Professional Documents

Culture Documents

Jawapan Bab 10

Uploaded by

hongOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jawapan Bab 10

Uploaded by

hongCopyright:

Available Formats

JAWAPAN

E (a) Perbelanjaan tetap / Fixed expense

BAB 10 Matematik Pengguna: Pengurusan K

ewangan (b) Perbelanjaan tidak tetap / Variable expense

(c) Perbelanjaan tidak tetap / Variable expense

(d) Perbelanjaan tetap / Fixed expense

10.1 Perancangan dan Pengurusan Kewangan (e) Perbelanjaan tetap / Fixed expense

(f) Perbelanjaan tidak tetap / Variable expense

A Menetapkan matlamat kewangan → Menilai kedudukan kewangan (g) Perbelanjaan tidak tetap / Variable expense

→ Mewujudkan pelan kewangan → Melaksanakan pelan (h) Perbelanjaan tidak tetap / Variable expense

kewangan → Mengkaji semula dan menyemak kemajuan

Setting goals → Evaluating financial status → Creating financial F 1. (a) Jumlah pendapatan / Total income

plan → Carrying out financial plan → Reviewing and revising the = RM2 200 + RM350 = RM2 550

progress Jumlah perbelanjaan / Total expenses

= RM800 + RM850 = RM1 650

B Matlamat Jangka Pendek

Short-term Goal Aliran tunai / Cash flow

• Membeli pakaian sukan = RM2 550 – RM1 650 = RM900

Buying sport attire \ Aliran tunai positif / Positive cash flow

• Membayar hutang RM500

(b) Jumlah pendapatan / Total income

Paying a debt of RM500

= RM2 500 + RM300 = RM2 800

• Menyimpan RM1 200 untuk membeli telefon pintar

Saving RM1 200 to buy a smartphone Jumlah perbelanjaan / Total expenses

= RM1 900 + RM1 170 = RM3 070

Matlamat Jangka Panjang

Long-term Goal Aliran tunai / Cash flow

• Menyimpan dana persaraan = RM2 800 – RM3 070 = –RM270

Saving for retirement fund \ Aliran tunai negatif / Negative cash flow

• Menyimpan untuk pendidikan anak-anak

2. Aliran tunai / Cash flow

Saving for children’s education

= RM2 600 + RM1 400 – (RM2 400 + RM1 800)

• Membuat pelaburan ASB bernilai RM250 000

= RM4 000 – RM4 200 = –RM200

Making ASB investment worth RM250 000

\ Aliran tunai Negatif / Negative cash flow

Selepas perubahan / After changes:

C Membeli satu set televisyen bersama kabinet

S Perbelanjaan tetap / Fixed expenses

Buy a set of television with the cabinet

= 90% × RM2 400 = RM2 160

Harga satu set televisyen bersama kabinet ialah RM4 500 Aliran tunai / Cash flow

M

The price of a set of television with the cabinet is RM4 500 = RM2 600 + RM1 400 – [RM2 160 + (RM1 800 – RM140)]

= RM4 000 – RM3 820

Menyimpan RM750 setiap bulan daripada jumlah = RM180

pendapatan bulanan RM5 000 \ Aliran tunai positif / Positive cash flow

A

Save RM750 each month from her monthly income of

RM5 000 G 1. (a) Jumlah simpanan / Total savings

= RM90 × 4 bulan / months

RM750 adalah 15% daripada pendapatan bulanannya = RM360

R

RM750 is 15% of the monthly income Boleh dicapai / Can be achieved

Dalam tempoh 6 bulan (b) Jumlah simpanan / Total savings

T = RM250 × 12 × 5

Within 6 months

= RM15 000

Tidak boleh dicapai

Cannot be achieved

D (a) Pendapatan aktif / Active income

(b) Pendapatan pasif / Passive income H 1. (a) x = RM2 800 – RM1 150 – RM1 550

(c) Pendapatan aktif / Active income = RM100

(d) Pendapatan aktif / Active income y = RM2 800 – RM1 150 – RM1 450

(e) Pendapatan pasif / Passive income = RM200

(f) Pendapatan pasif / Passive income

1 © Penerbitan Pelangi Sdn. Bhd.

