Professional Documents

Culture Documents

Accounting Cheat Code Complete

Accounting Cheat Code Complete

Uploaded by

maiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Cheat Code Complete

Accounting Cheat Code Complete

Uploaded by

maiCopyright:

Available Formats

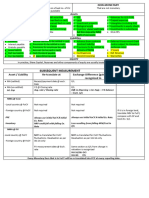

1 Cost model: Fair Value:

Historical cost Amount of IP Market

- Depreciatn V price

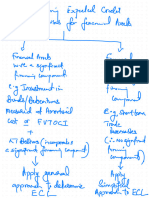

2 1. Contractual Cash

flow CCF test Long term (5 yrs)

Amortization

Cost

FVTPL sample

3

Bond Semi-Long term (2 yrs) FVOCI

Is this a Purpose-

Income Income

Bond? short

- Depreciation + Gain on property FVTPL

stock Long term (5 yrs) →

Purpose- FVOCI

Short → FVTPL

2. BM model

test

Bond Amortization

No amortization in stocks

This is

unrealize

gain

IS = interest in Bond

IS = cash IS = RE

Low dep. = high profit

6

You might also like

- Textbook Neoclassical Realist Theory of International Politics 1St Edition Norrin M Ripsman Ebook All Chapter PDFDocument53 pagesTextbook Neoclassical Realist Theory of International Politics 1St Edition Norrin M Ripsman Ebook All Chapter PDFtheresa.johnson888100% (8)

- European Rail Timetable 2012 PDFDocument2 pagesEuropean Rail Timetable 2012 PDFChristineNo ratings yet

- US CMA Gleim Part 2Document258 pagesUS CMA Gleim Part 2Joy Krishna Das100% (1)

- Accounting Cheat SheetDocument2 pagesAccounting Cheat Sheetrio_harcanNo ratings yet

- Financial Statement Analysis FIN658Document1 pageFinancial Statement Analysis FIN658azwan ayop50% (2)

- NEGOTIABLE INSTRUMENTS LAW Course OutlineDocument7 pagesNEGOTIABLE INSTRUMENTS LAW Course OutlineRee-Ann Escueta Bongato100% (4)

- 55 Comparison of Accounting AssumptionsDocument8 pages55 Comparison of Accounting Assumptionsmanoranjan838241No ratings yet

- Ind As 23 - Mind MapDocument2 pagesInd As 23 - Mind MapSarun ChhetriNo ratings yet

- INVESTMENTS W Matrix PFRS 9 PDFDocument7 pagesINVESTMENTS W Matrix PFRS 9 PDFAra DucusinNo ratings yet

- 1defined Benefits SummaryDocument2 pages1defined Benefits SummaryVince AbabonNo ratings yet

- 2Document4 pages2Janea Lorraine TanNo ratings yet

- BB Status17 - 01 - 2023 - Sme - Revolving - Scheme - PositionDocument2 pagesBB Status17 - 01 - 2023 - Sme - Revolving - Scheme - Positionmustcube3No ratings yet

- Fin - BIP-ACC-211-Week-8-9Document10 pagesFin - BIP-ACC-211-Week-8-9gelNo ratings yet

- Financial Derivatives CheatSheetDocument2 pagesFinancial Derivatives CheatSheetTiffanyNo ratings yet

- FL NotesDocument4 pagesFL NotesBarry AllenNo ratings yet

- JPM CDS vs. Bonds-1999-12-2Document4 pagesJPM CDS vs. Bonds-1999-12-2Veeken ChaglassianNo ratings yet

- Wacc Calculation SimplifiedDocument2 pagesWacc Calculation SimplifiedPranjalNo ratings yet

- Reading 24 - Understanding Balance SheetDocument1 pageReading 24 - Understanding Balance Sheetmaimaitaan120201No ratings yet

- Quantitative MethodsDocument35 pagesQuantitative Methodsphindocha30No ratings yet

- Insights Into ECLDocument12 pagesInsights Into ECLHunal Kumar MautadinNo ratings yet

- 13 Short Term FinancingDocument3 pages13 Short Term FinancingIrene LimpinNo ratings yet

- Fra MindmapDocument10 pagesFra MindmapNghĩaTrầnNo ratings yet

- Afar Notes by DR Ferrer Summary Bs AccountancyDocument22 pagesAfar Notes by DR Ferrer Summary Bs AccountancyAnne Echavez Pasco100% (2)

- SS - 5-6 - Mindmaps - Financial ReportingDocument48 pagesSS - 5-6 - Mindmaps - Financial Reportinghaoyuting426No ratings yet

- Bonds ReviewerDocument10 pagesBonds Reviewerjulian.cuyaNo ratings yet

- Series 6 ReviewDocument202 pagesSeries 6 ReviewAnthony McnicholsNo ratings yet

- Mat CalculaterDocument1 pageMat CalculatershriniskNo ratings yet

- Lecture 5.1-5.2 Notes SummaryDocument1 pageLecture 5.1-5.2 Notes SummaryihmagumparaNo ratings yet

