Professional Documents

Culture Documents

Blue

Uploaded by

sri316831Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Blue

Uploaded by

sri316831Copyright:

Available Formats

Wealth Creation Study 2006-2011 Theme 2012

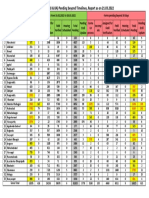

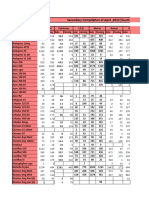

Blue Chips: In descending order of Total Return (dividend + capital gains) over FY00 to FY11

Blue Chip Stock price (INR)* Return over investment (INR) Value Appreciation EPS Divd

of Invt CAGR CAGR

Mar-00 Mar-11 Cap. Gain Divd* % share % of PP (INR) (x) CAGR (%) (%) (%)

Sesa Goa 2 290 289 13 4 816 304 185 61 49 40

Motherson Sumi 4 214 211 8 4 232 223 63 46 36 33

Havells India 7 371 364 7 2 99 379 51 43 44 22

Titan Inds 4 191 186 2 1 55 193 44 41 31 21

LIC Housing Finance 7 225 219 16 7 243 241 37 39 18 16

Federal Bank 14 419 405 27 6 194 446 32 37 49 34

Bharat Electronics 60 1,679 1,619 131 7 219 1,810 30 36 26 22

Exide Inds 6 143 137 4 3 67 147 25 34 23 20

Larsen & Toubro 72 1,653 1,581 59 4 82 1,713 24 33 26 20

Blue Star 19 372 353 37 10 196 409 22 32 18 14

Ipca Labs 15 302 287 14 5 93 316 21 32 22 17

GE Shipping Co 17 263 246 79 24 461 342 20 31 14 12

HDFC 38 699 661 41 6 106 739 19 31 22 28

Adani Enterprises 38 661 623 3 1 8 664 17 30 25 31

Container Corpn 76 1,212 1,136 91 7 119 1,303 17 29 16 17

ABB 50 792 742 17 2 34 809 16 29 5 6

CRISIL 40 595 555 27 5 68 622 16 28 23 36

State Bank of India 190 2,768 2,578 152 6 80 2,920 15 28 20 19

Asian Paints 177 2,527 2,350 127 5 72 2,654 15 28 23 21

GAIL (India) 38 465 427 58 12 152 523 14 27 12 10

Bosch 500 6,319 5,819 138 2 28 6,457 13 26 26 27

Bharat Forge 29 346 317 20 6 69 366 13 26 17 13

Dewan Housing 24 268 244 24 9 99 292 12 25 18 8

Tata Steel 68 621 552 95 15 139 715 10 24 26 15

Ashok Leyland 3 28 25 5 17 149 34 10 23 45 28

Hero MotoCorp 194 1,587 1,393 266 16 137 1,853 10 23 26 42

Nestle India 430 3,795 3,365 273 8 63 4,068 9 23 19 18

Pidilite Inds 17 149 133 7 5 40 156 9 23 19 21

Cummins India 57 489 432 35 8 62 524 9 22 19 28

M&M 81 699 618 41 6 51 740 9 22 20 19

Grasim Inds 303 2,461 2,158 200 8 66 2,661 9 22 22 19

Reliance Inds 128 1,048 920 42 4 32 1,089 9 22 19 14

ACC 140 1,076 935 108 10 77 1,184 8 21 26 31

Bajaj Auto 192 1,460 1,268 129 37 67 1,589 8 21 13 13

ITC 25 181 157 15 9 60 196 8 21 18 30

Dabur India 14 96 82 6 7 42 102 7 20 24 24

IOC 63 334 271 73 21 116 407 6 19 11 50

Colgate-Palmolive 145 815 670 98 13 67 913 6 18 20 18

Ambuja Cements 26 143 117 16 12 62 159 6 18 17 16

GSK Consumer 518 2,313 1,795 103 5 20 2,416 5 15 12 21

Cipla 90 321 231 14 6 15 335 4 13 19 25

Hindalco Inds 63 209 146 15 9 24 224 4 12 6 9

GSK Pharma 731 2,343 1,612 223 12 30 2,565 4 12 15 9

Britannia Inds 124 371 247 33 12 27 404 3 11 12 20

Infosys 1,113 3,237 2,124 146 6 13 3,382 3 11 38 13

Pfizer 507 1,225 718 122 14 24 1,346 3 9 18 16

