Professional Documents

Culture Documents

Finalletter 83-3152419 Thetrustproject 05052021 00

Finalletter 83-3152419 Thetrustproject 05052021 00

Uploaded by

Gabe Kaminsky0 ratings0% found this document useful (0 votes)

136 views2 pagesObtained by Gabe Kaminsky

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentObtained by Gabe Kaminsky

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

136 views2 pagesFinalletter 83-3152419 Thetrustproject 05052021 00

Finalletter 83-3152419 Thetrustproject 05052021 00

Uploaded by

Gabe KaminskyObtained by Gabe Kaminsky

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

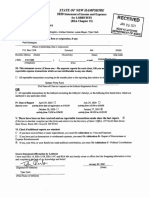

Department of the Treasury

Internal Revenue Service

‘Tax Exempt and Government Entities

TRS 0. Box 2508

Cincinnati, OH 45201

THE TRUST PROJECT

C/O SALLY LEHRMAN

446 OLD COUNTY RD STE 225

Date:

12/12/2021

Employer 10 numbor:

83-3162419

Person to contact:

Name: Michelle A Glutz

ID number: 31213

‘Telephone: 877-829-5500

‘Accounting period ending:

December 31

Public charity status:

PACIFICA, CA 94044 *TogeN"H(ANW)

Form 9056022 90- required

Yes

Efecto dato of exemption

December 10, 2018

Contribution deductibility:

Yes

‘Addendum applies:

No

DLN:

2605352704631

Dear Applicant:

We're pleased to tell you we determined you're exempt from federal income tax under Internal Revenue Code

(IRC) Section 501(c)(3). Donors can deduct contributions they make to you under IRC Section 170. You're also

qualified to receive tax deductible bequests, devises, transfers or gifts under Section 2055, 2106, or 2522. This

letter could help resolve questions on your exempt status. Please keep it for your records.

Organizations exempt under IRC Section 501(c)(3) are further classified as either publie charities or private

foundations. We determined you're a public charity under the IRC Section listed at the top of this letter.

You formed December 10, 2018, and filed your Form 1023, Application for Recognition of Exemption Under

Section 501(c)(3) of the Internal Revenue Code, on May 5, 2021. You failed to file a required annual

return or notice (Form 990, Form 990-EZ, Form 990-PF, or Form 990-N) for three consecutive years after you

formed and while your application was pending. As a result, {your tax-exempt status was automatically revoked

on May 15, 2021, the due date of your third 1g your Form 1023 as an

application for reinstatement and are recognizing your exemption as reinstated on the same day it was automatically

revoked. Asa result, you are recognized as tax exempt continuously from the effective date of exemption as

listed at the top of this letter.

If we indicated at the top of this letter that you're required to file Form 990/990-EZ/990-N, our records show

you're required to file an annual information return (Form 990 or Form 990-EZ) or electronic notice (Form

990-N, the e-Postcard). If you don't file a required return or notice for three consecutive years, your exempt

status will be automatically revoked.

If we indicated at the top of this letter that an addendum applies, the enclosed addendum is an integral part of

this letter.

Letter 947 (Rev. 2-2020)

Catalog Number 35182°

For important information about your responsibilities as a tax-exempt organization, go to www.irs.gov/charr

Enter "4221-PC" in the search bar to view Publication 4221-PC, Compliance Guide for 501(c)(3) Public

ies, which describes your recordkeeping, reporting, and disclosure requirements.

Sincerely.

votephee a. modi

Stephen A. Martin

Director, Exempt Organi:

Rulings and Agreements

Letter 947 (Rev. 2-2020)

Catalog Number 35182°

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Stripe Letter - August 2023 - Washington ExaminerDocument2 pagesStripe Letter - August 2023 - Washington ExaminerGabe KaminskyNo ratings yet

- Stripe Letter (00009782xF5606)Document4 pagesStripe Letter (00009782xF5606)Gabe KaminskyNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- HHS Advisory Board, Vot-ER, Alister MartinDocument2 pagesHHS Advisory Board, Vot-ER, Alister MartinGabe KaminskyNo ratings yet

- Vot-ER Articles of Incorporation, 2021Document5 pagesVot-ER Articles of Incorporation, 2021Gabe KaminskyNo ratings yet

- Mangi SJQ Supplement Letter - 3.9.24Document1 pageMangi SJQ Supplement Letter - 3.9.24Gabe KaminskyNo ratings yet

