Professional Documents

Culture Documents

Fin 435 Mudharabah and Murabahah

Uploaded by

AiniSyuhadaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fin 435 Mudharabah and Murabahah

Uploaded by

AiniSyuhadaCopyright:

Available Formats

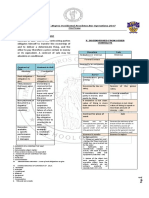

SYARIAH CONCEPT IN ISLAMIC BANKING

(PROFIT-SHARING CONTRACT)

Profit from the outcome of the

venture is shared between two

DEFINITION

parties according to mutually agreed

A form of partnership between profit sharing ratio

one who provides funds (Rabbul

Mal) and the other who provides Financial losses are borne by the

management expertise owner of capital (Rabbul Mal) that

(Mudarib) such losses are not due to the

Mudarib's misconduct, negligence or

breach of specified terms

MUDARABAH

CAPITAL

CONCEPT

The capital shall be

contributed by the capital

provider and shall be managed

by the manager to generate

Owner of TRUST ENTREPRENEUR income.

(expertise)

capital

The capital of Mudarabah may

be in the form of monetary or

non-monetary assets.

Monetary assets of different

PROFIT / LOSS currencies shall be valued

according to an agreed

currency at the time of signing

loss

the Mudarabah contract

TYPES OF

MUDARABAH

AL MUQAYYADAH AL MUTLAQAH

(RESTRICTED MUDARABAH) (UNRESTRICTED MUDARABAH)

Owner of capital (Rabbul Mal) may Owner of capital (Rabbul Mal)

specify a particular business or gives a full freedom to

particular place for the entreprenuer (Mudarib) to

entreprenuer (Mudarib) undertake whatever business he

deems fit.

NATION OF MUDARA

RMI BAH

TE

Mudarabah can be terminated any time by either of the two

parties by giving notice.

If Mudarabah was for a particular term, it will terminate at the

end of the term

Termination of Mudarabah means that the Mudarib cannot

purchase new goods for the Mudarabah. However, he may sell

the existing goods that were purchased before termination.

SYARIAH CONCEPT IN ISLAMIC BANKING

(Cost-plus Financing)

DEFINITION The bank will purchase the goods

that is wanted by the customer

Sell of goods at a price which includes and sell the goods at a higher

a profit margin which have been price

agreed by both parties (including the profit margin)

(the seller and the buyer)

Buyer will make payment at a

single amount

COMPONENTS OF MURABAHAH

Seller

Price

Contracting Parties

01 The contracting parties shall have the

legal capacity to enter into the murabahah Buyer

contract.

Sighah

Asset

Asset to be traded in a murabahah

contract shall the asset is recognised by

02

the Shariah, valuable, identifiable and

Merchandise

deliverable. or goods

PILLARS

Price

03 The price and the currency used shall be

OF MURABAHAH

determined and mutually agreed at the

time of entering into the murabahah

contract.

ES OF MURABAHAH AG

RUL REE

IC ME

AS Conditional sale:

NT

A condition which is the requirement of

sale (Valid).

Reasonable condition for the safety of

Subject matter (Valid).

Unreasonable condition but in

accordance with

normal market practice (Valid).

A condition that is Against the

requirement of sale, not in accordance

with the market practice Beneficial for

the seller or purchaser (void)

Condition Expenses of

of Murabahah

Subject matter

Price of Murabahah

URABAHAHAH CO TYPES OF MURABAHAH

ES OF M NTR

AG AC

ST T

Ordinary Murabahah Sale

Promise stage Agency stage Two parties : the seller and the buyer, where the seller as an

ordinary trader purchases the goods from the market

without depending on any order and promise to buy the

STAGES same from him and sells those to a buyer for cost plus profit.

OF

MURABAHAH

Acquiring

Murabahah based on Order and

Possession Execution Promise

Three parties: buyer, seller and the Bank as an intermediary

trader where the Bank upon receipt of order from the buyer

with a prior outstanding promise to buy the goods from the

Bank, purchases the ordered goods and sells those to the

ordering buyer at a cost plus agreed profit.

