Professional Documents

Culture Documents

Bill 1091601100

Uploaded by

Hoang DinhOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bill 1091601100

Uploaded by

Hoang DinhCopyright:

Available Formats

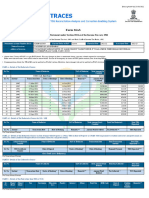

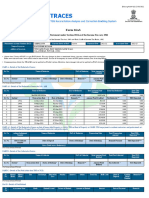

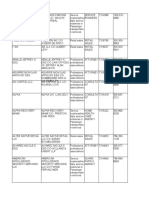

2020_DefaultedTaxBill_R02.

pdf 1 6/3/2020 4:39:29 PM

Dan McAllister

SAN DIEGO COUNTY

TREASURER-TAX COLLECTOR

1 TAX BILL YEAR ORIGINAL YEAR OF DEFAULT - JUL 01, 2021 THRU JUN 30, 2022

PAY ONLINE 2 PROPERTY DESCRIPTION

sdttc.com 2022/2023

CURRENT

OWNER MOORE, MARGARET S

7502 HIGH ST, LA JOLLA CA 92037-5213

3 TAX DEFAULT DATE

06-30-2022

4 PARCEL NO.

SPECIAL

MESSAGE 109-160-11-00

5 ORIGINAL PARCEL NO.

109-160-11-00

IF PROPERTY OWNERSHIP HAS CHANGED, PLEASE CONTACT

THE SAN DIEGO COUNTY ASSESSOR’S OFFICE AT (619) 236-3771

FOR ADDRESS CHANGE OR IMPORTANT TAX INFORMATION, SEE REVERSE SIDE

6 DEFAULTED PARCEL NO. 7 DEFAULTED AMOUNT 8 ADDITIONAL PENALTIES 9 DEFAULT CREDIT 10 SUSPENSE 11 AMOUNT DUE 12 IF PAID BY

109-160-11-00 92.62 45.32 0.00 0.00 137.94 05/31/2023

13 14

THE TAXES ON THIS PROPERTY ARE DEFAULTED REFER TO THE MONTH OF PAYMENT

FOR THE YEARS SHOWN BELOW FOR THE TOTAL AMOUNT DUE

YEAR(S) *CODE TAX BILL NUMBER **DEFAULTED AMOUNT MONTH YEAR ***AMOUNT DUE

2021 B 109-160-11-00 92.62 JUL 2022 126.74

DO NOT PAY AUG 2022 127.86

SEP 2022 128.98

DEFAULTED AMOUNT,

C

OCT 2022 130.10

PAY AMOUNT DUE. NOV 2022 131.22

M DEC 2022 132.34

JAN 2023 133.46

Y

FEB 2023 134.58

MAR 2023 135.70

CM

APR 2023 136.82

MY

MAY 2023 137.94

JUN 2023 139.06

DEFAULTED TAX BILL

CY

MONTHLY PENALTY & INTEREST: 1.12

CMY

:

K

154L (06/20)

CURRENT YEAR TAXES ARE NOT INCLUDED IN THE ABOVE AMOUNTS CURRENT YEAR TAXES ARE NOT INCLUDED IN THE ABOVE AMOUNTS

*CODE **DEFAULTED AMOUNT ***AMOUNT DUE

B = Both 1st & 2nd Installment Sum of base tax, 10% delinquent Sum of prior year taxes, delinquency penalties, costs, redemption penalties and redemption fees.

S = Second Installment Only penalties, and $10.00 cost

DETACH HERE DETACH HERE

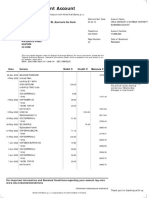

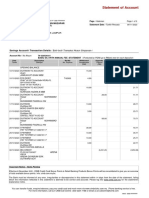

WRITE YOUR PARCEL NO. ON YOUR CHECK. SAN DIEGO COUNTY 2022 - 2023 DEFAULTED SECURED PROPERTY TAX STATEMENT

INCLUDE STUB WITH PAYMENT ORIGINAL YEAR OF DEFAULT JUL 01, 2021 THRU JUN 30, 2022

15 DEFAULTED PARCEL NO. 16 DEFAULTED AMOUNT -17 ADDITIONAL PENALTIES 18 DEFAULT CREDIT 19 SUSPENSE 20 AMOUNT DUE 21 IF PAID BY

