Professional Documents

Culture Documents

Brief Exercise Solutions - Chapter 10

Uploaded by

Quynh Nguyen Huong0 ratings0% found this document useful (0 votes)

5 views2 pagesOriginal Title

Brief Exercise Solutions_Chapter 10

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pagesBrief Exercise Solutions - Chapter 10

Uploaded by

Quynh Nguyen HuongCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

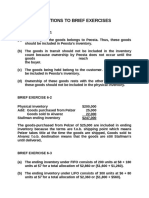

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 10-1

All of the expenditures should be included in the cost of the land.

Therefore, the cost of the land is $61,000, or ($50,000 + $3,000 + $2,500 +

$2,000 + $3,500).

BRIEF EXERCISE 10-2

The cost of the truck is $32,500 (cash price $30,000 + sales tax $2,100 +

painting and lettering $400). The expenditures for insurance and motor

vehicle license should not be added to the cost of the truck.

BRIEF EXERCISE 10-3

1. Maintenance and Repairs Expense........................... 45

Cash.....................................................................

2. Equipment................................................................... 400

Cash.....................................................................

BRIEF EXERCISE 10-4

Depreciable cost of $32,000, or ($38,000 – $6,000). With a four-year

useful life, annual depreciation is $8,000, or ($32,000 ÷ 4). Under the

straight-line method, depreciation is the same each year. Thus,

depreciation is $8,000 for both the first and second years.

BRIEF EXERCISE 10-5

It is likely that management requested this accounting treatment to

boost reported net income. Land is not depreciated; thus, by

reporting land at $120,000 above its actual value the company

increased yearly income by $8,000, or the reduction in

depreciation expense. This practice is not ethical because

management is knowingly misstating asset values.

BRIEF EXERCISE 10-6

The declining balance rate is 50%, or (25% X 2) and this rate is applied to

book value at the beginning of the year. The computations are:

Book Value X Rate = Depreciation

Year 1 $38,000 50% $19,000

Year 2 ($38,000 – $19,000) 50% $ 9,500

BRIEF EXERCISE 10-7

The depreciation cost per unit is 26 cents per mile computed as

follows:

Depreciable cost ($39,500 – $500) ÷ 150,000 = $.26

Year 1 30,000 miles X $.26 = $7,800

Year 2 20,000 miles X $.26 = $5,200

BRIEF EXERCISE 10-8

Book value, 1/1/17...............................................................$23,000

Less: Salvage value........................................................... 2,000

Depreciable cost..................................................................$21,000

Remaining useful life...........................................................4 years

Revised annual depreciation ($21,000 ÷ 4)........................$ 5,250

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Fundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions ManualDocument26 pagesFundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manualmisentrynotal6ip1lp100% (16)

- Depreciable Property and Eligible Capital Property: Solutions To Chapter 5 Assignment ProblemsDocument27 pagesDepreciable Property and Eligible Capital Property: Solutions To Chapter 5 Assignment ProblemsOktariadie RamadhianNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Brealey 5CE Ch09 SolutionsDocument27 pagesBrealey 5CE Ch09 SolutionsToby Tobes TobezNo ratings yet

- Class Exercise CH 10Document5 pagesClass Exercise CH 10Iftekhar AhmedNo ratings yet

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- Introduction To Managerial Accounting Canadian 5th Edition Brewer Solutions Manual 1Document36 pagesIntroduction To Managerial Accounting Canadian 5th Edition Brewer Solutions Manual 1warrenbakerrofjngwkia100% (27)

- Corporate Finance Canadian 7th Edition Jaffe Solutions ManualDocument16 pagesCorporate Finance Canadian 7th Edition Jaffe Solutions Manualtaylorhughesrfnaebgxyk100% (27)

- Chapter 7 Solutions 2241Document22 pagesChapter 7 Solutions 2241James0% (1)

- Chapter 13 Capital Budgeting Estimating Cash Flow and Analyzing Risk Answers To End of Chapter Questions 13 3 Since The Cost of Capital Includes A Premium For Expected Inflation Failure 1Document8 pagesChapter 13 Capital Budgeting Estimating Cash Flow and Analyzing Risk Answers To End of Chapter Questions 13 3 Since The Cost of Capital Includes A Premium For Expected Inflation Failure 1ghzNo ratings yet