You might also like

- SR Islamic Contracts Core FeaturesDocument22 pagesSR Islamic Contracts Core FeaturesMaham SarwarNo ratings yet

- T3 - Salient Features and ContractsDocument49 pagesT3 - Salient Features and Contractsmichael musillaNo ratings yet

- Partnership Contracts in Islamic Banking and FinanceDocument64 pagesPartnership Contracts in Islamic Banking and FinanceNik Razizi100% (1)

- Islamic FinanceDocument35 pagesIslamic FinanceMuhammed UsmanNo ratings yet

- Session 2 - Non Financial Contracts in Islamic Banking & FinanceDocument37 pagesSession 2 - Non Financial Contracts in Islamic Banking & FinanceMohamed Abdi LikkeNo ratings yet

- Chapter 2 - Islamic Contract in The International Trade FinancingDocument19 pagesChapter 2 - Islamic Contract in The International Trade FinancingAisyah AnuarNo ratings yet

- Mudarabah and Musharakah - : Participatory Modes of FinancingDocument45 pagesMudarabah and Musharakah - : Participatory Modes of FinancingKhurram MaqboolNo ratings yet

- Mudarabah: Week 4Document13 pagesMudarabah: Week 4Muhammad Obaid ElahiNo ratings yet

- Isb540 - MudharabahDocument15 pagesIsb540 - MudharabahMahyuddin Khalid100% (1)

- Specific Terms & Conditions For CASA-i ENGDocument3 pagesSpecific Terms & Conditions For CASA-i ENGKavinNo ratings yet

- Aleya - Ba1194c - Motor Vehicle Financing&personal FinancingDocument26 pagesAleya - Ba1194c - Motor Vehicle Financing&personal FinancingzahierulNo ratings yet

- Mudarabah ContractDocument26 pagesMudarabah ContractChirdchai Chantarat100% (2)

- Aitab (Bina Malaysia Bank Berhad)Document9 pagesAitab (Bina Malaysia Bank Berhad)Nur Amin Nor AzmiNo ratings yet

- Aitab (Bina Malaysia Bank Berhad)Document9 pagesAitab (Bina Malaysia Bank Berhad)Nur Amin Nor AzmiNo ratings yet

- Chapter 4 - SOGADocument29 pagesChapter 4 - SOGAWEI SZI LIMNo ratings yet

- Fiqh of Islamic FinanceDocument32 pagesFiqh of Islamic FinancenorhaiyaNo ratings yet

- MIA Tax Treatment On Islamic Finance PDFDocument24 pagesMIA Tax Treatment On Islamic Finance PDFHANISANo ratings yet

- Mud Ha RabahDocument21 pagesMud Ha RabahhamzaNo ratings yet

- Musharakah Bai' Muajjal (Credit Sale) : Musharakah (Joint Venture) Is AnDocument4 pagesMusharakah Bai' Muajjal (Credit Sale) : Musharakah (Joint Venture) Is AnNoha DbnNo ratings yet

- 6-DPD20032 Chapter 6 Partnership Based ContractDocument26 pages6-DPD20032 Chapter 6 Partnership Based ContractFikri Azman123No ratings yet

- Islamic Banking Lecture 5 & 6Document33 pagesIslamic Banking Lecture 5 & 6Soban MamoonNo ratings yet

- Fiqh of Islamic FinanceDocument32 pagesFiqh of Islamic FinanceHayat KhattakNo ratings yet

- Assignment: Chittagong Independent UniveristyDocument18 pagesAssignment: Chittagong Independent Univeristyifaat kaisarNo ratings yet

- Islamic Finance PresentationDocument21 pagesIslamic Finance PresentationZINEB YDIRNo ratings yet

- Slides - Accounting For Mudharabah FinancingDocument25 pagesSlides - Accounting For Mudharabah FinancingMasni Najib Kaaybee100% (1)

- SafariDocument12 pagesSafariCressia BaroteaNo ratings yet

- Murabaha Finance by Muhammad Tayyab RazaDocument58 pagesMurabaha Finance by Muhammad Tayyab RazaRabbiya GhulamNo ratings yet

- Islamic Banking (Murabahah)Document7 pagesIslamic Banking (Murabahah)khadijah zulkifliNo ratings yet

- Chapter 04 Introduction To Islamic Banking and Finance-FinalDocument68 pagesChapter 04 Introduction To Islamic Banking and Finance-FinalNashaad SardheeyeNo ratings yet

- Bai Salam, Bai Istisna and Bai Al-Inah (Yayasuha)Document26 pagesBai Salam, Bai Istisna and Bai Al-Inah (Yayasuha)Nur NasuhaNo ratings yet

- Islamic Business Transaction: November 2020Document17 pagesIslamic Business Transaction: November 2020TurkuazkitchenNo ratings yet

- Group Member 1: Abeer AzharDocument30 pagesGroup Member 1: Abeer Azharbeer beerNo ratings yet

