Professional Documents

Culture Documents

Fy-Fm - Unit - Iii & Iv

Fy-Fm - Unit - Iii & Iv

Uploaded by

Purna PatelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fy-Fm - Unit - Iii & Iv

Fy-Fm - Unit - Iii & Iv

Uploaded by

Purna PatelCopyright:

Available Formats

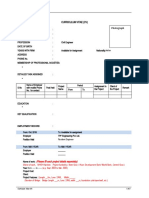

Mervin Classes P A G E – [ 1]

FUNCTIONAL MANAGEMENT

F.Y.B.Com. SEMESTER: II UNIT- III & IV

INDEX: UNIT PAGE NO.

STOCK EXCHANGE: III

[A]. MEANING OF STOCK EXC HANGE: 02 - 02

[B]. CHARACTERISTICS OF A GOOD MARKET: 02 – 04

[C]. FUNCTIONS OF STOCK E XCHANGE: 04 – 06

[D]. SERVICES OF STOCK EXCHANGE : 06 – 07

[E]. IMPORTANCE OR BEN EFI TS OF STOCK EXCHANGE : 07 – 08

[F]. PARTICIPANTS IN THE SECURITY MARKET: 08 – 10

[G]. PRIMARY & SECON DARY EQUITY MARKET: 10 – 12

[H]. BUYING AND SELLING S HARES : 12 – 14

[I]. PROCEDURE OF TRADING AND SETTLEMENT: 14 – 16

[J]. ROLE OF SEBI : 16 – 17

[K]. SECURITY MARKET: 17 - 19

SOURCES OF FINANCE: III

[A]. SOURCES OF FINANCE : 20 – 21

[B]. IMPORTANCE OF RATIO ANALYSI S: 21 – 23

PORTFOLIO MANAGEMENT: III

[A]. CONCEPT OF PORTFOLIO MANAGEMENT: 24 – 24

[B]. PROCESS OF PORTFOLIO MANAGEMENT: 24 – 25

[C]. SPECIFICATION OF INVESTMENT OBJECTIVE & CONSTRAINTS: 25 – 26

[D]. MEANING AN D METHODS OF SECURITY ANALYSIS : 26 - 27

STEPPI NG STO NE TO SUCCESS PTO – [2]

Mervin Classes P A G E – [ 2]

INDEX: UNIT PAGE NO.

OFFICE MANAGEMENT & MANAGEMENT

INFORMATION SYSTEM :

IV

[A]. MEANING AN D DEFINI TION S OF OFFICE: 28 - 29

[B]. MEANING OF OFFICE MA NAGEMENT: 29 - 30

[C]. IMPORTANCE OF OFFICE: 30 - 30

[D]. HISTORICAL DEVELOPMENTS & FACTORS CONTRIBUTING THE

30 - 31

GROWTH OF OFFICE WORK:

[E]. FUNCTIONS OF AND OFFICE : 31 - 34

[F]. OFFICE SYSTEMS /ROUTINES AND PROCEDURES: 34 - 35

[G]. OBJECTIVES OF SYSTEMS AND PROCEDURE: 35 - 36

[H]. IMPORTANCE OF OFFICE RECORDS: 36 - 36

[I]. MEANING OF FILING SY STEM: 37 - 43

[J]. MEANING OF INDEXING : 44 - 45

[K]. MANAGEMENT INFOR MATI ON SYSTEM [MI S] : 45 - 47

[L]. SIGNIFICANCE OF MANAGEMENT INFORMATION SYSTEM: 48 - 49

[M]. BENEFITS & LIMITATIONS OF MANAGEMENT

49 - 53

INFORMATION SYSTEM :

STEPPI NG STO NE TO SUCCESS PTO – [3]

Mervin Classes P A G E – [ 3]

UNIT: III

STOCK EXCHANGE

Explain the meaning and functions of Stock Exchange.

[A]. MEANING OF STOCK EXCHANGE:

A Stock Exchange is the place or market, where industrial securities are bought and sold,

according to rules and regulations. Securities include shares, stock, bonds and debentures

issued by companies, and government securities and bonds issued by semi-government units. It

provides capital to industry, commerce and government.

[1]. DEFINITION OF STOCK EXCHANGE :

As defined by the Securities Contracts [Regulation] Act, 1956, a stock exchange is;

[i]. “An association, organization or body of individuals, whether incorporated or not,

[ii]. Established for the purposes of assisting, regulating and controlling business in buying, selling

and dealing in securities”.

[B]. CHARACTERISTICS OF A GOOD MARKET:

A market provides a mechanism through which buyers and sellers interact for transfer of goods

or services. Two aspects of this general definition may be noted.

First, a physical location is not a necessary feature of a market. What matters is that the market

provides a platform for the buyers and sellers to communicate about the relevant aspects of the

transaction.

Second, the market per se need not own the goods and services. The function of the market is

to facilitate the transfer of goods and services.

The following characteristics are considered to evaluate the quality of a market:

[1]. Timely and accurate information

[2]. Liquidity

[3]. Transaction cost

[4]. Informational efficiency

[1]. TIMELY AND ACCURATE INFORMATION:

People participate in a market to buy or sell a good or service quickly at a price that reflects the

prevailing demand and supply. To establish the appropriate price, market participants would like

to have timely and accurate information on the volume and prices of past transactions and

currently outstanding bids and offers. So, the availability of timely and accurate information is an

attribute of a goods market.

[2]. LIQUIDITY:

In a liquidity market, it is easy to sell or buy an asset quickly at a price close to the prices of prior

transactions, assuming no new information is available. The liquidity of a market may be judged

in terms of its depth, breadth, and resilience. Depth refers to the existence of buy as well as sells

orders around the current market price. Breadth implies the presence of such orders in

substantial volume.

Resilience means that new orders emerge in response to price changes. Generally, equity

shares of large, well-established companies enjoy high marketability and equity shares of small

companies in their formative years have low marketability.

STEPPI NG STO NE TO SUCCESS PTO – [4]

Mervin Classes P A G E – [ 4]

[3]. TRANSACTION COS T:

A efficient market is one in which the transaction costs, as a percent of the value of the trade, are

low. Lower transaction costs imply internal efficiency.

[4]. INFORMATIONAL EFFICI ENCY:

A desirable attribute of the market is its ability to adequately reflect all available information and

adjust rapidly and rationally to the flow of new information. This attribute is called informational

efficiency or external efficiency.

To sum up, the characteristics of a good market are availability of timely and accurate

information, liquidity, low transaction costs, and informational efficiency.

[C]. FUNCTIONS OF STOCK EXCHANGE:

[1]. SPOT MARKET:

An organised stock exchange provides a ready and continuous market for buying and selling of

share, debenture and other securities.

It is a market for existing or second-hand securities. Persons with cash can convert it into

securities, and back to cash. This easy marketability of shares and securities increase their

liquidity.

The liquidity in turn increases the value of securities and facilities their use as collateral securities

for loan. As a continuous and ready market, it also provides price continuity and negotiability to

capital locked .up in investment.

The creditor constantly knows the worth of his security on the basis of the price quotations of

securities on the stock exchange.

[2]. DISSEMINATION OF PRI CE INFORMATION:

The stock exchange brings about the fairest and most accurate prices for shares and

debentures, and the prices reflect as closely as possible the present and future income yielding

prospectus of the various companies.

This is an important service to the investor. Under the stock exchange rules, all transactions in

the exchange are required to be recorded and made public so that the prices paid and received

become the official market quotations. On the basis of these quotations, every holder of

securities knows its worth at any point of time.

[3]. CAPITAL MOBILISATION :

Stock exchange mobilises the surplus funds of the community, i.e. funds, which would either

remain idle or would have been locked up in commercial banks getting lower interest incomes.

These are mobilised by the stock exchange for investment in corporate securities.

The publicity, which the stock exchange gives to various securities and their prices, induce

people to invest their savings in useful projects. The steady and continuous facilities provided by

the stock exchange for the purpose and sale of securities encourage people to save and invest.

It also creates the habit of risk taking among the general public.