- Cheating Sheet IFMDocument2 pagesCheating Sheet IFManggittutpinilih100% (1)

- FMP Mechanics of Futures SSEIDocument1 pageFMP Mechanics of Futures SSEIDIVYANSHU GUPTANo ratings yet

- FMP Mechanics of Futures SSEIDocument1 pageFMP Mechanics of Futures SSEIDIVYANSHU GUPTANo ratings yet

- 3 - Introduction To Fixed Income Valuation-UnlockedDocument53 pages3 - Introduction To Fixed Income Valuation-UnlockedAditya NugrohoNo ratings yet

- Textbook Financial Management Theory Practice Eugene F Brigham Ebook All Chapter PDFDocument53 pagesTextbook Financial Management Theory Practice Eugene F Brigham Ebook All Chapter PDFlola.brooks290100% (10)

- Textbook Fundamentals of Financial Management Concise Edition Eugene F Brigham Ebook All Chapter PDFDocument53 pagesTextbook Fundamentals of Financial Management Concise Edition Eugene F Brigham Ebook All Chapter PDFmatthew.moniz582100% (12)

- ACTG25 Chapter 5Document31 pagesACTG25 Chapter 5Mckenzie75% (4)

- AUDIT OF INVESTMENT - Debt SecuritiesDocument2 pagesAUDIT OF INVESTMENT - Debt SecuritiesJoshua LisingNo ratings yet

- 财务、企业理财、权益、其他Document110 pages财务、企业理财、权益、其他Ariel MengNo ratings yet

- Ias 21Document1 pageIas 21Dawar Hussain (WT)No ratings yet

- IFRS 9 Part 2Document24 pagesIFRS 9 Part 2ErslanNo ratings yet

- Study Notes in MAS Capital Budgeting Part 1 PDFDocument2 pagesStudy Notes in MAS Capital Budgeting Part 1 PDFHerald JoshuaNo ratings yet

- Intercorporate Investments 2019Document14 pagesIntercorporate Investments 2019Jähäñ ShërNo ratings yet

- Bonds PayableDocument1 pageBonds PayableHeaven HeartNo ratings yet

- CMA Inter FM Past Paper Question Trend+ Chapter Analysis XLSX GoogleDocument1 pageCMA Inter FM Past Paper Question Trend+ Chapter Analysis XLSX GoogleNARAYANNo ratings yet

- PMS Guide August 2019Document88 pagesPMS Guide August 2019HetanshNo ratings yet

- Concept Map: Partnership FormationDocument5 pagesConcept Map: Partnership FormationDaenielle EspinozaNo ratings yet

- 2.2 Audit of InvestmentsDocument1 page2.2 Audit of Investmentsantonette seradNo ratings yet

- PE CheatSheetV2Document2 pagesPE CheatSheetV2jitrapaNo ratings yet

- Finance Lease - LesseeDocument2 pagesFinance Lease - LesseeKezNo ratings yet

- Adjusting Entries / Jurnal PenyesuaianDocument4 pagesAdjusting Entries / Jurnal PenyesuaianRatu ShaviraNo ratings yet

- Running Out of TimeDocument2 pagesRunning Out of TimeAmar KashyapNo ratings yet

- Accounting NotesDocument72 pagesAccounting NotesCJNo ratings yet

- IFA Lesson 3 Slides (Financial Liabilities & Equity)Document53 pagesIFA Lesson 3 Slides (Financial Liabilities & Equity)zengruiqi20000302No ratings yet

- Financial Asset and Financial LiabilityDocument5 pagesFinancial Asset and Financial LiabilityNatasha Amira Amir RoesdiNo ratings yet

- 05 DerivativesDocument46 pages05 DerivativesquentindavignonNo ratings yet

- Full Download Book Financial Management Theory Practice PDFDocument41 pagesFull Download Book Financial Management Theory Practice PDFcalvin.williams888100% (23)

- Asse T Balance Sheet: Current Assets Non-Current AssetsDocument2 pagesAsse T Balance Sheet: Current Assets Non-Current AssetsSapto PhsNo ratings yet

- Fi3300 Chapter09Document40 pagesFi3300 Chapter09Yaru KamiNo ratings yet

- AFAR Notes by Dr. FerrerDocument21 pagesAFAR Notes by Dr. FerrerAko C Marz100% (1)

- 7 Financial Instruments - Regular - 240320 - 191524Document128 pages7 Financial Instruments - Regular - 240320 - 191524Taur VishalNo ratings yet

- Chap002 - How To Calculate Present Value - TuhocDocument13 pagesChap002 - How To Calculate Present Value - Tuhocgiabao2372004No ratings yet