109-160-11-00 92.62 45.32 0.00 0.00 137.94 05/31/2023

Dan McAllister PAY THIS AMOUNT

San Diego County Treasurer-Tax Collector

e-Pay at sdttc.com

MONTH: MAY $ 137.94

MOORE, MARGARET S

22 PAYABLE TO:

7502 HIGH ST, LA JOLLA CA 92037-5213

SDTTC 126.74 J 133.46 J

P.O. Box 129009

127.86 A 134.58 F

San Diego, California 92112 128.98 S 135.70 M

130.10 O 136.82 A

131.22 N 137.94 M

132.34 D 139.06 J

0100000926210916011001000009262109160110020 ⑁⑁

You might also like

- (HSBC Case 2021) Team 1 FTU2 - DisneylandDocument25 pages(HSBC Case 2021) Team 1 FTU2 - DisneylandCuongNo ratings yet

- Walmart Sample Training ProgramDocument17 pagesWalmart Sample Training ProgramNisha BrosNo ratings yet

- Dali Foods Group: Short Shelf Life Bread Brand Meibeichen LaunchedDocument8 pagesDali Foods Group: Short Shelf Life Bread Brand Meibeichen LaunchedAshokNo ratings yet

- Gasbill 1610790000 202211 20221122224206Document1 pageGasbill 1610790000 202211 20221122224206Kashan KhanNo ratings yet

- Gasbill 6094965643 202212 20230124224202Document1 pageGasbill 6094965643 202212 20230124224202Irfan RazaNo ratings yet

- Chap3A SuiteDocument3 pagesChap3A Suitejamel008No ratings yet

- Gasbill 1637628500 202212 20221228165913Document1 pageGasbill 1637628500 202212 20221228165913Asad KhanNo ratings yet

- Research PaperDocument1 pageResearch PaperRed BullNo ratings yet

- Cxopa8338n 2022Document4 pagesCxopa8338n 202218veera98No ratings yet

- Gasbill 6296551000 202107 20210808011855Document1 pageGasbill 6296551000 202107 20210808011855Muhammad TouseefNo ratings yet

- Cover LetterDocument2 pagesCover LetterValeria ValeraNo ratings yet

- Aaape9984b Q1 2023-24Document10 pagesAaape9984b Q1 2023-24Century Flour Mills Limited Head OfficeNo ratings yet

- Final Soa - MZ-01846 CorvillaDocument1 pageFinal Soa - MZ-01846 CorvillaThomas ShelbyNo ratings yet

- SSGC Bill JunDocument1 pageSSGC Bill Junshahzaib azamNo ratings yet

- Aabfh0358k Q1 2023-24Document4 pagesAabfh0358k Q1 2023-24pushpa GeoNo ratings yet

- Gasbill 9303691000 202209 20221019105941Document1 pageGasbill 9303691000 202209 20221019105941Gaming RoomNo ratings yet

- PPH 22 Ta2022Document13 pagesPPH 22 Ta2022kukorem022 PantaitimurNo ratings yet

- Gasbill - Mr. AYUBDocument1 pageGasbill - Mr. AYUBShazak KhanNo ratings yet

- RHY-Account Statement-2022-07-31Document3 pagesRHY-Account Statement-2022-07-31luxyitgirlNo ratings yet

- Adlpn2283n 2022Document4 pagesAdlpn2283n 2022SUNIL GAIKWADNo ratings yet

- SSGC Bill JunDocument1 pageSSGC Bill Junshahzaib azamNo ratings yet

- 31 Dec 2022 To 01 Jan 2023 FCMB StaementDocument1 page31 Dec 2022 To 01 Jan 2023 FCMB StaementNickNo ratings yet

- Releve Bancaire Agnini Mandjara FinaliseDocument4 pagesReleve Bancaire Agnini Mandjara FinaliseHornance KacouNo ratings yet

- Gasbill 9129201000 202201 20220216094206 PDFDocument1 pageGasbill 9129201000 202201 20220216094206 PDFSalman ZaidiNo ratings yet

- Torrent Power Now On Whatsapp: Your DetailsDocument2 pagesTorrent Power Now On Whatsapp: Your DetailsSatkar GarmentNo ratings yet

