Professional Documents

Culture Documents

AACA2 Receivables

Uploaded by

Joshua Lising0 ratings0% found this document useful (0 votes)

12 views1 page1. The document provides guidance on computing allowance for doubtful accounts (ADA) using different methods such as percentage of sales, percentage of accounts receivable, and aging methods.

2. It defines key terms like past due accounts, ADA before adjustments, control and subsidiary accounts receivable records.

3. The summary highlights problems that could arise with discrepancies between the control and subsidiary accounts receivable balances and how adjustments should be treated separately in each record.

Original Description:

Original Title

AACA2-Receivables

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The document provides guidance on computing allowance for doubtful accounts (ADA) using different methods such as percentage of sales, percentage of accounts receivable, and aging methods.

2. It defines key terms like past due accounts, ADA before adjustments, control and subsidiary accounts receivable records.

3. The summary highlights problems that could arise with discrepancies between the control and subsidiary accounts receivable balances and how adjustments should be treated separately in each record.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views1 pageAACA2 Receivables

Uploaded by

Joshua Lising1. The document provides guidance on computing allowance for doubtful accounts (ADA) using different methods such as percentage of sales, percentage of accounts receivable, and aging methods.

2. It defines key terms like past due accounts, ADA before adjustments, control and subsidiary accounts receivable records.

3. The summary highlights problems that could arise with discrepancies between the control and subsidiary accounts receivable balances and how adjustments should be treated separately in each record.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

AUDIT OF ACCOUNTS RECEIVABLE AUDIT OF ACCOUNTS RECEIVABLE

GUIDE DICTIONARY Final Balan

Issues with

METHODS OF COMPUTING ADA/BAD Past due accounts – accounts thatproblem Accounts

are r

DEBTS EXPENSE already beyond their credit period and Credit

not sale

Initial

yet paid by customers. Usually, mas malaki FinalSale

1. Percent of Sales Method ang rate of uncollectibility nito unlike sa Coll

It depends if where you would current accounts. 1.Recovery

First stra

multiply the uncollectibility rate: o So getting the % of AR could look Write-off

likea. ADA

o Sales revenue this: Accounts

b. Add:s

o Net sales o Current accounts xx*3% ARc.credit Lessb

o Credit sales o Past due accounts Overstatem

xx*10% d. Som

o Total xx Clerical

methe

o Net credit sales

Accounts

e. ADA

Proforma #1: ADA, end before adjustments – this is the

*Recovery

o Sales xx ending balance of ADA after the ff.2.line Second s

thea.proble

ADA

o Less: Cash sales xx items but before the bad debts expense:

entries,

compute it

o Credit sales xx o ADA given amount xx meaning

o Add: Recoveries xx allowanz

initially per

o Less: Write-offs (xx) *AR

Proforma #2: a. credit

“Rep

o Credit sales xx o Sometimes: Bad debts expensestrategy of

i. Ba

o Sales return xx initial ADA method used xx sa

o Sales discount xx o ADA, end (before adj.) xx Net Re

ii. Ba

o Net credit sales xx o And before the bad debts expenseo Acc

is computed using the 3 methods. oiii.Les Fin

2. Percent of AR Method o NRV

% of AR, ending balance Control account and subsidiary account 3.*nasa– itaas

Entry for ae

there are problems that would give youis twoyour comp

% of current accounts + % of past Strategy ft

(2) balances of AR. unadjusted

due accounts

o Adjustments should be accounted forsubsidiary

ADA acco

for

(Ex. AA, BB

3. Aging Method separately for control account and for

subsidiary account. 4. NRV of AR

Same output with Percent of AR 1.o IfAR,the e

o The problem will state if which record

method. customers

o ADA,

of AR (between the 2) would BB) be – Det

followed in the end. o Hindi

Difference between Percent of Sales and effect) lan

o Huwag mong ilalagay sa subsidiary % of s

Percent of AR problem th

% of sales: Sales * % = Bad debts account yung adjustment na for NRV, o

expense control account lang (and vice versa)

Inclusions

5. Expected

% of AR: AR, end * % = required 1. Advanc

o Entry:

ADA, end rationale)

o Amou

based sa

o BD

huwag mo

o BD

o Exp

You might also like

- Accounts Payables 3 DocumentsDocument4 pagesAccounts Payables 3 DocumentsHerald GangcuangcoNo ratings yet

- S. 482 CRPCDocument12 pagesS. 482 CRPCAbhishek YadavNo ratings yet

- Summary For Account ReceivablesDocument6 pagesSummary For Account ReceivablesDevine Grace A. Maghinay100% (1)

- AMLC Registration and Reporting GuidelinesDocument235 pagesAMLC Registration and Reporting GuidelinesTere TongsonNo ratings yet

