Professional Documents

Culture Documents

GST CT 13 2023

Uploaded by

Naga Obul ReddyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GST CT 13 2023

Uploaded by

Naga Obul ReddyCopyright:

Available Formats

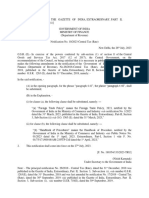

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II, SECTION 3,

SUB-SECTION (i)]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

CENTRAL BOARD OF INDIRECT TAXES AND CUSTOMS

NOTIFICATION

NO. 13/2023–CENTRAL TAX

New Delhi, the 24th May, 2023

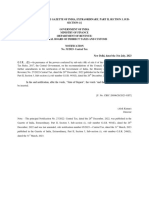

G.S.R.....(E).– In exercise of the powers conferred by sub-section (6) of section 39 read with section 168 of the

Central Goods and Services Tax Act, 2017 (12 of 2017) (hereafter in this notification referred to as the said

Act), the Commissioner hereby makes the following further amendment in notification of the

Government of India in the Ministry of Finance (Department of Revenue), No. 26/2019 –Central Tax,

dated the 28th June, 2019, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i)

vide number G.S.R.452(E), dated the 28th June, 2019, namely:–

In the said notification, in the first paragraph, after the fourth proviso, the following proviso shall be

inserted, namely: –

“Provided also that the return by a registered person, required to deduct tax at source under the provisions of

section 51 of the said Act in FORM GSTR-7 of the Central Goods and Services Tax Rules, 2017 under sub-

section (3) of section 39 of the said Act read with rule 66 of the Central Goods and Services Tax

Rules, 2017, for the month of April, 2023, whose principal place of business is in the State of Manipur,

shall be furnished electronically through the common portal, on or before the thirty-first day of May, 2023.”.

2. This notification shall be deemed to have come into force with effect from the 10th day of May, 2023.

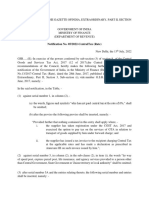

[F. No. CBIC-20006/10/2023-GST]

(Alok Kumar)

Director

Note: The principal notification No. 26/2019 –Central Tax, dated the 28th June, 2019 was published in the

Gazette of India, Extraordinary vide number G.S.R. 452(E), dated the 28th June, 2019 and was last

amended by notification No. 20/2020 –Central Tax, dated the 23rd March, 2020, published in the Gazette

of India, Extraordinary vide number G.S.R. 203(E), dated the 23rd March, 2020.

You might also like

- GST CT 16 2023Document1 pageGST CT 16 2023sridharanNo ratings yet

- Notfctn 10 Central Tax English 2021Document2 pagesNotfctn 10 Central Tax English 2021cadeepaksingh4No ratings yet

- 05 2024 CT EngDocument1 page05 2024 CT EngArun_ecNo ratings yet

- 10 2023 CTR EngDocument1 page10 2023 CTR EngMaheswar MajiNo ratings yet

- GST CT 31 2023 3Document1 pageGST CT 31 2023 3cadeepaksingh4No ratings yet

- GST CT 14 2023Document1 pageGST CT 14 2023sridharanNo ratings yet

- Notification No 9 CustomDocument1 pageNotification No 9 CustomShubham MittalNo ratings yet

- GST CT 37 2023 1Document1 pageGST CT 37 2023 1cadeepaksingh4No ratings yet

- Notfctn 02 2020 CGST Rate EnglishDocument1 pageNotfctn 02 2020 CGST Rate Englishdinesh kasnNo ratings yet

- Ce18 2023Document1 pageCe18 2023Aravind GovindarajaluNo ratings yet

- Notfctn 48 Central Tax English 2019Document2 pagesNotfctn 48 Central Tax English 2019CA Keshav MadaanNo ratings yet

- Notification26 2018Document1 pageNotification26 2018PrashantSinghNo ratings yet

- 01 2024 ITR Eng CorriDocument2 pages01 2024 ITR Eng Corrikk5860232No ratings yet

- Notification No. 08/2019-Central Tax (Rate) : Explanation. For The Purpose of This EntryDocument2 pagesNotification No. 08/2019-Central Tax (Rate) : Explanation. For The Purpose of This EntryIshanNo ratings yet

- Notification No. 16/2021 - Central Tax (Rate)Document2 pagesNotification No. 16/2021 - Central Tax (Rate)santanu sanyalNo ratings yet

- GST CT 32 2023 2Document1 pageGST CT 32 2023 2cadeepaksingh4No ratings yet

- Notfctn 02 2021 2020 CGST RateDocument2 pagesNotfctn 02 2021 2020 CGST RateJatinMittalNo ratings yet

- Explanation III. For The Purposes of This Notification, "Non-Assesse Online Recipient" HasDocument1 pageExplanation III. For The Purposes of This Notification, "Non-Assesse Online Recipient" HasSushant SaxenaNo ratings yet

- Notfctn 22 2021 CGST Rate 1Document1 pageNotfctn 22 2021 CGST Rate 1GST ACADEMY OF EXCELLENCE ERODE 73737 16648No ratings yet

