Professional Documents

Culture Documents

FIN533

Uploaded by

Najjah Zainudin193Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FIN533

Uploaded by

Najjah Zainudin193Copyright:

Available Formats

FACULTY OF BUSINESS AND MANAGEMENT

BACHELOR OF BUSINESS ADMINISTRATION (HONS) HUMAN RESOURCE

MANAGEMENT (NBH4A)

FIN533

PERSONAL FINANCIAL PLANNING

INDIVIDUAL ASSIGNMENTS

Family’s Financial Planning

LECTURER NAME

MRS. SHAHIRA BINTI ARIFFIN

Prepared by:

NAME MATRIC NUMBER

NURUL NAJJAH IZZAH BINTI ZAINUDIN 2021657534

TABLE OF CONTENTS

NO. DESCRIPTION PAGE

1.0 Family Background

1

2.0 Financial Planning and Analysis: 2-6

Personal Financial Statement

Balance Sheet

Cash Flow Statement

Financial Ratios Analysis

Income Tax Calculation

3.0 Recommendations and Suggestions 7

1.0 Family Background:

Mr. Zainudin Bin Hussain's consists of 6 members, namely himself, his wife, and has four

children. He is now self-employed as an Islamic primary school manager in the education

sector. While his wife is a full-time housewife and has no income. Next, his eldest son, 30-

year-old Muhammad Abdul Hadi, already works in the financial department at the same

company as Mr. Zainudin. Mr. Hadi is married persons.

Then, his second daughter, Nurul Najjwa, who is 23 years old. Working as a kindergarten

teacher in a private company. Next, Nurul Najjah is the third child who works as a clerk in an

Islamic primary school and is a bachelor's degree student in Business Administration at

UiTM Shah Alam as an epjj student. Finally, his youngest son, Muhammad Khairul Haziq, 17

years old, is still in school at SMK Sultan Abdul Aziz Shah, Kajang.

Mr. Zainudin's salary is worth RM9,000 a month. Combining these numbers will bring the

couple's total monthly income to RM13,000 per month, which can be considered as T20.

While the salary of their eldest son, Muhammad Abdul Hadi is RM4,000 and the second son

RM1,300. For the third child, the salary is RM2,100. Despite living in Kajang, this couple

has 2 suitable houses in Kajang and Kedah. The house in kedah does not have a bank loan. In

addition, they have 4 cars namely Honda HRV, Produa Kelisa and Produa Myvi. This couple

buys kelisa produa and produa myvi in cash and does not have any bank loans. While their

eldest son has a Honda Civic car. The Myvi car is used by Mr. Zainudin as transportation to

return to work and the Honda HRV is used by Ms. Aziyan as a travel car and transportation to

her workplace. While the second and third children use Produa Kelisa for daily

transportation.

Today, I will discuss my family's financial situation by calculating current income and

expenses. By doing this, we can see if my family has a bad or good financial situation. Then,

we can take some ways or steps to avoid the occurrence of family financial problems.

2.0 FINANCIAL PLANNING AND ANALYSIS:

Personal Financial Statement:

Description RM

Assets

Cash in hand 500

Saving account RHB 5,000

Saving account CIMB 5,000

ASB Balance 50,000

Saving account Tabung Haji 45,000

Double storey terrace house (market value) 540,000

Honda HRV (market value) 62,000

Honda civic (market value) 96,000

Produa Myvi (market value) 25,800

Produa Kelisa (Market value) 14,600

Smartphone Samsung (current value) 1000

Smartphone iPhone (current value) 2000

Laptop acer (current value) 1400

washer machine 1500

Samsung TV 1200

Liabilities

House loan balance 35000

Car loan 62,000

Income Tax 4,200

Income

Salary per month 9,000

Bonus 5,000

Expenses

Honda HR-V monthly instalment 1,200

Honda Civic monthly instalment 1,000

Double storey terrace house monthly instalment 880

Clothing expenses per year 1,000

Fuel, parking, and toll per month 380

Utilities per month 500

Hari Raya expenses 1,000

EPF Contribution (9%) 990

Electric, Water and Unifi 756

School fees for the 3rd and 4th child per year 1,600

ASB monthly instalment 912

Purchase washer machine on May 2022 2,000

Purchase Samsung TV on May 2022 1,800

Smartphone iPhone 2,000

Annual car insurance 2400

Income tax monthly payment 350

Zakat paid for year 975

BALANCE SHEET:

Balance sheet for Mr. Zainudin’s family as at 31st December 2022:

LIQUIDITY ASSETS RM CURRENT LIABILITY RM

Cash in hand 500 Income Tax 4200

Saving account RHB 5,000 Honda HR-V monthly instalment 14,400

(1200 x 12)

Saving account CIMB 5,000 Honda Civic monthly instalment 12,000

(1000 x 12)

Saving account Tabung 45,000

Haji

Total liquid Assets: 55,500 Total Current Liability: 30,600

LIFESTYLES ASSETS NON-CURRENT LIABILITIES

Double storey terrace house 540,000 House loan balance 30,000

Honda HRV 62,000 Car loan 62,000

Honda civic 96,000 Total Non-Current Liabilities: 97,000

Produa Myvi 25,800

Produa Kelisa 14,600 TOTAL LIABILITIES 127,600

Smartphone Samsung 1,000 NET WORKING CAPITAL 723,400

(Total Assets -Total Liabilities)

Smartphone iPhone 2,000

Laptop acer 1,400

washer machine 1,500

Samsung TV 1,200

Total Lifestyle Assets: 745,500

INVESTMENT ASSETS

ASB Balance 50,000

Total Investment Assets 50,000

TOTAL ASSETS 851,000 TOTAL LIABILITIES & NET 851,000

WORTH CAPITAL

CASH FLOW STATEMENT:

Cash flow statement for Mr. Zainudin’s family as at 31st December 2022:

RM RM

INCOME

Salary (9000x12) 108,000

Bonus 5,000

Total income: 113,000

EXPENSES

Double storey terrace house monthly instalment (880 x 12) 10,560

Clothing expenses per year 1,000

Fuel, parking, and toll expenses per month (380 x 12) 4,560

Utilities per month (500 x 12) 6,000

Hari Raya expenses 1,000

EPF Contribution (990 x 12) 11,880

Electric, Water and Unifi (756 x 12) 9,072

School fees for the 3rd and 4th child per year 1600

ASB monthly (912 x 12) 10,944

Purchase washer machine on May 2022 2,000

Purchase Samsung TV on May 2022 1,800

Smartphone iPhone 2,000

Annual car insurance 2400

Income tax monthly payment (350 x 12) 4,200

Zakat paid for year 975

TOTAL EXPENSES 69,991

Contribution To Dissaving: 43,009

FINANCIAL RATIO ANALYSIS

NO. RATIO CALCULATION COMMENTS

1 Current Ratio = Liquid Assets The current ratios show higher

Current Liabilities value than 1. This shows that

Encik Zainudin can maintain

=55,500 adequate liquidity so that he will

30,600 be able to make short-term

=1.81 times payments.

2 Liquid Asset to = Liquid Assets it shows Encik Zainudin ratio in a

Take-home-pay Take-home-pay x 12 good performance and have

Ratio liquidity enough. That means, he

=55,500 is have a safe side.

113,000 x12

= 5.89 month

3 Debt Ratio = Total Liabilities Encik Zainudin debt ratio in a

Total Assets X 100 good performance and still in a

safe side. This is because is lower

= 127,600 than 40% as worker in a

851,000 X 100 government sector. It indicates, he

= 14.99% may not face. any difficulties in

getting new loan.

4 Debt Service = Take-home-pay It shows Encik Zainudin debt.

Coverage Ratio Debt Service service coverage ratio in a good

Charges performance. This is because the

ratio is more than 1. It means,

=113,000 Encik Zainudin earns RM 2.62 for

43,009 every RM1 required debt

=RM 2.62 repayment. And he still has

abilities to make payments.