In this manner, it maintains a steady and regular flow of capital into new enterprises. Even the

dividend and interest earned on investments are invested in industrial enterprises or government

projects.

Thus, stock exchange facilitates infrastructure development in the country by providing financial

support through adequate capital support.

[4]. MOBILITY OF CAPITAL:

The liquidity of securities enables fixed capital investment to become negotiable, and therefore

mobile. It gives mobility to the capital, particularly in the direction of profitable avenues. People

like to invest their savings in securities in companies yielding good profits.

STEPPI NG STO NE TO SUCCESS PTO – [5]

Mervin Classes P A G E – [ 5]

The moment an enterprise ceases to be profitable; capital begins to leave it and begins to move

towards other profitable enterprises. This works through the security prices on the stock

exchange.

[5]. OFFERS LIQUIDITY:

The stock market quotations enable the investors to know the approximate worth of their

securities. The stock exchanges provide continuous markets, high negotiability of securities, and

correct evaluation by facilitating to liquidate investments as and when funds are required.

All these services are made available only if an organised stock exchange works under a code of

well-defined rules and regulations.

[6]. FACILITATES SPECULATION:

The essential idea of speculation is the purchase or sale of a commodity or security at one time,

with the object of making profit by its sale/purchase at another time.

The stock exchange enables shrewd businessmen or genuine investors to speculate and secure

substantial gains through fluctuations in security prices.

If a speculator expects a big rise in the price of a security, he begins to purchase it in advance,

and sell all his holding at the peak level for booking the profit. Speculators offer liquidity to the

markets.

[7]. BETTER CORPORATE GOV ERNANCE PRACTICES:

A company, which wants its securities to be quoted and traded on a stock exchange, has to get it

listed in the official trading list of the particular exchange. For this it has to follow certain rules and

fulfil certain conditions.

Such companies should also furnish all reasonable information concerning their financial affairs,

minority shareholders, etc. periodically to the exchanges where they are listed. Stock exchanges

exercise wholesome influence on the working and management of the companies through their

rules and regulations.

This factor safeguards the interest of the investing public, and also regulates company

management.

[8]. OFFERS PRICE STABILI TY:

Price stability is an essential element or requirement of liquidity. To provide for greater liquidity,

the investor should be able to withdraw his capital from investments at relatively small variations

from the last quoted price. Bulls, bears, and stockbrokers buy or sell securities accordingly, to

take price advantage.

For instance, speculators who expect future rise in share prices buy them at lower prices now,

and dispose them off in the future. This results in gradual price rise, and avoids violent

fluctuations in share prices.

On the other hand, stock traders make heavy buying when the share prices are low, and thus

increase the demand for securities.

This would lead to a rise in share prices. When share prices are high, they tend to depress the

rise by selling securities, and thus increase supply. Thus, stock exchanges ensure continuous

stability in share price through their regular purchase and sale of securities.

[9]. ENSURES WIDER OWNERS HIP OF SECURITIES:

If a company‟s securities are listed in different stock markets of the country, its securities will be

bought and sold by persons scattered all over the country, and the ownership is also widely

scattered.

Now, securities can be listed in overseas exchange also. Many of the leading Indian companies

like Tata, Infosys and Wipro are listed in overseas exchanges like London Stock Exchange,

NASDAQ, and so on.

STEPPI NG STO NE TO SUCCESS PTO – [6]

Mervin Classes P A G E – [ 6]

Thus, stock markets can tap more and more new sources of capital from the domestic market as

well as abroad. Broad ownership also tends to safeguard the corporate sector from criticism and

government interference. Thus, stock markets make efforts to spread shared ownership as

widely as possible.

[10]. BAROMETER OF BUSINES S PROGRESS:

Stock exchange also acts a barometer of the business conditions in the country. Booms and

depressions are reflected by the index of prices of various securities maintained by the stock

exchange.

The causes for the changes in the business climate can be ascertained by analysing the ups and

downs of the market quotations.

DISSEMINATION OF INF ORMATION:

The companies listed in the stock exchanges have to furnish quarterly financial results to the

respective stock exchanges. This information is published by the exchanges, and the analysis

uses this data and given their opinion about various scrip‟s traded in the market. These analyses

are published in print as well as visual media.

Often, the TV anchor personnel interviews the top executives of the companies with regard to their

policies and future plans. Such programmes not only provide information about the company to the

investors, they also give good publicity to the company as well, at no additional cost.

[D]. SERVICES OF STOCK EXCHANGE:

The Stock exchanges constitute an organized market wherein the securities issued by the Indian

companies and central and state government traded.

A well-ordered stock market performs the several economic functions as discussed below:

[1]. CONTINUOUS MARKET FOR SECURITIES:

The stock exchange provides a ready market for sale and purchase of securities. It provides

continuous marketability to the listed securities.

[2]. PROPER DIRECTION TO FLOW OF CAPITAL:

Stock exchange is a sensitive barometer of business activities. This is because, when the sales

and profit of a company increases, the prices of its shares are rising.

Thus, the prices of different securities indicate their relative profitability. This provides guidance

to the investors. They can invest their fund in the securities of those companies, which are more

profitable.

Thus, stock exchange provides proper direction to the flow of capital.

[3]. HELPS IN DISTRIBUTION OF NEW SECURITIES:

The listed securities fetch [gets] higher price as compared to unlisted securities. So, the listed

shares are more acceptable by investors. Due to this reasons, when the new shares or securities

are issued through stock exchange, they get good public response. So, it is possible to sell

shares easily.

[4]. ENSURES SAFETY OF FU NDS:

The stock exchange operates according to rules and regulations. Moreover, it takes necessary to

steps to prevent activities like overtrading, illegitimate speculations and manipulations. So, there

is safety of the funds of investors.

This increases their confidence in the stock market, and stimulates [encourage] large investment

in corporate securities.

STEPPI NG STO NE TO SUCCESS PTO – [7]

Mervin Classes P A G E – [ 7]

[5]. MOBILIZATION OF SAVI NGS:

Stock exchange helps in mobilization of savings, facilitates capital formation and assists the

process of economic growth.

In absence of stock exchange, it will not be possible to mobilize [to collect] the surplus funds of

people and to direct its investment in remunerative channels.

[6]. MIRROR OF BUSINESS C YCLE:

The investment depends upon the economic conditions of the country as well as the expected

boom or depression in the economy.

Now, the falling prices of the listed securities indicate the depression in the economy.

Similarly, increasing prices along with increases in an investment shows the booming conditions

in the economy.

Thus, the stock exchange indicates the economic conditions and business condition of economy.

So, it is known as the mirror of business cycle.

[7]. PROVIDES INFORMATION ABOUT PRICES AND SALES:

Stock exchange maintains a complete record of all transactions of different securities every day.

We can get information about minute to minute movement in the prices of selected shares on TV

Channels like, CNBC, Zee News, NDTV, etc.

This helps the investor to take decision on purchase or sale of securities.

[8]. BETTER ALLOCATION OF FUNDS:

As a result of stock market transactions, there is flow of funds from less profitable to more

profitable enterprises.

This ensures better allocation of financial resources of the economy.

Discuss the benefits/utility/Advantages/Importance of Stock Exchange.

[E]. IMPORTANCE OR BENEFITS OF STOCK EXCHANGE:

The functions performed and the services rendered by the Stock Exchange can be a lso

understood from the perspective of its benefits to the various sections/sectors in the

economy.

The benefits of Stock Exchanges are discussed below from the three perspectives:

[1]. BENEFITS OF STOCK EXCHANGE TO COMMUNITY AND COUNTRY:

[i]. It includes [develops or encourage] saving habits among people & helps in raising capital formation.

[ii]. Through capital mobilization, it helps in the process of economic growth.

[iii]. It ensures diversification of investment on the basis of stable and increasing yields [income].

[iv]. It provides proper evaluation of the worth [value] of different securities.

[v]. It gives idea of economic situation [depression or boom] of a country. Thus, it is a mirror of

economic situation of a country.

[vi]. Through stock exchange, people can invest their funds in safe and more profitable securities.