- Notfn 12 2019Document2 pagesNotfn 12 2019Sri CharanNo ratings yet

- Csadd01 2023 453274Document1 pageCsadd01 2023 453274Manish DahiyaNo ratings yet

- Notfctn 7 2019 CGST Rate EnglishDocument2 pagesNotfctn 7 2019 CGST Rate EnglishRamprakash vishwakarmaNo ratings yet

- G.S.R (E) :-In Exercise of The Powers Conferred by Section 168 of The Central Goods andDocument1 pageG.S.R (E) :-In Exercise of The Powers Conferred by Section 168 of The Central Goods andkumar45caNo ratings yet

- 01 2023 CT EngDocument1 page01 2023 CT Engcadeepaksingh4No ratings yet

- Notfctn 74 Central Tax English 2020Document1 pageNotfctn 74 Central Tax English 2020cadeepaksingh4No ratings yet

- NotificationDocument1 pageNotificationsanjeev1910No ratings yet

- Notfctn 78 Central Tax English 2020Document2 pagesNotfctn 78 Central Tax English 2020Ashish Yadav & AssociatesNo ratings yet

- 12 2022 CT Eng-3Document1 page12 2022 CT Eng-3cadeepaksingh4No ratings yet

- 07 EngDocument1 page07 EngYours YoursNo ratings yet

- 05 - 2022-Amendment To Notification 13Document2 pages05 - 2022-Amendment To Notification 13deepak.sharmaNo ratings yet

- 05 - 2022 CTR EngDocument2 pages05 - 2022 CTR EngJeremy RemlalfakaNo ratings yet

- csnt23 2022Document1 pagecsnt23 2022nitin DRINo ratings yet

- GST - Notification No. Order No. 02 - 2018 - Dated 31-12-2018 - Central GST (CGST)Document2 pagesGST - Notification No. Order No. 02 - 2018 - Dated 31-12-2018 - Central GST (CGST)ARJUN ATHREYANNo ratings yet

- Customs Notification 2 - 2023Document1 pageCustoms Notification 2 - 2023Raja SinghNo ratings yet

- GST CT 28 2023 5Document1 pageGST CT 28 2023 5cadeepaksingh4No ratings yet

- cs33 2013Document1 pagecs33 2013stephin k jNo ratings yet

- Amendment Recruitment Rules 24082023Document3 pagesAmendment Recruitment Rules 24082023Dilip BannerjiNo ratings yet

- 70 2019Document1 page70 2019Krishna GoyalNo ratings yet

- Customs Notification 44 - 2023Document1 pageCustoms Notification 44 - 2023Raja SinghNo ratings yet

- Notfctn 43 Central Tax EnglishDocument2 pagesNotfctn 43 Central Tax Englishapi-224058372No ratings yet

- Prescribing Modes of PaymentDocument1 pagePrescribing Modes of PaymentJalaj JainNo ratings yet

- GST Rate Fs Bricks Tiles EnglishDocument5 pagesGST Rate Fs Bricks Tiles EnglishdhananjayNo ratings yet

- TH THDocument2 pagesTH THKrishna GoyalNo ratings yet

- GSTNTF66Document1 pageGSTNTF66JGVNo ratings yet

- Notification No. 15/2021-Central Tax (Rate)Document2 pagesNotification No. 15/2021-Central Tax (Rate)santanu sanyalNo ratings yet

- Import Gatt DeclarationDocument2 pagesImport Gatt Declarationishan guptaNo ratings yet

- Notfctn 14 Central Tax English 2019Document2 pagesNotfctn 14 Central Tax English 2019sathishmrNo ratings yet

- Compensation Cess02 2021 Rate EngDocument1 pageCompensation Cess02 2021 Rate EngHemant SinhmarNo ratings yet

- Amendment Recruitment Rules 11092023Document3 pagesAmendment Recruitment Rules 110920238793160048ajayNo ratings yet

- 04.2017-Central Tax Dt. 28.06.2017Document1 page04.2017-Central Tax Dt. 28.06.2017rajanbardiaNo ratings yet

- CBDT Has Notified That The Provisions of Section 206C (1G) Shall Not ApplyDocument1 pageCBDT Has Notified That The Provisions of Section 206C (1G) Shall Not ApplySRIKANTA ROUTNo ratings yet

- st01 2017Document1 pagest01 2017Rajula Gurva ReddyNo ratings yet

- Circular 18-2023Document1 pageCircular 18-2023Advocate ChandraNo ratings yet

- Notification 98 2023Document1 pageNotification 98 2023tax.contactNo ratings yet

- CBIC Exempt Supply of Goods and Services From PSU To PSU From Applicability of Provisions Relating To TDS Vide Notification NoDocument1 pageCBIC Exempt Supply of Goods and Services From PSU To PSU From Applicability of Provisions Relating To TDS Vide Notification NoRaja Srinivasa ReddyNo ratings yet

- Notification42 2017Document1 pageNotification42 2017NDTV100% (1)