- Chapter 6 Answer Key (1 15)Document15 pagesChapter 6 Answer Key (1 15)Desrifta FaheraNo ratings yet

- Fundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manual 1Document36 pagesFundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manual 1jillhernandezqortfpmndz100% (23)

- CH 22 - Lu Solution-Intermediate Acct - Acct ChangesDocument9 pagesCH 22 - Lu Solution-Intermediate Acct - Acct Changesdaotam0% (1)

- Chapter 9 Assigned Question SOLUTIONSDocument31 pagesChapter 9 Assigned Question SOLUTIONSDang ThanhNo ratings yet

- HW 1, FIN 604, Sadhana JoshiDocument40 pagesHW 1, FIN 604, Sadhana JoshiSadhana JoshiNo ratings yet

- 3415 Corporate Finance Assignment 2: Dean CulliganDocument13 pages3415 Corporate Finance Assignment 2: Dean CulliganAdam RogersNo ratings yet

- Chapter 13 SolutionsDocument8 pagesChapter 13 Solutionsflyerfan3767% (3)

- Basic Tax EnvironmentDocument8 pagesBasic Tax EnvironmentPeregrin TookNo ratings yet

- Solutions To Problems: 13/e, Solutions Manual (For Instructor Use Only)Document5 pagesSolutions To Problems: 13/e, Solutions Manual (For Instructor Use Only)Adam IngberNo ratings yet

- Chapter 11Document10 pagesChapter 11Syed Sheraz AliNo ratings yet

- SM 9Document12 pagesSM 9wtfNo ratings yet

- Answer Chapter11 Cash Flow EstimationDocument3 pagesAnswer Chapter11 Cash Flow EstimationIsmah ParkNo ratings yet

- Chapter 10Document11 pagesChapter 10Saharin Islam ShakibNo ratings yet

- Solution Manual Managerial Accounting Hansen Mowen 8th Editions CH 10Document26 pagesSolution Manual Managerial Accounting Hansen Mowen 8th Editions CH 10hafiizah100% (2)

- 601 13,14 SolutionsDocument37 pages601 13,14 SolutionsRudi SyafputraNo ratings yet

- Solution To Ch11 ProblemsDocument35 pagesSolution To Ch11 Problemssabrina danteNo ratings yet

- F9FM-Session05 d08jkbnDocument30 pagesF9FM-Session05 d08jkbnErclanNo ratings yet

- Discount Cash Flow Analysis Chapter 9Document46 pagesDiscount Cash Flow Analysis Chapter 9Sidra KhanNo ratings yet

- Chapter 10Document13 pagesChapter 10Terry Conrad KingNo ratings yet

- Taxnz221 WS2 Actsols 05Document22 pagesTaxnz221 WS2 Actsols 05Joshua EbarleNo ratings yet

- Ch11 ShowDocument63 pagesCh11 ShowMahmoud AbdullahNo ratings yet

- Ross 6 e Chap 08 SM RevisedDocument15 pagesRoss 6 e Chap 08 SM RevisedmirroredlensNo ratings yet

- Management Accounting: Segment Reporting & DecentralizationDocument20 pagesManagement Accounting: Segment Reporting & DecentralizationSamiul AzamNo ratings yet

- Accounts AssignmentDocument10 pagesAccounts AssignmentRubab KanwalNo ratings yet

- Depreciation of Non Current Assets: Elizabeth - Accounting Privat ClassDocument28 pagesDepreciation of Non Current Assets: Elizabeth - Accounting Privat ClassSiti JulaehaNo ratings yet

- Typical Cash Flows at The Start: Cost of Machines (200.000, Posses, So On Balance SheetDocument7 pagesTypical Cash Flows at The Start: Cost of Machines (200.000, Posses, So On Balance SheetSylvan EversNo ratings yet

- Unit 5 - Depreciation - Chat Session 8 (Spring 2020)Document5 pagesUnit 5 - Depreciation - Chat Session 8 (Spring 2020)RealGenius (Carl)No ratings yet

- Financial Accounting Canadian 5th Edition Harrison Solutions Manual 1Document86 pagesFinancial Accounting Canadian 5th Edition Harrison Solutions Manual 1pearl100% (36)

