Professional Documents

Culture Documents

Tax Residency Certificates (TRC) : Inland Revenue Department

Tax Residency Certificates (TRC) : Inland Revenue Department

Uploaded by

paniya0 ratings0% found this document useful (0 votes)

40 views1 pageThe document outlines the steps taxpayers must follow to obtain a Tax Residency Certificate from the Inland Revenue Department, including submitting an email request with personal and tax identification details to the Commissioner of International Tax Policy and providing additional documents if an individual such as a national identity card. Contact information is also provided for inquiries about the tax residency certificate application process.

Original Description:

Original Title

PN_TC_2023-01_04042023_E (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the steps taxpayers must follow to obtain a Tax Residency Certificate from the Inland Revenue Department, including submitting an email request with personal and tax identification details to the Commissioner of International Tax Policy and providing additional documents if an individual such as a national identity card. Contact information is also provided for inquiries about the tax residency certificate application process.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

40 views1 pageTax Residency Certificates (TRC) : Inland Revenue Department

Tax Residency Certificates (TRC) : Inland Revenue Department

Uploaded by

paniyaThe document outlines the steps taxpayers must follow to obtain a Tax Residency Certificate from the Inland Revenue Department, including submitting an email request with personal and tax identification details to the Commissioner of International Tax Policy and providing additional documents if an individual such as a national identity card. Contact information is also provided for inquiries about the tax residency certificate application process.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

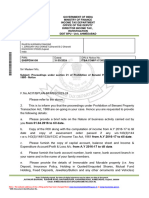

PN/TC/2023-01

30.03.2023

INLAND REVENUE DEPARTMENT

NOTICE TO TAXPAYERS

Tax Residency Certificates (TRC)

It is hereby notified that the following steps are to be followed to obtain tax Residency

Certificates

a) A request for TRC should be made to following officer via e-mail;

- Commissioner (International Tax Policy) itp@ird.gov.lk

niwunhella.soacr@ird.gov.lk

b) The following details should be provided;

Name of the Person

Type of person – Individual / Company / Partnership

Taxpayer Identification Number (TIN) (If available)

Current address

Contact number and official e-mail address of the person

Business activity of the person

Reason/s for applying for TRC

If an individual, following additional information are required

Scanned copies of National Identity Card, Front page of the

Passport with all Visa issued pages

Countries, for which TRC is required

c) If a TRC has already been issued for a previous year, attach a scaned copy of that

certificate.

For any inquiries, following officers could be contacted;

Office Mobile

Senior Deputy Commissioner (International Tax Policy) 001 213 5443

Commissioner (International Tax Policy) 001 213 5413 071 831 7186

,,,.,,

Commissioner General of Inland Revenue

TAXES – FOR A BETTER FUTURE

You might also like

- DTC Troubleshooting: Before You Troubleshoot, Review The General Troubleshooting InformationDocument32 pagesDTC Troubleshooting: Before You Troubleshoot, Review The General Troubleshooting InformationpaniyaNo ratings yet

- ZLT s10 Dialog UsermanualDocument2 pagesZLT s10 Dialog Usermanualpaniya100% (1)

- TIN Card As ID For Notarization PurposesDocument9 pagesTIN Card As ID For Notarization PurposesBobby Olavides SebastianNo ratings yet

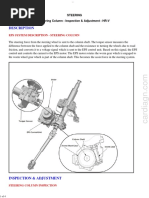

- Description: Eps System Description - Eps ControlDocument34 pagesDescription: Eps System Description - Eps ControlpaniyaNo ratings yet

- 1601E BIR FormDocument7 pages1601E BIR FormAdonis Zoleta AranilloNo ratings yet

- Classification Election. See Form 8832 and Its Instructions For Additional InformationDocument3 pagesClassification Election. See Form 8832 and Its Instructions For Additional InformationSamuel RodriguezNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Instructions For Completing Form No. 22T34 (22.03.2022)Document11 pagesInstructions For Completing Form No. 22T34 (22.03.2022)zzzzzzNo ratings yet

- Adobe Scan Apr 27, 2023Document1 pageAdobe Scan Apr 27, 2023Tina KhandelwalNo ratings yet

- Electronic/Magnetic Media Filing Transmittal For Wage and Withholding Tax ReturnsDocument1 pageElectronic/Magnetic Media Filing Transmittal For Wage and Withholding Tax ReturnsIRSNo ratings yet

- Ceibcbic GST Investigation Instruction 2 2021 22Document5 pagesCeibcbic GST Investigation Instruction 2 2021 22KANCHIVIVEKGUPTANo ratings yet

- EHBPD5410H - Issue Letter - 1063776688 (1) - 31032024Document3 pagesEHBPD5410H - Issue Letter - 1063776688 (1) - 31032024Shareeq MemonNo ratings yet

- Instructions For Completing Form No. 22t201int (07.03.2022)Document7 pagesInstructions For Completing Form No. 22t201int (07.03.2022)zzzzzzNo ratings yet