Thus, it ensures optimum and equitable utilization and avoids wastage of scarce financial

resources of a country.

[vii]. It helps the government in raising funds of public sector projects of national importance.

STEPPI NG STO NE TO SUCCESS PTO – [8]

Mervin Classes P A G E – [ 8]

[2]. BENEFITS [OR SERVICES] TO INVESTORS:

[i]. It provides guidance to investors regarding the choice of securities.

[ii]. It provides continuous marketability and liquidity of securities. So, the investors can sell their

security, when they require funds.

[iii]. It provides latest information about the prices of securities, [to the investors], through daily

quotations of listed securities.

[iv]. Purchases of listed securities are less risky [because it pre-supposes their evaluation by the

Stock Exchange Authorities].

[v]. It avoids undue fluctuations in the prices of securities, by balancing the operations of speculators

[bulls and bears].

[vi]. The securities, which can be easily sold on stock exchange, become a good collateral security for

loans.

[vii]. The stock exchange operates according to rules & regulations. This safeguards the interest of

investors.

[3]. BENEFITS TO THE COMPANIES:

[1]. It enlarges [widens] the market for securities.

[2]. When the shares/securities of a company are listed on the stock exchange, its credit-standing

and goodwill increases.

[3]. Listed securities get quick and better response from the investors.

[4]. Market value of listed securities is higher than that of unlisted securities. This increases the

financial stability, bargaining power [in takeover or merger] and the goodwill of the company.

[5]. It gives an idea of the general economic conditions of a nation and guides the company in its

investment decisions.

Who are the various participants of Stock Exchange.

[F]. PARTICIPANTS IN THE SECURITY MARKET:

The Indian securities market constitutes of a number of participants who link demanders of funds

with suppliers of funds. They are as follows:

REGULATORS:

The key agencies that have a significant regulatory influence, direct or indirect, over the

securities market are currently as follows:

[1]. The Company Law Board (CLB) which is responsible for the administration of the Companies Act,

2013.

[2]. The Reserve Bank of India (RBI) which is primarily responsible, inter alia (among other things),

for the supervision of banks, money market, and government securities market.

[3]. The Securities and Exchange Board of India (SEBI) which is responsible for the regulation of the

capital market.

[4]. The Department of Economic Affairs (DEA), an arm of the government, which, inter alia, is

concerned with the orderly functioning of the financial markets as a whole.

[5]. The Ministry of Company Affairs (MCA), an arm of the government, which is responsible for the

administration of corporate bodies.

[1]. STOCK EXCHANGES :

A stock exchange is an institution where securities that have already been issued are bought and

sold. The major exchanges in India are NSE and BSE.

STEPPI NG STO NE TO SUCCESS PTO – [9]

Mervin Classes P A G E – [ 9]

[2]. BANKERS TO AN ISSUE :

The bankers to an issue collect money on behalf of the company from the applicants.

[3]. BROKERS:

Brokers are registered members of the stock exchanges through whom investors transact. There

are approx. 10,000 brokers in India.

[4]. LISTED SECURITIES :

Securities that are listed on various stock exchanges and hence eligible for being traded there

are called listed securities. Presently a lot of securities are listed on all the stock exchanges in

India put together.

[5]. DEPOSITORIES:

A depository is an institution which dematerialises physical certificates and effects transfer of

ownership by electronic book entries. Presently there are two depositories, in India, viz., the

National Securities Depository Limited (NSDL) and the Central Depository Services (India)

Limited (CDSL).

[6]. FOREIGN INSTITUT IONAL INVESTORS:

Institutional investors from abroad who are registered with SEBI to operate in the Indian capital

market are called foreign institutional investors. There are approx. 600 of them and they have

emerged as a major force in the Indian Market.

[7]. MERCHANT BANKERS:

Firms that inter alia specialise in managing the issue of securities are called merchant bankers.

They have to be registered with SEBI.

[8]. PRIMARY DEALERS:

Appointed by the RBI, primary dealers serve as underwriters in the primary market and as

market makers in the secondary market for government securities.

[9]. MUTUAL FUNDS:

A mutual fund is a vehicle for collective investment. It pools and manages the funds to investors.

There are approx. 30 mutual funds in India.

[10]. CUSTODIANS:

A custodian looks after the investment back office of a mutual fund. It receives and delivers

securities, collects income, distributes dividends, and segregates the assets between

schemes.

[11]. REGISTRARS AND TRANS FER AGENTS:

A registrar and transfer agent is employed by a company or a mutual fund to handle all investor-

related services.

[12]. UNDERWRITERS:

An underwriter agrees to subscribe to a given number of shares or any other security in the even

the public subscription is inadequate. The underwriter, in essence, stands guarantee for public

subscription.

[13]. DEBENTURE TRUSTEES:

When debentures are issued by a company, a debenture trustee has to be appointed to ensure

that the borrowing firm fulfils its contractual obligations.

[14]. VENTURE CAPITAL FUND S:

A venture capital fund is a pool of capital which is essentially invested in equity shares or equity-

linked instruments of unlisted companies.

STEPPI NG STO NE TO SUCCESS PTO – [10]

Mervin Classes P A G E – [ 10]

[15]. CREDIT RATING AGENCI ES:

A credit rating agency assigns ratings primarily to debt securities.

Explain primary equity market and important changes introduced by SEBI.

[G]. PRIMARY & SECONDARY EQUITY MARKET:

[a]. PRIMARY EQUITY MARKE T:

Although the equity market in India has been functioning since the late nineteenth century, the

primary equity market, also called the new issues market, remained rather dull and inactive,

barring occasional but brief bursts of activity, till 1991.

In 1992, the Control of Capital Issues Act was abolished and SEBI was entrusted with the

responsibility of regulating the primary market.

A series of initiatives taken by SEBI, along with a more conducive environment that emerged in

the wake of economic reforms, imparted a strong boost to the primary market.

Some of the important changes introduced by SEBI are worth mentioning.

[1]. FREE:

Pricing Companies have been given freedom in pricing their equity shares and determining the

interest rate structure on their debt securities.

[2]. ISSUE OF CAPITAL AND DISCLOSURE REQUIREME NTS (ICDR):

Issues of securities have to conform to fairly elaborate disclosure requirements, so that investors

can take more informed decisions.

ICDR and their continual improvement have made Indian disclosure requirements comparable to

the best international practices. Of course, this had made the offer document quite voluminous.

[3]. EFFICIENT DELIVERY M ECHANISM:

SEBI has made it mandatory for all new IPOs to be issued only in the dematerialised form.

Further, the time lapse between the closure of an issue and the listing of shares has been

compressed.

There are three ways in which a company may raise equity capital in the primary market.

[a] Public issue,

[b] Rights issue,

[c] Private placement.

Discuss the secondary equity market.

[b]. SECONDARY EQUITY MAR KET:

The origin of the stock market in India goes back to the end of the eighteenth century when long-

term negotiable securities were first issued. However, for all practical purposes, the real

beginning occurred in the middle of the nineteenth century after the enactment of the Companies

Act in 1850, which introduced the feature of limited liability and generated investor interest in

corporate securities.

An important early event in the development of the stock market in India was the formation of the

Native Share and Stock Brokers’ Association at Bombay in 1875, the precursor of the present

day Bombay Stock Exchange. This was followed by the formation of associations/exchanges in

Ahmadabad (1894), Calcutta (1908), and Madras (1937).

STEPPI NG STO NE TO SUCCESS PTO – [11]

Mervin Classes P A G E – [ 11]

In addition, a large number of ephemeral exchanges emerged mainly in between periods only to

recede into oblivion during depressing times subsequently. In order to check such aberrations and

promote a more orderly development of the stock market, the central government introduced a

legislation called the Securities Contracts (Regulation) Act, 1956.

Under this legislation, it is mandatory on the part of a stock exchange to seek governmental

recognition.

National Stock Exchange (NSE) the Over the Counter Exchange of India Limited (OTCEI)

and Inter-connected Stock Exchange of India Limited (ISE) have mandate to nationwide

trading network. The Bombay Stock Exchange was established in 1875 and is one of Asia‟s

Oldest Stock Exchange.

