Professional Documents

Culture Documents

Meeusen1977 (6677)

Meeusen1977 (6677)

Uploaded by

zdenkaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Meeusen1977 (6677)

Meeusen1977 (6677)

Uploaded by

zdenkaCopyright:

Available Formats

Economics Department of the University of Pennsylvania

Institute of Social and Economic Research -- Osaka University

Efficiency Estimation from Cobb-Douglas Production Functions with Composed Error

Author(s): Wim Meeusen and Julien van Den Broeck

Source: International Economic Review, Vol. 18, No. 2 (Jun., 1977), pp. 435-444

Published by: Wiley for the Economics Department of the University of Pennsylvania and Institute of Social

and Economic Research -- Osaka University

Stable URL: http://www.jstor.org/stable/2525757 .

Accessed: 18/08/2013 11:23

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at .

http://www.jstor.org/page/info/about/policies/terms.jsp

.

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of

content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms

of scholarship. For more information about JSTOR, please contact support@jstor.org.

Wiley, Economics Department of the University of Pennsylvania, Institute of Social and Economic Research --

Osaka University are collaborating with JSTOR to digitize, preserve and extend access to International

Economic Review.

http://www.jstor.org

This content downloaded from 170.140.26.180 on Sun, 18 Aug 2013 11:23:43 AM

All use subject to JSTOR Terms and Conditions

INTERNATIONAL ECONOMIC REVIEW

Vol. 18, No. 2, June, 1977

EFFICIENCY ESTIMATION FROM COBB-DOUGLAS

PRODUCTION FUNCTIONS WITH COMPOSED

ERROR*

BY WIM MEFUSEN AND JULIEN VAN DEN B3ROECK'

1. INTRODUCTION

In the recent economic literature(Aigner and Chu [2], F0rsund and Hjalmarsson

[5], Seitz [11], and Timmer [12]), in continuation of the research initiated by

Farrell [4], much attention has been paid to the estimation of productive efficien-

cy by means of frontier production functions. In this journal, Richmond [10],

developing a suggestion made by Afriat [1], carried out the estimation of the

Cobb-Douglas production frontier by letting

(1) 'y = f(x,)k,, t = 1 ..., T

and applying ordinary least squares to the logarithmic transformation of (1),

after putting kt=e-zt, assigning a Gamma distribution Gz(z; n) to the random

variable Z, and introducing the statistical error vt - zt. Yt is the actual output,

xt is the corresponding (M x 1) vector of inputs, and f(x,) is the Cobb-Douglas

frontier production function.

It follows that the random variable K, with observed values kt (t=1,..., T),

represents the technical level of efficiency at the firm level, i.e., the proportion

between actual and potential output.

CR= 2-' is a consistent although upward biased estimator of the average

Richmond-efficiencylevel of the economy (or industry) given by

r00

(2) ER = E(K) = ezdGz(z; n) = 2-n

n= (Z

t

v2)/(T- Al - I) is the OLS estimator of the variance n of the random vari-

able V.

Of course, the estimates of the production elasticities are not affected in the

foregoing specification: the Afriat-Richmond production frontier comes about

by a mere upward shift on the logarithmic scale of the corresponding "average"

production function.

* Manuscript received January 16, 1976; revised May 24, 1976.

1 We should like to express our gratitude to Jacques Mairesse of INSEE at Paris for permitt-

ing LIS to use the data of the 1962 French Census of Manufacturing Industries. We are also

grateful to Dr. H. Deckers and G. Peperstraete of the Nuclear Research Centre at Mol (Belgium)

for their asistance with the calculations.

435

This content downloaded from 170.140.26.180 on Sun, 18 Aug 2013 11:23:43 AM

All use subject to JSTOR Terms and Conditions

436 MEEUSEN AND VAN DEN BROECK

It is our purpose to propose an alternative approach to the estimation of the

frontier production function, since the Afriat-Richmond measure yields, as we

shall show, systematically underestimated values for productive efficiency.

Contrary to Afriat and Richmond, who proceed as if every disturbance from the

theoretical value on the frontier results solely from human errors (information

deficiencies, adjustment costs, managerial errors on the level of the technical

operation of the plant, etc.), we shall introduce in our model of the frontier

production function, next to a disturbance due to inefficiency, a statistical dis-

turbance due to randomness in the real sense and to specification and measure-

ment errors.

2. THE EFFICIENCY MODEL WITH COMPOSED ERROR

We propose an efficiency model with a composed multiplicative disturbance

term, i.e., the product of a "true" error term and an efficiency measure:

Kt-(0xX)k~tu, t = 1,.T.

kt is an efficiency measure and is distributed in the (0, 1) interval; ut is a dis-

turbance in the proper sense and is distributed in the (0, oo) interval. tt, kt

and xt are mutually independent.

Considering the Cobb-Douglas production model and putting kt=exp(--t)

and ut=exp(-vt), we get

Yt = All xfte-ztedvt.

We assume that the Zt as well as the vt have a specified theoretical distribution.

The convolution of those distributions and a subsequent straightforward applica-

tion of the maximum likelihood method yields estimates of the relevant parameters.

It is clear that the two types of errors and not separated with regard to each

piece of available information. Once the parameters of the distribution obtained

through convolution are estimated, however certain characteristics, such as mo-

ments, of the pdf's of respectively K and U can be derived. The two kinds of

errors are separated a posteriori in this sense.

It is assumed that the vt are a random sample of a Gaussian distribution, with

zero mean and variance U2.

The Zt are of course distributed in the interval (0, oo).

It turns out that assigning an exponential distribution to Z leads to acceptable

properties of the model, both from a theoretical and computational point of

view.

Other distributions, which from an economic point of view seemed to be more

adequate (that is, distributions the pdf of which have a modal value between 0

and 1, such as the beta distribution or its right-truncated version) led to insUt--

mountable difficulties in finding a neat expression for the pdf of the composed

error.

This content downloaded from 170.140.26.180 on Sun, 18 Aug 2013 11:23:43 AM

All use subject to JSTOR Terms and Conditions

EFFICIENCY ESTIMATION 437

For the pdf of Z we put

fZ(z; A) -e-z 'z > 0

(k > 0)

()

= , < 0.

We get for the pdf of K e-:

fK(k; i) _k'', 0 < k < 1

- 0 , elsewhere.

The pdf of k is monotone decreasing or inticreasingfor 0<kA< 1, resp. A> l. If

t,

I k is uniformly distribUtedin the interval.

fK(k;A) fK(kiA) fK(k;A) gK(k;n)

k k k k

1<X<2 A=2 O>2 <n(<1

FIG. la FIG. I b

There are three possible shapes for the pdf corresponding to the situation where

higher efficiencies have higher probability densities. From an economic point of

view only these three cases can be considered as meaningful (Figure la).

This is in contrast with the pdf for k, 9K(k; n), generated by a Gamma proba-

bility density function (the procedure followed by Afriat and Richmond) where the

above mentioned situation only corresponds to one specific interval for the rele-

vant parameter (0< n < 1; see Figure Ib). The exponential pdf for Z clearly

imposes fewer restrictions on the distribution of efficiency than the Gamma pdf.

An additional argument in favor of the exponential pdf consists in the finite

values of the probability density corresponding to a maximal level of efficiency.

This is not the case with the pdf for K= e-z resulting from a Gamma-distribution

for Z.

Most of all, the choice of an exponential distribution for Z, leads to neat ex-

pressions for the average efficiency e,=E(K), and for the pdf of the composed

error term W = Z + V and its moments.

For the average efficiency level a, we obtain

This content downloaded from 170.140.26.180 on Sun, 18 Aug 2013 11:23:43 AM

All use subject to JSTOR Terms and Conditions

438 MEEUSEN AND VAN DEN BROECK

(3) = E(K) = i

Using the general expression for the pdf of a sum of two independent random

variables with respective pdf 's fz(z) and fx,(v), we get after some transformations

(4) f1W(w)= fz(z)fv(w - z)dz

=+exp ( j -iw) erfc(i2j7).

The following moments can easily be computed:

I ~ 1

~~~ 2

2 -

9 6orv_

A 3 )3 ' 4 4 + + 374.

The above expression for [12 is useful in determining which part of the total regres-

sion error is attributable to respectively inefficient operating and "true" statistical

disturbance. The skewness measure is positive and therefore indicates asym-

metry to the right. Fromn 4 we conclude that the distribution of the composed

error is leptocurtic, i.e., the corresponding pdf is sharper around the mode than

normal. If i. tends to infinity, i.e., efficiency approaches the 100%/level, fw(w)

obviously tends to the normal distribution.

It is clear that the average efficiency like defined in expression (3) can now no

longer be interpreted, as do Afriat and Richmond, as the average proportion p

between the actual and potential production level, since it holds that

2

P = Q Q fx(x)fw(w)dxdw = l e-wfw(iv)dw = le

It follows immediately that the average value of the proportion p is a thoroughly

misleading measure of efficiency.

3. DATA AND ESTIMATION PROCEDURE

The data from the 1962 French Census of Manufacturing Industries have been

used for a first verification of the foregoing model. The same data have already

been handled by Mairesse [8] to estimate production functions at the micro-

level for France. He compared them with similar production function results

for Norway, estimated by Griliches and Ringstad [6]. The results of the

latter enabled Richmond to implement his method to measure productive efficien-

cy. Ten industries have been selected; in decreasing order of the number of

firms at issue: machine construction and mechanical tools (953), textiles (824),

electrical engineering (679), paper (523), industrial chemicals (415), vehicles and

This content downloaded from 170.140.26.180 on Sun, 18 Aug 2013 11:23:43 AM

All use subject to JSTOR Terms and Conditions

EFFICIENCY ESTIMATION 439

cycles (356), footwear (341), milk products (320), sugar-works, distilleries and

beverages (292), and glass products (135). In each industry, the sample consists

of all corporate firms employing at least 20 workers and other salaried employees.

The production variable is measured by the value added at factor prices. The

labor variable is the unweighted sum of workers.

For the capital variable only the book value of gross fixed assets was available.

This seems justifiable: Griliches and Ringstad used both a capital service flow

measure based on fire insurance values of machinery and buildings and given

depreciation rates, and capital stock measures; their results were practically un-

affected.

We define the loglikelihood function as

log L(w)10)= logf1v(wvti/O)

o is the shorthand expression for the parameter vector with elements X, o, logA,

/1, and 12. A is the multiplicative constant. #1 and /2 are respectively the pro-

duction elasticities of capital and labor.

The maximum likelihood estimators 0 of the parameters of the new model have

been estimated by applying a combination of three minimization methods. The

first method consists of a Monte Carlo searching technique finding the neighbor-

hood of the global minimum. It leads to reasonable starting values for the next

minimization stage: simplices are formed which adapt themselves to the local func-

tion landscape, and contract in the neighborhood of a minimum [9]. The third

and last minimization technique is based on a variable metric method by.

Davidon [3]. The sequential application of these techniques provides for reliable

maximum likelihood estimators and in most cases for their standard errors.

The computer program supplies in addition the inverse of the Hessian of the log-

likelihood function in 0.

Since the sample sizes are large and the Cramer-Rao bound therefore is a close

approximation of the real covariance matrix, and since - as it will appear -

f (w) is nearly normal in most instances and 0 should then be "nearly sufficient",

the inverse of the Hessian in 0 can reasonably be looked upon as a good estimation

of the actual covariance matrix of the parameter 0. In those cases when the

loglikelihood function is not approximately parabolic in the neighborhood of

the maximum, the program supplies an estimate of the standard error (in the shape

of a confidence interval which is obviously no longer symmetrical around the

estimated value of the parameter) obtained by means of a scanning procedure.2

4. RESULTS OF THE EMPIRICAL ANALYSIS

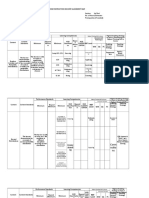

Comparing the elasticities of production of both the average and the frontier

Cobb-Douglas model (Table 1), we see that the elasticities of production remain

2 These methods have been incorporatedin a package of programs called MINUIT, by

1. Jinmesand M. Roos of CERN at Geneva.

This content downloaded from 170.140.26.180 on Sun, 18 Aug 2013 11:23:43 AM

All use subject to JSTOR Terms and Conditions

440 MEEUSEN AND VAN DEN BROECK

practically the same. In spite of the nonnormality of the distribution of the

composed error the regression coefficients have been very little affected. The re-

turns to scale remain constant for the industries under consideration. Only the

intercept changes in an upward direction. This is as expected. Although in this

case the production frontier turns out to be a neutral shift of the average produc-

tion function, this shall not necessarily be so in other applications.

From the results in Table 2 it follows that the most important part (at least

75% and in most cases much more) of the variance of the convoluted distribution

is due to statistical errors and therefore cannot be attributed to inefficiency.

Neglecting this fact may be fatal for efficiency measurement. The efficiency

parameter i. ranges from 16.684 (Glass products) to 2.4180 (Sugar-works, distill-

for all the industries.

ery, beverages) and is highly significant (at the level of 95%/)/)

When we calculate the average efficiency e, of the composed error model and

compare it with the efficiencies computed according to Richmond's method,

(see Table 3) it is easy to see that the latter are improbably low. This is not the

case for the composed error efficiency, which looks economically more plausible.

As sc is a monotone transformation of i., the industry with the highest A has also

the highest average efficiency, i.e., glass products with efficiency equal to 0.9435.

The sector sugar-works, distillery and beverages has the smallest average efficiency

namely 0.7074. Although for sugar-works, distillery and beverages the lower

extreme for E. corresponds to the lower extreme for the Richmond measure ER

this does not seem to imply a correspondence of a more general nature. On the

contrary, the low correlation coefficient (0.254) between the "composed" efficien-

cy measure and the Richmond measure leads to an opposite conclusion as it is not

significantly different from zero at the 90% level.

It is of interest to investigate the relationship between the structural parameters

and the efficiency in terms of their correlation (see Table 4). There is a slight

negative relation between the labor elasticity of production and the efficiency

parameter (-0.031). The correlation between the capital elasticity of production

and the efficiency parameter is greater and positive (0.430).

Their difference is not significant at an appreciable level. Consequently there

is no evidence on the existence of a relationship between the structural parameters

and efficiency. It is however evident that the mere consideration of ten industries

is insufficient and that further research on this question is required.

As to the sources of the established deviations from the 10000 level of productive

efficiency, they might partially overlap with the reasons for Leibenstein's X-

inefficiency: the contracts for labor are frequently incomplete, and not all inputs

are marketed or, if marketed, are not available on equal terms to all buyers (pa-

tents) [9, (412)]. Only a complete investigation of the market structure and the

internal organization and operation of the firms could give a more conclusive

answer on this issue.

It may also be interesting to calculate the proportion of firms with productive

efficiency at least equal to some given value K, where K is some given constant

(0 < c < 1). We have

This content downloaded from 170.140.26.180 on Sun, 18 Aug 2013 11:23:43 AM

All use subject to JSTOR Terms and Conditions

EFFICIENCY ESTIMATION 441

.10 c

0

C0 0 0t .c -9_

C) - CO- ON 00

-~~~~~~~~~~~~~~

~~~~~~~~~~~~7

O O CmN

C

-

CIA

i, . S ? ON '-c

.r-s CA

00

00

00

fn -_ '-

0 yCO - C r C-I r- t- 0 CO \ m 0 0

0 _ 0

a~~~~~~~~~~~~~

O oo k) _,, kr -- fr) tf, __(7N oo -,tc- - _.- - M ,)

___ ko In_ lcl

ts x

O O .~ - mt t . c, t - r- _ _ 1 m _,-__ QO _1\1t- _ N M -,

ci

: 0 O r0 00 r O l0 - Ct '-A CONC C- C - - )

o . ,a- CA -/ a

17i

4~~~~~~~~~~~~~~~~6) C-, (- 00 t \_ ,_ .- c co ob kr_ r- E, >

O0,- O~~~~~~~~~~~~~~~~~~

r )< ' ________ (- r"i _ ___ M (-\nI

xD C,')c(-\

______________ rr M o f -0.0 00t '

:~~~~~~~~

0 C) oC .O O O-

. . C . coOl

. ~ . . C) C oo o r-

00

W E0CO m m -om In a0n c1 a0n V) o o tm "C GI\H

C 00 00 t- r m i-i G

0i-t\OC tr1 \,) r- \O Itn

0

z z OUO t{~~~~~~~k)

r)

CN \ O oam 0 l > \0 st C C-I C UU

k Gfi n- t- A -..0 00 C0 m 00t CO m rt_

C) -

0 I O (.-O

H>L.- - __ ___ .___. _ .__

)

. ____ . _._- _ ____ ___ _._W

IC CD C) C) l O CO

[L1 FW Q~~~~~~~~~~~

5- O-V) O C,,- t- 00 ] 0E 0?? s lo CA 0 o" zt ,Cl- O

91~~~~~~~~~~~~~~~ I r- kr) rl CX Px-- m? rn 01 r" ) fof)C(,\m)m

,s1C ,c 1

< H - -Z:.

HV, 0 JCO ~~~~~~~~~~~~~-C

00- 0-Ct00 0CO(N'Ct00~ti, COO

q:C) mo

c

ZM

0

; 5O)'tO-~

O

C XO

O

r- s 0

O t .-n

0000C

~ in~

0000Ci C 1

OC

c-X

0 i

CN

(i.c

C

0.COu

00V

HN .0

S0 CO~i0V000

60~~~~~~~ )00C)000C

X0

\00 \0 mo0

00 C)06-0000 )00 cV CC 0)

. .

V ~_ 0tWc

U; 00 m - 0 c-i 0-n -

V 'ci- c~ ~) Ci C-- 00 In 00 In C--

3 0C;zoE

>u?>>O 'C s :

o C 0 -- 3 __ _ C s 5 OC )

00~~~~~~~~~~~~~~~~~~~~~~~0

bf) . u

00~~~~~~~~~~~~7: 7 0 u0

ct~~~~~~~~~~~~C

00 rA~> O0

CC"

-

CO-4 - '

This content downloaded from 170.140.26.180 on Sun, 18 Aug 2013 11:23:43 AM

All use subject to JSTOR Terms and Conditions

442 MEEUSEN AND VAN DEN BROECK

TABLE 2

COMPARISON BETWEEN THE VARIANCES OF THE ERRORS OF THE STANDARD AND

THE COIMPOSED ERROR COBB-DOUGLAS MODEL

Standard

Tridustry Cobb-Douglas Composed error

Industry

~~model

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ __2

_ _ _ _ _ _ _ _ _ _ _ _ 1/ 2 2

1) Glass products 0.8118 0.7898 0.0036

2) Milk products 0.6590 0.6438 0.0063

3) Textiles 0.9482 0.9309 0.0100

4) Machine construction

Mechnical tools 0. 72)06 0.7067 0.0114

5)Electrical machinery 0.8456 0.8154 0. 026 6

6) Vehicles and cycles 0.7885 0.7365 0.0451

7) Industrial chemicals 1.0039 0.9307 0.0706

8) Paper 0.7701 0.6970 0.0717

9) Footwear 0.4794 0.3714 0.1042

10) Sugar works, distillery

and beverages ___ 1.0935 0.9115 0.1719

TABLE 3

COMPARISON BETWEEN THE AFIRIAT-RiCHMOND AND COMPOSED ERROR

PRODUCTIVE EFFICIENCY

Afriat-Richmond __ Composed

Industry Gamma error

SC

1) Glass products 0.5697 0.9435

2) Milk products 0.6333 0.9265

3) Textiles 0.5183 0.9089

4) Machine construction

and Mechanical tools 0.6068 0.9036

5) Electrical Machinery 0.5565 0.8595

6) Vehicles and cycles 0.5789 0.8249

7) Industrial chemicals 0.4987 0.790 1

8) Paper 0.5864 0.7888

9) Footwear 0.7173 0.7560

10) Sugar works, distillery

and beverages ___ 0.4686 0.7069 __

'FAB1,E 4

COR~E'LATION MAIRIN OF THEI PARAMETrERS,OF TH-E COMPOSED ERROR MODELiI

Parameters Constant 2 q

Constant 1.000

i~~i -0.808 1.000

/32 0.556 -0.848 1.000

2 ~~-0.586 0.430 -0.031 1.000

a ~~~0.465 -0.237 0.167 --0.150 1.000

This content downloaded from 170.140.26.180 on Sun, 18 Aug 2013 11:23:43 AM

All use subject to JSTOR Terms and Conditions

EFFICIENCY ESTIMATION 443

Pr(K > K) = 5k(-1)dk = 1- Ki.

These proportions are given by way of illustration in Table 5 for various proba-

bility and efficiency levels.

A remarkablefeature of the results which should finally not be left undiscussed

is the often slight, and occasionally important, difference between the standard

errors on the production elasticities in the standard Cobb-Douglas model oil the

one hand, and in the composed error Cobb-Douglas model on the other. The

latter are systematically smaller than the former. These differencesin our opinion

shed some light upon the extent of mnisspecificationinvolved in the estimation

of production elasticities by means of a standard Cobb-Douglas model, that is,

a model in which no explicit account has been taken of the phenomenon of produlc-

tive efficiency.

5. CONCLUSIONS

Taking into account the purely statical definition of efficiency as adopted ill

the composed error model, we arrive at an average sectoral efficiency for the in-

dustries at issue which lies between .70 and .94. There is no significant statistical

relationship between our efficiency measure and Richmond's. The latter arrives

at results which are systematically lower than ours, which is only natural con-

sidering his negligence of the statistical error. The evidence from the limited

number of industries which were examined was not conclusive in finding a relation-

ship between the efficiency phenomenon and the other structural characteristics

of the production process. The aprioristic choice of the exponential distribution

for the efficiency variable and, for that matter, of the Cobb-Douglas specification

itself, is, of course, debatable. It could, therefore, be useful to compute the sen-

sitivity of our results with respect to this particular choice.

State University Centre Antwerp, Belgiumn

REFERENCES

[1] AFRIAT,S., "Efficiency Estimation of Production Functions," International Economic

Review, XIII (October, 1972), 568-598.

[2] AIGNER, D. AND S. Ciiu, "On Estimating the InduIstry Production Function," American

Economic Reviiewv,LVIII (Septenmber,1968), 826-839.

1.3] DAVIDON,W., "Variable Metric Method for Minimization," Computer Journal, X (1968),

406.

[4] FARRELL, M., "The Measurement of Productive Efficiency", Journal of the Royal Statisti-

cal Society-Series A, CXX (Part III, 1957), 253-290.

[5] F0RSUND, F. AND L. HJALMARSSON, "On the Measurement of Productive Efficiency,"

The Swedish Journal of Economics, LXXVI (June, 1974), 141-154.

[6] GaILICHES, Z. AND V. RINGSTAD, Economics of Scale and the Form of the Production

Function (Amsterdam: North Holland Publishing Company, 1971).

[7 ] LHFIBLNSTLJN,H., "Allocative Efficiency vs. 'X-Efficiency'," The American Econontic Revliew,

This content downloaded from 170.140.26.180 on Sun, 18 Aug 2013 11:23:43 AM

All use subject to JSTOR Terms and Conditions

444 MEEUSEN AND VAN DEN BROECK

LVI (June, 1966), 392-415.

[ 8 ] MAIRESSE,J., "Comparison of Production Function Estimates on the French and

Norwegian Census of Manufacturing Industries," in F. L. Altmann, 0. Kyn and H. I.

Wagener, eds, On the Measurement of Factor Productivitics. Theoretical Problems and

Empirical Results, Papers and Proceedings of the 2nd Reisenburg Symposium (Giittingen:

Vandenbroeck and Ruprecht, 1976).

[9] NELDER,J. AND R. MEAD, "A Simplex Metlhod for FLunction1Minimization", Computer

Journal, VII (1967), 308-313.

[10] RICHMOND, J., "Estimating the Efficiency of Production," International Economic Reviw,

XV (June, 1974), 515-521.

[11] SEITZ,W., "The Measurement of Efficiency Relative to a Frontier Production Function,"

American Journal of Agricultural Economics, LII (November, 1970), 505-511.

[12] TIMMER, C., "Using a Probabilistic Frontier Production Function to Measure Technical

Efficiency," Journal of Political Econotnoy,LXXIX (July-August, 1971), 776-794.

This content downloaded from 170.140.26.180 on Sun, 18 Aug 2013 11:23:43 AM

All use subject to JSTOR Terms and Conditions

You might also like

- CFA Level I: Ethical and Professional StandardsDocument13 pagesCFA Level I: Ethical and Professional StandardsBeni100% (3)

- Simulation-Based Econometric Methods PDFDocument185 pagesSimulation-Based Econometric Methods PDFJavierRuizRivera100% (1)

- NG - Argument Reduction For Huge Arguments: Good To The Last BitDocument8 pagesNG - Argument Reduction For Huge Arguments: Good To The Last BitDerek O'ConnorNo ratings yet

- 1976 McCormick. Computability of Global Solutions To Factorable Nonconvex Programs Part I - Convex Underestimating Problems PDFDocument29 pages1976 McCormick. Computability of Global Solutions To Factorable Nonconvex Programs Part I - Convex Underestimating Problems PDFDimitrisSotiropoulosNo ratings yet

- Econometrics 2 Exam AnswersDocument6 pagesEconometrics 2 Exam AnswersDavide Rossetti67% (3)

- Uncertainty Analysis of Heat-Exchanger Thermal Designs Using The Monte Carlo Simulation TechniqueDocument8 pagesUncertainty Analysis of Heat-Exchanger Thermal Designs Using The Monte Carlo Simulation TechniqueJenn Lusther MutiaNo ratings yet

- AdditionEfficiency EstimatingProductionFunctionsDocument6 pagesAdditionEfficiency EstimatingProductionFunctionsNorman MaldonadoNo ratings yet

- Capacitor Placement For Loss Reduction in Radial Distribution Networks: A Two Stage ApproachDocument6 pagesCapacitor Placement For Loss Reduction in Radial Distribution Networks: A Two Stage ApproachmohancrescentNo ratings yet

- Fabio EJORDocument12 pagesFabio EJORLaura Chaves MirandaNo ratings yet

- Two-Step Algorithms For Linear Inverse Problems With Non-Quadratic RegularizationDocument4 pagesTwo-Step Algorithms For Linear Inverse Problems With Non-Quadratic RegularizationJohny TravoltaNo ratings yet

- A Model-Trust Region Algorithm Utilizing A Quadratic InterpolantDocument11 pagesA Model-Trust Region Algorithm Utilizing A Quadratic InterpolantCândida MeloNo ratings yet

- Hypo DDDocument4 pagesHypo DDLia SpadaNo ratings yet

- Ieee Wind EnergyDocument16 pagesIeee Wind EnergyAnonymous ZFt1pzKY1No ratings yet

- Double IntegralsDocument12 pagesDouble IntegralsElena Pinka100% (1)

- Aggregation of Malmquist Productivity IndexesDocument11 pagesAggregation of Malmquist Productivity IndexesjanaNo ratings yet

- 2 Oieyqhwgfdewio 9 D 328 eDocument1 page2 Oieyqhwgfdewio 9 D 328 euihgfhjjhghNo ratings yet

- The Finite-Difference Time-Domain (FDTD) Algorithm: James R. NagelDocument7 pagesThe Finite-Difference Time-Domain (FDTD) Algorithm: James R. NagelRajesh UpadhyayNo ratings yet

- Optimal Choice Between Parametric and Non-ParametrDocument30 pagesOptimal Choice Between Parametric and Non-ParametrpabloninoNo ratings yet

- Autocovariance Least Square Method For Estimating Noise CovariancesDocument6 pagesAutocovariance Least Square Method For Estimating Noise Covariancesnadamau22633No ratings yet

- Gain Optimization of A Multi-Layer Printed Dipole Array Using Evolutionary ProgrammingDocument4 pagesGain Optimization of A Multi-Layer Printed Dipole Array Using Evolutionary ProgrammingA. VillaNo ratings yet

- Optimal Allocation of RenewableDocument17 pagesOptimal Allocation of RenewableMatthew SimeonNo ratings yet

- Machine Learning For Quantitative Finance: Fast Derivative Pricing, Hedging and FittingDocument15 pagesMachine Learning For Quantitative Finance: Fast Derivative Pricing, Hedging and FittingJ Martin O.No ratings yet

- Maple DuhamelDocument6 pagesMaple DuhamelMatteo SoruNo ratings yet

- Damrbine Rand InvDocument16 pagesDamrbine Rand InvВячеслав КарнаевNo ratings yet

- The Fourier Flexible Form - 1984 - GallantDocument6 pagesThe Fourier Flexible Form - 1984 - GallantMds DmsNo ratings yet

- A Predictive Approach To The Random Effect ModelDocument7 pagesA Predictive Approach To The Random Effect ModelKamal DemmamiNo ratings yet

- On The K-Ary Hypercube: Theoretical Computer Science 140 (1995) 333-339Document7 pagesOn The K-Ary Hypercube: Theoretical Computer Science 140 (1995) 333-339Khánh DuyNo ratings yet

- Journal of Cohiputaltonal PhysicsDocument5 pagesJournal of Cohiputaltonal PhysicsDimitrios Christos SarvanisNo ratings yet

- Agri Unit 3 - BhavaniDocument21 pagesAgri Unit 3 - BhavaniytafegtNo ratings yet

- What Energy Functions Can Be Minimized Via Graph Cuts?Document18 pagesWhat Energy Functions Can Be Minimized Via Graph Cuts?kenry52No ratings yet

- An Integrated Time-Depending Feasibility Analysis ModelDocument18 pagesAn Integrated Time-Depending Feasibility Analysis ModelthanosssNo ratings yet

- Production FunctionDocument7 pagesProduction FunctionKennara pradipta IdnNo ratings yet

- Econ300 Problem SetsDocument12 pagesEcon300 Problem SetsMark VazquezNo ratings yet

- (2002) Malzahn OpperDocument7 pages(2002) Malzahn OpperAmine HadjiNo ratings yet

- Steering and Visualization of Electro-Magnetic Simulations Using The Globus Implementation of A Computational GridDocument16 pagesSteering and Visualization of Electro-Magnetic Simulations Using The Globus Implementation of A Computational GridIdris TarwalaNo ratings yet

- Tolerance Interval For Exponentiated Exponential Distribution Based On Grouped DataDocument5 pagesTolerance Interval For Exponentiated Exponential Distribution Based On Grouped Datawww.irjes.comNo ratings yet

- Applied Sciences: Equivalence Between Fuzzy PID Controllers and Conventional PID ControllersDocument12 pagesApplied Sciences: Equivalence Between Fuzzy PID Controllers and Conventional PID ControllersxXElcaXxNo ratings yet

- The Renormalization Group and The Diffusion Equation: Masami Matsumoto, Gota Tanaka, and Asato TsuchiyaDocument13 pagesThe Renormalization Group and The Diffusion Equation: Masami Matsumoto, Gota Tanaka, and Asato TsuchiyapedroNo ratings yet

- Katholieke Universiteit Leuven, E.E. Dept., Kasteelpark Arenberg 10, B-3001 Heverlee, Belgium Email: (Deepaknath - Tandur, Marc - Moonen) @esat - Kuleuven.beDocument4 pagesKatholieke Universiteit Leuven, E.E. Dept., Kasteelpark Arenberg 10, B-3001 Heverlee, Belgium Email: (Deepaknath - Tandur, Marc - Moonen) @esat - Kuleuven.beSoumitra BhowmickNo ratings yet

- Strong Coupling Model For High-Tc Copper-Oxide SuperconductorsDocument8 pagesStrong Coupling Model For High-Tc Copper-Oxide SuperconductorsIAEME PublicationNo ratings yet

- Arnold 1974Document4 pagesArnold 1974litter_trashNo ratings yet

- Vojta PaperDocument41 pagesVojta PaperLuljanNo ratings yet

- Ch7 Asm SE-nptelDocument26 pagesCh7 Asm SE-nptelMainak ChatterjeeNo ratings yet

- A Two Parameter Distribution Obtained byDocument15 pagesA Two Parameter Distribution Obtained byc122003No ratings yet

- ch08 AnsDocument20 pagesch08 Ansrifdah abadiyahNo ratings yet

- Topic5 ProductionDocument9 pagesTopic5 ProductionRudy Martin Bada AlayoNo ratings yet

- Calculation of GOSF PDFDocument3 pagesCalculation of GOSF PDFpremNo ratings yet

- Andersson Djehiche - AMO 2011Document16 pagesAndersson Djehiche - AMO 2011artemischen0606No ratings yet

- TMP 6 EEEDocument3 pagesTMP 6 EEEFrontiersNo ratings yet

- A New Index Calculus Algorithm With Complexity L (1/4 + o (1) ) in Small CharacteristicDocument23 pagesA New Index Calculus Algorithm With Complexity L (1/4 + o (1) ) in Small Characteristicawais04No ratings yet

- Chapter 3-Theory-ProductionDocument25 pagesChapter 3-Theory-ProductionKumar SiddharthNo ratings yet

- Chapter 3-Theory-Production PDFDocument25 pagesChapter 3-Theory-Production PDFKumar SiddharthNo ratings yet

- MMC 1Document7 pagesMMC 1Hai Nguyen ThanhNo ratings yet

- Cobb Douglas and Returns To ScaleDocument6 pagesCobb Douglas and Returns To ScalemolnarandrasNo ratings yet

- Exercises PDFDocument33 pagesExercises PDFCarlos Eduardo Melo MartínezNo ratings yet

- Journal of Computer and System SciencesDocument8 pagesJournal of Computer and System SciencessutriNo ratings yet

- An Agent-Based Architecture For The Decision Support ProcessDocument11 pagesAn Agent-Based Architecture For The Decision Support ProcessLourdes B.D.No ratings yet

- Annals of MathematicsDocument42 pagesAnnals of MathematicsKauê SenaNo ratings yet

- 1976 Dodziuk FiniteDifferenceApproachHodge 1976Document27 pages1976 Dodziuk FiniteDifferenceApproachHodge 1976WH CNo ratings yet

- The Finite-Difference Time-Domain (FDTD) Algorithm: James R. NagelDocument7 pagesThe Finite-Difference Time-Domain (FDTD) Algorithm: James R. NagelSadie WilliamsonNo ratings yet

- CHP 1curve FittingDocument21 pagesCHP 1curve FittingAbrar HashmiNo ratings yet

- Balke Ma 1990Document10 pagesBalke Ma 1990Btari ArsytaNo ratings yet

- Kumbahar 2018Document105 pagesKumbahar 2018zdenkaNo ratings yet

- Karakaplan 2017Document14 pagesKarakaplan 2017zdenkaNo ratings yet

- Hayatullah 2017Document49 pagesHayatullah 2017zdenkaNo ratings yet

- Reinhard Lovell Thijs Se Nej or 2000Document18 pagesReinhard Lovell Thijs Se Nej or 2000zdenkaNo ratings yet

- Lovell EJOR1995Document11 pagesLovell EJOR1995zdenkaNo ratings yet

- 2021 4124 AjbeDocument24 pages2021 4124 AjbezdenkaNo ratings yet

- Kumbhakar 2017 SFA ReviewDocument103 pagesKumbhakar 2017 SFA ReviewzdenkaNo ratings yet

- Steele 1995Document22 pagesSteele 1995zdenkaNo ratings yet

- Efficiency Analysis Using STATADocument3 pagesEfficiency Analysis Using STATAzdenkaNo ratings yet

- Are Developing Countries Catching Up?: Vladimir Popov and K. S. JomoDocument14 pagesAre Developing Countries Catching Up?: Vladimir Popov and K. S. JomozdenkaNo ratings yet

- Detection of Multiple Change Points From Clustering Individual ObservationsDocument13 pagesDetection of Multiple Change Points From Clustering Individual ObservationsAlexandre HesslerNo ratings yet

- BIOMETRYcDocument319 pagesBIOMETRYcdawud kuroNo ratings yet

- Fundamental Statistics For The Behavioral Sciences v2.0Document342 pagesFundamental Statistics For The Behavioral Sciences v2.0Mark Kyle P. AndresNo ratings yet

- Statistics Session 4: "There Are Three Kinds of Lies: Lies, Damned Lies, and Statistics."Document34 pagesStatistics Session 4: "There Are Three Kinds of Lies: Lies, Damned Lies, and Statistics."Christina Sliney-BissNo ratings yet

- SMOGD User Manual Vsn2.6Document5 pagesSMOGD User Manual Vsn2.6Jaqueline Figuerêdo RosaNo ratings yet

- CFA - 2 & 3. Quantitative MethodDocument22 pagesCFA - 2 & 3. Quantitative MethodChan Kwok WanNo ratings yet

- Chapter 5 Indicators and VariablesDocument24 pagesChapter 5 Indicators and Variablestemesgen yohannesNo ratings yet

- RELAXING ASSUMPTIONS OF CLRMsDocument75 pagesRELAXING ASSUMPTIONS OF CLRMswebeshet bekeleNo ratings yet

- Adaptive FiltersDocument167 pagesAdaptive FiltersArunmozhliNo ratings yet

- Chapter IIDocument31 pagesChapter IIAnmut YeshuNo ratings yet

- Driscoll Kraay REStat 1998Document13 pagesDriscoll Kraay REStat 1998filipegaustiNo ratings yet

- Introduction To Inferential Statistics: Jomel R. AlanzalonDocument36 pagesIntroduction To Inferential Statistics: Jomel R. AlanzalonCedrick GamatanNo ratings yet

- C-7 Sampling DistribuDocument109 pagesC-7 Sampling DistribuBiruk MengstieNo ratings yet

- L16 QcarDocument9 pagesL16 QcarBruce bannerNo ratings yet

- MST-004 Statistical Inference: EstimationDocument4 pagesMST-004 Statistical Inference: EstimationvikrammoolchandaniNo ratings yet

- CDDocument90 pagesCDcjonNo ratings yet

- Advanced Statistical Approaches To Quality: INSE 6220 - Week 4Document44 pagesAdvanced Statistical Approaches To Quality: INSE 6220 - Week 4picalaNo ratings yet

- Ap Statistics Final Exam / Fall2007Document2 pagesAp Statistics Final Exam / Fall2007teachopensourceNo ratings yet

- Final Report Descriptive Statistics Group 4Document38 pagesFinal Report Descriptive Statistics Group 4QuanNo ratings yet

- Croon's Bias-Corrected Factor Score Path Analysis For Small-To Moderate - Sample Multilevel Structural Equation ModelsDocument23 pagesCroon's Bias-Corrected Factor Score Path Analysis For Small-To Moderate - Sample Multilevel Structural Equation ModelsPhuoc NguyenNo ratings yet

- Bias, Precision and AccuracyDocument15 pagesBias, Precision and Accuracyadrian0149No ratings yet

- First Semester: Highest Enabling Strategy To Have in Developing The Highest Thinking Skill To AssessDocument5 pagesFirst Semester: Highest Enabling Strategy To Have in Developing The Highest Thinking Skill To AssessJonory Qaquilala BojosNo ratings yet

- 1 Descriptive Analysis CompleteDocument11 pages1 Descriptive Analysis CompleteM WaleedNo ratings yet

- Buss. Stat CH-2Document13 pagesBuss. Stat CH-2Jk K100% (1)

- Market Power and Price Transmission in The Supply Chain Working PaperDocument48 pagesMarket Power and Price Transmission in The Supply Chain Working PaperIVI THEODOULOUNo ratings yet

- 8Document9 pages8Bahadır HarmancıNo ratings yet

- Principles of Data Analysis - Prasenjit Saha (2003) PDFDocument86 pagesPrinciples of Data Analysis - Prasenjit Saha (2003) PDFasantambNo ratings yet