Professional Documents

Culture Documents

QN 83

QN 83

Uploaded by

MR.diwash Pokhrel0 ratings0% found this document useful (0 votes)

10 views3 pages1. The company recorded a $300,000 revenue adjustment and $15,000 in finance costs on a loan.

2. $3,000,000 was spent on research expenses and $4,800,000 was capitalized as a non-current asset for research and development.

3. Property was revalued, resulting in a $2,400,000 gain recorded in other comprehensive income. Plant and equipment are recorded at cost less accumulated depreciation.

4. Loan balances and finance costs are recorded over three years. The non-current loan liability at the end of the period was $200,060,000.

Original Description:

fr

Original Title

qn 83

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The company recorded a $300,000 revenue adjustment and $15,000 in finance costs on a loan.

2. $3,000,000 was spent on research expenses and $4,800,000 was capitalized as a non-current asset for research and development.

3. Property was revalued, resulting in a $2,400,000 gain recorded in other comprehensive income. Plant and equipment are recorded at cost less accumulated depreciation.

4. Loan balances and finance costs are recorded over three years. The non-current loan liability at the end of the period was $200,060,000.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views3 pagesQN 83

QN 83

Uploaded by

MR.diwash Pokhrel1. The company recorded a $300,000 revenue adjustment and $15,000 in finance costs on a loan.

2. $3,000,000 was spent on research expenses and $4,800,000 was capitalized as a non-current asset for research and development.

3. Property was revalued, resulting in a $2,400,000 gain recorded in other comprehensive income. Plant and equipment are recorded at cost less accumulated depreciation.

4. Loan balances and finance costs are recorded over three years. The non-current loan liability at the end of the period was $200,060,000.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

w.

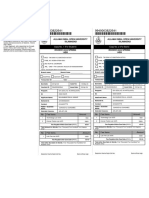

1 revenue $,000

correction dr inventory 2000

cr revenue 300

finance cost on loan 15

w.2 research and

development $,000

research expenses 3000 cos

capitalize cost 4800 sofp

w.3 Non current asset

property $,000

property at 1july 20X4 28500

depreciation at 30june 20X5 1900 cos

property at 30june 20X5 26600

property at fv at 30june20X5 29000 sofp

revaluation gain 2400 oci

plant and equipment

plant and equipment at cost 27100

accumulated depreciation 9100

depreciation at 30june 20x5 2700 cos

cv at 30 june 20X5 15300

w.4 loan note

year b/f finance cost cash paid

30june 20X5 19500 1560 1000

30june 20X6 20060 1604.8 1000

30june 20X7 20664.8 1653.184 21000

finance cost at 30june 20x5 1560

non current libility at 30 june 20X5 20060

w.5 financial asset

$,000

financial asset equity at FV at july 20x4 8800

financial asset equity at FV at 30june 20X5 9600

gain in investment 800

w.6 taxation $,000

current year tax provision 1200

increase in defferd tax 800

tax charge for year 2000 pl

w.7 dividend $,000

equuity share at 1july 20x4 30000

right share iddue 10000

total no of share 40000

issue at market value 1.7

share premium 7000

dividend paid 800

c/f

20060

20664.8

1317.984

pl

You might also like

- Packer and ScottDocument2 pagesPacker and ScottKiri chrisNo ratings yet

- Problem 1 - 5-6Document4 pagesProblem 1 - 5-6Lowellah Marie BringasNo ratings yet

- You Are Presented With The Following Trial Balance of Arbalrest, A Limited Liability Company at Account DR $ CR $Document4 pagesYou Are Presented With The Following Trial Balance of Arbalrest, A Limited Liability Company at Account DR $ CR $Nguyễn GiangNo ratings yet

- Therese Zyra Lipang - Worksheet Activity - 10 Column WsDocument4 pagesTherese Zyra Lipang - Worksheet Activity - 10 Column WsJuvelyn Repaso100% (1)