The most important development in the Indian stock market was the establishment of the

National Stock Exchange (NSE) in 1994. Within a short period, it emerged as the largest stock

exchange in the country surging ahead of the Bombay Stock Exchange (BSE) which was

historically the dominant stock exchange in India.

At present, NSE and BSE account for almost 100 percent of the total turnover on the Indian stock

market, thanks to three factors;

[i] advent of automated trading and the nation wide reach of NSE and BSE;

[ii] introduction of a common rolling settlement system; and

[iii] abolition of regional listing requirement.

Since NSE and BSE loom large over the Indian stock market, it may be instructive to learn about

their distinctive features.

Explain the distinctive features of National Stock Exchange.

THE NATIONAL STOCK EXCHANGE:

Inaugurated in 1994, the National Stock Exchange seeks to

(a) Establish a national wide trading facility for equities, debt, and hybrids,

(b) Facilitate equal access to investors across the country,

(c) Impart fairness, efficiency, and transparency to transactions in securities,

(d) Shorten settlement cycle, and

(e) Meet international securities market standards.

The distinctive features of NSE, as it functions currently, are as follows:

[1]. The NSE is a ring less, national, computerised exchange.

[2]. The NSE has two segments; [a] the Capital Market segment and the Wholesale Debt Market

segment. The Capital Market segment covers equities, convertible debentures, and retail trade in

non-convertible debentures.

The Wholesale Debt Market segment is a market for high value transactions in government

securities, PSU bonds, commercial papers, and other debt instruments.

[3]. The trading members in the Capital Market segment are connected to a central computer in

Mumbai through a satellite link-up, using VSATs (Very Small Aperture Terminals).

Incidentally, NSE is the first exchange in the world to employ the satellite technology. This enabled

NSE to achieve a nation-wide reach. The trading members in the Wholesale Debt Market segment

are linked through dedicated high speed lines to the central computer at Mumbai.

STEPPI NG STO NE TO SUCCESS PTO – [12]

Mervin Classes P A G E – [ 12]

Explain the distinctive features of Bombay Stock Exchange.

THE BOMBAY STOCK EXCHANGE:

Established in 1875, the Bombay Stock (BSE) is one of the oldest organized exchanges in the

world with a long, colourful and chequered history.

Its distinctive features are as follows:

[1]. The BSE switched from an open outcry system to a screen-based system in 1995 which is called

BOLT (which is an acronym for BSE-On Line Trading). It accelerated its computerisation

programme in response to the threat from the NSE.

[2]. To begin with, BOLT was a „quote-driven‟ as well as an „order-driven‟ system, with jobbers

(specialists) feeding two-way quotes and brokers feeding buy or sell orders. This hybrid system

reflected the historical practice of BSE where jobbers played an important role.

A jobber is a broker who trades on his own account and hence offers a two-way quote or a bid-

ask quote. The bid price reflects the price at which the jobber is willing to buy and the ask price

represents the price at which the jobber is willing to sell. From August 13, 2001, however, BSE,

like NSE, became a completely order-driven market.

[3]. In October 1996 SEBI permitted BSE to extend its BOLT network outside Mumbai. A number of

various, subsidiary companies of regional exchange became members of BSE and through them

members of regional exchanges now serve as sub-brokers of BSE. This has expanded the reach

of BSE considerably.

Explain the Procedure of Buying & Selling shares at Stock Exchange.

[H]. BUYING AND SELLING OF SHARES:

Procedure of buying and selling of shares involves the three basic steps:

[1] Locating a Broker [2] Placement of order [3] Executing the order

Traditionally, the investors or the person trading or intending to trade can do so only with the help

of the members authorized for same, i.e. brokers and others. But, with the introduction of

technological developments on the Indian stock exchanges the picture has changed.

Today, the person can trade in securities by various modes;

[1]. Trading through Brokers (Traditional Methods and Modern Method)

[2]. Internet trading; [1] Through banks [2] Through trading firms

The procedure of buying and selling of shares by various modes in explained below:

[1]. TRADING PROCEDURE OF BUYING & SELLING SHARES THROUGH

BROKERS:

[a]. PROCEDURE OF BUYING SHARES:

Following are the main steps in the procedure of buying shares or debentures.

[1]. SELECTING OR LOCATING A BROKER:

When a person wants to buy or to sell shares or securities, he has to select a broker. He should

select such a broker who can provide prompt and efficient service and protect his interest. To buy or

to sell the shares or debentures, he has to submit a client registration form and member-constituents

form. [Or a sub-broker client agreement form].

It contains the terms & conditions relating to order/trade confirmation, brokerage charged by a trading

member/registered sub-broker, and delivery of securities and funds.

STEPPI NG STONE TO SUCCESS PTO – [13]

Mervin Classes P A G E – [ 13]

[2]. PLACEMENT OF ORDER:

After selecting a suitable broker, he has to place an order to buy shares. The order must clearly

indicate:

[i]. The name of company

[ii]. Type of securities [equity, preference share, or debentures]

[iii]. No. of shares/securities, to be purchased and

[iv]. The maximum limit of price.

In stock exchange, all the transactions are settled through the depositories. So, he must have a

demat account with an authorized depository, before placing an order. [When he places an order,

he may specify the highest price or limit price. When he submits an order to buy, he must

indicate the quantity of shares to be purchased and the maximum price.]

[3]. EXECUTION OF ORDER:

On receiving the order, the broker will feed the same on his terminal. When the order is

confirmed, the broker informs the buyer and sends a “contract note”. It contains details of the

transaction. Now, the buyer has to make payment to broker within stipulated period. After making

the payment, the broker will transfer the shares in electronic form to his demat account.

[b]. PROCEDURE OF SELLING SHARES:

[1]. SELECTION OF BROKER:

As given in buying procedure.

[2]. PLACEMENT OF ORDER:

After selecting a broker, the seller has to place a sale order with the broker. It indicates the name

of company, no. of shares to be sold, and minimum price acceptable to seller. He may place a

“limit order” or “market order”. The limit order indicates the minimum price, acceptable to seller,

but the market price give an instruction to the broker to sell at the best possible market price.

Before placing the sale order, the seller must have the shares in his demat account.

[3]. EXECUTION OF ORDER:

On receiving the sale order, the broker will feed the same in his terminal. When the order is

confirmed, the broker will inform the seller and will send a contract note. Now, the seller has to

transfer the shares to broker by issue of a depository participant cheque.

This cheque transfers the shares from the demat account of seller to broker‟s account. After this,

the seller receives payment from the broker in about a week‟s time.

[2]. INTERNET TRADING:

[1]. INTERNET TRADING THR OUGH BANKS :

From February 2000, stock trading through internet was introduced in India with this another

mode of the trading was introduced, online trading through banks, authorized for the same. In

this case, apart from having computer, a modem, and a telephones and internet connection, one

has to open with the authorized banks, for the purpose, savings account, demat account as well

as the securities trading account. These banks through securities trading account feed on the

client‟s computer the terminal thus authorized (NSE/BSE).

The procedure for purchase and selling of the securities is changed here. The client does not

have to give details about the securities to be purchased / sold to the broker but, through the

securities trading account password can get the terminals of the stock exchanges (NSE/BSE),

can trade and monitor the ups and down in the stock market. Any transaction of either purchase

or sale, when placed, will be confirmed by the receipt from the concerned bank under the

depository services provided by them.

STEPPI NG STONE TO SUCCESS PTO – [14]

Mervin Classes P A G E – [ 14]

[2]. INTERNET TRADING THR OUGH TRADING FIRM :

Currently, ICICI Web trade, Share khan, Kotakstreet, Geogit securities, investment provides the

services of internet trading, and this manages the portfolio of the investors.

For internet trading through this mode, one has to get registered as a client with the internet

broker, apart from having a computer, a modem, and a telephone connection. One has to keep a

minimum deposit in the bank account with the internet broker, which the broker can directly debit

and credit.

For example; trading through ICICI web trade, one should open bank account as well as the

Demat account with the ICICI bank. Rest of the procedure remains same; here one has to place

the order with internet broker and accordingly carries out the trading.