- Sampaco v. Lantud DigestDocument3 pagesSampaco v. Lantud DigestErla ElauriaNo ratings yet

- Depreciable Amount (Total) Depreciation Rate (Per Year) Depreciation Expense (Per Year)Document3 pagesDepreciable Amount (Total) Depreciation Rate (Per Year) Depreciation Expense (Per Year)Charles Kevin Mina100% (1)

- FAR 04 ReceivablesDocument10 pagesFAR 04 ReceivablesRoseNo ratings yet

- Complete Accounting CycleDocument106 pagesComplete Accounting CycleFely MaataNo ratings yet

- Topic 6 - Bank ReconciliationRev (Students)Document32 pagesTopic 6 - Bank ReconciliationRev (Students)Novian Dwi RamadanaNo ratings yet

- AccountingDocument26 pagesAccountingMuhammad Jaafar AbinalNo ratings yet

- Topic 6 - Bank ReconciliationRev (Students)Document26 pagesTopic 6 - Bank ReconciliationRev (Students)Romzi100% (1)

- Caurdanetaan Piece Worker v. LaguesmaDocument14 pagesCaurdanetaan Piece Worker v. LaguesmaJamiah Obillo HulipasNo ratings yet

- Audit of Receivables - Notes & ReviewerDocument3 pagesAudit of Receivables - Notes & ReviewerJoshua LisingNo ratings yet

- Receivable FinancingDocument6 pagesReceivable FinancingErla PilapilNo ratings yet

- Receivable Financing: Quick Review!Document9 pagesReceivable Financing: Quick Review!Barbie BleuNo ratings yet

- Trade & Other Receivables Lecture NotesDocument7 pagesTrade & Other Receivables Lecture NotesRena Lyn ManzanoNo ratings yet

- 04 Accounts Receivable Answer KeyDocument9 pages04 Accounts Receivable Answer Keywheein aegiNo ratings yet

- 02 Receivable Lec PDFDocument7 pages02 Receivable Lec PDFRyan CornistaNo ratings yet

- Trade Receivable & AllowancesDocument7 pagesTrade Receivable & Allowancesmobylay0% (1)

- Pledge - : Far 6810 - Receivable FinancingDocument3 pagesPledge - : Far 6810 - Receivable FinancingKent Raysil PamaongNo ratings yet

- This Study Resource Was: Philippine School of Business AdministrationDocument6 pagesThis Study Resource Was: Philippine School of Business AdministrationNah HamzaNo ratings yet

- 2.3 Receivable FinancingDocument4 pages2.3 Receivable FinancingShally Lao-unNo ratings yet

- Session 9 The Trial BalanceDocument6 pagesSession 9 The Trial Balanceol.iv.e.a.gui.l.ar412No ratings yet

- FAR1Document5 pagesFAR1Rye Diaz-SanchezNo ratings yet

- CH 02Document31 pagesCH 02andrewfathyNo ratings yet

- CHAP 7 - LECTURER'S NOTES (1) (AutoRecovered)Document11 pagesCHAP 7 - LECTURER'S NOTES (1) (AutoRecovered)ManzMalayaNo ratings yet

- Module 3 - Accounts Receivable Part II - 111702467Document11 pagesModule 3 - Accounts Receivable Part II - 111702467shimizuyumi53No ratings yet

- Incomplete Record 2019Document3 pagesIncomplete Record 2019Parvatee Ramessur100% (1)

- Estimation of DADocument4 pagesEstimation of DAErla PilapilNo ratings yet

- 6 Branch AccountingDocument48 pages6 Branch AccountingsmartshivenduNo ratings yet

- RTGS Functional 02 Accounts and LiqudityDocument18 pagesRTGS Functional 02 Accounts and LiqudityRONYNo ratings yet

- Accounts ReceivableDocument4 pagesAccounts ReceivableErla PilapilNo ratings yet

- Are Present Obligation of An Entity: As A Result of Past EventsDocument14 pagesAre Present Obligation of An Entity: As A Result of Past EventsMARY ACOSTANo ratings yet

- Accounting Process 2Document2 pagesAccounting Process 2Glen JavellanaNo ratings yet

- 112.material For Receivable FinancingDocument8 pages112.material For Receivable FinancingJalanur MarohomNo ratings yet

- 02 - Receivables (P1-12)Document8 pages02 - Receivables (P1-12)Earl ENo ratings yet

- Chapter 8 Lecture Notes 2022 - Student VerDocument33 pagesChapter 8 Lecture Notes 2022 - Student VerThương ĐỗNo ratings yet

- 2 Adjusting Journal EntriesDocument6 pages2 Adjusting Journal EntriesJerric CristobalNo ratings yet

- Debit and Credit: Fundamentals of Accountancy, Business and Management 1Document10 pagesDebit and Credit: Fundamentals of Accountancy, Business and Management 1triicciaa faith100% (1)