- P3.5 Different Forms of Business CombinationDocument8 pagesP3.5 Different Forms of Business CombinationAgnes CahyaNo ratings yet

- Case StudyDocument34 pagesCase Studymarksman_para90% (10)

- 6 - Pat & Sat Co. - PALACIODocument7 pages6 - Pat & Sat Co. - PALACIOPinky DaisiesNo ratings yet

- Exercises Finalaccounts ExDocument2 pagesExercises Finalaccounts ExSounak NathNo ratings yet

- Memorandum of AgreementDocument3 pagesMemorandum of Agreementdiana lapinid100% (1)

- CH 4 Comprehensive ProblemDocument5 pagesCH 4 Comprehensive ProblemLNo ratings yet

- Extra Session 2 (30 Sept 2022) Spreadsheet (CH 3)Document2 pagesExtra Session 2 (30 Sept 2022) Spreadsheet (CH 3)georgius gabrielNo ratings yet

- Business Combinations - Net Asset AcquisitionDocument15 pagesBusiness Combinations - Net Asset AcquisitionLyca Mae CubangbangNo ratings yet

- Past ExamDocument9 pagesPast ExamHaziNo ratings yet

- Malabanan - Activity Chapter 2 2 PDFDocument5 pagesMalabanan - Activity Chapter 2 2 PDFJv MalabananNo ratings yet

- Tugas Chapter 5: Persentase Kepemilikan Pay Corporation 75%Document6 pagesTugas Chapter 5: Persentase Kepemilikan Pay Corporation 75%Iche IcheNo ratings yet

- Answer To Sample Question 2Document3 pagesAnswer To Sample Question 2Farid AbbasovNo ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- Consolidation ReportDocument10 pagesConsolidation Reportbabar zuberiNo ratings yet

- Example 2 - Tax ComputationDocument19 pagesExample 2 - Tax ComputationAminul Islam RubelNo ratings yet

- Accounting Chapter 10Document4 pagesAccounting Chapter 1019033No ratings yet

- Assignment in Financial Accounting: Jane B. Evangelista Bsba-2BDocument4 pagesAssignment in Financial Accounting: Jane B. Evangelista Bsba-2BJane Barcelona Evangelista0% (1)

- Consolidation of Financial Statements at Acquisition DateDocument4 pagesConsolidation of Financial Statements at Acquisition DateShiela Mae RedobleNo ratings yet

- Buscom Sample ProbDocument2 pagesBuscom Sample ProbJoresol AlorroNo ratings yet

- Bài tập buổi 12Document7 pagesBài tập buổi 12Huế ThùyNo ratings yet

- Cash Flow Statement AssignmentDocument2 pagesCash Flow Statement AssignmentYoungsonya JubeckingNo ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- Latian Soal UtsDocument3 pagesLatian Soal UtsTania TjanderaNo ratings yet

- BUSINESS COMBI (Activity On Goodwill Computation) - PALLERDocument5 pagesBUSINESS COMBI (Activity On Goodwill Computation) - PALLERGlayca PallerNo ratings yet

- DOW Exam Practise DEC 28 2020Document4 pagesDOW Exam Practise DEC 28 2020Hira SialNo ratings yet

- Contoh Akuisisi 100% Dan 100% Metode Cost (Tan Lee)Document10 pagesContoh Akuisisi 100% Dan 100% Metode Cost (Tan Lee)Kusnul WidiyaniNo ratings yet

- Solution For Activity On Consolidation at The Date of Acquisition For BmaDocument4 pagesSolution For Activity On Consolidation at The Date of Acquisition For BmaMaria Beatriz NavecisNo ratings yet

- Seatwork Ratio AnalysisDocument2 pagesSeatwork Ratio AnalysisMARIBEL SANTOSNo ratings yet

- PROBLEM 1: Intercompany Transfer of Inventory: Asistensi Akuntansi Keuangan Lanjutan IDocument4 pagesPROBLEM 1: Intercompany Transfer of Inventory: Asistensi Akuntansi Keuangan Lanjutan Izsaw zsawNo ratings yet