- NN 10Document1 pageNN 10JigmeNo ratings yet

- 40-2022-Custom-Increase in GST Import Rate From 5% To 12%Document2 pages40-2022-Custom-Increase in GST Import Rate From 5% To 12%legendry007No ratings yet

- Cess Old Car 1 DT 25.1.18Document1 pageCess Old Car 1 DT 25.1.18ashim1No ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- SovereignDocument151 pagesSovereignlenorescribdaccountNo ratings yet

- City of Pasig and Crispina V. Salumbre vs. Manila Electric CompanyDocument2 pagesCity of Pasig and Crispina V. Salumbre vs. Manila Electric CompanyRoms Roldan100% (1)

- Mcdonald Vs MacjoyDocument12 pagesMcdonald Vs MacjoyMike E DmNo ratings yet

- The Seven Great Monarchies: BY George Rawlinson, M.A.Document10 pagesThe Seven Great Monarchies: BY George Rawlinson, M.A.Gutenberg.orgNo ratings yet

- Cover Letter Speaker BoehnerDocument2 pagesCover Letter Speaker Boehnergerald7783No ratings yet

- Toby Joe Gutierrez v. Dan Moriarty, Warden, Attorney General of The State of New Mexico, 922 F.2d 1464, 10th Cir. (1991)Document17 pagesToby Joe Gutierrez v. Dan Moriarty, Warden, Attorney General of The State of New Mexico, 922 F.2d 1464, 10th Cir. (1991)Scribd Government DocsNo ratings yet

- Civil Law Bar Questions 2005 - 2010Document40 pagesCivil Law Bar Questions 2005 - 2010Habeas Corpuz0% (1)

- Figuracion v. Vda. de Figuracion G.R. No. 154322 August 22, 2006Document9 pagesFiguracion v. Vda. de Figuracion G.R. No. 154322 August 22, 2006Consuelo Narag GalagalaNo ratings yet

- STATE BAR ACT Unconstitutional (Eddie Craig)Document150 pagesSTATE BAR ACT Unconstitutional (Eddie Craig)RangerX3k100% (1)

- Punjab Public Service Commission Punjab Public Service Commission Punjab Public Service Commission PPSC - Gov.in SDocument3 pagesPunjab Public Service Commission Punjab Public Service Commission Punjab Public Service Commission PPSC - Gov.in SJashanjot SinghNo ratings yet

- In The High Court of New Zealand Tauranga Registry CRI 2011-470-13Document10 pagesIn The High Court of New Zealand Tauranga Registry CRI 2011-470-13norml_dunedinNo ratings yet

- In The Case Concerning in The Case Concerning: Team Code: P7Document23 pagesIn The Case Concerning in The Case Concerning: Team Code: P7Saurabh Kumar Singh0% (2)

- Examination of Witness Before Trial-CriminalDocument1 pageExamination of Witness Before Trial-CriminalJanalin TatilNo ratings yet

- Evidence ActDocument5 pagesEvidence Actraju634No ratings yet

- The Most Important Events in The History of UkraineDocument14 pagesThe Most Important Events in The History of UkraineBrentNo ratings yet

- Sourcebook On Local Public FinanceDocument84 pagesSourcebook On Local Public FinanceAlce Quitalig0% (1)

- Chapter-11 - Parliament & State Legislature - pdf-56Document13 pagesChapter-11 - Parliament & State Legislature - pdf-56Shivanand KamatarNo ratings yet

- Department of Defense PolicyDocument2 pagesDepartment of Defense PolicyhartNo ratings yet

- Administrative Law Final DraftDocument17 pagesAdministrative Law Final DraftShivam KumarNo ratings yet

- Arigo Vs SwiftDocument2 pagesArigo Vs SwiftfaithNo ratings yet

- Torres & Lopez vs. LopezDocument2 pagesTorres & Lopez vs. LopezmononikkiNo ratings yet

- Iec PDFDocument3 pagesIec PDFWeare1_busyNo ratings yet

- Automat Realty vs. Dela CruzDocument5 pagesAutomat Realty vs. Dela CruzVilpa Villabas100% (2)

- Trial Memo LBWDocument5 pagesTrial Memo LBWAnge Buenaventura Salazar100% (1)

- Sangguniang Panlungsod: Republic of The Philippines City of OlongapoDocument30 pagesSangguniang Panlungsod: Republic of The Philippines City of OlongapoRamil F. De Jesus100% (1)

- Florida Bar Complaint Strip Club Owner V Miami Beach CommissionerDocument56 pagesFlorida Bar Complaint Strip Club Owner V Miami Beach CommissionerDavid Arthur WaltersNo ratings yet

- Capital Punishment LeafletDocument2 pagesCapital Punishment Leafletas100% (1)

- BIR2306 LUELCO Santa CeciliaDocument18 pagesBIR2306 LUELCO Santa CeciliaMaria RinaNo ratings yet

- Remedial Law ReviewerDocument42 pagesRemedial Law ReviewerNicolo ManikadNo ratings yet

- POSSESSion & Its KindDocument44 pagesPOSSESSion & Its KindSaddam Hussian90% (20)