Professional Documents

Culture Documents

Holidays For Labor Law 1

Uploaded by

Shaira Ellyxa Mae VergaraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Holidays For Labor Law 1

Uploaded by

Shaira Ellyxa Mae VergaraCopyright:

Available Formats

1.

SPECIAL (NON-WORKING HOLIDAYS

- Not paid if unworked

- Sometimes observed in a locality

• EDSA People Power Revolution Anniversary

• Black Saturday

• Ninoy Aquino Day

• All Saint’s Day

• Feast of the Immaculate Conception of Mary

• Last Day of the Year

• Additional Special (non-working) day -Jan.2 •

Additional Special (Non-working day) -Nov. 2

2. REGULAR HOLIDAYS:

- paid even if unworked

- observed throughout the country

- Rate is TWICE if worked

• New Year’s Day - •

Maundy Thursday - •

Good Friday -

• Rizal Day - •

Christmas Day - •

Bonifacio Day - •

National Heroes Day

-• Independence

Day -

• Labor Day –

Source: Holidays | Official Gazette of the Republic of the Philippines (2023)

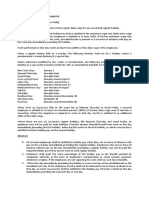

Overtime premium

Work performed beyond the normal working hours must be paid an additional

compensation equivalent to an employee’s regular wage plus at least 25% thereof.

Employees who work beyond 8 hours on a holiday or rest day shall also be paid an

additional compensation equivalent to the rate of the first 8 hours plus at least 30%

thereof.

Undertime work on a normal workday shall not be offset by overtime work on any other

workday. Philippine labor laws discourage the offset because the hourly rate of overtime is

higher than the hours missed when an employee works for less than 8 hours. However,

permission given to an employee to go on leave for a day in a regular work week shall not

exempt the employer from paying the additional compensation required for the overtime work

done.

Holiday premium

Holiday pay has been defined as payment of the regular daily wage for any unworked regular

holiday. This benefit does not apply to the following employees:

a. Government employees

b. Retail and service establishments regularly employing less than ten (10) workers

c. House helpers and persons in the personal service of another

d. Managerial employees provided they meet the conditions under the Labor Code

e. Officers or members of a managerial staff provided they meet the conditions under the

Labor

Code

f. Field personnel and other employees whose time and performance are unsupervised

by the employer, including those who are engaged on task or contract basis, purely

commission basis or those who are paid a fixed amount for performing work irrespective

of the time consumed in the performance thereof.

▪ Computation of holiday pay for regular holidays.

A. Employee’s regular workday

1. If unworked – 100%

2. If worked – 1st 8 hours – 200% while the excess of 8 hours – plus 30% of hourly rate on

said day B. Employee’s rest day

1. If unworked – 100%

2. If worked – 1st 8 hours – plus 30% of 200% while excess of 8 hours – plus 30% of hourly

rate on said day

▪ Computation of holiday pay for Special Non-Working Day

A. Employee’s regular workday

1. If unworked – No pay, unless there is a favorable company policy, practice, or collective

bargaining agreement (CBA) granting payment of wages on special days even if unworked.

2. If worked – 1st 8 hours – plus 30% of the daily rate of 100% while excess of 8 hours

– plus 30% of hourly rate on said day

B. Employee’s rest day

1. If unworked – No pay, unless there is a favorable company policy, practice, or collective

bargaining agreement (CBA) granting payment of wages on special days even if unworked.

2. if worked -1st 8 hours – plus 50% of the daily rate of 100% while excess of 8 hours – plus

30% of hourly rate on said day

▪ For those declared as special working holidays, for work performed, an employee is entitled

only to his basic rate. No premium pay is required since work performed on said days is

considered work on ordinary working days.

You can also search: Holiday pay rules out | Department of Labor and Employment (dole.gov.ph)

Examples:

1. Statement 1: Shaira works beyond 8 hours on a holiday. She shall be paid with an additional

compensation to the rate of the first 8 hours plus at least 30%.

Statement 2: Undertime work of Shaira will be offset by overtime work on any other workday.

Ans: S1: True

S2: FALSE it cannot be offset with overtime work

2. Work performed beyond the normal working hours must be paid an additional compensation

equivalent to an employee's regular wage plus at least ____ thereof.

Ans: Work performed beyond the normal working hours must be paid an additional

compensation equivalent to an employee’s regular wage plus at least 25% thereof.