- Chow2019 SIM AC2091 MockExamA StudentDocument23 pagesChow2019 SIM AC2091 MockExamA StudentPadamchand PokharnaNo ratings yet

- Cashflwo TABBA F7Document6 pagesCashflwo TABBA F7Pocpoca100% (2)

- Solution Chapter 14Document26 pagesSolution Chapter 14grace guiuanNo ratings yet

- Accounting For Price Level Changes 2Document9 pagesAccounting For Price Level Changes 2lil telNo ratings yet

- Prctice SetDocument9 pagesPrctice SetAdam CuencaNo ratings yet

- A. The Following Account Balances Were Presented On December 31, 2017Document3 pagesA. The Following Account Balances Were Presented On December 31, 2017Shiela Mae Pon AnNo ratings yet

- Statement of Comprihebsive IncomeDocument3 pagesStatement of Comprihebsive IncomeMuhammad MahmoodNo ratings yet

- Vending Machines SolutionDocument6 pagesVending Machines SolutionizquierdofacturaNo ratings yet

- Worked Example Chap12Document8 pagesWorked Example Chap12Giang Thái HươngNo ratings yet

- Buscom 3Document4 pagesBuscom 3dmangiginNo ratings yet

- Class Practice - Company Accounting - SolvedDocument7 pagesClass Practice - Company Accounting - SolvedMarcoNo ratings yet

- Bac 101Document6 pagesBac 101Ishak IshakNo ratings yet

- Output No. 3Document1 pageOutput No. 3chingNo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- Manatad - Accounting 14NDocument5 pagesManatad - Accounting 14NJullie Carmelle ChattoNo ratings yet

- Gross Profit 25,450.00Document6 pagesGross Profit 25,450.00AliNo ratings yet

- Auditing Problem Quiz 2 Long Problem SolutionsDocument7 pagesAuditing Problem Quiz 2 Long Problem Solutionsreina maica terradoNo ratings yet

- Tugas Pertemuan 5Document5 pagesTugas Pertemuan 5Ilham FaridNo ratings yet

- Questions On Preparation of Financial Statements 1-4Document4 pagesQuestions On Preparation of Financial Statements 1-4LaoneNo ratings yet

- Accn 101 Assignment Group WorkDocument8 pagesAccn 101 Assignment Group WorkkumbiraidavidNo ratings yet

- Consolidation - Cost vs. Equity MethodDocument8 pagesConsolidation - Cost vs. Equity MethodzaounxosakubNo ratings yet

- Bus ComDocument14 pagesBus ComSITTIE AINNAH SHIREEHN DIDAAGUNNo ratings yet

- Business CombinationDocument10 pagesBusiness CombinationJaira ClavoNo ratings yet

- Problem Solving Updates in Philippine Accounting and Financial Reporting StandardsDocument5 pagesProblem Solving Updates in Philippine Accounting and Financial Reporting StandardsgnlynNo ratings yet

- Kunci Jawaban Soal Latihan Pertemuan 6Document6 pagesKunci Jawaban Soal Latihan Pertemuan 6aprian caesarioNo ratings yet

- E5-26A: Cost-Method Consolidation For Majority-Owned SubsidiaryDocument9 pagesE5-26A: Cost-Method Consolidation For Majority-Owned SubsidiaryeryNo ratings yet

- Solution For Activity On Consolidation at The Date of AcquisitionDocument4 pagesSolution For Activity On Consolidation at The Date of AcquisitionRea June SumatraNo ratings yet

- IAS 28 Sol. Man.Document27 pagesIAS 28 Sol. Man.asher phoenixNo ratings yet

- Mock Exam 2 Suggested SolutionsDocument10 pagesMock Exam 2 Suggested SolutionsAna-Maria GhNo ratings yet

- BSBCUS501 Task 1 Develop A Customer Service PlanDocument7 pagesBSBCUS501 Task 1 Develop A Customer Service PlanYesi Handani100% (1)

