex through Industrials, Cement & Real estate

ancillaries.

De-globalisation is real: The global economy is undergoing a major shift, one that involves de-risking

of supply chains. Blame it on pandemic-induced mobility restrictions or geopolitical conflicts, but Key Highlights:

economic agents have realised the need for diversification. The shift is certain to take place but it is

too early to fathom the exact form in which it would culminate. But regardless of the form, we India to benefit from the global shift of

believe EM economies like India will be the major beneficiaries. However, the price of picking de-risking of supply chains

resilience over efficiency will be paid though inflation in the long run. Another trend having major

Inflation in DM economies still way above

implications on the world economy is the rise in US bond yields above its long-term trend, exerting

target; Policy pivot in 2023 unlikely

upward pressure on the cost of capital and suppressing the valuation multiples.

Co-ordinated fiscal and monetary

Don’t expect a policy pivot till H12023: If 2022 was the year of red hot inflation peaking, then 2023

intervention warranted in 2023, to wade

will be a year of gradual moderation in inflation but still hovering at elevated levels in DM

through uncertainties

economies. Inflation in EM economies was comparatively lower, especially in India, as food price was

the major contributor unlike in DM economies where food and energy prices both fuelled inflation. INR expected to trade in the range of 82-

Moderation in commodity prices and supply constraints are reflected in easing headline inflation, but 84/USD

expectation of a monetary policy pivot would be misplaced, at least till the end of H12023.

Indian markets set to command higher

Fiscal intervention needed to correct trade imbalances: The impact of high inflation and tight multiples from hereon

monetary policy actions reflected in slowing global growth in 2022. Even as the contraction in

manufacturing PMI and yield curve inversion in DM economies flashed a recessionary warning,

India’s growth estimates are relatively robust with slight moderation. Trade imbalances would be a

major impediment in 2023, hurting India’s growth. Although rising imports would be an indication

of improving consumption, but if it is not supported by a reciprocal rise in exports, then it would

dent India’s CAD and exert pressure on INR. Hence timely fiscal intervention will be warranted.

INR to trade in the range of 82-84/USD: The confluence of high inflation, the US Fed’s hawkish

monetary policy, geopolitical conflicts, and USD’s safe haven status have propelled the USD, leaving

commodity importers exposed to currency depreciation. The INR weakened 11% vs. USD in 2022,

but resilient domestic growth and the comfortable fiscal situation should support the INR, provided

trade imbalance does not impair the CAD in 2023. We expect INR to trade in the range of 82-

84/USD in 2023; any weakness in crude price will act as a buffer to the economy.

Clear roadblocks in the way of capex growth: Robust government and corporate fiscal situation and

ample firepower with banks are a perfect combination for a pick-up in the private investment cycle.

Our assessment of capex announcements within our coverage universe (200+ Cos.) has ratified our

view on the growth in capex. However, in order to capture the manufacturing opportunity, we

highlight aspects that need to be addressed, such as low labour productivity and inadequate scale of

manufacturing; these lacunae hamper India’s ability to becoming a manufacturing hub.

JM Financial Research is also available on:

India’s resilience to command higher multiples: If 2022 was the year of rising topline with squeezing Bloomberg - JMFR <GO>,

margins, then 2023 will be the year of moderating topline with easing margin pressures. We believe that Thomson Publisher & Reuters,

intense FII selling (USD 36bn) during Oct’21-Jun’22 has set the floor to valuation multiples and Indian S&P Capital IQ, FactSet and Visible Alpha

markets will command higher multiples from hereon. Nifty earnings are expected to grow at 10% in FY23

and 11% in FY24. We prefer private banks at least till H12023 beyond which we will re-evaluate our Please see Appendix I at the end of this

preference. The revival in private capex is expected to benefit sectors such as Industrials, Cement, and Real

report for Important Disclosures and

Disclaimers and Research Analyst

estate ancillaries. Geopolitical conflicts around the world would cause countries to enhance defence

Certification.

budgets, making defence an interesting play, notwithstanding expensive valuation.

JM Financial Institutional Securities Limited

2023 Outlook 3 January 2023

Table of Contents Page No

2023 Outlook 1

Globalisation: will it end? Who benefits? 3

Inflation trending down but will remain elevated in 2023 4

Does this mean that inflation is under control now? Rate cuts on the anvil? 6

Government intervention needed to shield the economy 7

INR to trade in the range of 82–84/USD in 2023 10

Conditions ripe for a pick-up in Private Capex 14

India’s resilience likely to command higher multiples 17

Buy/Sell Recommendations 19

JM Financial Institutional Securities Limited Page 2

2023 Outlook 3 January 2023

Globalisation – Will it end? Who benefits?

Of all the changes that have shaped the world economy in the past 2 years, one of the most

pronounced shifts that has gained traction globally is the preference towards moving supply

chains closer to the home country or with countries with common interest, and a

commitment towards making the supply chain more resilient although it would be

inflationary in the long run. This can be characterised as the first step towards de-

globalisation of the world economy.

Post Covid, the impact on the auto and electronics industries was most pronounced, as they

grappled with the shortage of semi-conductors. Even though pandemic-related bottlenecks

have eased, we believe geopolitical issues would still linger. The conscious efforts of de-

concentration of risks are becoming evident now; for instance, the world’s largest

semiconductor company (Taiwan Semiconductor Manufacturing Company –TSMC) is building

its first manufacturing plant outside Taiwan in the US and Japan in an attempt to create an

efficient supply chain for its US-based clients.

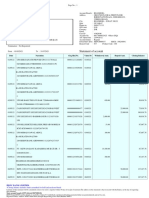

Exhibit 1. Global trade peaked in 2008 Exhibit 2. Bond yields inching above decadal trend

Merchandise Trade % of GDP US 10yr yield (%)

55

14

India

45 12

World

10

35

8

25 6

4

15

2

5 0

1963

1966

1969

1972

1975

1978

1981

1984

1987

1990

1993

1996

1999

2002

2005

2008

2011

2014

2017

2020

2023

1960

1963

1966

1969

1972

1975

1978

1981

1984

1987

1990

1993

1996

1999

2002

2005

2008

2011

2014

2017

2020

Source: World Bank, JM Financial Source: Fred, JM Financial | Note: shaded area represents recession period

Although it is too early to fathom whether this change will lead to 1) fully disintegrated

supply chains, 2) clusters of supply chains amongst friendly countries or 3) only a marginal

change in the pattern/framework of globalisation, we believe emerging economies would be

the biggest beneficiaries of this structural change. India with its vast labour force (430mn)

and policy push in the form of Production Linked Incentives Scheme (PLI), PM Gati Shakti and

National logistics Policy will be in a far better position to capture the manufacturing space.

Currently, India’s share in global manufacturing output is just 3.1%, and the current

geopolitical dynamics and India’s policy push towards manufacturing provide an opportunity

to improve its share in global manufacturing output.

Global trade as % of GDP (51%) had already peaked in 2008 and is yet to recover fully since

then. But it is pertinent to note that despite the pandemic (2020) and the war in Europe

(2021), global trade as a % of GDP has improved above 2018 levels – mainly due to inflation-

led higher growth in trade vs. GDP. India’s trade has followed a similar trajectory but is far

lower compared to the peak (43% vs. 30.5% in 2021); however, it has improved from the

pandemic period lows [Ex 1].

Another structural change that is playing out is the steep rise in US bond yields, surpassing its

decadal trend (Ex 2). Bank of Japan’s sudden change in tolerance limit (25bps to 50bps) to its

Yield Curve Control would have an effect of raising the yields further. This has far-reaching

implications that transverse beyond regions and industries. The resurgence of inflation

beyond long-run averages in DM economies and tight monetary policies to address inflation

are reflecting in the expectations of the bond markets (yields). In addition to increasing the

cost of capital, rising bond yields tends to suppress valuation multiples.

JM Financial Institutional Securities Limited Page 3

2023 Outlook 3 January 2023

Inflation trending down but will remain elevated in 2023

Easing commodity prices and supply constraints

The inflationary trend post opening up was mainly driven by supply side constraints although

demand also played its role. Global commodity prices peaked in Apr’22 and have gradually

softened since then. Crude oil prices are down 33% from peak levels in Jun’22; it is one of

the major commodities that have fiscal implications on the EM economies. In India’s case,

crude oil constitutes one third of the country’s import basket. As the world is readjusting

itself to the demand-supply equilibrium, early signs indicate that even supply-side bottlenecks

are easing. Global container freight rates have softened sharply and are closer to the pre-

pandemic period (Ex 10).