- Chapter 26 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document31 pagesChapter 26 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Chapter 11 Exercises and Problems Exercise 11-2: 1. Straight-LineDocument23 pagesChapter 11 Exercises and Problems Exercise 11-2: 1. Straight-LineHazel Rose CabezasNo ratings yet

- JRE300-April 2015 - Final Exam - SOLUTIONS KEYDocument11 pagesJRE300-April 2015 - Final Exam - SOLUTIONS KEYSCR PpelusaNo ratings yet

- Tutorial 06 Solution For Additional ProblemsDocument6 pagesTutorial 06 Solution For Additional ProblemsTrung ĐàmNo ratings yet

- More On Capital BudgetingDocument56 pagesMore On Capital BudgetingnewaznahianNo ratings yet

- ACM C A08 Construction Equipment Management Assignment 2: Submission Deadline: 2 September, 10amDocument2 pagesACM C A08 Construction Equipment Management Assignment 2: Submission Deadline: 2 September, 10amRushikesh ChevaleNo ratings yet

- Jawab Latihan Sesi 8Document2 pagesJawab Latihan Sesi 8Feni AlvitaNo ratings yet

- FM Solved PapersDocument83 pagesFM Solved PapersAjabba87% (15)

- Brigham Chap 11 Practice Questions Solution For Chap 11Document11 pagesBrigham Chap 11 Practice Questions Solution For Chap 11robin.asterNo ratings yet

- Solution CH.6Document14 pagesSolution CH.6Thanawat PHURISIRUNGROJNo ratings yet

- Harrison FA IFRS 11e CH07 SMDocument85 pagesHarrison FA IFRS 11e CH07 SMJingjing Zhu0% (1)

- Assignment #1 Solution (Chapters 3 and 5)Document5 pagesAssignment #1 Solution (Chapters 3 and 5)aklank_218105No ratings yet

- Cash Flow Estimation Brigham Case SolutionDocument8 pagesCash Flow Estimation Brigham Case SolutionShahid MehmoodNo ratings yet

- Chapter 6 - Answer KeyDocument8 pagesChapter 6 - Answer KeyĐặng Thanh ThuỷNo ratings yet

- Gitman - IM - ch11 (CFM)Document19 pagesGitman - IM - ch11 (CFM)jeankoplerNo ratings yet

- FM11 CH 11 Mini CaseDocument13 pagesFM11 CH 11 Mini CasesushmanthqrewrerNo ratings yet

- Chapter 9 Exercises - Plant AssetsDocument7 pagesChapter 9 Exercises - Plant Assetsmohammad khataybehNo ratings yet

- Performance MGMT Discussion QuestionsDocument7 pagesPerformance MGMT Discussion QuestionsSritel Boutique HotelNo ratings yet

- Pma 04 Group 5 Final Project ReportDocument20 pagesPma 04 Group 5 Final Project ReportQuynh Nguyen HuongNo ratings yet

- Topic 5Document22 pagesTopic 5Quynh Nguyen HuongNo ratings yet

- Research Report Structure (Suggested)Document2 pagesResearch Report Structure (Suggested)Quynh Nguyen HuongNo ratings yet

- Global Bike StoryDocument11 pagesGlobal Bike StoryHân NguyễnNo ratings yet

- Intro S4HANA Using Global Bike Data Sheet SD en v3.3Document2 pagesIntro S4HANA Using Global Bike Data Sheet SD en v3.3Big DripNo ratings yet

- SD Exercise en v4.1Document18 pagesSD Exercise en v4.1Quynh Nguyen HuongNo ratings yet

- Chapter 6 - Brief Exercises - SolutionsDocument4 pagesChapter 6 - Brief Exercises - SolutionsQuynh Nguyen HuongNo ratings yet

- Brief Exercise - Solutions - Chapter 9Document3 pagesBrief Exercise - Solutions - Chapter 9Quynh Nguyen HuongNo ratings yet

- Cost Acc. Final-CollierDocument15 pagesCost Acc. Final-CollierKathya SilvaNo ratings yet

- Empirical Tools of Public Finance: Solutions and ActivitiesDocument7 pagesEmpirical Tools of Public Finance: Solutions and ActivitiesAKÇA ELGİNNo ratings yet

