Professional Documents

Culture Documents

Carrefour Q3 2022 Sales Presentation 0

Uploaded by

FaIIen0nEOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Carrefour Q3 2022 Sales Presentation 0

Uploaded by

FaIIen0nECopyright:

Available Formats

Q3 2022 Sales

October 26th, 2022

Carrefour outperforms in the current environment

In the current inflationary and uncertain environment, Carrefour has set the objective to

protect customer purchasing power while consolidating its economic model

In Q3:

• Inflation accelerated in all European markets

• Shopping patterns evolved but consumption is overall resilient

• Carrefour outperformed, with market share gains in all key countries

• Carrefour private labels and accessible products stand out as a strong customer value proposition

• +38% growth in Group e-commerce, GMV above €1bn in Q3

• Grupo BIG integration proceeding smoothly with an acceleration in conversion program

Confidence in Carrefour performance for Q4/FY 2022

FY 2022 Net Free Cash Flow now expected comfortably above €1bn

Q3 2022 SALES October 26, 2022 2

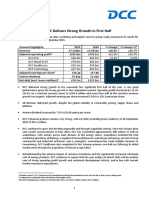

Q3 2022 sales up +11.3% LFL

+19.0%

+2.9% €23,504m

+4.9%

+11.3%

(0.1)% (0.1)%

€19,751m

Q3 2021 LFL Expansion & Petrol Calendar Forex Q3 2022

Gross sales M&A Gross sales

Q3 2022 SALES October 26, 2022 3

France:

FRANCE

Further market share gains

Q3 Sales inc. VAT

€10,547m

€5,114m

€3,470m

€1,964m

France Hypermarkets Supermarkets Other formats

Variation vs. Q3 21 +6.7% +5.1% +5.3% +14.2%

LFL ex. petrol

+6.6% +5.0% +6.3% +10.8%

ex. calendar

France outperforming the market with solid market share gains in value (+0.3pts) and volumes (+0.5pts)(1)

Strong LFL sales growth amid lower inflation vs other European countries

Food sales up +7.8% LFL, offsetting a (2.2)% LFL decrease in non-food

+22% growth in e-commerce, supported by dynamic home delivery

2022 lease management transfers completed (16 hypermarkets and 27 supermarkets)

New plan for 41 stores (16 hypermarkets and 25 supermarkets) announced for 2023

(1) Source: Nielsen

Q3 2022 SALES October 26, 2022 4

Europe: Continued strong momentum

Q3 Sales inc. VAT

€6,374m

€3,008m

€1,086m €1,053m

€555m €672m

Europe Spain Italy Belgium Poland Romania

Variation vs. Q3 21 +8.7% +12.2% +1.2% +4.3% +11.4% +11.8%

LFL ex. petrol

+8.6% +8.7% +7.1% +5.2% +18.5% +8.8%

ex. calendar

Spain: Solid performance and continued market share gains thanks to price leadership

Italy: Fifth consecutive quarter of LFL growth and continued increase in customer satisfaction

Belgium: First signs of recovery in a challenging market after management change in July 2022

Poland: Strong commercial momentum with outperformance in each format

Romania: Solid quarter in a context of high inflation

Q3 2022 SALES October 26, 2022 5

Latin

LATIN

America:

AMERICADouble-digit LFL growth

Q3 Sales inc. VAT

€6,583m

€5,551m

€1,031m

Latin America Brazil Argentina (1)

Variation vs. Q3 21 +49.6% +41.4% +93.1%

LFL ex. petrol

+24.6% +11.5% +91.3%

ex. calendar

€129m

Brazil: Strong momentum both in food and non-food

• Atacadão: +10.5% LFL in a context of sequential deflation on commodities

• Carrefour Retail (+15.0% LFL): Strong growth in food (+17.4%) and continued recovery in non-food (+10.8%)

• Food e-commerce GMV up 131% (total e-commerce up +95%), driven by rapid development of online sales at

Atacadão

• Financial services continued to improve, with credit portfolio up +24.5% and billings up +8.7%