Matematik Tingkatan 4 Jawapan Bab 10

(b) Jumlah simpanan / Total savings Pelan kewangan Encik Leong mempunyai pendapatan lebihan

= RM750 × 54 bulan / months kerana jumlah pendapatan melebihi jumlah perbelanjaan.

= RM40 500 Mr Leong’s financial plan has a surplus of income because the

Oleh itu, Rokiah dapat mencapai matlamat kewangan dan total income exceeds the total expenses.

dia mempunyai lebihan RM500 (RM40 500 – RM40 000)

daripada simpanannya.

Thus, Rokiah can achieve her financial goal and has PRAKTIS BERPANDU SPM

SPM

a surplus of RM500 (RM40 500 – RM40 000) from her

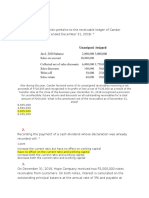

savings. 1. Mengembara ke Eropah.

S

(c) Gaji baharu / New salary Travel to Europe.

= 110% × RM3 500 = RM3 850

Kenaikan gaji membolehkan simpanan bulanan ditambah Kos mengembara ialah RM5 000.

M

dan Rokiah dapat mengumpul jumlah wang yang diperlukan The travelling cost is RM5 000.

dalam masa kurang daripada 54 bulan kerana jumlah

perbelanjaan masih sama. Menyimpan RM350 setiap bulan daripada pendapatan

The salary increment enables the monthly savings increase bulanan RM3 100.

A

and Rokiah can save the amount needed in less than Save RM350 every month from the monthly income of

54 months because the total expenses is still the same. RM3 100.

I 1. Simpanan tetap bulanan / Fixed monthly savings RM350 ialah 11% daripada jumlah pendapatan.

R

10 RM350 is 11% of the total income.

= × RM4 200

100

Dalam tempoh 15 bulan.

= RM420 T

Within 15 months.

Pendapatan pasif / Passive income

= RM1 400 + RM350

= RM1 750 2. (a) Aliran tunai / Cash flow

= Jumlah pendapatan – Jumlah perbelanjaan

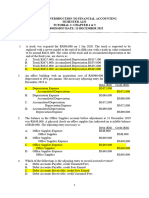

Pelan kewangan Total income – Total expenses

Pendapatan dan Perbelanjaan = RM2 500 + RM500 – RM1 200 – RM1 350

Financial plan

Income and Expenditure = RM450

(RM)

(Aliran tunai positif / Positive cash flow)

Pendapatan bersih Aliran tunai yang bernilai positif adalah baik kerana Xu Ling

Net income mempunyai lebihan pendapatan dan ini dapat membantunya

Gaji bersih / Net salary 4 200 menghadapi perbelanjaan yang tidak dijangka.

Pendapatan pasif / Passive income 1 750 Positive cash flow is good because Xu Ling has a surplus

Jumlah pendapatan bulanan 5 950 of income and this can help her in case of unexpected

Total monthly income expenses.

Tolak simpanan tetap bulanan (10% daripada gaji (b) Aliran tunai / Cash flow

bulanan) 420 = Jumlah pendapatan – Jumlah perbelanjaan

Minus fixed monthly savings (10% of monthly salary) Total income – Total expenses

Tolak simpanan dana kecemasan = RM2 500 – [110% × (RM1 200 + RM1 350)]

Minus savings for emergency fund 300 = RM2 500 – RM2 805

= –RM305

Baki pendapatan / Income balance 5 230

(Aliran tunai negatif / Negative cash flow)

Tolak perbelanjaan tetap bulanan Aliran tunai yang menjadi negatif kerana Xu Ling mempunyai

Minus monthly fixed expenses defisit pendapatan dan ini mungkin menyebabkan dia

Pinjaman rumah / Housing loan 1 000 mungkin menggunakan kad kredit kerana kekurangan wang.