Exhibit 3. Food category drove commodity prices higher Exhibit 4. Crude prices eased 37% from its peak

240 Commodities (Indexed Jan'18=100) Brent crude (USD/bl)

220 120

200

180 100

160

140 80

120

100 60

80

40

60

Nov-18

Nov-19

Nov-20

Nov-21

Nov-22

Feb-19

May-19

Aug-19

Feb-20

May-20

Aug-20

Feb-21

May-21

Aug-21

Feb-22

May-22

Aug-22

20

Dec-15

Dec-16

Dec-17

Dec-18

Dec-19

Dec-20

Dec-21

Dec-22

CRB Index CRB Metal Food Fats & Oil Textiles

Source: Bloomberg, JM Financial Source: Bloomberg, JM Financial

Has this reflected in the inflation print?

Yes and No.... It is seen that inflationary trends are initially driven by some specific goods or

services which if not dampened through monetary/fiscal measures, percolate to broad-based

items in the basket. Stubborn inflation has a tendency to impact inflation expectations, which

then becomes a part of business decisions and wages. It is at this stage that inflation

becomes entrenched, making it difficult to bring it under control.

Retail inflation in US was driven by high energy and food prices that peaked Jun’22 (9.1%).

Core inflation continued to remain elevated at 6% even in Nov’22, but a closer analysis

reveals that inflationary pressures shifted from goods to services since Feb’22 (Ex 8) - clearly

reflecting waning supply side pressures.

India’s case is different. Food prices contributed the most due to its higher weight (39%) in

the CPI basket while fuel prices (weight 6.8%) were under control as the impact of higher

crude oil prices was absorbed by the oil marketing companies (OMCs). Inflation print

exceeded the Reserve Bank of India’s (RBI) ceiling (6%) by a smaller margin (1.8% at its peak)

vs. 7% in case of the US. The coordinated fiscal (absorbed high crude prices) and monetary

(front-loading rate hikes) measures have helped keep a tab on headline inflation. However,

core inflation has remained sticky (~6.2%) over the past 13 months.

JM Financial Institutional Securities Limited Page 4

2023 Outlook 3 January 2023

Exhibit 5. Energy & food prices drove US inflation higher… Exhibit 6. …unlike in India, where food prices contributed the most

US CPI Inflation (%) 16 India CPI Inflation (%)

14 50

12 CPI 40 14 CPI

Food 12 Food

10 30

Energy (RHS) 10 Fuel and Light

8 20

8

6 10

6

4 0

4

2 Target -10 2

0 -20 0

-2 -30 -2

-4 -40 -4

Jul-17

Jul-22

Apr-16

Oct-18

Mar-19

Jan-20

Jun-20

Apr-21

Nov-15

May-16

Nov-16

May-17

Nov-17

May-18

Nov-18

May-19

Nov-19

May-20

Nov-20

May-21

Nov-21

May-22

Nov-22

Nov-15

Sep-16

Feb-17

Dec-17

May-18

Aug-19

Nov-20

Sep-21

Feb-22

Source: CEIC, JM Financial Source: CEIC, JM Financial

Exhibit 7. Markets expect moderation in inflation Exhibit 8. Services takes the baton from goods, inflation likely to

7.0 US inflation expectations (%) remain elevated in 2023

14.0 US Core CPI inflation (%)

6.0 12.0

1 yr ahead

10.0

3yr ahead Core Goods

5.0 8.0 Core Services

6.0

4.0

4.0

3.0 2.0

0.0

2.0

-2.0

Nov-18

Feb-19

Nov-19

Feb-20

Nov-20

Feb-21

Nov-21

Feb-22

Nov-22

May-19

Aug-19

May-20

Aug-20

May-21

Aug-21

May-22

Aug-22

Source: Bloomberg, JM Financial Source: US BLS, JM Financial

Exhibit 9. Supply side pressures have normalised Exhibit 10. Easing supply constraints reflected in freight rates

4.5 Global Supply Chain Pressure Index World Freight Index (USD/40ft container)

4.0

10,000

3.5

3.0 8,000

2.5

2.0 6,000

1.5

1.0 4,000

0.5

0.0 2,000

-0.5

-1.0 0

Dec-19

Mar-20

Jun-20

Sep-20

Dec-20

Mar-21

Jun-21

Sep-21

Dec-21

Mar-22

Jun-22

Sep-22

Dec-22

Nov-10

Nov-11

Nov-12

Nov-13

Nov-14

Nov-15

Nov-16

Nov-17

Nov-18

Nov-19

Nov-20

Nov-21

Nov-22

Source: NY Fed, JM Financial Source: Bloomberg, JM Financial

JM Financial Institutional Securities Limited Page 5

2023 Outlook 3 January 2023

Does this mean that inflation is under control now? Are rate cuts on the anvil?

Probably not…. Past trends indicate that premature loosening in monetary policy before

inflation eases decisively leads to resurgence of inflationary pressures. Central banks around

the world are, therefore, treading carefully. Year 2022 was the year of front-loading of rate

hikes and normalisation of liquidity, the full effect of which is yet to be reflected in the real

economy. But some pockets of economy have started to feel the heat through high interest

rates. Economic growth projections have been revised downwards, equity markets especially

new age companies trading at rich valuations have seen contraction in their multiples.

A section of the markets has sensed that the policy rates are in fairly restrictive territory and

is, therefore, anticipating a policy pivot (rate cuts). But considering inflation (7.1%) is still way

higher than the US Fed’s target (2%), there are still calls for fairly restrictive monetary policy.

Even the US inflation expectation (1-year ahead) pegs inflation at 5.9%, which is a slight

moderation from current levels but still way higher than the Fed’s target. We believe that

market expectations of a policy pivot are misplaced. Recent surveys indicate that expectations

of the terminal rate have inched up to ~5.25% from the Fed’s Dec’22 estimate of 5.1%.

We expect inflation to remain elevated in 2023, that too, fairly above the central banks’

inflation targets in DM economies while it is highly likely that EM economies like India meet

their inflation targets, ceteris paribus. We don’t see the US Fed cutting policy rates in at least

H1 of 2023; it will most likely hold policy rates in restrictive territory till inflation eases

decisively. One more round of rate hike is due in the case of the RBI (probably of 25bps) with

a terminal rate expectation of 6.5%; this could be followed by a pause before changing the

stance to “neutral” sometime at the start of H2 of 2023.

JM Financial Institutional Securities Limited Page 6

2023 Outlook 3 January 2023

Government intervention needed to shield the economy

Global economy shifts to a lower gear

The hawkish tone of global central banks in their fight against decadal-high inflation led to

front-loading of rate hikes at an unprecedented pace, the impact of which is yet to be fully

reflected in the real economy. However, a handful of global macro indicators are indicating a

slowdown in economic activity across economies – majorly among DM economies and China.

Manufacturing PMI of DM economies (48.8) entered the contraction phase in Oct’22, falling

below that of EM economies (49.8).

Moreover, an inversion in yield curve (UST) has historically pre-empted recessionary periods by

18 months, on average. The recent inversion in the US yield curve (both 10yr-2yr and 10yr-

3mnths) in Jul’22 has led markets to anticipate an impending recession in the US.

Global growth projections were slashed from 2.9% to 2.7% for 2023 by the International

Monetary Fund (IMF); advanced economies are expected to grow at an even lower rate of

1.1% in 2023. India’s growth estimates were lowered by the IMF to 6.1%, but it is still

higher among other major economies.

Exhibit 11. Mfg PMI of DM economies enters contraction zone Exhibit 12. India’s Mfg sector resilient amidst recessionary fears

Manufacturing PMI Manufacturing PMI (Avg)

60 60

55

55 50

45

50

40

45 35

EM 30

40 DM 25

20

35

India

EM

DM

US

EU

China

Jul-20

Jul-21

Jul-22

Nov-19

Jan-20

Mar-20

May-20

Sep-20

Nov-20

Jan-21

Mar-21

May-21

Sep-21

Nov-21

Jan-22

Mar-22

May-22

Sep-22

Nov-22

2020 2021 2022

Source: Bloomberg, JM Financial Source: IHS Markit, JM Financial

Exhibit 13. US yield curve inverted sharply in 2022… Exhibit 14. …similar inversion in US 10yr – 3mth yields

Yield curve (US 10yr - 2yr, %) US yield curve (10yr -3mnth, %)

4.0 5.0

3.5

4.0

3.0

2.5 3.0

2.0

1.5 2.0

1.0

1.0

0.5

0.0 0.0

-0.5

-1.0 -1.0

Jan-90

Jan-92

Jan-94

Jan-96

Jan-98

Jan-00

Jan-02

Jan-04

Jan-06

Jan-08

Jan-10

Jan-12

Jan-14

Jan-16

Jan-18

Jan-20

Jan-22

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

2012

2014

2016

2018

2020

2022

Source: JM Financial | Note: shaded area represents recession period Source: JM Financial | Note: shaded area represents recession period

JM Financial Institutional Securities Limited Page 7

2023 Outlook 3 January 2023

Exhibit 15. Global GDP estimates revised downwards Exhibit 16. Recession followed sharp hikes in Feds policy rates

Growth Change from Effective Fed Funds Rate (%)

20.0

IMF Projections: Oct'22 estimates previous estimates

18.0

Growth (YoY%) 2022 2023 2022 2023

16.0

World 3.2 2.7 0.0 -0.2

14.0

Advanced Economies 2.4 1.1 -0.1 -0.3

12.0

US 1.6 1.0 -0.7 0.0

10.0

Germany 1.5 -0.3 0.3 -1.1

8.0

Japan 1.7 1.6 0.0 -0.1

6.0

Emerging Economies 3.7 3.7 0.1 -0.2

4.0

India 6.8 6.1 -0.6 0.0

2.0

China 3.2 4.4 -0.1 -0.2

0.0

Brazil 2.8 1.0 1.1 -0.1

1962

1966

1969

1972

1976

1979

1982

1986

1989

1992

1996

1999

2002

2006

2009

2012

2016

2019

2022

Mexico 2.1 1.2 -0.3 0.0

Source: IMF, JM Financial | Note: Oct’22 projections

Source: Fred, JM Financial | Note: shaded area represents recession period

Need to correct India’s trade imbalance

As the world economy slows, goods producers will look for new export markets. Since India

is one of the largest markets with relatively resilient demand, its imports could rise further.

