Professional Documents

Culture Documents

Libro 1

Uploaded by

Juan Garmendia0 ratings0% found this document useful (0 votes)

4 views5 pagesOriginal Title

Libro1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views5 pagesLibro 1

Uploaded by

Juan GarmendiaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

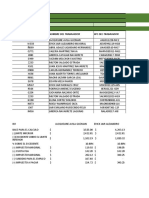

La Empresa LA CHINANGUITA S.A.

, desea conocer cuanto se le va a pagar de PTU a

DATOS DE DECLARACION ANUAL:

Ingresos Acumulables $20,350,280.00

Deducciones Autorizadas $15,390,250.00

Utilidad Fiscal $4,960,030.00

Factor $248,001.50

Trabajador Dias Trabajados Faltas Salario Trabajador

1 365 5 $91,250.00 1

2 365 $91,250.00 2

3 365 $91,250.00 3

4 365 $91,250.00 4

5 365 $91,250.00 5

6 365 10 $91,250.00 6

7 280 $70,000.00 7

8 280 $70,000.00 8

9 280 7 $70,000.00 9

10 280 $70,000.00 10

11 280 9 $70,000.00 11

12 150 $37,500.00 12

13 150 5 $37,500.00 13

14 150 $37,500.00 14

15 120 3 $30,000.00 15

16 115 $28,750.00 16

17 100 2 $25,000.00 17

18 98 3 $24,500.00 18

19 50 $12,500.00 19

20 30 $7,500.00 20

Total 4473 $1,118,250.00 Total

Trabajador Factor 1 Factor 2 Total

1 $20,158.17 $20,237.10 $40,395.27

2 $20,438.15 $20,237.10 $40,675.25

3 $20,438.15 $20,237.10 $40,675.25

4 $20,438.15 $20,237.10 $40,675.25

5 $20,438.15 $20,237.10 $40,675.25

6 $19,878.20 $20,237.10 $40,115.30

7 $15,678.58 $15,524.35 $31,202.93

8 $15,678.58 $15,524.35 $31,202.93

9 $15,286.61 $15,524.35 $30,810.96

10 $15,678.58 $15,524.35 $31,202.93

11 $15,174.62 $15,524.35 $30,698.97

12 $8,399.24 $8,316.62 $16,715.85

13 $8,119.26 $8,316.62 $16,435.88

14 $8,399.24 $8,316.62 $16,715.85

15 $6,551.41 $6,653.29 $13,204.70

16 $6,439.42 $6,376.07 $12,815.49

17 $5,487.50 $5,544.41 $11,031.91

18 $5,319.52 $5,433.52 $10,753.04

19 $0.00 $0.00 $0.00

20 $0.00 $0.00 $0.00

Total $248,001.50 $248,001.50 $496,003.000

o se le va a pagar de PTU a los trabajadores:

Factor 1 Factor 2

55.99491985 0.221776436

Dias Trabajados Factor 1 PTU a Repartir Trabajador Dias Trabajados

360 55.99491985 $20,158.17 1 360

365 55.99491985 $20,438.15 2 365

365 55.99491985 $20,438.15 3 365

365 55.99491985 $20,438.15 4 365

365 55.99491985 $20,438.15 5 365

355 55.99491985 $19,878.20 6 355

280 55.99491985 $15,678.58 7 280

280 55.99491985 $15,678.58 8 280

273 55.99491985 $15,286.61 9 273

280 55.99491985 $15,678.58 10 280

271 55.99491985 $15,174.62 11 271

150 55.99491985 $8,399.24 12 150

145 55.99491985 $8,119.26 13 145

150 55.99491985 $8,399.24 14 150

117 55.99491985 $6,551.41 15 117

115 55.99491985 $6,439.42 16 115

98 55.99491985 $5,487.50 17 98

95 55.99491985 $5,319.52 18 95

50 0 $0.00 19 50

30 0 $0.00 20 30

4429 $248,001.50 Total 4429

Factor 2 Salario Numero de Dias Trabajados

0.221776436 $91,250.00 $20,237.10

0.221776436 $91,250.00 $20,237.10

0.221776436 $91,250.00 $20,237.10

0.221776436 $91,250.00 $20,237.10

0.221776436 $91,250.00 $20,237.10

0.221776436 $91,250.00 $20,237.10

0.221776436 $70,000.00 $15,524.35

0.221776436 $70,000.00 $15,524.35

0.221776436 $70,000.00 $15,524.35

0.221776436 $70,000.00 $15,524.35

0.221776436 $70,000.00 $15,524.35

0.221776436 $37,500.00 $8,316.62

0.221776436 $37,500.00 $8,316.62

0.221776436 $37,500.00 $8,316.62

0.221776436 $30,000.00 $6,653.29

0.221776436 $28,750.00 $6,376.07

0.221776436 $25,000.00 $5,544.41

0.221776436 $24,500.00 $5,433.52

0 $12,500.00 $0.00

0 $7,500.00 $0.00

$1,118,250.00 $248,001.50

You might also like

- Contabilidad 002Document5 pagesContabilidad 002Juan GarmendiaNo ratings yet

- SENADocument4 pagesSENAJessicaNo ratings yet

- Material 2022F1 FIN331 01 198413Document6 pagesMaterial 2022F1 FIN331 01 198413Leonela CajasNo ratings yet