Ansuran kereta / Car instalment 800 The cash flow is negative because Xu Ling has a deficit of

Premium insurans / Insurance premium 380 income and this may cause her to use credit card due to lack

Jumlah perbelanjaan tetap bulanan 2 180 of money.

Total monthly fixed expenses

Tolak perbelanjaan tidak tetap bulanan PRAKTIS BERORIENTASIKAN SPM

SPM

Minus monthly variable expenses

Petrol dan tol / Petrol and toll 250 1. Naik pangkat / Getting a promotion

Bill utiliti / Utility bills 300

Jawapan / Answer: B

Hiburan / Entertainment 380

Pendidikan anak-anak / Children’s education 450

Perbelanjaan makanan / Food expenses 1 000 2. Aset dan liabiliti diperlukan bagi menilai kedudukan kewangan

Duit belanja keluarga / Family pocket money 400 seseorang.

Assets and liabilities are needed to evaluate financial status.

Jumlah perbelanjaan tidak tetap bulanan 2 780

Total monthly variable expenses Jawapan / Answer: B

Pendapatan lebihan / Surplus of income 270

© Penerbitan Pelangi Sdn. Bhd. 2

Matematik Tingkatan 4 Jawapan Bab10

3. Jumlah perbelanjaan tetap 5. Aliran tunai / Cash flow

Total fixed expenses = RM3 000 + RM300 – RM1 400

= RM70 + RM650 + RM500 = RM1 900

= RM1 220 Aliran tunai positif / Positive cash flow

Jumlah perbelanjaan tidak tetap

Total variable expenses 6. (a) Aliran tunai Rakesh / Rakesh’s cash flow

= RM760 + RM130 + RM175 + RM50 = RM3 450 + RM300 – RM2 205 – RM1 620

= RM1 115 = –RM75

Jawapan / Answer: A Aliran tunai Monash / Monash’s cash flow

= RM2 850 + RM400 – RM2 100 – RM780

4. Pendapatan pasif / Passive income = RM370

= RM800 + RM150 (b) Aliran tunai Monash lebih baik kerana dia mempunyai lebihan

= RM950 pendapatan.

Monash’s cash flow is better because he has a surplus of

Jawapan / Answer: B income.

3 © Penerbitan Pelangi Sdn. Bhd.

You might also like

- ANSWERS To CHAPTER 2 (Financial Statements, Taxes and Cash Flows)Document13 pagesANSWERS To CHAPTER 2 (Financial Statements, Taxes and Cash Flows)senzo scholarNo ratings yet

- Chapter 4 - Time Value of MoneyDocument28 pagesChapter 4 - Time Value of MoneyIm HerinNo ratings yet

- Accounting Book 1 Lupisan Baysa Answer KeyDocument176 pagesAccounting Book 1 Lupisan Baysa Answer KeyNicole Anne Santiago Sibulo67% (3)

- Dunnhumby - The Complete Journey User GuideDocument11 pagesDunnhumby - The Complete Journey User GuidePreetha RajanNo ratings yet

- Answer Chapter 4 Time Value of MoneyDocument6 pagesAnswer Chapter 4 Time Value of MoneyFatikchhari USO100% (1)

- Marketing ManagementDocument174 pagesMarketing ManagementTanmay ShuklaNo ratings yet

- Book BillsDocument6 pagesBook BillsPraveen YadavNo ratings yet

- Modul Maths C10Document11 pagesModul Maths C10nurinNo ratings yet

- H) Pelarasan Akaun Perdagangan Untung Rugi PenyataDocument2 pagesH) Pelarasan Akaun Perdagangan Untung Rugi PenyataSharon SivaNo ratings yet

- Managerial Accounting 10th Edition Crosson Solutions Manual 1Document35 pagesManagerial Accounting 10th Edition Crosson Solutions Manual 1casey100% (52)

- Managerial Accounting 10Th Edition Crosson Solutions Manual Full Chapter PDFDocument36 pagesManagerial Accounting 10Th Edition Crosson Solutions Manual Full Chapter PDFherbert.howard901100% (11)

