Professional Documents

Culture Documents

RBI Ombudsman Salient Features Aug 2022

Uploaded by

Shweta GahivarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RBI Ombudsman Salient Features Aug 2022

Uploaded by

Shweta GahivarCopyright:

Available Formats

Document ID: ECICI-IND-IOS-001

Executive Owner: India

Effective Date: August 05, 2022

Salient Features: Reserve Bank of India (RBI) - Integrated Ombudsman Scheme, 2021

RBI vide notification (Ref.CEPD.PRD.No.S544/13.01.001/2022-23) dated August 05, 2022 has directed that Credit

Information Companies (Regulation) Act, 2005 shall also be treated as a ‘Regulated Entity’ for the purpose of the RBI

Integrated Ombudsman Scheme, 2021 (“Scheme”). As a result, the Scheme shall also be applicable to Credit

Information Companies to the extent not specifically excluded under the Scheme.

The following are the salient features of the Scheme as per RBI Integrated Ombudsman Scheme, 2021:

▪ Any customer aggrieved by an act or omission of a Regulated Entity resulting in deficiency in service may file a

complaint under the Scheme personally or through an authorised representative as defined under clause

3(1)(c) of the Scheme.

▪ The complaint may be lodged online through the RBI Compliant Management Portal i.e. https://cms.rbi.org.in.

The complaint may also be submitted through electronic or physical mode to the RBI’s Centralised Receipt and

Processing Centre (CRPC) as notified by RBI.

▪ RBI Ombudsman, for the purpose of carrying out duties under this Scheme, may require the Regulated Entity

to provide any information or furnish certified copies of any document relating to the complaint which are or

is alleged to be in its possession.

▪ The Regulated Entity shall, on receipt of the complaint, file its written version in reply to the averments in the

complaint enclosing therewith copies of the documents relied upon, within 15 days before the Ombudsman

for resolution.

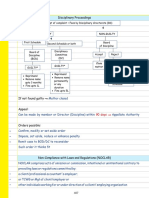

▪ The RBI Ombudsman shall pass an Award in the event of:

(a) non-furnishing of documents/information as enumerated in clause 14(4); or

(b) the matter not getting resolved under clause 14(9) based on records placed, and after affording a

reasonable opportunity of being heard to both the parties.

▪ The Award shall lapse and be of no effect unless the complainant furnishes a letter of acceptance of the Award

in full and final settlement of the claim to the Regulated Entity concerned, within a period of 30 days from the

date of receipt of the copy of the Award.

▪ The Regulated Entity shall comply with the Award and intimate compliance to the RBI Ombudsman within 30

days from the date of receipt of the letter of acceptance from the complainant, unless it has preferred an

appeal.

▪ The Regulated Entity may, within 30 days from the date of receipt of the letter of acceptance from the

complainant, file an appeal before the Appellate Authority. The Appellate Authority may, if it is satisfied that

the Regulated Entity had sufficient cause for not making the appeal within the time, may allow a further period

not exceeding 30 days.

For further details, please refer to the Scheme available on the RBI website at

https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=12371&Mode=0. The copy of the Scheme is also available at

our branch office, which will be provided to the customer for reference upon request.

You might also like

- 01 Principles 155 1Document18 pages01 Principles 155 1Luming100% (8)

- Leung Ben vs. P. J. O'Brien, Et Al. (Digest)Document1 pageLeung Ben vs. P. J. O'Brien, Et Al. (Digest)G S100% (1)

- Sbi Stock Statement Format in ExcelDocument33 pagesSbi Stock Statement Format in ExcelShadab Malik67% (3)

- Permanent Staffing Agreement - IDC TechnologiesDocument8 pagesPermanent Staffing Agreement - IDC TechnologiesAndrewOberoiNo ratings yet

- FORM 9. Certificate of Incorporation of Private Company. (COMPANIES REGULATIONS, 1966 - P.UDocument1 pageFORM 9. Certificate of Incorporation of Private Company. (COMPANIES REGULATIONS, 1966 - P.USenalNaldoNo ratings yet

- Salient Features Rbi Integrated Ombudsman SchemeDocument10 pagesSalient Features Rbi Integrated Ombudsman SchemeAnwesha PandaNo ratings yet

- Efore Shok Umar Orah Ember UdicialDocument8 pagesEfore Shok Umar Orah Ember UdicialSaloni KumarNo ratings yet

- Background Verification ClauseDocument4 pagesBackground Verification ClauseNarenNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument8 pages© The Institute of Chartered Accountants of IndiaKartik GuptaNo ratings yet