This will further widen its trade deficit. Although, in absolute terms, India’s trade deficit has

been as high as USD 190bn on an annual basis since FY13, fiscal deficit as a proportion of

GDP has improved substantially since FY13 from 10% to 4% in FYTD23 (Apr-Nov). High

trade deficit, in addition to depleting forex reserves, also drags the country’s balance of

payments (BoP) position, which, in turn, exerts pressure on INR.

A deeper analysis of the trade deficit reveals that it is almost entirely concentrated in Asia – of

which China alone forms 30%, Europe constitutes 12% while the American region cushions

the trade deficit by 9% (Ex 18). Corrective fiscal action should be targeted towards region-

wise normalisation of trade imbalances through export promotion and entering into Free

Trade Agreements (FTA) with specific countries. Identification of export opportunities in Asia

and Oil exporting countries alone will significantly improve India’s trade balance. India already

has entered into 13 FTAs with 22 countries – most recently with UAE and Australia; in

addition there are six active Preferential Trade Agreements (PTAs) covering 52 countries.

Exhibit 17. India’s trade deficit as % of GDP improved considerably Exhibit 18. Trade deficit entirely concentrated in Asia; American

since FY13 region cushions it by 8%

India's Trade Deficit % of GDP Share of India's Trade Deficit (Apr-Nov'22, %)

0

20

8

-2

0

-4 0 -4

-4 -20 -13

-6

-40

-8

-60

-10

-10

-12 -80

FYTD23

FY01

FY02

FY03

FY04

FY05

FY06

FY07

FY08

FY09

FY10

FY11

FY12

FY13

FY14

FY15

FY16

FY17

FY18

FY19

FY20

FY21

FY22

-100 -91

Africa America Europe Asia Others

Source: CMIE, JM Financial Source: CMIE, JM Financial

JM Financial Institutional Securities Limited Page 8

2023 Outlook 3 January 2023

Regardless of the need for a correction in India’s trade balance, over the years, it has been

observed that India’s export basket has improved to include more value-added products,

indirectly indicating an improvement in the employment profile of the country towards skill-

based jobs from casual labour-based jobs earlier. Since FY11, the share of engineering goods,

drugs formulations, organic chemicals, and telecom instruments in the export basket has

improved. While exports of low-skill manufactured products such as cotton yarn, textiles, and

gems have fallen (Ex 20), India’s service balance is in surplus (average USD 10bn in FYTD23)

thanks to software exports. Since ~80% of its software exports are concentrated in US and

Europe, an impending slowdown in DM economies will lead to a moderation in software

exports in 2023.

Exhibit 19. Major items in India’s export basket Exhibit 20. Export basket improving towards high skill items

Top Export items (% share) Share of Exports basket (2011-22, %)

Agri Products

2.5

Gems & Jewellery

Falling share

1.9 1.6 2 2 1 1

2.3 11.2 0.5 1 1

Pharma 0

-1 -1 -1 -3 -7

3.2 Metals -1.5 Improving share

Electronics

4.1 -3.5

Chemicals

Textiles -5.5

4.3

9.1

Iron & Steel

-7.5

Pearls

Drug formn.

Gems

Iron & Steel

RMG

Machinery

Telecom instr

Pharma

Eng gds

Cotton yarn

Org Chem.

textile

Electric Machinery

4.9

Cars

5.2

5.5 Auto Components

Source: CMIE, JM Financial | Apr-Oct’22 Source: CMIE, JM Financial

Exhibit 21. Services exports cushion India’s trade deficit

Net Inflow from Software services (% GDP)

4.0

3.6

3.5 3.5 3.4 3.4

3.5 3.4 3.3

3.0 3.1 3.0

2.9

3.0 2.7

2.5

2.0

1.5

1.0

0.5

0.0

FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22

Source: CMIE, JM Financial

JM Financial Institutional Securities Limited Page 9

2023 Outlook 3 January 2023

INR to trade in the range of 82–84/USD in 2023

INR’s performance (-10%) during 2022 was mainly a function of the strengthening USD than

INR weakness. DXYs rally was largely led by macroeconomic factors such as decadal high

inflationary trend in the US and the US Fed’s hawkish policy actions. The dollar’s safe haven

status exacerbated the rally further as the uncertainty around geopolitical conflicts and the

global slowdown became clearer. Weakness in USD post Sep’22 (-6.3%), helped, arrest the

slide in INR.

India’s forex reserves declined by ~USD 83bn during 2022; the markets anticipated that this

was used up in the RBI’s FX market intervention to shield INR. However, RBI maintained that

its FX market interventions were meant to curb excessive volatility and anchor expectations as

the value of the INR is market-determined. Moreover as per the RBI’s estimates, 67% of the

depletion in the forex reserves was due to valuation changes arising from strengthening USD

and higher US bond yields. Domestic factors also ensured that the depreciation in INR was

orderly. We believe that INRs trajectory in 2023 will be equally decided by global geopolitical

and growth dynamics (still fluid) and appropriate domestic fiscal management.

Exhibit 22. INR strengthen vs. USD but weakened vs. other Exhibit 23. Commodity exporters gained while importer’s currency

currencies post Oct’22 weakened in 2022

115 Currency Performance vs USD

INR index (Jan'22 =100)

Turkish Lira -28.9

110 Indian Rupee -10.1

Taiwanese Dollar

105 Indonesian Rupiah

Chinese Renminbi

100

Philippine Peso

South African Rand

95

South Korean Won

Malaysian Ringgit

90

Thai Baht

Mexican Peso

85

Russian Ruble

Jul-22

Jan-22

Mar-22

Apr-22

Apr-22

Jun-22

Jun-22

Oct-22

Oct-22

Nov-22

Dec-22

Feb-22

May-22

Aug-22

Aug-22

Sep-22

Brazilian Real 5.6

-15 -10 -5 0 5 10

INR/USD INR/Pound INR/Euro INR/Yen

Source: CMIE, JM Financial | Note RBI Reference Index Rate of INR USD-Pound-Euro-Yen Source: Bloomberg, JM Financial

JM Financial Institutional Securities Limited Page 10

2023 Outlook 3 January 2023

Amongst the multiple factors that determine the trajectory of the INR, we made an attempt

to assess the status of major determinants and its possible impact on the currency in 2023.

Based on our assessment we expect the INR to trade in the range of 82 -84/USD during

2023, ceteris paribus.

Current Account Deficit (CAD) to exert pressure on INR: India’s CAD is primarily driven by the

size of the trade deficit. Trade imbalance worsened in FY22 (USD 102bn), and at the current

run-rate of USD 25bn per month it is expected to worsen further in FY23 (USD 300bn). As

we have highlighted in the earlier chapter, India’s imports are likely to rise further considering

that resilient domestic demand will attract producers in search of export markets for their

products. This, in the absence of reciprocal growth in exports, will widen the country’s trade

deficit. However, easing crude prices will provide major support to the trade balance. Services

surplus cushioned the CAD to the tune of USD 104bn in FY22, which is expected to reach

USD 120bn in FY23. On Net – in absence of any fiscal corrective measures, rising trade deficit

will exert pressure on the INR in 2023.

Consistent capital flows: FDI net inflows were to the tune of USD 39bn in 2022 and are

expected to be consistent in 2023 also. FPI flows in 2022 have been negative (USD 20bn) on

net basis; considering India’s resilient growth coinciding with rich valuations, we expect FPI

net inflows to be marginally positive in 2023, eventually improving overall capital flows.

Centre’s comfortable fiscal and borrowing to keep bond yields in check: The government’s

financial situation is at its best in FY23, So much so that its budget estimates look

conservative. As per government estimates, gross tax revenue is expected to exceed estimates

by ~ INR 4trln. On the expenditure side, we expect additional subsidy burden (Food and

fertilizer) would be to the tune of Rs. 2.4tn (Ex 26). Considering the comfortable fiscal

situation, the government is unlikely to resort to additional borrowing over and above its

target (INR 14.3trln). This makes the fiscal deficit target (6.4% of GDP) in FY23 achievable.