Hind. Unilever 225 285 60 60 50 26 344 2 4 7 9

Wipro 549 478 -71 21 - 4 499 1 -1 32 56

Median of above - - 7 67 - 10 23 20 20

BSE Sensex 5,001 19,445 - - - - - 4 13 13 -

* Stock price and dividends adjusted for bonus issues, stock splits, rights, etc

% share stands for Dividend share in total return; % of PP stands for Dividends as % of Purchase Price

9 December 2011 24

You might also like

- Logic of English - Spelling Rules PDFDocument3 pagesLogic of English - Spelling Rules PDFRavinder Kumar80% (15)

- 100 Baggers PDFDocument202 pages100 Baggers PDFAmitabhDash97% (58)

- 2019 09 20 New Balance Harvard Business CaseDocument7 pages2019 09 20 New Balance Harvard Business CaseFrans AdamNo ratings yet

- 200-300 ET 500 Company List 2022Document6 pages200-300 ET 500 Company List 20220000000000000000No ratings yet

- Road Transport q1 2018Document18 pagesRoad Transport q1 2018AUDU SIMONNo ratings yet

- Claims & Objections Pendency Report 21.03.2022Document1 pageClaims & Objections Pendency Report 21.03.2022Madhu BabuNo ratings yet

- Summary List of QP NOS As On 23rd August 11 Sep 2017Document96 pagesSummary List of QP NOS As On 23rd August 11 Sep 2017Pavan Kumar NarendraNo ratings yet

- ET 500 Companies ListDocument22 pagesET 500 Companies ListKunal SinghalNo ratings yet

- Updated 23 Aug List of QP NOS With Notional Hours Training Duration 11 Sep 2017Document355 pagesUpdated 23 Aug List of QP NOS With Notional Hours Training Duration 11 Sep 2017Pavan Kumar Narendra100% (1)

- 1-25 ET 500 Company List 2022Document2 pages1-25 ET 500 Company List 20220000000000000000No ratings yet

- Summary QPDocument36 pagesSummary QPviahulNo ratings yet

- Rank 2022 Rank 2021 Company Revenue Revenue % CHG PAT PAT % CHG MCADocument6 pagesRank 2022 Rank 2021 Company Revenue Revenue % CHG PAT PAT % CHG MCA0000000000000000No ratings yet

- Mar-18 Days Raw Material Cycle WIP Cycle Finished Goods Cycle Inventory Holding Period 382 203 220 118 159 0 44 101 95 12 15 32 45 22 89 17 63 59 0 3Document2 pagesMar-18 Days Raw Material Cycle WIP Cycle Finished Goods Cycle Inventory Holding Period 382 203 220 118 159 0 44 101 95 12 15 32 45 22 89 17 63 59 0 3SeemaNo ratings yet

- Inventori 2020.Document7 pagesInventori 2020.irwansyahkickers1186No ratings yet

- Status of Grievances of Life InsurersDocument2 pagesStatus of Grievances of Life InsurersGarga SPNo ratings yet

- Aditya Enterprises May-19: Realty Automation & Security Systems PVT LTDDocument19 pagesAditya Enterprises May-19: Realty Automation & Security Systems PVT LTDAspire SuccessNo ratings yet

- Name of The Broker-ADARSH N.P: SL No. Script Code Script Name 3/2/2020Document15 pagesName of The Broker-ADARSH N.P: SL No. Script Code Script Name 3/2/2020Adarsh JainNo ratings yet

- Summary List of QP NOS As On 25october - 3rd NovDocument99 pagesSummary List of QP NOS As On 25october - 3rd NovBharani Kumar0% (1)