- ATCsec 5 Buycon273.aai - Ts@gembuyer - inDocument6 pagesATCsec 5 Buycon273.aai - Ts@gembuyer - inTENDER AWADH GROUPNo ratings yet

- Empanelment NoticeDocument5 pagesEmpanelment NoticeVikrant BansalNo ratings yet

- Empanelment Adv PDFDocument13 pagesEmpanelment Adv PDFT K JAINNo ratings yet

- MTP 3 15 Answers 1680935509Document8 pagesMTP 3 15 Answers 1680935509Umar MalikNo ratings yet

- State Bank of India - 16202294849613Document55 pagesState Bank of India - 16202294849613Ramesh gopeNo ratings yet

- Expression of Interest (EOI) For Hostel Mess ServicesDocument17 pagesExpression of Interest (EOI) For Hostel Mess ServicesSubhajit DasNo ratings yet

- Hindaun Karauli Rajasthan 3 2 2 2 3 0Document4 pagesHindaun Karauli Rajasthan 3 2 2 2 3 0Himanshu sharmaNo ratings yet

- ProblemDocument3 pagesProblemIsha MishraNo ratings yet

- Single Desk - G.O. MS. 85Document151 pagesSingle Desk - G.O. MS. 85Sandilya CharanNo ratings yet

- Incorporation of A Private Limited CompanyDocument5 pagesIncorporation of A Private Limited CompanyAnoop KalathillNo ratings yet

- InstructionsDocument4 pagesInstructionsSlyArnieNo ratings yet

- Term Sheet-DD Work (Booking Charges) - 240329 - 133514Document4 pagesTerm Sheet-DD Work (Booking Charges) - 240329 - 133514Shailesh MeshramNo ratings yet

- Indian Institute of Foreign TradeDocument10 pagesIndian Institute of Foreign TradeSATYA SHANKER KARINGULANo ratings yet

- MG AffidavitDocument2 pagesMG AffidavitS P JaladharanNo ratings yet

- Opd English Claim FormDocument2 pagesOpd English Claim Formpriyapj1911No ratings yet

- What Is Incorporation of A CompanyDocument4 pagesWhat Is Incorporation of A CompanyAnshika GuptaNo ratings yet

- NitDocument5 pagesNitVikas GahlotNo ratings yet

- FAQ - Corporate AgentsDocument4 pagesFAQ - Corporate AgentsSaahiel SharrmaNo ratings yet

- RFQ QMSIECMaterialsDocument26 pagesRFQ QMSIECMaterialsHarvey D. BatoonNo ratings yet

- Chapter 13 DirectorsDocument18 pagesChapter 13 DirectorsjaoceelectricalNo ratings yet

- IEPF Claim Instruction KitDocument10 pagesIEPF Claim Instruction KitAmit ZalaNo ratings yet

- 2 附件二 马来西亚建筑业发展局注册要求及流程Document57 pages2 附件二 马来西亚建筑业发展局注册要求及流程zhuzhuangjun0618No ratings yet

- 7/april/2020 Insolvency Code ContinuesDocument11 pages7/april/2020 Insolvency Code ContinuesMishika PanditaNo ratings yet

- 210703165404suraksha Smart City Phase 1 - BookletDocument9 pages210703165404suraksha Smart City Phase 1 - BookletRoshan chauhanNo ratings yet

- Unit IIDocument14 pagesUnit IICaddy BitchNo ratings yet

- Banking OmbudsmanDocument5 pagesBanking OmbudsmanUdit ThakranNo ratings yet

- Brand Realty Services Ltd. v. Sir John Bakeries India (P) LTD., 2022 SCC OnLine NCLAT 290Document5 pagesBrand Realty Services Ltd. v. Sir John Bakeries India (P) LTD., 2022 SCC OnLine NCLAT 290aadityaNo ratings yet

- Notice Inviting E Notice Inviting E Notice Inviting E Notice Inviting E - Tender (Nit) Tender (Nit) Tender (Nit) Tender (Nit)Document6 pagesNotice Inviting E Notice Inviting E Notice Inviting E Notice Inviting E - Tender (Nit) Tender (Nit) Tender (Nit) Tender (Nit)Saurabh AgrawalNo ratings yet

- Harpreet Singh C/O.Dr - Ajit Singh 288, Model Town Ludhiana 141002 Joint Holder 1: - Joint Holder 2: - Joint Holder 3Document4 pagesHarpreet Singh C/O.Dr - Ajit Singh 288, Model Town Ludhiana 141002 Joint Holder 1: - Joint Holder 2: - Joint Holder 3happy_atworkNo ratings yet

- Undertaking From BorrowerDocument7 pagesUndertaking From BorrowerDivyesh Varun D VNo ratings yet

- How To File Web Form IEPF 5Document14 pagesHow To File Web Form IEPF 5PrasadNo ratings yet

- Iepf5faq 23092019 PDFDocument9 pagesIepf5faq 23092019 PDFChandan GuptaNo ratings yet

- Export Development PromotionDocument22 pagesExport Development PromotionshrikantNo ratings yet

- Scope of The Work For Re-Designing and Re-Development of Website For Directorate General of Trade Remedies (DGTR)Document13 pagesScope of The Work For Re-Designing and Re-Development of Website For Directorate General of Trade Remedies (DGTR)dilsonenterprises2022No ratings yet

- Nit 1 PDFDocument9 pagesNit 1 PDFKatie JohnsonNo ratings yet

- Final Application Form - Restructuring 2.0 - RevisedDocument5 pagesFinal Application Form - Restructuring 2.0 - RevisedShabin ShabiNo ratings yet

- Application Transaction ProcedureDocument3 pagesApplication Transaction ProcedurefaridatunNo ratings yet

- HKKJRH Izkss - KSFXDH Lalfkku Ivukk: Indian Institute of Technology PatnaDocument16 pagesHKKJRH Izkss - KSFXDH Lalfkku Ivukk: Indian Institute of Technology PatnaRakhee GuptaNo ratings yet

- Sections 153 159 Companies Act, 2013 Rule 2 (D) Companies (Appointment and Qualification of Directors) Rules, 2014Document3 pagesSections 153 159 Companies Act, 2013 Rule 2 (D) Companies (Appointment and Qualification of Directors) Rules, 2014zenith chhablaniNo ratings yet

- PF Policy AluDocument13 pagesPF Policy AlukedarNo ratings yet

- Notification Cum Application For LIE-FY2023-24Document9 pagesNotification Cum Application For LIE-FY2023-24HIREN TRIVEDINo ratings yet

- GST Reg, Loopholes, Corrective MeasuresDocument5 pagesGST Reg, Loopholes, Corrective Measuresabhijeetpatel2007uNo ratings yet

- Assistance For Waste Management SchemeDocument10 pagesAssistance For Waste Management SchemeGlobal Industrial SolutionsNo ratings yet

- Deed of Agreement (To Be Furnished On Non-Judicial Stamp Paper Worth Rs. 100/-)Document7 pagesDeed of Agreement (To Be Furnished On Non-Judicial Stamp Paper Worth Rs. 100/-)Himanshu GandhiNo ratings yet

- Finalactivity BatistisDocument5 pagesFinalactivity BatistisPhoebe MagnoNo ratings yet

- Final Housekeeping Tender 2021Document36 pagesFinal Housekeeping Tender 2021MohakNo ratings yet

- Citizens CharterDocument5 pagesCitizens CharterPankaj MadheshiyaNo ratings yet

- Membership Department Circular No. 705 Ref. No: Nse/Mem/13601 December 3, 2009Document3 pagesMembership Department Circular No. 705 Ref. No: Nse/Mem/13601 December 3, 2009Dev Prakash GuptaNo ratings yet

- Registration Requirement and ProcedureDocument57 pagesRegistration Requirement and ProcedureLim Mei Fang67% (3)

- SCSDCDSCDocument5 pagesSCSDCDSCAmish GangarNo ratings yet

- Cls Corporate Regulation (Hons - Ii) Project On: "Registrar To Issue and Share Transfer AgentsDocument25 pagesCls Corporate Regulation (Hons - Ii) Project On: "Registrar To Issue and Share Transfer AgentsLucky RajpurohitNo ratings yet

- Rajiv Gandhi Swavlamban Rojgar Yojna (RGSRY) Needs Attention For Haryana Khadi and Village Industries Board - Abhishek KadyanDocument6 pagesRajiv Gandhi Swavlamban Rojgar Yojna (RGSRY) Needs Attention For Haryana Khadi and Village Industries Board - Abhishek KadyanNaresh KadyanNo ratings yet

- How To Get Registered As A Research Analyst and Instructions For Filling in Form ADocument3 pagesHow To Get Registered As A Research Analyst and Instructions For Filling in Form AnitinakkNo ratings yet

- Topic 4Document4 pagesTopic 4motu179No ratings yet

- KP Civil Servants APT Rules 1989 PDFDocument12 pagesKP Civil Servants APT Rules 1989 PDFArshad Khan Afridi100% (1)

- Week 10 Scope of Corporate Law and RegulationDocument21 pagesWeek 10 Scope of Corporate Law and RegulationBasit KhanNo ratings yet

- Broker-Assisted Customer Account Information Form (CAIF) - IndividualDocument6 pagesBroker-Assisted Customer Account Information Form (CAIF) - Individualmunic14No ratings yet

- Commercial Service RulesDocument19 pagesCommercial Service Rulesنعمان علی0% (1)

- WNC Citizens V Asheville NC ComplaintDocument22 pagesWNC Citizens V Asheville NC ComplaintDaniel WaltonNo ratings yet

- Circular Letter No 2021 7 Dated July 1 2021Document6 pagesCircular Letter No 2021 7 Dated July 1 2021Alvin Carl FortesNo ratings yet

- State Sovereignty Research PapersDocument6 pagesState Sovereignty Research Papersc9kb0esz100% (1)

- DONE The Heritage Hotel, Manila vs. Lilian Sio. G.R. No. 217896, June 26, 2019 - Ver 2Document1 pageDONE The Heritage Hotel, Manila vs. Lilian Sio. G.R. No. 217896, June 26, 2019 - Ver 2Kathlene JaoNo ratings yet

- Syarie Lawyers in Malaysia (Federal Territories)Document18 pagesSyarie Lawyers in Malaysia (Federal Territories)2022942791No ratings yet

- Registration and Incorporation of A CompanyDocument10 pagesRegistration and Incorporation of A CompanyFini GraceNo ratings yet

- Submission For Paper 1 - Indian Legal System - A Primer-21DIP008 - Nikhil PilaniaDocument17 pagesSubmission For Paper 1 - Indian Legal System - A Primer-21DIP008 - Nikhil PilaniaNikhil Pilania (IndiQube)No ratings yet

- Blank PDSDocument4 pagesBlank PDSJakeAmabaJacoBoNo ratings yet

- Corporation Law and Foreign Investments Act by Atty. Anselmo S. Rodiel IVDocument89 pagesCorporation Law and Foreign Investments Act by Atty. Anselmo S. Rodiel IVgherzy25No ratings yet

- Disciplinary Proceedings: Professional EthicsDocument3 pagesDisciplinary Proceedings: Professional EthicsDinesh MaheshwariNo ratings yet

- Municipal Corporation Greater Mumbai: FAQ For Application SubmissionDocument17 pagesMunicipal Corporation Greater Mumbai: FAQ For Application SubmissionJesse CooperNo ratings yet

- The Competition Act: by Avinash Kumar Singh & Anand SinghDocument43 pagesThe Competition Act: by Avinash Kumar Singh & Anand SinghAvinash SinghNo ratings yet

- Fackler Draft For DeeganDocument17 pagesFackler Draft For DeeganJJNo ratings yet

- Ordinance (CCTV)Document4 pagesOrdinance (CCTV)JeffsonNo ratings yet

- Hcs Allowances Rules 2016Document25 pagesHcs Allowances Rules 2016yogesh goyalNo ratings yet

- Ac2306 Producer Statement Construction ps3 DrainageDocument1 pageAc2306 Producer Statement Construction ps3 DrainagePrateek ChandraNo ratings yet

- Carpio Morales V Ca GR NO. 217126-27 November 10, 2015Document6 pagesCarpio Morales V Ca GR NO. 217126-27 November 10, 2015Phi SalvadorNo ratings yet

- Will and Gift: I.Vedhagirinath 131901075Document20 pagesWill and Gift: I.Vedhagirinath 131901075Vedha GiriNo ratings yet

- Article 2, New Civil CodeDocument2 pagesArticle 2, New Civil Codeangelica poNo ratings yet

- Case An Application by Bukoba Gymkhana ClubDocument2 pagesCase An Application by Bukoba Gymkhana ClubDavidNo ratings yet

- R. M. D. Chamarbaugwalla Vs The Union of India (With Connected ... On 9 April, 1957Document12 pagesR. M. D. Chamarbaugwalla Vs The Union of India (With Connected ... On 9 April, 1957Yash Vardhan DeoraNo ratings yet

- Oblicon - Chapter 1Document4 pagesOblicon - Chapter 1Brigit MartinezNo ratings yet