Professional Documents

Culture Documents

FAR1

Uploaded by

Rye Diaz-SanchezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAR1

Uploaded by

Rye Diaz-SanchezCopyright:

Available Formats

RECEIVABLE IN GENERAL ALLOWANCE METHOD

a. Aging - ADA end

TRADES AND OTHER RECEIVABLES

b. Percentage of Account Receivables - ADA end

- Collectible within one year or within normal operating cycle;

c. Percentage of Sales - DAE

whichever is higher

a. Aging

Trade (current asset)

- Past due

- Ordinary / primary course of business

- % of collectible | % of uncollectible

o Claims from customers

C (%) UC (%) Receiv Uncoll ADA

Nontrade

100 WO 25k 100,000 Beg

- Other than ordinary course of business

100 5m 97,500 DAE?

o Subscription receivable – Capital or reduction subscribe 98 2 1m 20k 10,000 Recov

share capital 80 20 500k 100k 182,500 end

o Current - Suppliers 75 25 250k 62.5k

Employees (depends on the period) NRV = 6.75m - 182,500

Officers (depends on the period) ↑

Damages Required Allowance for Doubtful Accounts, end.

Silent (not stated)

Claims Recovery – previously written off Written off

o Noncurrent - Shareholders Receivables ADA

Directors ADA Receivables

Affiliates (sister company)

o Advances / Loans Allowance

DAE 97,500 ADA 25,000

Measurement at Initial recognition - Fair value + Transaction cost ADA 97,500 Receiv 25,000 – can’t be collected

Subsequent measurement - Amortized cost (intangible asset)

Recovery 10,000

---

ADA 10,000

Net Realizable Value

Recei. – Allow. for UA / ADA

Short-term Receivables – Face value b. Percentage of Account Receivables

Long-term Receivable with interest - Face value (P+I=MV)

Long-term receivable without interest - Present value (P+1=MV) A/R ADA

Beg Collection Write off Beg

METHODS IN COMPUTING NRV Credit Sales Write off DAE

Recovery Sales R&A Recovery

DIRECT WRITE-OFF METHOD Sales D

- Proven that there is worthless 100% End ADA, end

Bad debts expenses

Receivable End of A/R x % = ADA, end.

c. Percentage of Sales B. 1% of GS = 50,000 DAE

Basis ADA

1. Gross Sales – not adjusted WO 20,000 Beg DAE 50,000

2. Net Sales - (GS-R&A – D) 50,000 DAE ADA 50,000

3. Credit Sales - (GS x % on account) | sales on account Recov

4. Net Credit Sales - (GS – R&A – D x % on account) 70,000 end

% x Basis = DAE ADA C. Aging – uncollectible ₱80,000 = ADA, end

Write off Beg ADA

DAE WO 20,000 Beg DAE 60,000

Recovery 60,000 DAE? ADA 60,000

Recov

ADA, end ? 80,000 end

D. 10% of A/R = 50,000 ADA, end

PROBLEM

ADA

WO 20,000 Beg DAE 30,000

Valix 5-1 Page 150 Requirement 30,000 DAE? ADA 30,000

1. DAE Recov

A/R 500k 2. ADA, end 50,000 end

NR 200k

ADA 20k a. 75% of all sales are credit

PROBLEM

Sales 5m 2% CS – uncollectible

Problem 4-1 Valix Page 127

SR&A 30k b. 1% of GS

SD 20k c. Aging – uncollectible ₱80,000 Trade NT-NC

d. 10% of A/R Receivable 2m - Trade A/R 775,000 /

ADA 50k Trade NR 100,000 /

Installment receivable 300,000 /

A.