The impact of this is evident in the benchmark yield, which was up by a marginal 0.9% in

2022. As per our estimates, GST collections will moderate in 2023 as inflation eases further

(Ex 27).

Services to drive GDP growth: GDP growth estimates for FY23 were lowered to 6.8% in the

RBI’s Dec’22 MPC meet from 7.2% in Sep’22 as the global slowdown is expected to have a

spillover effect on the domestic economy. We expect services to drive the next leg of growth

even as manufacturing stabilises in 2023. Although rising imports would be an indication of a

pick-up in consumption, appropriate fiscal measures will be required to correct the trade

imbalance to avoid a drag on the economy. Although we expect GDP growth to moderate to

6% in FY24, robust growth on a relative (vs. EM peers) basis will support the INR.

Exhibit 24. Forex reserves adequate to cover 9mths import Exhibit 25. Sharper rise in US yields vs. India

20

Import cover Ratio (X) 4.5 4.3 Change in Gsec yields in 2022 (%)

18 4.0 India US

3.6

3.5

16

3.0

2.5

14 2.5 2.4

2.1

12 2.0

1.4 1.4

1.5

10

1.0 0.9

8 0.5

Jul-19

Oct-15

Mar-16

Jan-17

Jun-17

Apr-18

Oct-20

Mar-21

Jan-22

Jun-22

Aug-16

Nov-17

Sep-18

Feb-19

Dec-19

May-20

Aug-21

Nov-22

0.0

1yr 2yr 5yr 10yr

st th

Source: CMIE, JM Financial Source: CEIC, JM Financial | Note: Change from 31 Dec’21 to 30 Dec’22

JM Financial Institutional Securities Limited Page 11

2023 Outlook 3 January 2023

Exhibit 26. Subsidy burden expected to rise by INR 2.4trln in FY23 Exhibit 27. GST collections to moderate with easing inflation

Major Subsidies (Rs. Tn) 80.0 20.0

8.0 Expected increase YoY%

7.0 60.0

of Rs. 2.4 tn GST (YoY%) 15.0

6.0 40.0 WPI Inflation (RHS)

5.0 2.4 10.0

20.0

4.0 8

3.0 0.0 5.0

2.0 4

4 -20.0

1.0 3 2 2 2 3 2 0.0

-40.0

0.0

FY23BE

FYTD23

FY16

FY17

FY18

FY19

FY20

FY21

FY22

-60.0 -5.0

Mar-19

Mar-20

Mar-21

Mar-22

Sep-18

Sep-19

Sep-20

Sep-21

Sep-22

Source: CEIC, JM Financial estimates Source: CEIC, JM Financial

Exhibit 28. Centre’s interest payments expected to improve Exhibit 29. Net borrowing still at elevated levels

Interest payments % GDP 7.0

3.5 Net Borrowings % GDP

3.5 3.43 6.0

3.40

3.4 3.37

5.0

3.4 3.3

3.3 4.0

3.3 3.2

3.2 3.0

3.2

3.1

3.2 3.1 3.1 2.0

3.1 3.1

3.1 3.1

3.0 1.0

3.1 4 5 5 4 4 3 3 3 2 2 5 3 4

3.0 0.0

FY23BE

FY11

FY12

FY13

FY14

FY15

FY16

FY17

FY18

FY19

FY20

FY21

FY22

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

Source: India budget, JM Financial Source: India Budget, JM Financial

Exhibit 30. Centre’s FD % of GDP should comfortably meet target of 6.4%

140.0 Fiscal Deficit % of BE (Oct -YTD)

119.7

120.0

103.9 102.4

96.1

100.0

80.0

60.0

45.6

36.3

40.0

20.0

0.0

Oct-17 Oct-18 Oct-19 Oct-20 Oct-21 Oct-22

Source: CGA, JM Financial

JM Financial Institutional Securities Limited Page 12

2023 Outlook 3 January 2023

Exhibit 31. Real GDP expected to grow at 6.8% in FY23

YoY% 2016 2017 2018 2019 2020 2021 2022 2023E

Real GVA 8.0 8.0 6.2 5.8 3.8 -4.8 8.1 6.4

Agriculture, Forestry and Fishing 0.6 6.8 6.6 2.1 5.5 3.3 3.0 3.1

Industry 9.6 7.7 5.9 5.3 -1.4 -3.3 10.3 5.0

Mining and Quarrying 10.1 9.8 -5.6 -0.8 -1.5 -8.6 11.5 4.8

Manufacturing 13.1 7.9 7.5 5.4 -2.9 -0.6 9.9 4.3

Electricity, Gas, Water & Other Utilities 4.7 10.0 10.6 7.9 2.2 -3.6 7.5 8.7

Construction 3.6 5.9 5.2 6.5 1.2 -7.3 11.5 5.8

Services 9.4 8.5 6.3 7.2 6.3 -7.8 8.4 8.1

Trade, Hotels, Transport, Comm & Broadcasting 10.2 7.7 10.3 7.2 5.9 -20.2 11.1 8.4

Financial, Real Estate & Professional Service 10.7 8.6 1.8 7.0 6.7 2.2 4.2 6.0

Public Administration, Defence & Oth Services 6.1 9.3 8.3 7.5 6.3 -5.5 12.6 11.3

Private sector GVA 10.1 8.0 5.8 6.3 3.0 -6.4 8.5 6.2

Non-Agri GVA 9.5 8.2 6.2 6.5 3.5 -6.2 9.1 7.0

Real GDP 8.0 8.3 6.8 6.5 3.7 -6.6 8.7 6.8

Source: JM Financial

Exhibit 32.Higher services surplus to cushion trade deficit; expect capital flows to remain resilient

Quarter ended (USD Bn) Jun'20 Sep-20 Dec-20 Mar-21 Jun-21 Sep-21 Dec-21 Mar-22 Jun-22 Sep-22

Current account 19.1 15.3 -2.2 -8.2 6.6 -9.7 -22.2 -13.4 -18.2 -36.4

Current account % GDP 3.7 2.4 -0.3 -1.0 1.0 -1.3 -2.6 -1.5 -2.2 -4.4

Merchandise trade -11.0 -14.8 -34.6 -41.7 -30.7 -44.5 -59.7 -54.5 -63.0 -83.5

Invisibles 30.0 30.1 32.4 33.6 37.3 34.8 37.6 41.1 44.8 47.2

Services 20.8 21.1 23.2 23.5 25.8 25.6 27.8 28.3 31.1 34.4

Transfers 17.0 18.4 19.3 18.8 19.0 19.0 21.3 21.1 22.9 24.8

Income -7.7 -9.4 -10.1 -8.7 -7.5 -9.8 -11.5 -8.4 -9.1 -12.0

Capital account 1.4 15.9 34.1 12.3 25.4 39.6 22.5 -1.7 28.0 6.9

Capital account % GDP 0.3 2.5 4.6 1.6 3.7 5.2 2.7 -0.2 3.4 0.8

Foreign investments 0.1 31.4 38.6 10.0 12.0 12.6 -1.3 -1.4 -1.0 13.0

FDI -0.5 24.4 17.4 2.7 11.6 8.7 4.6 13.8 13.6 6.4

Portfolio invest 0.6 7.0 21.2 7.3 0.4 3.9 -5.8 -15.2 -14.6 6.5

Loans 2.8 -3.9 0.3 7.7 2.8 7.8 10.0 12.9 7.7

Banking capital 2.2 -11.3 -7.6 -4.4 4.1 0.4 8.2 -6.0 19.0 -8.4

Other capital -3.7 -0.3 2.8 -1.0 6.6 18.9 5.6 -7.2 2.3 3.1

Errors & omissions -0.6 0.4 0.6 -0.7 -0.1 1.3 0.1 -0.9 0.7 -0.9

Overall Balance 19.8 31.6 32.5 3.4 31.9 31.2 0.5 -16.0 10.5 -30.4

BoP % of GDP 3.9 5.0 4.4 0.4 4.6 4.1 0.1 -1.8 1.3 -3.5

Source: CEIC, JM Financial

JM Financial Institutional Securities Limited Page 13

2023 Outlook 3 January 2023

Conditions ripe for a pick-up in private capex

The central government’s gross tax revenue has been robust, forming 37% of its budgeted

estimates for FY23 during Apr-Oct, which is the highest till now. In addition, most states also

witnessed robust revenue growth during the same period. On the capex front, the central

government’s capex picked up pace (27% CAGR since FY21) vs. 13% CAGR during FY14-20

while state capex growth has been strong across major states such as Punjab, Bihar, West

Bengal, Tamil Nadu and Gujarat on a 3-year CAGR basis. The Centre’s Gross Fixed Capital

Formation (GFCF), representing investments in the economy, grew 10.4% in Q2FY23 in real

terms. Capacity utilisation among manufacturers reached its highest level of 73.4% (3MMA)

in 3 years. Our analysis of ~2,800 listed companies revealed that debt levels improved

substantially in FY22, which we believe will lead to a pick-up in the new investment cycle.