Argentina: Another quarter of strong market outperformance, with sales growth exceeding inflation, driven by volumes

(1) Pre-IAS 29 (hyperinflation and foreign exchange)

Q3 2022 SALES October 26, 2022 6

Grupo

LATINBIG

AMERICA

integration ahead of plan and accelerating

New governance and management structure implemented on Day 1 (June 7)

Integration processes progressing smoothly

Acceleration of store conversions:

• 15 stores converted and reopened to date (7 in Q3: 4 to Atacadão and 3 to Carrefour)

• Converted stores performing above expectations €129m

• At least 50 store conversions by end-2022 (vs 35 initially)

Agreements signed for the disposal of 14 stores, as required by antitrust authority

(CADE), for R$443m

Q3 2022 SALES October 26, 2022 7

APPENDIX

CSR – Q3 2022 initiatives

› Climate and energy: First major retailer to partner with EcoWatt and EcoGaz

• Participation in the energy consumption reduction in France, notably in case of high

demand

› Disability: Agreement signed with French Handisport Federation to support inclusion

and increase recruitment of people with disabilities

› Fighting deforestation: Additional Action Plan to reinforce previous initiatives:

• Strengthened Governance (creation of a Forest Committee)

• €10m investment to support the preservation of Brazilian biomes

• 50% reduction in volumes of beef originating from critical areas by 2026

› Fight against food waste: “Nous Anti-Gaspi” anti-waste products launched in stores at

20% discount

Q3 2022 SALES October 26, 2022 9

Q3 2022 GROSS SALES

Change at

Change at current LFL Organic growth

Gross sales constant

exch. rates inc. ex. petrol ex. petrol

(in €m) exch. rates inc.