Customer credit (30,000) Current liab

75% of all sales are credit = 3,750,000 credit sales

Advances - supplies 150,000 /

2% CS – uncollectible = 75,000 DAE Customer credit (20,000) Current liab

Advance – subsidiary 400,000 /

ADA Claim - insurance 15,000 / nt

WO 20,000 Beg Sub. Recei due 60days 300,000 / nt

75,000 DAE Accrued interest recei 10,000 /

Recov

95,000 end Entry:

Advances - Subsidiary 400,000

DAE 75,000 AP 50,000

ADA 75,000 Receivables 350,000

PROBLEM RECEIVABLE FINANCING

Problem 4-2 Valix Page 128 - company is in financial risk

- receivable as collateral

AR

Beg 600,000 Collection 5,300,000 Forms

Charge Sales 6,000,000 Write off 35,000 1. Pledge

Shareholder subscriptio 200,000 Merchandise returns 40,000 o whole or all portion of receivable as collateral

Deposit on contract 120,000 Allowance-shipping dmg 25,000 2. Assignment

Claim – damages 100,000 Collection – claims 40,000 o only specific portion of receivable as collateral

IOU 10,000 Collection - subscription 50,000 3. Factoring

Cash advances - affiliat 100,000 o sales

Advances - suppliers 50,000 o use as collateral at the same time sold the account

end 1,690,000 4. Note receivable discount

1. AR = PLEDGE

2. Entry = - No entry would be necessary

3. Trade and other (current) = - It is sufficient that disclosure is made in a note to financial statement

4. Classification =

ASSIGNMENT

1. AR With recourse – if customer don’t pay, entitled to pay

AR Without recourse – no liability

Beg 600,000 5,300,000 Collection Notification – customer → bank

Charge Sales 6,000,000 35,000 Write off Nonnotification – customer → company → bank

40,000 Returns

25,000 Allowance Assigned A/R Set-up NP

End 120,000 A/R – assigned 3m Cash 2.5m

A/R 3m NP 2.5m

Collection

Cash 2m 750k

A/R – assigned 2m 750k

Payment (Principal & Interest)

NP 1.9m 600k

IE/IP 100k 50k

Cash 2m 650k

Return to General A/R

A/R 250k

A/R – assigned 250k nonnotification

FACTORING Note Receivable Discount

- receivable from factor → bank, financial institution - there is corresponding due date

- factor holdback = allowance

o sales, discount, write off To get Interest I = Principal x Rate x Time (I=Prt)

1,000,000 Receivables Cash 750,000 Maturity Value = P + I

50,000 5% service charge Receivable 200,000 Discount = MV x R x T ← hasn’t expired (days / 360) | R = 2nd

200,000 20% factor holdback SC / Loss 50k Net Proceeds = MV – Discount

750,000 Proceeds A/R 1m

Accrued Interest = Prt ← expired period (days / 360)

Loss on Factoring: Carrying value = Principal + Accrued Interest

Proceed – Total amount of receivable Gain or Loss = Net Proceeds – Carrying value

10,000 Return Sale Return 10,000 PROBLEM

25,000 Write off ADA 25,000 Problem 9-8 Valix Page 279

35,000 Recei. from factor 35,000

P = 500,000

Cash 165,000 R = 8% R = 10%

Receivable from factor 165,000 T = 1 year T = 6 months

PROBLEM Principal 500,000 Principal 500,000

Problem 8-9 Valix Page 252 Interest 40,000 Accrued I 20,000

MV 540,000 Carrying A 520,000

July 1 800,000 of A/R w/o recourse, notification Discount (27,000)

Factory fee 5% of A/R factored Net Proceeds 513,000 Loss 7,000

Withheld 10% of A/R factored

15 Fully collected less sales R&A 20,000 PROBLEM

31 Final settlement Problem 9-8 Valix Page 279

A/R 800,000 Cash 680,000 P = 2,000,000

Fee 40,000 Receivable 80,000 R= R = 10%

Withheld 80,000 Loss 40,000 T = 8 months T = 2 months

Proceeds 680,000 A/R 800,000

Principal 2,000,000 Principal 2,000,000

Receivables 800,000 Cash 60,000 Interest - Accrued I -

Return 20,000 Sales R&A 20,000 MV 2,000,000 Carrying A 2,000,000

Adjusted 60,000 A/R 80,000 Discount (100,000)