- Status of GP BUildings XLS As On 3.6.2023 NREGSDocument5 pagesStatus of GP BUildings XLS As On 3.6.2023 NREGSce mgnregsNo ratings yet

- BTMVC PvtSecCoDocument21 pagesBTMVC PvtSecCojapani08No ratings yet

- Contract Labour Report in Works Area As On 31 03 2023Document11 pagesContract Labour Report in Works Area As On 31 03 2023Jhansi PalliNo ratings yet

- Driver Scorecard Report V2.1Document2 pagesDriver Scorecard Report V2.1TimothyNo ratings yet

- I.22 Posisi Tabungan Rupiah Dan Valas Bank Umum Dan BPR Menurut Golongan Pemilik (Miliar RP)Document2 pagesI.22 Posisi Tabungan Rupiah Dan Valas Bank Umum Dan BPR Menurut Golongan Pemilik (Miliar RP)Izzuddin AbdurrahmanNo ratings yet

- Quality Dividend Yield Stocks - 301216Document5 pagesQuality Dividend Yield Stocks - 301216sumit guptaNo ratings yet

- Mandatory CSR Spending Big 500Document46 pagesMandatory CSR Spending Big 500Raj Kumar JhaNo ratings yet

- Ioq 2021 22 State Wise EnrollmentDocument1 pageIoq 2021 22 State Wise EnrollmentAkanshNo ratings yet

- Ioq 2021 22 State Wise EnrollmentDocument1 pageIoq 2021 22 State Wise EnrollmentVatsal JainNo ratings yet

- MMG BA Review SlidesDocument8 pagesMMG BA Review SlidessumitNo ratings yet

- PhotoDocument8 pagesPhotoPrasad GopiNo ratings yet

- 52.246665 Percent Joined and 47.753335 Percent Did NotDocument9 pages52.246665 Percent Joined and 47.753335 Percent Did NotRohit RajagopalanNo ratings yet

- Isms Code Accordi ON Coupon (Beginni NG Inventor Y) FT Menthol CH MentholDocument3 pagesIsms Code Accordi ON Coupon (Beginni NG Inventor Y) FT Menthol CH MentholLorraine Cleir LegardeNo ratings yet

- Laporan Monja 16 Februari 2024Document900 pagesLaporan Monja 16 Februari 2024setannyamanusiaNo ratings yet

- My SharesDocument1 pageMy SharesVenkat PalliNo ratings yet

- My SharesDocument1 pageMy SharesVenkat PalliNo ratings yet

- Loan AmortizationDocument3 pagesLoan AmortizationMiskatul ArafatNo ratings yet

- Archive 4Document2 pagesArchive 4B N SRIVIDYANo ratings yet

- Road Transport FRSC Q1 2023Document45 pagesRoad Transport FRSC Q1 2023AUDU SIMONNo ratings yet

- Safety Report OspiDocument1 pageSafety Report Ospiglenn dalesNo ratings yet

- AU463Document4 pagesAU463Dushyant ChoudharyNo ratings yet

- Form 20 Final Result SheetDocument12 pagesForm 20 Final Result SheetkgbijuNo ratings yet

- Weightage of Deffrent Co.'s in Nifty: Switch To NSE Switch To BSEDocument2 pagesWeightage of Deffrent Co.'s in Nifty: Switch To NSE Switch To BSEShakti ShuklaNo ratings yet

- Japan Companies in India 2022Document94 pagesJapan Companies in India 2022kickbuttoski100% (1)

- 51-75 ET 500 Company List 2022Document2 pages51-75 ET 500 Company List 20220000000000000000No ratings yet

- Section II QB Rating Sheet 9.23.08Document7 pagesSection II QB Rating Sheet 9.23.08Will MontgomeryNo ratings yet

- Directorate of Elementary & Secondary Education, Khyber Pakhtunkhwa, PeshawarDocument2 pagesDirectorate of Elementary & Secondary Education, Khyber Pakhtunkhwa, PeshawarSyed Muhammad IslamNo ratings yet

- DistrictCadre SummaryDocument2 pagesDistrictCadre SummaryShahid rahmanNo ratings yet

- DistrictCadre SummaryDocument2 pagesDistrictCadre SummaryAll in OneNo ratings yet

- DistrictCadre SummaryDocument2 pagesDistrictCadre SummaryAhsan khanNo ratings yet

- DistrictCadre SummaryDocument2 pagesDistrictCadre SummaryIhteshamNo ratings yet

- Directorate of Elementary & Secondary Education, Khyber Pakhtunkhwa, PeshawarDocument2 pagesDirectorate of Elementary & Secondary Education, Khyber Pakhtunkhwa, Peshawarmaqsood khanNo ratings yet

- 8to5frompivot&IR1 40Document3 pages8to5frompivot&IR1 40riteshNo ratings yet

- Pakistan Stock Exchange Daily Price Data 01.01.2016 TO 31.12.2016Document32 pagesPakistan Stock Exchange Daily Price Data 01.01.2016 TO 31.12.2016Zain QureshiNo ratings yet

- NSDC Courses ListDocument69 pagesNSDC Courses ListshekarNo ratings yet

- Information Technology 9626 June 2023 Grade Threshold TableDocument2 pagesInformation Technology 9626 June 2023 Grade Threshold TableEshaal MalikNo ratings yet

- Information Technology 9626 June 2023 Grade Threshold TableDocument2 pagesInformation Technology 9626 June 2023 Grade Threshold TableSumiyabazarNo ratings yet

- NaMo App Download Status - 24012024 - 0930 HrsDocument1 pageNaMo App Download Status - 24012024 - 0930 HrsKiraha PrakashNo ratings yet

- Contoh Ukuran Bak Curing Standar: KeteranganDocument8 pagesContoh Ukuran Bak Curing Standar: KeteranganFitria RindangNo ratings yet

- Keshavlal Compilation AgustDocument291 pagesKeshavlal Compilation AgustSandeep ShahNo ratings yet

- wk3 IBUS3109Document37 pageswk3 IBUS3109hanjun ZhaoNo ratings yet

- City Wise - Onboarding BreakupDocument374 pagesCity Wise - Onboarding Breakupramansharma1769No ratings yet

- Table-37.1 5Document8 pagesTable-37.1 5PriyankaNo ratings yet

- MinitabDocument9 pagesMinitabJBFPNo ratings yet

- BlueDocument1 pageBluesri316831No ratings yet

- BlueDocument1 pageBluesri316831No ratings yet

- BuffettDocument121 pagesBuffettsri316831No ratings yet

- Total 21285Document2 pagesTotal 21285sri316831No ratings yet

- Bear or Bull - Tips To Identify Current Phase of Indian MKT PDFDocument19 pagesBear or Bull - Tips To Identify Current Phase of Indian MKT PDFsri316831No ratings yet

- Vin PDFDocument1 pageVin PDFsri316831No ratings yet

- On The Attachment For Chakrabarty's Full Presentation) : Bear or Bull: Tips To Identify Current Phase of Indian MKTDocument5 pagesOn The Attachment For Chakrabarty's Full Presentation) : Bear or Bull: Tips To Identify Current Phase of Indian MKTsri316831No ratings yet

- Benchmark Prime Lending Rate (Historical Data) - SBI Corporate WebsiteDocument2 pagesBenchmark Prime Lending Rate (Historical Data) - SBI Corporate Websitesri316831No ratings yet

- On The Attachment For Chakrabarty's Full Presentation) : Bear or Bull: Tips To Identify Current Phase of Indian MKTDocument5 pagesOn The Attachment For Chakrabarty's Full Presentation) : Bear or Bull: Tips To Identify Current Phase of Indian MKTsri316831No ratings yet

- Bear or Bull - Tips To Identify Current Phase of Indian MKTDocument19 pagesBear or Bull - Tips To Identify Current Phase of Indian MKTsri316831No ratings yet