- Notes On Week 3Document11 pagesNotes On Week 3Christy CaneteNo ratings yet

- Cash Flows For AccountingDocument1 pageCash Flows For AccountingmyzevelNo ratings yet

- Ch02-Online MOduleDocument70 pagesCh02-Online MOduleNazmul Ahshan SawonNo ratings yet

- Receivable FinancingDocument34 pagesReceivable FinancingmaryzeenNo ratings yet

- 2k15-Fin. Reporting Analysis-3Document30 pages2k15-Fin. Reporting Analysis-3flamerydersNo ratings yet

- PDF Installment Sales Reviewer Problems - CompressDocument43 pagesPDF Installment Sales Reviewer Problems - CompressMischievous Mae0% (1)

- Advanced Financial AccountingDocument102 pagesAdvanced Financial AccountingYash WanthNo ratings yet

- Account Receivables Cheat Sheet NoviDocument1 pageAccount Receivables Cheat Sheet Novisiddesh pachkawadeNo ratings yet

- Far 2Document20 pagesFar 2millescaasiNo ratings yet

- Methods of Partnership LiquidationDocument1 pageMethods of Partnership LiquidationHancel NageraNo ratings yet

- Receivable FinancingDocument15 pagesReceivable FinancingArt EezyNo ratings yet

- Current LiabilitiesDocument3 pagesCurrent LiabilitiesKent Raysil PamaongNo ratings yet

- Auditing Problems SummaryDocument16 pagesAuditing Problems SummaryErika LanezNo ratings yet

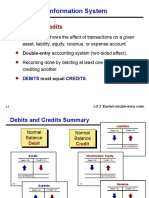

- Accounting Information System: Debits and CreditsDocument84 pagesAccounting Information System: Debits and CreditsDavid Bradley BeckNo ratings yet

- Adjusting Entries: Accrued Expense Accrued IncomeDocument3 pagesAdjusting Entries: Accrued Expense Accrued IncomeRyanKingNo ratings yet

- The Recording Process: Learning ObjectivesDocument23 pagesThe Recording Process: Learning ObjectivesSakib RafeeNo ratings yet

- CH 02Document46 pagesCH 02martinus linggoNo ratings yet

- Book Keeping AccountancyDocument8 pagesBook Keeping AccountancyNarra JanardhanNo ratings yet

- Chapter 6 Bank ReconciliationRev StudentsDocument20 pagesChapter 6 Bank ReconciliationRev StudentsNemalai VitalNo ratings yet

- Receivable Financing (Pledging, Assignment and Factoring)Document2 pagesReceivable Financing (Pledging, Assignment and Factoring)lcNo ratings yet

- Financial Accounting CH 2Document12 pagesFinancial Accounting CH 2Karim KhaledNo ratings yet

- Accounting For Project by AA59Document2 pagesAccounting For Project by AA59Alzahraa TradingNo ratings yet

- True or FalseDocument6 pagesTrue or FalseRainnel james AntaranNo ratings yet

- The Recording Process: Accounting Principles, Ninth EditionDocument32 pagesThe Recording Process: Accounting Principles, Ninth EditionJ PNo ratings yet

- Depreciation Reports in British Columbia: The Strata Lot Owners Guide to Selecting Your Provider and Understanding Your ReportFrom EverandDepreciation Reports in British Columbia: The Strata Lot Owners Guide to Selecting Your Provider and Understanding Your ReportNo ratings yet

- HOBA - NotesDocument2 pagesHOBA - NotesJoshua LisingNo ratings yet

- Quizlet For Ia2Document1 pageQuizlet For Ia2Joshua LisingNo ratings yet

- IA3 SMEsDocument2 pagesIA3 SMEsJoshua LisingNo ratings yet

- Construction ContractsDocument2 pagesConstruction ContractsJoshua LisingNo ratings yet

- INCTAX Chapter 8 Lecture NotesDocument4 pagesINCTAX Chapter 8 Lecture NotesJoshua LisingNo ratings yet

- Quiz 6 INCTAX DiscoveriesDocument1 pageQuiz 6 INCTAX DiscoveriesJoshua LisingNo ratings yet

- TAX Lecture Ch8-9Document1 pageTAX Lecture Ch8-9Joshua LisingNo ratings yet

- Spectrans - Installment Sales - NotesDocument1 pageSpectrans - Installment Sales - NotesJoshua LisingNo ratings yet

- INCTAX QuizletDocument4 pagesINCTAX QuizletJoshua LisingNo ratings yet

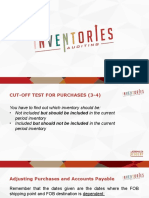

- AACA InventoriesDocument23 pagesAACA InventoriesJoshua LisingNo ratings yet

- Sheets (Iyun Ang I-A-Adjust Natin) : Add: Cost of Goods Sold XXDocument1 pageSheets (Iyun Ang I-A-Adjust Natin) : Add: Cost of Goods Sold XXJoshua LisingNo ratings yet