Although deposit growth was not able to catch up with credit growth, banks had ample

resources in the form of excess SLR of ~INR 17.5trln to meet the credit requirement.

We had highlighted in our report Capex: Ready for takeoff, how robust fiscal and capex of

both central and state governments will crowd in private investments. Clean balance sheets

of both banks and corporates and ample fire power at the disposal of banks (SLR balance) is

the perfect combination required for a pick-up in private investments.

Exhibit 33. Centre’s tax collection robust at 37% of FY23BE Exhibit 34. Centre’s capex picked up by 27% CAGR since FY21

40 Centre's Gross Tax Revenue (Apr-Oct) 37.0 80 4500 Central Gov. Capex (Apr-Oct, Rs. Bn)

4,090

35 4000

60

3500

30

40 3000

25

20 2500

20 2000

0

15 1500

-20 1000

10

500

5 -40

FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 0

FY17 FY18 FY19 FY20 FY21 FY22 FY23

% BE YoY% (RHS)

Source: CEIC, JM Financial Source: CEIC, JM Financial

Exhibit 35.Strong capex growth across major states on 3yr CAGR Exhibit 36. Debt position of chemicals, cap goods, durables, building

30 Capex Growth (3Yr CAGR%, Apr-Oct) material, pharma at its best

26

Interest coverage ratio (X)

25

20 18

15 20 FY18 FY19 FY20 FY21 FY22

14

12 12 11

9 9 15

10 8 7

6 6

4 3

% 2 10

0

0

5

-1

-

-10 -7

Auto Ancs

Chem & Fert.

Consumer

Consumer

Pharma & Health

Automobile

Building Material

Cap Goods

Durables

-16 -17

-20

WB

GJ

OD

MP

MH

MZ

CHH

TN

TR

JH

PJ

KL

UT

BH

KA

HP

UP

RJ

TG

AP

HR

Source: CEIC, JM Financial Source: Capitaline, JM Financial

JM Financial Institutional Securities Limited Page 14

2023 Outlook 3 January 2023

Exhibit 37. Current utilisation level calls for capacity addition Exhibit 38. Sufficient buffer available with banks in the form of

Capacity Utilisation (3MMA, %) excess SLR of INR 17.4trln

77.0

12% Excess SLR (% of NDTL)

75.0

73.0 11%

71.0

10%

69.0

67.0 9%

65.0 8%

63.0

7%

61.0

59.0 6%

57.0 5%

Jul-16

Jul-21

Jun-14

Nov-14

Apr-15

Dec-16

Oct-17

Mar-18

Jan-19

Jun-19

Nov-19

Apr-20

Dec-21

Sep-15

Feb-16

May-17

Aug-18

Sep-20

Feb-21

May-22

Nov-17

Feb-18

Nov-18

Feb-19

Nov-19

Feb-20

Nov-20

Feb-21

Nov-21

Feb-22

Nov-22

May-18

Aug-18

May-19

Aug-19

May-20

Aug-20

May-21

Aug-21

May-22

Aug-22

Source: CMIE, JM Financial Source: CMIE, JM Financial

Exhibit 39. Incremental credit % of GDP expected to revert >50 in FY23

Incremental credit to GDP Ratio (%)

90.0

70.0

50.0

30.0

10.0

-211

-10.0

-30.0

-50.0

Mar'04

Mar'05

Mar'06

Mar'07

Mar'08

Mar'09

Mar'10

Mar'11

Mar'12

Mar'13

Mar'14

Mar'15

Mar'16

Mar'17

Mar'18

Mar'19

Mar'20

Mar'21

Mar'22

Mar'23

Source: CMIE, JM Financial

Although the macro argument on the capex pick-up convinced market participants, the ever

changing global dynamics, geopolitical uncertainties, and hawkishness among global central

banks raised doubts on the corporate world’s ability to embark on a capex drive in these

uncertain times. To address the above concerns, we did an assessment within our coverage

universe (200+ companies) to gauge the on-ground reality on a company level. Our

assessment revealed that 1) almost all of the capex announced for FY24E is domestic oriented

2) 52% of the companies we cover have guided for growth in capex (here we compared 2yr

CAGR in Capex during FY22-24 vs. 5yr CAGR during FY18-22) 3) None of the companies are

contemplating any curtailment in their capex guidance except Vodafone whose capex

decision would be contingent on a fund-raise. Hence, the capex theme is intact and we

expect it to continue to play out in 2023 as well.

JM Financial Institutional Securities Limited Page 15

2023 Outlook 3 January 2023

India’s scope for improvement

The pick-up in the re-shoring trend will open up ample opportunities for India in the

manufacture of a wide range of products from toys to automobiles; in addition, setting up of

new manufacturing facilities will result in a pick-up in private investment in the economy.

Although India is better placed to capture new opportunities, we would like to highlight

some aspects that India lacks:

1) India’s labour productivity is one of the lowest in the world (Ex 35-36) – this can be

addressed through automation and investments in new technology.

2) Scale of manufacturing is miniscule compared to China – Effective policy push, easier

compliance and land availability will help companies achieve scale.

Exhibit 40. India’s labour productivity one of the lowest… Exhibit 41. …with no improvement over the years

Output/worker (USD) Output/worker (5yr CAGR,%)

60,000 8.0

7.0

50,000 2010 2010-15

6.0

2015 2016-20

40,000

5.0 2017-21

2021

30,000 4.0

3.0

20,000

2.0

10,000 1.0

0 0.0

Malaysia Brazil China Indonesia India Vietnam China Vietnam India Brazil Indonesia Malaysia

Source: ILOSTAT, JM Financial | GDP constant 2017 Intl. USD at PPP Source: ILOSTAT, JM Financial

JM Financial Institutional Securities Limited Page 16

2023 Outlook 3 January 2023

India’s resilience likely to command higher multiples

If 2022 was the year of rising topline with squeezing margins, then 2023 will be the year of

moderating topline with easing margin pressures due to softening commodity prices. Past

trends indicate that sales growth moves in tandem with wholesale inflation, and considering

inflation will moderate, going forward, we expect topline growth to moderate in 2023 (Ex

44) while margin pressures are expected to ease. We believe that the extent of the

disinflationary phase in 2023 will be shallow, keeping inflation elevated. Consensus is

building in EPS growth of 19% for FY23 and 13% for FY24; we expect it to taper to 10%

and 11% respectively.

Domestic equity markets were resilient even amidst heavy FII selling, as domestic flows came

to the rescue. Most intense FII selling continued for nine consecutive months during Oct’21 –

Jun’22 to the tune of USD 36bn (of which USD 12bn recouped till now) (Ex 45); during this

period, Nifty lost 10%. However, in 2022, although FII flows have been negative (USD 18bn),

Nifty gained 4.87%. Current Nifty’s 1 yr forward (PE) multiples trades 1 STD above mean,

while on a price to book it is just shy of 2 STD above the long-run mean. Our assessment of

the Nifty’s long-run valuation trajectory reveals that the average 1yr forward PE multiples for

the pre-Covid period was 15.9X, which is currently trading above 20X (Ex 49) even though FII

holdings are at its lowest (19%, Ex 50). We believe that the intense FII selling has stress-

tested Indian markets and set a floor to the valuation multiples. Indian markets will command

higher multiples, going forward, based on the resilience demonstrated by domestic flows.

RBI’s monetary policy is expected to be fairly hawkish; however, a change in stance to

“Neutral” is expected at the end of H1 2023. RBI is unlikely to cut policy rates in 2023.

Hence, banks will feel the heat of rising deposit rates after 1H2023. Till then, we prefer

private banks. We will re-evaluate our preference for Banks post 1H2023, when the picture

on NIMs (net interest margins) becomes clearer.

Based on our conviction on revival in private capex, we prefer to bet on capex beneficiaries

such as Industrials, Cement, and Real estate ancillaries. Defence as a theme is likely to do well

as heightened geopolitical conflicts will force countries to enhance their defence spending.