- Special Warfare Ma AP 2009Document28 pagesSpecial Warfare Ma AP 2009paulmazziottaNo ratings yet

- Present Continuous WorkshopDocument5 pagesPresent Continuous WorkshopPaula Camila Castelblanco (Jenni y Paula)No ratings yet

- TEsis Doctoral en SuecoDocument312 pagesTEsis Doctoral en SuecoPruebaNo ratings yet

- Thomas Noochan Pokemon Review Final DraftDocument6 pagesThomas Noochan Pokemon Review Final Draftapi-608717016No ratings yet

- Matthew DeCossas SuitDocument31 pagesMatthew DeCossas SuitJeff NowakNo ratings yet

- Kofax Cross Product Compatibility MatrixDocument93 pagesKofax Cross Product Compatibility MatrixArsh RashaNo ratings yet

- Curriculum Vitae Mukhammad Fitrah Malik FINAL 2Document1 pageCurriculum Vitae Mukhammad Fitrah Malik FINAL 2Bill Divend SihombingNo ratings yet

- Hypnosis ScriptDocument3 pagesHypnosis ScriptLuca BaroniNo ratings yet

- Industrial Visit Report Part 2Document41 pagesIndustrial Visit Report Part 2Navratan JagnadeNo ratings yet

- Army Public School Recruitment 2017Document9 pagesArmy Public School Recruitment 2017Hiten BansalNo ratings yet

- JD For Library Interns Sep 2023Document2 pagesJD For Library Interns Sep 2023Bharat AntilNo ratings yet

- Motion Exhibit 4 - Declaration of Kelley Lynch - 03.16.15 FINALDocument157 pagesMotion Exhibit 4 - Declaration of Kelley Lynch - 03.16.15 FINALOdzer ChenmaNo ratings yet

- Panera Bread Company: Case AnalysisDocument9 pagesPanera Bread Company: Case AnalysisJaclyn Novak FreemanNo ratings yet

- Bootstrap DatepickerDocument31 pagesBootstrap DatepickerdandczdczNo ratings yet

- Ollie Nathan Harris v. United States, 402 F.2d 464, 10th Cir. (1968)Document2 pagesOllie Nathan Harris v. United States, 402 F.2d 464, 10th Cir. (1968)Scribd Government DocsNo ratings yet

- Research Report On Energy Sector in GujaratDocument48 pagesResearch Report On Energy Sector in Gujaratratilal12No ratings yet

- List of Vocabulary C2Document43 pagesList of Vocabulary C2Lina LilyNo ratings yet

- Gastric Emptying PresentationDocument8 pagesGastric Emptying Presentationrahul2kNo ratings yet

- PT - Science 5 - Q1Document4 pagesPT - Science 5 - Q1Jomelyn MaderaNo ratings yet

- Grammar For TOEFLDocument23 pagesGrammar For TOEFLClaudia Alejandra B0% (1)

- PHD Thesis - Table of ContentsDocument13 pagesPHD Thesis - Table of ContentsDr Amit Rangnekar100% (15)

- SULTANS OF SWING - Dire Straits (Impresión)Document1 pageSULTANS OF SWING - Dire Straits (Impresión)fabio.mattos.tkd100% (1)

- Togaf Open Group Business ScenarioDocument40 pagesTogaf Open Group Business Scenariohmh97No ratings yet

- EMI - Module 1 Downloadable Packet - Fall 2021Document34 pagesEMI - Module 1 Downloadable Packet - Fall 2021Eucarlos MartinsNo ratings yet

- PCI Bank V CA, G.R. No. 121413, January 29, 2001Document10 pagesPCI Bank V CA, G.R. No. 121413, January 29, 2001ademarNo ratings yet

- Jurnal UlkusDocument6 pagesJurnal UlkusIndri AnggraeniNo ratings yet

- Pa Print Isang Beses LangDocument11 pagesPa Print Isang Beses LangGilbert JohnNo ratings yet

- Account Intel Sample 3Document28 pagesAccount Intel Sample 3CI SamplesNo ratings yet