- Chapter 3 - NewDocument14 pagesChapter 3 - NewNatasha GhazaliNo ratings yet

- Al-Wadeah Principal and It's Feature Al-Wadeah Principal and It's FeatureDocument8 pagesAl-Wadeah Principal and It's Feature Al-Wadeah Principal and It's Featurevivekananda RoyNo ratings yet

- 7islamic Capital MarketDocument161 pages7islamic Capital MarketPriyonggo SusenoNo ratings yet

- MurabahaDocument11 pagesMurabahaOGETO WESLEYNo ratings yet

- Mudarba & MusharkaDocument62 pagesMudarba & MusharkaAbid KhanNo ratings yet

- Chapter 7 - Murabahah by Kantakji PDFDocument22 pagesChapter 7 - Murabahah by Kantakji PDFimieNo ratings yet

- Bay SalamDocument20 pagesBay Salamkhadijah zulkifliNo ratings yet

- Principles of FuturesDocument22 pagesPrinciples of FuturesJUSINIA TERA SIMONNo ratings yet

- sbp-MurabahaAgreement Doc 1 MMFADocument7 pagessbp-MurabahaAgreement Doc 1 MMFAnadeemuzairNo ratings yet

- 7islamic Capital MarketDocument161 pages7islamic Capital MarketPriyonggo SusenoNo ratings yet

- Term Descriptions: Glossary of TermsDocument2 pagesTerm Descriptions: Glossary of TermsabdellaNo ratings yet

- DIMINISHING-MUSHARIKA-14112021-072718pmDocument24 pagesDIMINISHING-MUSHARIKA-14112021-072718pmAwn AqdasNo ratings yet

- Musharakah Mutanaqisah As An Islamic Financing Alternative To BBADocument3 pagesMusharakah Mutanaqisah As An Islamic Financing Alternative To BBAhakimi1568No ratings yet

- Reviewer SalesDocument13 pagesReviewer SalesJana marieNo ratings yet

- Islamic Financial Systems-2Document17 pagesIslamic Financial Systems-2محمد حسنین رضا قادریNo ratings yet

- Arbitrage Trading in Commodities-4Document2 pagesArbitrage Trading in Commodities-4James LiuNo ratings yet

- Mfrs112 - Income TaxesDocument13 pagesMfrs112 - Income TaxesMUHAMMAD ALIF AMMAR BIN ZAFRINo ratings yet

- The Concept of Mudarabah DR - Mufti Muhammad SohailDocument20 pagesThe Concept of Mudarabah DR - Mufti Muhammad SohailMUHAMMAD TALATNo ratings yet

- Islamic Modes of Finance: Theory and Key Shariah PrinciplesDocument40 pagesIslamic Modes of Finance: Theory and Key Shariah PrinciplesnuasyamNo ratings yet

- MUDARBAHDocument17 pagesMUDARBAHAbdullah NaeemNo ratings yet

- Isb540 - SalamDocument17 pagesIsb540 - SalamMahyuddin Khalid0% (1)

- Chapter6 Overview of SukukDocument49 pagesChapter6 Overview of SukukOctari NabilaNo ratings yet

- SALESDocument10 pagesSALESEeuhNo ratings yet

- Week 6 Islamic Financing InstrumentDocument30 pagesWeek 6 Islamic Financing Instrument2 Ashlih Al TsabatNo ratings yet

- New Islamic Modes of Finance1Document69 pagesNew Islamic Modes of Finance1Abdul MaroofNo ratings yet

- The Use of Interest Rate As Benchmark Concept Paper MurabahahDocument4 pagesThe Use of Interest Rate As Benchmark Concept Paper MurabahahNur Hidayah JalilNo ratings yet

- Investment Pricing Methods: A Guide for Accounting and Financial ProfessionalsFrom EverandInvestment Pricing Methods: A Guide for Accounting and Financial ProfessionalsNo ratings yet

- Contingent Convertible Bonds, Corporate Hybrid Securities and Preferred Shares: Instruments, Regulation, ManagementFrom EverandContingent Convertible Bonds, Corporate Hybrid Securities and Preferred Shares: Instruments, Regulation, ManagementNo ratings yet

- Elc 501 Article Analysis DraftDocument9 pagesElc 501 Article Analysis DraftAiniSyuhadaNo ratings yet

- Chap 9 - Bank Reg & MGMTDocument10 pagesChap 9 - Bank Reg & MGMTAiniSyuhadaNo ratings yet

- Chap 3 - MMDocument15 pagesChap 3 - MMAiniSyuhadaNo ratings yet

- Chap 8 - Prod and ServicesDocument32 pagesChap 8 - Prod and ServicesAiniSyuhadaNo ratings yet

- Modified - What Do We Know About Capital Structure Ppt-Anindya, PijushDocument51 pagesModified - What Do We Know About Capital Structure Ppt-Anindya, PijushAnindya MitraNo ratings yet

- AccountingDocument437 pagesAccountingNeel Hati100% (1)

- Share Market Basics - Learn Stock Market Basics in India - Karvy OnlineDocument7 pagesShare Market Basics - Learn Stock Market Basics in India - Karvy Onlinevenki420No ratings yet

- Revision Test Paper: Cap Ii (June 2017)Document12 pagesRevision Test Paper: Cap Ii (June 2017)binuNo ratings yet

- Securities and Regulations CodeDocument57 pagesSecurities and Regulations CodeBeth Diaz Laurente100% (1)

- Larisa Warren, The Owner of East Coast Yachts, Has DecidedDocument2 pagesLarisa Warren, The Owner of East Coast Yachts, Has DecidedammelukNo ratings yet

- Quiz 5 Problems Second Semester AY2223 With AnswersDocument4 pagesQuiz 5 Problems Second Semester AY2223 With AnswersManzano, Carl Clinton Neil D.No ratings yet

- Chapter 1 - Income TaxDocument30 pagesChapter 1 - Income TaxKhanh LinhNo ratings yet

- Lý Thị Nguyệt Bh00055 Asm1 BeeDocument17 pagesLý Thị Nguyệt Bh00055 Asm1 BeeThu NguyệtNo ratings yet

- Financial Management Notes SRK UNIT 2Document13 pagesFinancial Management Notes SRK UNIT 2Pruthvi RajNo ratings yet

- Absolute Return: The Way To Make Money in Emerging Markets?Document26 pagesAbsolute Return: The Way To Make Money in Emerging Markets?Stelu OlarNo ratings yet

- 05 Investment PropertyDocument40 pages05 Investment Propertyaprina.sNo ratings yet

- Fa2 Mock Exam 2Document10 pagesFa2 Mock Exam 2Iqra HafeezNo ratings yet

- Faii Chapter Vi - 0Document16 pagesFaii Chapter Vi - 0chuchuNo ratings yet

- Derivatives Assignment (Completed)Document21 pagesDerivatives Assignment (Completed)Juneid ImritNo ratings yet

- Marico Financial Model (Final) (Final-1Document22 pagesMarico Financial Model (Final) (Final-1Jayant JainNo ratings yet

- TQ9 - Year End Adjustments - UPDATEDocument2 pagesTQ9 - Year End Adjustments - UPDATEWEI SZI LIMNo ratings yet

- Financial Management Midtem ExamDocument4 pagesFinancial Management Midtem Examzavria100% (1)

- Strategy Tester - SFE Gold Fever - FixDocument140 pagesStrategy Tester - SFE Gold Fever - FixFrado SibaraniNo ratings yet

- Module 5 - Credit Instruments and Its Negotiation PDFDocument13 pagesModule 5 - Credit Instruments and Its Negotiation PDFRodel Novesteras ClausNo ratings yet

- Presentation On Merchant BankingDocument19 pagesPresentation On Merchant BankingSneha SumanNo ratings yet

- Accounting Group Assignment 1Document7 pagesAccounting Group Assignment 1Muntasir AhmmedNo ratings yet

- Financial ManagementDocument76 pagesFinancial ManagementJulio RendyNo ratings yet

- A Collection of Case Studies On Financial Accounting Concepts-YJKDocument65 pagesA Collection of Case Studies On Financial Accounting Concepts-YJKJkNo ratings yet

- Ares Pathfinder Core Fund Presentation To The City of Phoenix January 2024 Redacted vFINALDocument26 pagesAres Pathfinder Core Fund Presentation To The City of Phoenix January 2024 Redacted vFINALgeorgi.korovskiNo ratings yet

- FtyhtDocument4 pagesFtyhtVamsi ChennuruNo ratings yet

- Rosewood Hotels & Resorts: Customer Lifetime Value (CLTV) Analysis InputsDocument3 pagesRosewood Hotels & Resorts: Customer Lifetime Value (CLTV) Analysis InputsVishal GoyalNo ratings yet

- BM 2023 Fact Sheet (Eng) - 20230614Document3 pagesBM 2023 Fact Sheet (Eng) - 20230614AliChNo ratings yet

- Shikha Kanwar Diamond Chemicals PLCDocument2 pagesShikha Kanwar Diamond Chemicals PLCShikha KanwarNo ratings yet

- Objective Question Bank For LeverageDocument2 pagesObjective Question Bank For LeverageadhishcaNo ratings yet