- Ir 6104Document1 pageIr 6104Kit ChuNo ratings yet

- 2306 - 2307Document57 pages2306 - 2307Dearly EnzoNo ratings yet

- NeecoDocument5 pagesNeecoMagno AnnNo ratings yet

- CBDT Circular 19 2019 Income Tax DT 14 August 2019 Quote Din in It Notices CommunicationsDocument2 pagesCBDT Circular 19 2019 Income Tax DT 14 August 2019 Quote Din in It Notices CommunicationsLalit Mohan JindalNo ratings yet

- December, 2021Document2 pagesDecember, 2021armand resquir jrNo ratings yet

- Cert 2307V2018 InnoveDocument1 pageCert 2307V2018 InnoveLeo BagtasNo ratings yet

- AACAK3555H - Hearing Notice Us 250 - 1051543424 (1) - 29032023Document4 pagesAACAK3555H - Hearing Notice Us 250 - 1051543424 (1) - 29032023Kishori PatilNo ratings yet

- Ent - X: Special Second DivisionDocument36 pagesEnt - X: Special Second DivisionEugene SardonNo ratings yet

- Tax Deduction at Source (TDS) GST ActDocument34 pagesTax Deduction at Source (TDS) GST Actdpo sheikhpuraNo ratings yet

- AHJPT8244M - Show Cause Notice For Proceedings Us 148A - 1063028654 (1) - 20032024Document4 pagesAHJPT8244M - Show Cause Notice For Proceedings Us 148A - 1063028654 (1) - 20032024hadassaha VNo ratings yet

- Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.091019703743452Document1 pageIncome Tax Pan Services Unit: ACKNOWLEDGEMENT NO.091019703743452Sumanth RNo ratings yet

- 2307 Jan 2018 ENCS v3Document2 pages2307 Jan 2018 ENCS v3Mdrrmo San MiguelNo ratings yet

- Bir Form 2307 Final FireDocument18 pagesBir Form 2307 Final FireJONATHAN VILLANUEVANo ratings yet

- Skyreign Travel & Tours Corp. - 03312021Document1 pageSkyreign Travel & Tours Corp. - 03312021Lhynette JoseNo ratings yet

- 2307 012023 FlashDocument2 pages2307 012023 FlashGregorio LSNo ratings yet

- 2307 Creditable Tax Withheld at SourceDocument8 pages2307 Creditable Tax Withheld at SourceBarangay BugasNo ratings yet

- US Internal Revenue Service: f8878 - 2002Document2 pagesUS Internal Revenue Service: f8878 - 2002IRSNo ratings yet

- MinorList (Allart)Document3 pagesMinorList (Allart)Felix RufusNo ratings yet

- 2307 Jan 2018 ENCS v3Document13 pages2307 Jan 2018 ENCS v3chatNo ratings yet

- Di Gi Tal Si Gnature Certi Fi Cate Subscri Pti On FormDocument2 pagesDi Gi Tal Si Gnature Certi Fi Cate Subscri Pti On FormTapan MohapatraNo ratings yet

- RFP BotswanaDocument260 pagesRFP BotswanaKrishna Prakash100% (1)

- Itr-V Acwps3168b 2023-24 129905930310723Document1 pageItr-V Acwps3168b 2023-24 129905930310723aruncaoffice1979No ratings yet

- BIR FORM 2307 SampleDocument6 pagesBIR FORM 2307 SampleEasyHear Philippines by NuGen Hearing Devices, Inc.No ratings yet

- Cash Payout Scheme Registration Form (For Cheque Payment To Registrant)Document3 pagesCash Payout Scheme Registration Form (For Cheque Payment To Registrant)karlosgwapo3No ratings yet

- 2307 Jan - Feb 2020Document4 pages2307 Jan - Feb 2020Marvin CeledioNo ratings yet

- Application For Tax Compliance Verification Certificate Non-Individual TaxpayersDocument1 pageApplication For Tax Compliance Verification Certificate Non-Individual TaxpayersYvonne Jane TanateNo ratings yet

- Annex 033779700803822Document1 pageAnnex 033779700803822Sayed ShoiabNo ratings yet

- Cert 2307V2018 Global MirakelDocument2 pagesCert 2307V2018 Global MirakelLeo BagtasNo ratings yet

- Stamp Duty NEWDocument9 pagesStamp Duty NEWANDI HARDIANTINo ratings yet

- Government of West Bengal Directorate of Commercial Taxes 14, Beliaghata Road, Kolkata-700015Document4 pagesGovernment of West Bengal Directorate of Commercial Taxes 14, Beliaghata Road, Kolkata-700015Ankit Jeswani (IN)No ratings yet

- Work Permits New Guideline Amendments 2021 23.11.2021Document7 pagesWork Permits New Guideline Amendments 2021 23.11.2021Sabrina BrathwaiteNo ratings yet

- BIR Form 2307Document2 pagesBIR Form 2307Angelique MasupilNo ratings yet

- AW Company Registration Form - IntDocument1 pageAW Company Registration Form - IntWinnie Pamela KalpukaiNo ratings yet