- Afar Quicknotes: GATO, Abdul Barri Indol MSU - Main Campus 09452146094Document19 pagesAfar Quicknotes: GATO, Abdul Barri Indol MSU - Main Campus 09452146094Zech PackNo ratings yet

- Chapter 6 Cfas ReviewerDocument2 pagesChapter 6 Cfas ReviewerBabeEbab AndreiNo ratings yet

- Effectiveness of Hand Wash and Sanitizer: COVID19: Bulletin of Pure & Applied Sciences-Zoology January 2020Document5 pagesEffectiveness of Hand Wash and Sanitizer: COVID19: Bulletin of Pure & Applied Sciences-Zoology January 2020CarolineNo ratings yet

- Boiling Water Reactor Owners Group Emergency Procedure and Severe Accident GuidelinesDocument9 pagesBoiling Water Reactor Owners Group Emergency Procedure and Severe Accident GuidelinesEnformableNo ratings yet

- Chapter-1 Introduction of POMDocument67 pagesChapter-1 Introduction of POMBhupendra SsharmaNo ratings yet

- Alcatel Omnipcx Enterprise: 1 The Communication ArchitectureDocument6 pagesAlcatel Omnipcx Enterprise: 1 The Communication ArchitectureuvsubhadraNo ratings yet

- Helene Cixous Sorties PDFDocument7 pagesHelene Cixous Sorties PDFPrafulla NathNo ratings yet

- William Ong Genato, Complainant, vs. Atty. Essex L. SILAPAN, RespondentDocument12 pagesWilliam Ong Genato, Complainant, vs. Atty. Essex L. SILAPAN, RespondentAnonymous 8L5rrGPXmrNo ratings yet

- Crim Bar Q & ADocument11 pagesCrim Bar Q & ACherry Ann LayuganNo ratings yet

- Model HS Question PaperDocument12 pagesModel HS Question Paperminhasworld953No ratings yet

- SALLYANNE - HIM in AustraliaDocument35 pagesSALLYANNE - HIM in AustraliaAndi Ka NurNo ratings yet

- Huawei - TOW/SWOT/Environment/Situational AnalysisDocument10 pagesHuawei - TOW/SWOT/Environment/Situational AnalysisAlex NeohNo ratings yet

- Role of Venture Capital in Indian EconomyDocument53 pagesRole of Venture Capital in Indian EconomySanket Patkar0% (1)

- Triumph Debate Sept Oct BriefDocument101 pagesTriumph Debate Sept Oct BriefImadukNo ratings yet

- Sttart Up Company 2012 ArticleDocument5 pagesSttart Up Company 2012 ArticleResearch and Development Tax Credit Magazine; David Greenberg PhD, MSA, EA, CPA; TGI; 646-705-2910No ratings yet

- PERSONS Updates On JurisprudenceDocument93 pagesPERSONS Updates On JurisprudenceSofia DavidNo ratings yet

- POS Interface Materials Control MICROS Simphony 1.xDocument39 pagesPOS Interface Materials Control MICROS Simphony 1.xRanko LazeskiNo ratings yet

- 2022 2023 đề cương giữa kì 1 khối 10Document10 pages2022 2023 đề cương giữa kì 1 khối 10Thuy Duong NguyenNo ratings yet

- United States v. John Castonguay, 843 F.2d 51, 1st Cir. (1988)Document9 pagesUnited States v. John Castonguay, 843 F.2d 51, 1st Cir. (1988)Scribd Government DocsNo ratings yet

- English Language Poverty Ulando UpdatedDocument15 pagesEnglish Language Poverty Ulando UpdatedRichard DerbyNo ratings yet

- Attribution Theory and CrisisDocument5 pagesAttribution Theory and Crisiskenya106No ratings yet

- 28 Sep 2012 976082.2 0 Delta Corp Limited L65493PN1990PLC058817Document21 pages28 Sep 2012 976082.2 0 Delta Corp Limited L65493PN1990PLC058817HimanshuNo ratings yet

- Free English Paper (p2)Document4 pagesFree English Paper (p2)free accountNo ratings yet

- Aboriginal-And-Culturally-Responsive-Pedagogies-Assessment 2Document9 pagesAboriginal-And-Culturally-Responsive-Pedagogies-Assessment 2api-435769530No ratings yet

- Sse1112 PDFDocument113 pagesSse1112 PDFVenkada RamanujamNo ratings yet

- 1.for Print Handout - Encounter With JesusDocument3 pages1.for Print Handout - Encounter With JesusFeds Gula Jr.No ratings yet

- PPM SampleDocument61 pagesPPM SamplePro Business Plans50% (2)

- Whats Working in Affiliate Marketing 2021Document316 pagesWhats Working in Affiliate Marketing 2021Anna100% (1)

- Study of Christian Cabal Ah ResourcesDocument58 pagesStudy of Christian Cabal Ah Resourcestiger76100% (1)