Exhibit 42. Growth outperformed Value in 2022 Exhibit 43. Disinflationary trend to moderate corp. sales growth

MSCI India Value vs Growth returns (%) 60 YoY% 20

67

70.0

Net Sales (Ex Fin, YoY%) 15

2019 2020 2021 2022 40

WPI Inflation (RHS)

50.0 10

20

33 32

5

30.0 23 23 24 24

0

10 0

8 10 8

10.0 5

1 -20

-5

-10.0 -4 -9 -5 -40 -10

India Growth Mid Cap Growth Small Cap Growth India Value

Mar-13

Mar-14

Mar-15

Mar-16

Mar-17

Mar-18

Mar-19

Mar-20

Mar-21

Mar-22

Sep-13

Sep-14

Sep-15

Sep-16

Sep-17

Sep-18

Sep-19

Sep-20

Sep-21

Sep-22

Source: MSCI, JM Financial Source: Captaline, JM Financial | Note: ~2900 listed companies

JM Financial Institutional Securities Limited Page 17

2023 Outlook 3 January 2023

Exhibit 44. FII flows returning after consistent selling in since Oct’21 Exhibit 45. DIIs supported markets throughout 2021 & 2022

10000 FII Net Flows (USD Mn) DII Net Flows (Rs. Bn)

8000 350

6000

250

4000

Record Outflows

2000 of USD 36Bn

150

0

-2000 50

-4000

-50

-6000

-8000 -150

Dec-20

Apr-21

Jun-21

Oct-21

Dec-21

Apr-22

Jun-22

Oct-22

Dec-22

Feb-21

Aug-21

Feb-22

Aug-22

Apr-21

Oct-21

Apr-22

Oct-22

Dec-20

Feb-21

Jun-21

Aug-21

Dec-21

Feb-22

Jun-22

Aug-22

Dec-22

Source: CMIE, JM Financial Source: CMIE, JM Financial

Exhibit 46. Nifty PE multiples Exhibit 47. P/B mutiples

30 Nifty 1 Yr fwd PE 4.5 Nifty 1yr Fwd PB

4.0

25

3.5

20

3.0

15 2.5

10 2.0

1.5

5

1998

2001

2004

2007

2010

2013

2016

2019

2022

1995

1998

2001

2004

2007

2010

2013

2016

2019

2022

Series1 Mean 1 STD

PE Mean 1 STD

-1 STD 2 STD - 2 STD -1 STD 2 STD - 2 STD

Source: Bloomberg, JM Financial Source: Bloomberg, JM Financial

Exhibit 48. Nifty likely to command higher multiples going forward Exhibit 49. FII Holding at its lowest at 19%

Nifty Average 1yr Fwd PE (X) 24% FII holding in Indian markets (%)

24

Pre-Covid avg. PE 21.5

20.9 23%

23.2%

20

15.9

16.9 22%

15.8

16 14.8

21%

12 11.2

20%

8 19.3%

19%

4

18%

0 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 Jun 22 Sep 22

Yr 96-00 Yr 01-05 Yr 06-10 Yr 11-15 Yr 16-20 Yr 21-22

Source: Bloomberg, JM Financial Source: Bloomberg, JM Financial

JM Financial Institutional Securities Limited Page 18

2023 Outlook 3 January 2023

Buy/Sell Recommendations

Auto & Auto Ancs

Maruti Suzuki (Buy, TP INR 11,000)

During the previous product cycle (FY14-19, MSIL expanded its market share from c.40%

to c.51% and its EBITDA margin expanded by 600bps to c.15%. MSIL has entered into a

new product cycle. The recently launched Baleno, Brezza and Grand Vitara have been

received well and pending order book remains strong. Multiple new UV launches are

expected to follow - 5-door Jimny and Baleno crossover SUV in CY23 and new 3-row SUV

in CY24. This will drive performance, going ahead.

Samvardhana Motherson (Buy, TP INR 115)

Recovery in global automotive production, higher content/vehicle and inorganic growth is

expected to drive growth in the automotive business. Strong order book for non-

automotive business (led by Aerospace and Medical segment) will further support

diversification. SAMIL is at the end of its capex cycle and has the requisite capacity to

meet its medium-term targets. Lower working capital on easing supply chain, improving

profitability, and higher operating leverage will drive performance, going ahead.

BFSI

Banking

Bandhan (Buy, TP INR 325)

In our view, Bandhan is gradually addressing investors’ long-standing concerns regarding

geographical concentration and higher ticket sizes. Also, the management has

highlighted its intent to shore up coverage on an on-going basis by creating additional

provisions, which should reduce the volatility in its earnings profile. Despite its issues,

Bandhan has delivered average RoE of 14.8% over the last 5 years (11.9% in the last 3

years). As it benefits from cyclical tailwinds in the microfinance business, which is further

aided by its own course correction, current valuations (1.6x at FY24E P/BV and 7.9x FY24E

P/E), in our view, make risk-reward favourable given FY24E RoA/RoE expectations of

2.9%/22.4%. We maintain BUY with an unchanged TP of INR 325. Any further recoveries

from CGFMU claims could be an additional upside.

NBFC

Poonawalla Fincorp (Buy, TP INR 445)

Poonawalla Fincorp Ltd. (PFL) is a diversified lender focused on consumer and small

businesses with digital-first products. Poonawalla Finance acquired Magma Fincorp in

4QFY21 and rebranded it as Poonawalla Fincorp. Since then the company has entirely

shifted its strategy across product portfolio, customer segment, and geography.

The company realigned the customer base towards credit-tested borrowers (vs. new-to-

credit earlier) and small/ medium businesses with formal source of income and adequate

documentation in urban areas (vs. rural earlier). It focuses on digital transactions (vs. cash

transactions earlier), product diversification, granularity and cross-sell opportunities. After

the fund infusion by the new promoters, the company witnessed multiple credit rating

upgrades by leading rating agencies, which resulted in a decline in cost of funds, thereby

enabling it to offer fine pricing to customers.

Asset quality deteriorated over FY19-3QFY21 due to macroeconomic headwinds caused

by Covid-induced stress (wherein GS3/ NS3 increased from 4.8%/ 3.1% in FY19 to 6.9%/

JM Financial Institutional Securities Limited Page 19

2023 Outlook 3 January 2023

4.5% in 3QFY21). But it has improved remarkably since then: GS3/ NS3 stood at 1.5%/

0.8% as of 2QFY23, driven by: i) Healthy collection efficiency trends, ii) Stringent risk

management practices including tighter underwriting, iii) Accelerated write-off policy.

90% of the new customers onboarded have CIBIL score > 700 for unsecured

underwriting and most of the overall customers have CIBIL score > 750. Additionally, with

the usage of data analytics, the entire book originated over the last 12 months has 30+

DPD of sub 0.3%, which is best in class.

We expect earnings expansion ahead as operating leverage kicks in to drive RoA of 3.4%

(RoE of 15.4%) in FY25E albeit near-term RoEs appear suppressed, given high

capitalisation levels (45% Tier1, as of 2QFY23).

Cement

Ambuja Cements (Buy, TP INR 610)

Ambuja Cements’ acquisition by the Adani Group will help the company boost its

capacity significantly (plans 2x capacity expansion over the next 5 years). We believe that

EBITDA per tonne will start improving materially on account of i) fall in power and fuel

cost, ii) integration with other Adani group companies, and iii) broad-based demand pick-

up. With a well-established pan-India network and high capacity utilisation, we feel

Ambuja can scale up volume in cement / value-added products led by new capacity

additions. It is currently trading at 16.5x Sep’24E EV/EBITDA. We maintain a ‘BUY’ rating

and a Sep’23 TP of INR 610.

Dalmia Bharat (Buy, TP INR 2,140)

Dalmia is presently one of the leading players in South, Northeast and East markets and is

looking to become a pan-India player through timely capacity additions (14-16% CAGR

to reach 110-130MTPA by 2031; 49MTPA by 2024 and 70-75MTPA by 2027; prior to

Jaypee acquisition: 37MTPA). Dalmia recently completed the acquisition of Jaypee’s

cement assets at an enterprise value of INR 56.66bn adding 9.4MTPA cement capacity,

6.7MTPA clinker capacity and thermal power capacity of 280MW. With a lean balance

sheet and aggressive expansion plans, we feel Dalmia will continue inorganic expansions.

It is currently trading at 10.5x Sep’24E EV/EBITDA. We maintain BUY with a Sep’23 TP of

INR 2,140.

Chemicals

Navin Fluorine (Buy, TP INR 5,090)

Navin Fluorine’s decision to assign three operating CEOs for three business units has

eliminated the execution and key man risk to a large extent. Over the years, Navin

Fluorine has emerged as a preferred partner when it comes to fluorination chemistry in

both Agrochemicals and Pharma segments. We believe Navin could win further contracts

for HFOs and Fluorospeciality chemicals for Agro and Pharma Intermediates. The company

is looking to expand HF capacity at Dahej to increase availability of HF post

commissioning of various projects. Going forward, we believe that with higher utilisation

of the HPP plant, margins should improve considerably. Moreover, recovery in CDMO in

2HFY23 and a new USD 16mn order in FY24 should drive significant growth in the

CDMO vertical in the near term while ramp-up of newer capacities (MPP and dedicated

agrochemical capacity) should boost specialty chemicals sales in 2HFY23 and FY24. We

maintain BUY with a Sep’23 TP of INR 5,090 as we believe Navin’s long-term contracts

along with strong entry barriers offered by its fluorination expertise provide long-term

revenue growth visibility.