- Gasbill 2806127854 202207 20220811162251Document1 pageGasbill 2806127854 202207 20220811162251Usman NoonariNo ratings yet

- Credit Card Statement - AddressDocument2 pagesCredit Card Statement - AddressKiranNo ratings yet

- DownloadDocument1 pageDownloadDisebo Mama-DintleNo ratings yet

- Mukesh Kumar ShahDocument2 pagesMukesh Kumar Shahrutuja rogeNo ratings yet

- BFZPS6321F-2022 AsDocument4 pagesBFZPS6321F-2022 AsAstral CorporationNo ratings yet

- Chap2B SuiteDocument14 pagesChap2B Suitejamel008No ratings yet

- Gasbill 5687436293 202209 20221020201329Document1 pageGasbill 5687436293 202209 20221020201329Rajan MaiNo ratings yet

- Payroll Activity Details: Bay Beak Co. From 1 January 2022 To 31 January 2022Document2 pagesPayroll Activity Details: Bay Beak Co. From 1 January 2022 To 31 January 2022Janine Leigh BacalsoNo ratings yet

- BillSTMT 4588260001664681Document2 pagesBillSTMT 4588260001664681Sajid AliNo ratings yet

- SSGC Duplicate Bill20210123 090016Document1 pageSSGC Duplicate Bill20210123 090016Ghulam Baqir MazariNo ratings yet

- There Are No Active Loans Available For The Customer.: Suman KumarDocument7 pagesThere Are No Active Loans Available For The Customer.: Suman KumarRokoxNo ratings yet

- 40c4b8d7e9 2022091001961 4596179-UnlockedDocument2 pages40c4b8d7e9 2022091001961 4596179-UnlockedBlake WagnerNo ratings yet

- SSGC Duplicate Bill20210323 132303Document1 pageSSGC Duplicate Bill20210323 132303toseef ul islamNo ratings yet

- Kartu Piutang NewDocument1 pageKartu Piutang Newodolz126No ratings yet

- Gasbill 6166150000 202012 20201229150550Document1 pageGasbill 6166150000 202012 20201229150550Hasan ShahNo ratings yet

- Accounting Payroll February.4.2022-Releasing ReceiptDocument8 pagesAccounting Payroll February.4.2022-Releasing Receiptcherish nicole lopezNo ratings yet

- March, 2023 Domestic: Customer Number: Billing Month: Tariff/Customer Class: Bill ID: 493556555496Document1 pageMarch, 2023 Domestic: Customer Number: Billing Month: Tariff/Customer Class: Bill ID: 493556555496Khalil juttNo ratings yet

- GasbillDocument1 pageGasbillasif razaNo ratings yet

- Apr 22Document3 pagesApr 22honey moneyNo ratings yet

- PTO Vouchers March.15.2022-Releasing ReceiptDocument1 pagePTO Vouchers March.15.2022-Releasing Receiptcherish nicole lopezNo ratings yet

- File OpenDocument1 pageFile OpenAbdul MoizNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Sourabh PunshiNo ratings yet

- CBFPS9716K 2022Document4 pagesCBFPS9716K 2022Hritik SinghNo ratings yet

- Gasbill 5568246016 202112 20211228191312Document1 pageGasbill 5568246016 202112 20211228191312ahmedNo ratings yet

- GRA Taxpayer PortalDocument1 pageGRA Taxpayer PortalCourageNo ratings yet

- ThiasDocument1 pageThiassam cyberNo ratings yet

- Statement of Account: Customer Name Start DateDocument3 pagesStatement of Account: Customer Name Start DateAdisa LeeNo ratings yet

- Fund Transfer 2022Document14 pagesFund Transfer 2022ShielaNo ratings yet

- Civil WorksDocument7 pagesCivil WorksJoy DimaculanganNo ratings yet

- 29th July 2022Document2 pages29th July 2022Morena hartnettNo ratings yet

- RHY-Account Statement-2022-08-31Document3 pagesRHY-Account Statement-2022-08-31luxyitgirlNo ratings yet

- Form 26asDocument6 pagesForm 26asSubramanyam JonnaNo ratings yet

- Jun 22Document3 pagesJun 22honey moneyNo ratings yet

- Dec 22Document3 pagesDec 22PankajNo ratings yet

- Bku Desember 1 22Document3 pagesBku Desember 1 22cinthiaNo ratings yet

- Statement of Accounts - 184545858Document5 pagesStatement of Accounts - 184545858DEEPAK KUMAR NANDANo ratings yet

- Aeipk2207b 2022Document4 pagesAeipk2207b 2022Varinder KumarNo ratings yet

- ICAEW Accounting QB 2023Document80 pagesICAEW Accounting QB 2023daolengan03No ratings yet

- Oracle® Daily Business Intelligence: Implementation Guide Release 12Document726 pagesOracle® Daily Business Intelligence: Implementation Guide Release 12Andres RosendoNo ratings yet

- Case Study TPM Jet AirwaysDocument15 pagesCase Study TPM Jet AirwaysSanjay Domdiya100% (1)

- Electronic Reservation Slip (ERS) : 2100858446 12056/Ndls Janshtabdi Second Sitting (RESERVED) (2S)Document3 pagesElectronic Reservation Slip (ERS) : 2100858446 12056/Ndls Janshtabdi Second Sitting (RESERVED) (2S)vineetkr.2349No ratings yet

- Packaging Industry ReportDocument44 pagesPackaging Industry ReportKunalNo ratings yet

- Project Proposal To Establish A Chicken ProjectDocument4 pagesProject Proposal To Establish A Chicken ProjectIsaac Chinoda100% (1)

- 15 Marzo 21 BrikelDocument20 pages15 Marzo 21 BrikelAndres TabaresNo ratings yet

- Research Paper On DominosDocument4 pagesResearch Paper On Dominoshgrmzbikf100% (1)

- APDRDocument2 pagesAPDRKyrene MartinezNo ratings yet

- Casio Pest-AnaylsisDocument7 pagesCasio Pest-Anaylsistheresemondelo0No ratings yet

- EntrepDocument7 pagesEntrepPantz Revibes PastorNo ratings yet

- QL Ar2021Document120 pagesQL Ar2021saw hung yeatNo ratings yet

- Chellan Federal-BankDocument1 pageChellan Federal-BankAbhijith. ANo ratings yet

- Cover Sheet: - To Record Overall Project and Assessment DetailsDocument62 pagesCover Sheet: - To Record Overall Project and Assessment DetailsNabilBouabanaNo ratings yet

- Sem-V - Principles of Taxation LawDocument2 pagesSem-V - Principles of Taxation LawChoudhary Shadab phalwan100% (1)

- Statement Cimb NovDocument3 pagesStatement Cimb NovfaqrullhNo ratings yet

- Our Products: Powercore Grain Oriented Electrical SteelDocument20 pagesOur Products: Powercore Grain Oriented Electrical SteelkoalaboiNo ratings yet

- Portfolio IMDocument8 pagesPortfolio IMtikvicfNo ratings yet

- LTC MCQDocument56 pagesLTC MCQcaretakercellroldhNo ratings yet

- Strategic Supply Chain Management PPT ScheduleDocument3 pagesStrategic Supply Chain Management PPT ScheduleMan unitedNo ratings yet

- Corporate StrategyDocument15 pagesCorporate StrategyAbhilasha BagariyaNo ratings yet

- Atriark WhitepaperDocument40 pagesAtriark Whitepaperbudi satrio pratamaNo ratings yet

- Draft CIPL - 4 Inch DP S135Document1 pageDraft CIPL - 4 Inch DP S135Hammy SariNo ratings yet

- 6-SOM-service InventoryDocument10 pages6-SOM-service InventoryUrmilaAnantNo ratings yet

- Standard Terms and Conditions Senheng - APPLE IPHONE 12 1.0 Promotion PeriodDocument2 pagesStandard Terms and Conditions Senheng - APPLE IPHONE 12 1.0 Promotion PeriodcikgutiNo ratings yet

- An Overall Financial Analysis of Tesla: Jingyuan FangDocument6 pagesAn Overall Financial Analysis of Tesla: Jingyuan FangShahmala PerabuNo ratings yet

- Photoshop Javascript Ref 2020Document233 pagesPhotoshop Javascript Ref 2020deathvimNo ratings yet