Professional Documents

Culture Documents

HHH-111 Risk Assessment 01

Uploaded by

hassanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HHH-111 Risk Assessment 01

Uploaded by

hassanCopyright:

Available Formats

Framework Step 3: Identify and Assess Risks of Material Misstatement for the Accounting Estimate

Figure 3.2: Process for Identifying Risks of Material Misstatement (A)

3.1.1: Identify Risks of Misstatement

Using the information obtained from our risk assessment procedures, including the audit evidence obtained in

understanding relevant controls (i.e., evaluating the design of relevant controls and determining whether

they have been implemented), we identify the risks of misstatement related to accounting estimates. In this

context, risks of misstatement do not represent all possibilities of any misstatement of any magnitude, but

rather those risks or risk factors that we believe require further consideration to determine whether they

have the potential to give rise to misstatements that, individually or in aggregate, could material misstate

the financial statements and which therefore may be risks of material misstatement. Our ultimate goal is to

identify risks of material misstatements. However, risks of misstatement are considered in order to help us

form the appropriate basis to support our identification of a complete population of risks of material

misstatement applicable to the financial statements being audited. Most accounting estimates may have

multiple risks of misstatement.

Note A potential pitfall when identifying risks of misstatement is to consider all possible risks related

to a particular account balance or disclosure to be risks of misstatement instead of identifying

just those risks that have the potential to cause misstatements that would be material to the

financial statements. Not all risks will have the potential to cause a material misstatement

and, therefore, we would not identify all of them as risks of misstatement.

The risk assessment procedures we perform provide the audit evidence necessary to support the

identification of risks of misstatement and our assessment of such risks (including the identification of which

identified risks are ultimately identified as risks of material misstatement, and assessed as lower, higher, or

Accounting Estimates: A Practical Guide to Auditing 82

Framework Step 3: Identify and Assess Risks of Material Misstatement for the Accounting Estimate

significant). Therefore, the results of our risk assessment procedures are an integral part of the audit

evidence we obtain to support our opinion on the financial statements.

Note The explicit requirement to identify “risks of misstatement” exists in the PCAOB AAM

[PCAOB AAM 13150.3(a)]; however, our audit approach requires that we “identify risks….by

considering what can go wrong” [AAM 13150.4(a)], which we interpret to mean the same

as identifying risks of misstatement and an interim step to our identification of the risks of

material misstatement. Therefore, the process of identifying risks of misstatement and the

assessment of which risks are risks of material misstatement is considered foundational to

the risk assessment process under our audit approach (i.e., we believe the process of

considering risks of misstatement is a stepping stone between the identification of risks and

risk factors and our identification of the risks of material misstatement).

As discussed in Framework Step 1, "Identify Accounting Estimates," Figure 3.3 that follows illustrates the

population of risks and risk factors that we considered while performing our risk assessment procedures

related to accounting estimates, and which may or may not represent risks of misstatement.

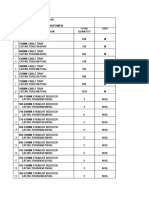

Figure 3.3: Risks and Risk Factors

In order to identify risks of misstatement related to accounting estimates, we consider and use the

information gathered from the procedures described in Framework Step 1, "Identify Accounting Estimates,"

and Framework Step 2, "Understand How Management Makes the Accounting Estimate." In doing so, we

eliminate the risks and risk factors that, when considered individually or in the context of all the information

collected through risk assessment procedures, do not reasonably present a risk of misstatement that needs

further evaluation. Using professional judgment, at this point it will likely be relatively easy to conclude that

some or many risks and risk factors are not risks of material misstatement; the remaining population are

risks of misstatement, which are a subset of the risks and risk factors considered (represented by the white

circle in Figure 3.4).

Accounting Estimates: A Practical Guide to Auditing 83

Framework Step 3: Identify and Assess Risks of Material Misstatement for the Accounting Estimate

Figure 3.4: Risks of Misstatement

Note For many risks or risks factors, it is likely that we may be able to conclude that the risk

does not present a risk of misstatement and, therefore, further evaluation of the risk to

understand if it presents a risk of material misstatement is not needed. Often these

judgments may occur with very little effort.

For example, virtually all consumer product entities could be subject to

product liability claims, so the exposure to product liability claim liabilities

would likely give rise to one or more risks of misstatement for most entities.

For many entities, however, the nature of the products sold by the entity and

a history of no such claims might allow us to easily determine these risks do

not represent a risk of material misstatement.