- Managerial Accounting 10th Edition Crosson Solutions Manual 1Document36 pagesManagerial Accounting 10th Edition Crosson Solutions Manual 1josehernandezoimexwyftk100% (31)

- BKM 10e Chap014Document8 pagesBKM 10e Chap014jl123123No ratings yet

- Chapter 09 Installment PurchaseDocument37 pagesChapter 09 Installment PurchasefatinNo ratings yet

- Total Assets 5 500rDocument2 pagesTotal Assets 5 500rGeorge HigginsNo ratings yet

- Accruals and Prepayments: AlreadyDocument4 pagesAccruals and Prepayments: AlreadyLOW YAN QINNo ratings yet

- CUTE Tutorial - Sample QuestionsDocument72 pagesCUTE Tutorial - Sample QuestionsRamakrishnan Ramachandran100% (1)

- Solution Manual For Managerial Accounting 10th EditionDocument35 pagesSolution Manual For Managerial Accounting 10th EditionAnnGregoryDDSemcxo100% (79)

- Question 1Document8 pagesQuestion 1premsuwaatiiNo ratings yet

- CH 7Document36 pagesCH 7GhadaNo ratings yet

- Maf 620 Dutch LadyDocument9 pagesMaf 620 Dutch LadyNur IfaNo ratings yet

- Pembahasan Soal AC Part 1Document34 pagesPembahasan Soal AC Part 1suci monalia putriNo ratings yet

- Im2 3Document35 pagesIm2 3musheeb1No ratings yet

- PFP AssignmentDocument3 pagesPFP Assignmenttanj-wp21No ratings yet

- Tugas 2 - AnsalDocument5 pagesTugas 2 - AnsalDita Sari LutfianiNo ratings yet

- Financial ManagementDocument22 pagesFinancial ManagementSapan AnandNo ratings yet

- Financial Management AnsDocument2 pagesFinancial Management AnsBryan LeeNo ratings yet

- Business and Finance Solution FinalDocument8 pagesBusiness and Finance Solution FinalRashid Ali JatoiNo ratings yet

- Sisilia Eva - Jawaban Tugas Individu AlkDocument7 pagesSisilia Eva - Jawaban Tugas Individu Alksisilia evaNo ratings yet

- Basic Accounting IDocument24 pagesBasic Accounting IAlpha HoNo ratings yet

- Financial Statements and Cash Flow: Solutions To Questions and ProblemsDocument10 pagesFinancial Statements and Cash Flow: Solutions To Questions and ProblemsTing-An KuoNo ratings yet

- 2nd Training Session 2022 03 14 18 41 46Document24 pages2nd Training Session 2022 03 14 18 41 46Sara PiccioliNo ratings yet

- Required Reserve Ratio 13%Document2 pagesRequired Reserve Ratio 13%Ahsan AliNo ratings yet

- Solutions To End-of-Chapter Three ProblemsDocument13 pagesSolutions To End-of-Chapter Three ProblemsAn HoàiNo ratings yet

- Assesment Task - Tutorial Questions Question No.1: Capital BudgetingDocument10 pagesAssesment Task - Tutorial Questions Question No.1: Capital BudgetingJaydeep KushwahaNo ratings yet

- 3.2 Credit and Debt ManagementDocument21 pages3.2 Credit and Debt ManagementRonald Deck YamiNo ratings yet

- KKPDocument18 pagesKKPMuhammadAl-FatehNo ratings yet

- CH 11 Time Value of MoneyDocument27 pagesCH 11 Time Value of MoneyMichelle Davinna Michael HerryNo ratings yet

- Demo LeverageDocument18 pagesDemo LeverageIftikhar baigNo ratings yet

- Bkaf1023: Introduction To Financial Accounting Semester A231 Tutorial 2: Chapter 4 & 5 Submission Date: 15 December 2023Document12 pagesBkaf1023: Introduction To Financial Accounting Semester A231 Tutorial 2: Chapter 4 & 5 Submission Date: 15 December 2023chenwei gohNo ratings yet

- Session 9 Flexible Budgets and Variance AnalysesDocument98 pagesSession 9 Flexible Budgets and Variance Analyseschloe lamxdNo ratings yet