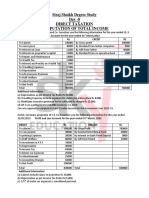

Personal Income Tax:

RM

INCOME:

Salary 108,000

Bonus 5,000

Total Aggregate Income 113,000

Less: tax reliefs

Individual 9,000

Children’s:

3rd Child 8,000

4th Child 2,000

EPF 7,000

Lifestyle (Smartphone iPhone) 2,500

Lifestyle (Unifi bill internet) 2,500

Total Tax Relief 31,000

Chargeable Income 82,000

(Income relief)

The 1st RM70,000 4,400

The remaining RM7,000 '=21% x7000 = 1470

Total gross tax payable 5870

Less: tax rebate

zakat 975

Net Tax Payable 4895

(Gross tax-rebate-mtd)

3.0 Recommendations and Suggestions

Personal financial planning is significant because it is the effectively method for planning

and managing personal financial activities such as income received, spending, saving,

investing includes protecting an individual each of his family. Mr Zainudin can also assess the

most prevalent and crucial components to have an enriching life experience. So, based on Mr

Zainudin’s financial planning, there are some suggestions and recommendation for him to

make some improvement towards his family financial planning.

First, Mr. Zainudin recommends making a special budget for his family. Based on his

financial records, he faces less risk because his total expenses do not exceed his annual

income. However, he needs to be more careful and always remind himself to reduce

unnecessary expenses. Also, creating a budget is a great way to understand your financial

constraints. Therefore, he also needs to ensure that his entire family follows the budget that

has been made continuously to get a better surplus than the deficit every year.

Second, Mr. Zainudin needs to focus on saving and it can be done by making a budget

with the children and teaching them about the importance of saving. Even if the children are

grown up, it is not a wrong way to persuade them about the good side of saving to get better

results for their own family. As a result, children will be careful in spending the money given

by their parents. However, it does not mean that Mr. Zainudin and his family cannot spend on

any entertainment etc. but they must use the money according to their reasonable financial

ability.

Finally, he supposedly needs to cut down on household expenses. From the outflow

statement shows that household expenses have the most amount spent in a year. It is quite

worrying because this expense alone is close to Mr. Zainudin's total income every year. So, he

needs to ensure that these expenses are reduced by using methods such as making a list of

essential needs needed for the whole family and prioritizing the need to continue daily life so

that each can enjoy even at a moderate rate.

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Personal Financial Planning (Fin533) Individual AssignmentDocument8 pagesPersonal Financial Planning (Fin533) Individual Assignmentnurul shuhadah khalidiNo ratings yet

- Tutorial PFPDocument20 pagesTutorial PFPGAW KAH YAN KITTYNo ratings yet

- Isb535 Individual Assignment-1Document14 pagesIsb535 Individual Assignment-1Raziq ProNo ratings yet

- Fin 533Document11 pagesFin 533FATIMAH MOHAMAD ISANo ratings yet

- Personal Financial PlanningDocument14 pagesPersonal Financial Planningsuhana safieeNo ratings yet

- Family Financial Planning FIN533Document22 pagesFamily Financial Planning FIN533SITI FATIMAH AMALINA ABDUL RAZAKNo ratings yet

- FIN 533 INDIVIDUAL ASSIGNMENT OTW NewDocument30 pagesFIN 533 INDIVIDUAL ASSIGNMENT OTW Newsyed hakeemNo ratings yet

- ABFT2020 Tutorial 8 and 9 - Relief and Personal TaxationDocument10 pagesABFT2020 Tutorial 8 and 9 - Relief and Personal TaxationHuilunNgoNo ratings yet

- Internal Controls in MicrofinanceDocument10 pagesInternal Controls in Microfinancemugenyi DixonNo ratings yet

- Fin 533 Group AssgmtDocument3 pagesFin 533 Group AssgmtSiti Sawkiahzamroti Abu HasanNo ratings yet

- Fin242 Role Play AssignmentDocument23 pagesFin242 Role Play Assignment2022628154No ratings yet

