Professional Documents

Culture Documents

ITR V Ajesh Soni

Uploaded by

Aditya AroraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ITR V Ajesh Soni

Uploaded by

Aditya AroraCopyright:

Available Formats

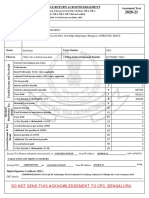

INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT Assessment Year

[Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3,

ITR-4(SUGAM), ITR-5, ITR-6, ITR-7 filed and verified]

2020-21

(Please see Rule 12 of the Income-tax Rules, 1962)

PAN AGFPS2208H

Name AJESH SONI

SHOP NO 2009-10, , , MANIMAJRA, CHANDIGARH, CHANDIGARH, 160101

Address

Status Individual Form Number ITR-3

Filed u/s 139(1)-On or before due date e-Filing Acknowledgement Number 245486591080221

Current Year business loss, if any 1 0

Taxable Income and Tax details

Total Income 623450

Book Profit under MAT, where applicable 2 0

Adjusted Total Income under AMT, where applicable 3 623450

Net tax payable 4 38678

Interest and Fee Payable 5 2835

Total tax, interest and Fee payable 6 41513

Taxes Paid 7 41526

(+)Tax Payable /(-)Refundable (6-7) 8 -10

Dividend Tax Payable 9 0

Distribution Tax

Interest Payable 10 0

Dividend

details

Total Dividend tax and interest payable 11 0

Taxes Paid 12 0

(+)Tax Payable /(-)Refundable (11-12) 13 0

Accreted Income & Tax

Accreted Income as per section 115TD 14 0

Additional Tax payable u/s 115TD 15 0

16 0

Detail

Interest payable u/s 115TE

Additional Tax and interest payable 17 0

Tax and interest paid 18 0

(+)Tax Payable /(-)Refundable (17-18) 19 0

Income Tax Return submitted electronically on 08-02-2021 16:08:57 from IP address 61.2.241.76 and verified by

AJESH SONI

having PAN AGFPS2208H on 08-02-2021 16:08:57 from IP address 61.2.241.76 using

Digital Signature Certificate (DSC).

17430966CN=e-Mudhra Sub CA for Class 2 Individual 2014,OU=Certifying Authority,O=eMudhra Consumer Services Limited,C=IN

DSC details:

DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- MURALIDHARAN PILLAI - 10-Jan-2021 - 193247100Document1 pageMURALIDHARAN PILLAI - 10-Jan-2021 - 193247100raghav shettyNo ratings yet

- 9 M - 28-Dec-2020 - 917355441Document1 page9 M - 28-Dec-2020 - 917355441Arihant SatpathyNo ratings yet

- PDF 332384320310321 PDFDocument1 pagePDF 332384320310321 PDFSekharNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurudarshilNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalurusachinkotadiyaaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruYogesh SainiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMadhan Kumar BobbalaNo ratings yet

- PDF 575108620220920Document1 pagePDF 575108620220920amaresh kumar mallikNo ratings yet

- PDF 142704210080121Document1 pagePDF 142704210080121MugdhaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAbhishek SaxenaNo ratings yet

- RACS Itr 2020-2021Document1 pageRACS Itr 2020-2021Lakshay SharmaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruPradip ShindeNo ratings yet

- 2020 10 13 16 14 03 443 - 1602585843443 - XXXPS4444X - Acknowledgement PDFDocument1 page2020 10 13 16 14 03 443 - 1602585843443 - XXXPS4444X - Acknowledgement PDFPradip ShindeNo ratings yet

- PDF 796371500091220Document1 pagePDF 796371500091220dimplevats1982No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruRavi KumarNo ratings yet

- 2020 07 21 14 18 51 966 - 1595321331966 - XXXPA5493X - Acknowledgement PDFDocument1 page2020 07 21 14 18 51 966 - 1595321331966 - XXXPA5493X - Acknowledgement PDFVasanth Kumar AllaNo ratings yet

- XXXPB6007X - Itr VDocument1 pageXXXPB6007X - Itr VSuraj RajputNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruVipin SaxenaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengalururrrrNo ratings yet

- Itr-V Aompp8846d 2020-21 472578820180820Document1 pageItr-V Aompp8846d 2020-21 472578820180820patelriaNo ratings yet

- PDF Class Note 1Document1 pagePDF Class Note 1Sachin KadamNo ratings yet

- 2020 12 28 19 53 31 299 - 1609165411299 - XXXPB6935X - AcknowledgementDocument1 page2020 12 28 19 53 31 299 - 1609165411299 - XXXPB6935X - AcknowledgementRenil BabuNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurujitendra39.kumarNo ratings yet

- Narayanswamy Srinivas Murthy 11-Feb-2021 251755691Document1 pageNarayanswamy Srinivas Murthy 11-Feb-2021 251755691Nishanth SrinivasNo ratings yet

- PDF 960046120301220Document1 pagePDF 960046120301220Ender gamerNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMahaNo ratings yet

- PDF 912540700271220Document1 pagePDF 912540700271220Dhruv KNo ratings yet

- PDF 928543220281220Document1 pagePDF 928543220281220Rajendra Prasad sahaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruvasantNo ratings yet

- 2021 12 01 19 51 21 534 - 1638368481535 - XXXPS1936X - AcknowledgementDocument1 page2021 12 01 19 51 21 534 - 1638368481535 - XXXPS1936X - AcknowledgementvasantNo ratings yet

- 2020 08 20 15 29 32 099 - 1597917572099 - XXXPK1485X - Acknowledgement PDFDocument1 page2020 08 20 15 29 32 099 - 1597917572099 - XXXPK1485X - Acknowledgement PDFCDO DLTNo ratings yet

- Itr-V Bogpp6352h 2020-21 767088050301120Document1 pageItr-V Bogpp6352h 2020-21 767088050301120DEVIL RDXNo ratings yet

- 2021 05 09 19 19 45 309 - 1620568185309 - XXXPK6024X - ItrvDocument1 page2021 05 09 19 19 45 309 - 1620568185309 - XXXPK6024X - ItrvRohan KapurNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMohammad WaseemNo ratings yet

- 2020 11 28 13 48 32 813 - 1606551512813 - XXXPM2440X - AcknowledgementDocument1 page2020 11 28 13 48 32 813 - 1606551512813 - XXXPM2440X - AcknowledgementMadhu HarshithaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMaheshNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruChinmay BhattNo ratings yet

- LJ Huf FinancialDocument21 pagesLJ Huf Financialsunil jadhavNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruHarjot SinghNo ratings yet

- PDF 487599040240820Document1 pagePDF 487599040240820kotasrihariNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMadhan Kumar BobbalaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMadhan Kumar BobbalaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruRoshanjit ThakurNo ratings yet

- 2020 12 22 18 03 02 020 - 1608640382020 - XXXPK2897X - AcknowledgementDocument1 page2020 12 22 18 03 02 020 - 1608640382020 - XXXPK2897X - AcknowledgementAbhay DasNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruCA ANDANI GSTNo ratings yet

- 2020 09 03 21 10 10 959 - 1599147610959 - XXXPS0467X - AcknowledgementDocument1 page2020 09 03 21 10 10 959 - 1599147610959 - XXXPS0467X - Acknowledgement150819850No ratings yet

- 2019-20 ItrDocument1 page2019-20 ItrMitesh PatelNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruADITYA KUMAR MISHRANo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruRahul SrivastavaNo ratings yet

- 2020 12 12 23 10 30 664 - 1607794830664 - XXXPR2886X - Acknowledgement PDFDocument1 page2020 12 12 23 10 30 664 - 1607794830664 - XXXPR2886X - Acknowledgement PDFJagesh RanjanNo ratings yet

- 2020 07 31 16 05 55 486 - 1596191755486 - XXXPK8367X - AcknowledgementDocument1 page2020 07 31 16 05 55 486 - 1596191755486 - XXXPK8367X - AcknowledgementSiva Jyothi KNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruHimangshu KarNo ratings yet

- ITR Slip 20-21Document1 pageITR Slip 20-21Mukesh Kumar GuptaNo ratings yet

- 2020 12 19 21 04 28 561 - 1608392068561 - XXXPM1087X - AcknowledgementDocument1 page2020 12 19 21 04 28 561 - 1608392068561 - XXXPM1087X - AcknowledgementSanjay KNo ratings yet

- Itr FormDocument1 pageItr FormSharath Reddy MaddirevulaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAyush AgarwalNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBijendra KumarNo ratings yet

- Ramavath A.Y 2020-21 Tax - AcknowledgementDocument1 pageRamavath A.Y 2020-21 Tax - AcknowledgementBhashya RamavathNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruUsha Kiran PNo ratings yet

- GSTR3B 04agfps2208h1zo 062020Document3 pagesGSTR3B 04agfps2208h1zo 062020Aditya AroraNo ratings yet

- GSTR3B 04agfps2208h1zo 042020Document3 pagesGSTR3B 04agfps2208h1zo 042020Aditya AroraNo ratings yet

- Computation Ajesh SoniDocument8 pagesComputation Ajesh SoniAditya AroraNo ratings yet

- Computation Meenakshi SoniDocument6 pagesComputation Meenakshi SoniAditya AroraNo ratings yet

- Airtel PricingDocument2 pagesAirtel PricingAditya AroraNo ratings yet

- 2018-19 Balance SheetsDocument2 pages2018-19 Balance SheetsAditya AroraNo ratings yet

- Coca ColaDocument3 pagesCoca ColaAditya AroraNo ratings yet

- Personal Finance ReviewerDocument12 pagesPersonal Finance ReviewerJan Allyson BiagNo ratings yet

- Demand and Its AttributesDocument33 pagesDemand and Its AttributesSeniorb LemhesNo ratings yet

- TrillionaireDocument23 pagesTrillionaire19marstian82No ratings yet

- Sample Natural Form of Statement of Comprehensive IncomeDocument1 pageSample Natural Form of Statement of Comprehensive IncomeHazel Joy DemaganteNo ratings yet

- (David W. Noble) Death of A Nation American CultureDocument400 pages(David W. Noble) Death of A Nation American CultureSyed Sabir MuhammadNo ratings yet

- Power of LifetimeDocument104 pagesPower of Lifetimeoluwasegun David100% (1)

- Human Values Questions & Answers LongDocument80 pagesHuman Values Questions & Answers LongSuyash SinghNo ratings yet

- Chinas QuestDocument889 pagesChinas Questdrago66No ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSaurya KumarNo ratings yet

- Being The SolutionDocument46 pagesBeing The Solutionsheelam54761No ratings yet

- How Are Income and Wealth Linked To Health and LongevityDocument22 pagesHow Are Income and Wealth Linked To Health and Longevityshu100% (2)

- Reservation System and Its HistoryDocument13 pagesReservation System and Its HistoryHarmanSinghNo ratings yet

- JKH On The Recent MMR-MMT DebatesDocument41 pagesJKH On The Recent MMR-MMT Debateskmp897862No ratings yet

- 2nd RenaissanceDocument452 pages2nd RenaissanceIguaNo ratings yet

- Sat TDocument8 pagesSat TSamuelNo ratings yet

- Economic Development and EnvironmentDocument25 pagesEconomic Development and EnvironmentNiloy KrittikaNo ratings yet

- Module 4 IntaxDocument14 pagesModule 4 IntaxPark MinyoungNo ratings yet

- Greening America's Schools: Costs and BenefitsDocument26 pagesGreening America's Schools: Costs and BenefitsKristian Erick BautistaNo ratings yet

- Economic Survey Volume I Complete PDFDocument298 pagesEconomic Survey Volume I Complete PDFShweta Mungre100% (1)

- 10-04-14 EditionDocument32 pages10-04-14 EditionSan Mateo Daily JournalNo ratings yet

- Company Fundamentals - Financial Summary: Statement DataDocument10 pagesCompany Fundamentals - Financial Summary: Statement DataNovi AnriNo ratings yet

- Why Nations Fail Daron AcemogluDocument571 pagesWhy Nations Fail Daron AcemogluJisheng Liu97% (86)

- Managing Within The Dynamic Business Environment: Taking Risks and Making ProfitsDocument20 pagesManaging Within The Dynamic Business Environment: Taking Risks and Making ProfitsRafayet Omar Shuvo100% (1)

- Module 03 - Income Tax ConceptsDocument34 pagesModule 03 - Income Tax ConceptsLEON JOAQUIN VALDEZNo ratings yet

- Banco Mundial Manual Calculo AnsDocument23 pagesBanco Mundial Manual Calculo AnsEco_heterdoxaNo ratings yet

- The Psychology of Money Housel en 39499Document6 pagesThe Psychology of Money Housel en 39499rdeepak9975% (4)

- Martinez Final ResearchDocument15 pagesMartinez Final ResearchFerdinand MartinezNo ratings yet

- 01 - SEN Amartya (2000) Development As FreedomDocument78 pages01 - SEN Amartya (2000) Development As FreedomAlejandro GomezNo ratings yet

- PROFESSIONAL ETHICS HUMAN VALUES Notes PDFDocument58 pagesPROFESSIONAL ETHICS HUMAN VALUES Notes PDFAchintDuggal100% (1)

- Test Bank For College Physics 5th Edition Alan GiambattistaDocument36 pagesTest Bank For College Physics 5th Edition Alan Giambattistapotshardmonied5cuc100% (44)