Generally, our documentation of our risk assessment procedures, as well as the risks of

material misstatement included in our RoMM working papers (or equivalent documentation)

or in the risk strategy view of EMS, will provide sufficient documentation to support our risk

assessment; this includes risks at both the financial statement level and assertion level.

For audits performed using the PCAOB AAM, the documentation of our risk assessment

procedures is required to include a summary of the identified risks of misstatement and the

auditor’s assessment of risks of material misstatement at the financial statement and

assertion levels (PCAOB AAM 12000.32). Our risk assessment will likely result in most risks

of misstatement identified as being determined to be risks of material misstatement. When,

on the basis of evidence from risk assessment procedures, risks of misstatement are

concluded not to present risks of material misstatement, the audit documentation includes

support for the professional judgments, documented in a manner sufficient to enable an

experienced auditor, having no previous connection to the audit, to understand the

conclusions reached. Due to these assumptions, as supported by the evidence from the

performance of risk assessment procedures, separate documentation identifying the risks of

misstatement generally is not needed in the audit working papers to comply with this

requirement. See Section 3.4, "Documentation Considerations," for further discussion.

For example, as part of our risk assessment procedures performed in Framework Step 1, "Identify

Accounting Estimates," and in understanding the entity’s selection of accounting principles related to

revenue recognition, we identified that the entity is engaged in long-term construction-type contracts

and uses the percentage of completion method. As a result, we identified the potential for the financial

Accounting Estimates: A Practical Guide to Auditing 84

Framework Step 3: Identify and Assess Risks of Material Misstatement for the Accounting Estimate

statements to be materially misstated due to inappropriate amounts of revenue being recognized. We

believe that there are one or more risks of misstatement related to this revenue stream that need to be

further assessed to determine whether they are risks of material misstatement, because of the

complexity and size of the account.

For example, as part of our risk assessment procedures performed in Framework Step 1, "Identify

Accounting Estimates," we obtained evidence that the entity received notification from a regulatory

agency indicating its identification as a potentially responsible party pursuant to enforcement actions.

The amounts involved appear to be substantial and no liability is currently recorded. As a result, we

identified the potential for the financial statements to be materially misstated as a result of non-

recognition of a liability for the environmental obligation, measuring the liability at an inappropriate

amount, or inadequate disclosures. We believe there are one or more risks of misstatement related to

this accounting estimate that need to be further assessed to determine whether they are risks of

material misstatement.

For example, as part of our risk assessment procedures performed in Framework Step 2, "Understand

How Management Makes the Accounting Estimate," and in understanding management’s process for

determining employee benefit obligations, we discovered that management has been offering plan

participants lump-sum settlement payments related to their vested pension rights. As a result, we

identified the potential for the financial statements to be materially misstated as a result of incomplete

or non-recognition of liabilities related to the entity’s estimated pension benefit obligations associated

with the settlements, measurement of the various components of the pension liabilities at inappropriate

amounts, or inadequate disclosures. We believe there are one or more risks of misstatement related to

this accounting estimate that need to be assessed to determine if they are risks of material

misstatement.

Note It is important to note that a seemingly immaterial accounting estimate may have the

potential to result in a material misstatement resulting from estimation uncertainty (i.e., the

size of the amount recognized or disclosed in the financial statements for an accounting

estimate may not be an indicator of its estimation uncertainty) (PCAOB AAM 23004.57 or AAM

23004.57).

When identifying risks of misstatement, we are concerned with risks related to financial reporting; however,

business risks may also give rise to financial reporting risks. We may have identified these broader business

risks during Framework Step 1, "Identify Accounting Estimates," or Framework Step 2, "Understand How

Management Makes the Accounting Estimate." We may consider these broader business risks to help us

identify risks that have the potential for causing an accounting estimate to be materially misstated.

For example, in connection with our discussions with management related to changes to the business from

the prior year, we were informed that as part of an effort to increase profitability (the entity's business

objective), management decided to change its practices relating to the extension of credit, such that credit is

now being extended to customers that would not have qualified for credit under historical practices.

