Professional Documents

Culture Documents

Payment and Settlement

Payment and Settlement

Uploaded by

NAVANEET DESHPANDEOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Payment and Settlement

Payment and Settlement

Uploaded by

NAVANEET DESHPANDECopyright:

Available Formats

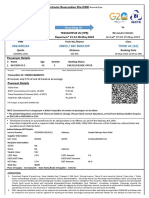

Paper: 07, Front Office Operation and Management

Module: 14 Billing methods and settlement: Modes of bill payment

Principal Investigator Prof. S. P. Bansal

Vice chancellor

Indira Gandhi University, Meerpur, Rewari, Haryana

Co-Principal Investigator Dr. Prashant K. Gautam

Director, UIHMT

Panjab University, Chandigarh

Dr. Ankush Ambardar

Paper Coordinator Assistant Professor

Department of Tourism & Hotel Management

Kurukshetra University, Kurukshetra

Dr. Ankush Ambardar

Content Writer Assistant Professor,

Department of Tourism & Hotel Management

Kurukshetra University, Kurukshetra

Tel

Prof. Manjula Chaudhary

Content Reviewer Professor

Department of Tourism & Hotel Management

Kurukshetra University, Kurukshetra

Tourism & Front Office Operations and Management

Hospitality Billing methods and settlement: Modes of bill payment

Items Description of Module

Subject Name Tourism and Hospitality

Paper Name Front Office Operations and Management

Module Title Billing methods and settlement: Modes of bill payment

Module Id Module no-14

Pre- Requisites Knowledge of modes of payment

Objectives To study the modes of payment and the process of bill

settlement

Keywords Credit card, Charge card, Bill to company, Travelers cheque

QUADRANT-I

Module 14 BILLING METHODS AND SETTLEMENT: MODES OF BILL PAYMENT

1. LEARNING OUTCOME

2. INTRODUCTION

3. MODE OF BILL SETTLEMENT – CASH

3.1 Local currency

3.2 Personal Cheques

3.3 Traveller’s Cheques

3.4 Foreign Currency

3.5 Bank Credit Cards

3.6 Bank Debit Cards

4. MODE OF BILL SETTLEMENT - CREDIT

4.1 Charge Cards

4.2 Corporate Accounts

4.3 Travel Agent Vouchers

5. SUMMARY

1. LEARNING OUTCOME

After completing this module students will be able to:

i. Understand the concept of bill settlement used in hotels.

ii. Various types of bill settlement.

iii. Know various types of credit cards and debit cards.

Tourism & Front Office Operations and Management

Hospitality Billing methods and settlement: Modes of bill payment

iv. Precautions taken while receiving payment through various modes.

BILLING METHODS AND SETTLEMENT: MODES OF BILL PAYMENT

2. INTRODUCTION:

One of the important phase of guest cycle is departure, which is even know as checkout procedure. The

main operations at checkout include settlement of bill, taking review of the guests of their stay and

looking forward for brand loyalty by providing personalized service at the departure. It is important as

it’s the last point of interaction between guest and the hotel staff. The most important functions of

checkout is to collect payment form the guest acceptable through various modes of payments.

Accounts to be settled at checkout can be divided into two main types namely own accounts and

company accounts, based on who is paying the bill. The guest may pay bill on their departure with

currency (local or foreign), traveler’s cheques, bank credit cards and charge cards. Company account

on the other hand are those accounts which are not settled directly by the guest but are settled by a

company or a travel agent. These accounts are transferred to the account department after the guest has

checked and signed the bill as being correct. The account department then sends the bill and invoice to

the company or travel agent for payments.

3. MODE OF BILL SETTLEMENT – CASH

A cash settlement is any form of settlement which can be paid into the bank on the same day as it is

received. A cash payment in full at checkout will bring an account balance to zero. The folio is zeroed

out and marked paid. If a guest indicates during registration that he will be paying his bill with cash,

front office should immediately be on the alert. Advance payment from the guest needs to be requested

in such case, as the guest could be a skipper, meaning the guest may leave the hotels without paying

bills.