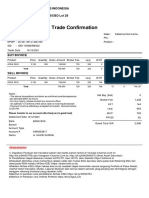

- Trade ConfirmationDocument1 pageTrade ConfirmationHavid KurniaNo ratings yet

- INDOQUARTZDocument10 pagesINDOQUARTZyip.kendalNo ratings yet

- Saic M 1001Document8 pagesSaic M 1001noor mohamedazeezNo ratings yet

- 1 23ba PDFDocument997 pages1 23ba PDFKoosha SaghariNo ratings yet

- l88 Bus Time TableDocument18 pagesl88 Bus Time Tablesharat7No ratings yet

- Economics A: Thursday 16 May 2019Document32 pagesEconomics A: Thursday 16 May 2019Afifa At SmartEdgeNo ratings yet

- Agriculture Seminar 2Document3 pagesAgriculture Seminar 2Babe'sNo ratings yet

- ACCA P5 Exam Questions AnalysisDocument7 pagesACCA P5 Exam Questions AnalysisGerard BrowneNo ratings yet

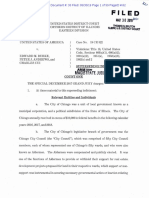

- Burke IndictmentDocument59 pagesBurke Indictmentjroneill100% (2)

- Clash Info PDFDocument4 pagesClash Info PDFVlads lz gajah laipstrimNo ratings yet

- SMC Simplified by TJRTRADESDocument37 pagesSMC Simplified by TJRTRADESmangoz1224No ratings yet

- Cost Accounting Tutorial 8 - PROBLEMDocument3 pagesCost Accounting Tutorial 8 - PROBLEMelgaavNo ratings yet

- SIrena As of Feb 11Document50 pagesSIrena As of Feb 11Paula AlmeydaNo ratings yet

- 5 The Search For A Sound Business Idea 1Document24 pages5 The Search For A Sound Business Idea 1Baila BakalNo ratings yet

- MIL-B-81934 2C Bearings, Self LubricatingDocument5 pagesMIL-B-81934 2C Bearings, Self LubricatingthomasNo ratings yet

- Struktur Organisasi HrgaDocument13 pagesStruktur Organisasi HrgaIhkwan RisnulNo ratings yet

- Greater Hyderabad Municipal Corporation: Building Permit Order Town Planning SectionDocument4 pagesGreater Hyderabad Municipal Corporation: Building Permit Order Town Planning SectionLaxmiprasad NagarapuNo ratings yet

- Especificacion Palas (Cucharas para Pala)Document1 pageEspecificacion Palas (Cucharas para Pala)jose chaveroNo ratings yet

- Assignment QuestionDocument13 pagesAssignment Question7336 Vikas MouryaNo ratings yet

- NEXO Sliding SleeveDocument3 pagesNEXO Sliding SleevetongsabaiNo ratings yet

- Introduction Law and EconomicsDocument12 pagesIntroduction Law and EconomicsShubham YadavNo ratings yet

- Canadian Jeweller Magazine November 2009Document88 pagesCanadian Jeweller Magazine November 2009rivegaucheNo ratings yet

- Gaston Road Monitoring - 1660349396Document5 pagesGaston Road Monitoring - 1660349396Reymundo BejaNo ratings yet

- PDSLimitSwitchBoxFC 1Document4 pagesPDSLimitSwitchBoxFC 1Samuel MacêdoNo ratings yet

- Existing Loans - Mabini Colleges IncDocument2 pagesExisting Loans - Mabini Colleges IncJane zabalaNo ratings yet

- Take It From NT:-Cash Book Plays Role of Both Journal As Well As LedgerDocument17 pagesTake It From NT:-Cash Book Plays Role of Both Journal As Well As LedgerAnonymous b4qyneNo ratings yet

- D&D 5.0 - Aventura (Nível 7) O Refúgio Perdido Do ArquimagoDocument30 pagesD&D 5.0 - Aventura (Nível 7) O Refúgio Perdido Do ArquimagoMurilo TeixeiraNo ratings yet

- Equitable Banking Corp v. Special Steel ProductsDocument1 pageEquitable Banking Corp v. Special Steel ProductsYsa Sumaya100% (1)