Explain the Procedure of Trading and Settlement.

[I]. PROCEDURE OF TRADING & SETTLEMENT:

The listed securities on the stock exchanges, its trading as well as the settlement have passed

through various changes with the development of the technology, increasing interest of the

investors and the requirements for amending the rules and regulations of stock exchanges,

thereby keeping a check on the entire functioning of the Stock exchanges as well as the players

of this game.

The picture of trading and settlement of the securities before as well as at present is explained

below:

[a]. PROCEDURE OF TRADING SYSTEM:

In stock exchange, only listed and permitted securities are traded. Further, only the members of

stock exchange [brokers] can buy or sell securities at the stock exchange. So, if a person wants

to buy or to sell the securities, he has to place his orders with the brokers/members of the

exchange.

There are two ways of organizing trading activities:

[1]. OPEN OUTCRY SYSTEM :

In this system, the traders shout and use certain signals on the trading floor of stock exchange to

buy or to sell the shares.

Buyers make their bids and sellers make their offers and by bargain, transactions are concluded

at agreed prices. When the offers of both the parties match with each other, a transaction is

confirmed. Now In India this system has been stopped.

[2]. SCREEN-BASED SYSTEM:

In this system, the physical trading floor is replaced by computer screen and there is sale and

purchase of shares through the computer network. The screen-based system is also known the

Open Electronic Limit Order Book [OELOB] market system.

Following are the main features of this system:

[i]. The buyers and sellers place their orders on computer terminal. These orders may be limit

orders or market orders.

In limit order, price limit is specified for sale or purchase of shares. A market order is an order to

buy or to sell at the best prevailing price.

[ii]. The computer instantly tries to match the offers of buyers and seller. The matching is done on

the basis of price and time priority.

When the offers of seller and buyer match with each other the transaction is confirmed.

STEPPI NG STONE TO SUCCESS PTO – [15]

Mervin Classes P A G E – [ 15]

[b]. PROCEDURE OF SETTLEMENT SYSTEM:

[1]. PHYSICAL MOVEMENT OF THE SECURITIES-DE-MATERIALIZED MODE:

[a]. TRADITIONALLY:

Trades in India were settled by physical delivery. There was the physical movement of the

securities, from seller to seller‟s broker, from seller‟s broker to purchaser‟s broker (through the

clearing house of the stock exchange), and from purchaser‟s broker to the purchase.

Further, the purchaser has to ledge the securities with the transfer agents of the company and

the process of transfer took one to three months. This had further led to high paper cost, and

created bad paper risk, including the transfer charges and the uncertainty factor.

[b]. MODERN DAY TRANSACTI ONS:

Modern day transactions are settled mainly through electronic delivery facilitated by depositories

to overcome the problems of the physical transfers and the cost thereby.

A depository is an institution which dematerialize physical certificates and the effect of transfer of

ownership in made through electronic book entries.

[c]. DEMATERIALIZED TRADI NG SYSTEM IN INDIA:

In order to enable dematerialized trading in India, Central Government circulated the Depository

Ordinance in 1995, which was followed by the Depositories Act 1996. Each depository has to

be registered with the Securities and Exchange Board of India.

Every depository will be required to be registered with the SEBI. Investors will have the choice of

continuing with the existing share certificates or opt for the depository mode.

While the depository will be registered owners in the register of the company, the investors will

enjoy the economic benefits and the voting rights on the shares concerned. Shares in the

depository mode will be fungible. This means they will cease to have distinctive numbers.

Investors having entered the depository mode can leave the system and get share certificate

from the company as registered owners in the books of the company.

Ownership changes in the depository system will be made automatically on the basis of delivery

against payment; there will be no stamp duty on transfer of ownership. Any loss caused to the

beneficial owners due to the negligence of the depository or the participant will be indemnified by

the depository. The National Securities Depositories Limited (NSDL) was the first

depository in India, set up in 1996. NSDL was promoted by National Stock Exchange and

with the collaboration of some financial institutions.

The Central Depositories Securities (India) Limited (CDSL), was incorporated in 1999 with

collaboration of Bombay Stock Exchange and banks.

Initially, investors were given a choice to continue the physical delivery of securities or opt for the

dematerialized mode of the transfer, but, later with regulations of SEBI it was made compulsory.

It means that if one wants to buy or sell shares on any exchange, they have to do it only in the

dematerialized form. Investors willing to join the depository mode are required to register with the

agents of the depositories i.e. open the “demat Account” with the agents of the depositories. For

example; agencies like banks, financial institutions, and large brokerage firms.

[2]. SETTLEMENT:

[a]. WEEKLY ACCOUNT PERIO D SETTLEMENT SYSTEM :

Share transactions in India were also settled on the basis of the weekly account period. (In BSE

the account period was from Monday to Friday and in NSE the account period was from

Wednesday to Tuesday). It means that the purchases and selling transactions during the account

period were settled at the end of the week, and the actual transfer of securities and the amount

was the difference thus arrived. But this system led to uncontrolled speculative activity and

periodic market crisis.

STEPPI NG STONE TO SUCCESS PTO – [16]

Mervin Classes P A G E – [ 16]

For example; suppose if you have purchased 200 shares of Reliance at Rs.4,000 a share on

Monday and sold 100 of the shares at Rs.4500 a share on Friday.

Here you were suppose to take the delivery of only remaining 100 shares by paying Rs.3,50,000

(purchase consideration-8,00,000 and Sale consideration 4,50,000) at the end of the account period.

[b]. ROLLING SETTLEMENT S YSTEM:

In rolling settlement system, purchase and selling of the securities was one virtually and not in

reality, but for which the account was maintained by the parties, broker as well as investor.

In this account, the details of the transactions were recorded as if the transaction has actually

taken place.

The purchase or sale of securities continue as specified by the investor, until and unless, any of

the party (Broker or investor), demands for settlement of the account. On demanding, from either

of the party, the balance amount was then transferred along with the number of shares, to the

concerned party.

[c]. INTRA-TRADE:

In case of intra-trade, the person trading has to settle the transaction on the same day. It means,

for example, if the shares are purchased in morning at a particular price, then the same share

are to be sold in the evening at the price prevailing in the market of those securities.

The license of the broker, not following these rules, of its selected settlement options, will be

cancelled or forfeited by the stock exchange authorities.

[d]. DELIVERY BASED:

Many of the investors prefer the pattern of “delivery based”, for their transaction in the securities.

Here, the person is not compelled to sell of the securities within the time declared in advance, but

it is at his own discretion, to sell or to buy the securities.

Explain need/objectives, functions and role of SEBI in India.

[J]. ROLE OF SEBI:

Before the establishment of the Securities and Exchange Board of India (SEBI), the principal

legislations governing the securities markets in India were the Capital Issues Control Act, 1956

(governing the primary market) and the Securities Contract (Regulations) Act, 1956, (governing

the secondary market).

The regulatory powers were vested with the Controller of Capital Issues (for the primary market)

and the Stock Exchange Division (for the secondary market) in the Ministry of Finance,

Government of India.

In 1989, SEBI was created by an administrative fiat of the Ministry of Finance. Since then, SEBI

has gradually been granted more and more powers. With the repeal of the Capital Issues Control

Act and the enactment of the SEBI Act in 1992, the regulation of the primary market has become

the preserve of SEBI.

Further, the Ministry of Finance, Government of India, has transferred most of the powers under

the Securities Contracts (Regulations) Act, 1956 to SEBI

[a]. NEED/OBJECTIVES OF S EBI:

The basic objective of SEBI is to protect the investor‟s right and to enforce an orderly (well

managed) growth of markets. However, the major objectives of SEBI are as follows:

[1]. To promote fair dealing by the issue of security and to ensure a market place from where they

can raise funds at a relatively low cost.

[2]. To protect/safeguard the interest of investors and to ensure continuous flow of savings to the

market.