- Norjihan's Family (Financial Planning) LATEST UPDATE 8.44Document11 pagesNorjihan's Family (Financial Planning) LATEST UPDATE 8.44MUHAMAD FADHIL ABDUL WAHABNo ratings yet

- Financial Plan: Jaipuria Institute of Management LucknowDocument7 pagesFinancial Plan: Jaipuria Institute of Management Lucknowmak_max11No ratings yet

- GP Group3 Acc220b2dDocument6 pagesGP Group3 Acc220b2dALIESYA FARHANA ALI HUSSAIN GHAZALINo ratings yet

- HW 20 June 2020 Name: Mohamad Fidri Bin Shamsudin Class: Atx-C Lecturer: Ms NabilahDocument12 pagesHW 20 June 2020 Name: Mohamad Fidri Bin Shamsudin Class: Atx-C Lecturer: Ms NabilahPutera IzwanNo ratings yet

- Dharmasagara First Grade College:, Dommasandra Income Tax-Ii Section - ADocument3 pagesDharmasagara First Grade College:, Dommasandra Income Tax-Ii Section - AambarishNo ratings yet

- Personal Financial Planning (Fin533)Document17 pagesPersonal Financial Planning (Fin533)Azwin YusoffNo ratings yet

- 1) Assignment ACC PDFDocument18 pages1) Assignment ACC PDFMashitah ShuibNo ratings yet

- Individual Assignment - EffaDocument16 pagesIndividual Assignment - EffayuhanaNo ratings yet

- Family PlanningDocument15 pagesFamily PlanninghazeemNo ratings yet

- Balance Sheet June 2018Document3 pagesBalance Sheet June 2018SITI NURFARHANA AB RAZAKNo ratings yet

- 2095 - Chi - Nguyen - Phuong - 10200092 - Nguyen - PHuong - Chi - 9589 - 1660271688 ..Document13 pages2095 - Chi - Nguyen - Phuong - 10200092 - Nguyen - PHuong - Chi - 9589 - 1660271688 ..Nguyen Phuong ChiNo ratings yet

- Personal Assigment PDFDocument13 pagesPersonal Assigment PDFImran Azizi Zulkifli67% (3)

- Personal Financial PlanningDocument7 pagesPersonal Financial Planningatma afisah100% (1)

- Jawaban Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Document22 pagesJawaban Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Vincenttio le CloudNo ratings yet

- Company Tax SS Sept 2021 (Rate 2021) .For StudentsDocument3 pagesCompany Tax SS Sept 2021 (Rate 2021) .For StudentsizzahNo ratings yet

- Feasibility StudyDocument28 pagesFeasibility StudyRoberto Velasco MabulacNo ratings yet

- Wealth ManagementDocument178 pagesWealth Managementgauravshahi21967% (3)

- Muhammad Nabil Izzuddin Bin Musa Ba247 2DDocument10 pagesMuhammad Nabil Izzuddin Bin Musa Ba247 2D2022898118No ratings yet

- Lecture 4 Islamic Banking Operations - DepositDocument44 pagesLecture 4 Islamic Banking Operations - DepositborhansetiNo ratings yet

- Married Couples Case PDFDocument5 pagesMarried Couples Case PDFSeemaNo ratings yet

- Question - Test Acc106 Mac 2021 - 2july2021Document4 pagesQuestion - Test Acc106 Mac 2021 - 2july2021Fara husnaNo ratings yet

- 02 Acc GR 12 Companies Work SheetDocument8 pages02 Acc GR 12 Companies Work Sheet218041659mqikelayNo ratings yet

- Practical ExerciseDocument9 pagesPractical Exercisesharini subramaniamNo ratings yet

- T4Q RCA2 2020 Personal Tax Comp FocusDocument3 pagesT4Q RCA2 2020 Personal Tax Comp FocusHaananth SubramaniamNo ratings yet

- Chapter 3 ExercisesDocument8 pagesChapter 3 ExercisesNguyen Khanh Ly K17 HLNo ratings yet