- Pwede Maging Given Sa Problem: For P350,000 CashDocument3 pagesPwede Maging Given Sa Problem: For P350,000 CashJoshua LisingNo ratings yet

- ASI - Audit of Banks - Part 1Document12 pagesASI - Audit of Banks - Part 1Joshua LisingNo ratings yet

- AUDIT OF INVESTMENT - Debt SecuritiesDocument2 pagesAUDIT OF INVESTMENT - Debt SecuritiesJoshua LisingNo ratings yet

- AUDIT OF INVESTMENTS - Equity SecuritiesDocument5 pagesAUDIT OF INVESTMENTS - Equity SecuritiesJoshua LisingNo ratings yet

- Audit of PPE - Notes (Part 1)Document3 pagesAudit of PPE - Notes (Part 1)Joshua LisingNo ratings yet

- AUDIT OF INVESTMENTS - AssociateDocument4 pagesAUDIT OF INVESTMENTS - AssociateJoshua LisingNo ratings yet

- What Are The Main Economic and Financial Characteristics of ADocument6 pagesWhat Are The Main Economic and Financial Characteristics of ASwati MiraniNo ratings yet

- Sip ReportDocument52 pagesSip ReportRavi JoshiNo ratings yet

- Msds Hydroxypropyl Methyl Cellulose HPMCDocument5 pagesMsds Hydroxypropyl Methyl Cellulose HPMCWANGYUSHENG Kima Chemical Co LtdNo ratings yet

- 6 Take Heed That Ye Do Not Your Alms Before Men, To Be Seen of Them: Otherwise Ye Have No Reward ofDocument8 pages6 Take Heed That Ye Do Not Your Alms Before Men, To Be Seen of Them: Otherwise Ye Have No Reward ofChristopher SullivanNo ratings yet

- Maximum Availability Architecture - Oracle Database 10: Case Study: Amtrust BankDocument7 pagesMaximum Availability Architecture - Oracle Database 10: Case Study: Amtrust BankPrabhakar ReddyNo ratings yet

- Factsheet 01142016Document1 pageFactsheet 01142016Jeongwan SeoNo ratings yet

- Partnership Final Accounts: Tar EtDocument40 pagesPartnership Final Accounts: Tar EtVenkatesh Ramchandra100% (3)

- Pricing TechniquesDocument10 pagesPricing Techniquesvijay_kumar1191No ratings yet

- Local Media1764479852878615105Document140 pagesLocal Media1764479852878615105Ramareziel Parreñas RamaNo ratings yet

- Monsour Et Al v. Menu Maker Foods Inc - Document No. 118Document3 pagesMonsour Et Al v. Menu Maker Foods Inc - Document No. 118Justia.comNo ratings yet

- RACMA3Document680 pagesRACMA3Irish Irvin Orara AlejandroNo ratings yet

- Work of Investment Banking (Repaired)Document12 pagesWork of Investment Banking (Repaired)Shivani Singh ChandelNo ratings yet

- Common GoodDocument13 pagesCommon GoodXyzzielleNo ratings yet

- Feeder Vessel Companies in IndiaDocument25 pagesFeeder Vessel Companies in IndiaManoj DhumalNo ratings yet

- Ifas 1 PDFDocument8 pagesIfas 1 PDFAcha BachaNo ratings yet

- Apple Versus Epic - Records Request FilingDocument9 pagesApple Versus Epic - Records Request FilingMike WuertheleNo ratings yet

- IIAS JournalDocument73 pagesIIAS Journalamit_264No ratings yet

- Form PDF 250740030290722Document9 pagesForm PDF 250740030290722ANSH FFNo ratings yet

- 1) Samson v. Court of Appeals20180316-6791-6bfrcwDocument7 pages1) Samson v. Court of Appeals20180316-6791-6bfrcwVictoria EscobalNo ratings yet

- Work Order For ConstructionsDocument5 pagesWork Order For ConstructionsLaxmipathi Rao LakkarajuNo ratings yet

- Ethics NotesDocument8 pagesEthics NotesJames Glerry AaronNo ratings yet

- ResooDocument3 pagesResooskbacjawannorteNo ratings yet

- Briarlane Rental Application Draft 4Document2 pagesBriarlane Rental Application Draft 4api-495059695No ratings yet

- Deed of SaleDocument4 pagesDeed of Salemaribeth ramirezNo ratings yet

- Research Paper On Sme Banking in BangladeshDocument5 pagesResearch Paper On Sme Banking in Bangladeshmgrekccnd100% (1)

- Tax Digest 3Document12 pagesTax Digest 3Patricia SanchezNo ratings yet