3. Rizal Day is a regular holiday. If MJ is required to work during the Rizal Day by her employer

Shaira, the additional compensation MJ will receive is at least:

Ans: 100%

Explanation: The TOTAL COMPENSATION of a regular holiday when worked, is 200% or

twice his regular salary. Therefore, the ADDITIONAL COMPENSATION received is half of the

200%, which is 100%.

4. Marcy's rest day is EVERY SUNDAY. All Saint's Day is a special non-working holiday. If All Saint's

Day happened to fall on a Sunday, and Marcy was required to work, she shall be paid an ADDITIONAL

compensation of at least:

Ans: 50%

Explanation: Rest Day on a Special Non-Working Holiday is entitled to a PLUS 50% of the

daily rate of 100%. Therefore, the ADDITIONAL COMPENSATION is 50%.

5. Christine, Allen, Camille and Kashica who work beyond 8 hours on a holiday or rest day shall also

be paid an additional compensation equivalent to the rate of the first 8 hours plus at least ____

thereof.

Ans: 30%

You might also like

- 97 Frequently Asked Questions About Compensation: With Answers from SHRM's Knowledge AdvisorsFrom Everand97 Frequently Asked Questions About Compensation: With Answers from SHRM's Knowledge AdvisorsNo ratings yet

- Labor Law Final Exam Suggested Answers 2CDocument50 pagesLabor Law Final Exam Suggested Answers 2CMariaHannahKristenRamirez100% (1)

- 4D 4G Labrev Volume 1Document1,094 pages4D 4G Labrev Volume 1Mary Ann Tan100% (1)

- Wage and Wage-Related Benefits 1. Minimum WageDocument6 pagesWage and Wage-Related Benefits 1. Minimum WageMary InvencionNo ratings yet

- Employee Benefits and ServicesDocument19 pagesEmployee Benefits and ServicesFaith JazzNo ratings yet

- Payroll Salary and Compensation in The PhilippinesDocument8 pagesPayroll Salary and Compensation in The Philippinesdefaens8053No ratings yet

- Grimaldo, Marvin: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesGrimaldo, Marvin: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldFranc Anthony GalaoNo ratings yet

- DIGESTS Labor Standards MidtermsDocument250 pagesDIGESTS Labor Standards MidtermsJetJuárez100% (4)

- Internal Memorandum: Certificate PH17/1587Document11 pagesInternal Memorandum: Certificate PH17/1587mariel darkangelNo ratings yet

- Payroll Salary Compensation and Benefits in The PhilippinesDocument4 pagesPayroll Salary Compensation and Benefits in The PhilippinesRossele B. CabeNo ratings yet

- Basic Philippine Labor Laws and RegulationsDocument13 pagesBasic Philippine Labor Laws and RegulationsEduard DorseyNo ratings yet

- Revising Feasibility StudyDocument110 pagesRevising Feasibility StudyMay Ann Verzosa Soniel100% (1)

- When Work On Rest Day Be AuthorizedDocument19 pagesWhen Work On Rest Day Be AuthorizedJohanna GutierrezNo ratings yet

- Labor LawDocument2 pagesLabor LawKarl LuzungNo ratings yet

- RFBT.10 - Lecture Notes (Labor Law)Document9 pagesRFBT.10 - Lecture Notes (Labor Law)Monica GarciaNo ratings yet

- Asif Ahmed Ayon 1712987630 - Human Resource Management - Alternative Individual AssessmentDocument9 pagesAsif Ahmed Ayon 1712987630 - Human Resource Management - Alternative Individual AssessmentValakNo ratings yet

- MODULE 7 Labor Standards ACA Baconga AJPDocument4 pagesMODULE 7 Labor Standards ACA Baconga AJPChristine JotojotNo ratings yet

- Wage Rates (Labor Law I)Document9 pagesWage Rates (Labor Law I)Miguel Anas Jr.No ratings yet

- Juris Orbis Labor Law Midterm ReviewerDocument19 pagesJuris Orbis Labor Law Midterm ReviewerAlcy Lorraine HicbanNo ratings yet

- REGFRA SSS LABOR - Merged - CompressedDocument47 pagesREGFRA SSS LABOR - Merged - CompressedJaynalyn MonasterialNo ratings yet

- CE Laws 4140 Phil Labor Code 2Document5 pagesCE Laws 4140 Phil Labor Code 2jun junNo ratings yet

- What Is PayrollDocument3 pagesWhat Is PayrollAbraham Mayo MakakuaNo ratings yet

- Labor Standards 2010 HolidaysDocument49 pagesLabor Standards 2010 HolidaysRheneir MoraNo ratings yet