Tourism & Front Office Operations and Management

Hospitality Billing methods and settlement: Modes of bill payment

NOTE: Currently, cash payments above Rs. 2, 00,000/- need you to request for a copy or number of

the Income Tax PAN card of the guest. The procedure for handling various cash settlements:

3.1 Local currency:

When the guest pays in local currency, the cashier accepts and counts the amount in front of the guest.

The cashier needs to take time to ensure accuracy. The amount needs to be retained and kept outside

the cash drawer till transaction is completed. While returning change to the guest, cashier needs to

count loud. A receipt of the transaction needs to be given to the guest. A cashier should perform one

transaction at a time and may politely ask the other guest to wait.

Source: http://im.rediff.com/money/2013/aug/27eco2-1.jpg

3.2 Personal Cheques:

Most of the hotels do not accept personal cheques from free individual travellers or walk –inns. Some

hotels accept personal cheques only during banking hours in order to obtain verification if desired. A

cashier generally should not accept a cheque without a cheque card. The cheque card shows the

amount in the account and denotes that the limit is sufficient to cover the bill. The signature on the

cheque card and the cheque leaf needs to be matched. It is important to match the amount in words and

amount in figures. The name of the hotel should be spelt correctly. Cheques drawn on foreign banks

and third party cheques should never be accepted.

4

Tourism & Front Office Operations and Management

Hospitality Billing methods and settlement: Modes of bill payment

Source: https://www.chequesnow.ca/wp-content/uploads/2011/01/XSKIPER-CPA.png

3.3 Traveller’s Cheques:

A TC or travellers’ cheque is an internationally accepted cheque for a certain sum of money in a

specific currency that can be exchanged elsewhere for local currency. Travellers’ cheques are issued by

various banks in various denominations of Rs. 500, Rs. 1000, etc. and are as good as cash. TC concept

became popular because carrying it is safe. A bank company issues travellers’ cheques according to the

individual deposits. The individual has to sign at one place on the travellers’ cheque in the presence of

the issuing authority- bank manager, etc. The receipt issued while purchasing the travellers cheque

from the bank contains the serial number of travellers cheques issued to the customer. The same has to

be kept safely and may be required at the time of filing a complaint of theft or loss.

While receiving payment from travellers’ cheque, one has to ensure that the cheque is not damaged or

mutilated. The identity of the guest needs to be confirmed with any one photo ID. The guest is

requested to sign in front of the cashier, so as to match the signatures done at the bank. In case of

foreign currency travellers’ cheque the exchange rate has to be calculated before accepting and if any

balance in local currency need to be given. An encashment certificate, as used while converting foreign

currency, should be signed by the guest and he should be given a copy of it.

5

Tourism & Front Office Operations and Management

Hospitality Billing methods and settlement: Modes of bill payment

Source: https://www.exchangerates.org.uk/images/travellers-cheques.jpg

3.4 Foreign Currency:

In order to accept payments in foreign currency, the hotel has to take authorization/license from the

RBI for the same. The cashier of the hotel is authorized to deal in any currency exchanges made by the

guests. Foreign currency is acceptable from in-house guests only, but if a non-resident guest requests

for foreign exchange the cashier needs to seek authorization from the management. Daily foreign

currency exchange rates are clearly displayed at the FO Cashier for information of the guests.

When a guest checks out on payment of foreign currency, the following needs to be done:

Cashier needs to confirm room number of the guest and request for guest passport.

Cashier should check the type of currency to be exchanged and determine its exchange rate as

per government banking regulations.

Bill needs to be calculated in foreign currency and receive the currency accordingly.

The amount is to be returned in local currency accurately.

Cashier has to prepare foreign currency encashment certificate giving the amounts received, the

exchange rate and the amount of local currency returned, details of the guest, passport number,

nationality, etc are also entered in the certificate.

Tourism & Front Office Operations and Management

Hospitality Billing methods and settlement: Modes of bill payment

The guest is requested to sign on the certificate and the same is compared with the signature on

the passport.

The original copy of the Encashment Certificate is given to the guest.

The second copy of encashment certificate is attached to the cash/ notes.

The third copy is left in the book as record.

The details need to be filled in the cashier report/ cash sheet.

The details are even filled in the Foreign Currency Control Sheet.