petrol ex. calendar ex. calendar

petrol

France 10,547 6.7% 6.7% 6.6% 5.1%

Hypermarkets 5,114 5.1% 5.1% 5.0% 2.6%

Supermarkets 3,470 5.3% 5.3% 6.3% 4.6%

Others, inc. convenience 1,964 14.2% 14.2% 10.8% 12.8%

Other European countries 6,374 8.7% 9.0% 8.6% 7.9%

Spain 3,008 12.2% 12.2% 8.7% 9.2%

Italy 1,086 1.2% 1.2% 7.1% 0.7%

Belgium 1,053 4.3% 4.3% 5.2% 5.1%

Poland 555 11.4% 15.6% 18.5% 19.2%

Romania 672 11.8% 11.3% 8.8% 11.2%

Latin America (pre-IAS 29) 6,583 64.4% 49.6% 24.6% 27.8%

Brazil 5,551 64.8% 41.4% 11.5% 14.9%

Argentina (pre-IAS 29) 1,031 62.3% 93.1% 91.3% 93.3%

Group total (pre-IAS 29) 23,504 +19.0% +16.1% +11.3% +11.0%

IAS 29 impact 225

Group total (post-IAS 29) 23,729

Q3 2022 SALES October 26, 2022 10

Q3 LFL OVER 3 YEARS

LFL ex. petrol ex. calendar Q3 2020 Q3 2021 Q3 2022

France 3.8% -0.3% 6.6%

Hypermarkets 2.5% -2.8% 5.0%

Supermarkets 4.9% 2.2% 6.3%

Others, inc. convenience 5.4% 2.5% 10.8%

Other European countries 1.9% -1.2% 8.6%

Spain 6.3% -2.3% 8.7%

Italy -8.0% 0.8% 7.1%

Belgium 5.4% -5.4% 5.2%

Poland -1.4% 0.9% 18.5%

Romania 0.0% 5.9% 8.8%

Latin America 28.4% 7.3% 24.6%

Brazil 26.0% -1.8% 11.5%

Argentina 41.4% 57.0% 91.3%

Group total +8.7% +1.0% +11.3%

Q3 2022 SALES October 26, 2022 11

Q3 2022 TECHNICAL EFFECTS

Calendar Petrol Forex

France 0.0% 1.5% -

Hypermarkets 0.1% 2.3% -

Supermarkets -0.1% 0.8% -

Others, inc. convenience -0.2% 1.0% -

Other European countries -0.2% 0.7% -0.3%

Spain -0.1% 1.8% -

Italy -0.2% 0.7% -

Belgium -0.8% - -

Poland 0.1% -3.7% -4.3%

Romania 0.2% 0.0% 0.4%

Latin America -0.1% -1.3% 14.8%

Brazil 0.0% -1.3% 23.4%

Argentina -0.2% - -30.8%

Group total -0.1% -0.1% +2.9%

Q3 2022 SALES October 26, 2022 12

STORES UNDER BANNERS AT END Q3 2022

Cash & Soft

(#) Hypermarkets Supermarkets Convenience Total

Carry discount

France 253 1,039 4,406 148 33 5,879

Other European countries 459 2,006 3,492 12 86 6,055

Spain 205 160 1,076 - 51 1,492

Italy 43 440 1,025 12 - 1,520

Belgium 40 439 310 - - 789

Poland 94 151 683 - 7 935

Romania 43 189 122 - 28 382

Others 34 627 276 - - 937

Latin America 183 522 572 277 - 1,554

Brazil 100 427 147 264 - 938

Argentina 83 95 425 13 - 616

Others(1) 166 450 49 23 - 688

Total 1,061 4,017 8,519 460 119 14,176

(1) Africa, Middle-East, Dominican Republic and Asia

Q3 2022 SALES October 26, 2022 13

DISCLAIMER

This presentation contains both historical and

forward-looking statements. These forward-

looking statements are based on Carrefour

management's current views and assumptions.

Such statements are not guarantees of future

performance of the Group. Actual results or

performances may differ materially from those

in such forward-looking statements as a result

of a number of risks and uncertainties, including

but not limited to the risks described in the

documents filed with the Autorité des Marchés

Financiers as part of the regulated information

disclosure requirements and available on

Carrefour's website (www.carrefour.com), and

in particular the Universal Registration

Document. These documents are also available

in the English language on the company's

website. Investors may obtain a copy of these

documents from Carrefour free of charge.

Carrefour does not assume any obligation to

update or revise any of these forward-looking

statements in the future.

You might also like

- Carrefour Q1 2023 Presentation 1Document16 pagesCarrefour Q1 2023 Presentation 1FaIIen0nENo ratings yet

- Carrefour - H1 - 2022 - Results - Analysts Presentation (1) - 2Document31 pagesCarrefour - H1 - 2022 - Results - Analysts Presentation (1) - 2FaIIen0nENo ratings yet

- Press Release Carrefour H1 2022 Results - 1Document26 pagesPress Release Carrefour H1 2022 Results - 1FaIIen0nENo ratings yet

- PR - Carrefour Sales Q3 2022Document15 pagesPR - Carrefour Sales Q3 2022FaIIen0nENo ratings yet

- PR - Carrefour Q1 2022 Sales - 1Document11 pagesPR - Carrefour Q1 2022 Sales - 1FaIIen0nENo ratings yet

- Press Release Carrefour Q4+FY 2022 - 0Document26 pagesPress Release Carrefour Q4+FY 2022 - 0FaIIen0nENo ratings yet

- Press Release Carrefour Q4+FY 2023 - 0Document25 pagesPress Release Carrefour Q4+FY 2023 - 0dumitruadriana369No ratings yet

- 9M 2022 Presentation FinalDocument23 pages9M 2022 Presentation FinalThe Phoenix InvestmentNo ratings yet

- Q2 2020 Sales H1 2020 Results: July 28, 2020Document42 pagesQ2 2020 Sales H1 2020 Results: July 28, 2020José Manuel EstebanNo ratings yet

- Press Release Vallourec Reports Third Quarter and First Nine Months 2020 ResultsDocument16 pagesPress Release Vallourec Reports Third Quarter and First Nine Months 2020 ResultsShambavaNo ratings yet