- LocalDocument3 pagesLocalAngelica AbelloNo ratings yet

- Andit LABOR REVIEWDocument58 pagesAndit LABOR REVIEWAtty. Angelica DeiparineNo ratings yet

- Holiday PayDocument9 pagesHoliday PayRIJJIE Y�IGO DEVERANo ratings yet

- Labor Law Review Lecture WORDDocument25 pagesLabor Law Review Lecture WORDAmicus CuriaeNo ratings yet

- Employee Benefits: 1. Holiday PaysDocument3 pagesEmployee Benefits: 1. Holiday PaysRhea Mae BendoyNo ratings yet

- Conditions and EmploymentDocument54 pagesConditions and EmploymentBenedict SheaNo ratings yet

- Two Regular Holidays Falling On The Same DayDocument3 pagesTwo Regular Holidays Falling On The Same DayLady Alfie Comaling RudasNo ratings yet

- LAWDocument13 pagesLAWjanahandreasNo ratings yet

- Payments (Labor Code of PH)Document20 pagesPayments (Labor Code of PH)yor7724No ratings yet

- Labor LawDocument6 pagesLabor LawElden Cunanan BonillaNo ratings yet

- Labor StandardsDocument98 pagesLabor Standardsqueen espinasNo ratings yet

- Labor Standards ReviewerDocument7 pagesLabor Standards ReviewerCj NightsirkNo ratings yet

- Notes On Holiday PayDocument3 pagesNotes On Holiday PayPaul Christian Balin CallejaNo ratings yet

- 11 Labor LawDocument19 pages11 Labor LawRyDNo ratings yet

- Conditions of Work-And-Rest PeriodsDocument40 pagesConditions of Work-And-Rest PeriodsMariel Denoyo BanosanNo ratings yet

- Overtime PayDocument2 pagesOvertime PayEJ BenalayoNo ratings yet

- Computation of Pay For HolidaysDocument4 pagesComputation of Pay For HolidaysSaiNo ratings yet

- Benefits of Wage EarnersDocument16 pagesBenefits of Wage EarnersJulianaNo ratings yet

- Payroll Salary Compensation and Benefits in The PhilippinesDocument7 pagesPayroll Salary Compensation and Benefits in The PhilippinesBernard AndomangNo ratings yet

- DOLE Guidelines Holiday PayDocument2 pagesDOLE Guidelines Holiday PayJun San DiegoNo ratings yet

- Labor Code Art.-89Document16 pagesLabor Code Art.-89Joanne LeenNo ratings yet

- Bam200 Sas12Document25 pagesBam200 Sas12Mary Joy Jessa BernardinoNo ratings yet

- Compensation and WagesDocument13 pagesCompensation and WagesJulie AbanesNo ratings yet

- What Are The General Holidays in Manitoba?Document7 pagesWhat Are The General Holidays in Manitoba?Ken ShackelNo ratings yet

- Labor and Social LegislationDocument10 pagesLabor and Social LegislationBochai BagolorNo ratings yet

- Benefits of A Wage EarnerDocument30 pagesBenefits of A Wage EarnerAniceta EstrellaNo ratings yet

- HRM - HolidaysDocument3 pagesHRM - HolidaysCresel ReposoNo ratings yet

- Government Mandated BenefitsDocument2 pagesGovernment Mandated BenefitsBon HartNo ratings yet

- Matrix of Statutory Rights of WorkersDocument4 pagesMatrix of Statutory Rights of Workersraminicoff100% (1)

- Compensation Law, Policies and RegulationsDocument3 pagesCompensation Law, Policies and RegulationsRodelia OpadaNo ratings yet

- Labor Standards (Conditions of Employment Pt. 2) : Atty. Stephanie Joy A. Rolusta-Valdez DMMMSU-MLUC College of LawDocument55 pagesLabor Standards (Conditions of Employment Pt. 2) : Atty. Stephanie Joy A. Rolusta-Valdez DMMMSU-MLUC College of LawSteps RolsNo ratings yet

- North Eastern Mindanao State University (Nemsu) : Section: HRM3CDocument3 pagesNorth Eastern Mindanao State University (Nemsu) : Section: HRM3CCyril Ann IriberriNo ratings yet

- Labor Laws and Legislation - Note 2 FinalsDocument5 pagesLabor Laws and Legislation - Note 2 FinalsMargarette Rose RamosNo ratings yet

- MODULE 7 Labor Standards (ACD) Pacturan, CJADocument3 pagesMODULE 7 Labor Standards (ACD) Pacturan, CJACzarina JaneNo ratings yet