- Gan AdoresDocument9,451 pagesGan AdoresAlba BautistaNo ratings yet

- Objetivo Mensual AnualDocument8 pagesObjetivo Mensual AnualK-bron TrejoNo ratings yet

- Day Balance Daily % Growth Daily Profit Goal TP: Necessary Lot Size Based On One Trade Per Daynecessary Lot Size Based On One Trade Per DayDocument8 pagesDay Balance Daily % Growth Daily Profit Goal TP: Necessary Lot Size Based On One Trade Per Daynecessary Lot Size Based On One Trade Per DayVeeraesh MSNo ratings yet

- Plazo (Meses, Saldo Insoluto Pago Mensual TotalDocument6 pagesPlazo (Meses, Saldo Insoluto Pago Mensual Totalfelixomar1No ratings yet

- A B C D E F Lincoln Unified School District: 2019-2020 Certificated Salary ScheduleDocument1 pageA B C D E F Lincoln Unified School District: 2019-2020 Certificated Salary Scheduleapi-298382936No ratings yet

- Forecast 663210613-9Document1 pageForecast 663210613-99twyp8bpd2No ratings yet

- 2019-2020 Compensation PlanDocument17 pages2019-2020 Compensation PlanrustyNo ratings yet

- Victoria Secret: Clave Del Trabajador Nombre Del Trabajador RFC Del TrabajadorDocument6 pagesVictoria Secret: Clave Del Trabajador Nombre Del Trabajador RFC Del TrabajadorGabriel Garcia LealNo ratings yet

- Laascanood WARD MAN ROOM Foundation Works: Bill of Quantities (BOQ) OUTPATIENTDocument8 pagesLaascanood WARD MAN ROOM Foundation Works: Bill of Quantities (BOQ) OUTPATIENTAbdirazak MohamedNo ratings yet

- Crédito en Efectivo: 22 - Febrero - 2022Document4 pagesCrédito en Efectivo: 22 - Febrero - 2022Yael Eduardo Cuarenta MartínezNo ratings yet

- Tabla LinealDocument2 pagesTabla LinealJenny MariaNo ratings yet

- Sample Data For RegressionDocument2 pagesSample Data For RegressionAravindVenkatramanNo ratings yet

- Salary Data Current Salary Beginning Salary Previous Experienceducation (Years) Beginning SalaryDocument7 pagesSalary Data Current Salary Beginning Salary Previous Experienceducation (Years) Beginning SalaryIman NurainaNo ratings yet

- Proyecto Final EpDocument21 pagesProyecto Final EpFernanda LozanoNo ratings yet

- Maximizing retirement savings with increased contributionsDocument6 pagesMaximizing retirement savings with increased contributionsScott SchroederNo ratings yet

- 50 PipDocument3 pages50 PipSpine StraightenerNo ratings yet

- Restaurant Inventory: Inventory ID Name Description Unit Price Quantity in StockDocument6 pagesRestaurant Inventory: Inventory ID Name Description Unit Price Quantity in StockDaryl GomezNo ratings yet

- Trabajo Final de Ingeniería EconomicaDocument30 pagesTrabajo Final de Ingeniería EconomicaSergio HernandezNo ratings yet

- Live Policy V2 (AR) .Document2 pagesLive Policy V2 (AR) .lola omarNo ratings yet

- Weekly Profit TrackerDocument18 pagesWeekly Profit TrackeralishaNo ratings yet

- Crédito Al Consumo: 30 - Octubre - 2020Document3 pagesCrédito Al Consumo: 30 - Octubre - 2020Alberic Meza AyalaNo ratings yet

- Evaluación Financiera Real BessDocument21 pagesEvaluación Financiera Real BessrolandogaraysalazarNo ratings yet

- Ing. Economica Pregunta 2Document2 pagesIng. Economica Pregunta 2Sheiler Alvarado SanchezNo ratings yet

- MES Saldo Deuda Interes IVA Pago Adelanto Saldo FinalDocument11 pagesMES Saldo Deuda Interes IVA Pago Adelanto Saldo FinalDaniel RamírezNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Crédito en Efectivo: 27 - Febrero - 2022Document2 pagesCrédito en Efectivo: 27 - Febrero - 2022Alejandro Pérez RodríguezNo ratings yet