STEPPI NG STONE TO SUCCESS PTO – [17]

Mervin Classes P A G E – [ 17]

[b]. SALIENT FEATURES (PR INCIPLES) SEBI ACT 1 992:

Following are the salient features of the SEBI Act 1992:

[1]. The SEBI shall be a body corporate (corporate personality/legal entity). It has name with

perpetual succession and common seal.

[2]. The SEBI has right to acquire, hold and dispose of the property in its own name.

[3]. The head office shall be Bombay. The SEBI may establish offices at other places in India.

[4]. The central government makes the appointment of the chairman and members of SEBI.

[5]. The govt. can prescribe terms of office & other conditions of service of chairman & member of the

board.

[6]. The members of the SEBI have to do the general superintendence, direction and management of the

SEBI.

[7]. The primary duty of the SEBI is to protect the interest of investors in securities and to promote

the development and regulate the market by various measures.

[c]. FUNCTIONS OF SEBI :

[1]. Regulating the business in stock exchange and other securities.

[2]. Registering and regulating the working of stock brokers, sub-brokers, share transfer agents,

merchant bankers, underwriters, portfolio managers associated with stock market.

[3]. Promoting and regulating self regulatory organizations.

[4]. Registering and regulating the working of collective investment scheme like mutual fund.

[5]. Prohibiting fraudulent and unfair trade practices.

[6]. Promoting investor‟s education and trading to intermediaries.

[7]. Prohibiting insider trading.

[8]. Regulating substantial acquisition of shares and take over of companies.

[9]. Undertaking inspection and conducting inquires and audit of the stock exchange, intermediaries

an self-regulatory organizations.

[10]. Performing the functions and exercising powers under the provisions of securities contract

(Regulations) Act, 1956, as may be delegated by central board.

[11]. Levying fees or other charges to carry out the purpose of the act.

[12]. Conducting research on above purpose.

[13]. Performing other functions as may be prescribed by relevant authorities.

[K]. SECURITIES MARKET:

The sensex falls by 360 points in a day of hectic trading. The Reserve Bank of India lowers the

repo rate by 25 basis points.

The Government of India raises Rs.4500 crore rupees by issuing bonds with a maturity of 10

years, so on and so forth. All these are example of securities market at work. Most people are

aware that this market has an important bearing on modern life and they speak of “ Dalal Street”,

the “gild – edged market” and the “Nifty” with a somewhat vague understanding of these terms.

The securities market is the market for equity, debt, and derivatives. The debt market in turn may

be divided into three parts, viz, the government securities market, the corporate debt market, and

the money market.

The derivatives market, in turn may be divided into two parts, viz., the options market and the

futures market. The structure of the securities market is shown in the figure below.

STEPPI NG STONE TO SUCCESS PTO – [18]

Mervin Classes P A G E – [ 18]

Except the derivatives market, each of the above market has two components, viz., the primary

market and the secondary market. The market where new securities are issued is called the

primary market and the market where outstanding securities are traded is called the secondary

market.

Structure of the Securities Market

Securities

Market

Equity Debt Derivatives

Market Market Market

Government Corporate Money Option Future

Securities Debt Market Market Market

Market Market

PUBLIC ISSUES:

By far the most important method of issuing securities, a public issue involves sale of securities

to the public at large. Public issues in India are governed by the provisions of the Companies Act,

2013, Issue of capital and Disclosure Requirement (ICDR) Regulations of SEBI, and the listing

agreement between the issuing company and the stock exchanges.

The Companies Act describes the procedure to be followed in offering shares to the public and

the type of informations to be disclosed in the prospectus and the SEBI guidelines impose certain

conditions on the issuers besides specifying the additional information to be disclosed to the

investors.

SEBI INITIATIVES:

SEBI has taken a number of steps in the last few years to reform the Indian capital market. It has

covered the entire range of capital market activities through nearly 30 legislations.

The important initiatives are mentioned below.

[1]. FREEDOM IN DESIGNING AND PRICING INSTRUMENT:

Companies now enjoy substantial freedom in designing the instruments of financing as long as

they fully disclose the character of the same. More important, they enjoy considerable freedom in

pricing the same.

[2]. BAN ON BADLA:

The financial irregularities of 1992 highlighted the deficiencies of the „badla‟ system which

permitted excessive controlling. To rectify the defects in trading practise, the „badla‟ system has

been banned.

STEPPI NG STONE TO SUCCE SS PTO – [19]

Mervin Classes P A G E – [ 19]

[3]. SCREEN – BASED TRADING:

Thanks to the competition posed by the National Stock Exchange and the insistence or

encouragement done by SEBI, all the exchanges have switched to screen – based trading.

[4]. ELECTRONIC TRANSFER:

The traditional method of transfer by endorsement on security and registration by issuer has

been replaced by electronic transfer in book, entry from by depositories.

[5]. RISK MANAGEMENT:

A comprehensive risk management system has been put in place. Inter alia (amongst other

things), it covers capital adequacy limits on exposure and turnover, margins based on VAR (

value at risk), client level gross margins, online monitoring of positions, stringent KYC (know your

customers) norms, market – wide circuit breakers, and script – wise price bands.

[6]. ROLLING SETTLEMENT:

The trading cycle, which was previously one week, has been reduced to one day and the system

of rolling settlement has been introduced.

[7]. CORPORATE GOVERNANCE CODE:

A new code of corporate governance, based on the recommendations of the Kumaramangalam

Birla Committee report, has been defined. It has been operationalised by inserting a new clause

(cluase49) in the Listing Agreement the agreement that a listed company enters into with the

stock exchange where its securities are listed.

[8]. CHANGE IN MANAGEMENT STRUCTURE:

Stock exchanges easier were broker dominated SEBI now requires 50 percent non- broker

directors. Further, it has mandated that a non- broker professional be appointed the Executive

Directors.

STEPPI NG STONE TO SUCCESS PTO – [20]

Mervin Classes P A G E – [ 20]

UNIT: III

SOURCES OF FINANCE

Explain the Sources of Finance.

[A]. SOURCES OF FINANCE:

One of the most difficult problems in the new venture creation process is obtaining financing. For

the entrepreneur the available financing needs are to be considered from the perspective of debt

versus equity and using internal versus external funds.

[a]. DEBT VS EQUITY FINANCING:

There are two types of financing needs to be considered;

[1]. Debt financing and

[2]. Equity financing.

[1]. DEBT FINANCING:

Debt financing is a financing method involved an interest-bearing instrument, usually a loan, the

payment of which is only indirectly related to the sales and profits of the venture. Typically, debt

financing (also called asset-based financing) requires that some asset (such as car, house, plant,

machine, or land) be used as collateral.

Debt financing requires the entrepreneur to pay back the amount of funds borrowed as well as a

fee expressed in terms of the interest rate. If the financing is short term (less than 1year), the

money is usually used to provide working capital to finance inventory, accounts receivable, or the

operation of the business. The funds are repaid from the sales and profits during the year.

Long-term debt (lasting more than 5 years) is frequently used to purchase some asset such as

a machinery, land or building, with part of the value the asset (usually from 50 to 80 per cent of

the total value) being used as collateral for the long-term loan. Particularly when interest rates

are low, debt (as opposed to equity) financing allows the entrepreneur to retain a larger

ownership portion in the venture and have a greater return on the equity.

The entrepreneur needs to be careful that the debt is not so large that regular interest payments

becomes difficult, as if it becomes impossible to make the payment then, a situation will arise

which will reduce the growth and development and possibly lead the company into liquidation

[2]. EQUITY FINANCING :

Equity financing does not require collateral and offers the investors some form ownership

position in the venture. The investor shares in the profits of the venture as well as any disposition

of its assets on a pro rata basis based on the percentage the business owned. Key factors

favouring the use of one type of financing, another is the availability of funds, the assets of the

venture, and the prevailing interest rates. Usually, an entrepreneur meets financial needs by

employing combination of debt and equity financing.

All ventures will have some equity, as all ventures are owned by some person or institution.

Although owner may sometimes not be directly involved in the day-to-day management of the

venture, there is always equity funding involved that is provided by the owner. The amount of

equity involved will of course vary the nature and size of the venture.