- Adjustments To Financial Statements Tutorial No: 13Document6 pagesAdjustments To Financial Statements Tutorial No: 13me myselfNo ratings yet

- Tutorial Chapter 5Document8 pagesTutorial Chapter 5Aisyah SafiNo ratings yet

- Model Question PaperDocument3 pagesModel Question Paperi.am.dheeraj8463No ratings yet

- Govt. Higher Secondary School AngulDocument62 pagesGovt. Higher Secondary School AngulBiswaranjan TripathyNo ratings yet

- PGBPDocument3 pagesPGBPJimmy ShergillNo ratings yet

- RDGRT 4 Erte 4Document3 pagesRDGRT 4 Erte 4Lorelyn TriciaNo ratings yet

- Assignment (20%) TRIMESTER 1, 2019/2020 BAC2674 Taxation I: % of Similarity % of Marks DeductionDocument5 pagesAssignment (20%) TRIMESTER 1, 2019/2020 BAC2674 Taxation I: % of Similarity % of Marks DeductionArjun DonNo ratings yet

- BBCA3183 - Finals TaxationDocument10 pagesBBCA3183 - Finals TaxationDivesha RaviNo ratings yet

- P3 Set 1-1Document5 pagesP3 Set 1-1Shingirayi MazingaizoNo ratings yet

- ACT-202-Report North End PDFDocument11 pagesACT-202-Report North End PDFSoria Zoon HaiderNo ratings yet

- 3300 Question PaperDocument4 pages3300 Question PaperPacific TigerNo ratings yet

- Ind Assignment - Islamic Financial PlanningDocument15 pagesInd Assignment - Islamic Financial PlanningAtiqah AzmanNo ratings yet

- FIN242 REPORT Group 3Document32 pagesFIN242 REPORT Group 3Izzat FarhanNo ratings yet

- Day 8 TaxationDocument2 pagesDay 8 TaxationKhan Shadab -27No ratings yet

- Acctg 9 Worksheet Week 2Document2 pagesAcctg 9 Worksheet Week 2Muhammad Bin Farooq (Mo)No ratings yet

- COURSE CODE: ACC117/106/100 Declaration Form of Group AssignmentDocument9 pagesCOURSE CODE: ACC117/106/100 Declaration Form of Group AssignmentMARLINDAH RAHIMNo ratings yet

- Tax 267 Feb21 PyqDocument8 pagesTax 267 Feb21 PyqKenji HiroNo ratings yet

- 10 & 11 (Guevarra, Lacsamana, Pagara, Pasia)Document14 pages10 & 11 (Guevarra, Lacsamana, Pagara, Pasia)Laurence ImmanuelleNo ratings yet

- T11 Relief&Rebates Student Oct 2021Document5 pagesT11 Relief&Rebates Student Oct 2021CHAN KER XINNo ratings yet

- Mohd Azmezanshah Bin SezwanDocument4 pagesMohd Azmezanshah Bin SezwanMohd Azmezanshah Bin SezwanNo ratings yet

- CILO 4 - Prepare The Financial Statements.: Profit or Loss)Document5 pagesCILO 4 - Prepare The Financial Statements.: Profit or Loss)Neama1 RadhiNo ratings yet

- Annai Therasa Arts and Science College: Model ExaminationDocument6 pagesAnnai Therasa Arts and Science College: Model ExaminationJayaram JaiNo ratings yet

- Acc466 - Group G - Project 1Document28 pagesAcc466 - Group G - Project 1Nur SyafiqahNo ratings yet

- Financial Budget: Reporter: Katherine MiclatDocument57 pagesFinancial Budget: Reporter: Katherine MiclatMavis LunaNo ratings yet

- GCC Listed Banks ReportDocument92 pagesGCC Listed Banks Reportaziz ziaNo ratings yet

- Valuation Provision GST S.No Particulars 1 Sec. 15 (1) Definition of ValueDocument5 pagesValuation Provision GST S.No Particulars 1 Sec. 15 (1) Definition of ValueAnonymous ikQZphNo ratings yet