- Chapter 9 Check Figures and Complete SolutionsDocument6 pagesChapter 9 Check Figures and Complete SolutionsAmrita AroraNo ratings yet

- Week 3 - ACCY111 NotesDocument4 pagesWeek 3 - ACCY111 NotesDarcieNo ratings yet

- NOTES On CAPITAL BUDGETING PVFV Table - Irr Only For Constant Cash FlowsDocument3 pagesNOTES On CAPITAL BUDGETING PVFV Table - Irr Only For Constant Cash FlowsHussien NizaNo ratings yet

- Corporate Finance: Time Value of MoneyDocument33 pagesCorporate Finance: Time Value of Moneykamiya_rautelaNo ratings yet

- Principles of Accounting Needles 12th Edition Solutions ManualDocument19 pagesPrinciples of Accounting Needles 12th Edition Solutions Manualfrizz.archlyiwmhmn100% (46)

- Full Download Principles of Accounting Needles 12th Edition Solutions Manual PDF Full ChapterDocument36 pagesFull Download Principles of Accounting Needles 12th Edition Solutions Manual PDF Full Chapteremigrate.tegumentxy6c6100% (19)

- Financial Statements AnalysisDocument49 pagesFinancial Statements AnalysisBilal MustafaNo ratings yet

- Corporate Finance - Assignment 1 - 11.02.23Document10 pagesCorporate Finance - Assignment 1 - 11.02.23Nabila Abu BakarNo ratings yet

- Fabm2 Quarter 1 Week 1 (Jenny Mae D. Otto Grade 12 Abm-Yen)Document2 pagesFabm2 Quarter 1 Week 1 (Jenny Mae D. Otto Grade 12 Abm-Yen)Jenny Mae OttoNo ratings yet

- Mock Exam AnswersDocument19 pagesMock Exam AnswersDixie CheeloNo ratings yet

- Business Finance - CH 6 SolutionDocument6 pagesBusiness Finance - CH 6 SolutionRita100% (1)

- Ranjit Sandoval - Quiz 8 10.19.2020 Due On 10.26.2020Document3 pagesRanjit Sandoval - Quiz 8 10.19.2020 Due On 10.26.2020Ranjit SandovalNo ratings yet

- Time Value of Money (New)Document22 pagesTime Value of Money (New)NefarioDMNo ratings yet

- Tutorial 2 AnswerDocument9 pagesTutorial 2 AnswerPiriya TharshiniNo ratings yet

- Managerial Accounting 14th Edition Warren Solutions Manual 1Document36 pagesManagerial Accounting 14th Edition Warren Solutions Manual 1josehernandezoimexwyftk100% (22)

- Chapter 3 DonemsDocument32 pagesChapter 3 Donemsforyourhonour wongNo ratings yet

- Week5 Ch6 Tutorial QDocument9 pagesWeek5 Ch6 Tutorial Qhantong690No ratings yet

- 02 Time Value of MoneyDocument50 pages02 Time Value of MoneyFauziah Husin HaizufNo ratings yet

- Financial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsDocument9 pagesFinancial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsJulyMoon RMNo ratings yet

- Vdu 3 WvyDocument55 pagesVdu 3 WvyNitin ArasappanNo ratings yet

- Chapter 41 Mergers and TakeoversDocument14 pagesChapter 41 Mergers and TakeoversBao Thanh Nguyen LamNo ratings yet

- Issue Analysis Group 2Document16 pagesIssue Analysis Group 2anamargaridajoaquim66No ratings yet

- 111111Document15 pages111111Mylene HeragaNo ratings yet

- Ome 664: Project Procurement and Contracting: LECTURE 1: Introduction To Procurement ManagementDocument46 pagesOme 664: Project Procurement and Contracting: LECTURE 1: Introduction To Procurement ManagementYonas AlemayehuNo ratings yet

- Advertisement Compaign: (Product:Ariel Detergent (Document15 pagesAdvertisement Compaign: (Product:Ariel Detergent (Iqra ChNo ratings yet