- 2307 NEW PLDTDocument2 pages2307 NEW PLDTdayneblazeNo ratings yet

- 2307 Jan 2018 ENCS v3 Annex BDocument2 pages2307 Jan 2018 ENCS v3 Annex BAnonymous Z37BIV88% (24)

- Certificate of Creditable Tax Withheld at Source: Sharp (Phils) CorporationDocument17 pagesCertificate of Creditable Tax Withheld at Source: Sharp (Phils) CorporationromnickNo ratings yet

- Advisory: IRMO ADVISORY No. 5, S. 2020Document2 pagesAdvisory: IRMO ADVISORY No. 5, S. 2020GiYan SalvadorNo ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument36 pagesCertificate of Creditable Tax Withheld at SourceProbinsyana KoNo ratings yet

- 1904 January 2018 ENCS FinalDocument3 pages1904 January 2018 ENCS FinalFatima LunaNo ratings yet

- Taxation of Salaried EmployeesDocument39 pagesTaxation of Salaried Employeessailolla30No ratings yet

- Ace Hardware Philippines, IncDocument2 pagesAce Hardware Philippines, IncBen Carlo RamosNo ratings yet

- 347 School Office Supplies IncDocument2 pages347 School Office Supplies IncBen Carlo RamosNo ratings yet

- Income Tax Pan Services Unit: Reference: Our Letter Ref - No. TIN/PAN/CR-II/N-8810552613810721171 Dated 11-SEP-2021Document3 pagesIncome Tax Pan Services Unit: Reference: Our Letter Ref - No. TIN/PAN/CR-II/N-8810552613810721171 Dated 11-SEP-2021Rashid KhanNo ratings yet

- The immigration offices and statistics from 1857 to 1903From EverandThe immigration offices and statistics from 1857 to 1903No ratings yet

- Description: Steering Steering Column - Inspection & Adjustment - HR-VDocument4 pagesDescription: Steering Steering Column - Inspection & Adjustment - HR-VpaniyaNo ratings yet

- Rugged 5-In-1 Environmental MeterDocument1 pageRugged 5-In-1 Environmental MeterpaniyaNo ratings yet

- Gree Manual p5Document13 pagesGree Manual p5paniyaNo ratings yet

- Removal & Installation: Suspension Tire Pressure Monitoring System - Service Information - HR-VDocument1 pageRemoval & Installation: Suspension Tire Pressure Monitoring System - Service Information - HR-VpaniyaNo ratings yet

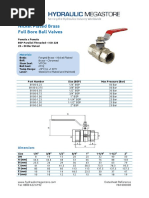

- Brass Low Pressure Ball ValvesDocument1 pageBrass Low Pressure Ball ValvespaniyaNo ratings yet

- Gree Manual p1Document13 pagesGree Manual p1paniyaNo ratings yet

- Gree Manual p4Document13 pagesGree Manual p4paniyaNo ratings yet

- Gree Manual p3Document13 pagesGree Manual p3paniyaNo ratings yet

- Removal & Installation: Steering EPS Motor / Control Unit - Service Information - HR-VDocument2 pagesRemoval & Installation: Steering EPS Motor / Control Unit - Service Information - HR-VpaniyaNo ratings yet

- Ambu PEEP ValvesDocument2 pagesAmbu PEEP ValvespaniyaNo ratings yet

- S-849 - December 2018 Page - 6Document1 pageS-849 - December 2018 Page - 6paniyaNo ratings yet

- S-849 - December 2018 Page - 5Document1 pageS-849 - December 2018 Page - 5paniyaNo ratings yet

- Datenblatt / Data Sheet U51DL-012KK-5Document6 pagesDatenblatt / Data Sheet U51DL-012KK-5paniyaNo ratings yet

- Torque Specifications (Ka/Kc Models)Document5 pagesTorque Specifications (Ka/Kc Models)paniyaNo ratings yet

- Datenblatt / Data Sheet U51DL-012KK-5Document6 pagesDatenblatt / Data Sheet U51DL-012KK-5paniyaNo ratings yet

- S-849 - December 2018 Page - 3Document1 pageS-849 - December 2018 Page - 3paniyaNo ratings yet

- Helix Portable Ventilators: Sustainable First Choice FlexibleDocument3 pagesHelix Portable Ventilators: Sustainable First Choice FlexiblepaniyaNo ratings yet

- Sash Cross SectionDocument2 pagesSash Cross Sectionpaniya100% (1)

- Diaphragm Pump - CompressorDocument2 pagesDiaphragm Pump - CompressorpaniyaNo ratings yet

- AUS PEEPValves 493480097 V02 0712Document2 pagesAUS PEEPValves 493480097 V02 0712paniyaNo ratings yet

- Ordering Specifications: Item No. DescriptionDocument1 pageOrdering Specifications: Item No. DescriptionpaniyaNo ratings yet

- Arici CHP VIIDocument44 pagesArici CHP VIIpaniyaNo ratings yet

- 02 Lectures OpenFOAM Solver ModificationDocument33 pages02 Lectures OpenFOAM Solver ModificationpaniyaNo ratings yet