Professional Documents

Culture Documents

Customes in Islamic Finance

Customes in Islamic Finance

Uploaded by

Abdullahi ManirOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Customes in Islamic Finance

Customes in Islamic Finance

Uploaded by

Abdullahi ManirCopyright:

Available Formats

Customs and traditions are an integral part of Islamic finance as they reflect the practices and norms

of the community. In Islamic finance, customs are considered an important source of law as they

provide guidance on issues that are not explicitly addressed in the Quran or Sunnah. In this essay, we

will discuss the role of customs in Islamic finance and their importance as a source of law.

The Role of Customs in Islamic Finance

Customs are an important source of law in Islamic finance because they reflect the practices and

norms of the community. In Islamic finance, customs can provide guidance on issues that are not

explicitly addressed in the Quran or Sunnah. For example, customary practices can help determine

the standard of care required of a trustee or the types of investments that are considered

permissible. Customary practices can also help establish the market rate for certain financial

transactions, such as the price of gold or the profit margin for a murabaha transaction.

Customs can be defined as practices that have been accepted and followed by a community over a

period of time. In Islamic finance, customs are often referred to as "urf" or "adat." Urf refers to the

customs and practices that are followed by a community, while adat refers to the customary

practices that are followed by a particular tribe or group of people.

Customs are an important source of law in Islamic finance because they provide guidance on issues

that are not explicitly addressed in the Quran or Sunnah. For example, the Quran and Sunnah

provide guidelines on the types of investments that are considered permissible in Islam, but they do

not provide specific guidance on the types of investments that are considered permissible in Islamic

finance. Customs can help fill this gap by providing guidance on the types of investments that are

considered permissible in Islamic finance.

Customs can also help establish the market rate for certain financial transactions. For example, the

price of gold is often determined by the market rate, which is established based on the customs and

practices of the community. Similarly, the profit margin for a murabaha transaction is often

determined by the market rate, which is established based on the customs and practices of the

community.

Customs can also help ensure that Islamic finance is responsive to the needs of the community and

reflects the values and principles of Shariah. For example, customs can help ensure that Islamic

finance is socially responsible by promoting the welfare of the community and avoiding practices

that are harmful to society.

The Importance of Customs as a Source of Law in Islamic Finance

Customs are an important source of law in Islamic finance because they reflect the practices

You might also like

- Islamic Theology. Traditionalism and Rationalism (PDFDrive)Document120 pagesIslamic Theology. Traditionalism and Rationalism (PDFDrive)Oktarisanti Syahda PutriNo ratings yet

- The Chancellor Guide to the Legal and Shari'a Aspects of Islamic FinanceFrom EverandThe Chancellor Guide to the Legal and Shari'a Aspects of Islamic FinanceNo ratings yet

- DocumentDocument2 pagesDocumentAbdullahi ManirNo ratings yet

- Quran in Islamic FinanceDocument2 pagesQuran in Islamic FinanceAbdullahi ManirNo ratings yet

- IntroductionDocument21 pagesIntroductionmuhammad jaffarNo ratings yet

- Jurnal Kaidah Kelompok 12Document12 pagesJurnal Kaidah Kelompok 12REFALDI R. IHSANNo ratings yet

- 11-2-Ahmad - 5 - Iktinaz and Islamic Monetary PolicyDocument15 pages11-2-Ahmad - 5 - Iktinaz and Islamic Monetary PolicySiti Nur RosifahNo ratings yet

- Islamic Economics and FinanceDocument20 pagesIslamic Economics and FinancearyonsNo ratings yet

- Islamic Finance Effect On Public Islamic Bank BerhadDocument39 pagesIslamic Finance Effect On Public Islamic Bank BerhadHari Dass100% (1)

- The Islamic Economic System As A Model For The World To FollowDocument5 pagesThe Islamic Economic System As A Model For The World To FollowZ_JahangeerNo ratings yet

- About Islamic BankingDocument2 pagesAbout Islamic BankingSara RothNo ratings yet

- Iktin Z and Islamic Monetary: PolicyDocument15 pagesIktin Z and Islamic Monetary: PolicyShaz MaNo ratings yet

- Significance.104 SairDocument6 pagesSignificance.104 SairSyed sair SheraziNo ratings yet

- My Proposal For PHD-2Document16 pagesMy Proposal For PHD-2Alhumaidy TomNo ratings yet

- MRP Interim Ankush 09bs0000323Document15 pagesMRP Interim Ankush 09bs0000323sonu1aNo ratings yet

- Name AQIB BBHM-F19-067 BBA-5ADocument5 pagesName AQIB BBHM-F19-067 BBA-5AJabbar GondalNo ratings yet

- Principles and Practice of Islamic Finance Systems (Dr. Julius Bertillo)Document19 pagesPrinciples and Practice of Islamic Finance Systems (Dr. Julius Bertillo)Dr. Julius B. BertilloNo ratings yet

- The Extent of Tawhid and Effect To Islamic Finance ActivitiesDocument9 pagesThe Extent of Tawhid and Effect To Islamic Finance ActivitiesFaridz RahimNo ratings yet

- RFLR v9 n3 1Document6 pagesRFLR v9 n3 1Yousef AbuhejlehNo ratings yet

- Attempt Count: 1: Student Name: ABASS GBLA Student ID: 10102295 Course Name/Code: ECM 401 Assignment QuestionDocument4 pagesAttempt Count: 1: Student Name: ABASS GBLA Student ID: 10102295 Course Name/Code: ECM 401 Assignment QuestionAbass GblaNo ratings yet

- The Role of Islamic Finance in The Economy of UzbekistanDocument4 pagesThe Role of Islamic Finance in The Economy of UzbekistanAcademic JournalNo ratings yet

- Maqasid Al Shariah in Islamic FinanceDocument22 pagesMaqasid Al Shariah in Islamic Financemiaser 1986No ratings yet

- Business Communication 5001 Assignment No 1 Autumn 2020Document21 pagesBusiness Communication 5001 Assignment No 1 Autumn 2020Mujtaba AhmedNo ratings yet

- 1 - Introduction To The Islamic Financial SystemDocument49 pages1 - Introduction To The Islamic Financial Systemyloli9201No ratings yet

- Islamic Finance - TonyDocument18 pagesIslamic Finance - TonylimNo ratings yet

- Islamic Finance Final ProjectDocument83 pagesIslamic Finance Final ProjectMohammed YunusNo ratings yet

- Parallelism Between Interest Rate and PR PDFDocument9 pagesParallelism Between Interest Rate and PR PDFSayed Sharif HashimiNo ratings yet

- Economic System of IslamDocument6 pagesEconomic System of IslamHamza KayaniNo ratings yet

- Intro To Islamic FinanceDocument58 pagesIntro To Islamic FinancesamiyamirNo ratings yet

- Chapter - 1Document29 pagesChapter - 1Maruf AhmedNo ratings yet

- Ravi ReportDocument9 pagesRavi ReportAli RawaniNo ratings yet

- The Role of Islamic Financial Systems and Banking Institutions in Global Economic RecoveryDocument41 pagesThe Role of Islamic Financial Systems and Banking Institutions in Global Economic Recoveryjhulz0763No ratings yet

- Theoretical Studies in Islamic Banking and FinanceFrom EverandTheoretical Studies in Islamic Banking and FinanceRating: 5 out of 5 stars5/5 (1)

- Sukuk in Various Jurisdictions: Shari'ah and Legai IssuesDocument22 pagesSukuk in Various Jurisdictions: Shari'ah and Legai Issuesibraheem alaniNo ratings yet

- Islamic Accounting Ch1Document33 pagesIslamic Accounting Ch1Yusuf HusseinNo ratings yet

- Article 4Document22 pagesArticle 4Heap Ke XinNo ratings yet

- Conventional and Islamic Indices: A Comparison On PerformanceDocument16 pagesConventional and Islamic Indices: A Comparison On PerformanceLAMOUCHI RIMNo ratings yet

- Napier Haniffa Introduction To Islamic Accounting 2011Document14 pagesNapier Haniffa Introduction To Islamic Accounting 2011OwlNo ratings yet

- "Shari'a", and The Exact Literal Translation of "Shari'a" Is "A Clear Path To Be Followed andDocument7 pages"Shari'a", and The Exact Literal Translation of "Shari'a" Is "A Clear Path To Be Followed andJohn Marc ChullNo ratings yet

- Business Ethics in Islam Hifza Mumtaz SAP: 11947Document3 pagesBusiness Ethics in Islam Hifza Mumtaz SAP: 11947Jerry Khan NiaziNo ratings yet

- The Principles of Islamic Marketing CH1Document24 pagesThe Principles of Islamic Marketing CH1Shah AzeemNo ratings yet

- 6179-Article Text-15651-1-10-20190217Document10 pages6179-Article Text-15651-1-10-20190217Habib Sultan KhelNo ratings yet

- An Empirical SurveyDocument26 pagesAn Empirical SurveyRafiqul IslamNo ratings yet

- Book - Islamic Banking, Basic Guide PDFDocument49 pagesBook - Islamic Banking, Basic Guide PDFJIREN SHIS HAMUNo ratings yet

- Islamic Jurisprudence AssignmentDocument14 pagesIslamic Jurisprudence AssignmentSalman malikNo ratings yet

- Afs3513 Jurnal Review A18b0734Document4 pagesAfs3513 Jurnal Review A18b0734Nur NabilaNo ratings yet

- Islamic Financial SystemDocument13 pagesIslamic Financial SystemMushood AmjadNo ratings yet

- Maqasid Al KhassahDocument5 pagesMaqasid Al KhassahAi Ni HajjarNo ratings yet

- What Are Definition of Islamic Capital Market (ICM)Document45 pagesWhat Are Definition of Islamic Capital Market (ICM)Zizie2014No ratings yet

- Islamic Micro Finance ReportDocument30 pagesIslamic Micro Finance ReportRajeev Singh BhandariNo ratings yet

- Islamic Accounting TheoryDocument3 pagesIslamic Accounting TheoryAulia ZahraNo ratings yet

- Chap 3 #Document14 pagesChap 3 #Yoo ChueningNo ratings yet

- Islamic Banking and Prohibition of Riba/interest: Full Length Research PaperDocument5 pagesIslamic Banking and Prohibition of Riba/interest: Full Length Research PaperAlina MalikNo ratings yet

- MPRA Paper 20204Document32 pagesMPRA Paper 20204thotosthoNo ratings yet

- Islamic Financing Arrangements Used in Islamic Banking: Author: Ehsan ZarrokhDocument25 pagesIslamic Financing Arrangements Used in Islamic Banking: Author: Ehsan ZarrokhD'n Hafiz DraegonoidNo ratings yet

- Article Review 1Document5 pagesArticle Review 1muhammad nasrulNo ratings yet

- Overview of Islamic AccountingDocument25 pagesOverview of Islamic AccountingNovi WulandariNo ratings yet

- Shariah in Islamic FinanceDocument2 pagesShariah in Islamic FinanceAbdullahi ManirNo ratings yet

- DocumentDocument2 pagesDocumentAbdullahi ManirNo ratings yet

- DNA Transcription and Translation of RNADocument35 pagesDNA Transcription and Translation of RNAAbdullahi ManirNo ratings yet

- Assessment of Public Knowledge of Antibiotic Use and Antimicrobial Resistance in Gusau NigeriaDocument4 pagesAssessment of Public Knowledge of Antibiotic Use and Antimicrobial Resistance in Gusau NigeriaAbdullahi ManirNo ratings yet

- Andreas Breivik's Mental BackgroundDocument4 pagesAndreas Breivik's Mental BackgroundAnte VrankovićNo ratings yet

- Islamic Classical Sciences: Patronization of Islamic RulersDocument11 pagesIslamic Classical Sciences: Patronization of Islamic RulersismailNo ratings yet

- Sufi and Hasidic DanceDocument21 pagesSufi and Hasidic DanceAnonymous CsIsNr100% (1)

- Qurb e Deedar Urdu Translation With Persian TextDocument153 pagesQurb e Deedar Urdu Translation With Persian TextSultan ul Faqr Publications100% (1)

- Fiqh (Halal and Haram Foods)Document3 pagesFiqh (Halal and Haram Foods)Abdurrazzaq Oba UthmanNo ratings yet

- PrayersDocument8 pagesPrayersBilal AhmadNo ratings yet

- Music Cultures of The WorldDocument28 pagesMusic Cultures of The WorldAndrew Spoleti100% (1)

- An Islamic State. The Case of IranDocument6 pagesAn Islamic State. The Case of IranPaja BláhováNo ratings yet

- The Islamic Political Theory of Muhammad Baqir Al Sadr of Iraq - PreviewDocument40 pagesThe Islamic Political Theory of Muhammad Baqir Al Sadr of Iraq - PreviewSafura Butul AliNo ratings yet

- Trial Version: Islamic Critical Thinking: The Perception of Muslim Engineering Students in Universiti Teknologi PetronasDocument4 pagesTrial Version: Islamic Critical Thinking: The Perception of Muslim Engineering Students in Universiti Teknologi PetronasmsanusiNo ratings yet

- Bahare Shariat 4 by Sadrush ShariaDocument359 pagesBahare Shariat 4 by Sadrush ShariaMohammad Izharun Nabi HussainiNo ratings yet

- Wassamu Alaikum Warahmatullahi WabarakatuhDocument2 pagesWassamu Alaikum Warahmatullahi WabarakatuhMuhammad AsroruddinNo ratings yet

- Multiculturalism ChaplinDocument51 pagesMulticulturalism ChaplinNil Santos100% (1)

- NASHEEDDocument4 pagesNASHEEDJazeera OriginNo ratings yet

- Bahasa Diplomasi Nabi Muhammad Saw: ArticleDocument17 pagesBahasa Diplomasi Nabi Muhammad Saw: ArticleNur Izaaz AfiqahNo ratings yet

- Isl438 - Al-Mīrāth Islamic Law of SuccessionDocument90 pagesIsl438 - Al-Mīrāth Islamic Law of SuccessionSofiyyahNo ratings yet

- Medieval Islamic Apocalyptic Tradition PDFDocument220 pagesMedieval Islamic Apocalyptic Tradition PDFlukasesane100% (1)

- Nafs PDFDocument1 pageNafs PDFSheik Mansoor ANo ratings yet

- Post RN BSC 2ns Years BooksDocument7 pagesPost RN BSC 2ns Years BooksJaved Noor Muhammad GabaNo ratings yet

- Religious Obligations of Muslim WomenDocument66 pagesReligious Obligations of Muslim Womenkashmir100% (3)

- Jamia HistoryDocument21 pagesJamia Historya-468951100% (1)

- Mojiza 22 RajabDocument4 pagesMojiza 22 RajabShoyeb AlamNo ratings yet

- Matematika SMP - Pengumuman NSSC 2.0Document60 pagesMatematika SMP - Pengumuman NSSC 2.0ramaNo ratings yet

- A Brief Biography of Imam Ali Bin Muhammad Al-Naqi (A.s.)Document56 pagesA Brief Biography of Imam Ali Bin Muhammad Al-Naqi (A.s.)Hhhh GehrhhNo ratings yet

- Quick Notes Islamiyat PDFDocument20 pagesQuick Notes Islamiyat PDFShafay Fahad DarNo ratings yet

- Cambridge O LEVEL ISLAMIYAT 2024-25Document13 pagesCambridge O LEVEL ISLAMIYAT 2024-25cjNWKFNQAJ,KNo ratings yet

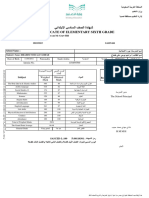

- السادس الابتدائي عام بنين - We Can Mc Graw Hill منتظم ابتدائية نDocument26 pagesالسادس الابتدائي عام بنين - We Can Mc Graw Hill منتظم ابتدائية نماجد الماجدNo ratings yet

- 4a - Surat Al-HajjDocument19 pages4a - Surat Al-Hajjfarooq100% (3)

- Sayyid Mashhoor Kunhikoya Thangal VadakaraDocument11 pagesSayyid Mashhoor Kunhikoya Thangal VadakaraMoosathasleem Arimbra100% (4)