- Benefit-Cost Analysis: Non-Profit Motive in Public EconomyDocument3 pagesBenefit-Cost Analysis: Non-Profit Motive in Public EconomyEdrick Lloyd NagoyNo ratings yet

- Tontines, Public Finance, and Revolution in France and England, 1688-1789Document31 pagesTontines, Public Finance, and Revolution in France and England, 1688-1789Ven GeanciaNo ratings yet

- Interest - Mini SurveyDocument1 pageInterest - Mini SurveyRay FaustinoNo ratings yet

- Bir Form 1601-CDocument4 pagesBir Form 1601-Csanto tomas proper barangay100% (1)

- Z XEb RUG5 R REHu 5 XyDocument89 pagesZ XEb RUG5 R REHu 5 XysvkrocksNo ratings yet

- PartngershipDocument2 pagesPartngershipHarmandeep SinghNo ratings yet

- Functions in ExcelDocument37 pagesFunctions in Excelssnil1970100% (1)

- EOS - Disney Pixar - Group 7Document9 pagesEOS - Disney Pixar - Group 7Amod VelingkarNo ratings yet

- Petition For Extraordinary Writ of Mandate, Application For Temporary Stay...Document61 pagesPetition For Extraordinary Writ of Mandate, Application For Temporary Stay...robertian100% (3)

- PHilex Mining Corp Vs CIRDocument15 pagesPHilex Mining Corp Vs CIRNelly HerreraNo ratings yet

- FRM Presentation 2Document20 pagesFRM Presentation 2Paul BanerjeeNo ratings yet

- MBF13e Chap10 Pbms - FinalDocument17 pagesMBF13e Chap10 Pbms - FinalYee Cheng80% (5)

- International EconomicsDocument2 pagesInternational Economicsvivek2270834No ratings yet

- SBLC Purchase 38+2 R1 SKVDocument23 pagesSBLC Purchase 38+2 R1 SKVKRIYERNo ratings yet

- Chapter On NPA - 13032020 PDFDocument105 pagesChapter On NPA - 13032020 PDFs s singhNo ratings yet

- Consolidated Balance Sheet of Reliance Industries: - in Rs. Cr.Document58 pagesConsolidated Balance Sheet of Reliance Industries: - in Rs. Cr.rotiNo ratings yet

- Maf620 FMC570Document8 pagesMaf620 FMC570ewinzeNo ratings yet

- Exercise On Hedging (KEY)Document2 pagesExercise On Hedging (KEY)juringNo ratings yet

- TNEB Online Payment PDFDocument1 pageTNEB Online Payment PDFpavanNo ratings yet

- Inventories and Investment Theories v2Document10 pagesInventories and Investment Theories v2Joovs JoovhoNo ratings yet

- IndiaBanks GoldilocksWithAMinorBump20230310 PDFDocument26 pagesIndiaBanks GoldilocksWithAMinorBump20230310 PDFchaingangriteshNo ratings yet

- RHB-Product Disclosure Sheet-Personal FinancingDocument4 pagesRHB-Product Disclosure Sheet-Personal FinancingMohd Imran NoordinNo ratings yet

- Dasar Penilaian Bumi Dan Bangunan Dibawah Harga Pasar (Studi Di Dipenda Kabupaten Mojokerto)Document25 pagesDasar Penilaian Bumi Dan Bangunan Dibawah Harga Pasar (Studi Di Dipenda Kabupaten Mojokerto)Deni Dwi PutraNo ratings yet

- High Probability Trading Triggers For Gold & SilverDocument52 pagesHigh Probability Trading Triggers For Gold & Silverabrar_90901No ratings yet

- NAV As at 29th January 2021Document33 pagesNAV As at 29th January 2021Avinash GanesanNo ratings yet

- Chapter Four Interm P2Document10 pagesChapter Four Interm P2saed cabdiNo ratings yet

- Case Study Olympian Backpacks Inc.Document18 pagesCase Study Olympian Backpacks Inc.Rimuru TempestNo ratings yet