Net Proceeds 1,900,000 Loss 100,000

PROBLEM Margin / Mark-up

Problem 9-11 Valix Page 280 Based on Cost or Sale

P = 6,000,000 COST SALE

R = 10% R = 12% S 140% 100%

T = 6/12 T = 2 months C 40% 60%

GP 40% 40%

Principal 6,000,000 Principal 6,000,000

FG 40% Profit on Sales

Interest 300,000 Accrued I 100,000 400,000 selling price

MV 6,300,000 Carrying A 6,100,000

Discount (252,000) Sales 400,000 Sales 400,000

Net Proceeds 6,048,000 Loss 52,000 Cost 240,000 Cost 285,000

GP 160,000 GP 115,000

INVENTORIES

Service type - supplies NS/NI NS + Ratio

Merchandise type - materials inventory

Manufacturing type - raw materials finished goods Goods held on consignment - consignee (tayo may hawak – not ours)

work in progress factory goods Goods out on consignment - consignor (tayo ang owner)

Legal test “ownership” Problems:

“title” Problem 10-1 Valix Page 303

Exercise 2-2 Ocampo Page 2-27

FOB shipping point – buyer

FOB destination – seller

Consignment – consignor (owner)

consignee (display) sm

1. Goods owned and on hand

2. Goods in transit and sold FOB destination

3. Goods in transit and purchased FOB shipping point

4. Goods out on consignment to consignee

5. Goods in the hands of salesmen or agents

6. Goods held by customers on approval or on trial

SYSTEM TO RECORD INVENTORY

Periodic – physical count

Perpetual – Stock card

MI | COGS

You might also like

- Korean Business Dictionary: American and Korean Business Terms for the Internet AgeFrom EverandKorean Business Dictionary: American and Korean Business Terms for the Internet AgeNo ratings yet

- 02 - Receivables (P1-12)Document8 pages02 - Receivables (P1-12)Earl ENo ratings yet

- Week 3 AssignmentDocument6 pagesWeek 3 AssignmentWilson ChipetaNo ratings yet

- Ca Inter FM Summary2Document12 pagesCa Inter FM Summary2Krishna GuptaNo ratings yet

- ACC1002X HelpsheetDocument2 pagesACC1002X HelpsheetsantahahaNo ratings yet

- Week 3 assignment insightsDocument7 pagesWeek 3 assignment insightsWilson ChipetaNo ratings yet

- Depreciable Amount (Total) Depreciation Rate (Per Year) Depreciation Expense (Per Year)Document3 pagesDepreciable Amount (Total) Depreciation Rate (Per Year) Depreciation Expense (Per Year)Charles Kevin Mina100% (1)

- Delta4 122006Document8 pagesDelta4 122006mariaplacerda.fradeNo ratings yet

- Adjusting Entries and Merchandising BusinessDocument5 pagesAdjusting Entries and Merchandising BusinessLing lingNo ratings yet

- Review Session - NUS ACC1002 2020 SpringDocument50 pagesReview Session - NUS ACC1002 2020 SpringZenyuiNo ratings yet

- Atm Cafm Practical Revision NotesDocument95 pagesAtm Cafm Practical Revision Notesdroom8521No ratings yet

- Receivables IntermediateDocument25 pagesReceivables IntermediateRyou ShinodaNo ratings yet

- Analyzing Financial Performance of RAD CompanyDocument23 pagesAnalyzing Financial Performance of RAD CompanyChu Ngoc AnhNo ratings yet

- Anh-Nguyen s3814738 Assignment-3B ACCT2105-1Document23 pagesAnh-Nguyen s3814738 Assignment-3B ACCT2105-1Chu Ngoc AnhNo ratings yet