This is a business strategy designed to drive more revenue and profitability (i.e., a measured business risk

that management has undertaken), but the new strategy may cause us to conclude that there is the

possibility of new or increased (as compared to prior year) risks relating to valuation of receivables that could

cause the financial statements to be materially misstated (e.g., due to the non-recognition of an allowance

for doubtful accounts related to receivables from these new customers that may have higher credit risk), or

the recorded allowance being inadequate. For example, if those responsible for estimating the allowance for

doubtful accounts or for reviewing the process and the outcome are not aware of, or do not properly consider

the effects of, the new credit policy, the estimate of the allowance for doubtful accounts has the potential to

be misstated such that the financial statements could be materially misstated (financial reporting risk).

For example, we are aware that the entity is in a period of significant growth, achieved largely through a

series of acquisitions that have been made throughout the United States. As part of this business strategy,

Accounting Estimates: A Practical Guide to Auditing 85

You might also like

- Risk Management and Information Systems ControlFrom EverandRisk Management and Information Systems ControlRating: 5 out of 5 stars5/5 (1)

- HHH-111 Risk Assessment 05Document6 pagesHHH-111 Risk Assessment 05hassanNo ratings yet

- The Fraud Audit: Responding to the Risk of Fraud in Core Business SystemsFrom EverandThe Fraud Audit: Responding to the Risk of Fraud in Core Business SystemsNo ratings yet

- HHH-111 Risk Assessment 02Document4 pagesHHH-111 Risk Assessment 02hassanNo ratings yet

- HHH-111 Risk Assessment 03Document4 pagesHHH-111 Risk Assessment 03hassanNo ratings yet

- The Audit Risk ModelDocument7 pagesThe Audit Risk ModelNatya NindyagitayaNo ratings yet

- Questionnaire Tally SheetDocument19 pagesQuestionnaire Tally SheetJester Ten-ten BermejoNo ratings yet

- AUD339 (NOTES CP5) - Audit Planning & Fieldwork 2Document28 pagesAUD339 (NOTES CP5) - Audit Planning & Fieldwork 2pinocchiooNo ratings yet

- Aud339 Audit Planning Part 2Document26 pagesAud339 Audit Planning Part 2Nur IzzahNo ratings yet

- F8-Risk Based Approach To AuditingDocument2 pagesF8-Risk Based Approach To AuditingMoe AungNo ratings yet

- AudTheo Compilation Chap9 14Document130 pagesAudTheo Compilation Chap9 14Chris tine Mae MendozaNo ratings yet

- Lecture 6-Audit RiksDocument6 pagesLecture 6-Audit Riksakii ramNo ratings yet

- Manjares - AUDIT RISKDocument2 pagesManjares - AUDIT RISKApril ManjaresNo ratings yet

- Auditing - The Risk-Based ApproachDocument9 pagesAuditing - The Risk-Based ApproachSallie Keyziah MarjakneeNo ratings yet

- Assessing and Responding To Risks in A Financial Statement AuditDocument8 pagesAssessing and Responding To Risks in A Financial Statement AuditGerman ChavezNo ratings yet

- Risk Analysis and Statistical Sampling in Audit - Methodology - Comptroller and Auditor General of IndiaDocument13 pagesRisk Analysis and Statistical Sampling in Audit - Methodology - Comptroller and Auditor General of IndiaIsmailNo ratings yet

- CH 5Document2 pagesCH 5Scholastica DaniaNo ratings yet

- Audit Methodology FS 10Document114 pagesAudit Methodology FS 10hewo100% (1)

- HHH-111 Risk Assessment 04Document4 pagesHHH-111 Risk Assessment 04hassanNo ratings yet

- Audit Process - Psba PDFDocument46 pagesAudit Process - Psba PDFMariciele Padaca AnolinNo ratings yet

- Audit and AssuaranceDocument131 pagesAudit and AssuaranceApala EbenezerNo ratings yet

- Audit Risk ModelDocument12 pagesAudit Risk ModelDennis NjonjoNo ratings yet

- 4 Audit RiskDocument10 pages4 Audit RiskHussain MustunNo ratings yet

- Risk-Based Approach To Conducting A Quality AuditDocument55 pagesRisk-Based Approach To Conducting A Quality AuditKyla Marie MojicoNo ratings yet

- The Audit Quality Forum (2005) Thus Concluded Than A Simple Agency Model Involves That, " As A ResultDocument7 pagesThe Audit Quality Forum (2005) Thus Concluded Than A Simple Agency Model Involves That, " As A ResultRODRIGO JR. MADRAZONo ratings yet

- Week 8Document3 pagesWeek 8Anonymous J0pEMcy5vY100% (1)

- Auditing Book EditedDocument72 pagesAuditing Book EditedJE SingianNo ratings yet