- Plazo mensual total Capital e InteresesDocument12 pagesPlazo mensual total Capital e InteresesMartín ForezNo ratings yet

- Suma de CortesDocument2 pagesSuma de CortesGustavo Juarez PimentelNo ratings yet

- 100-89732 $7,790,000 Comercio 4 8,2Document1 page100-89732 $7,790,000 Comercio 4 8,2alfonso lopezNo ratings yet

- LR Borrowed $ 15000 Loan at A 14% Annual Rate Compounded Monthly Which Is To Be Repaid Over 5 YearsDocument7 pagesLR Borrowed $ 15000 Loan at A 14% Annual Rate Compounded Monthly Which Is To Be Repaid Over 5 YearsashabNo ratings yet

- Data Driven Decision Making - Course 3 Scenario Analysis Student WorkbookDocument5 pagesData Driven Decision Making - Course 3 Scenario Analysis Student WorkbookSharys Mea MaglasangNo ratings yet

- Factura Distribuidora MireyaDocument4 pagesFactura Distribuidora MireyaAnabel AdamesNo ratings yet

- Level Starting Balance Percentage Risk Risk Dollars Profit Dollars Profit PercentageDocument3 pagesLevel Starting Balance Percentage Risk Risk Dollars Profit Dollars Profit PercentageajayNo ratings yet

- 44.pratibha Sahoo (Micro Economics)Document4 pages44.pratibha Sahoo (Micro Economics)SHREEMAYEE PANDANo ratings yet

- Stanley College OSHC-Sheet - 100418Document3 pagesStanley College OSHC-Sheet - 100418Victor EleeasNo ratings yet

- In-State Tuition: Wake Technical Community College Summer 2018 Tuition & FeesDocument1 pageIn-State Tuition: Wake Technical Community College Summer 2018 Tuition & FeesMouad ChoummaNo ratings yet

- Tugas Kelompok 5 - Studi Kasus Franklin LumberDocument30 pagesTugas Kelompok 5 - Studi Kasus Franklin LumberAgung IswaraNo ratings yet

- Stock Dads Compound Interest CalculatorDocument4 pagesStock Dads Compound Interest CalculatorMNo ratings yet

- Interes 1Document9 pagesInteres 1Milo GuevaraNo ratings yet

- SI Summary Revenue and Key Metrics Aug 2021Document88 pagesSI Summary Revenue and Key Metrics Aug 2021Lindon ManehetaNo ratings yet

- Current Salary Beginning Salary Previous Experience (Months) Education (Years)Document2 pagesCurrent Salary Beginning Salary Previous Experience (Months) Education (Years)Xuyến Nguyễn Thị CẩmNo ratings yet

- Nomina Empresa Colcan S.A.S 2018Document5 pagesNomina Empresa Colcan S.A.S 2018patriciaNo ratings yet

- Davis Steel Distributors warehouse inventory analysis and average inventory estimate of $380KDocument3 pagesDavis Steel Distributors warehouse inventory analysis and average inventory estimate of $380KSivaMarojuNo ratings yet

- MF Juros CompostosDocument4 pagesMF Juros CompostosWagnerNo ratings yet

- Boutique Hotel Financial ModelDocument15 pagesBoutique Hotel Financial ModelNgọcThủy0% (1)

- EdidedDocument3 pagesEdidedinfoahmad7788No ratings yet

- Matematica Financiera Paso 2Document21 pagesMatematica Financiera Paso 2ana maria gutierrezNo ratings yet

- A7 PlmaDocument4 pagesA7 PlmaLuis Méndez AlonsoNo ratings yet

- Tablas de Amortizacion Credito Consumo 36: Tasa Interés MensualDocument8 pagesTablas de Amortizacion Credito Consumo 36: Tasa Interés MensualSergio Antonio MayorgaNo ratings yet

- Retirement Planner1Document4 pagesRetirement Planner1Kaylee KrebsNo ratings yet

- Actividad 7 Mat FinancieraDocument10 pagesActividad 7 Mat Financierajuguetes ymasNo ratings yet

- Bienvenidos Al Modelo, "Trading Hecho Sencillo"Document18 pagesBienvenidos Al Modelo, "Trading Hecho Sencillo"Daniel RamirezNo ratings yet

- Tasa de Descuento: 7.00% Evaluacion Financiera Del Proyecto MesDocument2 pagesTasa de Descuento: 7.00% Evaluacion Financiera Del Proyecto MesJose SosaNo ratings yet

- Ejercicio de Tablas de AmortizacionDocument11 pagesEjercicio de Tablas de AmortizacionOscar J. LombanaNo ratings yet