Source:http://2.bp.blogspot.com/64VAD73HttY/UBONtYN9ynI/AAAAAAAAAEc/ho4oGZDGGg

A/s1600/FOREIGN+ENCASHMNT+CERTIF.jpg

3.5 Bank Credit Cards:

A credit card or plastic money is a card which is used to obtain goods and services and even cash, on

credit terms, without paying cash. The card is used worldwide because of its various benefits in terms

of usage, size. It is issued by mostly all banks. The card holder does not have to carry cash which is

prone to being lost or stolen and is beneficial for travellers. All credit cards are issued for a particular

period and have an expiry date. Credit payment can be extended to a guest depending on the credit

cards Floor Limit which is set by the credit card company. To confirm the credit limit of the credit card

and to confirm the validity of the card, the cashier must get authorization from the credit card company

through on-line authorization. Once the floor limit of the card is obtained and if the bill exceeds then

the rest of payment could be collected through cash. The total transactions of the card holder during a

7

Tourism & Front Office Operations and Management

Hospitality Billing methods and settlement: Modes of bill payment

month are presented by the credit card company to the card holder for settlement on a monthly basis.

Cardholder can pay the outstanding amount during a defined period or to pay a percentage of the

outstanding amount, thus agreeing to pay the balance amount later at a higher rate of interest than

usual. Settlement to be done through credit cards should be confirmed at the time of arrival. Details of

guest credit card should be requested to reduce any problem related to acceptance at the time of

departure.

Source: http://www.hospitality-school.com/wp-content/uploads/2010/01/hotel-credit-card-payment.jpg

Procedure for accepting settlement through credit cards:

Check that the hotel accepts the credit card of the issuing company, e.g. SBI, American

Express, HDFC etc.

Match the name and signature on the credit card are the same as those on the registration

card.

Check for expiry date of the credit card.

Swipe the card on the electronic data capture machine (EDC) and block an amount for the

stay on the credit card and the credit card company will issue an authorisation code that is

noted on the guest registration card for further reference.

An imprint of the credit card has to be taken on a credit card voucher.

Tourism & Front Office Operations and Management

Hospitality Billing methods and settlement: Modes of bill payment

The GRC and imprinted voucher with the guest’s signature will be placed in the guest folio

with the cashier till departure of the guest.

The cashier has to prepare credit card company voucher with details of total bill and date of

settlement.

The cashier need to ensure that the detailed imprinted voucher is signed by the guest and the

signature matches that on credit card of the guest. And the voucher containing the

authorised blocked amount will be destroyed by the cashier.

After completing the guest account the top copy of the bill and the guest/cardholder’s copy

of the credit card voucher are given to the guest.

Precautions for handling credit cards:

1. Expiration date: The cashier need to check the expiry date of the card and request guest for any

other mode of payment pointing out the expiry of the card.

2. On-line Authorisation /verification: On-line computer services are been used for validation of

credit cards by most of the hotels. The required transaction data may be entered on a touch-tone

keypad or automatically input through a magnetic strip reader. The verification service

generates an authorisation code or a denial code for the transaction and the same status may be

communicated to the cardholder/guest.

3. Cancellation Bulletins/Hot List: The validity of the credit card can be checked through hot list

or cancellation bulletins issued periodically by the companies, where on-line authorisation is

not available.

4. Invalid Card: In case the credit card proves to be invalid, an alternate form of payment is

requested from the guest.

5. Floor limits: It is the maximum amount in credit card charges the hotel is permitted to accept on

behalf of the guest at one time without special authorisation from the bank company.

The different categories of credit cards are:

Auto / Fuel Credit Cards

9

Tourism & Front Office Operations and Management

Hospitality Billing methods and settlement: Modes of bill payment

Balance transfer Credit Cards

Business Credit Cards

Cashback cards

Classic Credit Cards

Co-branded Credit Cards

Contactless Credit Cards

Credit cards for Women

Entertainment Cards

Gold Credit Cards

Lifestyle Cards

Platinum Credit Cards

Premium/Signature Credit Cards

Prepaid Credit Cards

Rewards Cards

Silver Credit Cards

Titanium Credit Cards

Travel Cards

3.6 Bank Debit Cards:

A debit card is a plastic payment card that can be used instead of cash when making purchases. It is

similar to a credit card, but unlike a credit card, the money comes directly from the user's bank

account when performing a transaction. These are plastic cards with a magnetic strip on the reverse

side. These cards authorize direct transfer of funds from a guest’s bank account to the hotel’s bank

account for charges incurred rather than being billed to the guest on a monthly basis as in credit cards.