- Articles of PartnershipDocument2 pagesArticles of Partnershiprylee7100% (2)

- Chapter 7 BelardoDocument8 pagesChapter 7 BelardoAndrea BelardoNo ratings yet

- Evaluating Projects With The Benefit / Cost Ratio Method: XXXXXX XXXXXX XXXXXXX XXDocument30 pagesEvaluating Projects With The Benefit / Cost Ratio Method: XXXXXX XXXXXX XXXXXXX XXRhizhail MortallaNo ratings yet

- Tutorial Questions FMF June 2022 Tutorial 3 B - 6Document12 pagesTutorial Questions FMF June 2022 Tutorial 3 B - 6Clarinda LeeNo ratings yet

- Sachin Dapse - Curriculum VitaeDocument6 pagesSachin Dapse - Curriculum VitaeSachin DapseNo ratings yet

- Far FinalDocument24 pagesFar FinalJon MickNo ratings yet

- Bangalore - PNBHFL Approved ProjectsDocument7 pagesBangalore - PNBHFL Approved Projectsaman3327No ratings yet

- This Is A Contract Agreement To Export Enjera & Ethiopian SpicesDocument2 pagesThis Is A Contract Agreement To Export Enjera & Ethiopian SpicesSefanit MetaferiaNo ratings yet

- Dwnload Full Managerial Accounting 5th Edition Braun Solutions Manual PDFDocument35 pagesDwnload Full Managerial Accounting 5th Edition Braun Solutions Manual PDFlinnet.discreet.h5jn2s100% (9)

- Franchise Disclosure Document KFC Us, LLC A Delaware Limited Liability Company 1900 Colonel Sanders Lane Louisville, KY 40213 502-874-8300Document468 pagesFranchise Disclosure Document KFC Us, LLC A Delaware Limited Liability Company 1900 Colonel Sanders Lane Louisville, KY 40213 502-874-8300Irish Marie D. Braza100% (1)

- CommunautoQuebec 2023-09Document1 pageCommunautoQuebec 2023-09raphael.touze1No ratings yet

- Group # 1 Abm-Gb3aa, Pr-2 Peta (Final Output)Document88 pagesGroup # 1 Abm-Gb3aa, Pr-2 Peta (Final Output)Ericka Dela CruzNo ratings yet

- Midterms - Oblicon - 2019 - 1st SemDocument2 pagesMidterms - Oblicon - 2019 - 1st SemVlad ReyesNo ratings yet

- Annual Report Kimia Farma 2010 (Low Quality For Email)Document196 pagesAnnual Report Kimia Farma 2010 (Low Quality For Email)gugun8667% (3)

- Summary of IFRS 6Document2 pagesSummary of IFRS 6Juanito TanamorNo ratings yet

- EIS Mentor N23Document308 pagesEIS Mentor N23abhishekkapse654No ratings yet

- Pengaruh Kualitas Pelayananterhadap Loyalitas Pelanggan Dengan Kepuasan Pelanggan Sebagai Variabel Intervening Pada Evony Coffee Shop SiantarDocument7 pagesPengaruh Kualitas Pelayananterhadap Loyalitas Pelanggan Dengan Kepuasan Pelanggan Sebagai Variabel Intervening Pada Evony Coffee Shop Siantar27.Aditya NugrahaNo ratings yet

- Taguchi Loss Function For Process Product Development 1665460430Document7 pagesTaguchi Loss Function For Process Product Development 1665460430ashutoshpal21No ratings yet

- Compare The Data Collection Methods For Concept TestingDocument3 pagesCompare The Data Collection Methods For Concept TestingVikram KumarNo ratings yet

- Khomli - Georgian Spices & Seasonings: " Specialized in Medical HerbsDocument8 pagesKhomli - Georgian Spices & Seasonings: " Specialized in Medical HerbsNin QetelauriNo ratings yet

- Slides (5) 副本Document34 pagesSlides (5) 副本Andrew ChanNo ratings yet

- Petrol One AR 2018 PDFDocument142 pagesPetrol One AR 2018 PDFizwanNo ratings yet