- Edenred - 2023 02 21 Fy 2022 Results Presentation VdefDocument70 pagesEdenred - 2023 02 21 Fy 2022 Results Presentation VdefaugustocestariraizenNo ratings yet

- 2020 - 21 Full Year Results - RNS - PART 1.docx - DownloadassetDocument43 pages2020 - 21 Full Year Results - RNS - PART 1.docx - DownloadassetErika SNo ratings yet

- Record Growth in Q3 (+8.4% LFL) : Third-Quarter 2020 Key FiguresDocument14 pagesRecord Growth in Q3 (+8.4% LFL) : Third-Quarter 2020 Key FiguresJosé Manuel EstebanNo ratings yet

- Carrefour H1 2021 Results 2Document32 pagesCarrefour H1 2021 Results 2Thu TrangNo ratings yet

- FY 2022 Results: Q4 2022 SalesDocument37 pagesFY 2022 Results: Q4 2022 SalesJoachim VIALLONNo ratings yet

- Signify Third Quarter Results 2022 ReportDocument19 pagesSignify Third Quarter Results 2022 Reportsumanthsumi2023No ratings yet

- Vallourec Press Release Q2 H1 2022 ResultsDocument15 pagesVallourec Press Release Q2 H1 2022 ResultsAditya DeshpandeNo ratings yet

- VIV PR Vivendi Q1 2022 RevenuesDocument9 pagesVIV PR Vivendi Q1 2022 RevenuesRafa BorgesNo ratings yet

- Interims 2223 Di Pres - WebsiteDocument27 pagesInterims 2223 Di Pres - Websitecena1987No ratings yet

- S4capital Annual Report and Accounts 2021Document172 pagesS4capital Annual Report and Accounts 2021ignaciaNo ratings yet

- Press Release - 2023Document9 pagesPress Release - 2023Molnár BálintNo ratings yet

- 1H 2022-Newlat-Food-Presentation-finalDocument21 pages1H 2022-Newlat-Food-Presentation-finalThe Phoenix InvestmentNo ratings yet

- Interim Report 2021Document39 pagesInterim Report 2021Priya ShindeNo ratings yet

- Interim Results Announcement 21 September 2022Document33 pagesInterim Results Announcement 21 September 2022UnStudentSilitorNo ratings yet

- 2019 07 18 1H19 Results en PDFDocument18 pages2019 07 18 1H19 Results en PDFSangeetha ManoharanNo ratings yet

- Kingfisher PLC 2020-21 Annual Report - 090421.PDF - DownloadassetDocument190 pagesKingfisher PLC 2020-21 Annual Report - 090421.PDF - Downloadassetsebastian fernando cruz morenoNo ratings yet

- 2023 03 14 Bollore CP 2022 - en VF 1Document9 pages2023 03 14 Bollore CP 2022 - en VF 1Miguel RamosNo ratings yet

- 2021 - 22 - Q2 Trading Update - RNSDocument4 pages2021 - 22 - Q2 Trading Update - RNSTudor PopaNo ratings yet

- Q1 FY21 Adversely Impacted by COVID 1 9Document4 pagesQ1 FY21 Adversely Impacted by COVID 1 9Esha ChaudharyNo ratings yet

- RG 2021 Fy Results GB-PRDocument8 pagesRG 2021 Fy Results GB-PRpaulouisvergnesNo ratings yet

- AGM Presentation 28 April 2022Document22 pagesAGM Presentation 28 April 2022YukiNo ratings yet

- Edita Food Industries Reports FY2020 EarningsDocument8 pagesEdita Food Industries Reports FY2020 EarningsHesham ElnggarNo ratings yet

- RIL 1Q FY24 Analyst Presentation 21july23Document58 pagesRIL 1Q FY24 Analyst Presentation 21july23Sudeep RNo ratings yet

- De000kbx1006 Ja 2019 Eq e 00Document214 pagesDe000kbx1006 Ja 2019 Eq e 00Aditi DasNo ratings yet