- Provision For DepreciationDocument10 pagesProvision For DepreciationAsh InuNo ratings yet

- Financial Accounting Analysis Cheat SheetDocument1 pageFinancial Accounting Analysis Cheat SheetMinyu LvNo ratings yet

- Pointers To Review: FABM 2: Recording Phase: Answer KeyDocument9 pagesPointers To Review: FABM 2: Recording Phase: Answer KeyMaria Janelle BlanzaNo ratings yet

- Ch9 ACCT1101 DE S1 2223 MOODLEDocument67 pagesCh9 ACCT1101 DE S1 2223 MOODLE华邦盛No ratings yet

- M2 Managerial AccountingDocument36 pagesM2 Managerial AccountingshubhamNo ratings yet

- X Company Financial ReportsDocument21 pagesX Company Financial ReportsChristian Gerard Eleria ØSCNo ratings yet

- Accounting & Finance Course ObjectivesDocument41 pagesAccounting & Finance Course ObjectivesIbrahim QariNo ratings yet

- Lecture 2 - Interpreting Financial Statements + Seminar QuestionDocument17 pagesLecture 2 - Interpreting Financial Statements + Seminar QuestionMahad UzairNo ratings yet

- Chapter 03 Solutions ManualDocument75 pagesChapter 03 Solutions ManualElio AseroNo ratings yet

- DEPARTMENTAL ACCOUNTSDocument17 pagesDEPARTMENTAL ACCOUNTSAyush AcharyaNo ratings yet

- ReceivablesDocument20 pagesReceivablesGemmalyn FolguerasNo ratings yet

- Caie A2 Level Accounting 9706 Theory v1Document12 pagesCaie A2 Level Accounting 9706 Theory v1Juveria RazaNo ratings yet

- Pyq Flashcards Ratios&APDocument4 pagesPyq Flashcards Ratios&APkala1975No ratings yet

- BUSN7008 Week 5 Receivables and PayablesDocument33 pagesBUSN7008 Week 5 Receivables and PayablesberfamenNo ratings yet

- Partnership Q1 To Q3 SolutionsDocument8 pagesPartnership Q1 To Q3 SolutionsJAYARAJALAKSHMI IlangoNo ratings yet

- Account Classification and Presentation: Account Title Classification Financial Statement A Normal BalanceDocument4 pagesAccount Classification and Presentation: Account Title Classification Financial Statement A Normal BalanceGurusamy KNo ratings yet

- Notes for L3Document11 pagesNotes for L3yuyin.gohyyNo ratings yet

- IFRS vs USGAAP DifferencesDocument7 pagesIFRS vs USGAAP DifferencesRahul AgarwalNo ratings yet

- 04 Accounts Receivable Answer KeyDocument9 pages04 Accounts Receivable Answer Keywheein aegiNo ratings yet

- Lecture 1 - Revision - Accrual Accounting ConceptsDocument46 pagesLecture 1 - Revision - Accrual Accounting ConceptsMuzzamil YounusNo ratings yet

- Chapter 6 Cfas ReviewerDocument2 pagesChapter 6 Cfas ReviewerBabeEbab AndreiNo ratings yet

- Advanced Accounting SolutionsDocument75 pagesAdvanced Accounting SolutionsDipen AdhikariNo ratings yet

- From Reported to Actual Earnings: Correcting Accounting ItemsDocument17 pagesFrom Reported to Actual Earnings: Correcting Accounting ItemsArpit KumarNo ratings yet

- AccountingDocument67 pagesAccountinggunanNo ratings yet

- 06 Liquidity & Leverage RatiosDocument4 pages06 Liquidity & Leverage RatiosAkansh NuwalNo ratings yet

- Chart of Accounts PDFDocument2 pagesChart of Accounts PDFMwangi Josphat67% (9)