- Key Areas of Project ManagementDocument3 pagesKey Areas of Project ManagementPeng GuinNo ratings yet

- Solved On January 1 2017 Hardy Inc Purchased Certain Plant AssetsDocument1 pageSolved On January 1 2017 Hardy Inc Purchased Certain Plant AssetsAnbu jaromiaNo ratings yet

- Guide To Formal Letters - The BasicsDocument3 pagesGuide To Formal Letters - The BasicsCostelCosNo ratings yet

- 3.3.1 ANNUAL HSE STATISTICS REPORT 21aDocument1 page3.3.1 ANNUAL HSE STATISTICS REPORT 21aTunde SodeindeNo ratings yet

- Assignment - Organisational Theory, Structure & DesignDocument5 pagesAssignment - Organisational Theory, Structure & DesignvinzwssNo ratings yet

- Build Customer RelationshipsDocument20 pagesBuild Customer RelationshipsFazleRabbiNo ratings yet

- Retail Loyalty ProgrammesDocument15 pagesRetail Loyalty ProgrammesnikhilNo ratings yet

- X SF STD InvDocument1 pageX SF STD InvIslamic BayanNo ratings yet

- Contemp World Module 2 Topics 1 4Document95 pagesContemp World Module 2 Topics 1 4Miguel EderNo ratings yet

- PostingandTrialBalance Kareen LeonDocument7 pagesPostingandTrialBalance Kareen LeonMerdwindelle AllagonesNo ratings yet

- Big Data Dreams A Framework For Corporate StrategyDocument10 pagesBig Data Dreams A Framework For Corporate StrategyMehmet AkgünNo ratings yet

- "UBER" Marketing PlanDocument18 pages"UBER" Marketing PlanJdBoy TkdNo ratings yet

- Kertas Kerja Neraca LajurDocument11 pagesKertas Kerja Neraca LajurSri Winarsih RamadanaNo ratings yet

- Blue Horseshoe Business PlanDocument16 pagesBlue Horseshoe Business PlanJackie SmithNo ratings yet

- Final Star Rating of Hospital Building Brochure 1Document16 pagesFinal Star Rating of Hospital Building Brochure 1suresh kumarNo ratings yet

- Chamber of Real Estate and Builders Associations Inc Vs The Hon Executive Secretary Alberto Romulo Et AlDocument20 pagesChamber of Real Estate and Builders Associations Inc Vs The Hon Executive Secretary Alberto Romulo Et AlMark Gabriel B. MarangaNo ratings yet

- Order Interdistrict Movement Restriction 17.05.2021Document3 pagesOrder Interdistrict Movement Restriction 17.05.2021Nitin SharmaNo ratings yet

- Becg CecDocument25 pagesBecg CecZeel TamakuwalaNo ratings yet

- Black Book - Suraj Kirtan Ram - Roll No. 32Document86 pagesBlack Book - Suraj Kirtan Ram - Roll No. 32Suraj RamNo ratings yet

- AS-Book SummaryDocument28 pagesAS-Book Summarysoumithansda286No ratings yet

- Quality Notification in SAP QM: QM02: DetailsDocument12 pagesQuality Notification in SAP QM: QM02: DetailsGangarani GallaNo ratings yet

- QP 10 Corrective Action ProcedureDocument4 pagesQP 10 Corrective Action ProcedureSocialWelfare SilangNo ratings yet

- Solution Case 5-5Document3 pagesSolution Case 5-5Khoirul AnamNo ratings yet

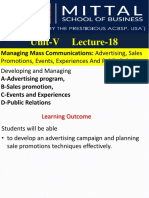

- L18 Managing Mass CommunicationsDocument31 pagesL18 Managing Mass CommunicationsAshish kumar ThapaNo ratings yet

- Structured Learning ExerciseDocument32 pagesStructured Learning ExerciseAngelie LopezNo ratings yet

- Case Study - Workers AttitudeDocument3 pagesCase Study - Workers AttitudeAmna PervaizNo ratings yet