- Written Report-Labor StandardsDocument9 pagesWritten Report-Labor StandardsGodwin CabacunganNo ratings yet

- HRM AssessmentDocument6 pagesHRM AssessmentNiejean SatoruNo ratings yet

- Notes On Computation of WagesDocument6 pagesNotes On Computation of WagesNashiba Dida-AgunNo ratings yet

- Payroll Salary Compensation and Benefits in The PhilippinesDocument8 pagesPayroll Salary Compensation and Benefits in The PhilippinesIsrael FortoNo ratings yet

- Labor Standards - Conditions of WorkDocument75 pagesLabor Standards - Conditions of WorkGay C. Caragan-MakaniNo ratings yet

- Overtime PayDocument4 pagesOvertime PayRyle Dan ClementeNo ratings yet

- Maximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryFrom EverandMaximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryNo ratings yet

- Iverson and Zatzick The Effects of Downsizing On Labor ProductivityDocument16 pagesIverson and Zatzick The Effects of Downsizing On Labor ProductivityAaronNo ratings yet

- CH 3, Attitudes & Job SatisfactionDocument13 pagesCH 3, Attitudes & Job SatisfactionUsmanAhmedKhanNo ratings yet

- SAn Mateo Daily Journal 11-17-18 EditionDocument32 pagesSAn Mateo Daily Journal 11-17-18 EditionSan Mateo Daily Journal100% (2)

- Department of Labor: 81-AiDocument4 pagesDepartment of Labor: 81-AiUSA_DepartmentOfLaborNo ratings yet

- Dissertation On International Business PDFDocument6 pagesDissertation On International Business PDFCheapestPaperWritingServiceSingapore100% (1)

- Child LaborDocument22 pagesChild LaborgheljoshNo ratings yet

- HSM 543 Health Services Finance Week 7 Course Project AnswerDocument64 pagesHSM 543 Health Services Finance Week 7 Course Project AnswerMike RussellNo ratings yet

- Human Resources Development - Trends in HR Consulting Domain and Capability BuildingDocument32 pagesHuman Resources Development - Trends in HR Consulting Domain and Capability BuildingShreyansh RavalNo ratings yet

- Employee Job Satisfaction at Spade EMSDocument31 pagesEmployee Job Satisfaction at Spade EMSAlok kumarNo ratings yet

- Mining For Tech Talent Gold Seven Ways To Find and Keep Diverse TalentDocument7 pagesMining For Tech Talent Gold Seven Ways To Find and Keep Diverse TalentpenstyloNo ratings yet

- Guidelines For Rating PADocument2 pagesGuidelines For Rating PAMohammed AldaffaieNo ratings yet

- Job OfferDocument5 pagesJob OfferJelyn DeseoNo ratings yet

- And Commission On Audit, As FollowsDocument219 pagesAnd Commission On Audit, As FollowsRoyalhighness18No ratings yet

- Nigel Bassett-Jones - Strategic Human Resource Management - A Systems Approach-Routledge (2023)Document310 pagesNigel Bassett-Jones - Strategic Human Resource Management - A Systems Approach-Routledge (2023)Pontianak sampitNo ratings yet

- Matriz de Validacion de Competencias en RRHHDocument16 pagesMatriz de Validacion de Competencias en RRHHjohngito1No ratings yet

- CHAPTER 13 PPT PDFDocument90 pagesCHAPTER 13 PPT PDFMeiza AyaNo ratings yet

- SM CH-4 (Evaluating Company Resources & Competitive Capabilities)Document7 pagesSM CH-4 (Evaluating Company Resources & Competitive Capabilities)Tama SahaNo ratings yet

- Policy On Persons With Disabilities (Trinidad & Tobago)Document17 pagesPolicy On Persons With Disabilities (Trinidad & Tobago)shivani_rajaram100% (1)

- HR AuditDocument58 pagesHR AuditThomas KengaNo ratings yet

- Lippincott Williams & WilkinsDocument15 pagesLippincott Williams & WilkinsDragonSovereignNo ratings yet

- Osh Individual AssignmentDocument3 pagesOsh Individual AssignmentMagnetica ShuNo ratings yet

- Ramirez Vs Mar FishingDocument6 pagesRamirez Vs Mar FishingPhrexilyn PajarilloNo ratings yet

- Panama Labor Laws - Part IDocument2 pagesPanama Labor Laws - Part Iernst_haftNo ratings yet

- Financial Analysis of NFLDocument16 pagesFinancial Analysis of NFLSid RawatNo ratings yet