- Accountancy Review Center (ARC) of The Philippines Inc.: Student HandoutsDocument5 pagesAccountancy Review Center (ARC) of The Philippines Inc.: Student HandoutsRNo ratings yet

- Aud Application 2 - Handout 6 Revaluation (UST)Document5 pagesAud Application 2 - Handout 6 Revaluation (UST)RNo ratings yet

- DCF Valuation: Formula: 3 MethodsDocument1 pageDCF Valuation: Formula: 3 Methodsmadhav madhavNo ratings yet

- Calculate profit or loss and accrued costs for construction contractsDocument1 pageCalculate profit or loss and accrued costs for construction contractsJohn WickNo ratings yet

- Account Classification and Presentation: Account Title Classification Financial Statement Normal Balance ADocument3 pagesAccount Classification and Presentation: Account Title Classification Financial Statement Normal Balance AJanine Bernadette C. Bautista3180270No ratings yet

- TK1 W3 S4 R3Document4 pagesTK1 W3 S4 R3angga33No ratings yet

- Change in PSR (1) - MergedDocument10 pagesChange in PSR (1) - Mergedpriyanshu ahujaNo ratings yet

- Ratio AnalysisDocument6 pagesRatio AnalysisDhirendra Singh patwalNo ratings yet

- Audit Accounts Receivable GuideDocument1 pageAudit Accounts Receivable GuideJoshua LisingNo ratings yet

- Fabm 4THDocument3 pagesFabm 4THDrahneel MarasiganNo ratings yet

- US CMA Gleim Part 2Document258 pagesUS CMA Gleim Part 2Joy Krishna Das100% (1)

- Accounting Equation & ClassificationDocument12 pagesAccounting Equation & ClassificationNur Amira NadiaNo ratings yet

- Account ClassificationDocument3 pagesAccount ClassificationUsama MukhtarNo ratings yet

- Advanced Accounting Part 1 Quiz SolutionsDocument20 pagesAdvanced Accounting Part 1 Quiz SolutionsNikki GarciaNo ratings yet

- Final-Accounts-Q - A P&L ACCDocument31 pagesFinal-Accounts-Q - A P&L ACCNikhil PrasannaNo ratings yet

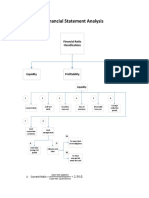

- Financial Statement AnalysisDocument5 pagesFinancial Statement AnalysisYousab KaldasNo ratings yet

- Lecture 33 Credit+Analysis+-+Corporate+Credit+Analysis+ (Ratios)Document33 pagesLecture 33 Credit+Analysis+-+Corporate+Credit+Analysis+ (Ratios)Taan100% (1)

- FMF T7 DoneDocument24 pagesFMF T7 DoneThongkit ThoNo ratings yet

- Rules in VolleyballDocument60 pagesRules in VolleyballRye Diaz-SanchezNo ratings yet

- 07 The Globalization of ReligionDocument9 pages07 The Globalization of ReligionRye Diaz-SanchezNo ratings yet

- Comprehensive Question With AnswerDocument90 pagesComprehensive Question With AnswerRye Diaz-SanchezNo ratings yet

- Contracf Table Ver.2Document3 pagesContracf Table Ver.2Rye Diaz-SanchezNo ratings yet

- PRTC Practial Accounting 1Document56 pagesPRTC Practial Accounting 1Pam G.71% (21)

- MIDTERM POINTERS Group Games PDFDocument6 pagesMIDTERM POINTERS Group Games PDFRye Diaz-SanchezNo ratings yet

- Consignment Case StudyDocument5 pagesConsignment Case Studypatricia pillarNo ratings yet

- Consignment Process Without PODocument5 pagesConsignment Process Without POramakrishnaNo ratings yet

- 13 Vegetable Oil Corp V TrinidadDocument2 pages13 Vegetable Oil Corp V TrinidadRocky GuzmanNo ratings yet

- Chapter 11 Part 2 - Consignment (RR) : Problem 8 - Transactions Kept Separate (Perpetual Inventory Method)Document14 pagesChapter 11 Part 2 - Consignment (RR) : Problem 8 - Transactions Kept Separate (Perpetual Inventory Method)Jane DizonNo ratings yet

- Risk Surcharge: AWB No: H63537762 Owner CarrierDocument1 pageRisk Surcharge: AWB No: H63537762 Owner CarrierAnandNo ratings yet

- Auction Notice: Auction and Disposal of Waste PaperDocument1 pageAuction Notice: Auction and Disposal of Waste PaperNATIONAL JOBS OFFICIALNo ratings yet

- Ecnote Z16810622Document1 pageEcnote Z16810622custom shopNo ratings yet

- 7 Wich Is One A CheaperDocument12 pages7 Wich Is One A CheaperCallejas PipeNo ratings yet

- Top 20 SAP SD Interview QuestionsDocument32 pagesTop 20 SAP SD Interview QuestionsKiran BharatiNo ratings yet

- Cat SolutionDocument47 pagesCat Solutiontarunsharma23112003No ratings yet

- Organizational Structure, Pricing, Credit Checks, and Sales ProcessesDocument19 pagesOrganizational Structure, Pricing, Credit Checks, and Sales Processesramesh100% (1)

- SAP Materials Management OverViewDocument243 pagesSAP Materials Management OverViewMihai Toma75% (4)

- Joint Venture AccountingDocument37 pagesJoint Venture AccountingKHUSHI MEHTANo ratings yet

- Accounts Chapter-Wise Test 5 (Suggested Answers)Document7 pagesAccounts Chapter-Wise Test 5 (Suggested Answers)Shweta BhadauriaNo ratings yet

- Module 9Document3 pagesModule 9trixie maeNo ratings yet

- Ariba SCCDocument16 pagesAriba SCCBhaskar AmbikapathyNo ratings yet

- AstDocument19 pagesAstshaylieeeNo ratings yet

- Audit-Of Inventory ACHA - KJDocument47 pagesAudit-Of Inventory ACHA - KJKhrisna Joy AchaNo ratings yet

- Consignment Contract 2-14-16Document3 pagesConsignment Contract 2-14-16api-304095757No ratings yet

- P 6-3 DrebinDocument6 pagesP 6-3 DrebinJulia Pratiwi ParhusipNo ratings yet

- InventoriesDocument6 pagesInventoriesralphalonzo100% (3)

- Import and Re-Export Food RequirementsDocument46 pagesImport and Re-Export Food RequirementsAnonymous 1gbsuaafddNo ratings yet

- Consignment Agreement TemplateDocument5 pagesConsignment Agreement TemplateJack AristonNo ratings yet

- What Customs Manual Says About Disposal of Unclaimed and Uncleared CargoDocument3 pagesWhat Customs Manual Says About Disposal of Unclaimed and Uncleared CargoCM AngNo ratings yet

- Notes On InventoriesDocument13 pagesNotes On InventoriesEzer Cruz BarrantesNo ratings yet

- Consignment Accounting Journal EntriesDocument2 pagesConsignment Accounting Journal EntriesVenn Bacus RabadonNo ratings yet

- Sample Consignment AgreementDocument3 pagesSample Consignment AgreementChamp041886% (7)

- Manage Materials Effectively with an MMISDocument30 pagesManage Materials Effectively with an MMISRitter GamingNo ratings yet

- 14 ConsignmentDocument8 pages14 ConsignmentangeelinaNo ratings yet

- Hans Gabriel T. Cabatingan BSA1 - 4: Merchandise of 610,000 Is Held by Sadness On ConsignmentDocument4 pagesHans Gabriel T. Cabatingan BSA1 - 4: Merchandise of 610,000 Is Held by Sadness On ConsignmentHans Gabriel T. CabatinganNo ratings yet