- KalyDocument5 pagesKalyJurie BalandacaNo ratings yet

- Lesson 8 Identifying and Assessing The ROMMDocument5 pagesLesson 8 Identifying and Assessing The ROMMMark TaysonNo ratings yet

- Tema EnglezaDocument7 pagesTema EnglezaLupitu Aura DanielaNo ratings yet

- Lecture 3-Risk Materiality-Jan 2020Document99 pagesLecture 3-Risk Materiality-Jan 2020Ching XueNo ratings yet

- Control RiskDocument19 pagesControl RiskAnonymous HBzUFPliGsNo ratings yet

- Brain Teaser Questions Chapter 6Document4 pagesBrain Teaser Questions Chapter 6ainmazni officialNo ratings yet

- Boynton SM Ch.12Document25 pagesBoynton SM Ch.12Eza RNo ratings yet

- Lecture 3-Risk Materiality-JUNE 2023 Revised 1Document103 pagesLecture 3-Risk Materiality-JUNE 2023 Revised 1Sheany LinNo ratings yet

- Trainings On 21 December 2023Document25 pagesTrainings On 21 December 2023ngabonziza samuelNo ratings yet

- Audit Strategy 516Document6 pagesAudit Strategy 516Diane Marie DuterteNo ratings yet

- Auditing - Chapter 3Document54 pagesAuditing - Chapter 3Tesfaye SimeNo ratings yet

- Audit Risk Experts Strategies To Managing RiskDocument7 pagesAudit Risk Experts Strategies To Managing RiskYasir RafiqNo ratings yet

- The Audit Risk ModelDocument9 pagesThe Audit Risk Modelamaliya atmawijayaNo ratings yet

- Acctg 14 - Midterm Lesson Part3Document21 pagesAcctg 14 - Midterm Lesson Part3NANNo ratings yet

- WK 5 Audit Risk and MaterialityDocument43 pagesWK 5 Audit Risk and MaterialityYalliniNo ratings yet

- Tutorial - 3-Answers - For - Selected - Questions PresentationDocument6 pagesTutorial - 3-Answers - For - Selected - Questions Presentationcynthiama7777No ratings yet

- Assignment 2 ButtDocument4 pagesAssignment 2 ButtMehwish ButtNo ratings yet

- The Risk Based AuditDocument6 pagesThe Risk Based AuditHana AlmiraNo ratings yet

- 10 Identifying and Assessing RiskDocument3 pages10 Identifying and Assessing RiskIrish SanchezNo ratings yet

- What Is A Risk-Based Audit Approach?Document4 pagesWhat Is A Risk-Based Audit Approach?migraneNo ratings yet

- Phase I-Risk Assessment Planning The AudDocument21 pagesPhase I-Risk Assessment Planning The AudGelyn CruzNo ratings yet

- Audit Opinion Audited Financial Statements An Unqualified Opinion Financial StatementsDocument4 pagesAudit Opinion Audited Financial Statements An Unqualified Opinion Financial StatementsTahrimNaheenNo ratings yet

- AuditingDocument99 pagesAuditingWen Xin GanNo ratings yet

- Materiality and Risk Assessment: Answers To Review QuestionsDocument3 pagesMateriality and Risk Assessment: Answers To Review QuestionsAndrew NeuberNo ratings yet

- Take Risk of Risk AssestmentDocument5 pagesTake Risk of Risk AssestmentHertantoNo ratings yet

- Aas of IcaiDocument41 pagesAas of Icaibudsy.lambaNo ratings yet

- PBEPIII Inherent Risk PDFDocument5 pagesPBEPIII Inherent Risk PDFkim romanoNo ratings yet

- Chapter 8 IS Audit Risk, Audit SamplingDocument8 pagesChapter 8 IS Audit Risk, Audit SamplingMuriithi Murage100% (1)

- School of Business, Economics and Management Bps430: Audit Practice and Performance Review Chapter 4: The Theory of AuditingDocument73 pagesSchool of Business, Economics and Management Bps430: Audit Practice and Performance Review Chapter 4: The Theory of AuditingChibwe ChinyamaNo ratings yet

- Expected Learning Outcomes: After Studying This Chapter, You Should Be Able ToDocument21 pagesExpected Learning Outcomes: After Studying This Chapter, You Should Be Able ToMisshtaCNo ratings yet