In some cases, the equity may be entirely provided by the owner, such as to run a small Ice

Cream Parlour or pushcart in the mall or at a sporting event. Larger ventures may require ample

owners, including private investors and/or venture capitalists. This equity funding provides the

basis of debt funding, which together make up the capital structure of the venture.

STEPPI NG STON E TO SUCCESS PTO – [21]

Mervin Classes P A G E – [ 21]

[b]. INTERNAL VS EXTERNAL FUNDS:

Financing is also available from both internal and external funds. The type of funds most

frequently employed is internally generated funds.

Internally generated funds can come from several sources within the company profits, sale

of assets, and reduction in working capital, extended payment terms and accounts

receivable.

In every new venture, the start-up years involve putting all the profits back into the venture; even

outside equity investors do not expect any dividends in these early years. The needed funds can

be sometimes be obtained by selling assets which are not of any use.

Assets, whenever possible, should be on a rental basis (preferably on a lease with an option to

buy) and not on ownership basis, as long as there is not a high level of inflation and the rental

terms are favourable.

This will help the entrepreneur preserve cash, a practice that is particularly critical during the

start-up- phase of the company‟s operation.

A short-term, internal source of funds can be obtained by reducing short-term assets; inventory,

cash and other working-capital items. Sometimes an entrepreneur can generate the needed cash

for a period of 30 to 60 days through extended payment terms from suppliers.

Although care must be taken to ensure good supplier relations and continuous sources of supply,

taking a few extra days in payment can generate needed short-term funds.

A final method of internally generating funds is collecting bills (accounts receivable) more quickly.

Key account holder should not be irritated by implementation of these practices.

Mass merchandisers, for example, pay their bills to supply companies in 60 to 90 days,

regardless of a supplying company‟s accounts receivable policy, the size of the company, or the

discount offered for prompt payment.

If a company wants this mass merchandiser to carry its product, it will have to abide by this

payment schedule. The other general source of funds is external to the venture.

Alternative sources of external financing need to be evaluated on three bases; the length of time

the funds are available, the cost involved, and the amount of company control lost.

In selecting the best source of funds, each of the sources needs to be evaluated along these

three dimensions. The more frequently used sources of funds are from entrepreneur himself,

family and friends.

Commercial banks, R & D limited partnership, government loans programs and grants, venture

capital and private placement.

Explain the meaning of ratio analysis and some of its types.

[B]. IMPORTANCES OF RATIO ANALYSIS AND ITS TYPES:

Calculations of financial ratio can also be extremely valuable as an analytical and control

mechanism to test the financial well-being of a new venture during its early stages.

These ratios serve as a measure of the financial strengths and weaknesses of the venture, but

should be used with caution since they are only one control measure for interpreting the financial

success of the venture.

There is no single set of ratios that must be used, nor are there standard definitions for all ratios.

Ratio analysis is typically used on actual financial results but can also provide the entrepreneur

with some sense of where problems exist in the Performa statement as well.

STEPPI NG STONE TO SUCCESS PTO – [22]

Mervin Classes P A G E – [ 22]

[1]. LIQUIDITY RATIO:

[a]. CURRENT RATIO:

This ratio is commonly used to measure the short-term solvency of the venture or its ability to

meet its short-term debts. The current liabilities must be covered from cash or its equivalent; or

otherwise the entrepreneur will need to borrow money to meet these obligations.

The formula and calculation of this ratio when current assets are Rs.108,050 and current

liabilities are `.40,500 is:

Current assets 108,050

= 40,500 = 2.67 times

Current liabilities

While a ratio of 2:1 is generally considered favourable, the entrepreneur should also compare

this ratio with any industry standards. One interpretation of this result is that for every rupees of

current debt, the company has Rs.2.67 of current assets to cover it.

[b]. ACID TEST RATIO:

This is a more rigorous test of the short-term liquidity of the venture because it eliminates

inventory, which is the fast liquid current asset.

The formula given for the same current assets (1,08,050) and liabilities(40,500) and inventory of

Rs.10,450 is:

Current assets inventory (108,050- 10,450) 97,600

= 40,500 = 2.40 times

Current liabilities

The result from this ratio suggests that the venture is very liquid since it has assets convertible to

cash of Rs.2.40 for every rupees of short-term obligations. Usually a 1:1 ratio would be

considered favourable in most industries.

[2]. ACTIVITIES RATIO:

[a]. AVERAGE COLLECTION P ERIOD:

This ratio indicates the average number of days it takes to come accounts receivable into cash.

This ratio helps the entrepreneur to gauge the liquidity of accounts receivable or the ability of the

venture to collect from its customers.

Using the formula with account receivable of Rs.46,400 and sales of Rs.995,000 results in:

Accounts receivable 46,400

× 365 × 365 = 17 days

Average daily sales 9,95,000

This particular result needs to be compared with industry standards since collection will vary

considerably. However, if the invoice indicates a 20 days payment required, and then one (17

days) could conclude that most customers are paying you on time.

[b]. INVENTORY TURNOVER:

This ratio measures the efficiency of the venture in managing and selling its inventory. A high

turnover is a favourable sign indicating that the venture is able to sell its inventory quickly. There

could be a danger with a very high turnover that the venture is under stocked, which could result in

lost orders. Managing inventory is very important to the cash flow and profitability of a new venture.

The calculations of this ratio when the cost of goods sold is Rs.645,000 and the inventory is

Rs.10,450 are:

Cost of goods sold 6,45,000 = 61.72

Inventory 10,450

This would appear to be an excellent turnover as long as the entrepreneur feels that he or she is

not losing sales because of under stocking inventory.

STEPPI NG STONE TO SUCCESS PTO – [23]

Mervin Classes P A G E – [ 23]

[3]. LEVERAGE RATIOS:

Debt ratio many new ventures will incur debt as a means of financing the start-up. The debt ratio

helps the entrepreneur to assess the firm‟s ability to meet all its obligations (short and long term).

It is also a measure of risk because debt also consists of a fixed commitment in the form of

interest and principal repayment.

With total liabilities of Rs.249,700 and total assets of Rs.308,500, the debt ratio is calculated

below:

Total liabilities 2,49,700

x 100 x 100 = 81%

Total assets 3,08,500

This result indicates that the venture has financed about 81 percent of its assets with debt. On

paper this looks very reasonable but would also need to be compared with industry data.

DEBT TO EQUITY:

This ratio assesses the firm‟s capital structure. It provides a measure of risk to creditors by

considering the funds invested by creditors (debt) and inventors (equity). The higher percentage

of debt the greater the degree of risk to any of the creditors.

The calculation of this ratio using the same total liability with stockholder‟s equity being

Rs.58,750 is:

Total liabilities

2,49,700 = 4.25 times

Stockholder‟s equity

58,750

This result indicates that this venture has been financed mostly from debt. The actual investment

of the entrepreneurs or the equity base is about one-fourth of what is owed.

[4]. PROFITABILITY RATIOS:

[a]. NET PROFIT MARGIN :

This ratio represents the venture‟s ability to translate sales into profits. You can also use gross

profit instead of net profit to provide another measure of profitability. In either case the important

to know what it is reasonable in your industry as well as to measure these ratios over time.

This ratio and calculation when net profit is Rs.8,750 and the same net sales are Rs.999,000

is:

Net profit 8,750

Net sales x 100 9,99,000 x 100 = 0.88%

[b]. RETURN ON INVESTMENT:

The return on investment measures the ability of the venture to manage its total investment in

assets. You can also calculate a return on equity, which substitutes stockholder‟s equity for total

assets in the formula below and indicates the ability of the venture in generating a return to the

stockholders.

The formula and calculation of the return on investment when total assets are Rs.2,00,400 and

net profit is Rs.8,750 is:

Net profit 8,750

x 100 x 100 = 4.37%

Total assets 2,00,400

The result of this calculation will also need to be compared with industry data. However, the

positive conclusion is that the firm has earned a profit in its first year and has returned 4.37 % on

its asset investment. There are many other ratios that could also be calculated.