Some debit cards have a credit card logo embossed on them which indicates they are acceptable at

places where the credit card is accepted. Debit cards may also be used on the Internet either with or

without using a PIN. Internet transactions may be conducted in either online or offline mode. Debit

10

Tourism & Front Office Operations and Management

Hospitality Billing methods and settlement: Modes of bill payment

cards are processed similarly to credit cards while receiving payment for services provided by the

hotel.

The imprint of the debit card with validation machine is taken. Years back guest signature were taken

on the imprinted and completed voucher, but now a days signatures are not required if pin is used. The

cashier processes debit card voucher as a cash payment on the guest folio.

Types of Debit Cards in India:

Visa Debit Cards. These debit cards are issued with the bank's tie-up with VISA payment

services providing the Verified by Visa platform for online transactions.

Visa Electron Debit Cards.

MasterCard Debit Cards.

Contactless Debit Cards.

RuPay Debit Cards.

Maestro Debit Card.

4. MODE OF BILL SETTLEMENT – CREDIT

A credit settlements are such for which a hotel does not receive immediate payment on the day of

departure. These include

4.1 Charge Cards:

These are credit cards which are issued by private card organisations. Example American Express,

Dinner Club, Carte Blanchs, etc. When a guest settles their account with a charge card, the hotel does

not receive payment on the same day. Instead at the end of each shift the cashier will transfer all the

bills settled by charge card to the account department for them to follow up. At the end of week or

month the accounts department of the hotel sends statements of the total amount charged to the private

card organisations, together with copies of all the imprints on receiving the statement and imprints, the

credit card company will pay the amount to the hotel less its commission.

11

Tourism & Front Office Operations and Management

Hospitality Billing methods and settlement: Modes of bill payment

4.2 Corporate account/Direct billing or Bill to company/ (BTC):

Most of the hotels extend credit to guests by agreeing to bill the guest or the guests company for

charges incurred. The direct billing arrangement, is normally established through correspondence

between the guest or company and the hotel.

The company or guest will need to complete an application for credit approval from the hotel. The

Controller of the hotel will then perform a credit check to determine the credit rating and a credit limit.

The house limit of credit set by the hotel can vary depending on the amount of projected charges and

the amount of time allowed for charges to be paid and the credit rating of the company. Further, the

application is accompanied with a list of people/employees of the company who are authorized to use

the account. It is the responsibility of the company to monitor the authorized use of the credit. It is

observed that the company will settle only the room charges and possibly breakfast charges and the

incidental charges like telephone, laundry, etc. is paid by the guest themselves. The guest account is

divided into master account (settled by the company) and incidental account (settled by the guest). At

departure, the guest is supposed to sign the folio and the same is billed for collection from the accounts

department. On the other hand the incidental charge if any are to be paid at the time of departure. At

check out, the guest signs the folio and statement is directly billed for collection. Guest signs the folio

and accepts the responsibility to pay the bill should direct billing account not pay the bill. The front

office cashier needs to follow standard operating procedures to ensure trouble free payments.

Procedure for handling settlement at checkout for direct billing accounts:

1. At the time of check-in, cashier should request corporate and personal identification of the

guest.

2. It has to be checked that the individual is authorised by the company to bill to the account.

3. Check and verify that the company is listed in the company volume guaranteed rate (CVGR)

list of the hotel.

4. Any credit limit per employee or the services included in the agreement with the company need

to be assessed. The services not mentioned in the agreement will be billed separately to the

guest’s Incidental folio.

12

Tourism & Front Office Operations and Management

Hospitality Billing methods and settlement: Modes of bill payment

5. The cashier creates a Master and Incidental folio.

6. Master account- the account is settled by the company. The guest bill is shown to the guest for

inspection, verification and signature at checkout.

7. Incidental account- bill is settled by guest in cash or credit card, as previously confirmed at

check-in.

8. The cashier prepares a transfer voucher to transfer charges to direct billing account in city

ledger.

4.3 Travel Agent Vouchers:

Guests travelling through a travel agent need to carry a voucher issued by the concerned travel agent

for arrangements of various services like accommodation, food & beverage, etc made at the hotel and

the copy of the same is sent directly by travel agent to the hotel. The guest uses the services and the

payment to the hotel is made directly by the travel agent according to the already determined rates

agreed upon less the commission of travel agent for bringing business to the hotel. The payment period

for the travel agent to the hotel also depends upon the agreed terms and conditions. Airlines also follow

a system of vouchers that are issued to layover passengers in case of delayed flights or cancellations.

The payment is done by the concerned airline company. In case of travel agent and airline, two

accounts master and incidental are prepared because usually the travel agent or the airline settles bills

of rooms and some packages charges. The rest services not covered under the package have to be

settled by the guest covering under incidental folio.

13

Tourism & Front Office Operations and Management

Hospitality Billing methods and settlement: Modes of bill payment

Source: http://www.russianembassy.org.za/images/Consular_documents/voucher.png

Procedure for handling a travel agent voucher (TAV):

Master folio:

1. At arrival of the guest, the cashier need to check travel agent voucher and compares with the

hotel copy sent by the travel agent for accurate billing instructions.

2. The vouchers are to be verified by the guest at the time of check-out and the same is signed by

the guest to confirm receipt of services at the hotel as the payment has to be made by the travel

agent.

3. Guests will be given their incidental account/folio for settlement by cash, credit card, etc. and a

receipt issued at the time of departure.

4. Once the guest checks out, the master account and attached vouchers are transferred to the

accounts department city ledger. According to the terms and conditions, at the end of the week

or month, the vouchers and a statement of the total account is sent to the travel agent for

collection.

5. The travel agent settles the account less the commission charged by them.

6. Guest are presented with their incidental accounts/folios for settlement at the departure.

7. The settlement is usually done by cash, credit card or other already-approved and confirmed

method.

14

Tourism & Front Office Operations and Management

Hospitality Billing methods and settlement: Modes of bill payment

8. The copy of guest’s bill, with receipt, is given to the guest.

5. SUMMARY:

Bill settlement at the front office is one of the important function to be performed. It includes tracking

transaction from pre-arrival stage of guest cycle till departure of the guest. Most care has to be taken at

the time of check-out, considered the last stage of guest contact with hotel. The mode of payment has

to be identifies at the time of check-in of the guest and care has to be taken while preparing guest

account and precautions to be taken while collecting payment through any mode like local currency,

foreign currency, credit cards, debit cards, travel vouchers, corporate account settlement. A hotel

intends to accept all kind of mode of payment for promoting hotel sales both from house guests and

non-guests/city guests. Non acceptance may reduce sale of products and services. Correct measures

need to be taken while handling any mode of payment for any loses to the hotel or dissatisfaction of

guests. For any confusion related to accounts need to be communicated with senior staff members or

from accounts department of the hotel.

15

Tourism & Front Office Operations and Management

Hospitality Billing methods and settlement: Modes of bill payment

16

Tourism & Front Office Operations and Management

Hospitality Billing methods and settlement: Modes of bill payment

You might also like

- Check Out ProcedureDocument16 pagesCheck Out ProcedureNAVANEET DESHPANDENo ratings yet

- Night AuditingDocument19 pagesNight AuditingNAVANEET DESHPANDENo ratings yet

- Chapter - 6 Methods of Payment 6.1 Settlement of Bills:-: 1. Currency NotesDocument5 pagesChapter - 6 Methods of Payment 6.1 Settlement of Bills:-: 1. Currency Notesmadhu anvekarNo ratings yet

- Modes of Settlement in HotelsDocument11 pagesModes of Settlement in HotelsNeha Gupta0% (1)

- Control of Cash and Credit: Cash Control - Cash Control Involves All The Transactions Which The Guest Makes inDocument14 pagesControl of Cash and Credit: Cash Control - Cash Control Involves All The Transactions Which The Guest Makes inAryan BishtNo ratings yet

- Table of Contents Page NoDocument9 pagesTable of Contents Page NofghjkNo ratings yet

- Check Out ProcedureDocument11 pagesCheck Out ProcedureAnas KhanNo ratings yet

- Front Office AccountingDocument18 pagesFront Office AccountingNAVANEET DESHPANDENo ratings yet

- Check Out & SettlementDocument78 pagesCheck Out & SettlementDeepak KumarNo ratings yet

- Check Out & Settlement Procedures in A HotelDocument8 pagesCheck Out & Settlement Procedures in A HotelPritilata Acharya100% (1)

- Check Out& Settlement PDFDocument11 pagesCheck Out& Settlement PDFRina FatmasariNo ratings yet

- Check Out & SettlementDocument11 pagesCheck Out & SettlementKing HiramNo ratings yet

- SOP For Credit Card Acceptance in HotelsDocument3 pagesSOP For Credit Card Acceptance in HotelsImee S. YuNo ratings yet

- SOP For Credit Card Acceptance in HotelsDocument3 pagesSOP For Credit Card Acceptance in HotelsImee S. YuNo ratings yet

- Front Office CashieringDocument21 pagesFront Office Cashieringmhatet_ignacio100% (1)

- Front Office Cashiering and Preparation of Night AuditDocument44 pagesFront Office Cashiering and Preparation of Night AuditJc Garcia100% (9)

- Check-Out Procedures: B.Sc. (HHA) / 2 Year/ Checkout ProceduresDocument10 pagesCheck-Out Procedures: B.Sc. (HHA) / 2 Year/ Checkout ProceduresAryan BishtNo ratings yet

- Front Office Assignment: The: Checkout ProcedureDocument14 pagesFront Office Assignment: The: Checkout ProcedureHARSHITNo ratings yet

- Credit Card SettlementDocument15 pagesCredit Card SettlementpranalipadalkarNo ratings yet

- FORM V Commerce NotesDocument25 pagesFORM V Commerce NotesAshfa FathimaNo ratings yet

- Check Out ProceduresDocument14 pagesCheck Out Proceduresmadhu anvekarNo ratings yet

- SecA - Grp2 - Guest Cycle - Detailed StudyDocument5 pagesSecA - Grp2 - Guest Cycle - Detailed StudyhimanshuNo ratings yet

- Card Business Debit and Credit CardsDocument17 pagesCard Business Debit and Credit CardsmahiNo ratings yet

- Credit Card ProcessingDocument58 pagesCredit Card ProcessingDipanwita Bhuyan92% (13)

- Module 3 Banker & CustomerDocument33 pagesModule 3 Banker & CustomerSumiya YousefNo ratings yet

- Notes Check Out and Settlement RC PDFDocument20 pagesNotes Check Out and Settlement RC PDFPrabir HalderNo ratings yet

- Week 5 Cashiering & AuditDocument18 pagesWeek 5 Cashiering & AuditGlenn BragaNo ratings yet

- How Credit Card Transaction Processing Works - Steps, Fees & ParticipantsDocument15 pagesHow Credit Card Transaction Processing Works - Steps, Fees & ParticipantsSeanSean ParkNo ratings yet

- Introduction To Banking ServicesDocument62 pagesIntroduction To Banking ServicesNiyati SandisNo ratings yet

- Unit 1 Check Out & SettelmentDocument39 pagesUnit 1 Check Out & SettelmentPitm BungachinaNo ratings yet

- Checkout and SettlementDocument12 pagesCheckout and SettlementAshishDJoseph100% (2)

- Briefly Explain The Each Guest Cycle StagesDocument2 pagesBriefly Explain The Each Guest Cycle StagesDianne CuizonNo ratings yet

- BankingDocument3 pagesBankingValika KapitorNo ratings yet

- MFS - Plastic Money MuskanDocument24 pagesMFS - Plastic Money Muskansangambhardwaj64No ratings yet

- Front O 3Document39 pagesFront O 3asfawNo ratings yet

- Check Out Procedure and Account SettlementDocument61 pagesCheck Out Procedure and Account SettlementNitin GuptaNo ratings yet

- Bhote PramodDocument20 pagesBhote PramodRam MudguleNo ratings yet

- Guest CycleDocument4 pagesGuest CycleUdit BairoliyaNo ratings yet

- Unit Four: Hotel Staff, Planning and Booking A HolidayDocument7 pagesUnit Four: Hotel Staff, Planning and Booking A HolidayInna PapillionNo ratings yet

- Fo - Lesson - Guest AccountsDocument24 pagesFo - Lesson - Guest AccountsMark Anthony LibecoNo ratings yet

- Vision Plus TheoryDocument59 pagesVision Plus TheoryMolay Bairagi100% (1)

- Assignment CBMS: Ques 1. Explain Pre-Paid and Post-Paid Payment Systems in DetailDocument8 pagesAssignment CBMS: Ques 1. Explain Pre-Paid and Post-Paid Payment Systems in Detail19001601062 VAISHALINo ratings yet

- Guest Departure N Methods of PayDocument13 pagesGuest Departure N Methods of PaynevilleatnibrNo ratings yet

- Batislao, Benedict P. BSHM 3C Front Office Operation Chapter 1&2 ActivityDocument3 pagesBatislao, Benedict P. BSHM 3C Front Office Operation Chapter 1&2 ActivityJezreel LaoNo ratings yet

- Project CreditDocument49 pagesProject Creditshailendramishra8286No ratings yet

- Checkout and SettlementDocument19 pagesCheckout and Settlementmadhu anvekarNo ratings yet

- Pelaksanaan Prinsip Mengenal Nasabah (Karakter) Dalam Transaksi Perbankan Dengan Kartu KreditDocument5 pagesPelaksanaan Prinsip Mengenal Nasabah (Karakter) Dalam Transaksi Perbankan Dengan Kartu KreditMeliza cahayaNo ratings yet

- Cheque: What Is It?: Cheque Statistics Cheque Cheque ChequeDocument13 pagesCheque: What Is It?: Cheque Statistics Cheque Cheque ChequeMAdhuNo ratings yet

- Eco 2ND YrDocument23 pagesEco 2ND YrKrishna SaklaniNo ratings yet

- Applied Group 2Document24 pagesApplied Group 2Abigail AsuncionNo ratings yet

- CBO Module 1 Retail Banking Deposit ProductsDocument17 pagesCBO Module 1 Retail Banking Deposit ProductsRajabNo ratings yet

- 3.3 Forms of PaymentDocument21 pages3.3 Forms of PaymentrodneyivanjohnsonNo ratings yet

- 4.credit Card PolicyDocument4 pages4.credit Card PolicylensmanagementltdNo ratings yet

- What Are Cheques ReportDocument7 pagesWhat Are Cheques ReportROMMIL BALLENOSNo ratings yet

- Guest Cycle and ReservationsDocument21 pagesGuest Cycle and ReservationsnevilleatnibrNo ratings yet

- Chapter 6 CBO BBM 5th Sem 1Document14 pagesChapter 6 CBO BBM 5th Sem 1Nikesh GhimireNo ratings yet

- Fo Sem 3 Unit 2Document9 pagesFo Sem 3 Unit 2Amaan KhanNo ratings yet

- Review of Some Online Banks and Visa/Master Cards IssuersFrom EverandReview of Some Online Banks and Visa/Master Cards IssuersNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Evaluation of Some Online Banks, E-Wallets and Visa/Master Card IssuersFrom EverandEvaluation of Some Online Banks, E-Wallets and Visa/Master Card IssuersNo ratings yet

- Nivedita Ypr To BGM 28 May 2023Document3 pagesNivedita Ypr To BGM 28 May 2023NAVANEET DESHPANDENo ratings yet

- MBA Project Topics For RetailDocument3 pagesMBA Project Topics For RetailNAVANEET DESHPANDENo ratings yet

- Facilities MGT Texas Univ of CommerceDocument4 pagesFacilities MGT Texas Univ of CommerceNAVANEET DESHPANDENo ratings yet

- Chapter 1 Classification of HotelsDocument20 pagesChapter 1 Classification of HotelsNAVANEET DESHPANDENo ratings yet

- MHM&CT-2 Year PGM With Syllabi PDFDocument26 pagesMHM&CT-2 Year PGM With Syllabi PDFNAVANEET DESHPANDENo ratings yet

- Food and Beverage Services TutorialDocument92 pagesFood and Beverage Services TutorialJeanLaedaGobrinNo ratings yet

- Banquet PersonnelDocument21 pagesBanquet PersonnelNAVANEET DESHPANDENo ratings yet

- Political System USDocument4 pagesPolitical System USIrina IonescuNo ratings yet

- RFID Project 2 PDFDocument44 pagesRFID Project 2 PDFastewayb_964354182No ratings yet

- Psir MainDocument79 pagesPsir MainIAMSAJAN5No ratings yet

- ProjectDocument18 pagesProjectmahin0% (1)

- 12 English Study Material Prose Chapter 6Document3 pages12 English Study Material Prose Chapter 6Vaishu UparkarNo ratings yet

- Solar Photovoltaic Technology and Systems by Chetan Singh SolankiDocument2 pagesSolar Photovoltaic Technology and Systems by Chetan Singh SolankiSunilNo ratings yet

- Come Closer Biennale Matter of Art Guide 2020Document60 pagesCome Closer Biennale Matter of Art Guide 2020sjl99No ratings yet

- Factors That Influencing HealthDocument10 pagesFactors That Influencing Healthmeryati sinambelaNo ratings yet

- Ba 5012 Security Analysis and Portfolio Management Unit 1 Part ADocument7 pagesBa 5012 Security Analysis and Portfolio Management Unit 1 Part AHarihara PuthiranNo ratings yet

- Past Perfect Worksheet Trabajo 05-05-2022Document2 pagesPast Perfect Worksheet Trabajo 05-05-2022Cristian PoloNo ratings yet

- Bugarin National High School: Department of EducationDocument6 pagesBugarin National High School: Department of EducationNick TejadaNo ratings yet

- Science 7 Q4 Long QuizDocument4 pagesScience 7 Q4 Long QuizChin ChinNo ratings yet

- Rural Uplift Programme in IndiaDocument3 pagesRural Uplift Programme in IndiavanshajNo ratings yet

- Travel and Expense Policy V1Document14 pagesTravel and Expense Policy V1Damien FloresNo ratings yet

- Premarital Sex Perception Engagement andDocument6 pagesPremarital Sex Perception Engagement andDestra NovallNo ratings yet

- Albert Burgess, Jr. v. Angela Dunbar, 4th Cir. (2015)Document4 pagesAlbert Burgess, Jr. v. Angela Dunbar, 4th Cir. (2015)Scribd Government DocsNo ratings yet

- Takunda Advisor PositionsDocument3 pagesTakunda Advisor Positionssilent besaNo ratings yet

- Guinlist: Advanced Grammar and Vocabulary in Academic & Professional EnglishDocument8 pagesGuinlist: Advanced Grammar and Vocabulary in Academic & Professional EnglishGeorge Lubiano PastorNo ratings yet

- Old and New True and False in The Worldv PDFDocument30 pagesOld and New True and False in The Worldv PDFSvorad ZavarskýNo ratings yet

- Quiz: EnglishDocument1 pageQuiz: EnglishDeiNo ratings yet

- SANTHOSH RAJ DISSERTATION Presentation1Document11 pagesSANTHOSH RAJ DISSERTATION Presentation1santhosh rajNo ratings yet

- Online Public TransportationDocument14 pagesOnline Public TransportationSaad KhanNo ratings yet

- Module 1 - Session 7 Activity 1. Self-ReflectionDocument4 pagesModule 1 - Session 7 Activity 1. Self-ReflectionMariel GregoreNo ratings yet

- Legal OpinionDocument2 pagesLegal Opinionjoelhermitt100% (1)

- Gns 102 Lecture Notes NewDocument71 pagesGns 102 Lecture Notes NewOchiwu Moses100% (1)

- Finmar Equity AssessmentDocument3 pagesFinmar Equity AssessmentChristen HerceNo ratings yet

- Mighty To SaveDocument3 pagesMighty To SaveRalph Jan Lumilis SajulgaNo ratings yet

- PT Ro 04 11083Document183 pagesPT Ro 04 11083jayendrapatilNo ratings yet

- Best Practices in Adolescent Literacy Instruction PDFDocument418 pagesBest Practices in Adolescent Literacy Instruction PDFMaria Cequena100% (3)

- United States v. McNamara, 4th Cir. (1996)Document6 pagesUnited States v. McNamara, 4th Cir. (1996)Scribd Government DocsNo ratings yet