- Press Release Carrefour FY 2015 ENDocument11 pagesPress Release Carrefour FY 2015 ENMarina GonzálezNo ratings yet

- A V-Shaped Recovery For Crédit Agricole GroupDocument41 pagesA V-Shaped Recovery For Crédit Agricole Groupkovi mNo ratings yet

- Key Highlights: Heineken N.V. Reports 2022 Half Year ResultsDocument32 pagesKey Highlights: Heineken N.V. Reports 2022 Half Year ResultsEric NkediNo ratings yet

- Financial Review: 2020 PerformanceDocument8 pagesFinancial Review: 2020 PerformanceTHU TAO DUONG THANHNo ratings yet

- Lucas Bols, 2021-2022 PRESS RELEASEDocument17 pagesLucas Bols, 2021-2022 PRESS RELEASEjasper laarmansNo ratings yet

- Kingfisher Annual Report 2019.PDF - DownloadassetDocument196 pagesKingfisher Annual Report 2019.PDF - Downloadassetsurbhiaggarwal13No ratings yet

- Adidas Q4Document12 pagesAdidas Q4Bhavya BankaNo ratings yet

- Beiersdorf Completes Successful Fiscal Year 2021Document5 pagesBeiersdorf Completes Successful Fiscal Year 2021Pancho Ahumada RojasNo ratings yet

- Presentation Fy 2017Document28 pagesPresentation Fy 2017José Manuel EstebanNo ratings yet

- Lafargeholcim: The Global Leader in Sustainable and Innovative Building Materials and SolutionsDocument12 pagesLafargeholcim: The Global Leader in Sustainable and Innovative Building Materials and SolutionsSibouss NNo ratings yet

- Carrefour FY 2021 0Document39 pagesCarrefour FY 2021 0Voto TwitNo ratings yet

- Aviva Hy2021 Analyst PackDocument119 pagesAviva Hy2021 Analyst PackIan McConnochieNo ratings yet

- 2022 Full Year Results Press Release CCHBC-FY-2022-press-release-20230214Document48 pages2022 Full Year Results Press Release CCHBC-FY-2022-press-release-20230214FelipeWeissNo ratings yet

- Earnings Release Cencosud 1Q22 (ENG)Document44 pagesEarnings Release Cencosud 1Q22 (ENG)LeonardoNo ratings yet

- 2023 04 24 Bollore Cat1 2023 UkDocument4 pages2023 04 24 Bollore Cat1 2023 UkMiguel RamosNo ratings yet

- 91 Full Year Results Presentation May 2022Document41 pages91 Full Year Results Presentation May 2022floferNo ratings yet

- Earnings Release 3Q22 1Document12 pagesEarnings Release 3Q22 1Yousif Zaki 3No ratings yet

- Resultats Annuels2007Document5 pagesResultats Annuels2007Eric MureithiNo ratings yet

- Introduction To Ascential 2022 PDFDocument9 pagesIntroduction To Ascential 2022 PDFLauraBrizuelaNo ratings yet

- Unaudited Results For The Twelve Months Ended 31 December 2022Document25 pagesUnaudited Results For The Twelve Months Ended 31 December 2022Tomas ChungaNo ratings yet

- Press Release - 2022Document7 pagesPress Release - 2022felipeNo ratings yet

- Bekaert Delivers On Margin, Working Capital, and Debt Deleverage PrioritiesDocument21 pagesBekaert Delivers On Margin, Working Capital, and Debt Deleverage PrioritiesAlberto LeaoNo ratings yet

- Enx - Q42021 - PR VF - 0Document33 pagesEnx - Q42021 - PR VF - 0Aicha Ben TaherNo ratings yet

- Heineken NV Full Year 2018 Results PresentationDocument16 pagesHeineken NV Full Year 2018 Results PresentationCedric AjodhiaNo ratings yet

- Pendragon PLC - FY21 HY ResultsDocument46 pagesPendragon PLC - FY21 HY ResultsMessina04No ratings yet