JM Financial Institutional Securities Limited Page 20

2023 Outlook 3 January 2023

SRF (Buy, TP INR 3,000)

SRF remains at the forefront of capturing growth from the various sub-sections of the

fluoro-chemicals space. Going forward, SRF aims to a) incur chemicals capex of ~ INR

120-130bn over the next 5 years, b) grow the chemicals business at 20% while

maintaining 20% RoCE, c) accelerate growth of the pharma piece to more than 30%, d)

take the fluoropolymer revenue contribution to USD 150-200mn over the next 5 years,

and e) grab the incremental opportunities in HFOs, electronic and battery chemicals. SRF

is also eager to enter into the HFO space once the patents of various HFOs (especially of

1234yf) expire over the next 2-5 years. Currently SRF primarily manufactures

agrochemical intermediates, but it intends to go up the agrochemical value chain and

plans to commercialise eight active ingredients. We maintain BUY with a Sep’23 TP of INR

3,000 as these well-laid-out plans gives confidence on the long-term growth visibility of

SRF.

Fine Organics (Sell, TP INR 3,560)

We believe that the market is overlooking a) easing of product supplies, resulting in

spreads returning to normal levels, b) Fine’s already high market share in the plastic

additives segment, c) one-step process and high linkage of Fine’s products to vegetable

oil prices, d) correction in vegetable oil prices, and e) the recent acquisition of Croda’s

similar business at much lower valuations. Since the disruptions of product supplies is

likely to have eased in early May, Fine continued to make higher spreads in 1HFY23 and

we expect spreads to normalise post that. Fine’s already high market share (~30-35%) in

the plastic additives segment leaves limited upside potential. Erucic Acid prices have also

shown a sharp correction (~34% from Nov’21) and this will lead to gross margin

contraction in the coming quarters. In our view, there has been no structural change in

Fine’s product profile or business model. In fact, sharp movements in vegetable oil prices

have highlighted the high linkage of Fine’s products to commodity prices. We maintain

SELL with an unchanged DCF-based TP of INR 3,560 (implying 33x Sep’24E EPS).

Consumers

HUL (Buy, TP INR 2,855)

Well diversified portfolio & superior execution provide HUL a relatively better ability to

navigate current challenging times. Likely rural recovery, uptick in Personal care portfolio

(drives mix & margins), GSK synergies gradually playing out & ability to extract cost

savings will aid the earnings trajectory over medium to long term. We like HUL – bad

news are well-known and the going is likely to only get better hereon. We believe it is

best placed to navigate through challenging times, which justifies premium valuations

(52x FY24e)

GCPL (Buy, TP INR 1,000)

New CEOs well-defined roadmap (harness the tailwinds in a few of the attractive

categories, increased collaboration across geographies, increased investments behind

media and sampling, and focus on category development), improved execution in Africa

& gradual recovery in Indonesia will aid improvement in overall earnings growth. We

believe the execution machinery being put in place will yield the desired results over the

medium-term. At CMP, stock is trading at 42x FY24e, lower compared to its 5 year

average.

Westlife (Buy, TP INR 900)

Consistent delivery & superior execution on key metrics clearly highlights that its strategic

initiatives (on portfolio expansion and omni-channel capabilities) are working pretty well

in enhancing profitability, thereby driving its ability to expand faster. Remain believers in

JM Financial Institutional Securities Limited Page 21

2023 Outlook 3 January 2023

Westlife’s capabilities to capitalise on the growing QSR opportunity in India. Healthy

outperformance vs peers justifies premium valuations (29x FY24e comparable EBITDA)

Go Fashion (Buy, TP INR 1,410)

Capabilities (wide-portfolio, superior unit economics) in place to sustain leadership

position in high growth women’s bottom-wear segment. An in-place execution template,

lack of formidable competition and the company’s focus on newer growth drivers (online

channel and new product extensions) provide assurance on the future runway for growth.

At CMP stock trades at 29x on one year forward basis & we believe superior execution

justifies premium valuations.

Healthcare

Sun Pharma (Buy, TP INR 1,180)

Sun’s global specialty portfolio has seen stellar growth led by Ilumya, Cequa and Winlevi

and we expect this to continue. Sun is conducting Phase III clinical trials for Psoriatic

Arthritis indication for Ilumya which, along with a structural shift towards anti-IL23 drugs,

provides a long runway for growth;

Sun has been consistently outperforming domestic industry growth while sustaining

market leadership. Sun recently expanded its domestic field force by 10%, which will

sustain IPM outperformance as productivity increases;

Ex-Taro margins have been on the rise, alleviating higher R&D cost concerns;

Healthy R&D pipeline and potential in-licensing opportunities provide long-term revenue

visibility;

Strengthening balance sheet with robust cash balance (ex-Taro) provides sufficient

headroom to grow inorganically;

Given the strong earnings up-cycle and attractive valuations (trades at 23x/20x FY24/FY25

earnings), upward re-rating cannot be ruled out.

Biocon (Buy, TP INR 395)

Viatris acquisition positions Biocon as an integrated global biosimilars play. Viatris revenue

and Serum vaccine contribution will start contributing 3Q onwards;

Biocon has multiple levers: (1) Syngene’s Zoetis deal with USD 50mn p.a. potential

(average 10yr contribution) and capacity expansions; (2) New API facility in Vizag will drive

growth for the Generics business, which has been constrained due to capacity; (3)

Upcoming biosimilars launches such as Insulin Aspart, Bevacizumab, Adalimumab and rH-

Insulin; (4) Enviable biosimilars pipeline; and (5) Continued market share gains in Semglee;

We believe new product approvals, Serum vaccine contribution, Viatris integration and

commercial success in developed markets will gradually re-build street confidence hereon;

Attractive valuations (trades at 24x/16x FY24/FY25 earnings), strengthening leadership

team, marquee investor backing and a high risk-reward proposition, in our view, makes

Biocon an attractive BUY.

Key risks include: delays in approval/ launches, debt sustainability and competitive

intensity.

JM Financial Institutional Securities Limited Page 22

2023 Outlook 3 January 2023

Industrials

Tega Industries (Buy, TP INR 700)

Tega is the second largest producers of polymer-based mill liners. Introduction of new

products - DynaPrime liners have opened up a US$ 900mn metallic liner market for

conversion.

Sticky customer base as 75%+ sales comes from repeat orders.

De-risked business model due to low customer concentration (top 10 customers: 29% of

sales) and diverse manufacturing base (India, Chile, South Africa, and Australia).

We forecast sales/EPS CAGR of 16%/25% over FY22-25E, as we expect penetration in its

Dynaprime range to drive growth and expect margins to improve to 21-22% by FY24-25

(vs 19.2% in FY22).

Voltas (Buy, TP INR 1,150)

Backward integration for compressors and AC components through JV with Highly and

investments under PLI scheme

On track to gain 10% market share in refrigerators and washing machine through Voltas

Beko

Recovery in order inflows as restructuring of projects division is completed.

We believe the worst is behind for Voltas and we expect the company to retain its market

share given measures taken by the company.

We bake in sales/adj PAT CAGR of 20%/27% over FY22-25E.

IT Services

Wipro (Buy, TP INR 480)

Positive changes happening in the company: We believe the changes brought in by the

new leadership team – a structured approach to nurture large /strategic clients, increased

rigour to monitor pipeline, strong local frontline leadership, and a shift towards

performance-driven culture – are long-term positives for the company.

Sharp valuation correction: Wipro re-rated sharply (12x to 30x from Jun’20 to Nov’21)

after Thierry took the helm as pro-active organisational changes and newer acquisitions

helped it capture the demand tailwind. Just as its re-rating was ahead of peers, the

subsequent valuation correction was also the highest (38% vs. 11-32% for the top-5).

Limited exposure to stressed verticals: Wipro has traditionally been very strong in Energy

and Utility, a rare bright spot in the current environment. Further, at 35%, Wipro’s

exposure to BFSI, a relative less impacted vertical, is the highest. Over 60% exposure to

Americas also bodes well.

We believe positive changes at Wipro, muted expectations and valuation discount make

for a good entry point.

Tech Mahindra (SELL, TP INR 970)

Highest exposure to stressed verticals: Communication sector has seen sharp earnings

cuts over the past 6 months both in S&P500 (-12.5%) and FTSE100 (-3.5%). TECHM’s

40% exposure to this sector is a key risk. Besides, TECHM has high exposure to

Manufacturing (16%) and Technology (10%), which are showing signs of stress.

Margins still under stress: A slower growth trajectory is likely to defer margin recovery

further. We expect FY23E exit EBIT margin to be 12.9% vs. 14% guided earlier. In fact,

we expect margins to remain range-bound till FY25E.

JM Financial Institutional Securities Limited Page 23

2023 Outlook 3 January 2023

Further downside risk to valuation: TECHM’s PER has corrected by 28% TTM, next only to

Wipro among the top-5. Despite that, the stock is still trading at 7% premium to its 5-

year median. We see further correction as growth/margins lag peers.