- Adeel Mangi Supplemental Letter March 2024 Senate Judiciary CommitteeDocument1 pageAdeel Mangi Supplemental Letter March 2024 Senate Judiciary CommitteeGabe KaminskyNo ratings yet

- UNRWA Elimination ActDocument3 pagesUNRWA Elimination ActGabe KaminskyNo ratings yet

- 2024 Community Civic Engagement Program ApplicationDocument8 pages2024 Community Civic Engagement Program ApplicationGabe KaminskyNo ratings yet

- Lawsuit State, FDRLST, DW, Preliminary Injunction. Feb, 6, 2024Document51 pagesLawsuit State, FDRLST, DW, Preliminary Injunction. Feb, 6, 2024Gabe Kaminsky100% (1)

- ZLI Coalition Prosecution Request To AGDocument51 pagesZLI Coalition Prosecution Request To AGGabe KaminskyNo ratings yet

- 2022 GDI Tax Forms (AN Foundation)Document15 pages2022 GDI Tax Forms (AN Foundation)Gabe KaminskyNo ratings yet

- Invest in Our Future PT 3Document11 pagesInvest in Our Future PT 3Gabe KaminskyNo ratings yet

- Tyler Clark, Sixteen Thirty Fund Lobbying: Nikki Haley CampaignDocument3 pagesTyler Clark, Sixteen Thirty Fund Lobbying: Nikki Haley CampaignGabe KaminskyNo ratings yet

- Tyler Clark Lobbying For Sixteen Thirty Fund: Nikki Haley CampaignDocument1 pageTyler Clark Lobbying For Sixteen Thirty Fund: Nikki Haley CampaignGabe KaminskyNo ratings yet

- 2022 GDI Tax Forms (Disinformation Index)Document32 pages2022 GDI Tax Forms (Disinformation Index)Gabe KaminskyNo ratings yet

- Al-Haq Gaza War 2023 - NGO MonitorDocument5 pagesAl-Haq Gaza War 2023 - NGO MonitorGabe KaminskyNo ratings yet

- Daily Wire and Federalist Lawsuit Against State Department On Global Disinformation Index, Gabe KaminskyDocument67 pagesDaily Wire and Federalist Lawsuit Against State Department On Global Disinformation Index, Gabe KaminskyGabe KaminskyNo ratings yet

- Report: U.N. Teachers Celebrated Hamas MassacreDocument68 pagesReport: U.N. Teachers Celebrated Hamas MassacreWilliams PerdomoNo ratings yet

- 2022 OJS246 710894 enDocument4 pages2022 OJS246 710894 enGabe KaminskyNo ratings yet

- NYC Teacher Judi Cheng Email To UFT Union Employees 10/17/23.Document3 pagesNYC Teacher Judi Cheng Email To UFT Union Employees 10/17/23.Gabe KaminskyNo ratings yet

- 2023-08-03 JDJ To Ahmed - CCDHDocument3 pages2023-08-03 JDJ To Ahmed - CCDHGabe KaminskyNo ratings yet

- Alito 2022 Financial DisclosureDocument13 pagesAlito 2022 Financial DisclosureJimmy HooverNo ratings yet

- FDR 2022 Thomas-CDocument9 pagesFDR 2022 Thomas-CGabe KaminskyNo ratings yet

- Letter Calling For Jennifer Granholm's ResignationDocument5 pagesLetter Calling For Jennifer Granholm's ResignationNick PopeNo ratings yet

- 2023-07-26 CDP Supplement To MUR 8119Document2 pages2023-07-26 CDP Supplement To MUR 8119Gabe KaminskyNo ratings yet

- Granholm Supplemental Ethics Complaint - Ford DRAFTDocument10 pagesGranholm Supplemental Ethics Complaint - Ford DRAFTGabe KaminskyNo ratings yet

- 65 DB 76Document17 pages65 DB 76Gabe KaminskyNo ratings yet

- 07.12.23 Letter To Sec Granholm Re FordDocument2 pages07.12.23 Letter To Sec Granholm Re FordGabe KaminskyNo ratings yet

- 07.24.2023 - Follow-Up Letter To Global Engagement CenterDocument2 pages07.24.2023 - Follow-Up Letter To Global Engagement CenterGabe KaminskyNo ratings yet

- NLPC IRS Complaint Against Alianza Americas July 10, 2023Document9 pagesNLPC IRS Complaint Against Alianza Americas July 10, 2023Gabe KaminskyNo ratings yet