- Google App EngineDocument5 pagesGoogle App EngineDinesh MudirajNo ratings yet

- SEERS Medical ST3566 ManualDocument24 pagesSEERS Medical ST3566 ManualAlexandra JanicNo ratings yet

- Feasibility Study of Diethyl Sulfate ProductionDocument3 pagesFeasibility Study of Diethyl Sulfate ProductionIntratec SolutionsNo ratings yet

- Mid Term Exam 1Document2 pagesMid Term Exam 1Anh0% (1)

- Labstan 1Document2 pagesLabstan 1Samuel WalshNo ratings yet

- Dissertation On Indian Constitutional LawDocument6 pagesDissertation On Indian Constitutional LawCustomPaperWritingAnnArbor100% (1)

- Form Three Physics Handbook-1Document94 pagesForm Three Physics Handbook-1Kisaka G100% (1)

- Expense Tracking - How Do I Spend My MoneyDocument2 pagesExpense Tracking - How Do I Spend My MoneyRenata SánchezNo ratings yet

- Presentation Report On Customer Relationship Management On SubwayDocument16 pagesPresentation Report On Customer Relationship Management On SubwayVikrant KumarNo ratings yet

- 5 Star Hotels in Portugal Leads 1Document9 pages5 Star Hotels in Portugal Leads 1Zahed IqbalNo ratings yet

- Address MappingDocument26 pagesAddress MappingLokesh KumarNo ratings yet

- Difference Between Mountain Bike and BMXDocument3 pagesDifference Between Mountain Bike and BMXShakirNo ratings yet

- Activity Description Predecessor Time (Days) Activity Description Predecessor ADocument4 pagesActivity Description Predecessor Time (Days) Activity Description Predecessor AAlvin LuisaNo ratings yet

- Income Statement, Its Elements, Usefulness and LimitationsDocument5 pagesIncome Statement, Its Elements, Usefulness and LimitationsDipika tasfannum salamNo ratings yet

- How To Create A Powerful Brand Identity (A Step-by-Step Guide) PDFDocument35 pagesHow To Create A Powerful Brand Identity (A Step-by-Step Guide) PDFCaroline NobreNo ratings yet

- Information Security Chapter 1Document44 pagesInformation Security Chapter 1bscitsemvNo ratings yet

- EXTENDED PROJECT-Shoe - SalesDocument28 pagesEXTENDED PROJECT-Shoe - Salesrhea100% (5)

- BSCSE at UIUDocument110 pagesBSCSE at UIUshamir mahmudNo ratings yet

- ST JohnDocument20 pagesST JohnNa PeaceNo ratings yet

- Cs8792 Cns Unit 1Document35 pagesCs8792 Cns Unit 1Manikandan JNo ratings yet

- Urun Katalogu 4Document112 pagesUrun Katalogu 4Jose Luis AcevedoNo ratings yet

- Lab Session 7: Load Flow Analysis Ofa Power System Using Gauss Seidel Method in MatlabDocument7 pagesLab Session 7: Load Flow Analysis Ofa Power System Using Gauss Seidel Method in MatlabHayat AnsariNo ratings yet

- Reflections On Free MarketDocument394 pagesReflections On Free MarketGRK MurtyNo ratings yet

- Unit 1Document3 pagesUnit 1beharenbNo ratings yet

- CI Principles of EconomicsDocument833 pagesCI Principles of EconomicsJamieNo ratings yet

- Termination LetterDocument2 pagesTermination Letterultakam100% (1)

- TSR KuDocument16 pagesTSR KuAngsaNo ratings yet

- Production - The Heart of Organization - TBDDocument14 pagesProduction - The Heart of Organization - TBDSakshi G AwasthiNo ratings yet

- United Nations Economic and Social CouncilDocument3 pagesUnited Nations Economic and Social CouncilLuke SmithNo ratings yet

- Process States in Operating SystemDocument4 pagesProcess States in Operating SystemKushal Roy ChowdhuryNo ratings yet