We believe TECHM’s higher exposure to stressed verticals, lower margin profile and weak

macro should translate into a discount to historical valuation.

Internet

Nazara Tech (Sell, TP INR 650)

Nazara has multiple (subscale) growth segments but lacks a strong core to drive synergies

and put the flywheel in motion, making the long-term compounding growth narrative

th

unclear. As highlighted in our downgrade report dated 20 Sept 2022 (Too many “put-

and-takes”), lack of shareholders’ value creation by MTG, a Swedish gaming company

with a holdco structure like Nazara, is a case in point.

As we argued in 1QFY23 update recent acquisitions have structurally lowered Nazara’s

margin profile. Lack of synergies across multiple disjointed businesses restricts operating

leverage. Slowdown in high margin businesses is further pulling margins down.

Headwinds in RMG (TN ordinance), eSports (BGMI ban) and Datawrkz (demand softness?)

are clouding outlook.

We forecast Revenue/EBITDA/EPS CAGR of 41%/27%/33% over FY22-25E, while we

expect margins to remain subdued due to structurally lower margin profile of its recent

acquisitions, and headwinds in fastest growing categories (RMG and KIddopia).

Zomato (BUY, TP INR 126)

Zomato remains our top pick in the Internet sector despite expectations of near-term

growth blip due to macro factors. Our conviction is based on immense growth potential

within its existing customer base and under-penetration in both Food Delivery and Quick

Commerce verticals; high likelihood of profitability achievement in core business (ex-

Blinkit) by 2QFY24 (management guidance) and tightening-up of the private funding

environment that is likely to reduce the competitive intensity in the Quick Commerce

vertical, which, in turn, can lead to accelerated profitability at the consolidated level.

Recent Prosus releases also indicate that Zomato is outperforming Swiggy (in terms of

market share) in both Food Delivery as well as Quick Commerce verticals despite

significant ramp-up in investments by the latter, likely indicating better execution

capabilities of the former. Overall, we expect Food Delivery GOV to grow at a CAGR of

~26% over FY22-25E and expect consol. business (including Blinkit) to achieve adj.

EBITDA break-even by FY25.

PB Fintech (Buy, TP INR 910)

PB Fintech is our next pick as the company remains a dominant play on insurance

distribution in India, which has long-term tailwinds due to poor insurance penetration in

the country and efforts in place to enhance penetration. The company remains the largest

insurance distributor in the country in both online and offline formats. Furthermore,

Paisabazaar has bounced back strongly from the Covid period and remains a play on

credit growth in the country with most consumers starting their research journey for loans

and credit cards with a google search. The management has been reiterating expectations

of group level adjusted EBITDA (excluding ESOPs) break-even in Q4FY23 and expectations

of adding INR 1.5-2bn in incremental EBITDA every year to reach INR 10bn in PAT in

FY27. We get comfort from the fact that the company has strong moats in insurance

distribution with almost 40% market share in online insurance, and it is expected to

remain the flag-bearer with online penetration in the sector rising (expected to grow in

double digits for the foreseeable future). We expect group revenue to grow at 34%

FY23-27E CAGR with adj. EBITDA margin of 11.0% in FY27E.

JM Financial Institutional Securities Limited Page 24

2023 Outlook 3 January 2023

Media & Entertainment

Sun TV (Buy, TP INR 760)

Sun TV, South India’s leading broadcast network, is one of the most profitable media

companies globally. Sun’s industry leading margin profile reflects the company’s deep

understanding of its viewer base, focus on content monetisation, and access to low-cost

talent. This has resulted in higher inventory turn, low cost of content, and industry

leading subscription growth.

We believe Sun TV’s IPL franchise is an under-appreciated asset and it would be the

biggest beneficiary of 3x rise in Media rights value in the latest auction. Our DCF-based

methodology pegs Sunrisers Hyderabad’s value at INR 66bn.

Sun TV’s core broadcasting business (ex-IPL, Ex-Cash) trades at 5x FY24E core EPS. This is

at a discount even to print media companies as well as distribution companies (cable

operators), which is unjustified in our view. We believe either the market is undervaluing

the core business or IPL. In any case, we see a strong case for re-rating for the stock.

We forecast Sun TV’s revenue to grow at CAGR of 13% over FY22-25E driven by

14%/4%/39% CAGR in advertising/subscription/IPL revenues. Strong growth and

improved margins in IPL should drive 30bps margin expansion, resulting in 11% EPS

CAGR. We ascribe 7x EV/EBITDA to the core broadcasting business and we value IPL

separately using DCF.

Metals

Hindalco Industries (Buy, TP INR 525)

Aluminium prices have recently rallied on hopes of improved demand from China amidst

easing Covid norms. Increased smelter curtailments across Europe on account of the

energy crisis and multi-year low LME inventory will likely support aluminium prices going

forward. Hindalco remains well placed given a) Novelis – maintaining medium-term

EBITDA/t guidance of ~US$525, b) improving trajectory for India aluminium business

given thermal coal price correction, c) enhanced coal security post acquisition of

Meenakshi and Chakla coal mines at recent auctions, and d) growth capex to augment

downstream capacity amidst encouraging demand for FRP products. Hindalco, given

~75%+ steady/strong EBITDA being non-LME linked, remains our preferred play in the

metal space.

Oil & Gas

RIL (Buy, TP INR 2,950)

ARPU on a structural up-trend; Jio on track to ~45% RMS: We believe ARPU is on a

structural uptrend given the consolidated industry structure, future investment needs and

to avoid a duopoly market. Further, Jio is poised to acquire a significant share of

subscribers from VIL in the event of a duopoly market structure, enabling stronger pricing

power and better digital cross-sell and up-sell opportunities. Hence, we expect Jio ARPU

to post a 10% CAGR over FY23-28; Jio to attain ~45% RMS target by FY25E (vs. 42% in

FY22).

Retail - driving omni-channel capabilities across segments: RIL is driving omni-channel

capabilities across Retail segments as well as extending JioMart to Consumer Electronics

and Fashion & Lifestyle. This could become a sizeable value-creation opportunity in the

future

Though continued high capex is a key near-term concern, we have a BUY (TP of INR

2,950) given RIL’s industry leading capabilities across businesses and expectation of

robust 14-15% EPS CAGR over next 3-5 years. At CMP, the stock is trading at FY24E P/E

of 24.9x (3yr average: 23.0x) and EV/EBITDA of 12.7x (3yr average: 13.1x).

JM Financial Institutional Securities Limited Page 25

2023 Outlook 3 January 2023

Indraprastha Gas (Buy, TP INR 500)

We have BUY on IGL (TP of INR 500) due to its: a) robust pricing power given that CNG is

40%/20% cheaper than petrol/diesel, and b) steady volume growth story based on its

existing lucrative NCR market (CNG penetration in private cars in Delhi is still only ~23%)

and expansion into new, lucrative nearby cities and intercity traffic. The Kirit Parikh

committee recommendation of capping domestic APM gas price at $6.5/mmbtu (vs

current price of $8.57/mmbtu) is a near-term positive for CGD companies. At CMP, IGL is

trading at FY24 P/E of 17x (3yr average: 23x) and FY24P/B of 3.5x (3yr average: 4.6x)

ONGC (Buy, TP INR 205)

We maintain BUY on ONGC (TP INR 205) given strong dividend play (7-8% dividend yield)

and also because CMP is discounting only ~USD 50/bbl net crude realisation while our TP

is based on USD 65/bbl net crude realisation and various changes in windfall tax

suggesting the government is fine with ONGC making net crude realisation of ~USD

75/bbl. ONGC and Oil India will also benefit from the high domestic gas price. At CMP,

ONGC trades at 4.6x FY24E EPS and 0.6x FY24E BV (3-year avg. of ~0.6x).

Real Estate

DLF (Buy, TP INR 465)

For FY23, DLF has a guidance of INR 80bn worth of booking value, and it remains well on

track with steady launches of INR 20-25bn every quarter. In the annuity business, the

DCCDL portfolio offers growth visibility with 100% pre-leasing of Downtown Gurgaon at

25% premium to Cyber Park (opposite Downtown Gurgaon and commenced last year),

and it is likely to have exit rentals of INR 44 / 49bn for FY23 / FY24. We continue to like

DLF’s strong market positioning in a fast-rebounding Delhi NCR market, and as the cycle

progresses further, DLF with its steady annuity cash flows and fully paid-up land banks

remains extremely well placed to scale up across segments. It is currently trading at 0.8x

P/NAV. We maintain BUY with a Sep’23 TP of INR 465.

Macrotech Developers DLF (Buy, TP INR 1,425)

For FY23, Macrotech has a guidance of INR 115bn worth of booking value, and it remains

well on track as it has achieved INR 60.04bn in 1HFY23. MDL has added 4 new JDA