STEPPI NG STONE TO SUCCESS PTO – [24]

Mervin Classes P A G E – [ 24]

UNIT: III

PORTFOLIO MANAGEMENT

Explain the Concept and Process of Portfolio Management.

[A]. CONCEPT OF PORTFOLIO MANAGEMENT:

Portfolio management is the professional management of various securities like, shares, bonds

etc. and assets e.g. real estate. To meet specified investment goals for the benefit of the

investors. Investors may be institutions like insurance companies, pension funds, corporations,

etc. or private investors like both directly via investment contracts and more commonly via

collective investment schemes, e.g. mutual funds.

The term asset management is often used to refer to the investment management of collective

investments, at the same time as the more generic fund management may refer to all forms of

institutional investment as well as investment management for private investors.

Investment managers who specialize in advisory or discretionary management on behalf of

(normally wealthy) private investors may often refer to their services as wealth management or

portfolio management often within the context of so-called “private banking”.

The provision of „investment management services‟ includes elements of financial analysis, asset

selection, stock selection, plant implementation and ongoing monitoring of investments.

Investment management is a large and important global industry in its own right responsible for

taking care of trillions of dollars, euro, pounds and yen. It comes under the remit of financial

services many of the world‟s largest companies are at least in part investment managers and

employ millions of staff and create billions in revenue. Fund manager (or investment adviser in the

U.S.) refers to both a firm that provides investment management services & an individual who directs

fund management decisions.

[B]. PROCESS OF PORTFOLIO MANAGEMENT:

Investment management (or portfolio management) is a complex activity which may be shown

into the following steps.

[1]. SPECIFICATION OF INVESTMENT OBJECTIVES AND CON STRAINTS:

The typical objectives sought by investors are current income, capital appreciation, and safety of

principal. The relative importance of these objectives should be specified. Further, the constraints

arising from liquidity, time horizon, tax, and special circumstances must be identified.

[2]. CHOICE OF THE ASSET MIX:

The most important decision in portfolio management is the asset mix decision. Very broadly, this

is concerned with the proportions of „stock‟ (equity shares and units/shares of equity-oriented

mutual funds) and „bonds‟ (fixed income investment) in the portfolio. The appropriate „stock-bond‟

mix depends mainly on the risk tolerance and investment horizon of the investor.

[3]. FORMULATION OF PORTF OLIO STRATEGY:

Once a certain asset mix is chosen, suitable portfolio strategy has to be made. Two broad

choices are available; an active portfolio strategy or a passive portfolio strategy.

An active portfolio strategy tries hard to earn superior risk-adjusted returns by resorting to

market timing, or sector rotation [pharma, construction, IT, etc.] or security selection [equity,

preference, debenture, etc.], or some combination of these.

A passive portfolio strategy, on the other hand, involves holding a broadly diversified portfolio

and maintaining a pre-determined level of risk exposure [combination of equity and debt capital].

STEPPI NG STONE TO SUCCESS PTO – [25]

Mervin Classes P A G E – [ 25]

[4]. SELECTION OF SECURITIES:

Generally, investors pursue an active stance with respect to security selection. For stock

selecting, investors commonly go by fundamental analysis and/or technical analysis. The factors

that are considered in selecting bonds (or fixed income instruments) are yield to maturity, credit

rating, term to maturity, tax shelter, and liquidity.

[5]. PORTFOLIO EXECUTION :

This is the phase of portfolio management which is concerned with implementing the portfolio

plan by buying and/or selling specified securities in given amounts. Though often glossed over in

portfolio management discussions, this is an important practical step that has a bearing on

investment results.

[6]. PORTFOLIO REVISION

The value of a portfolio as well as its composition the relative proportions of stock and bond

components may change as prices of stocks and bonds fluctuate. Of course, the fluctuation in

stock prices is often the dominant factor underlying this change.

In response to such changes, periodic rebalancing of the portfolio is required. This primarily

involves a shift from stocks to bonds or vice versa. In addition, it may call for sector rotation as

well as security switches.

[7]. PERFORMANCE EVALUATION:

The performance of a portfolio should be evaluated periodically. The key dimensions of portfolio

performance evaluation are risk and return and the key issue is whether the portfolio return is

proportionate with its risk exposure. Such a review may provide useful feedback to improve the

quality of the portfolio management process on a continuing basis.

Explain Port Folio management‟s Objective and Constraints.

[C]. SPECIFICATION OF INVESTMENT OBJECTIVE AND CONSTRAINTS:

The first step in the portfolio management process is to specify the investment policy which

summaries the objectives, constraints and preferences of the investor.

The investment policy may be expressed as follows:

[a]. OBJECTIVES:

[i] Return requirements and [ii] Risk tolerance

Aspects to be considered;

[1]. Income:

To provide a steady stream of income through regular interest/dividend payment to the investors.

[2]. Growth:

To increase the value of the principal amount though capital appreciation.

[3]. Stability:

To protect the principal amount invested from the risk of loss.

[b]. CONSTRAINTS AND PREFERENCES:

In purchasing your investment objective, which is specified in terms of return requirement and

risk tolerance, you should bear in mind the constraints arising out of or relating to the following

factors:

[i] Liquidity, [ii] Investment horizon, [iii] Taxes, [iv] Regulations and [v] Unique circumstances

STEPPI NG STONE TO SUCCESS PTO – [26]

Mervin Classes P A G E – [ 26]

[1]. LIQUIDITY:

Liquidity refers to the speed with which an asset can be sold, without suffering any significant

discount to its fair market price.

For example, money market instruments are the most liquid assets, whereas antiques are among

the least liquid. Taking into account your cash requirements in foreseeable future, you must

establish the minimum level of „cash‟ you want in your investment portfolio.

[2]. INVESTMENT HORIZON :

The investment horizon is the time till the investment or part thereof is planned to be liquidated to

meet a specific need. For example, the investment horizon may be years to fund a child‟s college

education or thirty years to meet retirement needs. The investment horizon has an important

bearing on the choice of assets

[3]. TAXES:

What matters finally is the post-tax return from an investment. Tax considerations therefore have

an important bearing on investment decisions. So, carefully review the tax shelters available to

you and incorporate the same in your investment decisions.

[4]. REGULATIONS:

While individual investors are generally not constrained much by law, institutional investors have

to conform to various regulations. For example, mutual funds in India are not allowed to hold

more than 10 percent of the equity shares of a public company.

[5]. UNIQUE CIRCUMSTANCES :

Almost every investor faces unique circumstances. For example, an individual may have the

responsibility of looking after ageing parents. Or, an endowment fund may be precluded from

investing in the securities of companies making alcoholic products and tobacco products.

Explain the meaning and methods of security analysis.

[D]. MEANING AND METHODS/NEED OF SECURITY ANALYSIS:

Securities that have return and risk characteristics of their own, in combination make up a

portfolio. The entire process of estimating return and risk for individual securities is known as

securities analysis. A portfolio is simply a collection or group of securities considered in total as

a single investment unit. A portfolio can be defined very broadly and be taken to include property,

antiques works of art, bullion, commodities, financial securities, etc. When any particular portfolio

is assessed the concern will be with us overall characteristics, its expected return and its risk.

Portfolio theory is concerned with the problem of making a selection of optimum investments in

respect of a particular investor, taking into account the anticipated returns and the risks

associated with them and the requirements of the investor in the short, medium and long-term

and his attitude towards risk. Portfolio management is the dynamic function of evaluating and

revising the portfolio in terms of stated investor objectives.

The methods of Securities Analysis are classified under two heads;

[1]. Fundamental Analysis, and

[2]. Technical Analysis.

[1]. FUNDAMENTAL ANALYSIS:

Fundamental analysis is the analysis of basic details (fundamental details) of the business. Such

as the revenue, expenses, assets, liabilities and all other fundamental aspects of the company. It

takes in to account those variables which are directly related with the company.

STEPPI NG STONE TO SUCCESS PTO – [27]

Mervin Classes P A G E – [ 27]

There are two types of fundamental analysis,

[a]. Quantitative analysis and

[b]. Qualitative analysis.

[a]. QUANTITATIVE ANALYSIS: