Professional Documents

Culture Documents

Lesson 1 Aasi

Lesson 1 Aasi

Uploaded by

din matanguihan0 ratings0% found this document useful (0 votes)

1 views1 pageCash basis accounting recognizes revenue when cash is received and expenses when cash is paid, while accrual basis accounting recognizes revenue when earned regardless of when cash is received and expenses when incurred regardless of when cash is paid. Accrual basis accounting provides a more accurate picture of a company's financial performance over a period by recognizing revenue and expenses in the periods to which they relate rather than when cash changes hands.

Original Description:

Original Title

LESSON 1 AASI

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCash basis accounting recognizes revenue when cash is received and expenses when cash is paid, while accrual basis accounting recognizes revenue when earned regardless of when cash is received and expenses when incurred regardless of when cash is paid. Accrual basis accounting provides a more accurate picture of a company's financial performance over a period by recognizing revenue and expenses in the periods to which they relate rather than when cash changes hands.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views1 pageLesson 1 Aasi

Lesson 1 Aasi

Uploaded by

din matanguihanCash basis accounting recognizes revenue when cash is received and expenses when cash is paid, while accrual basis accounting recognizes revenue when earned regardless of when cash is received and expenses when incurred regardless of when cash is paid. Accrual basis accounting provides a more accurate picture of a company's financial performance over a period by recognizing revenue and expenses in the periods to which they relate rather than when cash changes hands.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

AASI: Cash and Accrual Basis

Cash Basis Accounting

Cash basis accounting is a system that recognizes revenue

when cash is received and expenses when cash is paid.

Accrual Basis Accounting

It is an accounting system that recognizes revenue when

earned rather than when cash is received and recognizes expenses

as it is incurred rather than when cash is paid.

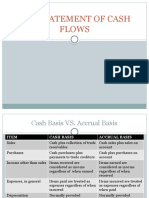

Comparison of Cash Basis and Accrual Basis Accounting

Item of Cash Basis Accrual Basis

Comparison

Sales Includes: Cash sales, Collection Includes: Cash sales, Credit sales

of trade AR, Collection of trade (sale account)

NR

Income other Includes only those collected Includes those items earned during

than sales during the period the period

Purchases Includes: Cash purchase, Includes: Cash purchases,

Payment of trade AP, Payment Purchase on account

of trade NP, Payment in

advance to suppliers I

Expenses. in Includes only those expenses Includes those items that are

general that are paid incurred regardless of when paid

Depreciation Depreciation is typically Depreciation is typically provided

provided except when the cost

of equipment was treated as

expense

Bad debts No bad debts expense is Doubtful accounts are treated as

recognized since cash basis bad debts

does not recognize receivables.

T Accounts Approach

You might also like

- Accounting Crash Course NotesDocument7 pagesAccounting Crash Course NotesShashank MallepulaNo ratings yet

- Chapter 4 Revenues and Other Receipts PDFDocument5 pagesChapter 4 Revenues and Other Receipts PDFSteffany Roque100% (1)

- Cash Basis To Accrual Basis of AccountingDocument15 pagesCash Basis To Accrual Basis of Accountingmary grace abrisNo ratings yet

- The Statement of Cash FlowsDocument12 pagesThe Statement of Cash Flowshamida saripNo ratings yet

- AUD02 - 03 Cash and Accrual BasisDocument16 pagesAUD02 - 03 Cash and Accrual BasisMark BajacanNo ratings yet

- Accounts ReceivableDocument6 pagesAccounts Receivablejustinenakpil09No ratings yet

- Zeus MillanDocument7 pagesZeus MillanannyeongNo ratings yet

- Accounting For MerchandisingDocument2 pagesAccounting For MerchandisingEvelyn MaligayaNo ratings yet

- Cash and Accrual Single Entry PDFDocument8 pagesCash and Accrual Single Entry PDFJoyce Anne GarduqueNo ratings yet

- Applied Auditing: Chapter 5 Cash and Accrual BasisDocument5 pagesApplied Auditing: Chapter 5 Cash and Accrual BasisDarlene SarcinoNo ratings yet

- Cash, Accrual, and SingleDocument42 pagesCash, Accrual, and Singlejohn_domingo_3No ratings yet

- Certs - Cash Basis VS Accrual BasisDocument3 pagesCerts - Cash Basis VS Accrual BasisCJ ManaloNo ratings yet

- Cash To Accural BasisDocument3 pagesCash To Accural BasisfrondagericaNo ratings yet

- Merchandising CompaniesDocument7 pagesMerchandising CompaniesGoogle UserNo ratings yet

- ReceivablesDocument20 pagesReceivablesGemmalyn FolguerasNo ratings yet

- Accounting CycleDocument6 pagesAccounting CycleMosheikh PlaysNo ratings yet

- Notes - FAR - Loans and Receivables (Financial Assets at Amortized Cost)Document10 pagesNotes - FAR - Loans and Receivables (Financial Assets at Amortized Cost)ElaineJrV-IgotNo ratings yet

- Accounting and Merchandising Business PDFDocument18 pagesAccounting and Merchandising Business PDFZairah HamanaNo ratings yet

- Acc 103 - Day 24 - TGDocument9 pagesAcc 103 - Day 24 - TGMJ RoxasNo ratings yet

- Revision of Double Entry SystemDocument2 pagesRevision of Double Entry SystemHasan ShoaibNo ratings yet

- Cash and Accrual Basis AccountingDocument14 pagesCash and Accrual Basis AccountingJohn Patrick MercurioNo ratings yet

- C4 Accounts ReceivableDocument33 pagesC4 Accounts ReceivableShergie GozumNo ratings yet

- Acc 103 - Day 24 - TGDocument9 pagesAcc 103 - Day 24 - TGleisky3.07No ratings yet

- Reo Notes - Audit ProbDocument13 pagesReo Notes - Audit ProbgeexellNo ratings yet

- Caie As Level Accounting 9706 Theory v1Document28 pagesCaie As Level Accounting 9706 Theory v1BrizzyNo ratings yet

- P2 Notes MerchandisingDocument14 pagesP2 Notes Merchandisingchen.abellar.swuNo ratings yet

- Accrual Versus Cash Basis AccountingDocument4 pagesAccrual Versus Cash Basis AccountingDariya DobrevaNo ratings yet

- Periodic Inventory PDFDocument33 pagesPeriodic Inventory PDF48pgcw62kkNo ratings yet

- Cash and Account ReceivableDocument27 pagesCash and Account Receivableletkristal shineNo ratings yet

- Handouts Session 4Document5 pagesHandouts Session 4Allaisa Mae JacobNo ratings yet

- Accounting PrinciplesDocument36 pagesAccounting PrinciplesEshetieNo ratings yet

- Lesson 7 - Special JournalsDocument4 pagesLesson 7 - Special JournalsUnknownymousNo ratings yet

- Receivables - 2021 - Part 1Document19 pagesReceivables - 2021 - Part 1kfangirlthingzNo ratings yet

- Class 2 PDFDocument17 pagesClass 2 PDFRajat AgrawalNo ratings yet

- Chapter 14: Cash and Accrual BasisDocument60 pagesChapter 14: Cash and Accrual BasissofiaNo ratings yet

- Accounts Receivable and Estimation of Doubtful Accounts PDFDocument21 pagesAccounts Receivable and Estimation of Doubtful Accounts PDFJamaica IndacNo ratings yet

- As Level Accounting Notes.Document75 pagesAs Level Accounting Notes.SameerNo ratings yet

- Chapter 4 Lecture Trade and Non Trade Receivables Part 1 StudentDocument3 pagesChapter 4 Lecture Trade and Non Trade Receivables Part 1 StudentAshlene CruzNo ratings yet

- As Accounting Unit 1 RevisionDocument12 pagesAs Accounting Unit 1 RevisionAhmed NiazNo ratings yet

- As Level Accounting NotesDocument77 pagesAs Level Accounting NotesRoHan ChooramunNo ratings yet

- 06.marchandising Operation-FinalDocument53 pages06.marchandising Operation-FinalChowdhury Mobarrat Haider AdnanNo ratings yet

- Acc117-Chapter 5Document51 pagesAcc117-Chapter 5Fadilah JefriNo ratings yet

- Bought To You by Please Donate To Keep Us Alive AS-Level Accounting Unit 1 Revision Notes Mrs Carpenter-Unit 1 Accounting Revision NotesDocument12 pagesBought To You by Please Donate To Keep Us Alive AS-Level Accounting Unit 1 Revision Notes Mrs Carpenter-Unit 1 Accounting Revision Notesmuhtasim kabirNo ratings yet

- Merchandising BusinessDocument31 pagesMerchandising BusinessAngelo ReyesNo ratings yet

- Lesson / Topic: Accounts Receivable Learning Target(s)Document8 pagesLesson / Topic: Accounts Receivable Learning Target(s)Kim FloresNo ratings yet

- Cash and Receivables: Competency Appraisal Lecture Prof. Jazel Mae Z. Celerinos, CPADocument46 pagesCash and Receivables: Competency Appraisal Lecture Prof. Jazel Mae Z. Celerinos, CPAMae NamocNo ratings yet

- Chapter 14 1Document17 pagesChapter 14 1Nile NguyenNo ratings yet

- Accrual vs. Cash AccountingDocument33 pagesAccrual vs. Cash AccountingAbhishek ShetyeNo ratings yet

- Pas 7Document3 pagesPas 7Sacedon, Trishia Mae C.No ratings yet

- Trade and Other ReceivablesDocument2 pagesTrade and Other Receivablesmastery90210No ratings yet

- Accounting For RECEIVABLES PDFDocument3 pagesAccounting For RECEIVABLES PDFZeus GamoNo ratings yet

- The Basis of All Accounting Is Concerned With The Ascertaining and Analyzing of Business ResultsDocument42 pagesThe Basis of All Accounting Is Concerned With The Ascertaining and Analyzing of Business ResultsAswin S PanickerNo ratings yet

- Accounting For Merchandising CompaniesDocument40 pagesAccounting For Merchandising CompaniesAnonymous mnAAXLkYQC100% (1)

- Accounting For Merchandising CompaniesDocument40 pagesAccounting For Merchandising CompaniesAnonymous mnAAXLkYQCNo ratings yet

- Single Entry SystemDocument4 pagesSingle Entry SystemRhea Royce CabuhatNo ratings yet

- Cash and Accrual Basis & Single Entry - OUTLINEDocument3 pagesCash and Accrual Basis & Single Entry - OUTLINESophia Marie VerdeflorNo ratings yet

- FAR.0724 - Trade and Other ReceivablesDocument12 pagesFAR.0724 - Trade and Other ReceivablesDenise Abbygale Ganzon100% (1)

- Group of Management: Presentation On Accounting and Its TerminologiesDocument28 pagesGroup of Management: Presentation On Accounting and Its Terminologiesdiksha malviyaNo ratings yet

- Accounting Interview QuestionsDocument5 pagesAccounting Interview QuestionsMadhura ManeNo ratings yet

- CPA Financial Accounting and Reporting: Second EditionFrom EverandCPA Financial Accounting and Reporting: Second EditionNo ratings yet

- Lesson 2 AasiDocument1 pageLesson 2 Aasidin matanguihanNo ratings yet

- STCM 04 Ge CVPDocument2 pagesSTCM 04 Ge CVPdin matanguihanNo ratings yet

- STCM 03AbsorptionandVariableCostingDocument5 pagesSTCM 03AbsorptionandVariableCostingdin matanguihanNo ratings yet

- Lesson 5 BtaxDocument6 pagesLesson 5 Btaxdin matanguihanNo ratings yet

- Lesson 4 BtaxDocument4 pagesLesson 4 Btaxdin matanguihanNo ratings yet

- Lesson 6 BtaxDocument5 pagesLesson 6 Btaxdin matanguihanNo ratings yet