- Chapter 5Document11 pagesChapter 5fekadegebretsadik478729No ratings yet

- SAICA ISA 315 Revised 2019 Event - Questions and AnswersDocument12 pagesSAICA ISA 315 Revised 2019 Event - Questions and AnswersDragan StojanovicNo ratings yet

- Audit RiskDocument6 pagesAudit RiskShahood Ur RehmanNo ratings yet

- Surveying Lab ManualDocument76 pagesSurveying Lab ManualIan Lawrence YupanoNo ratings yet

- Bird Et Al (2005)Document11 pagesBird Et Al (2005)Ewan MurrayNo ratings yet

- Json Out InvoiceDocument2 pagesJson Out Invoicetkpatel529No ratings yet

- 193-Cable Tray QtyDocument4 pages193-Cable Tray QtyprkshshrNo ratings yet

- Types of Speeches and Speech StyleDocument1 pageTypes of Speeches and Speech StyleSai RiveraNo ratings yet

- Manual SomachineDocument228 pagesManual SomachineMauricio NaranjoNo ratings yet

- Psychology Concepts and Applications 4Th Edition Nevid Solutions Manual Full Chapter PDFDocument49 pagesPsychology Concepts and Applications 4Th Edition Nevid Solutions Manual Full Chapter PDFfidelmanhangmhr100% (9)

- ATS Monitoring Device InstructionsDocument25 pagesATS Monitoring Device InstructionsVinhNo ratings yet

- Business Ethics PDFDocument16 pagesBusiness Ethics PDFRitika DiwakarNo ratings yet

- Lesson Outline: Introduction To LeadershipDocument2 pagesLesson Outline: Introduction To LeadershipAmritpal SinghNo ratings yet

- Report On Industrial Visit ScribdDocument11 pagesReport On Industrial Visit ScribdJakeer CJNo ratings yet

- 11-001 Gergess Author Proof CorrectedDocument18 pages11-001 Gergess Author Proof CorrectedJamil JmlNo ratings yet

- Executive Leadership: Artificial Intelligence Primer For 2021Document10 pagesExecutive Leadership: Artificial Intelligence Primer For 2021ranga.raman100% (1)

- TAPCON® 240: Voltage Regulator For Regulating TransformersDocument6 pagesTAPCON® 240: Voltage Regulator For Regulating TransformerscastrojpNo ratings yet

- Gold Experience B1 WorkbookDocument14 pagesGold Experience B1 WorkbookOli Sisti100% (2)

- Forensic Module 2 MidtermDocument27 pagesForensic Module 2 MidtermAdrias IvanNo ratings yet

- ZXR10 8900 Series: Hardware Installation ManualDocument109 pagesZXR10 8900 Series: Hardware Installation ManualErnestoLopezGonzalezNo ratings yet

- BAEnglish Language Linguistics PDFDocument93 pagesBAEnglish Language Linguistics PDFAnonymous p5BEJzvqrkNo ratings yet

- Energy TransportDocument16 pagesEnergy TransportainmnrhNo ratings yet

- MANUALrev Fviewing 1Document12 pagesMANUALrev Fviewing 1saleossNo ratings yet

- 5 Dysfunctions of A TeamDocument5 pages5 Dysfunctions of A TeamSreejit Menon100% (2)

- Add Maths F4 Topical Test 3 (E)Document3 pagesAdd Maths F4 Topical Test 3 (E)HANIFAH50% (2)

- The Psychometrician Licensure Examinations (Pmle) : Impact To The Behavioral Science CurriculumDocument21 pagesThe Psychometrician Licensure Examinations (Pmle) : Impact To The Behavioral Science CurriculumghNo ratings yet

- Planer MachineDocument37 pagesPlaner Machinemechfame89% (9)

- Motorola Pt4 - VHF - WWW - Manualesderadios.com - ArDocument24 pagesMotorola Pt4 - VHF - WWW - Manualesderadios.com - Arpisy74No ratings yet

- NF EN 10028-3-EnglishDocument17 pagesNF EN 10028-3-Englishhakan gecerNo ratings yet

- DAA NotesDocument97 pagesDAA Notesanish.t.pNo ratings yet

- Dynamic Modelling of Gas TurbinesDocument8 pagesDynamic Modelling of Gas TurbinesdannyNo ratings yet

- 2001 Daewoo Nubira Service Manual2 PDFDocument685 pages2001 Daewoo Nubira Service Manual2 PDFalberto 32100% (1)